Starting an LLC in 2025 goes beyond the initial filing fees—it involves ongoing costs that can vary significantly based on your business's location and needs. Whether you're a first-time entrepreneur or an established professional, understanding these expenses is crucial to budgeting effectively and avoiding surprises.

From state-specific filing fees to annual reports and optional services, forming an LLC comes with financial responsibilities that provide valuable legal protections and operational advantages. Knowing these costs upfront helps you make informed decisions and set a strong foundation for your business.

In this guide, we’ll cover:

- The full cost breakdown of starting and maintaining an LLC.

- State-by-state comparisons of filing fees in 2025.

- Strategies to reduce costs without compromising quality or compliance.

Let’s dive in and uncover the true cost of launching your LLC this year!

The True Cost of Starting an LLC in 2025

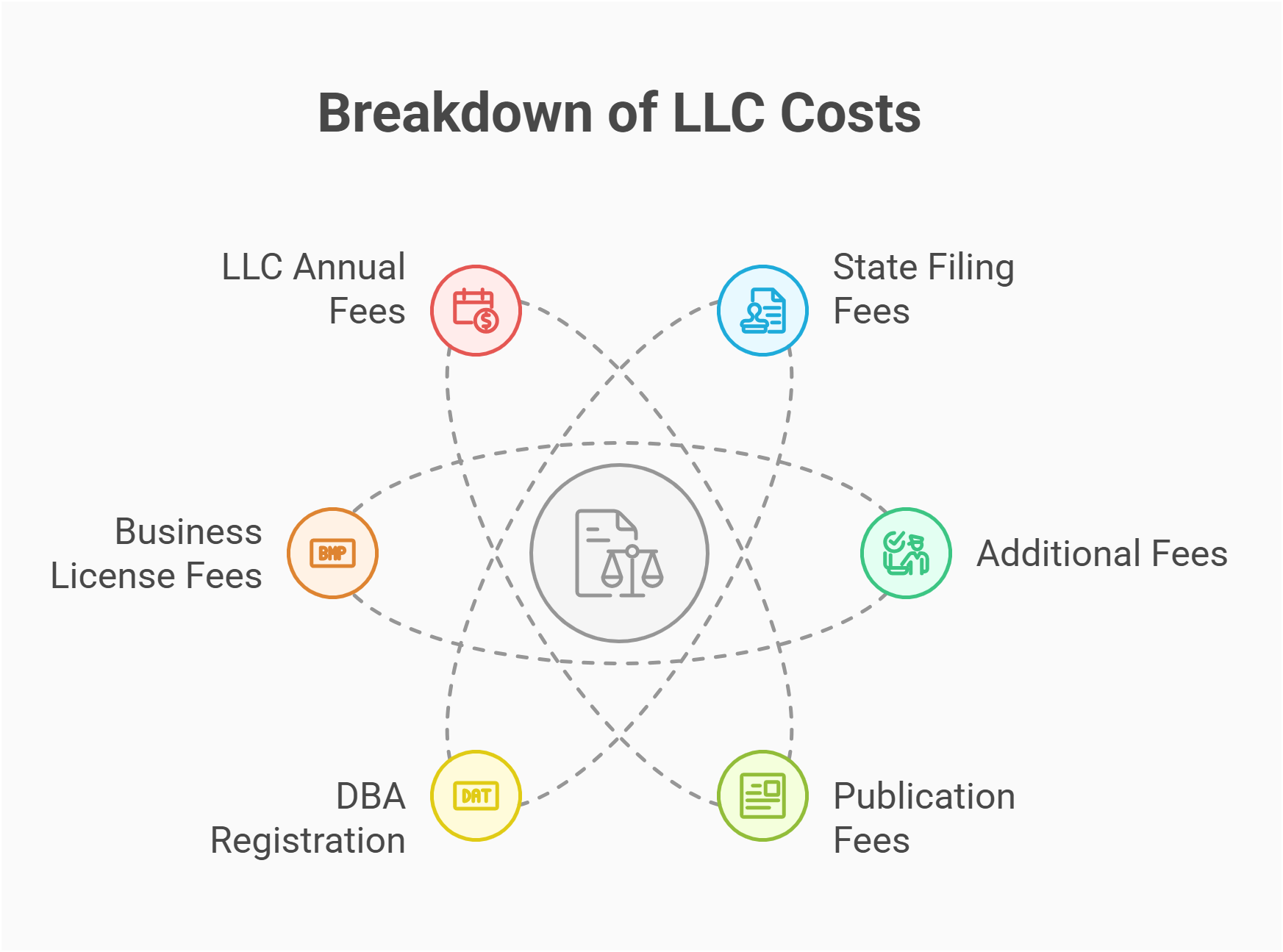

Launching an LLC isn’t just about a one-time filing fee; there are ongoing expenses that pop up every year or at key stages of growth. While these fees can feel like obstacles, they often provide valuable legal protections. Below, we’ll examine the core outlays, why cost to start an llc can differ between states, and typical price ranges across the nation.

