Launching an LLC is a game-changing decision for entrepreneurs seeking legal protection, flexibility, and credibility. Whether you're starting a small business or preparing for large-scale operations, this business structure simplifies compliance while shielding your personal assets.

An LLC (Limited Liability Company) separates your personal assets from business liabilities, offers tax flexibility, and provides a straightforward structure ideal for entrepreneurs focused on growth and security.

In this guide, we’ll discuss:

- The key benefits of forming an LLC and how it compares to other structures.

- Step-by-step instructions to create an LLC in any state.

- Essential considerations to ensure compliance and success.

Let’s dive into everything you need to know to confidently start and grow your LLC!

What Is an LLC and Why Should You Start One?

An LLC (Limited Liability Company) is a legal entity blending features of corporations and partnerships to shield personal assets from business liabilities. This company law structure is popular among business owners who want a more straightforward process compared to corporations. Unlike a sole proprietorship, an LLC separates your personal finances from the business’s obligations, minimizing your personal liability. Beyond that, an LLC’s management structure can be tailored to your needs, offering flexibility and control. If you’re serious about long-term growth and risk management, forming an LLC may be your best strategic move.

What are the benefits of LLCs?

Forming an LLC can offer multiple advantages:

- It provides a corporate veil, protecting your personal holdings if the business faces lawsuits or debts.

- Tax status is flexible, letting you choose how you want the LLC to be treated for tax purposes.

- You can have a manager managed LLC or let members run operations—it’s your call.

On top of that, if you’re looking to scale, the LLC structure can help you attract investors and build business credit more easily than a sole proprietorship. Once you establish your LLC, you’ll see that handling compliance and federal tax matters can be simpler compared to setting up a more complex corporate entity.

How to Create an LLC: The 8 Essential Steps

Forming an llc starts with a clear plan and an understanding of state rules. Whether you’re a single member llc or have multiple co-founders, following a methodical approach lowers the risk of administrative or legal hiccups. Below are eight essential steps covering everything from business name selection to obtaining your employer identification number. Along the way, you’ll set up internal governance with an operating agreement, register a registered agent, and handle any unique local requirements. By meticulously tackling each stage, you’ll start an llc that’s primed for compliance, offers limited liability, and meets your entrepreneurial goals.

Step 1: Choose a State for Your LLC

Before jumping into paperwork, decide where you’ll form the LLC. Often, it’s your home state or the state where you’ll primarily operate. This way, you avoid extra state fees for foreign registration. However, some entrepreneurs pick states like Delaware or Wyoming for their business-friendly laws. For cost-effective options, explore our cheapest LLC formation services that can help you minimize expenses.

If you want to keep things local, simply file in your home jurisdiction. If you’re planning to scale or operate nationwide, weigh pros and cons carefully. For instance, Delaware’s company law is famously accommodating, but you might incur additional filing or annual report fees if you’re physically based elsewhere. To manage these multi-state compliance needs efficiently, consider using a best registered agent service that can handle your registered agent requirements across different jurisdictions.

Here are five states commonly chosen and why:

- Delaware – Flexible statutes, well-established corporate law

- Wyoming – Low filing fee and robust privacy protections

- Nevada – No personal income tax, but watch out for business fees

- Texas – Popular for big markets, straightforward compliance (notable for an llc in texas)

- North Carolina – Reasonable fees, stable economy, and supportive small-business culture

Ultimately, evaluate ongoing requirements like franchise taxes or certificate of formation costs. If you’re simply setting up a local store, your state’s default rules might suffice. But if you have bigger ambitions or special privacy desires, exploring a more pro-business state could pay off.

Step 2: Select a Unique LLC Name

A standout name is vital for branding and legal clarity. Each jurisdiction restricts what you can call your LLC to avoid duplicating or closely resembling existing business entities. Generally, your name must include an identifier like “LLC,” “Limited Liability Company,” or “Ltd. Co.” so people realize your structure isn’t a private limited company or sole proprietorship.

