Looking for the best registered agent services in 2025? Our top picks are: Northwest Registered Agent for privacy + human support, ZenBusiness for automation and a clean dashboard, Harbor Compliance for multi-state compliance tracking, Bizee for the lowest startup cost, and LegalZoom for enterprises that want a wider legal ecosystem. Below, we compare features, pricing, and best-fit scenarios and include a 50-state cheat sheet so you can match a provider to your exact needs.

Why choosing the right registered agent matters for your business

Selecting the best registered agent service isn’t merely a regulatory checkbox—it’s a foundational decision that protects your company’s standing and keeps you from missing a legal notice. Beyond mail forwarding, a registered agent serves as your designated agent for process of service, ensuring official documents are received and routed promptly.

The critical role of registered agents in maintaining compliance

Registered agents are the business’s official point of contact with government agencies and courts. They receive time-sensitive documents and help preserve your limited liability protections by being available at a physical location during regular business hours so nothing important slips through the cracks. Understanding what is registered agent services include helps owners appreciate how these professionals safeguard legal communications.

A registered agent typically receives and processes these official documents:

- Service of process documents (lawsuits, subpoenas)

- Tax notifications and correspondence

- Annual report reminders and filing deadlines

- Corporate compliance notices

- Regulatory communications

These items reflect what states and compliance guides say registered agents handle routinely.

A professional agent doesn’t just receive documents; they help you interpret which compliance requirements apply, track deadlines, and keep organized records of legal mail so your business stays protected.

Affordable, Compliant, and Reliable

ZenBusiness offers responsive support and registered agent services that keep your business in good standing.

Cost of poor service: Business risks and legal consequences

The consequences of choosing an inadequate registered agent in Texas or any state can be severe and far-reaching. Many business owners discover these repercussions only after significant damage has occurred, when missed documents or deadlines have already triggered legal complications. In Texas, many companies have discovered that relying on the best registered agent service Texas can significantly reduce compliance risks while ensuring prompt legal notifications.

Potential consequences of poor registered agent service include:

- Default judgments from unaddressed lawsuits

- Administrative dissolution of your corporation or limited liability company

- Loss of good standing and reputational harm

- State penalties and reinstatement costs

- Increased risk of adverse outcomes (including potential personal liability if you operate while dissolved)

- Missed tax deadlines resulting in penalties and interest

(Courts can enter defaults when defendants don’t respond; many states list failure to maintain an agent/office as a dissolution trigger.)

Selecting a reliable agent isn't just about legal compliance—it's essential protection for everything you've built. For instance, numerous business owners find that opting for the best registered agent service for LLC not only streamlines compliance but also reinforces their operational security.

Top 5 registered agent services compared

Like a home’s foundation, your choice of trusted registered agent remains largely invisible until problems arise—yet nothing else in your corporation or llc stands secure without it. When things go wrong, missed legal notice or service of process can ripple into costly issues.

Our comprehensive evaluation examines how these services perform across critical dimensions including document handling efficiency, compliance support, technology integration, and overall value. These rankings reflect extensive testing and real-world performance metrics.

| Service | Rating | Primary Strength | Cost | Our Take |

|---|---|---|---|---|

| Northwest Registered Agent | Privacy Protection | $125/year | While slightly pricier than competitors, their privacy focus is unmatched in the industry. Their small-firm approach (and dedicated support team) means you’ll speak to knowledgeable reps who understand your context. They’re not the most tech-forward option, but their attention to detail compensates for a somewhat dated interface. | |

| ZenBusiness | Technology Interface | $99 first year; renews $199/year | The platform is intuitive, with solid compliance alerts for hands-off users. During peak formation seasons, overall processing times can vary, but day-to-day workflows remain easy to manage. Good value for founders comfortable in a primarily digital environment. | |

| Harbor Compliance | Compliance Tracking | $99 first year; renews $149/year | Impressive compliance software and dashboards, though there’s a learning curve for solo entrepreneurs. The onboarding is detailed and pays dividends for regulated industries. You’re primarily investing in the software ecosystem backed by proactive reminders. | |

| Bizee (formerly Incfile) | Affordability | $119/year | Great for budget-sensitive startups; pricing is straightforward with few surprises. Communication is generally friendly, though more complex compliance questions may require extra follow-up or outside guidance. | |

| LegalZoom | Enterprise Services | $249/year | The brand carries weight and offers broad service integrations. For multi-state entities, standardized processes are reassuring; small businesses may find the price high relative to needs. Processing speeds for some services can vary by plan, and premium tiers may include expedited options. |

Northwest Registered Agent — highest privacy protection (9.4/10)

Northwest Registered Agent has a long-standing focus on privacy and in-house handling, which is why it tops our list. They explicitly do not sell client data and operate with Privacy by Default, while their local teams scan incoming court documents and any legal notice directly to your account for fast access. Customer Support is handled by dedicated Corporate Guides® who know your file.

NWRA’s safeguards emphasize control and minimal data exposure: locally scanned documents from state offices (not outsourced hubs), consistent in-house support, and systems designed to keep owner info off easily mined public records where possible. For many limited liability company owners who want a trusted registered agent, this is a practical way to reduce data-broker visibility while staying responsive to official mail.

