Are you looking to protect your personal assets by forming an LLC in New Jersey? Wondering which filings and fees you need to handle to launch smoothly? Curious how to move from idea to registered business in just a few simple steps?

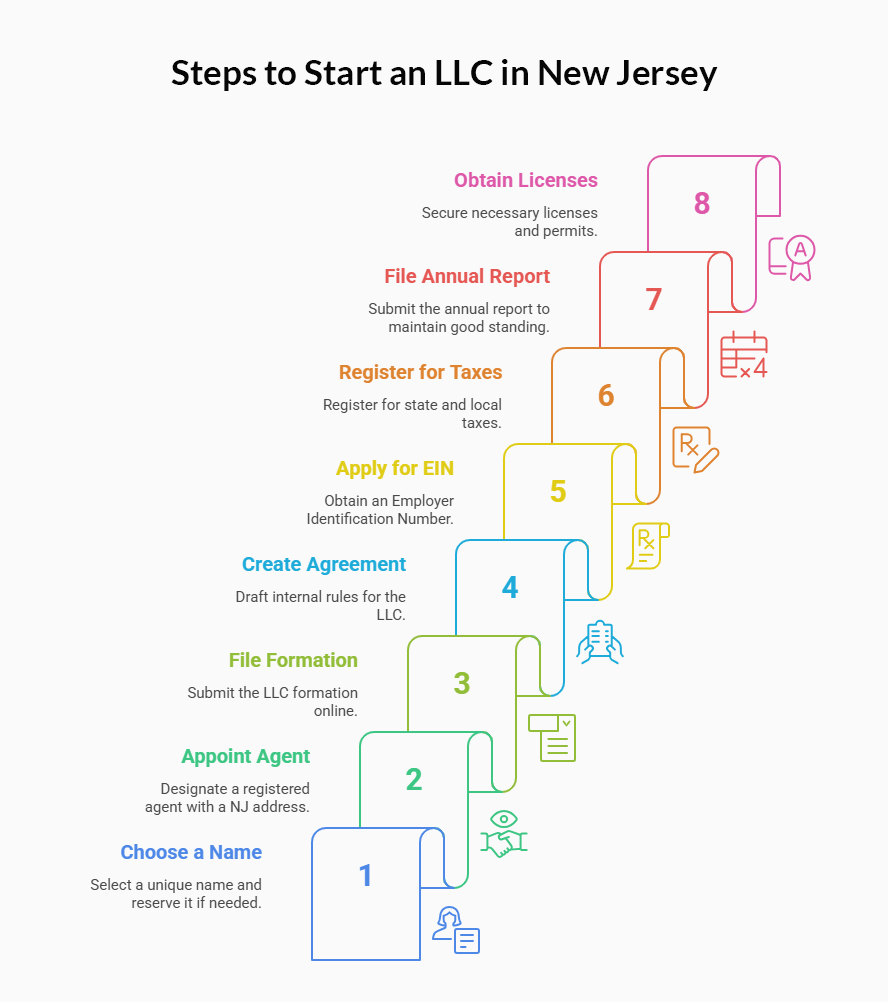

To start an LLC in New Jersey, first choose a unique business name and optionally reserve it for $50. Appoint a registered agent with a physical New Jersey address, then file the Certificate of Formation online through the NJ Business Gateway and pay the $125 filing fee. After state approval—often within minutes—obtain your EIN for free from the IRS and draft an internal operating agreement to define management and profit-sharing. Finally, plan for your annual report due each anniversary month ($75), ensuring ongoing compliance without surprises.

In this guide, you’ll learn:

- Naming rules, availability searches, and optional name reservation

- How to appoint and change your registered agent

- Step-by-step instructions to file your Certificate of Formation

- Post-formation essentials: EIN application, operating agreement, and annual report

Ready to get started? Let’s dive into how to launch your New Jersey LLC!

Why Start an LLC in New Jersey?