Understanding LLC Filing Fees

When you form your llc with the state, you generally file articles of organization and pay a state filing fee. These costs required to form an LLC cover official administration. For some states, this sum is quite low; for others, it can be more than a few hundred dollars. Typically:

- The minimum cost of filing might be around $50 to $150 for most states.

- Additional fees might apply if you expedite paperwork or orm an foreign llc.

- Some states have separate charges if you must also publish a notice (like in new york).

Understanding your state’s baseline helps you gauge whether you should consider an alternative business structure or location to keep expenses manageable.

Why LLC Costs Vary by State and Business Needs

These differences don’t hinge solely on geography. Each jurisdiction sets unique rules for state filing fees and overall compliance. That’s why an LLC in new mexico might cost less than an llc in new york or llc in colorado. Also, depending on the complexity of your company—like if it’s a company with multiple members or if you’re planning advanced ventures—your llc operating agreement or licensing fees may require more investment. If you foresee expansions, a robust setup at launch may also save you from additional costs down the road.

Average Cost of Starting an LLC Across the U.S.

While there’s no single average cost that fits every region, fees tend to fall within a broad bracket:

- $50 to $150 in states known for affordability

- $200 to $500 in high-cost jurisdictions or those with additional publication rules

- Possibly $0 in states offering special promotions, though that’s rare

Below are some typical line items you’ll see across the country:

- Initial llc formation filing

- Optional DBA or trade name registration

- Business license or permit fees

- LLC annual fee or recurring periodic report charges

By clarifying these charges in advance, you can realistically forecast the cost to form an llc and minimize sticker shock.

usiness credit—you also inherit potential pitfalls. The LLC might have hidden debts, pending lawsuits, or outdated tax returns. A negative reputation can also hamper future growth. Knowing these issues, you must carefully evaluate every aspect, from outstanding tax purposes to intangible factors like staff morale or prior management mishaps. Proper due diligence is key to ensuring you buy a strong foundation rather than a sinking ship.

Filing Fees for LLCs: A State-by-State Comparison

Although your baseline cost to create an llc largely depends on location, certain states stand out for affordability, while others demand heftier sums. Below, we’ll show you which ones rank as the cheapest for LLC formation and the priciest. We’ll also detail filing fees for all 50 states in 2025—so you can see at a glance whether your llc might cost more or less than you’d expect.

Cheapest States to Start an LLC: Where to Save Money

Some states truly shine in cost-effectiveness for new or small business setups. According to current data (updated for 2025), these are the top 10 budget-friendly states for an LLC:

- Kentucky – Low initial filing, modest recurring fees

- Michigan – Competitive base fee, straightforward compliance

- Missouri – Reasonable filing with minimal annual obligations

- Arkansas – Affordable formation plus easy updates

- Delaware – Known for corporate benefits, but LLC fees can be low for basic structures

- Iowa – Simplified process and moderate ongoing costs

- Indiana – Generally low cost to start your llc and maintain

- Montana – Inexpensive registration, though specialized businesses may pay extra

- New Mexico – Offers one of the lowest filing fees in the Southwest

- Wisconsin – Minimal state fee, plus friendly environment for growth

Note: Even if your home state isn’t on this list, sometimes it’s better to file where you operate, especially if forming an out-of-state LLC triggers extra compliance or corporate income tax obligations.

Start Your LLC Today

Launch your LLC effortlessly with Northwest Registered Agent. Simplify filings and secure compliance with expert support.

States with the Highest Filing Fees: What to Expect

On the flip side, states like California or Massachusetts carry notably higher up-front costs. For instance, California imposes at least $70 to file but also includes an annual fee (the dreaded $800 minimum tax for many LLCs). Meanwhile, Massachusetts may require $500 or more for initial registration. Bear in mind that a higher filing fee doesn’t always translate to better benefits; it’s often tied to local tax structures or franchise tax rules.