If privacy and personalized support matter to you, read my full review of Northwest Registered Agent to help you pick a registered agent you can rely on and maintain a registered agent that protects your compliance posture.

ZenBusiness — best technology interface (8.65/10)

ZenBusiness combines approachable pricing with a clean, web-based dashboard that makes it easy to maintain a registered agent for your limited liability company and stay on top of filings. Their platform centralizes documents and deadlines so you’re less likely to miss something important during regular business hours.

Key technological advantages of ZenBusiness include:

- Real-time compliance alerts and custom notifications (via Worry-Free Compliance add-on)

- Secure document storage with advanced search functionality

- Automated annual report preparation and filing (through Worry-Free Compliance)

- Mobile-friendly access

- Integrated LLC formation package options for new businesses

This technology focus is especially helpful for digital-first owners who want minimal manual tracking. The compliance calendar and alerts in Worry-Free Compliance automatically tracks all your deadlines across multiple jurisdictions, eliminating the administrative burden of managing different state requirements manually. With affordable upgrade options that include worry-free compliance guarantees, they offer expandable service that grows with your business.

If you're looking for a reliable service to launch your LLC hassle-free, read my full review of ZenBusiness to see why it might be the best fit for your needs.

Harbor Compliance — best compliance tracking tools (8.25/10)

Harbor Compliance stands out for multi-state oversight and sophisticated dashboards. Their proprietary Entity Manager gives clear visibility into registrations, deadlines, and filings—ideal if your corporation or llc operates across jurisdictions and needs to maintain a registered agent in many states.

The centralized portal surfaces upcoming events and historical filings, reducing the need to bounce between state sites. For teams juggling numerous entities (or regulated industries), standardized workflows help you stay ahead of court documents and state obligations while ensuring receive legal notices are stored and actioned in one place.

You can read our full review of Harbor Compliance to see why I recommend their service.

Bizee (Formerly IncFile) — most affordable for startups (7.9/10)

For budget-conscious entrepreneurs, Bizee offers registered agent service at $119/year, with a free first year when bundled with formation—meaning many startups can launch a limited liability company while keeping overhead low. Pricing sits below many major providers while maintaining respectable support for essentials.

While Bizee doesn’t pack every premium feature, its reliable handling of court documents, basic mail forwarding, and compliance alerts help you receive legal notices without paying for extras you may not need early on. For lean teams, this balance of cost and coverage is a practical way to keep your corporation or llc in good standing.

If you’re starting an LLC on a budget, read our full review of Bizee to compare pricing, features, and ease of use—and to decide when to pick a registered agent versus upgrading later as needs grow.

LegalZoom — best for enterprise-level businesses (7.05/10)

LegalZoom’s registered agent service is backed by a platform that has helped form over 4 million businesses, with systems built for scale. For larger organizations, the combination of compliance specialists, high-volume document handling, and a built-out support infrastructure can simplify coordination across multiple entities and states.

Beyond the core RA function, LegalZoom’s ecosystem spans business and legal solutions—from contracts and IP filings to tax services—so established companies can centralize more of their compliance workflow. Features like scanned documents, a Compliance Calendar with email reminders, and unlimited cloud storage make it easier to maintain a registered agent without constant manual tracking.

Pricing is at the premium end: $249/year for registered agent service. For growth-stage and enterprise clients that value an integrated suite and predictable workflows, the added breadth can justify the cost, particularly when operating a national footprint. Some large enterprises even opt for integrated support provided by PEO companies to further enhance their HR and compliance operations as they scale.

If you want the full breakdown, see our LegalZoom review to evaluate fit and timing.

What are the registered agent requirements in each state?

Understanding state-specific rules is crucial when choosing a registered agent. Each state has its own legal obligations, fees, and availability standards that can impact your LLC's compliance.

Registered agent requirements vary by state, and failing to meet them can lead to penalties or dissolution. Below, we’ve compiled key information for all 50 states to help you stay compliant. Use this chart to compare registered agent rules, annual fees, and specific obligations based on your LLC’s location.

| State Name | Official State Website | Additional Information |

|---|---|---|

| Alabama | alabama.gov |

Tax Considerations: Alabama imposes the annual Business Privilege Tax on LLCs (initial return due within 2.5 months of formation; subsequent returns generally due 3.5 months after the start of the taxable year). Compliance: Annual Business Privilege Tax return (Form PPT) required with the Department of Revenue. Real Estate Laws: Security deposit rules apply; local requirements may vary. |

| Alaska | alaska.gov |

Tax Benefits: No state income tax and no statewide sales tax (local sales taxes may apply). Compliance: Biennial report due every two years; $100 filing fee for domestic LLCs. Real Estate Laws: Generally landlord-friendly; no statewide rent control. |

| Arizona | az.gov |

Tax Considerations: State income tax applies; LLCs can elect corporate taxation. Compliance: No annual report for LLCs; publication of Articles of Organization required if the known place of business is in a county other than Maricopa or Pima. Real Estate Laws: Generally landlord-friendly; no state rent control. |

| Arkansas | arkansas.gov |

Tax Considerations: Annual franchise tax of $150 for LLCs. Compliance: Annual franchise tax report due by May 1 each year. Real Estate Laws: Security deposit limits apply; check local codes for additional standards. |