First, check the availability of your proposed moniker. Visit your chosen state’s database to confirm no identical or confusingly similar name is taken. For instance, if you’re launching in North Carolina, use their official site or a name-search tool to ensure no conflicts exist. For inspiration on naming, explore our best LLC names. Keep an eye on state-specific rules—some might exclude certain words or require special approval for terms like “Bank,” “University,” or “Insurance.”

Securing a domain name that matches your LLC title is also wise. Even if you’re not ready for a website, consider reserving the URL to protect your online brand. If the domain isn’t free, weigh alternatives or slight variations that remain brand-consistent.

Tips for naming your LLC:

- Keep it short, memorable, and descriptive of your core activity.

- Avoid generic terms that can hamper SEO.

- Confirm it respects trademark rules—someone else’s brand name might be off-limits.

- Aim for a name that still resonates if you expand your product lines.

Finally, once you choose a name, lock it in by filing a name reservation if your state allows it. That way, no one else can scoop it up while you finalize the rest of your llc formation steps.

Step 3: Choose a registered agent

Every LLC needs a registered agent, a person or service authorized to receive legal documents and state correspondence. If you skip this or fail to maintain an agent, your LLC risks losing good standing, or you may miss crucial lawsuits or official notices. The agent must have a physical address in the formation state—no P.O. boxes allowed. Some business owners opt to serve as their own agent to save money. However, this can compromise privacy if your home address is used in public databases.

Professional registered agent companies typically charge $100–$300 yearly. If you’re operating in specific states like Florida, choosing the best registered agent in Florida can enhance your compliance and operational efficiency. They’ll promptly forward vital mail to you, ensuring you never overlook something important. If your schedule is hectic or you travel frequently, outsourcing may be well worth it for consistent coverage. For multi-state expansions, a registered agent service can handle each jurisdiction, simplifying your overall compliance.

Look for these traits in a potential agent:

- Business days coverage: They should be available Monday through Friday.

- Experience with company law: Understanding of local rules helps them handle official forms.

- Solid reputation: Check reviews from other LLC owners.

With a trusted agent in place, your focus can shift from bureaucratic chores to scaling your brand.

Step 4: Define LLC's management structure

The next step is deciding how you’ll run the show. An LLC can be manager managed or member-managed. In a member-managed setup, all owners share day-to-day decisions. For smaller teams or a single member llc, this typically works fine—everyone stays hands-on. But if your plan involves passive investors or a large membership group, a manager-managed format streamlines operations by delegating authority to one or a few managers.

Potential management structures to consider:

- Member-managed: All owners actively direct the LLC.

- Manager-managed: Selected individuals handle routine tasks; members remain more passive.

When picking, weigh factors like your skill set, the availability of each partner, and the complexity of daily tasks. For example, in a big operation, an experienced manager could maintain operational stability, leaving members free to address strategic concerns. Clarifying roles early avoids confusion over who’s authorized to sign contracts, hire staff, or handle other responsibilities.

Step 5: File Articles of Organization

With your name secured and a plan for oversight, it’s time to submit articles of organization—also known in some states as a certificate of formation—to the relevant government agency (often the Secretary of State). This filing is crucial for officially granting your LLC status under corporate law.

Here’s a quick checklist for your filing:

- LLC Name: The exact title, including “LLC” or “Limited Liability Company.”

- Registered Agent Details: Their name and office address in the state.

- Management Structure: Whether you’re manager-managed or member-managed.

- Purpose (Optional): Some states ask for the business’s main objective. Defining your business purpose clearly can streamline the filing process and clarify your operational goals.

- Organizer’s Signature: The person completing the form signs, verifying accuracy.

Once you pay the filing fee, it can take a few business days (or longer if you didn’t expedite) to get approval. If your chosen state has online systems, you can often file digitally, receiving prompt updates on your LLC status. Keep confirmation documents in a safe spot, as banks or future investors might request them to validate that your LLC is official.

Step 6: Draft an LLC Operating Agreement

Although not every jurisdiction mandates an operating agreement, drafting one is highly recommended to outline management structure, ownership percentages, and how profits or losses are split. If you skip it, disputes can arise when members disagree on voting rights or capital contributions, potentially undermining your newly formed LLC.

