How to start an LLC in Oklahoma is one of the top queries for new entrepreneurs in 2025 — and for good reason. With just a $100 state filing fee, no franchise tax, and a quick online application process, Oklahoma makes it surprisingly affordable to launch a limited liability company. Optional costs like a registered agent ($0–$125/year), trade name registration ($10–$50), and the required $25 annual certificate put total startup costs between $125 and $300, making it one of the most budget-friendly states for forming a business.

To start an LLC in Oklahoma, file Articles of Organization with the Secretary of State and pay a $100 filing fee. You’ll also need to appoint a registered agent and file a $25 annual certificate to remain compliant.

This guide walks you through every step of forming an LLC in Oklahoma — from choosing a business name and preparing an operating agreementto handling taxes, licenses, and keeping your business in good standing. Whether you're starting solo or scaling up, we’ll show you exactly how to do it, simply and affordably.

What Is an Oklahoma LLC and Why Should You Form One?

Oklahoma is one of the cheapest states for LLC (Limited Liability Company) registration. It is a perfect state to start a business that has a high chance of success due to less hassle. As a business entity, Oklahoma LLC protects the owners from liability while still allowing operational flexibility. Even if you’re not operating yet, forming an LLC before starting your business helps you reserve your name, build credibility, and protect your assets early. As a result, it is a popularly chosen option for start-ups and small businesses.

What Are the Main Benefits of an LLC in Oklahoma?

There are many benefits of forming an LLC in Oklahoma and one of them is the taxation. The corporation itself may not be directly taxed, but rather the profits and losses of the business entity are passed through to the owners’ personal income tax. This tax setup can help you avoid double taxation and annual reporting.

Furthermore, with an Oklahoma limited liability company, you will have flexibility in managing your company. When you operate alone or with the partners, you can customize your operating agreement as per how decisions are made, profits are shared, and responsibilities are divided; you have flexibility in this unlike that in a corporation.

Oklahoma-Specific Liability and Flexibility Features

Forming a limited liability company in Oklahoma comes with unique legal and structural advantages that strengthen your protection as a business owner. The state’s laws are designed to shield personal assets while allowing flexible management options that benefit both solo entrepreneurs and growing teams. Whether you're forming a new LLC in Oklahoma or converting from another business entity, the statutory support here goes beyond the basics.

Key advantages include:

- Protection from personal liability for most company debts and obligations

- Strong asset shielding provisions under Oklahoma state law

- Flexible management structures allowed in your operating agreement

- Legal recognition of single-member LLCs with full liability protection

- No annual franchise tax required for LLCs in Oklahoma

Should You Start an LLC in Oklahoma? Pros and Cons to Consider

Forming an LLC in Oklahoma is often a good idea, but that doesn’t mean they are without draw backs. Some entrepreneurs may find the initial learning or filing process intimidating. Plus, you need to keep various records, submit an annual certificate, and fulfill ongoing legal obligations that may not fit for hobbyists or part-time undertaking.

That said, for most serious business owners, the benefits far outweigh the drawbacks. The limited liability company structure offers personal asset protection, low cost to start, and simplified taxes. Still exploring your options? Here’s how Oklahoma measures up against the leading states to start an LLC. Use the table below to weigh key pros and cons before making your decision.

| Pros | Cons |

|---|---|

| Personal liability protection | Requires ongoing state compliance |

| Low state fees and no franchise tax | Learning curve for new business owners |

| Customizable operating structure | Must file annual certificate |

| Pass-through taxation | Not ideal for very casual side gigs |

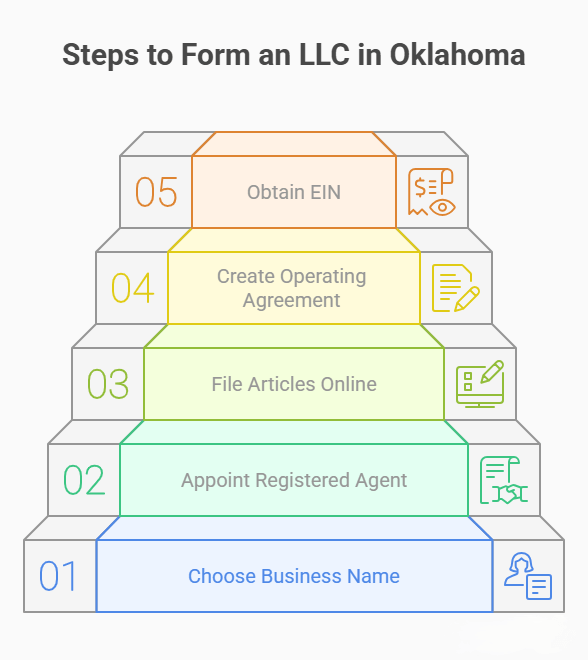

How to Form an LLC in Oklahoma: The Official 5-Step Process

Getting an LLC in Oklahoma is a straightforward process that most people can complete in only a few business days. You don’t need to hire an attorney and you won’t get buried in piles of paper—just follow five official steps and you’ll have a fully recognized business entity in the state.