| California | ca.gov |

Tax Considerations: California imposes an annual $800 LLC tax; an additional LLC fee may apply based on California-source income. Compliance: Statement of Information due within 90 days of formation, then every two years. Real Estate Laws: Strong tenant protections; rent control ordinances in certain jurisdictions. |

| Colorado | colorado.gov |

Tax Considerations: State income tax applies; LLCs can elect corporate taxation. Compliance: Periodic report due annually; $25 online filing fee (effective July 1, 2024). Real Estate Laws: Generally landlord-friendly; no state rent control. |

| Connecticut | ct.gov |

Tax Considerations: The Business Entity Tax was repealed; other state taxes may apply depending on classification. Compliance: Annual report due by March 31; $80 filing fee for LLCs. Real Estate Laws: Security deposit interest required; rate set annually by the Department of Banking. |

| Delaware | delaware.gov |

Tax Considerations: LLC annual franchise tax is $300 (no annual report for LLCs). Compliance: Franchise tax due June 1 each year for LLCs. Real Estate Laws: Generally landlord-friendly; no statewide rent control. |

| Florida | myflorida.com |

Tax Benefits: No personal state income tax. Compliance: Annual report due January 1–May 1; $138.75 fee; $400 late fee after May 1. Real Estate Laws: Generally landlord-friendly; no statewide rent control (local rules may apply). |

| Georgia | georgia.gov |

Tax Considerations: State income tax applies; LLCs can elect corporate taxation. Compliance: Annual registration due by April 1; $60 filing fee (multi-year options available). Real Estate Laws: Security deposit rules apply; generally no statewide rent control. |

| Hawaii | hawaii.gov |

Tax Considerations: State income tax applies; General Excise Tax (GET) applies broadly, including to rental income. Compliance: Annual report due each year in the quarter of the registration anniversary (Mar 31 / Jun 30 / Sep 30 / Dec 31); $15 filing fee. Real Estate Laws: Tenant protections under state law; specific landlord obligations for habitability and repairs. |

| Idaho | idaho.gov |

Tax Considerations: State income tax applies; LLCs may elect corporate taxation. Compliance: Annual report required; $0 fee; due by the end of the LLC’s anniversary month (file online via SOSBiz). Real Estate Laws: Generally landlord-friendly; no statewide rent control. |

| Illinois | illinois.gov |

Tax Considerations: State income tax applies; Personal Property Replacement Tax may apply. Compliance: Annual report due before the first day of the LLC’s anniversary month; $75 filing fee. Real Estate Laws: Tenant-friendly in some jurisdictions; Chicago has strict rental regulations. |

| Indiana | in.gov |

Tax Considerations: State income tax applies; LLCs can elect corporate taxation. Compliance: Business Entity Report due biennially in the anniversary month; $32 online or $50 paper filing. Real Estate Laws: Generally landlord-friendly; no statewide rent control. |

| Iowa | iowa.gov |

Tax Considerations: State income tax applies; LLCs can choose corporate taxation. Compliance: Biennial report for LLCs due by April 1 in odd-numbered years; $30 online or $45 paper filing. Real Estate Laws: Generally landlord-friendly; specific regulations on security deposits. |

| Kansas | kansas.gov |

Tax Considerations: State income tax applies; LLCs may elect corporate taxation. Compliance: Information Report filed every two years; $100 online or $110 paper (replaces prior annual report process). Real Estate Laws: Generally landlord-friendly; no statewide rent control. |

| Kentucky | kentucky.gov |

Tax Considerations: State income tax applies; LLCs may be subject to the Limited Liability Entity Tax (LLET). Compliance: Annual report due by June 30; $15 filing fee. Real Estate Laws: Generally landlord-friendly; security deposit rules apply. |

| Louisiana | louisiana.gov |

Tax Considerations: State income tax applies; LLCs can choose corporate taxation. Compliance: Annual report due each year on or around the formation anniversary; $30 filing fee (online card payments may include a small convenience fee). Real Estate Laws: Generally landlord-friendly; no statewide rent control. |

| Maine | maine.gov |

Tax Considerations: State income tax applies; LLCs may elect corporate taxation. Compliance: Annual report due by June 1; $85 filing fee for domestic entities ($150 for foreign). Real Estate Laws: Tenant protections apply; strict rules on security deposits and eviction procedures. |

| Maryland | maryland.gov |

Tax Considerations: State income tax applies; some entities also file personal property returns with local assessments. Compliance: Annual Report and Personal Property Return (Form 1) due April 15; standard filing fee $300 (waivers may apply for family farms or qualifying retirement-plan participation). Real Estate Laws: Tenant protections vary by locality; some jurisdictions (e.g., Montgomery County) have rent stabilization measures. |

| Massachusetts | mass.gov |

Tax Considerations: State income tax applies; LLCs may be subject to corporate excise if taxed as a corporation. Compliance: Annual report due by the anniversary date; $500 filing fee (online filings may include a processing add-on). Real Estate Laws: Tenant-friendly; strict security-deposit rules and strong tenant protections. |