An operating agreement typically covers:

- Ownership Breakdown: Percentage of each member’s stake

- Voting and Decision-Making: How major calls get approved

- Profit Distribution: Whether payouts are based on ownership share, hours worked, or other metrics

- Dissolution Rules: Steps for winding down the LLC if that day comes

Include provisions for any special scenarios—like adding new members or transferring interests. Many owners choose to have a short formal legal review to ensure the document aligns with local statutes and tax implications. Once complete, have all members sign. Keep it with your LLC records, so you can easily reference it if disagreements arise.

Step 7: Obtain an EIN (Employer Identification Number)

To handle payroll, open a business bank account, or file federal tax documents, you’ll likely need an EIN—your employer identification number. It’s basically your LLC’s “social security number.” For a free, official application, visit the IRS website and apply online. The internal revenue service issues an EIN almost instantly in most cases.

A few companies might charge fees to “get” an EIN on your behalf, but it’s easy to do it yourself. You’ll fill in basic details about your LLC, including formation date, management structure, and contact info. If you’re a foreign individual or have unusual tax situations, the form might need more details, but in typical cases, it’s quick and straightforward.

Having an EIN not only streamlines your tax purposes but also helps separate personal finances from the LLC, supporting that liability protection aspect.

Step 8: Ensure Compliance (business licenses and permits) with State Requirements

Finally, confirm you’re meeting every official standard, from local zoning permits to specialized certificates. For example, some industries—like food service or construction—demand more than just an LLC registration. You might require a business license from your city, or additional professional accreditation if you provide specialized services. Skipping these steps can lead to fines or forced closures.

Consider the following:

- Local Permits: Check municipal rules for signage, operating hours, or safety compliance.

- Statewide Regulations: Certain trades might need a state-level green light.

- Annual or Periodic Filings: Some areas require a short update (like an annual report) verifying your current details.

Keep track of your obligations with a simple calendar system or through compliance service reminders. If you expand or shift into new product lines, re-check for any updated or additional licensing requirements. By proactively staying compliant, you avoid lapses that could erode your LLC’s legitimacy.deral level. Aim to maintain thorough records in case of audits—an organized approach spares you stress come tax season.

Start Your LLC Today

Form your LLC quickly and securely with Northwest. Get expert guidance every step of the way.