Filing Fees in All 50 States (2025)

Below is a snapshot of each U.S. state in alphabetical order. The details reflect the cost of filing an LLC, the official website link for formation references, and any relevant remarks. These state fees and notes are updated for 2025 but may also vary if legislatures introduce new rules:

| State | 2025 LLC Filing Cost | Official Gov Address (Link) | Remarks | Annual Report Cost | Processing Time |

|---|---|---|---|---|---|

| Alabama | $150 | Alabama Secretary of State | Additional county fees may apply | Varies | Varies |

| Alaska | $250 | Alaska Division of Corporations | Relatively straightforward formation process | Varies | Varies |

| Arizona | $50 | Arizona Corporation Commission | Publishing notice required in some counties | Varies | Varies |

| Arkansas | $45 | Arkansas Secretary of State | Known for minimal annual obligations | Varies | Varies |

| California | $70 (plus $800/yr) | California Secretary of State | Franchise tax of $800 per year if revenue is over a threshold | $800 | Varies |

| Colorado | $50 | Colorado Secretary of State | e-Filing makes it simple and quick; llc in colorado remains popular | Varies | Varies |

| Connecticut | $120 | Connecticut Secretary of State | Higher recurring fees if you fail to file annual report | Varies | Varies |

| Delaware | $90 | Delaware Division of Corporations | Famous for corporate-friendly laws, does not exempt LLCs from annual fees | $300 | 1-2 weeks |

| Florida | $125 | Florida Department of State | Annual report required, or face steep penalties | $138.75 | 2-3 weeks |

| Georgia | $100 | Georgia Corporations Division | Must keep llc name records updated | $50 | 1-2 weeks |

| Hawaii | $50 | Hawaii Business Express | Online filing recommended | $15 | 1-2 weeks |

| Idaho | $100 | Idaho Secretary of State | Foreign LLC also requires certificate of authority | $0 | 2-3 weeks |

| Illinois | $150 | Illinois Secretary of State | Annual maintenance around $75 | $75 | 2-3 weeks |

| Indiana | $95 | Indiana Secretary of State | Great for small business with minimal overhead | $50 | 1-2 weeks |

| Iowa | $50 | Iowa Secretary of State | Very affordable initial filing | $60 | 1-2 weeks |

| Kansas | $160 | Kansas Secretary of State | Must file annual report every year | $50 | 2-3 weeks |

| Kentucky | $40 | Kentucky Secretary of State | Among the cheapest states to form an LLC | $15 | 1-2 semaines |

| Louisiana | $100 | Louisiana Secretary of State | Additional local taxes might apply | $25 | 2-3 semaines |

| Maine | $175 | Maine Secretary of State | Simple online system, includes annual report fees | $85 | 2-3 semaines |

| Maryland | $100 | Maryland Business Express | Must pay personal property return if holding business assets | $300 | 2-3 semaines |

| Massachusetts | $500 | Massachusetts Secretary of the Commonwealth | Higher up-front cost, but stable corporate environment | $500 | 3-4 semaines |

| Michigan | $50 | Michigan Corporations Division | Notable for lower cost to forming an llc, plus user-friendly e-file | $25 | 1-2 semaines |

| Minnesota | $135 (paper), $155 online | Minnesota Secretary of State | Online filing slightly pricier but faster | $50 | 2-3 semaines |

| Mississippi | $50 | Mississippi Secretary of State | Reasonable setup fees | $25 | 1-2 semaines |

| Missouri | $50 (online) | Missouri Corporations | Typically considered low cost | $40 | 1-2 semaines |

| Montana | $70 | Montana Secretary of State | No sales tax environment, but watch for local fees | $20 | 2-3 semaines |

| Nebraska | $100 | Nebraska Secretary of State | Publication might be required | $30 | 2-3 semaines |

| Nevada | $75 + additional fees | Nevada Secretary of State | Higher business license fee, known for corporate-friendly laws | $200 | 2-3 semaines |

| New Hampshire | $100 | New Hampshire Corporation Division | Annual requirements for renewal | $100 | 2-3 semaines |

| New Mexico | $50 | New Mexico Secretary of State | Among the lowest in the nation | $0 | 1-2 semaines |

| New York | $200 | New York Department of State | Publication required in certain counties, can raise total cost | $9 | 3-4 semaines |

| North Carolina | $125 | NC Secretary of State | Single member llc easily formed, annual reports needed | $202.50 | 2-3 semaines |