| Michigan | michigan.gov |

Tax Considerations: State income tax applies; LLCs can elect corporate taxation. Compliance: LLC Annual Statement due Feb. 15 each year; $25 filing fee (special rules for entities formed after Sept. 30). Real Estate Laws: Generally landlord-friendly; state law preempts local rent control. |

| Minnesota | mn.gov |

Tax Considerations: State income tax applies; LLCs can choose corporate taxation. Compliance: Annual renewal due by December 31; $0 if filed on time (reinstatement fees apply if administratively dissolved). Real Estate Laws: Tenant-friendly; strong disclosure and tenant-rights requirements. |

| Mississippi | ms.gov |

Tax Considerations: State income tax applies; LLCs can elect corporate taxation. Compliance: LLC Annual Report due April 15; no fee for domestic LLCs (file online). Real Estate Laws: Landlord-friendly; no state rent control. |

| Missouri | mo.gov |

Tax Considerations: State income tax applies; LLCs can choose corporate taxation. Compliance: No annual report required for LLCs (corporations must file). Real Estate Laws: Generally landlord-friendly; no state rent control (local ordinances may vary on other requirements). |

| Montana | mt.gov |

Tax Considerations: No state sales tax; state income tax applies. Compliance: Annual report due by April 15; fee typically $20, but filing fees were waived for 2025 if filed by the deadline. Real Estate Laws: Tenant-friendly; habitability and tenant-rights protections apply. |

| Nebraska | nebraska.gov |

Tax Considerations: State income tax applies; LLCs can elect corporate taxation. Compliance: LLC biennial report due in odd-numbered years by April 1 (delinquent June 1); typical electronic filing fee $25 under state statute. Real Estate Laws: Generally landlord-friendly; no state rent control. |

| Nevada | nv.gov |

Tax Benefits: No state income tax; annual state business license required. Compliance: Annual List ($150 for LLCs) plus Business License renewal ($200) — $350 combined. Real Estate Laws: Landlord-friendly; no statewide rent control (local rules may address other rental issues). |

| New Hampshire | nh.gov |

Tax Benefits: No state personal income or sales tax; Interest & Dividends Tax repealed for periods beginning Jan. 1, 2025. Compliance: Annual report due April 1; $100 filing fee (online filings include a small processing add-on). Real Estate Laws: Generally landlord-friendly; no statewide rent control. |

| New Jersey | nj.gov |

Tax Considerations: State income tax applies; LLCs may be subject to Corporation Business Tax if taxed as a corporation. Compliance: Annual report due each year by the end of the entity’s anniversary month; $75 fee. Real Estate Laws: Tenant-friendly in many municipalities; local rent control and tenant-protection ordinances common. |

| New Mexico | nm.gov |

Tax Considerations: State income tax applies; LLCs can choose corporate taxation. Compliance: No annual or biennial report for LLCs (corporations file biennially). Real Estate Laws: Generally landlord-friendly; no statewide rent control. |

| New York | ny.gov |

Tax Considerations: State income tax applies; NYC/other local rules may apply. Compliance: Biennial statement required (every 2 years; $9 fee); LLCs must complete the state publication requirement and file a $50 Certificate of Publication. Real Estate Laws: Strong tenant protections; rent control/stabilization in select municipalities. |

| North Carolina | nc.gov |

Tax Considerations: State income tax applies; LLCs can elect corporate taxation. Compliance: LLC annual report due April 15 each year; $200 by mail ($203 online). Real Estate Laws: Generally landlord-friendly; no statewide rent control. |

| North Dakota | nd.gov |

Tax Considerations: State income tax applies; LLCs can choose corporate taxation. Compliance: LLC annual report due November 15; $50 fee. Real Estate Laws: Landlord-friendly; no statewide rent control. |

| Ohio | ohio.gov |

Tax Considerations: State income tax applies; LLCs can elect corporate taxation. Compliance: No periodic (annual/biennial) report for LLCs. Real Estate Laws: Generally landlord-friendly; no statewide rent control. |

| Oklahoma | ok.gov |

Tax Considerations: State income tax applies; LLCs can choose corporate taxation. Compliance: LLC Annual Certificate due each year by the anniversary month; $25 fee. Real Estate Laws: Landlord-friendly; no statewide rent control. |

| Oregon | oregon.gov |

Tax Considerations: State income tax applies; Corporate Activity Tax may apply. Compliance: Annual report due each year by the anniversary date; $100 fee for LLCs. Real Estate Laws: Tenant-friendly; statewide rent control in effect. |

| Pennsylvania | pa.gov |

Tax Considerations: State income tax applies; local taxes may apply depending on location. Compliance: Annual report required (Act 122); LLCs file by September 30 each year; $7 fee. (Decennial report eliminated.) Real Estate Laws: Generally landlord-friendly; no statewide rent control. |

| Rhode Island | ri.gov |

Tax Considerations: Most LLCs owe a $400 annual charge to the Division of Taxation; state income tax applies. Compliance: LLC annual report filing window currently Feb 1–May 1; $50 fee; $25 late penalty after May 31. Real Estate Laws: Tenant-friendly in many areas; local rules vary. |

| South Carolina | sc.gov |

Tax Considerations: State income tax applies; LLCs taxed as corporations file corporate returns. Compliance: No annual report for LLCs unless taxed as a corporation (then corporate return/initial CL-1 applies). Real Estate Laws: Landlord-friendly; no statewide rent control. |