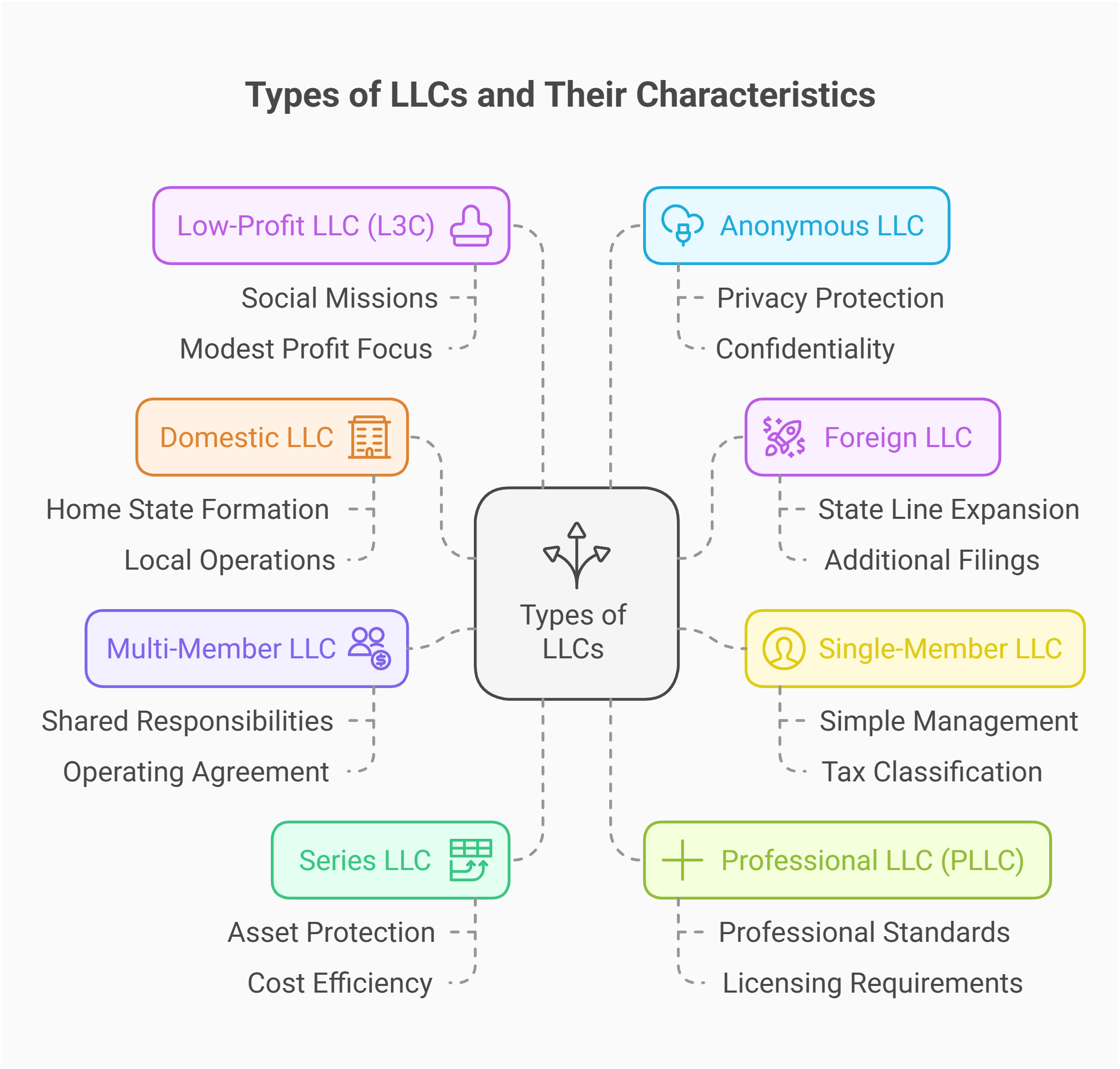

The 8 types of LLCs: how to choose the right form

In the U.S., limited liability companies come in various forms, each tailored to specific needs. From single-member setups to advanced series llc structures, picking the right variant can shape your risk level and tax load. Below, we’ll briefly highlight eight popular LLC types and help you decide which suits your business goals.

1. Domestic LLC

A domestic LLC forms in the owner’s home state, meaning if you live and operate in Texas, you’d file an llc in texas as “domestic.” It’s the simplest route for local entrepreneurs, with minimal extra registration. You’ll handle standard llc formation steps—filing the needed documents in your home jurisdiction. Because you won’t be subject to foreign qualification fees, domestic LLCs can keep compliance straightforward. Ideal for small-scale or community-based ventures.

2. Foreign LLC

A foreign LLC is simply an LLC formed in another state that registers to do business outside its “home” territory. For instance, if you want to operate in Florida but originally formed the LLC in Delaware, you must register as a foreign LLC in Florida. Although the term “foreign” might sound international, it’s purely domestic—just crossing state lines. This structure is useful for expansions but often adds more annual report or filing obligations.

3. Single-Member LLC

A single member llc is owned by one individual or entity. It retains the hallmark benefits—like personal liability protection—without requiring a partner’s involvement. Though simpler to manage, you still file the same initial documents (like articles of organization) and can elect the LLC’s tax purposes classification. This model suits freelancers or small-scale owners who want a formal structure but minimal overhead. Just remember, certain states have specific rules for single-member setups.

4. Multi-Member LLC

A multi-member LLC includes two or more owners, each typically holding membership interests. This format can distribute responsibilities, capital, or expertise across the team. Setting it up involves the same core steps, but your operating agreement typically outlines each member’s share of votes and earnings. If you’re inviting multiple partners, define beneficial ownership terms to avoid confusion. Multi-member LLCs are popular among families, friends, or professional groups pooling resources.

