Thinking about launching your own LLC in Louisiana? You’re not alone. Louisiana is a great state for anyone who wants to take charge of their financial future. Their business-friendly policies combined with low costs and a favorable Gulf Coast location make this an appealing location.

To start an LLC in Louisiana, file Articles of Organization with the Secretary of State ($100), submit your Initial Report (included), appoint a Louisiana registered agent (free or $50–$150/year), and obtain a free EIN from the IRS. You’ll also pay $30 each year for your annual report. Expect to spend $130–$250 in your first year, depending on whether you use professional services.

Whether you're starting fresh or switching over from another setup, you'll learn what to do at every stage—like choosing the right name and submitting your Articles of Organization. It’s tailored to Louisiana, so you’re not stuck guessing.

Let’s get started—and help you set up an LLC that’s ready to go the distance.

Why Choose a Louisiana LLC? Understanding the Benefits

Louisiana provides a strong combination of affordable pricing, legal protection, and flexibility making it one of the best states for LLC formation. Starting a business here is a strategic decision, because of less compliance burden and unique state incentives, allows an advantage of long-term operations and access to the expanding Southern Market. Small business entrepreneurs located in cities like Baton Rouge and New Orleans benefit from a small business community where they can rely on others and ask for help. In contrast to a Sole Proprietorship, an LLC creates a legal separation personal and business liabilities.

What Are the Key Advantages of an LLC Structure?

A limited liability company is more than just basic protection, it’s practical and flexible for the modern entrepreneur. With the flexibility of limited liability, it provides protection while enabling easy operating management. Unlike corporations, LLCs minimize paperwork and give owners more control over daily operations. The model is especially appealing for those who want tax efficiency and liability separation (see how it compares in our LLC vs. PLLC comparison). Below are six key benefits of LLC structure:

- Limited personal liability – Your personal assets are shielded from business debts and lawsuits.

- Pass-through taxation – Profits go directly to owners without facing corporate tax.

- Flexible ownership – LLCs can have single or multiple members, including individuals or entities.

- Simple management – No board of directors or shareholder meetings required.

- Professional credibility – Boosts trust with vendors, clients, and financial institutions.

- Fewer formal requirements – Less paperwork compared to corporations.

Is Louisiana a Good State for Forming an LLC?

Yes, especially if you want the option to secure your business with an affordable solution. The Louisiana state filing fee is one of the lowest in the notheast region. To add on, the louisiana department of revenue offers targeted tax incentives for startups and small companies. These factors make it financially attractive to form an LLC here.

However, keep in mind that Louisiana has a few extra compliance steps. You’ll need to file an initial report along with your articles of organization, and submit an annual report each year. While these tasks aren’t overly complex, they’re mandatory to keep your limited liability company in good standing.

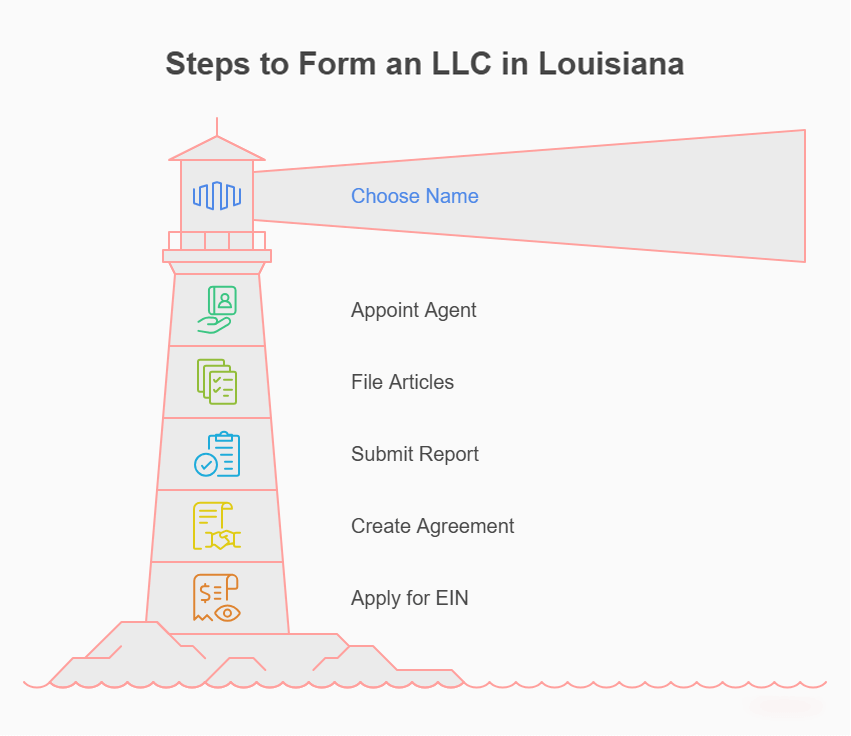

How to Get an LLC in Louisiana: Step-by-Step Process

The process of forming an LLC in Louisiana is easy and straightforward. The steps are the same whether you file through the GeauxBiz portal or submit documents by mail. Starting an LLC in Louisiana can be a quick and easy process for anyone willing to prepare properly. All filings can be done online without having to visit your local municipal office.

