How to start an LLC in Maryland is a question that thousands of future business owners type into Google every year — and for good reason. Maryland is affordable, accessible, and supports entrepreneurs significantly. If you're looking to launch a business that's both protected and professional, forming an LLC here is a smart move.

To start an LLC in Maryland, you must file Articles of Organization online via the Maryland Business Express portal ($100), appoint a registered agent with a Maryland address (free or $50–$150/year), and obtain an EIN from the IRS (free). If you want to reserve a business name, it costs $25 for 30 days. Expect to pay around $150–$300 upfront to form your LLC and $300 per year for your annual report and Personal Property Return.

Maryland makes forming an LLC refreshingly straightforward, whether you're launching your first side hustle, or upgrading your solo venture into something bigger. In this guide, you'll find every step laid out clearly — from picking the perfect name to keeping your LLC in good standing for years to come. We’ll guide you through every step to launch your Maryland LLC with confidence.

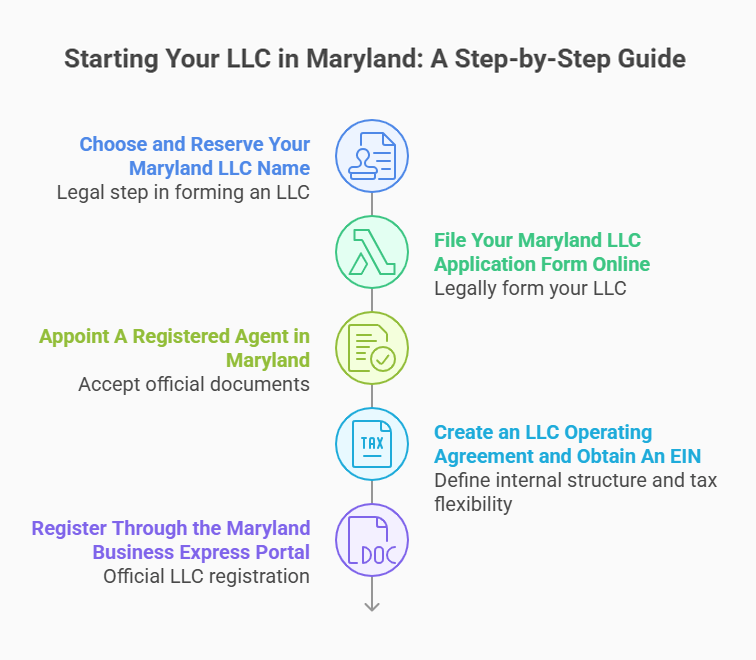

How To Start, Form, And Register an LLC In Maryland: Step-By-Step Guide

By starting a limited liability company in Maryland, you step into a state that supports growth and provides helpful resources. You can go from idea to launch quickly thanks to Maryland's business-friendly environment, fast online systems, and no franchise tax. This guide gives you the tools to properly register your Maryland LLC from the start.

Step 1: Choose and Reserve Your Maryland LLC Name

Choosing a name is your first legal step in forming an LLC in Maryland. Your business name must be distinguishable from other other business entities registered with the Maryland Department of Assessments and Taxation. The name must have “Limited Liability Company” or an accepted abbreviation in it like “LLC.” The name must not be understood as a term that implies name association with a government body or a restricted profession.

Before you register, run a name search using Maryland's Business Express database to verify availability. If the name you want is available, you can reserve it for $25, valid for 30 days. An expedited reservation option is available for an additional $20, with processing typically completed within 7 days. Use this period to do your branding, buy the domain name and check the name works both legally and for the long term. A good name should be searchable, compliant, and future-proof.

Step 2: File Your Maryland LLC Application Form Online

To legally form your LLC in Maryland, you'll need to file the articles of organization through the Maryland Business Express portal. It is completely online, easy-to-use, and can take less than 10 minutes to complete if you have everything ready. Prior to starting your application, you'll want to take some details.

Required Information:

- Proposed business name for your LLC.

- Name and physical address of your resident agent.

- Street address of your principal office in Maryland.

- Type of business entity and management structure.

- Contact email for official communication.

- Signature of the authorized person submitting the form.

The standard filing fee is $100, whether you file online or by mail, and expedited processing is available for an additional $50. Online filings may take up to 2 weeks to process, while paper submissions can take 6–8 weeks. Learn more about the full timeline here.

Step 3: Appoint A Registered Agent in Maryland

Every LLCs in Maryland must appoint a statutory agent (also known as a registered agent ) to accept official documents on behalf of the company. The individual or entity must have a physically present in Maryland and must maintain normal business hours to receive tax notices, lawsuits, and compliance notices. It guarantees the reliable access of the state to your business.