| North Dakota | $135 | North Dakota Secretary of State | Includes initial articles filing | $50 | 2-3 semaines |

| Ohio | $99 | Ohio Secretary of State | No annual or biennial reports for LLCs | $0 | 1-2 semaines |

| Oklahoma | $100 | Oklahoma Secretary of State | Straightforward process, plus modest recurring fees | $25 | 2-3 semaines |

| Oregon | $100 | Oregon Secretary of State | $100 annual report each year | $100 | 2-3 semaines |

| Pennsylvania | $125 | PA Department of State | Sliding scale for certain specialized filings | $70 | 2-3 semaines |

| Rhode Island | $150 | Rhode Island Department of State | Must file an annual report to keep in good standing | $50 | 2-3 semaines |

| South Carolina | $110 | SC Secretary of State | Straightforward approach, but local taxes vary | $25 | 2-3 semaines |

| South Dakota | $150 | South Dakota Secretary of State | Low overall taxes, but watch out for specialized fees | $50 | 2-3 semaines |

| Tennessee | $300 (min) | Tennessee Secretary of State | Annual fee can be $300 or more, based on member count | $300 | 3-4 semaines |

| Texas | $300 | Texas Secretary of State | Also has separate franchise tax for certain LLCs | $0 | 2-3 semaines |

| Utah | $70 | Utah Division of Corporations | Good environment for start an llc with simple reporting | $15 | 1-2 semaines |

| Vermont | $125 | Vermont Secretary of State | Must file an annual/biennial report | $35 | 2-3 semaines |

| Virginia | $100 | Virginia SCC | Straightforward online system | $50 | 1-2 semaines |

| Washington | $180 | Washington Secretary of State | City-level B&O taxes can apply | $60 | 2-3 semaines |

| West Virginia | $100 | WV Secretary of State | Maintain an llc easily with moderate annual fees | $25 | 2-3 semaines |

| Wisconsin | $130 | WI Department of Financial Institutions | Low overhead, e-filing recommended | $25 | 2-3 semaines |

| Wyoming | $100 | Wyoming Secretary of State | Popular for liability protections, often chosen by out-of-state owners | $50 | 2-3 semaines |

Keep in mind, data cost varies if legislatures enact new policies or if specialized add-ons (like professional licensing) apply to your business.

Additional Costs When Forming an LLC

Beyond the mandatory state fees, a few optional or secondary expenses can pop up, especially if you’re leveraging professional help or require certain documents. Below, we’ll explore common add-ons like a registered agent or an official operating agreement—and whether they’re worth the price.

Registered Agent Fees: What to Know Before You Choose

A registered agent service typically handles official mail, ensuring you never miss lawsuits or government notices. The cost might be:

- $0 if you act as your own agent (but that can hamper privacy)

- $100–$300 per year if using a professional agent

- Possibly higher for premium coverage, like 24/7 phone support

Most business owners prefer a professional to keep personal addresses off public records. Plus, you avoid risking loss of good standing if you’re unavailable to receive crucial documents.

Operating Agreement Costs: DIY vs Legal Services

While not always mandatory with the state, an llc operating agreement clarifies membership roles and distributions. Below is a table contrasting the standard approaches:

| Option | Approx. Cost | Key Benefit |

|---|---|---|

| DIY (Template) | $0 – $50 | Simple for a single member LLC, fast to complete |

| Online Legal Document | $50 – $200 | Basic customization with disclaimers |

| Full Attorney Drafting | $300 – $1,000+ | Thorough coverage of all scenarios |

For many small business owners, a template suffices, but if your LLC has multiple partners or intricate profit-split structures, paying an attorney might ensure airtight clarity. For many small business owners, a template suffices, but if your LLC has multiple partners or intricate profit-split structures, attorney fees for creating an LLC might ensure airtight clarity.

EIN Registration: Is It Really Free Through the IRS?

Yes, the internal revenue service offers Employer Identification Numbers (EIN) at zero cost. Simply apply online via the IRS website. Some third-party LLC formation platforms tack on charges for “EIN acquisition,” but you can always do it yourself. An EIN is crucial if you want a separate bank account or llc taxed differently (like an S-corp). Just be sure to complete the process on the official IRS site, and you’ll dodge unnecessary fees.

Hidden Costs You Shouldn’t Overlook

A handful of smaller or less obvious expenses can take new owners by surprise. These may not appear at initial formation but pop up as your enterprise grows or changes. Planning for them means fewer stress points and a more realistic forecast.