Step 1: Choose a Compliant Business Name

Choosing a unique name is the first step to start LLC in Oklahoma, as per Oklahoma state guidelines. Choose a unique name that seriously distinguishes your LLC from every existing LLC in the Oklahoma Secretary of State’s business database. Before filing, you can minimize the chances of rejection by doing a free name search on the official business search tool. Need help using the platform? Follow this step-by-step guide on checking LLC name availability in Oklahoma to check availability and reserve your business name securely.

Oklahoma also requires your business entity name to include a designator like “LLC” or “Limited Liability Company.” Avoid restricted words like “bank” or “insurance” unless properly licensed. If your name meets these legal requirements, you can reserve it for up to 60 days before officially filing your articles of organization.

Step 2: Appoint Your Oklahoma Registered Agent

Every Oklahoma LLC needs to appoint a registered agent, who can receive legal notices or government documents and accept service of process. The agent can either be a qualified person or a professional registered agent service which must have a physical office address in Oklahoma and must be available during the business hours.

Choosing the right agent is a legal requirement so that your business entity maintains its good standing with the Oklahoma Secretary of State. Most owners hire commercial services for convenience, privacy and reliability. Not sure who to choose? Explore this comparison of the top registered agents in Oklahoma to find trusted providers based on price, features, and service quality.

Step 3: File Articles of Organization Online

To form an LLC in Oklahoma, you’ll officially submit your articles of organization through the Oklahoma Secretary of State's SOSDirect portal. Electronic filing is fast, easy to use and gets instantly processed by online system. This is the most common way to file and most applications process the next business day or same day as long as all details are correct.

Once your application is submitted, you are required to include certain information to legally recognize your business entity. It’s very important to be accurate, as any difference or omission could bring rejection or costly changes. f you're unsure what to include or how the form works, review this guide on what a Certificate of Organization is and why it matters before you file. Before you submit your filing to the system, you can see a preview of your filing and once it is accepted, you will get a confirmation.

Required information includes:

- LLC name (must comply with naming rules)

- Principal place of business in Oklahoma

- Name and address of your registered agent

- Whether the LLC is member-managed or manager-managed

- Effective date of formation (can be immediate or future)

- Signature of an authorized person

Step 4: Create a State-Compliant Operating Agreement

Even though it’s not legally required, drafting an operating agreement is one of the smartest steps you can take when forming an Oklahoma LLC. This internal document sets out the legal structure, member rights and duties, voting rights, profit distributions, and management rules of your limited liability company.

A written operating agreement can increase your liability protection in a multi-member business. Using Operating Agreements can help resolve any internal disputes. It also helps resolve internal disputes, clarifies expectations, and proves your LLC is a legitimate business entity in the eyes of banks, courts, and investors.

Step 5: Obtain a Federal Employer Identification Number (EIN)

As soon your Oklahoma LLC is created, you need to get a federal employer identification number (EIN) by applying through the IRS. You will need this number to open a bank account for your business, hire employees, pay taxes, and follow state and federal business laws.

You can apply for it online at irs.gov. It costs nothing, needs a few minutes only, and if all your info checks out then you will get your EIN granted immediately. Just be careful to apply directly through the IRS—many third-party websites charge unnecessary fees or try to upsell unrelated services.

Best LLC Formation Services to Help You Start Easily in OK

If you want to start an LLC in Oklahoma quick and stress-free, then using a formation provider or registered agent service can save you time and prevent filing errors. These services make things easy for you – from drafting the articles of incorporation to compliance with the Oklahoma Secretary of State. If you’re considering forming a business entity for the first time, would prefer an expert on your team, or want reminders about compliance deadlines like your annual certificate, they can help.

Here are three trusted options worth considering:

- Northwest Registered Agent – Known for privacy-first practices, free operating agreement templates, and top-tier customer support. Pricing starts at $39 plus state fees.