| South Dakota | sd.gov |

Tax Benefits: No state income tax; sales and use tax may apply. Compliance: Annual report due the first day of the anniversary month; $55 online / $70 by mail; $50 late fee. Real Estate Laws: Generally landlord-friendly; no statewide rent control. |

| Tennessee | tn.gov |

Tax Considerations: No state income tax on wages; franchise & excise taxes may apply to LLCs depending on taxation status. Compliance: LLC annual report due the first day of the 4th month after fiscal year end; $300 minimum (then $50 per member over six; max $3,000). Real Estate Laws: Landlord-friendly; no statewide rent control. |

| Texas | texas.gov |

Tax Benefits: No state income tax; franchise tax may apply (no-tax-due threshold updates periodically). Compliance: Annual franchise tax report & Public Information/Ownership Information Report due May 15; entities under the no-tax-due threshold don’t file a No Tax Due Report but must file PIR/OIR. Real Estate Laws: State preempts local rent control except in limited emergencies; no statewide rent control. |

| Utah | utah.gov |

Tax Considerations: State income tax applies; LLCs can elect corporate taxation. Compliance: Annual renewal (report) due each anniversary; $18 fee (includes portal surcharge). Real Estate Laws: Generally landlord-friendly; no statewide rent control. |

| Vermont | vermont.gov |

Tax Considerations: State income tax applies; LLCs may elect corporate taxation. Compliance: LLC annual report due within the first three months after fiscal year end; $45 fee (domestic LLCs). Real Estate Laws: Tenant-friendly; strong habitability and deposit rules. |

| Virginia | virginia.gov |

Tax Considerations: State income tax applies; LLCs may elect corporate taxation. Compliance: No LLC annual report; $50 annual registration fee due by the last day of the anniversary month (late penalty $25). Real Estate Laws: Generally landlord-friendly; no statewide rent control. |

| Washington | wa.gov |

Tax Considerations: No state income tax; B&O tax may apply to LLC activity. Compliance: Annual report due by the last day of the anniversary month; $70 fee. Real Estate Laws: Statewide rent cap enacted in 2025 (HB 1217) limits most annual increases; local rent control remains preempted by state law. |

| West Virginia | wv.gov |

Tax Considerations: State income tax applies; LLCs can elect corporate taxation. Compliance: Annual report due Jan 1–Jun 30 each year; $25 fee (typical late penalty $50). Real Estate Laws: Generally landlord-friendly; no statewide rent control. |

| Wisconsin | wisconsin.gov |

Tax Considerations: State income tax applies; LLCs may elect corporate taxation. Compliance: Annual report due by the end of the anniversary quarter; $25 online ($40 mail). Real Estate Laws: Generally landlord-friendly; no statewide rent control. |

| Wyoming | wyoming.gov |

Tax Benefits: No state income tax; annual report license tax applies. Compliance: Annual report due by the first day of the anniversary month; license tax is $60 minimum or $0.0002 of in-state assets (whichever is greater). Real Estate Laws: Landlord-friendly; no statewide rent control. |

Best registered agent services for specific business scenarios

Is there really a “one-size-fits-all” registered agent solution? Your business structure, growth stage, privacy needs, and operational geography all influence which service will deliver optimal value for your specific situation. Selecting a registered agent that aligns with your unique needs ensures you receive the right level of support at the appropriate price point.

Best for high-net-worth individuals and asset protection

For high-net-worth clients focused on asset protection, privacy typically outweighs price. The right registered agent service should pair strong confidentiality practices with flawless document handling.

Essential features for asset protection include:

- nhanced privacy policies with no data selling

- Experience with complex ownership structures

- Private scanning and document-handling protocols

- Discreet physical address options in appropriate jurisdictions

Northwest Registered Agent emphasizes privacy with “Privacy by Default” (including “no data sales”) and in-house document handling—useful when confidentiality is paramount. Harbor Compliance is well-suited to complex, multi-entity structures thanks to its compliance software and monitoring tools. Also, be clear on the difference between a registered agent and an organizer for LLC—the organizer forms the entity, while the agent handles legal correspondence going forward.

Privacy-Focused & Proven Nationwide

Northwest provides premium registered agent support with industry-best legal mail handling and compliance tools.

Best for e-commerce and digital-first businesses

Digital-native businesses require registered agent services with strong technology integration, automated notifications, and efficient remote access to critical documents. The right provider enhances your business formation strategy with tools that complement your digital operations model.

Essential technology features for digital businesses:

- API integrations with common business platforms

- Mobile-optimized access and notifications

- Electronic document delivery and storage

- Automated compliance calendar with smart alerts

- Digital signature capabilities for time-sensitive responses

ZenBusiness stands out for a streamlined interface, document scanning to a secure dashboard, and optional Worry-Free Compliance for alerts and annual-report help, helpful for remote operations. If you manage a Washington LLC, remember the state requires your registered agent to maintain a physical, in-state address and be available during business hours.

How to effectively compare and choose a registered agent service

The industry has moved beyond basic mail-forwarding into technology-enabled compliance support. That evolution makes choosing a registered agent service more consequential for your corporation or llc, especially if you care about business address privacy and predictable compliance.