Launching a business entity in the Garden State offers far more than proximity to New York City. Founders tap a deep talent pool, coastal logistics hubs, and nation-leading median household income, all while locking in personal-asset protection that sole proprietors lack. Add predictable flat fees and a tech-forward filing system, and New Jersey becomes a practical—not pricey—home base for growth. If you’re weighing other options, see our ranking of the best state to form an LLC for fee and compliance comparisons.

Limited Liability Protection for Owners

Forming a limited liability company wraps your personal car, savings, and home in a legal shield. Courts can pursue only the assets titled to the LLC, not those in your name, if a lawsuit strikes. That single advantage beats general partnerships or sole proprietorships hands-down.

- Creditors cannot seize personal property for business debts

- Your name stays off vendor liens and judgment dockets

- Members choose how much capital to risk, preserving liquidity

- Liability protection applies to both active managers and silent investors

This firewall also bolsters credibility with lenders, who prefer entities that survive owner turnover. Because New Jersey recognizes charging-order protection, a member’s personal creditor can’t vote company interests, keeping day-to-day control safely in house. Need to move quickly? Learn how to form an LLC without a business plan and launch in a single afternoon.

Flexible Tax Treatment and Business Structure

New Jersey lets each business structure pick its own federal tax path. A default LLC enjoys pass-through status—profits land on Schedule C, avoiding double taxation. Elect S-corp treatment and members can draw reasonable salaries, trimming self-employment tax. Larger ventures can even file Form 8832 to be taxed as a C-corp, leveraging lower federal rates and reinvested earnings. Layered atop state options like the Business Alternative Income Tax, these choices let founders tailor cash-flow and exit strategies without changing the underlying entity.

Step 1 – Choose a Name for Your New Jersey LLC

Your name is the first public signal of professionalism. Follow these steps to forming an llc: confirm the label is unique, reserve it if needed, and secure any trade names before signing a lease or printing marketing swag.

Naming Rules and Restrictions in New Jersey

The state demands that every llc in new jersey name be “distinguishable” from existing entities. Adding punctuation or changing “Company” to “Co.” won’t fly. You must include “LLC,” “L.L.C.,” or “Limited Liability Co.” and avoid restricted words like “Bank,” “Trust,” or “Insurance” without regulator approval. Names can’t imply government affiliation or contain obscene language, and they can’t mislead consumers about professional licensing. Finally, your chosen label may not exceed 200 alphanumeric characters, including spaces.

Search Name Availability via NJ Business Portal

Start at the business registration lookup on the New Jersey Business Gateway. Enter the exact spelling, then try common variations and plurals. The portal flags active, revoked, and merged entities—anything too close is off-limits. Run trademark and domain checks next; overlapping with a federal mark can trigger costly rebranding. Screenshot your clear search results and save the PDF—they serve as evidence if someone later contests your use.

Reserve Your LLC Name (Optional – $50 Fee)

If branding work will stretch past today, file Form UNRR-1 and pay the filing fee of $50 to lock the name for 120 days. The online form auto-approves in minutes, emailing a reservation number you’ll enter when you later submit your Certificate of Formation. You can renew once for another 120 days, but a second extension requires showing “good cause,” so time your designers and trademark attorneys accordingly. Skip the reservation altogether if you’re ready to file now—New Jersey processes full formations just as quickly.

Register a Trade Name (DBA) in New Jersey

Running storefronts under a catchy label? File a County Trade Name Certificate to add that alias to public records filing. Costs vary by county—$50 in Bergen, $54 in Atlantic City—and the record lasts five years. Unlike the state-level LLC name, DBAs can duplicate across counties, so confirm neighboring jurisdictions if you plan regional expansion. Banks demand the stamped certificate before opening POS merchant accounts, and ecommerce platforms may freeze payouts without it, so handle DBA paperwork before your launch countdown hits zero.

Step 2 – Appoint a Registered Agent

Every filing must list a registered agent with a Garden State street address to accept lawsuits and tax mail. Choose wisely: this contact becomes the public face of your legal correspondence and determines how quickly you learn about compliance deadlines.

Who Can Be a Registered Agent in NJ?