Business Licenses and Permits: Are They Mandatory?

In most states, certain professions—like contractors, real estate agents, or health providers—need state or local licenses. Even everyday services might require a local permit. To inspire your own, explore our LLC names examples to find the perfect name for your business. These fees can be minimal or quite steep, depending on your field. Some municipalities demand you hold a city business license that you renew every year. If you skip these, you risk fines or forced closures.

Trademarking Your Business Name: How Much Does It Add?

If your brand is unique or national in scope, trademarking can protect it. Costs typically begin around $225 to $400 per class of goods or services when filing with the USPTO, plus attorney fees if you want expert help. While not mandatory to start an llc, it’s a wise step if you plan to expand across multiple states, preventing copycats from leveraging your name or logo.

Premium LLC Formation Services: Are They Worth It?

Numerous online providers bundle convenience features like “fast-track filing,” compliance reminders, or specialized docs. While some owners find these perks valuable, others see them as upsells. If you’re comfortable filing yourself, skipping extra packages can slash expenses significantly. On the other hand, if you’re short on time or prefer hands-free solutions, it may also be worth paying a bit more for guaranteed thoroughness.

Affordable LLC Setup

ZenBusiness helps you form and maintain your LLC without breaking the bank. Save time and cut costs with their streamlined services.

Ongoing Costs of Maintaining an LLC

Forming your company is just the first step. You’ll likely face recurring fees, which can include an annual fee, franchise tax, or renewal costs. Understanding them ensures you can maintain an llc in good standing year after year.

Annual Report Fees: How They Vary by State

Filing an annual report or periodic report typically runs $20 to $200, depending on the jurisdiction. In some places, you’ll pay this per year, in others it’s every two. Missing these deadlines often leads to late penalties, possibly even an administrative dissolution of your LLC. This is crucial: once your business is dissolved at a state level, you lose liability protections and may have to re-file from scratch.

Franchise Taxes: States That Require Them

A handful of states, such as California and Texas, impose a franchise tax on entities. This tax isn’t identical to corporate income tax but ensures the state profits from your right to do business within its borders. The cost often scales with your revenue or capital. If you operate in a high-tax region, your LLC might see an annual bill of a few hundred dollars or more. Understanding your local code ensures you’re not blindsided by extra levies.

Compliance Costs: Staying in Good Standing

Beyond paying renewal fees, you might need to update your llc name or articles of organization if membership shifts. Some states also require you to re-confirm contact details each year, or to confirm no changes if everything remains stable. Meeting these minor tasks—like a quick statement listing members—keeps your LLC in compliance. Failing to do so can accumulate fines, undercut your liability shield, or hinder new expansions.

Cost Breakdown for Online LLC Formation Services

Multiple online services compete to help you start an llc, each offering a variety of plans. Some keep it bare-bones; others tack on advanced features for an extra fee. Understanding what these packages include can keep you from overspending.

Comparing Popular Platforms: LegalZoom, ZenBusiness, Harbor Compliance, Rocket Lawyer

LegalZoom

Known for brand recognition. They’ll handle filing fees but often upsell on compliance notifications. Good for general support but can be pricier.

ZenBusiness

Offers llc formation service with straightforward tiers. Typically more budget-friendly than major competitors. Known for user-friendly dashboards.

Harbor Compliance

Tailored for high compliance needs, especially if you’re in heavily regulated industries. Registered agent service is integrated with deeper compliance checks.

Rocket Lawyer

Focuses on ongoing legal support. Good if you want broader legal docs—like will drafting or advanced operating agreements—beyond LLC formation.

Standard Plans vs Premium Features: Which Offers Better Value?

Many providers’ base packages cover essential tasks—like verifying the process to start your LLC—while skipping niceties like an official binder or expedited shipping. If you prefer a quick, no-frills approach, standard tiers might suffice. Premium plans, however, may include ongoing compliance reminders, business website creation, or advanced document management. Weigh your convenience versus paying for benefits you may also replicate on your own.

How to Avoid Upsells and Hidden Fees in Online Platforms

To dodge surprising charges:

- Inspect the checkout screen carefully for pre-checked add-ons

- Understand cost to maintain after the first year (some freebies expire)

- Compare final totals across at least two platforms

- Look for disclaimers on “free” services that require monthly membership

A little vigilance ensures you pay only for the cost to form an llc service you genuinely want.

