Starting an LLC in Arizona is one of the best things you can do when launching a new business for 2025. Arizona has lower startup costs, less red tape, and one of the easiest LLC formation processes in the United States. When starting a small one-man consulting business or scaling a big operation, formation of limited liability company here protects your assets and enhances your credibility from day one.

To start an LLC in Arizona, you must file Articles of Organization with the Arizona Corporation Commission ($50 standard, or $85 expedited), appoint a statutory agent with an Arizona street address, and — unless you're in Maricopa or Pima County — publish a formation notice in a local newspaper ($60–$120). You’ll also want an Operating Agreement (free to $100), and may register a trade name ($10–$20) if needed. Overall, expect to spend $150–$300 to form your LLC and $0–$100 annually for ongoing compliance.

This guide walks you through everything you need to launch your Arizona LLC — step-by-step. You’ll learn how to choose a name, file your paperwork online through the eCorp portal, meet the publication requirement, and stay compliant with state rules. We’ve also included tips on drafting an operating agreement, opening a business bank account, and registering for taxes. If you're looking to form your LLC the right way, this guide has you covered — no fluff, just clear instructions for real-world business owners.

Why Should You Start an LLC in Arizona?

Choosing where to form your LLC is an important decision. Arizona’s low tax structure, minimal regulations and low fees make it one of the cheapest States for forming and growing small businesses without the red tape. With online tools and easy access to resources, Arizona is also helping make it easier for businesses – from startups to foreign entities to expand.

Key Benefits of Forming an LLC in Arizona

Having an LLC in Arizona provides a business with real advantages from the start. You will benefit from low startup costs, legal protection, flexible tax option and a jurisdiction that uses the minimum necessary regulations. Here are four key reasons to form an LLC in Arizona – plus, the state’s strong digital infrastructure makes licensing and business operations smoother.

These benefits aren’t just theoretical, they directly support smoother day-to-day operations and long-term growth. Limited liability protects your personal finances. Flexible taxation means you can save money come tax season. Lower startup costs reduce the barrier to entry. Because of fewer formalities—Arizona does not require LLCs to file annual reports (Arizona Corporation Commission)—you spend time running your business, not paperwork.

Top 4 Benefits of Forming an LLC in Arizona:

| Benefit | Details |

|---|---|

| Personal liability protection | Saves your personal assets from business loans or lawsuits. |

| Tax flexibility | Choose between S corporation or C corporation or partnership and more. |

| Low startup costs | Filing fee: $50 standard, or $50 + $35 for expedited processing. |

| Minimal ongoing formalities | No annual report required by the Arizona Corporation Commission. |

Is an LLC the Right Business Structure for You in Arizona?

There is no single best business entity; it will depend on your goals and liability on how you want to operate your business. The owners of a limited liability company enjoy flexibility and pass-through tax advantages. But a limited liability company plan is not suitable for every owner or every business model.

If you’re from out of state or country, Arizona will allow foreign LLCs to operate in state, but you’ll need a Foreign Registration Statement–which is $150 standard or $185 expedited. A local registered agent service must be appointed in Arizona.

LLCs can also elect to be taxed as an S corporation or C corporation at the federal level by filing IRS Form 2553 or 8832. This can offer potential tax savings depending on your profit structure, payroll, and reinvestment plans. Be sure to consult a tax advisor to determine whether these options are right for your situation.

Visit the Arizona Secretary for official advice, comparisons by type, and a step-by-step process. Always search Arizona rules before selecting your preferred form of entity.