Any adult resident or domestic legal entity can serve—yourself, an employee, or a commercial provider—as long as the address isn’t a P.O. box and someone is available during business hours. Out-of-state corporations must appoint a New Jersey agent before the Jersey Division of Revenue approves their authority filing. For more on qualifying foreign versus domestic entities, check out our domestic LLC guide. Residential agents should post their names on the mailbox; sheriffs will not leave service with roommates or doormen. Remember, missing a court summons because you were on vacation doesn’t excuse default judgment.

Self vs. Commercial Agent: Pros, Cons, and Costs

Acting as your own agent costs nothing, but your home address hits the public database, and you must be present 9-to-5. A commercial service keeps you private, scans mail same-day, and forwards alerts for the business owners who travel—or sleep past delivery hours.

| Option | Annual cost | Privacy | Compliance alerts | Multi-state expansion |

|---|---|---|---|---|

| Self | $0 | Low (address public) | Manual tracking | Must appoint new agents |

| Commercial provider | $99–$149 | High (provider address) | Email & SMS reminders | One dashboard for all states |

Most high-growth founders spring for a service once investor due-diligence or media exposure makes privacy priceless. To compare top platforms, explore our review of the best LLC service in NJ.

Step 3 – File the Certificate of Formation

New Jersey brings everything online, so the moment you submit the certificate of formation your LLC pops into the state database—usually within minutes. Treat this filing as your company’s birth certificate; banks, landlords, and insurers will all ask for the stamped PDF before doing business. Curious about overall timing? Learn how long it takes to form an LLC in NJ.

Required Information to Include

The Jersey Division of Revenue keeps the form short, yet each blank line matters. Gather every detail first to avoid time-out errors and duplicate filings.

- Legal name exactly as cleared in Step 1

- Physical and mailing addresses for the principal office

- Registered-agent name and street address

- LLC purpose—“any lawful activity” is fine for most industries. Unsure what to write? Get guidance on crafting your business purpose for LLC statement.

- Duration (leave “perpetual” unless you plan a sunset date)

- Name and signature of the organizer filing online

Once you form an llc with accurate data, the system issues an entity ID and payment receipt. Store both in cloud storage; you’ll need the ID when you open tax accounts and apply for local permits.

Online Filing vs. Paper Filing – Process & Fees

Most founders file through the state’s NJ Business Gateway because the portal approves instantly and the $125 card payment posts immediately. For a complete step-by-step walkthrough, see our guide on how to form an LLC. Paper submissions take three to five business days plus mail time and still carry the same $125 charge—no discount for old-school envelopes. The jersey department of Treasury will return paper forms that arrive without the exact name, required suffix, or agent consent, costing you weeks. Online filers can correct typos the same day for $25, while paper filers must start from scratch. Unless a lender demands wet signatures, digital wins on speed, error handling, and automatic PDF storage.

Get the NJ Business Registration Certificate (BRC)

Right after approval, head back to the portal and download your BRC. This document proves tax registration and is mandatory before bidding on state contracts or applying for a business bank account. The certificate is free, but you must enter your entity ID and NAICS code correctly; typos trigger a help-desk ticket that can take 72 hours to resolve. Print one copy for storefront posting—the Division of Taxation may fine $100 if it isn’t displayed during inspections.

Start Your New Jersey LLC Online With ZenBusiness

Avoid paperwork errors, instant approval delays, and compliance stress. ZenBusiness helps you file, get your EIN, and stay compliant — fast.

Step 4 – Create an Operating Agreement

An operating agreement turns legal theory into day-to-day reality. New Jersey doesn’t collect or review the document, yet courts rely on it to settle fights over money, voting, and buyouts. Skipping this step leaves your fate to default statutes that rarely match founder intent.

- Define capital contributions and future funding rounds

- Set voting thresholds for admitting new members or approving debt

- Outline profit distributions—percentages, schedules, and reserves

- Establish exit routes: death, divorce, or voluntary sale

- Choose mediation or arbitration venues to dodge drawn-out lawsuits

Whether you’re bootstrapping in Hoboken or courting VC money near atlantic city, a clear agreement signals professionalism and protects friendships. Single-member LLCs gain credibility, too; the document proves a clean line between personal and company assets, reinforcing liability protection if creditors ever challenge the veil.