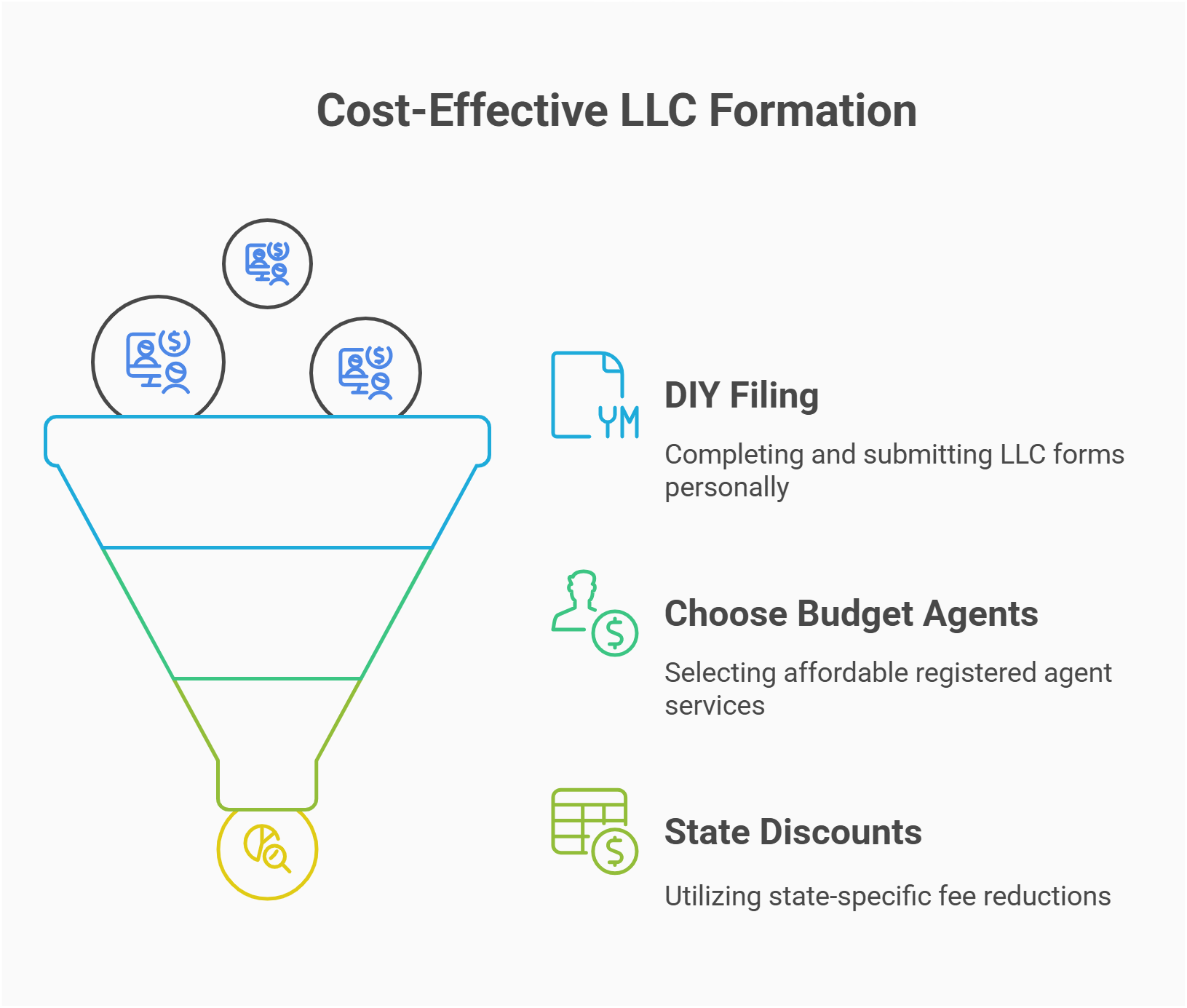

Reducing LLC Costs Without Sacrificing Quality

While forming an LLC can be pricey, you can cut corners responsibly. Below, we’ll highlight how to handle a do-it-yourself approach for llc formation, pick budget-friendly agent services, or exploit unique state programs that lighten the financial load.