You can be your own agent or use a registered agent service which typically costs $50–$150 per year. Although you can self-appoint for free, doing it with a third party offers better privacy and reliability. Plus it also helps in avoiding missing any important legal notices.

Step 4: Create an LLC Operating Agreement and Obtain An EIN

An operating agreement defines your LLC's internal structure, member responsibilities, voting rights, and profit distribution terms. Though Maryland doesn't require one, having it strengthens your legal foundation and supports your protection as a business entity. Below is a table highlighting why you should create this document before you apply for your EIN or open a business bank account.

Benefit Description:

| Benefit | Description |

|---|---|

| Legal Protection | Reinforces limited liability for all members |

| Internal Clarity | Sets rules for voting, capital contributions, and decision-making |

| Tax Flexibility | Helps define how your LLC will be taxed (eg, partnership or corporation) |

| External Credibility | Required by some banks and investors for financial transactions |

After signing the agreement, you can file online for your free EIN at the IRS website to handle hiring and tax reporting. Once your EIN is issued, you can also choose how your LLC will be taxed at the federal level. Single member LLCs are taxed as sole proprietorships by default. The multi-member LLCs are taxed as partnerships by default. Alternatively, you can elect being taxed as an S Corporation by filing IRS Form 2553 or as a C Corporation using IRS Form 8832. These elections may affect the manner in which profits are distributed and taxed. Therefore, you should contact a tax adviser before making an election.

Step 5: Register Through the Maryland Business Express Portal

To begin your official LLC in Maryland registration, visit the Maryland Business Express Portal and create an account. The portal is the state's primary digital system for new entity filings. You'll need a valid email address and your entity details to start.

After creating an account, you will need to upload all the necessary documents like your articles of organization and the completed application form. Make sure your files are labeled properly and comply with the file size and format requirements of the portal.

Once uploaded, submit your application through the portal. You'll receive an on-screen confirmation and an official filing receipt via email from the Maryland Department within 1–2 business days.

Maryland LLC Requirements: What You Must File and Maintain

Forming an LLC is only the beginning, keeping it compliant is the real challenge. In Maryland, ongoing filings are required, which when missed incur penalties or dissolution. To safeguard your business entity and its position, know what to file and maintain. Every step counts, including filing the Personal Property Return and submitting your annual report. Learn more at the official registration guide .

Key Legal and Compliance Requirements for Maryland LLCs

To remain active and in good standing, every limited liability company in Maryland has obligations to comply with the law. Noncompliance would be enforced by the Maryland Department of Assessments and Taxation through administrative dissolution and fines. Below are the mandatory requirements LLCs must do every year and as needed.

- Submit the annual report and Personal Property Return by April 15.

- Maintain an up-to-date registered agent and business address.

- File changes to the articles of organization if there are structural updates.

- Renew applicable business licenses and local permits.

- Respond promptly to notices from the State Department of Assessments and Taxation (SDAT).

Additionally, if your LLC operates under a name different from its legal name, you’ll need to register a DBA (Doing Business As) at the county level. Fees typically range from $10 to $20. Ignoring any of these could cost your company its legal protections and good standing.

In case you need to prove your LLC’s legal existence or compliance status, you may request the Maryland Department of Assessments and Taxation for a Certificate of Good Standing. Standard certificate: $20; long-form : $40. You need to get this Document for Business banking, borrowing money, or filing legal documents.

If your LLC hires employees, sells taxable goods, or collects sales tax, you must register with the Comptroller of Maryland for a State Tax ID. This registration ensures compliance with state income tax and Sales & Use Tax obligations and should be completed early to avoid penalties.

Maryland LLC Filing Fees and Other Initial Costs

Starting an LLC in Maryland involves several up-front costs ( see how it compares ) that business owners should plan for. Mainly state filing fee, which is worth $100 if done online through the Business Express portal. Paper submissions will cost a little more and take longer. To this end, businesses may also pay a fee for a certified copy of the articles of organization, name reservation (optional), and expedited services for faster approval.

Although not the cheapest in the nation, Maryland's start-up costs are lower than those of neighboring Virginia and Delaware. Nevertheless, the new business-owners can cut costs by handling the paperwork themselves or using bundled LLC formation services with registered agent coverage. Planning ahead helps avoid unnecessary fees and supports a leaner startup budget. You can also compare annual LLC fees by state to see how Maryland compares

What Ongoing Compliance Requirements Apply?

Maryland LLC requires follow-up attention after forming your LLC to maintain its good standing. Every year you need to file a Personal Property Return with the Department of Assessments and Taxation and pay the $300 annual report fee, both by April 15. This fee can be waived if your business registers and contributes to MarylandSaves before December 31. Depending on your business type, you may also have state and local tax obligations (including income tax, sales/use tax, etc.) to comply with. Compare LLC tax rates across stateshere to see how Maryland stacks up. Late filings may result in penalties or administrative dissolution.