Step 5 – Apply for an EIN (Employer Identification Number)

Think of an EIN as your LLC’s Social Security number—every payroll check, wholesale purchase, and tax return pivots on this nine-digit ID. Obtaining one is free, and the IRS approval letter often lands in less time than it takes to brew coffee, so don’t let the employer identification step linger on your to-do list.

Do You Need an EIN for Your LLC?

If your LLC hires staff, opens a U.S. bank account, or elects S-corp status, the internal revenue service requires an EIN. Even single-member companies benefit: vendors prefer it over sharing a Social Security number, and Stripe or PayPal will hold funds if the tax ID is missing. Multi-member entities have no choice—federal law demands an EIN before the first informational return. In short, securing the identifier early eliminates banking and payroll hiccups later.

Apply Online at IRS.gov (Free Process)

IRS.gov’s wizard walks you through five screens. Pick “Limited Liability Company,” enter member count and state, then supply the organizer’s SSN or ITIN. The site issues the EIN instantly and generates a PDF CP-575 letter—download and email it to your bank the same morning you start an llc account. International owners without SSNs fax Form SS-4 and get approval within four business days. Guard the EIN; scammers mine new-entity lists. Update it only if you change the tax classification or add new payroll states.

Step 6 – Comply with NJ Tax and Regulatory Requirements

New Jersey rewards diligent founders with fast approvals, but it also penalizes those who ignore tax sign-ups. This section shows how to register with the jersey division of revenue, collect sales tax, and keep multi-member returns on schedule—tasks that protect cash flow and credibility with lenders.

Register for Employer Withholding if Hiring Staff

Any LLC issuing a W-2 must open a Combined Registration Application (CRA) account before the first payroll run. The online wizard activates your business registration number, assigns a withholding schedule, and links you to Taxation’s EFT platform. Within ten days you’ll receive PINs for quarterly RT-W reconciliations; missing them risks a 5 % late penalty plus daily interest. Outsourcing payroll? Add your provider’s bank routing in the CRA to avoid rejected ACH debits and employee pay delays.

Sales Tax Certificate of Authority for Retailers

Selling taxable goods or SaaS in New Jersey demands a Certificate of Authority (Form NJ-REG). Registration is free, but the state expects electronic returns once gross receipts pass $100,000 or 200 transactions. Your sales tax rate starts at 6.625 %, then local Urban Enterprise Zones may slice it to 3.3125 %. Display the certificate at every physical location—inspectors fine $100 per unposted site and can padlock repeat offenders.

Partnership Return Filing for Multi-Member LLCs

Two-plus-member LLCs file Form NJ-1065 even if electing pass-through status. Attach federal Schedule K-1s, allocate income using New Jersey sourcing rules, and remit the Business Alternative Income Tax if owners exceed the safe-harbor threshold. Forgetting this annual report leads to a $100 per month penalty, capped at $2,000—steep enough to erase small-team profits.

Estimated Tax Payments for Certain LLC Types

LLCs taxed as C-corps or under BAIT must submit quarterly estimates via Form CBT-150. Underpay by more than 10 % and the Division adds a 5 % interest charge on the shortfall. Automate EFT debits through the division of revenue portal to hit the April, June, September, and December checkpoints without manual math.

CBT-100 Filing for Electing Corporations

If your LLC chooses C-corp status, file Form CBT-100 by the fifteenth day of the fourth month after year-end. The flat 9 % income tax applies to entire net income, but credits for R&D, urban jobs, or film production can trim liability. Attach your federal 1120 and pay online to avoid a $200 paper-processing surcharge.

Step 7 – File the New Jersey Annual Report

Think of the annual report as your LLC’s yearly wellness check: update addresses, confirm managers, and pay a modest $75 to keep standing active. Missing this one-page form turns your business entities status to “revoked,” blocking bank loans and dissolving liability protection until you reinstate.