Filing Your LLC Yourself: Steps and Potential Savings

By skipping a middleman, you handle the process to start your business personally:

- Gather and complete your articles of organization from the official website

- Submit them through your state’s e-file system or mail them in

- Pay the standard state filing fees directly—no markup

- Confirm receipt from the state, finalizing your registration

- Create or sign an llc operating agreement

This self-service route typically saves you $50–$300 compared to some formation services. However, it might take a bit more time to research state forms. If you’re looking to minimize expenses, consider using a cheap LLC service that offers essential features without unnecessary add-ons.

Choosing Affordable Registered Agent Services

If you prefer not to handle official mail at your home or office, consider a cheaper agent service. Some well-known providers offer annual coverage around $100–$120. Watch out for offers that promise “$0” but require monthly add-ons. The key is to ensure they’ll promptly forward all documents and keep your contact details updated with the state.

Taking Advantage of State-Specific Discounts

Some states occasionally promote new business expansions with lower llc annual fee or waived initial filings for new ventures. For instance, Colorado historically adjusted rates for certain periods, letting you pay below the usual colorado secretary of state fee. Checking your state’s official site or announcements can uncover short-term promotions. This might become even more relevant if you’re flexible on where to incorporate or if you’re scouting multiple jurisdictions.

Advanced Strategies for Cost Management

For some businesses, even small cost differences can add up. Entrepreneurs looking to operate across state lines, or those seeking the most favorable tax environment, may consider more intricate strategies. Let’s look at multi-state LLC tactics, plus ways to reduce burdens from taxes and overhead.

Forming an LLC in a Cost-Friendly State: Pros and Cons

Registering in a low-fee place—like new mexico or Wyoming—might shrink initial outlays. Yet, if your physical operations remain in another jurisdiction, you’ll often need to register as a foreign llc there, incurring additional fees and paperwork. This approach can still be beneficial, but weigh the potential savings against compliance tasks in both states. Some owners find the hassle outweighs any short-term cost breaks.

Multi-State LLC Costs: How to Optimize for Savings

Expanding beyond your home base might require separate filings, each with unique annual fee obligations. If you plan to do business in multiple areas, consider:

- Centralizing operations in the cheapest feasible state

- Minimizing overhead by partnering with local reps, avoiding a full foreign registration if possible

- Checking local regulations on franchise tax if your revenue surpasses certain thresholds

Clarity on these points ensures no unexpected charges hamper your multi-state ambitions.

Leveraging Tax Deductions to Offset LLC Formation Expenses

Business-related startup fees are often deductible under federal tax law, subject to caps. Consult the internal revenue service guidelines to see how to categorize and write off your formation spending. If your llc invests heavily in state fees or trademark protection, part of that might reduce your income tax burden. By carefully tracking each cost, you might recoup a portion come tax season.

Special Cost Considerations for Different Business Types

Not all LLCs operate the same. If you’re in real estate, e-commerce, or freelancing, each domain has distinct cost variables. Understanding these can help tailor your budget and ensure your llc with the right strategy for your field.

Real Estate LLCs: Unique Fees and Expenses

Real estate often calls for specialized licensing, plus robust coverage to shield personal assets. Expect:

- Additional local business license or property usage permits

- Higher insurance premiums if you’re renting out properties

- Potential foreign registration if you buy real estate across multiple states

Though these add up, many investors happily pay to limit personal liability and isolate different properties via separate LLCs.

E-Commerce Businesses: Costs to Start and Scale

Digital sellers might face fewer location-based rules, but you’ll likely invest in:

- E-commerce platform fees (Shopify or Amazon store)

- Bank account or payment processor charges

- Possibly nexus-based taxes if shipping across states

A well-structured e-commerce LLC helps you stay organized for taxes, inventory tracking, and expansions.

Freelancers and Gig Workers: Is an LLC Financially Viable?

Freelancers often begin as a sole proprietorship because it’s quick and cheap. But if your gig grows, the protection of a formal business entity might be worth the cost. Even the cost to maintain the LLC (like modest renewal fees) can be a small price for peace of mind. Evaluate how stable your revenue is, and see if liability coverage via an LLC is essential for your line of work.

Expert Insights: Is Starting an LLC Worth the Cost?

While fees can appear daunting, forming an LLC typically pays off in legal safeguards and tax flexibility. Below, we’ll look at a few deeper considerations: from immediate liability protection to the break-even point on your LLC expenses.

Balancing the Benefits of Liability Protection Against Costs

One major perk of an LLC is protecting personal assets from business lawsuits. If your brand fails or faces claims, the corporate “veil” often shields your home or savings. This can be invaluable—how much would it cost if you faced a direct lawsuit as an individual? Weighing that peace of mind against a few hundred in fees usually leans in favor of forming an llc.