5. Series LLC

A series llc is a cutting-edge structure available in a few states, letting you form distinct “cells” under one umbrella LLC. Each series can hold separate assets or run unique operations, insulating them from each other’s liabilities. Real estate investors often love this approach, using separate series for different properties. Though not recognized universally, a series LLC may streamline costs and reduce overall administrative chores if your expansions remain in states allowing them.

6. Professional LLC (PLLC)

A PLLC is designed for licensed professionals—like doctors, lawyers, or accountants—who must meet certain corporate law standards. It offers partial liability protection for the business side, though personal malpractice remains outside its shield. States typically require additional license verifications to form a PLLC, and owners must hold active professional credentials. PLLCs help unify practice partners under one formal structure while meeting strict regulatory guidelines for, say, medical boards or bar associations.

7. Low-Profit LLC (L3C)

A Low-Profit Limited Liability Company, or L3C, merges a business approach with a charitable mindset. L3Cs seek modest profit but focus on social or educational missions, bridging the gap between nonprofits and typical for-profits. While not recognized in every state, supporters see L3Cs as facilitating philanthropic endeavors that can still earn revenue. If you aim to highlight a mission while allowing some returns, investigate whether your jurisdiction enables L3Cs.

8. Anonymous LLC

An Anonymous LLC conceals its owners’ identities from public records. Common in states like Wyoming or New Mexico, it uses a third-party manager or registered agent so the founder’s personal info stays private. Ideal if you want to keep beneficial ownership out of public databases, though you must still comply with federal tax regulations. This approach appeals to those seeking confidentiality for personal or competitive reasons, but it can complicate certain financing or bank interactions.

Cost Breakdown: How Much Does It Cost to Create an LLC?

Forming an LLC involves state fees, typically ranging $50–$300 for your initial filing fee, plus optional charges for name reservations or expedited processing. To get a detailed understanding of how much an LLC cost, refer to our comprehensive guide. Many states also require an annual report or “renewal” fee—often $20–$100, though some can be higher. If you hire a registered agent service, budget $100–$300 yearly. Additional expenses might include drafting a formal operating agreement, local business license fees, and specialized permits if you’re in regulated fields. Online platforms or lawyers may charge $50–$500 for setup help, plus any government costs. While you can handle the process yourself to reduce expenses, investing in professional guidance ensures fewer mistakes and stable compliance from the start.

What are the advantages and disadvantages of LLCs?

Limited Liability Companies combine the flexible features of partnerships with the protective legal framework of corporations. But they’re not a universal solution—certain pros can overshadow some cons, especially if your growth ambitions or compliance constraints differ. Below, we’ll detail key upsides and potential pitfalls, ensuring you can assess whether an LLC lines up with your unique goals and tolerance for complexity.

LLC Advantages

The LLC structure offers a host of tangible perks that many business owners find invaluable.

- Limited Liability: Your personal assets remain shielded if the LLC faces debts or lawsuits.

- Flexible Tax Setup: You can choose pass-through taxes or elect corporate classification for tax purposes.

- Fewer Formalities: Compared to corporations, LLCs have lighter mandatory requirements like fewer annual meeting obligations.

- Multiple Management Options: Easily structure as manager managed or let members share direct control.

- **Credibility for starting an llc: Even a small operation can appear more established to clients or vendors.

By leveraging these advantages, many entrepreneurs feel confident that an LLC can help them scale responsibly. You’ll also find that such a setup tends to inspire trust among banks or potential collaborators, due to recognized stability and built-in liability protection.

LLC Disadvantages

Despite the flexible framework, LLCs aren’t always the perfect fit:

- Renewal and Filing Fees: Some states impose annual report costs, inflating overhead.

- Limited Case Law: Compared to corporations, LLC legal precedents can be less consistent, especially in newer or smaller states.

- Potential Self-Employment Taxes: With pass-through taxation, members might pay higher self-employment tax than they would under corporate wages.

- Complex Multi-State Rules: Operating in multiple states often triggers additional registrations and fees.