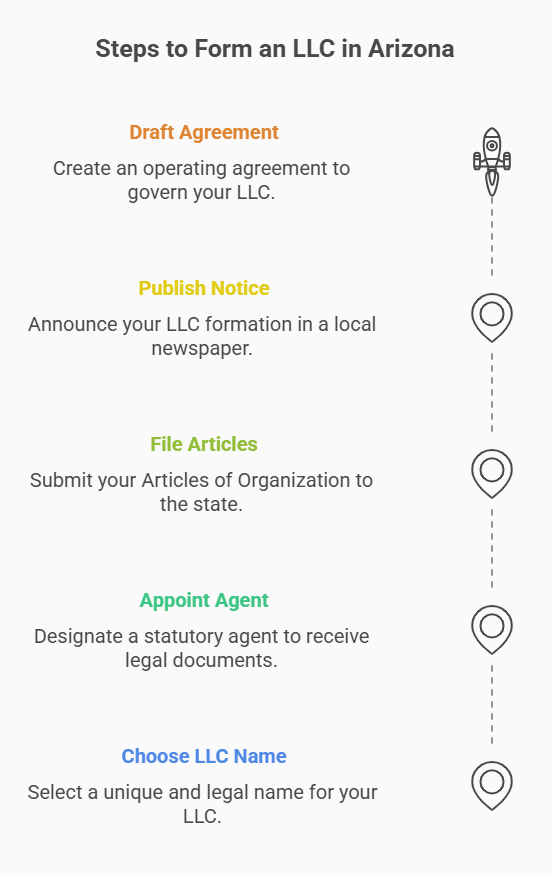

Key Steps to Start Your LLC in Arizona

Creating an LLC in Arizona can be accomplished by completing a simple five-step process. To start, you select a unique name and register it. To finish the process, you will appoint a statutory agent, file your Articles of Organization, publish a formation notice in a local newspaper, and draft an operating agreement. Just stick to the following steps, and don’t forget to check with the Arizona Corporation Commission for anything else you have to do.

Step 1: Choose and Register Your Arizona LLC Name

Your LLC name is the foundation of your business identity. It must be unique (original), legal, and distinctive from any other Arizona business entity or name. A right name builds trust for your brand & makes your brand easy to market online and offline. Check for domain availability too. If you want to create a customized website or implement digital marketing, it can be very useful.

If you're not ready to file yet, Arizona lets you reserve your LLC name for 120 days — it costs $10 for standard processing or $45 if expedited. And if you plan to operate under a different name than your legal LLC name, you’ll need to register a trade name (DBA) with your county — typically $10–$20, depending on the location.

Before you file your form, use the name search tool provided by the Arizona Corporation Commission. You’ll find official instructions, helpful articles, and other resources to check availability and avoid duplication. Whether you're preparing to start your LLC or adjusting for tax reasons, choosing the right name is a critical first move—even for businesses in places like Santa Cruz County.

Arizona LLC Naming Rules:

- Must include “Limited Liability Company” or an abbreviation like “LLC” or “L.L.C.”

- Cannot contain words that mislead (e.g., “bank,” “university,” unless approved)

- Must be distinguishable from other registered names

- No terms implying government affiliation

- Cannot contain offensive or prohibited language

- Must use standard English alphabet (no special symbols or characters)

Step 2: Appoint Your Arizona Registered (Statutory) Agent

Every Arizona LLC is required to appoint a statutory agent to receive legal documents on behalf of the business. This individual or business is your LLC’s formal liaison with the state. Without one, your LLC filing won’t be accepted. This person will serve as your official Arizona registered agent, responsible for accepting service of process and important notices.

An Arizona physical address must be listed for your agent and available during normal business hours. You can be your own agent or designate someone you trust to be your agent. You can also hire a professional registered agent service. Arizona provides detailed requirements on the Statutory Agent Information page. The statutory agent must list a real street address, not a P.O. Box, as this ensures your business entity can reliably receive mail and legal notices. Learn more about Arizona's registered agent requirement to ensure your filing meets state rules.

Step 3: File Your Arizona Articles of Organization

Filing your Articles of Organization makes your Arizona LLC official. It’s the legal step that tells the state your business exists. You can file online quickly through the Arizona Corporation Commission’s eCorp portal. Detailed filing steps are provided in the following sections.

Step-by-Step Guide to Filing Your Arizona Articles of Organization

The quickest way to get your LLC started is by filing your Articles of Organization online. The eCorp portal allows you to access an organized system that will take you through each section. To register your LLC, you will need to put together your LLC’s basic information, select a management structure, and make the payment.

Arizona charges a $50 standard filing fee, with an optional $35 expedited processing fee (totaling $85 if selected). Processing times vary and are updated weekly by the Arizona Corporation Commission. Online filings are often processed within 1–2 business days (24–48 hours). You’ll receive confirmation by email once approved (timeline details here). This process involves multiple steps, each with specific requirements based on your business type.