- ZenBusiness – Offers all-in-one business formation packages, including EIN filing, worry-free compliance, and annual report reminders. Plans from $0 + state fees.

- Harbor Compliance – Best for growing companies needing advanced legal support, multi-state filings, and custom compliance tracking. Starts at $99 + fees.

Still comparing providers? See the full breakdown of the best-rated LLC service providers in Oklahoma to find one that fits your budget, timeline, and business goals.

Get a Reliable Oklahoma Registered Agent With Northwest

Northwest prioritizes your privacy with secure mail handling, fast uploads, and real-time alerts—backed by friendly in-house support.

Understanding the Costs to Start and Maintain an Oklahoma LLC

Before you start an LLC, it's important to understand every potential cost—not just the filing fee. Oklahoma offers one of the most affordable paths to forming a limited liability company, but there are still recurring obligations like your annual certificate, registered agent fees, and any industry-specific licenses and permits. For a complete look at startup and maintenance costs across all 50 states, check out this detailed guide about the real cost of starting an LLC.

This section breaks down all initial and ongoing expenses, helping you plan ahead and stay compliant. Whether you’re bootstrapping a solo venture or budgeting for a multi-member business entity, knowing your true cost to start an LLC in Oklahoma is essential.

Filing Fee for Articles of Organization

You'll pay a filing fee of $100 to the Oklahoma Secretary of State to officially set up your LLC in Oklahoma. You must pay this one-time fee when submitting your articles of organizationonline SOSDirect or by mail.

Compared to other states, Oklahoma’s LLC startup fee is highly competitive. Some states charge over $300 just to register a limited liability company, making Oklahoma a cost-effective choice for small businesses looking to minimize their upfront expenses.

Annual Certificate Fee and Renewal Process

In this state, every limited liability company must file an annual certificate with the Secretary of State. The certificate of good standing shows that your LLC is active and has complied with state regulations and is authorized to conduct business. It must be submitted annually by the anniversary date of your LLC’s formation. The filing fee is $25 — one of the lowest in the country. Filing late may invite late penalties or administrative dissolution. You can complete the entire process online through SOSDirect. Compared to neighboring states, Oklahoma’s low cost makes compliance easier for startups and small businesses keeping long-term costs in check.

| State | Annual Fee | Due Date | Filing Method |

|---|---|---|---|

| Oklahoma | $25 | Anniversary date | Online via SOSDirect |

| Texas | $0 | May-15 | Franchise tax report |

| Arkansas | $150 | May-01 | Online or mail |

| Kansas | $55 | 15th day of 4th month | Online or mail |

For a national comparison of costs, check out this guide to state-by-state LLC annual fees to see how Oklahoma compares to more expensive states like California, Texas, and Arkansas.

Other Potential Costs (Registered Agent, Licenses, Taxes)

Other than the basic filing fee and annual certificate fee, most Oklahoma LLCs will incur other startup and maintenance costs. Depending on your industry, local authority, and whether you bring in external help. Not all of them are necessary, but they can affect your total cost to start and keep your business entity in good standing.

Awareness of these extra costs helps avoid surprise fees that arise due to registered agent services, licenses, permits, etc. Just as important as forming your Oklahoma LLC is budgeting for taxes, city fees, or a trade name registration.

Additional expenses may include:

- Registered agent fees (free to $125+/year)

- Local and state business licenses (varies by industry and city)

- Specialized licenses and permits (e.g., health, construction, alcohol)

- State and federal taxes (sales, income, franchise depending on structure)

- Trade name or DBA registration (approx. $25–$50)

- Industry-specific bonds, insurance, or professional certifications

After Formation: Managing Your Oklahoma LLC

Forming your LLC in Oklahoma is just the beginning. To keep your business entity in good standing, you’ll need to meet ongoing legal and financial obligations. After you form your new business, various tasks beyond filing your annual certificate must be completed. These tasks entail record-keeping and state tax compliance. For ongoing success, it is important to complete these post-formation tasks.

This section outlines what to do after your LLC is approved—so you stay legally protected, tax-ready, and fully operational year after year.

Annual Certificate Filing and Ongoing Renewal Process

Every year, the Oklahoma Secretary of State requires that the LLC files an annual certificate. This filing verifies that your business entity remains operational, updates contact and ownership information, and affirms that your company is in compliance with state law. You must pay the filing fee of $25 by your anniversary date of formation.