Step 1: Choose a Name That Complies with Louisiana Requirements

Your business name must follow Louisiana’s legal naming standards. It must contain “Limited Liability Company” or “LLC,” and be clearly distinguishable from existing companies. You should checkand perform a search in the state’s commercial database (see LLC name examples to get ideas) to confirm availability. If the name is valid but you’re not filing right away, you can reserve it through the Secretary of State to prevent others from claiming it first.

Step 2: Appoint a Louisiana Registered Agent

Every limited liability company in Louisiana must appoint a registered agent to receive legal documents and state notices on behalf of the business. This is a legal requirement that ensures your company stays compliant with state communication.

You can appoint an individual who resides in Louisiana or hire a registered agent service. When selecting an agent, many business owners take these factors into account particularly if they want privacy and availability during business hours.

Step 3: File Your Louisiana LLC Articles of Organization (Via GeauxBiz Portal or by Mail)

As part of the steps to start an LLC, you have to file the articles of organization (also called certificate of organization) with the Louisiana Secretary of State. There are several ways to file in Louisiana, including applying through the GeauxBiz portal, mailing documents and in-person delivery to Baton Rouge. Depending on how it gets filed, a fee will be placed upon the filing. The online filings are often more efficient and hassle-free than the other options. Make sure to submit paperwork correctly first time to the state in order to prevent delays or a rejection.

Available Filing Methods:

- File through the GeauxBiz Portal (recommended)

- Submit by mail to the Secretary of State’s office

- Hand-deliver documents to the Baton Rouge office

- Work with an attorney or formation service to submit paperwork on your behalf

Step 4: Submit the Initial Report and Other Required Forms

You must submit an initial report with your articles of organization when you form an LLC in Louisiana. The report will include the physical address of the business, as well as the names of the members or managers, and the registered agent’s name and address. These details ensure your company’s public record starts accurate from day one. Depending on your business activity or structure, Louisiana may request additional documents before your limited liability company is officially recognized and entered into the state’s commercial registry.

Step 5: Create a Louisiana LLC Operating Agreement (Optional but Recommended)

Even though it is not required by law, one major benefit of forming an LLC is the ability to create an operating agreement. This internal document is a detailed explanation of the structure and workings of your business. It tells us about the ownership shares, member roles, voting rights, and profit sharing along with the distribution of general profits. It helps set clear expectations.

If your LLC has more than one member, you will want to put together a written agreement to avoid misunderstandings that could lead to litigation. Single-member LLCs, this solidifies the separation of your personal and business finances—supporting your liability immunity in an issue. An operating agreement also lets banks and investors know that you are credible and legitimate.

Step 6: Apply for an EIN and Set Up a Business Bank Account

After your limited liability company is formed, you’ll need to get an Employer Identification Number (EIN) through the Internal Revenue Service. You’ll need the EIN for tax basis, hiring, and bank accounts. You can apply online for licensure at the IRS website.

With an EIN in hand, you can open a dedicated business bank account. Keeping your company’s finances separate from personal accounts is key to maintaining liability protection and ensuring accurate bookkeeping for your llc in louisiana.

Let ZenBusiness Handle Your Registered Agent Needs in Louisiana

From legal mail to compliance alerts, ZenBusiness acts as your Louisiana agent so nothing gets missed.

Louisiana LLC Filing Requirements, Application, and How to File

In Louisiana, it is mandatory to submit certain formation documents and meet all all state-level requirements to legally operate a limited liability company. Among these are your articles of organization, initial report, and relevant business licenses. Full instructions are available at the Louisiana Business Services site, which guides users through every submission process and helps ensure compliance with all reporting obligations. You should also prepare to pay the Limited Liability Entity Tax (LLET), which starts at $175 and is recalculated based on your company’s gross revenue.

Louisiana LLC Application: What You Need to File

Before you file, you must gather the required documents for your Louisiana LLC application. These include official paperwork that forms the foundation of your business, proving its legal existence and structure. The louisiana secretary requires complete and accurate submissions to avoid rejection. Ensure to have properly signed all the forms and the registered agent is designated and licensing paperwork is included. When you present everything in order, it makes approval process easier and avoids unnecessary issues.

Required Documents:

- Articles of organization

- Initial report

- Registered agent information

- Business license or permits, if applicable

- Filing fee payment confirmation

Louisiana LLC Articles of Organization: Key Information to Include

The articles of organization serve as the primary formation documents for registering your limited liability company with the state of Louisiana. This form must include your official business name, principal office address, type of management (member- or manager-managed), and full contact information for your registered agent. It’s a legal declaration of your business’s existence.

You may also choose to include optional details like your business purpose, how profits will be shared, and the company’s intended duration. If all information is submitted correctly, your filing will be approved without delays. Visit the Louisiana Secretary of State’s website for complete, updated filing instructions and to begin the submission process.

How to Apply for an LLC License in Louisiana

To operate your LLC legally in Louisiana, you will probably need a business license or multiple permits depending on your business operation and location. Licenses are approved by state and local authorities, which can vary greatly by parish and area of location. For more information, contact the Louisiana Department of Revenue and the Local Government Offices. Many businesses need to apply online for licensure, especially in regulated industries such as medical services, construction, and retail. This is done through a specified state board or licensing agency before you open for business. In addition, all LLCs must register with the Louisiana Department of Revenue to handle local taxes like sales tax, business licenses, and the Limited Liability Entity Tax (LLET). These boards are intended to maintain professional standards and keep businesses in accordance with state law.

How to Form an LLC in Louisiana for Free: Is It Possible?

While you can reduce costs, forming an LLC in Louisiana is never entirely free. The state charges mandatory fees for filing and reports, which cannot be waived. If you don’t want to spend money through third parties, do the paperwork yourself and use government resources.

What Fees Are Mandatory When Starting an LLC?

Forming an LLC in Louisiana requires paying a few unavoidable government fees. These cover essential steps like submitting your articles of organization, filing your initial report, and maintaining your LLC annual report each year. Even if you skip outside help, you’ll still need to pay the required state costs. Some services—like acting as your own registered agent—can save money. The chart below compares actual state fees versus typical costs charged by third-party filing companies.

Comparison of Mandatory Fees:

| Fee Type | State Fee | Third-Party Range |

|---|---|---|

| Articles of Organization | $100 | $150–$300 |

| Initial Report | Included | $40–$100 |

| Annual Report | $30 | $75–$150 |

| Registered Agent | Free (self) / $0 | $100–$150 |

Are There Free Resources to Help You Start an LLC?

Louisiana has several official tools and free assistance programs for people trying to form an LLC on a budget. Users can file checklists, check name availability, receive personalized step-by-step guidance through GeauxBiz portal.

The Louisiana Secretary of State and Department of Revenue also provide downloadable starter kits, phone support, and compliance FAQs that help you form a limited liability company for a very low out-of-pocket cost.

Common Mistakes When Trying to Save on LLC Formation Costs

When forming an LLC in Louisiana as cheaply as possible, things can go wrong Many mistakes include filing the wrong documents, skipping the operating agreement, or employing an unqualified registered agent just to cut costs. One common error is missing the annual report deadline, which falls on the anniversary of your LLC’s formation date. Failing to file on time may lead to late fees or administrative dissolution by the Secretary of State. Others forget to file the initial report or fail to file annual reports on time—leading to late fees or administrative dissolution Don't just use the free template, it is outdated info. A small investment now can spare you from costly business and legal issues later.

FAQ About LLC Louisiana: Timeline, Options, and Requirements

People have many questions about processing times, name registration, and required filing when forming an LLC in Louisiana. This area covers the most commonly worried about registration and annual fees so you don’t delay and remain fully compliant.

How Long Does It Take to Get an LLC in Louisiana?

When you file through the GeauxBiz portal it is typically processed between 1 to 2 days. Mailed submissions may take 5 to 7 business days. To avert delays in gaining approval, ensure you do not have any incomplete document or payment issues. All your filing information should be double-checked before submission of your formation documents.

How to Add a DBA to an LLC in Louisiana?

If you want to operate under a name other than your legal name, you should file a Trade Name Registration with the Louisiana Secretary of State. This is separate from reserving your LLC’s legal name and comes with a $75 filing fee per name. You can deliver the form online or by mail, include the applicable filing fee alongsides. A name search must be conducted first for availability and rejection.

How Much Is an LLC in Louisiana?

The core state filing fee for forming an LLC in Louisiana is $100. Additional costs include a $30 annual report fee and optional charges for a registered agent or expedited processing. Total startup costs typically range from $130 to $300, depending on your filing method and service use. You’ll need to pay these fees directly to the state or service provider at the time of filing.

What Is a Louisiana LLC Search and When Should You Use It?

A Louisiana LLC search lets you verify business names, check entity status, and access formation documents. It’s essential before filing to avoid name conflicts. You can perform a commercial search using the Louisiana business search tool on the Louisiana Secretary of State website.

Is the GeauxBiz Portal the Only Way to File for a Louisiana LLC?

No. The GeauxBiz portal is the most convenient option. You may also file by mail or in person at our Baton Rouge location. All methods allow you to submit your formation documents and articles of organization, but online filings are typically faster.

Harbor Compliance Keeps Your Louisiana LLC Compliant

Stay in good standing with a dedicated registered agent that delivers fast alerts, expert help, and legal mail forwarding.