Nationwide vs. state-specific registered agents – which is better?

When deciding on a registered agent, several key factors influence whether a nationwide provider or state-specific agent will better serve your current and future needs.

| Criteria | Nationwide Registered Agents | State-Specific Registered Agents |

|---|---|---|

| Multi-State Support | Built-in expansion capabilities | Often require new relationships in each state |

| Consistency | Standardized processes across states | Quality and processes may vary |

| Local Expertise | Generalized knowledge of all states | Deep expertise in specific jurisdiction |

| Pricing Structure | Often volume discounts for multiple states | Potentially lower single-state costs |

| Technology Integration | Usually more advanced platforms | Varies significantly by provider |

For most growing businesses, nationwide providers offer significant advantages in scalability and consistency. However, businesses operating exclusively in one state with no expansion plans might find specialized local agents provide sufficient service at competitive rates. In fact, many entrepreneurs quickly realize they need an agent for an LLC to navigate complex multi-state regulatory environments effectively.

Essential features that separate the best from the rest

When you evaluate providers, look for capabilities that turn a vendor into a partner. A trusted registered agent should reliably receive legal notices and organize them so nothing slips through the cracks.

Critical features to evaluate include:

- Same-day electronic document forwarding

- Compliance calendar with automated alerts

- Secure online document storage and organization

- Dedicated compliance specialists (not general CSRs)

- Privacy protection policies and data handling

- Experience with your specific entity type

- Additional compliance support services

The best providers don't just receive your mail—they function as true compliance partners that actively help protect your business from regulatory risks. While basic mail forwarding fulfills minimum requirements, premium registered services provide proactive support that prevents problems before they occur.

Head-to-head provider comparisons for common business types

For small businesses prioritizing affordability, Northwest versus Bizee comes down to value trade-offs. Northwest emphasizes privacy (no data sales) and hands-on support, while Bizee focuses on low cost. At standard rates, Northwest is about $6 more per year ($125 vs. $119) for comparable registered agent service on a basic limited liability company.

Multi-state operations often compare Harbor Compliance with Northwest. Harbor’s software (Entity Manager) provides portfolio-level tracking across jurisdictions, useful when you must maintain a registered agent footprint in many states; Northwest remains a good fit if you prioritize privacy and straightforward handling of legal notice.

High-growth startups frequently weigh ZenBusiness against LegalZoom. ZenBusiness pairs a clean dashboard with optional Worry-Free Compliance (alerts and annual-report help), while LegalZoom’s suite adds a Compliance Calendar and unlimited cloud storage. Pricing commonly differs: ZenBusiness lists $99 for the first year (then $199), while LegalZoom’s registered agent runs $249/year—so pick a registered agent based on features you’ll actually use as a limited liability company. Other industry leaders, such as CSC registered agent services, also offer robust support designed for enterprise-level needs.

Understanding the true cost of registered agent services

“You get what you pay for” fits registered agent services: the base annual fee is only part of the picture. A bargain provider that fumbles time-sensitive mail can rack up compliance penalties and admin costs that dwarf any savings. Understanding the complete cost of registered agent services structure is essential for making value-based decisions.

Look for timely alerts, privacy tools, and transparent pricing to safeguard your LLC.

Evaluate flat vs. renewal rates and bundled services for the best value.

Check for real-time assistance to handle urgent issues like lawsuits or mail delivery.

- 1. List potential agents based on reputation and coverage scope.

- 2. Compare their pricing models and included features.

- 3. Assess customer reviews for real-time support and reliability.

Standard pricing breakdown across top providers

When estimating your total registered agent cost, look beyond the homepage price. The real pricing structure can include line items that affect your budget and how fast you get documents (e.g., electronic delivery versus paper forwarding).

Standard cost elements to consider include:

- Base annual service fee

- Document processing fees (per document or unlimited)

- Electronic delivery vs. physical mail forwarding charges

- Compliance alert and monitoring fees

- Document storage and retrieval costs

- Additional state jurisdictions pricing

Transparent providers often spell out whether they charge “per document” extras and what’s included in delivery and storage. For example, Northwest lists a flat $125/year model and emphasizes “Privacy by Default,” while ZenBusiness publishes $99 first year; $199 renewal and includes secure digital delivery and notifications. Harbor Compliance explicitly states flat-rate pricing with no per-document fees. Review each fee schedule before you pick a registered agent.

Volume discounts and multi-state pricing options

If you operate in multiple states, volume discounts and multi-year pricing can materially lower your total. Harbor Compliance publicly advertises discounted multi-year rates; industry roundups also note that some nationwide providers offer multi-state breaks. Large organizations can negotiate enterprise pricing that bundles enhanced SLAs and centralized billing.