Missing deadline for filing may result in late penalties, loss of good standing status, or even administrative dissolution of the entity. The SOSDirect system will allow you to do so quickly and securely. To stay in compliance, create calendar reminders, keep your filing receipt and always check to confirm your renewal was received.

Registering for State Taxes and Withholding

You might need to register with the Oklahoma Tax Commission after forming an LLC in Oklahoma depending on what you do. If your business entity will sell merchandise, hire employees or engage in taxable services, state tax registration is mandatory. This includes collecting sales tax and withholding income tax from wages, and possibly paying franchise or other business taxes.

Follow these steps to register:

- Visit the Oklahoma Taxpayer Access Point (OkTAP)

- Create a business account and login

- Submit your registration for sales, withholding, or other applicable taxes

- Wait for confirmation and your state tax ID number

Opening a Business Bank Account in Oklahoma

The next step after getting your Oklahoma LLC approved is to open a separate business bank account. Having a dedicated business account helps you separate your personal from your business finances clearly. This is essential for liability protection and accurate tax reporting. Over time, it will also help you build established business credit.

To open an account, most banks will require your EIN, articles of organization, and a signed operating agreement. Be sure the account is under the business entity name and not your personal name. This reinforces your legal separation and helps maintain your LLC’s standing if ever audited or challenged in court.

Maintaining Good Standing and Record‑Keeping

Your Oklahoma LLC has to comply with the requirements of good standing besides filing your annual certificate. It is also important to properly document and track the operations, ownership transfers, and tax filings of your business entity. Your liability protection is aided by these records and may be needed in audits or lawsuits.

You should store your articles of organization, operating agreement, annual filings, and other key correspondence safely. Schedule each deadline on a bullet-proof calendar, with everything backed up online. Documenting your own records makes it easy to stay in compliance and prove your LLC is operating legitimately.

Frequently Asked Questions About Oklahoma LLCs

If you’re not sure how to start an LLC, you’re not alone. Oklahoma LLC formation is often filed with the same issues by entrepreneurs. These include registered agent options, logistics, and more. This FAQ section contains a list of the most commonly asked questions answered quickly and simply so that you can proceed confidently. If you’re still exploring the basics, this complete guide on starting an LLC step-by-step covers key benefits, steps, and compliance tips for forming your business in any state.

Can You File Your Oklahoma LLC Articles of Organization Online Instead of by Mail?

Yes. You can file your articles of organization online through the Oklahoma Secretary SOSDirect system. Filing online is faster, more convenient, and typically processed within 1–2 business days—much quicker than mailing physical documents.

How Long Does the LLC Approval Process Take in Oklahoma?

Most LLC in Oklahoma filings are processed within 1 to 2 business days when submitted online through the Oklahoma Secretary’s SOSDirect portal. Mailed submissions can take up to 7–10 business days. Online filing is the fastest and most reliable option for quick approval.

Can You Act as Your Own Registered Agent in Oklahoma?

Yes, you can be your LLC's own registered agent in Oklahoma. But, you must have a physical office in the state and be available during normal business hours to accept service of process. A lot of owner select a registered agent service instead for reasons privacy, convenience and avoiding missing important notices.

Do You Need a Lawyer to Start an LLC in Oklahoma?

No, most entrepreneurs can start an LLC in Oklahoma without an attorney. Oklahoma Secretary of State makes it easy, you can complete the process online. However, you may want to get legal help if you have complicated ownership structures or want a custom operating agreement.

What's the Difference Between an LLC and a Sole Proprietorship?

A limited liability company offers personal asset protection, meaning your home or savings can’t be seized for business debts. In contrast, a sole proprietorship provides no legal separation—you and your business are the same entity in the eyes of the law. An LLC in Oklahoma also offers better credibility, access to funding, and flexible taxation options.

How Do You Check If Your Oklahoma LLC Is in Good Standing?

You can check if your LLC in Oklahoma is in good standing by checking the Oklahoma Secretary of State business search page. Enter your business entity name to view current status, recent filings, and compliance history. Keeping up with your annual certificate ensures you stay active and avoid administrative issues.

Can You Pay for Your Oklahoma LLC Filing with a Credit Card?

Yes, the Oklahoma Secretary of State accepts major credit cards for online filing fee payments made through SOSDirect. This makes it fast and easy to start an LLC without needing checks or money orders. Make sure your card information is correct to avoid filing delays.

Start Your Oklahoma Business Fast with Harbor Compliance

Avoid red tape, missed deadlines, and rejected filings. Harbor Compliance makes forming an LLC smooth and secure.