Annual Due Date and $75 Filing Fee

Your report is due the last day of your LLC’s anniversary month. Log into the Business Gateway, verify registered-agent data, and submit the $75 card payment. Late filers owe an extra $25; after 120 days, the Revocation Unit pulls your charter and charges $200 to restore it. Plan a recurring calendar alert or delegate the task to your registered agent service—it’s cheaper than resurrection paperwork. For detailed instructions on your yearly filing, see our guide to the LLC annual report in New Jersey.

How to File Online via the NJ Business Gateway

Navigate to “File Annual Report,” enter your 10-digit entity ID, and authenticate with EIN or officer name. The portal auto-loads last year’s info; edits take seconds. Download the receipt PDF and email it to lenders as proof of good standing. Paper submissions vanished in 2024, so the division of revenue no longer accepts checks—digital is mandatory.

Step 8 – Obtain Necessary Business Licenses and Permits

Licensing in New Jersey is a patchwork: state boards, county clerks, and shore-town inspectors each add layers. Map every requirement early so your limited liability partnership passes audits and opens on schedule.

- State-level: contractors need a $110 Home Improvement Contractor number; salons register with the Cosmetology Board for $195.

- County-level: food handlers take an $80 safe-serve course; health departments inspect annually.

- Municipal: Atlantic City’s mercantile license runs $150 and renews each June.

Budget fingerprinting fees and zoning hearings—$50 to $300 depending on township. Keep approval letters in a compliance binder; forgetting to renew can trigger daily fines or forced closures during peak season.

Ongoing Compliance Requirements

Once your LLC is live, staying compliant is a marathon, not a sprint. New Jersey keeps the checklist short, but business owners who miss a single step can see bank loans stalled or liability shields pierced in court. Use the timeline below to make ongoing tasks automatic rather than last-minute scrambles.

- Every January 15 – confirm payroll tax tables and renew workers’-comp policies

- Anniversary month – file the $75 Annual Report and update the registered agent address if you’ve moved

- Quarterly – remit sales-tax returns and, if elected, Business Alternative Income Tax estimates

- Within 30 days of ownership change – amend the Certificate of Formation online ($25)

- Five-year mark – renew county trade-name certificates and check that your operating agreement still matches reality

Build these dates into project-management software or let your commercial agent push SMS reminders. A five-minute filing today costs far less than a $200 late penalty or, worse, administrative revocation that erases years of brand equity.

FAQs – New Jersey LLC Formation

Starting a company shouldn’t feel like decoding tax code. The answers below cut through legal jargon so you can act with confidence and launch faster. Each response is based on current 2025 guidelines from the jersey division of revenue.

How long does it take to start an LLC in New Jersey?

Online filings usually stamp “Approved” within 10 minutes, while paper forms take three-to-five business days once they reach Trenton. Add a day if the name search flags corrections. Need speed? File before 3 p.m. ET to get same-day PDFs for bank-account openings.

What’s the total cost to form and maintain an LLC in NJ?

Expect $125 for the Certificate of Formation and $75 each year for the Annual Report. Optional costs include $50 for name reservation, $99 – $149 for a commercial registered agent, and county-level DBA fees around $54. All-in, most single-member LLCs spend $300 – $450 in year one and $174 – $224 in subsequent years.

Can I form an LLC without living in New Jersey?

Yes. Non-residents can form an llc so long as they appoint an in-state registered agent with a physical street address. You’ll still file the same online forms, but plan on paying out-of-state income tax where you reside plus New Jersey tax on income sourced inside the Garden State.

Is a business license mandatory for all LLCs in NJ?

No blanket license exists, but industries touching health, safety, or finance—like daycare, food service, and real-estate brokerage—need state board approval. Many municipalities, including atlantic city, also require mercantile permits. Check state, county, and city lists before opening to avoid surprise shutdown orders.

Can I change my registered agent later?

Absolutely. File the Commercial Registered Agent Change (Form REG-RA) online, pay $25, and the new agent activates immediately. Remember to update your bank and insurance carriers so legal mail doesn’t bounce. Skipping the update risks default judgments if a lawsuit lands at the wrong door.

Choose Harbor Compliance as Your New Jersey Registered Agent

Harbor Compliance ensures your New Jersey business never misses a notice with professional Registered Agent service.