Tax Advantages of an LLC: Do They Justify the Expenses?

For many, an LLC can be taxed as a pass-through entity, bypassing certain corporate income taxes. Some owners eventually opt for S-corp status to reduce self-employment taxes. Though the llc annual fee is an outlay, the tax savings may offset it per year. Checking with an accountant or referencing official guides helps confirm if llc taxed as an S-corp might best suit your revenue level.

ROI Analysis: How Quickly Can You Recover LLC Costs?

If you anticipate robust revenue soon after launching, the money spent on your LLC might return quickly via brand credibility or contract eligibility. Many vendors prefer contracting with company with an official structure, seeing it as more professional. In some industries, a formal LLC can help you land bigger deals that overshadow the initial startup fees. Ultimately, if it paves the way for higher-paying partnerships or expansions, the cost can be recouped in short order.

Frequently Asked Questions About LLC Costs

Still wondering if a do-it-yourself approach is feasible or if each state’s fees differ drastically? Below are concise, high-impact answers to common questions about the cost to form an llc. Each is designed to pop up in Google’s featured snippet, giving you quick clarity on forming your LLC in 2025.

In most states, there’s no entirely free route to create an LLC because a state fee is mandatory. A few states might waive or temporarily reduce filing fees, but it’s rare to have zero outlay for llc formation. You might see ads for “free” or “$0” LLC formation services, yet they usually pass along the required state filing fees plus upsell extras like an llc operating agreement or registered agent service. If the state itself doesn’t impose charges, you still have to handle potential annual report or permit expenses. So, truly free is extremely uncommon.

Failing to pay your annual fee often leads to administrative dissolution. This means your LLC is no longer recognized with the state—you lose liability protections, and operating under that company name can become illegal. Additionally, your business may incur late penalties, making it cost to maintain even higher when you eventually remedy the lapse. If you ignore repeated notices, your bank accounts could be frozen, and you might be forced to refile from scratch. Timely compliance ensures the LLC stays in good standing, safeguarding your personal assets and brand reputation.

Startup and formation expenses can typically be deducted, up to certain caps, on your federal taxes. The internal revenue service treats many LLC fees as organizational costs, which you may also write off partially in the year incurred, with the remainder amortized over time. Beyond direct cost of filing, you could potentially deduct your llc formation service charges, annual fees, or even aspects of your business license. However, all deductions must be “ordinary and necessary” for operating your small business. Confirm specifics with a tax professional or the IRS guidelines to maximize savings.

When you form an llc in your home state, you pay domestic fees. Once you expand or do business beyond your primary location, you often register as a foreign llc in other states. Filing fees for a foreign entity can be equal to—or sometimes higher than—domestic ones, plus you might pay ongoing charges (like periodic report costs) in each region. The same is true for annual fee obligations. While forming a foreign LLC is necessary if you actively operate out-of-state, the extra compliance overhead can add to your bottom line.

If you’re comfortable with official forms and process to start the LLC, a DIY approach might save you $50 to $300 in service fees. All you pay is your state fees. However, mistakes during the application or compliance updates can be costly if you’re unsure about the correct procedures. Online providers, though they charge for convenience, often reduce the chance of errors and handle your formalities quickly. For owners short on time or worried about compliance intricacies, paying extra for a reliable platform or professional can be well worth the investment.

In California, known for a mandatory $800 franchise tax, new LLCs historically have to pay this minimal tax each year they’re active. Recent legislation at times waived or delayed the llc annual fee for first-year entities, but policies shift. Check the California Franchise Tax Board’s current rules to confirm. Some owners opt to wait until near year-end to file or choose another state. Nonetheless, if you’re actively conducting business in California, you generally can’t dodge the $800 payment for every year, unless state law provides a temporary exemption.

LLC costs can feel high due to state filing fees, recurring charges like annual report or franchise tax, and the optional services that many owners buy—like a professional agent or advanced formation packages. States impose these fees to fund administrative overhead and ensure compliance. For example, the cost to form an llc in some states is steep because local governments rely on registration income. Additionally, specialized licenses or city-level taxes can stack up. While forming an LLC isn’t always cheap, its liability protections and potential tax benefits often justify the investment.

Navigate LLC Costs Easily

Harbor Compliance provides tailored solutions to manage your LLC expenses and maintain compliance. Start your business with confidence.