For Maryland income taxes, deadlines vary depending on your LLC’s tax classification. Failing to file or pay on time can trigger penalties—either 0.001% of the unpaid tax or a minimum charge, plus 2% monthly interest on the outstanding balance. Learn more at the Maryland Comptroller's business tax services page.

Form Your Maryland LLC with ZenBusiness

ZenBusiness handles all the steps to launch your Maryland LLC, from name reservation to filing.

Managing Your Maryland LLC for Long-Term Success

The actions you take after forming your Maryland LLC will affect its long-term success. To thrive long-term, proactive management is key. To ensure that your limited liability company scales, stay compliant, reinvest profits, and adjust your business plan to market trends. Success isn't an accident, built by informed decisions, strong leadership, and knowing what your business needs at each stage.

What Does MD LLC Mean in Business Documents?

“MD LLC” means Maryland limited liability company. The phrase appears in legal documents to designate the jurisdiction of your business and its structure. It is important to add this designation when signing a business contract, filling out tax papers, opening a business bank account. This ensures clear identification of your entity, provides you with stronger liability protections, and ensures compliance with Maryland law, whether in-state or interstate.

How To Keep Your Maryland LLC in Good Standing

To be in good standing, your Maryland LLC must have met all ongoing legal, tax, and administrative requirements. To keep your liability protection and qualify for loans, make sure to maintain this status so you can operate in MD or go somewhere else. Here’s how to renew your LLC and avoid falling out of compliance. Missing deadlines or filings may incur late fees, penalties or even administrative dissolution.

To protect your business, implement a compliance strategy. This consists of monitoring due dates, digital tools, and automatic breadcrumbs. Many businesses benefit from designing one person or hiring a registered agent service to ensure that documents are submitted on time and requirements are not missed.

Checklist of Things to Keep Your LLC Compliant

1. File your annual report and personal property return on time.

2. Renew any applicable business license or industry-specific permits.

3. Pay state and federal taxes promptly.

4. Maintain a current registered agent on record.

5. Update the Maryland Department about any changes to your business address or ownership.

6. Store operating agreements and meeting notes securely.

7. Use a calendar or compliance software to track obligations.

How To Update, Reinstate, Or Dissolve a Maryland LLC

If your Maryland LLC experiences changes, such as a new address, a name change, or a change in ownership, then you must file Articles of Amendment through the Maryland Department. This will keep the public records accurate and your business compliance issue free. You can file updates online using Maryland Business Express and this filing generally requires a small fee. Filing an Amendment costs $100, while a Cancellation is free. If you need faster processing, you can request expedited service for $50. Other statutory changes like mergers or continuations may also require additional filings and documentation.

If your LLC's status has been administratively dissolved, you can reinstate it. You must file forms, pay back taxes and penalties, and submit proof that all missed annual filings have been completed. Reinstating your company revives its legal standing and restores its authority to conduct business in Maryland.

To dissolve your LLC, you will file Articles of Cancellation with the SDAT (State Department of Assessments and Taxation). You need to pay your debts, inform your creditors, and distribute any remaining assets. If you dissolve properly you will avoid having any future liability or tax issues.

FAQ About Starting and Managing an LLC In Maryland

Most business owners slow things down because they have common questions about creating and operating a Maryland LLC. This FAQ section contains the most commonly asked questions that you may have when forming your company, along with easy and practical solutions for them.

Is Maryland a Good State to Form An LLC?

Yes, Maryland is a strong choice. The state has competitive taxes, access to major East Coast markets and a well-educated workforce. With proximity to Washington, DC by enabling the development of business resources such as Maryland Business Express, it provides new entities with digital tools and fast processing – ideal conditions to form and grow a limited liability company.

What Licenses and Permits Are Required for Maryland LLC?

Every Maryland LLC must make sure they follow state and local business license regulations. You may need to apply for permits or registrations depending on your industry, such as health, zoning, or professional requirements. According to the Maryland Department of Labor, Licensing, and Regulation, certain industries (like construction, healthcare, and financial services) may require registration. You may also need federal authorizations, depending on your business activities. Use the SBA licensing guide to identify what applies to your business. Then, apply through the Maryland Business Express portal or local agencies.

How To File Taxes for Maryland LLC?

Depending on what you elect with the IRS, your Maryland LLC can be taxed either as a sole proprietorship, partnership, or corporation. You will file federal returns and submit state income and sales taxes to the Comptroller of Maryland. Deadlines vary by structure. For accurate reporting and compliance, it's smart to consult a qualified tax professional.

Harbor Compliance Offers Maryland Registered Agent Services

Stay protected with Harbor Compliance’s dependable Registered Agent service in Maryland.