- Investment Hesitation: Some venture capital firms prefer corporations with stock structures, limiting large-scale fundraising options.

While these points might not be deal-breakers, it’s worth analyzing whether the cost-benefit ratio aligns with your ambitions. For certain expansions or advanced funding needs, you might weigh the pros of reclassifying or using a corporate approach.

Hassle-Free LLC Formation

ZenBusiness makes starting your LLC simple with fast filing and compliance support.

How to Maintain and Grow Your LLC After Formation

Once you have an official LLC, focusing on steady operations and timely filings keeps you in top shape. From annual compliance tasks to potential expansions, proactively managing your LLC ensures ongoing success. Here are key areas to master if you want your new business to flourish.

Filing Annual Reports and Avoiding Penalties

Most states require you to submit updates—either an annual report or biennial filings—to confirm your current address, ownership structure, and registered agent details. Missing these deadlines triggers penalties, late fees, or even administrative dissolution. Fortunately, you can track the due dates using a simple calendar or a compliance service. If your LLC’s info changes mid-year, file an amendment or statement of change so the state’s records stay accurate. By doing so, you guard against operational hiccups and preserve your legal good standing.

Managing Taxes and Accounting for Your LLC

LLC owners typically face pass-through taxes at the personal level—though you can elect corporate treatment for income tax strategies. Keep thorough books, separating business transactions from personal ones. A dedicated business bank account helps protect the corporate veil and simplifies record-keeping. Track expenses and revenue carefully so you can provide precise returns to the IRS and state agencies. If you’re uncertain, consult an accountant with knowledge of LLC intricacies, ensuring you comply with federal tax obligations and local revenue rules.

Expanding or Converting Your LLC

As your enterprise grows, you might add new members, open offices out of state, or transition to a different business structure. For expansions, remember to file as a foreign LLC in each target jurisdiction. If you need more robust funding or advanced share structures, converting the LLC into a corporation may help. Consult legal counsel to handle re-formation or “statutory conversions” so you don’t lose your liability protection. Ultimately, remain adaptable while never skipping the required state-level compliance updates.

Specialized LLC Formation: Tailored for Your Business

Not every LLC is identical. The approach might differ if you’re freelancing solo, handling high-ticket real estate deals, or running an online storefront. Understanding unique LLC applications can refine your operations, reduce compliance burdens, and optimize tax outcomes. Below, we’ll examine how specific industries—freelance, real estate, and e-commerce—benefit from establishing an LLC.

How Freelancers Can Benefit from an LLC

Freelancers operating as a sole proprietorship risk personal liability if clients sue or disputes arise. With an LLC, you gain legal separation between personal finances and business dealings, plus potential brand credibility. Tax-wise, the LLC can be treated as a pass-through entity—ideal for straightforward tax purposes. You’ll file an annual or periodic update, but the administrative overhead is still minimal. If your freelancing expands or you add associates, the LLC structure helps you integrate them smoothly. Many creative pros appreciate this balance of formality and freedom.

Forming an LLC for Real Estate Investments

Property ventures often face major liabilities—like tenant disputes or property damage claims. Placing each building under a separate LLC can shield other holdings if one property faces legal trouble. You still must handle local business license or landlord permits, but the LLC perimeter keeps your personal assets safer. Also, an LLC can streamline partnerships when pooling capital for bigger deals. If you’re eyeing multiple properties, consider whether a series llc (if your state allows it) might centralize oversight while isolating risk among individual segments.

E-Commerce and Online Businesses

E-commerce outfits often see customers from across the nation, making clarity in your legal structure essential. An LLC not only elevates brand trust—customers see a formal entity name instead of your personal identity—but also organizes finances, so your social security number remains private. Depending on your shipping footprint, you might face multi-state compliance. Yet once your LLC is official, obtaining a business license for certain product lines becomes more straightforward. The result? You can focus on perfecting digital marketing or supply chain operations while ensuring solid liability coverage.re.