Here’s how to file online:

- Go to eCorp.azcc.gov and create a user account.

- Click “Create a New LLC” and choose “Domestic LLC.”

- Enter your LLC name, principal address, and statutory agent info.

- Choose your management structure (member- or manager-managed).

- Upload any required documents (e.g., cover sheet, attachments).

- Review everything carefully and pay the $50 filing fee.

- Submit your application and wait for email confirmation.

What You Need to Include in Your Articles of Organization

The legal name, principal address of business, and name and address of statutory agent of your LLC must appear in its Articles of Organization. You must also state whether your LLC will be managed by members or designated managers.

It is also possible to add optional provisions, which may set for the LLC’s business purpose, duration, or limitations on authority. While Arizona law does not require them, adding them can clarify expectations between members and reduce disputes later on.

Step 4: Meet the Arizona LLC Publication Requirement

The state of Arizona has a specific requirement for most new LLCs: they must provide a publication in an approved newspaper announcing their LLC formation. LLCs based in Maricopa and Pima counties are exempt from this requirement. If your LLC’s recognized workplace is situated in a county other than Maricopa or Pima, this requirement applies. You have to publish for a period of three weeks within 60 days of consent. Typical cost ranges from $60 to $120, depending on the newspaper. Always check with the permitting department or county division to see that you meet every requirement.

Select a newspaper from the Arizona Corporation Commission’s list of approved newspapers to comply. Once the notice runs, when you get an affidavit of publication, keep it with you. You don’t have to file it with the state, but you might need to for your bank or business license.

Step 5: Draft Your Arizona LLC Operating Agreement

An operating agreement outlines how your LLC will be run. It discusses the duties of members, the allocation of profit, voting rights, and withdrawal impact from the business. While Arizona does not require the filing of this document, having one helps protect your legal structure and prevents internal disputes. Whether you have a single member or multiple members, having one ensures that everybody is on the same page. Furthermore, it adds legitimacy to your LLC when seeking partnerships or a bank loan.

Start Your Arizona LLC with ZenBusiness

ZenBusiness makes forming an Arizona LLC simple and fast—name check, filing, and compliance support included.

What Are the Essential Requirements for Your Arizona LLC?

Forming your LLC is only the beginning. To remain in compliance and in good standing with the State, your business must meet certain ongoing requirements. You must keep your statutory agent and records up to date, as well as your filing and tax obligations. Not meeting them may bring penalties, even dissolution.

As of March 21, 2025, Arizona domestic LLCs are exempt from FinCEN’s beneficial ownership reporting under the Corporate Transparency Act — a federal rule still enforced in most other states. This exemption simplifies compliance at the federal level for most small Arizona businesses.

Depending on how your LLC is taxed, you will file state and federal tax returns. It can be taxed from a sole proprietorship, partnership, S-Corp or C-Corp. To keep your Arizona LLC in good standing, you must meet all IRS deadlines. If you want to do a more complex tax structure, consider getting an accountant to help manage compliance.

Understanding Arizona LLC Filing and Compliance Rules

Arizona LLCs don’t have to file annual reports. Nevertheless, there are some filing obligations you must stay on top of. If anything changes, you will need to update your statutory agent. If necessary, you will need to maintain your business license. It may be necessary to report changes to your LLC's structure or change of address.

To update your business address or statutory agent, file a Statement of Change with the Arizona Corporation Commission. The fee is $5 for standard processing or $40 for expedited. Keeping this information current ensures your LLC doesn’t miss important legal notices or fall out of good standing. Additional local tax or permit requirements may exist for cities and counties.

If you don’t comply, your company might get dissolved or fees charged to your company. You also might lose your limited liability protection. You have to keep your LLC records updated and respond to official notices. For the full list of statutory obligations, refer to Arizona Revised Statutes, Title 29 (LLC Laws).

How to Keep Your Arizona LLC in Good Standing

In order to keep your LLC active, you want to stay organized. Ensure that your statutory agent information is updated always, maintain your business records properly and renew your local licenses or permit as applicable. Don’t ignore notices from the Arizona Corporation Commission. You must report a change of business address, ownership or structure through eCorp. Arizona no longer requires LLCs to file annual reports, the requirement was repealed in 2018. However, you must file statutory updates if any changes occur.