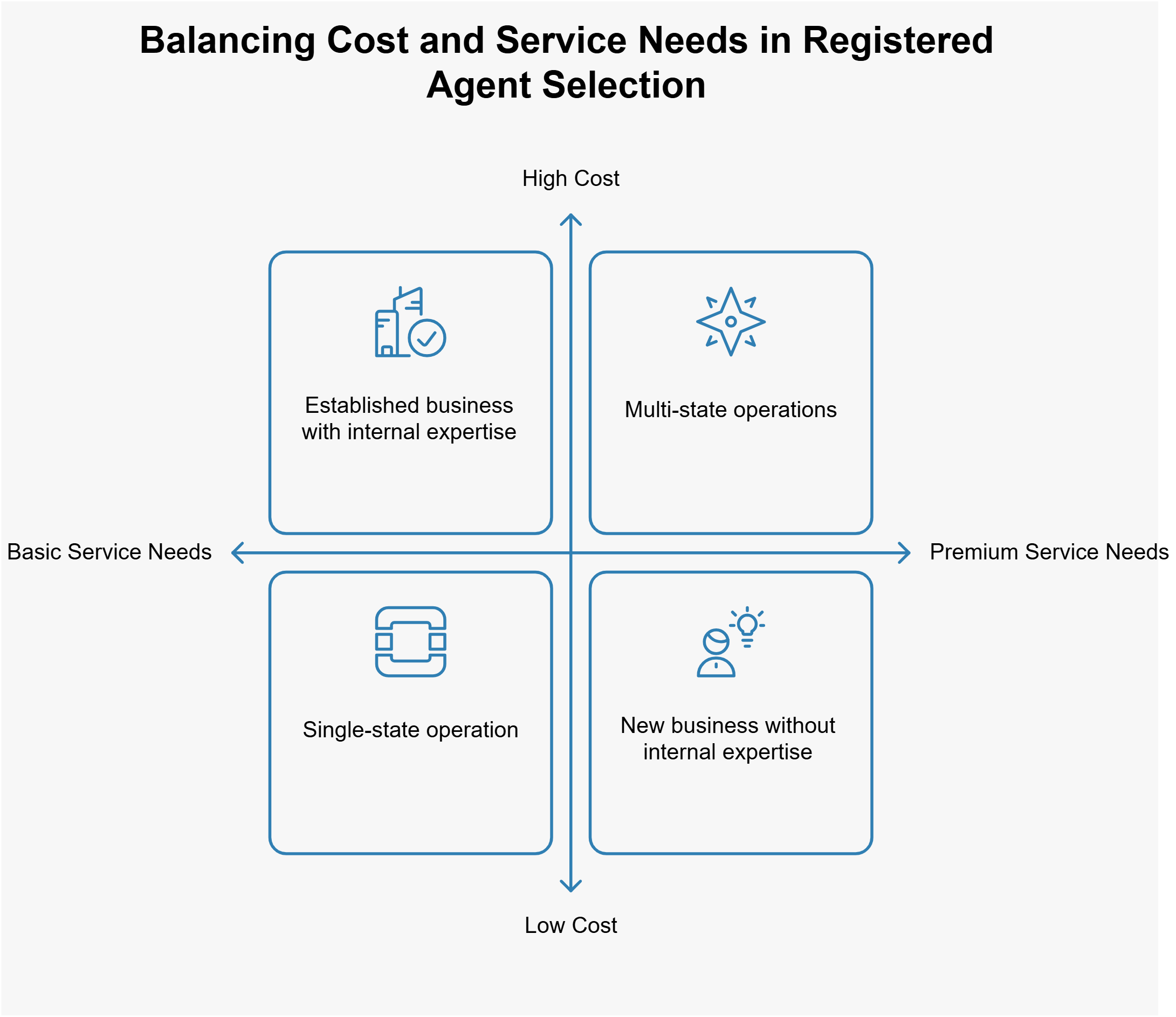

Cheap registered agent services – when to save and when to invest

Basic plans can be perfectly fine when your needs are simple; premium tiers make sense when the risk and complexity rise. Aim for the features you’ll actually use, and maintain a registered agent relationship that matches your risk profile—not someone else’s checklist.

When basic service is sufficient:

- Single-state operations with simple structures

- Established businesses with internal compliance expertise

- Low-litigation-risk industries with minimal regulatory complexity

- Entities with minimal privacy concerns or public information

When premium service delivers better value:

- Multi-state operations managing several jurisdictions

- High-net-worth structures needing heightened confidentiality

- Regulated industries with complex obligations

- New businesses without internal legal/compliance staff

The goal isn’t “cheapest,” it’s best price point for the features you need. As reference points, ZenBusiness lists $99 first year; $199 renewal, Harbor Compliance lists $99 first year; $149 renewal, and Northwest’s rate is $125/year flat—use these baselines to compare any commercial registered agent against your requirements.

How we evaluated and ranked these registered agent services

We’ve all seen those ominous “FINAL NOTICE” letters—so our process began by hiring a registered agent service from each provider, completing onboarding, and monitoring how they handled legal notice and other documents across multiple states. This hands-on approach exposed differences you won’t spot in marketing pages. Moreover, many new business owners also explore the offerings of the best LLC formation companies to streamline their entire setup process from the start.

Our methodology: pricing, compliance support, and customer service

For pricing, we looked past teaser rates to the true total cost, including add-ons and multi-state scenarios. We mapped each provider’s pricing structure, noted any per-document charges, and assessed whether multi-year or volume discounts actually reduce the base annual fee over time.

For compliance support, we evaluated systems that track deadlines, deliver alerts, and keep records organized. We tested how clearly each registered agent service helps a limited liability company interpret requirements and how quickly electronic documents arrive compared to physical forwarding.

For customer service, we measured response times across phone, email, and chat, and noted the depth of expertise. Standout teams paired fast replies with knowledgeable guidance—more than scripted CSRs — so clients could act on court documents and filings without delay.

Transparency and accuracy standards in our review process

To maintain objectivity throughout our evaluation process, we established strict standards for data collection and assessment. All services were tested using identical business scenarios and document types, ensuring direct comparability across metrics including processing speed, notification efficiency, and reliability of registered agents.

Our independence from provider influence remains paramount—we receive no compensation for rankings or preferential placement in our reviews. While we may receive affiliate commissions for referred customers, these commercial relationships never influence our assessments or rankings. That's why we encourage users to read customer reviews and conduct their own research as well. This editorial firewall ensures our recommendations reflect genuine services provided by registered agents rather than marketing relationships, allowing us to provide guidance you can trust when selecting a partner for this critical business function.

Frequently asked questions about finding the best registered agent

Did you know that 67% of business owners report confusion about what services a registered agent should provide beyond basic statutory requirements? This uncertainty highlights the importance of understanding fundamental aspects of the role of a registered agent before making this consequential decision for your business compliance strategy.

How do registered agent services differ from basic statutory agents?

A statutory agent fulfills only minimum legal requirements by maintaining a street address during business hours and accepting service of process documents. In contrast, comprehensive registered agent services provide significant additional value through compliance monitoring, document organization, electronic delivery, secure storage, and proactive notification systems. They function as true compliance partners rather than mere document recipients, helping protect your business from missed deadlines and requirements while providing better protection for sensitive legal communications than basic mail acceptance services.

What qualifies a registered agent as “nationwide”?

A true nationwide agent maintains physical offices or authorized representatives meeting statutory requirements in all 50 states plus Washington D.C. This infrastructure enables them to provide their registered agent service consistently across jurisdictions, simplifying compliance for businesses operating in multiple states. Quality nationwide providers maintain standardized processes, centralized document management, and unified compliance tracking regardless of where documents are served.

How often should you reassess your registered agent service?

Regular evaluation of your registered agent relationship ensures your service continues meeting your evolving business needs as you grow and expand. The process to change registered agent is typically straightforward but should be timed carefully to avoid compliance gaps.

Key times to reassess include:

– When expanding into new states

– Following significant business structure changes

– After experiencing service issues or delays

– When compliance needs become more complex

– During annual budget review processes

Most businesses benefit from evaluating their registered agent services per year performance annually to ensure they're receiving appropriate service levels as their needs evolve.

Is it worth switching registered agents to save money?

Potential savings from switching to a lower-cost provider must be weighed against transition risks including potential gaps in service coverage during the changeover process. The steps to change registered agent involve filing formal paperwork with the state, which requires careful timing and coordination.

For stable businesses with straightforward compliance needs, switching to save $50-100 annually may prove worthwhile if the new provider offers comparable reliability. However, businesses with complex regulatory requirements or operating in high-risk industries should prioritize service quality and proven reliability over modest potential savings that could be quickly erased by a single missed filing or improperly handled legal document. However, some business owners choose to act as your own registered agent in order to maintain direct control over their legal documentation, even though this approach involves additional responsibilities.

What happens if your registered agent fails to fulfill their duties?

When a registered agent mishandles documents or fails to provide timely notification, the consequences can be severe. Courts may enter default judgments against you in litigation, state authorities can administratively dissolve your business entity, and regulatory agencies may impose penalties for missed deadlines. These outcomes can expose owners to personal liability by compromising your limited liability protection.

Available remedies include: replacing the agent immediately, filing for reinstatement if administrative dissolution occurs, requesting court relief for missed deadlines, and in cases of negligence, pursuing damages from the agent's errors and omissions insurance. Understanding these risks highlights why the advantages of using a registered agent with a proven track record of reliability should be a primary consideration. Exploring the benefits of having a registered agent can clearly illustrate how proactive service prevents costly legal oversights and compliance failures.

Can I be my own registered agent?

Usually yes, if you have a physical in-state street address and can stay available during business hours. Downsides: your home/work address becomes public, you may miss deliveries when traveling, and you shoulder all scanning/recordkeeping. Most owners use a professional RA for privacy, reliability, and multi-state coverage.

Do I have to appoint a registered agent for my LLC or corporation?

In almost every U.S. state, yes—LLCs and corporations must list a registered agent and registered office in the formation filing and keep one on record to remain in good standing. If you expand into another state (“foreign qualify”), you’ll appoint an in-state RA there too.

- NASS: Corporate registration directory

- Delaware Corp Division: FAQs — Registered Agent

- Northwest: Registered Agent Service

- ZenBusiness: Registered Agent Service

- Bizee (Incfile): Registered Agent ($119/year; 1st year free)

- Harbor Compliance: Registered Agent Service

- LegalZoom: Registered Agent Overview ($249/year)

- Forbes Advisor: Best Registered Agent Services (2025)

Serious Compliance for Serious Founders

Harbor Compliance delivers high-touch registered agent services with annual report tracking and expert guidance.