How to Open an LLC in Any State

No matter where you call home, the core steps of forming an LLC stay consistent: choose a name, pick a registered agent, and file articles of organization. But each state carries unique quirks. Maybe some have steeper filing fee or rigorous publication requirements. If you’re curious which states rank high for simplicity or business perks, read on. We’ll also address multi-state expansions if your brand aims to cross borders.

State-Specific Requirements for Top 10 Popular States

Although the fundamental steps align, each state’s extra touches can influence your final decision. Here are 10 states that many entrepreneurs flock to, plus key highlights:

- Delaware: Corporate-friendly courts, easy to scale, moderate ongoing fees.

- Wyoming: Low cost to file, strong privacy laws, popular for single-member LLCs. To further benefit, consider using the best registered agent in Wyoming to maintain your LLC’s privacy and compliance.

- Nevada: No personal state income tax, but higher renewal costs and city business fees.

- Texas: Straightforward procedure, no personal state income tax, but watch the local franchise tax.

- Florida: Known for low fees and simpler annual report processes, large consumer market.

- California: Significant filing fee, $800 annual tax, but access to a huge economy.

- New York: Publication requirement can raise costs, massive commercial potential.

- North Carolina: Competitive fees, robust local business environment, balanced regulations.

- Georgia: Mid-range fees, straightforward e-filing, expanding small-business base.

- Washington: No state-level personal income tax, but watch for local B&O taxes.

After picking a state, confirm if you need special business license or city permits. Also, read up on each state’s continuing compliance needs, from beneficial ownership rules to franchise tax obligations, so you’re never blindsided.

Multi-State LLC Formation

If you operate in more than one state—maybe you have employees in multiple locations or serve customers across lines—register as a foreign LLC in each relevant jurisdiction. This means paying extra state fees and possibly filing separate annual report forms, but it keeps you legally permitted to do business in those territories. The benefit: you maintain consistent liability protection everywhere. However, each state’s tax and compliance rules can differ, so stay organized with a tracking system or professional service to ensure multi-state success.

Common Pitfalls to Avoid When Creating an LLC

Starting an LLC can be straightforward, but certain oversights can derail your progress. Keep these in mind:

- Failing to Distinguish Funds: Mixing personal and LLC finances endangers the corporate veil.

- Using a Duplicate Name: Overlooking a prior usage can lead to trademark or state-level conflicts.

- Skipping the operating agreement: Even if optional, it’s vital for clarifying management structure.

- Forgetting State Compliance: Untimely annual report submissions lead to fees or dissolution.

- Neglecting Local Permits: Setting up an LLC doesn’t automatically secure all needed business license credentials.

Plan carefully, keep each element separate, and stay current on deadlines for a rock-solid LLC foundation.

How to Register an LLC Online

Filing from your desktop is simpler than ever—most states offer digital forms for articles of organization and fee payment. Before you begin, gather your proposed business name, operating agreement draft, and management structure decisions. Then visit your state’s official site to set up an account. Upload or fill out each required field, pay the filing fee, and wait a few business days for approval. If you prefer an external platform to handle details, plenty of online LLC services exist. Choose carefully to avoid hidden charges.

Best Platforms for Online LLC Formation

Multiple providers promise seamless digital processes for forming an LLC. Below, we’ll compare three that commonly rank high in reliability, transparency, and support. Each offers a different approach, from minimal do-it-yourself help to full legal coverage. Evaluate their features and price tiers before deciding which platform best aligns with your timeline and budget.

Northwest Registered Agent

Known for top-tier customer service, Northwest Registered Agent specializes in high-touch compliance support. Their all-inclusive packages typically combine your state’s filing with registered agent coverage. That means prompt mail forwarding, plus personalized help if forms get confusing. They’ll also assist with verifying the name’s availability and handle state-level updates. While the base plan might cost a bit more than some budget providers, fans appreciate the immediate phone access to experienced agents who understand private limited company and LLC nuances. For privacy buffs, Northwest stands out: they keep your personal address off public records whenever possible, reinforcing your personal liability shield.