What Should You Do After Forming Your Arizona LLC?

Filing your Articles of Organization is just the beginning. After your LLC is approved, there are a few important items you’ll want to handle so that you can legally operate your new business and give it some protection. The following steps after formation will help set up your finance, stay compliant with taxes, and build your credibility. If you're comparing LLC formation services in Arizona, check out this guide to top-rated providers. Beyond service providers, don’t overlook basic internal safeguards. For example, many people forget to set up a secure login and access (acc) protocol for their online financial tools. Operating a business in Arizona also means staying aware of local regulations and the benefits provided by the state government.

Some things—getting an EIN or opening a business bank account—should be done right away. While others, such as granting licenses and establishing accounting systems, will ensure your operations run smoothly in the long term. Here’s what to do next.

Post-Formation Checklist:

- Apply for an EIN from the IRS. Many owners also choose to secure their business identity with business insurance, and set up a plan to track income and expenses from the start.

- Open a business bank account

- Register for state and local taxes if applicable

- Obtain necessary business licenses or permits. If your primary location is in Phoenix, double-check with the city for any special filing rules or local taxes.

- Create a bookkeeping and accounting system We also recommend using a trusted legal guide or consulting local authority websites to ensure ongoing compliance.

- Set up business insurance coverage

- Draft and sign your Operating Agreement

- Secure your business domain and online presence

If you plan to work with a bank, lender, or major client, you may be asked to provide a Certificate of Good Standing. This document confirms your LLC is legally registered and in compliance. You can order one from the Arizona Corporation Commission for $10 (standard) or $45 (expedited), with the same fees applying to certified document copies.

A Transaction Privilege Tax (TPT) license is required for most businesses in the state from the Arizona Department of Revenue. Similar to a sales tax permit, this license applies to businesses that sell goods or taxable services. You can apply online through azdor.gov. Also check if the business activity or location requires registration at the city level. In addition, some counties may impose an excise tax on the lodging, rental, or utility industries. Review local taxes for your county and type of business.

Arizona LLC Registration and Requirements: Frequently Asked Questions

Still have questions? You're not alone. Many business owners want quick, clear answers before forming an LLC in Arizona. Costs can vary depending on your location—especially for businesses in northern or rural parts of the state. If you're comparing Arizona with other states, this FAQ will help you decide where and how to form your LLC.

What Is the Process for Arizona LLC Registration?

To form an LLC in Arizona, you must have a unique name, designate a statutory agent and file your Articles of Organization. You will file with the Arizona Corporation Commission. If required, publish a formation notice. It usually takes 10–15 business days (standard), or 4–6 days (expedited) — per the Arizona Corporation Commission, May 2025.

How Do You Search for an Existing Arizona LLC?

The Arizona Corporation Commission has an entity search tool you can use to search registered LLCs. Input your business name or file number to check registration details, the current status and the statutory agent. This online tool is free and updated in real time. You can use it to find out if the name is available or whether something else is already using the name. A quick Google search is also a good idea to make sure the name you want isn't widely used.

Can You Form Your Arizona LLC Online?

Yes, Arizona allows you to form an LLC entirely online using the eCorp portal. It's the fastest and most convenient option. You will deal with less paperwork, gain faster approvals and are able to track your application live. Most business owners prefer this method for its simplicity.

Can You Use a Virtual Address or PO Box for Your Arizona LLC?

No, in Arizona, your LLC must provide a physical street address for your statutory agent and principal place of business. PO boxes or virtual address are not accepted unless they include a real street address where someone is available during business hours.

Can You Form an Arizona LLC If You Are Not a US Resident?

Yes, non-US residents can legally form an LLC in Arizona. You don't have to be a citizen or resident to register, own, or operate an LLC. Still, you'll require a US statutory agent, plus further steps for taxes and banking may be necessary. Learn more from the Arizona District Office of the SBA.

Form Your Arizona LLC with Harbor Compliance

Harbor Compliance guides you through every step of Arizona LLC formation with full compliance support.