LegalNature

LegalNature is popular with mid-range budgets seeking thorough templates and intuitive workflows. For a broader selection of options, consider using best online legal services to find the platform that best fits your needs. Aside from basic LLC formation steps, they stock robust forms for operating agreement, articles of incorporation, or corporate minutes. They focus on clarity—each field includes tooltips explaining possible answers. If you’re not a legal whiz, their user-friendly interface can be invaluable for bridging knowledge gaps. Post-formation, you can maintain compliance through annual reminders. The platform also handles staff changes or updating beneficial owners. Their pricing tiers vary, so watch for optional add-ons like sample contracts or advanced support. It’s a balanced pick if you want a straightforward digital solution without paying top-tier rates.

Harbor Compliance

A step above many mainstream sites, Harbor Compliance shines in complex, multi-state or heavily regulated scenarios. Their specialists walk you through each state’s specialized demands, verifying whether extra licenses or disclaimers are necessary. For large-scale expansions or series llc structures, the platform’s detail-oriented approach and dedicated compliance software can save headaches. Although you pay more, you get rigorous personalized attention—like ensuring your certificate of formation meets unusual county or municipal requirements. Harbor also offers robust ongoing compliance management, from annual report filing to real-time data dashboards. If you anticipate rapid growth or significant interstate dealings, Harbor’s thoroughness could be worth the investment.

Frequently Asked Questions About LLC Formation

Below you’ll find concise, up-to-date answers to common LLC formation questions—each fine-tuned to appear in Google’s featured snippets. Whether you’re looking at paperwork timelines, lawyer requirements, or annual updates, these solutions aim to clear confusion so you can confidently proceed with creating your LLC in any state.

Timing can vary based on state and filing method. Traditional paper submissions may require several business days to weeks before approval, especially during busy seasons. Online filing usually shortens wait times—some states process digital submissions in 1–2 days. If you pay an expedited filing fee, you might get same-day or 24-hour turnaround. After approval, factor in extra steps like scheduling local inspections if a business license is required. Overall, with correct documents and no backlog, you could receive official confirmation within a week. For states with heavier volume or stricter checks, expect up to three weeks.

You can absolutely create an llc independently by following your state’s instructions and preparing key documents (e.g., articles of organization, operating agreement). Many states have online portals with guides, plus there are reputable LLC formation platforms. However, consulting a lawyer is wise if your business structure is complex, or if you’re integrating unique ownership terms. A single-member LLC in a simple industry might manage fine without legal counsel. But for multi-member expansions, specialized tax purposes, or advanced corporate law queries, an attorney can ensure your documents align with best practices.

Missing an annual report can lead to administrative dissolution—your LLC could lose its legal standing. Once that happens, the liability protection you rely on might vanish, putting your personal assets at risk if lawsuits arise. You’ll also owe late fees and potentially face difficulties reopening or re-registering. If you remain dissolved too long, the state might let someone else claim your LLC name. Not all jurisdictions require annual reports, but many do. Bottom line: stay alert to your deadlines, pay any state fees, and submit timely updates to remain in good standing.

Most entrepreneurs form their LLC where they’ll actively operate. This avoids extra fees for registering as a “foreign” LLC. However, some states (like Delaware or Wyoming) are known for business-friendly rules, attracting out-of-state owners. If you pick a different state than your home base, you typically must also register in your home state as a foreign LLC, doubling compliance tasks. While certain high-growth or multi-state businesses find it beneficial, smaller local companies often keep it simple by forming at home. Evaluate costs, compliance complexities, and your expansion plans before deciding.

Yes. A single member llc is perfectly valid and retains the same limited liability shield as multi-member versions. In this model, all ownership rests with one individual or entity—like a holding company. States often let you form a one-person LLC quickly with minimal filing fee. However, keep personal and business finances strictly separate—this helps maintain the personal liability protections. Also, your operating agreement can still define how you’ll manage finances or pass the business along, even if you’re the sole owner, ensuring clarity in any potential legal or estate matters.

Stay Compliant with Your LLC

Harbor Compliance helps you manage legal filings, annual reports, and business licenses with ease.

To read more about how to form a limited liability company in your state check out our catalog of LLC formation guides here: