Choosing an LLC service shouldn’t feel like a gamble. We compared true total cost (including registered agent renewals), turnaround speed, and what’s actually included to find the best options for different founders. Whether you want a $0 launch, privacy-first support, or concierge compliance, the right pick depends on your priorities and timeline. Use the quick picks below to decide in minutes, then dive into reviews and state-specific timing tips.

Quick Summary – Top Picks & Who They’re For

If you want the best LLC services without surprises, start by matching your budget to how much help you need. Founders who value privacy-first support typically pick Northwest Registered Agent for its $39 LLC filing and clear, flat registered agent service pricing. Budget hunters often choose a $0 plan from LegalZoom, ZenBusiness, or Bizee, then add only what they actually need. Premium, compliance-heavy needs (multi-state, regulated industries) tend to fit Harbor Compliance thanks to hands-on guidance and predictable RA renewals.

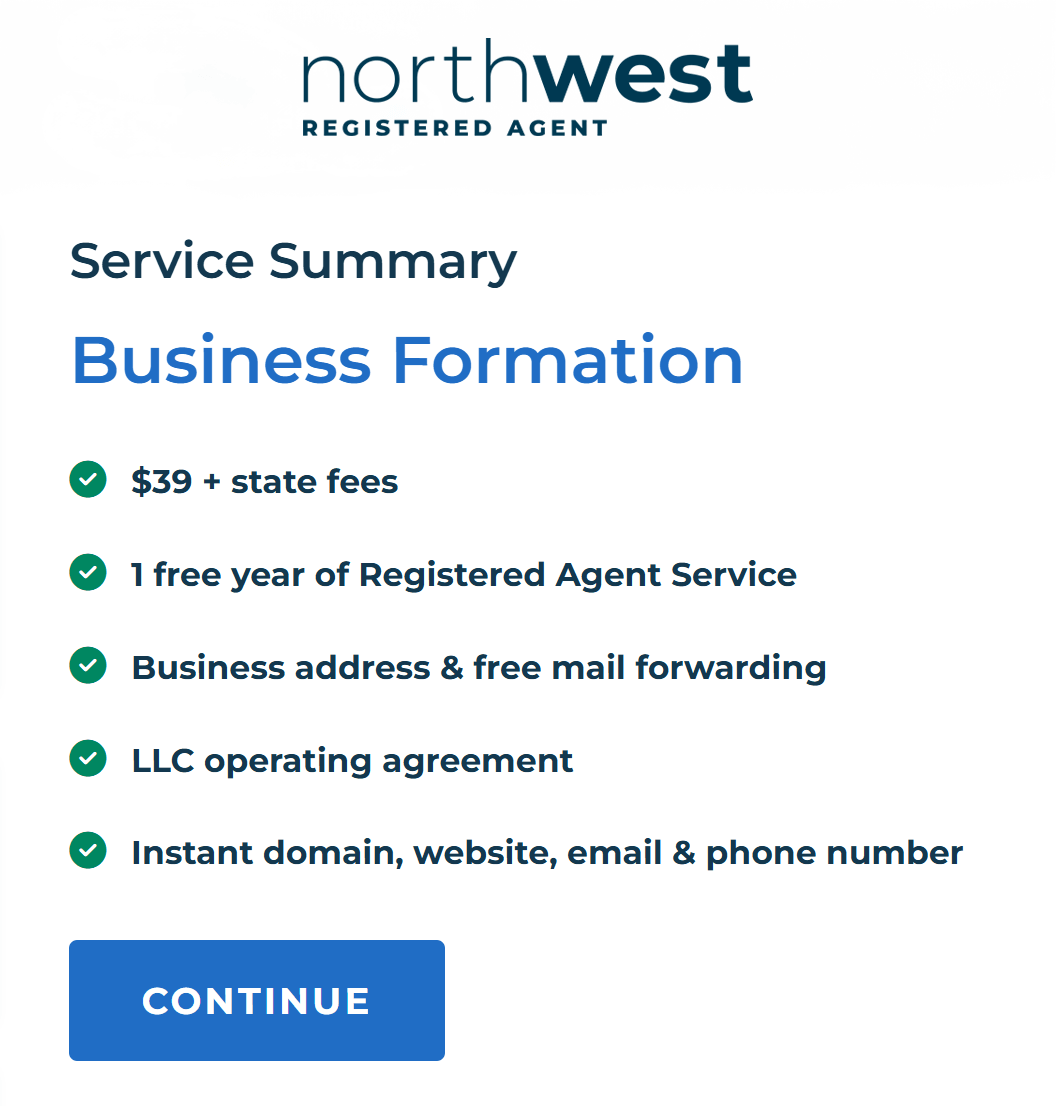

- Northwest Registered Agent – Best overall (privacy + support): You pay $39 + state fee to form and get a free first year of registered agent service; renews at $125/yr.

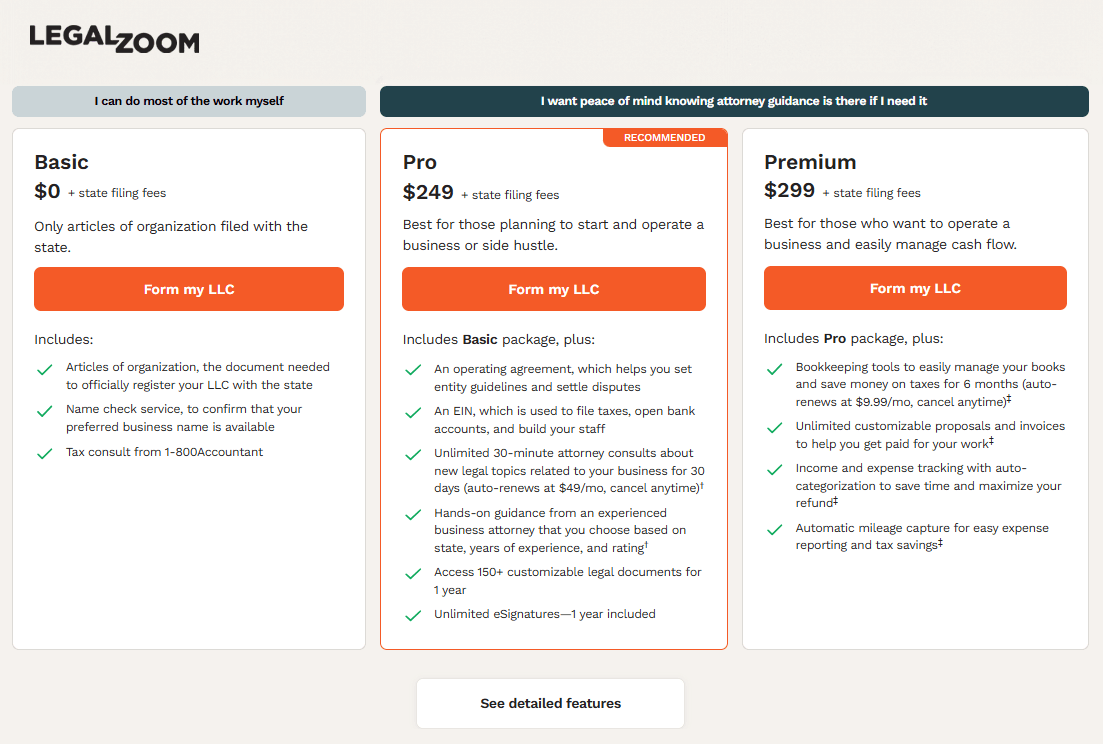

Great if you value minimal upsells and strong privacy. - LegalZoom – Best legal platform bundle: $0 + state fee entry with deep legal ecosystem; RA is $249/yr.

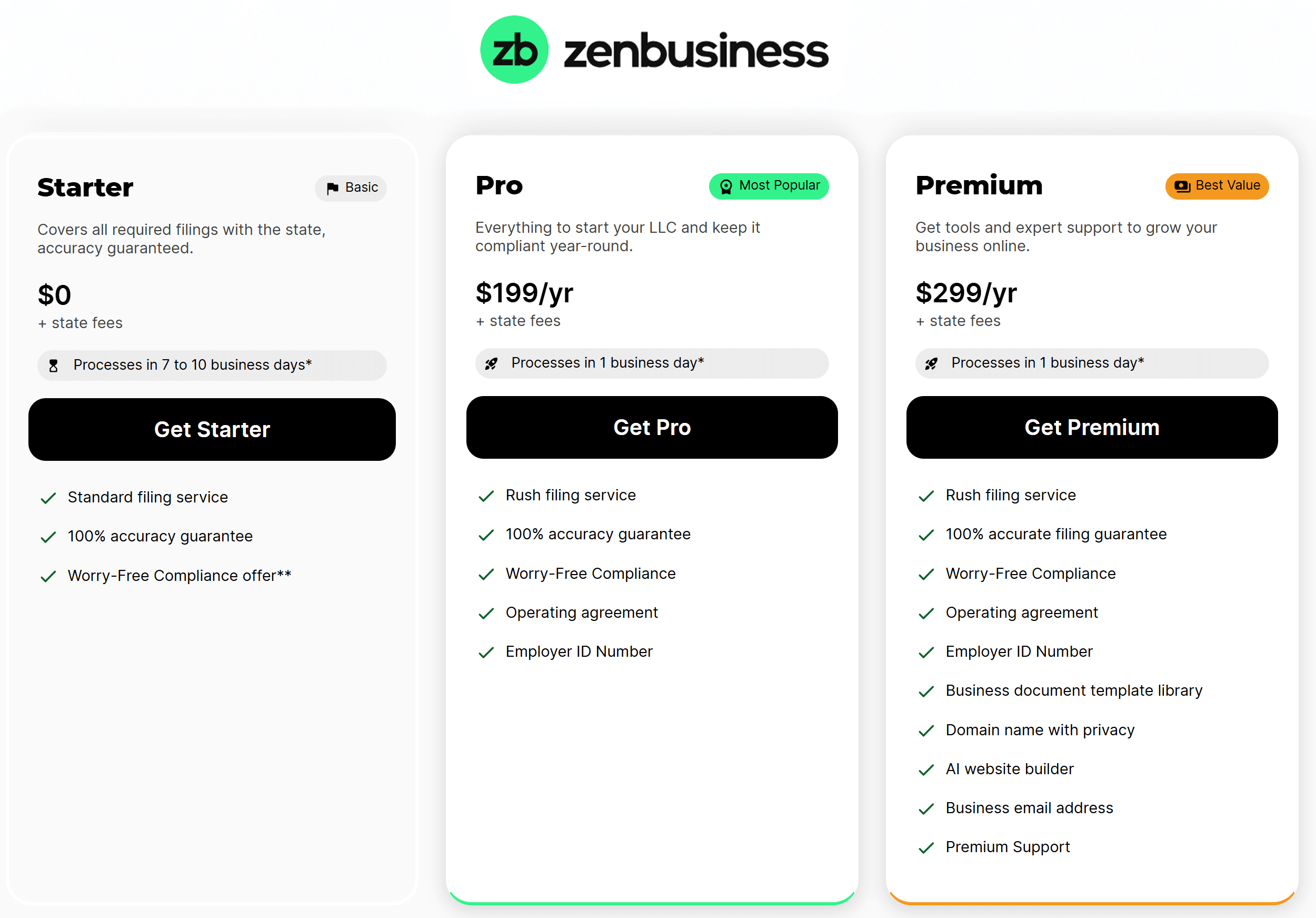

Choose if you want ongoing legal docs and brand familiarity. - ZenBusiness – Best essentials value: $0 + state fee Starter; upgrade for rush filing and compliance tools; RA add-on ($99 first year, renews $199).

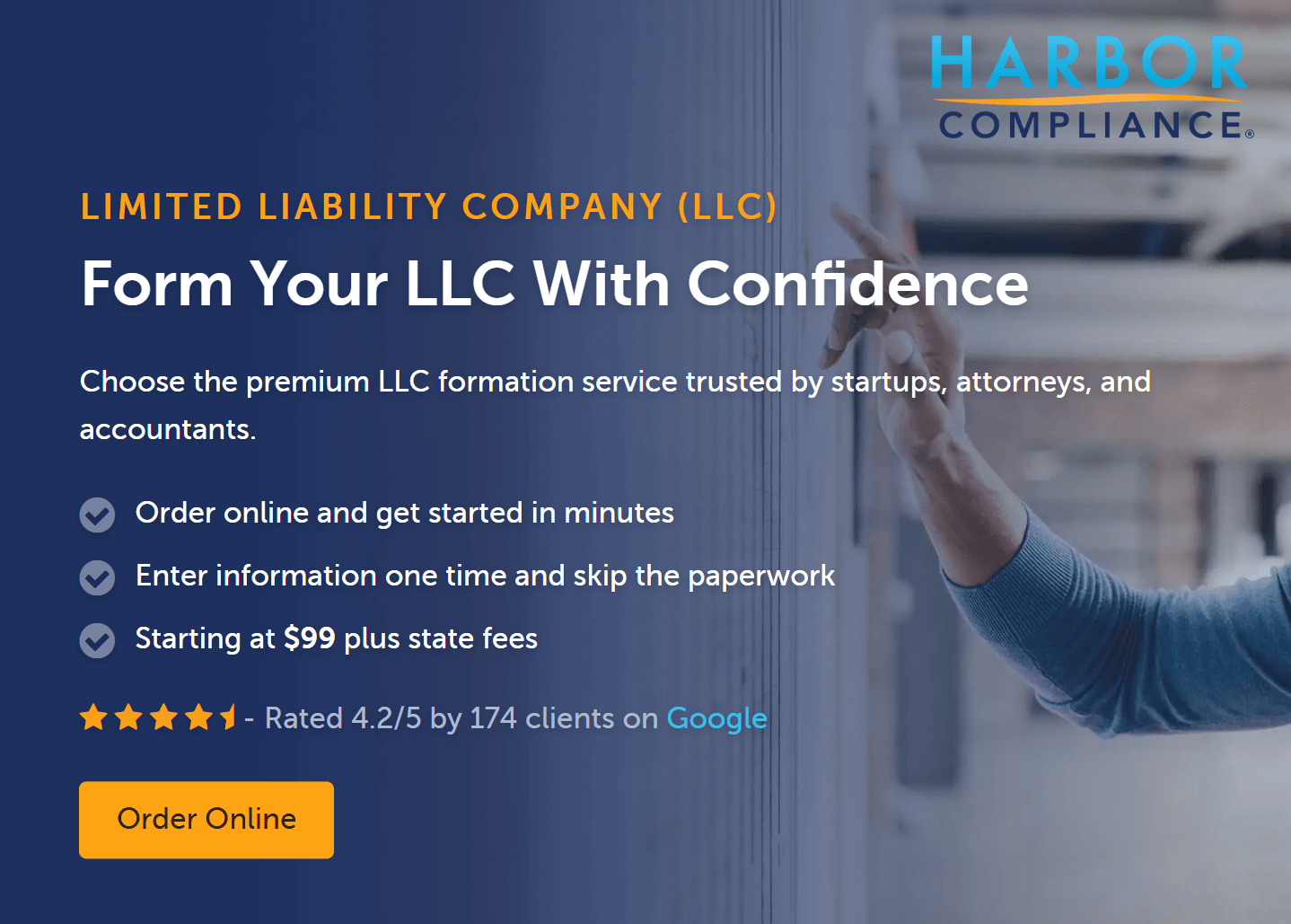

Excellent for founders wanting speed + low upfront cost. - Harbor Compliance – Best premium/concierge: Formation from $99 + state fees with strong compliance software; RA $99 first year, $149 renewal.

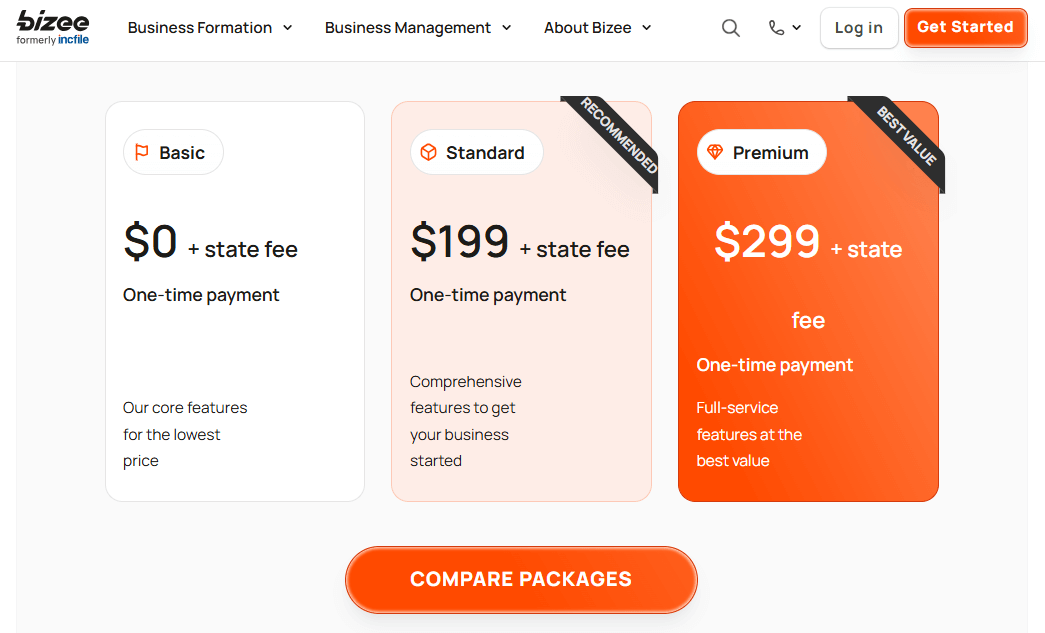

For regulated or multi-state operators. - Bizee (formerly Incfile) – Best $0 plan alternative: Silver $0 + state fee with free RA year-1; RA renews around $119/yr. Watch upsells at checkout.

Top 10 LLC Services – Reviews (2025)

Use this quick-glance table to compare upfront pricing, whether first-year registered agent service is included, typical renewal rates, and the “best for” fit. Prices exclude state filing fees and can vary by state.

Comparison table:

| Service | Starter Price | Year-1 RA Included? | RA Renewal | Processing Time |

|---|---|---|---|---|

| Northwest Registered Agent |

$39 + state fee | Yes | $125/yr | Files very fast (often same-day); state approval varies, e.g., FL ~5 business days. |

| LegalZoom |

$0 + state fee | No | $249/yr | Standard 5–14 business days; 1-day company filing with Expedited Processing. |

| ZenBusiness |

$0 + state fee | No (add-on) | $199/yr (promo $99 1st yr) | Starter typically ~5–7 business days; 1-business-day “Rush” available. |

| Harbor Compliance |

from $99 + state fee | Often in higher tiers | $149/yr (after $99 1st yr) | State-driven; DE standard ~3 weeks; DE expedite options from 24h down to 1h. |

| Bizee (Incfile) |

$0 + state fee | Yes | ~$119/yr | Next-business-day submission; state times vary (e.g., FL ~3 weeks; 3-day expedited). |

| MyCompanyWorks |

$79 + state fee | Only in higher tiers | $119/yr | Same-day processing if ordered by 3pm ET; otherwise next business day. |

| Rocket Lawyer |

$0 (with membership) or $99.99 + state fee | No | $124.99/yr with membership (full $249.99) | Company filing typically 1–2 business days; state pages show 3–5 days in NY. |

| Inc Authority |

$0 + state fee | Yes | $179/yr | Premium Rush submits to state within 24h; typical state time often ~7–10 business days. |

| BizFilings |

from $99 + state fee | 3 months free | $220/yr | Routine filings often ~4–6 weeks; expedited commonly ~1–2 weeks (state-dependent). |

| IncNow (Delaware) |

from $89 + state fee | Yes (Delaware) | $109–$119/yr | Standard next-day/3–4 business-day turnaround; DE expedite options available. |

Notes:

- “Year-1 RA included?” indicates whether a free first year of registered agent is bundled with formation (some providers include partial periods like 3 months).

- Renewal rates shown are typical/advertised; multi-year or membership discounts may apply (e.g., Rocket Lawyer). Always verify in-cart before purchase.

- “Processing time” reflects each provider’s internal submission speed plus a quick snapshot of typical state turnaround (since approvals ultimately depend on each Secretary of State).

1. Northwest Registered Agent: 9.45/10 (Best Overall LLC Service)

Northwest keeps it intentionally simple: $39 + state fee to form your LLC, with a free first year of registered agent service that renews at $125/year, a rare combo of low entry and predictable renewal. Turnaround is state-dependent, and Northwest publishes realistic timelines: for example, Virginia online approvals the same day, Florida often ~5 business days (10 by mail), Michigan up to ~2 weeks, and New Jersey online in ~2 days (expedite options down to 1 hour in person/fax). You’re paying for a privacy-first shop that files cleanly and knows the state quirks.

Pros

- Flat $39 filing + first-year RA; renewal $125/yr.

- Privacy-by-Default culture and clear documentation.

- State-specific speed guidance helps you plan (e.g., VA, FL, MI, NJ).

Cons

- No $0 plan (competitors do).

- Fastest approvals still depend on state queues/expedite rules, not Northwest. (They’re transparent about this on state pages).

Overall

For founders who value privacy, responsive humans, and clear long-term RA math, Northwest is the safest “set-and-forget” pick. If you can afford $39 instead of chasing a $0 headline, you get lower friction and fewer surprises at renewal.

For details on performance, pricing, and privacy policies, see our in-depth Northwest Registered Agent review.

2. LegalZoom: 9.2/10 (Best online legal service)

LegalZoom’s hook is $0 + state fee formation and a big-brand legal ecosystem. Plan on adding registered agent service at $249/year. Processing is clearly stated: standard ~5–14 business days, or 1-day company processing with a paid expedite; state approval then follows the state’s own timing. If you want one roof for filing, RA, and ongoing legal docs, the convenience premium makes sense. (Compare tiers and RA policies in our full LegalZoom review and pricing guide).

Pros

- $0 Basic plan; add services as needed.

- RA is available nationwide at $249/yr (posted publicly).

- Transparent processing windows; optional 1-day LegalZoom expedite.

Cons

- RA price is higher than niche RA providers.

- More à-la-carte upsells than boutique firms.

Overall

Choose LegalZoom if you want a brand-name legal stack and don’t mind paying $249/yr for RA. The speed options are straightforward, and worth it if your launch date is tight.

3. ZenBusiness: 8.25/10 (Best Essentials LLC Service)

ZenBusiness combines a $0 + state fee Starter with modern tooling. Their registered agent service is $99 for the first year (when added) and $199/year thereafter. On speed, Zen is explicit: typical internal processing is ~5–7 business days on Starter; Rush filing (included in higher tiers) pushes your order to 1 business day on Zen’s side. Actual approval depends on the state, but they publish state-specific examples and expedited paths (e.g., MN or AZ to 1–2 days with a fee). See our ZenBusiness pricing & features review for timing notes and upgrade math.

Pros

- $0 entry; upgrade only if you need speed or extras.

- Clear RA pricing ($99 first year, $199/yr after).

- Practical speed guidance and “Rush” queueing.

Cons

- RA isn’t bundled; total cost rises as you add compliance tools.

- Some state timelines still bottleneck at the SOS level (normal).

Overall

If you want a $0 start with a credible speed path, ZenBusiness nails the basics and makes it simple to buy just the speed you need, without locking you into a high base plan.

4. Harbor Compliance: 7.15/10 (Best Premium LLC Service)

Harbor Compliance is the concierge/compliance pick. Formation starts at $99 + state fees, and its RA is $99 for the first year, $149/year thereafter. They lean into predictable compliance software and hands-on coordination, plus state-specific, expedite-aware timelines (e.g., DE: 24-hour, same-day, 2-hour, or 1-hour options; NY/NJ/DC also show concrete expedite windows). You’re paying more for project management and clarity, not a $0 teaser.

Pros

- Transparent RA pricing ($99 first year, $149 renewal).

- Deep state guidance with real expedite matrices (DE/NY/NJ/DC).

- Good fit for multi-state or regulated businesses.

Cons

- Not the cheapest; value shows up on complex filings, not bare-bones.

- Some pages list higher formation bundles via third-party reviews; align scope to avoid overbuying.

Overall

Pick Harbor when compliance certainty matters more than the rock-bottom headline price. Their team surfaces the real timeline choices (and costs) so you can hit a date with fewer surprises.

If you need a deeper look at concierge fit, read our hands-on Harbor Compliance review.

5. Bizee (Incfile): 7.30/10 (Best $0 plan alternative)

Bizee is the classic budget play: $0 + state fee filing with the first year of registered agent service included; renewal is $119/year thereafter. They commit to next-business-day submission on their side; actual SOS approval depends on the state, and Bizee documents common expedite paths (e.g., DC same-day with fee; GA and AZ can be 1-hour/2-hour/next-day with the right state expedite). It’s a compelling combo if you want the lowest upfront and clear Year-2 math.

Pros

- $0 formation + year-1 RA; $119/yr renewal.

- Next-business-day submission; robust state expedite guides.

- Simple dashboard and lots of state FAQs.

Cons

- Upsells appear at checkout (normal for $0 plans).

- Support queues can stretch in peak seasons (state volume driven).

For pros/cons and renewal details, see our complete Bizee (Incfile) review.

Overall

If your priority is lowest upfront with a known RA renewal, Bizee hits that brief, and their state-by-state expedite notes make timing easier to plan.

Start your LLC for $0 with Bizee

Bizee offers free LLC formation (just pay state fees), plus tools to grow your business, perfect for startups on a budget.

6. Rocket Lawyer: 7.20/10 (Best for online legal services)

Rocket Lawyer is a membership-led option: your first LLC filing is $0 (excl. state fees) with Rocket Legal+ (otherwise $99.99), and registered agent service runs $124.99/year with membership ($249.99 full price). They publish state pages with concrete processing windows (e.g., New York 3–5 business days and Wyoming 2–3 business days) plus per-state expedite notes where available. If you want filings, legal docs, and attorney Q&A under one roof, their $239.88/year membership can pencil out, especially with “first filing free” and half-off subsequent filings.

For plan math and caveats, see our full Rocket Lawyer review.

7. MyCompanyWorks: 6.65/10 (Best for responsive customer support)

MyCompanyWorks is a no-subscription, straight-shooting alternative: Basic from $79 + state fees, registered agent service $99/year (promised “never to increase”), and same-business-day processing on orders received by cutoff; their pricing page also notes next-business-day handling across core filings. That mix (fast internal processing plus predictable RA) appeals if you’d rather avoid $0 plans with heavier upsells.

Explore packages and turnaround specifics in our MyCompanyWorks review of pricing & speed.

7. Inc Authority: 6.10/10 (Best for free LLC formation)

Inc Authority’s draw is $0 formation (you pay only the state fee) with the first year of registered agent service included. For timing, their FAQ says Rush Service submits within 24 hours, while state approvals range widely (about 1 week to 6 months depending on state workload); their own guidance pegs typical formations around 7–10 days. Renewal pricing for RA isn’t clearly posted on-site, but reputable reviewers consistently report $179/year after the free year, confirm in cart before purchase.

For pros/cons and renewal notes, see our Inc Authority review (fees & renewals).

9. BizFilings: 5.60/10 (Best for educational resources)

BizFilings (Wolters Kluwer) includes 3 months of registered agent service with formation and then renews at $220/year. On processing, they state 24–48-hour filing time for their part (document prep/submission), while state approval often takes longer; many filings can be expedited for a fee. This is a steady, corporate-style choice if you value a conservative brand and a compliance dashboard over the cheapest headline price.

For details on bundles and RA terms, read our BizFilings (Wolters Kluwer) review.

10. IncNow: 5.20/10 (Best for personalized services)

IncNow is a Delaware specialist with packages that include a free first year of registered agent service and an ongoing $109/year renewal, among the lowest reputable rates. Turnaround is clearly posted: 3–4 business days on standard packages, next-day with paid expedite, and Delaware offers 24-hour, same-day, 2-hour, 1-hour, even 30-minute state expedite tiers if you need a guaranteed clock. If you’re set on Delaware, IncNow’s in-state expertise and transparent timing make planning straightforward.

Other LLC Services

Not seeing a perfect fit among the top 10? The mini-reviews below cover four credible alternatives with clear notes on pricing and registered agent service expectations. Skim for what matters most: budget, ongoing RA fees, niche specializations (like Nevada), or a classic à-la-carte workflow.

11. Incorporate.com

Incorporate(dot)com offers straightforward filing packages (Starter $99, Essentials $249, Works $349 + state fees) and typically pairs formation with CSC’s registered agent service, commonly listed around $235/year and not bundled free. That structure makes the upfront price simple but the ongoing RA cost higher than most budget competitors, so confirm add-ons during checkout before you commit.

For a deeper look at packages, RA costs, and turnaround, see our Incorporate.com review.

12. CorpNet

CorpNet is a family-run provider with transparent pricing and broad compliance help. Packages start from $79 + state fees, and standalone registered agent service runs $149/year nationwide. There’s no free first-year RA bundle, but CorpNet posts clear, à-la-carte rates and maintains up-to-date state filing info, which appeals to founders who want predictable, line-item costs.

Compare options in our CorpNet review.

13. IncParadise

IncParadise is a Nevada-centric shop known for low-maintenance RA pricing: registered agent service is $89/year, with a steep discount ($40/year) if you prepay multiple years. They also publish practical Nevada cost breakdowns and operate RA coverage in all 50 states, making them a fit for founders who want Nevada expertise without premium RA renewals.

14. MyCorporation

MyCorporation’s Basic package is typically $109 + state fees; the Deluxe and Premium tiers add a year of registered agent service, which then renews at $120/year. This model suits founders who prefer classic bundles over $0 plans and want a mainstream brand with clear RA pricing posted on its site.

15. Direct Incorporation

Direct Incorporation blends formation with brand-building: packages commonly start around $147–$174 + state fees (state/menu dependent) and include web/logo and even trademark options on higher tiers. Every plan bundles six months of registered agent service, which then renews at about $159/year. That mix makes it attractive if you want formation plus light marketing assets in one place, just budget for the RA renewal after month six.

16. InCorp

InCorp is best known for its nationwide RA pricing: $129/year standard, with multi-year discounts as low as $87/year. If you also need filing help, LLC/corporation formation typically starts at $99 + state fees. The value prop is straight compliance at a predictable rate, especially if you prepay multiple years of registered agent service.

17. SunDoc Filings

SunDoc shines for California speed: they’re based in Sacramento and known for hand-delivering documents to the Secretary of State for rush filings, useful when timing matters. Packages run roughly $79 / $99 / $279 + state fees, and registered agent service is an add-on (typically about $149–$159/year, varies by state). If you’re filing in CA and need a fast turnaround, SunDoc’s local advantage plus official SOS in-person expedite options can be a difference-maker.

18. Incorporate Fast (great for rush filings)

Incorporate Fast leans into speed: same-day processing on LLC orders, with packages at $99 / $199 / $299 + state fees and a free first year of registered agent service. It’s a solid pick when you want filings kicked off immediately; just verify year-2 RA pricing at checkout (RA is included year one and may be handled via third-party partners).

- Best LLC Services in Maine

- Best LLC Services in New Hampshire

- Best LLC Services in Vermont

- Best LLC Services in Massachusetts

- Best LLC Services in Rhode Island

- Best LLC Services in Connecticut

- Best LLC Services in New York

- Best LLC Services in New Jersey

- Best LLC Services in Pennsylvania

- Best LLC Services in Washington DC

- Best LLC Services in Ohio

- Best LLC Services in Michigan

- Best LLC Services in Indiana

- Best LLC Services in Illinois

- Best LLC Services in Wisconsin

- Best LLC Services in Minnesota

- Best LLC Services in Iowa

- Best LLC Services in Missouri

- Best LLC Services in North Dakota

- Best LLC Services in South Dakota

- Best LLC Services in Nebraska

- Best LLC Services in Kansas

How We Rank & How to Choose

We score each LLC service on what actually changes your total cost and launch timeline: pricing honesty (including $0-plan trade-offs), registered agent service policy, turnaround speed/expedites, what’s included (Operating Agreement, EIN, alerts), and support/refunds. We cross-check claims against agency sources (IRS, SOS) and each provider’s own policy pages.

Pricing transparency & $0-plan trade-offs

“$0 + state fee” means the provider waives its service fee, you still pay the state. The win is low upfront cost; the trade-offs are add-ons (EIN, OA templates, rush filing) and higher Year-2 renewals. Check whether the site shows full fee math before checkout, and remember EINs are free from the IRS (some services charge to obtain one on your behalf). State filing fees and licensing costs vary widely by state and entity, so budget that first.

Quick checks (use this before you buy):

- Is the provider’s base fee + state fee shown together? Are taxes/shipping/registered office extras disclosed?

- What is the RA renewal after the promo year? Is it clearly posted?

- EIN: DIY at IRS.gov for $0 (online, fax, or mail).

- Any “rush”/expedite upsells, what do they actually change versus the state’s timeline?

- Does the provider publish a state fee chart or link to state sources (SBA/state SOS)?

Registered agent policy

Every LLC must maintain a registered agent and registered office in its formation state; many providers include year-1 RA, then renew at a posted annual rate. Beyond price, look at privacy: using an agent places their street address on public records for service of process (not your home/office), which can reduce junk mail and protect personal info. Delaware’s SOS, for example, confirms the legal RA requirement and role. If you’re forming outside your home state, an in-state agent is mandatory.

What good RA policies look like:

- Renewal price is clearly posted (no chat-only quotes).

- Commercial RA coverage in all 50 states (if you’ll expand).

- Mail scanning and compliance reminders are included, not nickel-and-dimed.

- A clear privacy statement about using the agent’s address on public filings (subject to state forms).

Turnaround speed and expedited filing options

Two clocks matter: the company’s internal submission speed and the state’s approval time. For example, Delaware offers paid expedites (from Next Day to Same Day, 2-hour, and 1-hour) while Florida publishes live processing dates for online vs. mail submissions. A provider’s “rush” moves your order to the front of their queue; only the state’s expedite (when available) accelerates approval. Always confirm what each speed label means.

Examples (so you can benchmark):

| State example | What the state publishes |

|---|---|

| Delaware | Expedited tiers: 1-hour, 2-hour, Same Day, Next Day (extra fees). |

| Florida | Public “Document Processing Dates” page shows current backlog by channel. |

What’s included: Operating Agreement, EIN, Compliance alerts

Inclusions vary. Many plans bundle an Operating Agreement template; some charge extra. You can get your EIN free at the IRS (online approval in minutes; ~4 business days by fax; ~4 weeks by mail), so paid EIN add-ons are optional convenience. Compliance alerts (annual report reminders, franchise tax prompts) help avoid late fees but shouldn’t be locked behind pricey tiers. If you’re new to LLCs, skim a credible primer on Operating Agreements to understand what the template should cover.

What to verify in the bundle:

- OA template quality (single- vs multi-member provisions).

- EIN: included vs. upcharge, and whether you even need the service.

- Alerts/dashboards: included on the base plan or only in premium tiers?

Support quality & refund terms

Support and refunds determine how forgiving the service is when plans change. Examples: LegalZoom’s guarantee excludes government/third-party fees and filings already submitted; ZenBusiness advertises a 60-day money-back guarantee (less state/third-party fees) with additional specifics in its Terms. Read the actual guarantee page, not just marketing snippets, and assume state fees are non-refundable once submitted.

How we test this:

- Look for a dated guarantee page and any carve-outs.

- Try multiple support channels (chat/phone/email) during business hours.

- Check if cancellations are self-serve in the dashboard vs. ticket-only.

Data sources & scoring weights (brief methodology)

We use a weighted rubric (100% total), re-verified Nov 3, 2025:

- Pricing transparency & total cost of ownership (30%) – base price clarity, state fee disclosure, renewals, upsells.

- Registered agent policy (25%) – whether year-1 is included, posted renewal, coverage/privac y claims; legal RA requirement validated with SOS sources.

- Turnaround speed (20%) – internal handling vs. state approval; verified against state pages and published expedite matrices.

- What’s included (10%) – Operating Agreement template quality, EIN add-on vs. DIY, alerts.

- Support & refunds (10%) – dated guarantees/terms, exclusions, and ease of contacting support.

- Regulatory context (5%) – we monitor BOI/CTA changes; in March 2025, Treasury exempted most domestic companies from BOI reporting while foreign reporting companies still file, confirm current status on FinCEN’s site as rules may change.

Primary data sources we rely on (examples): IRS (EIN), SBA (state fees & registration basics), state SOS (processing/expedites), and official provider pricing/guarantee pages.

- Best LLC Services in Delaware

- Best LLC Services in Maryland

- Best LLC Services in Virginia

- Best LLC Services in West Virginia

- Best LLC Services in Kentucky

- Best LLC Services in North Carolina

- Best LLC Services in South Carolina

- Best LLC Services in Georgia

- Best LLC Services in Florida

- Best LLC Services in Alabama

- Best LLC Services in Mississippi

- Best LLC Services in Tennessee

- Best LLC Services in Louisiana

- Best LLC Services in Arkansas

- Best LLC Services in Texas

- Best LLC Services in Oklahoma

Special Cases That Change Your Pick

Some founders need privacy, fast compliance in “publication” states, non-US onboarding help, or support for Series LLCs/PLLCs. Below are quick decision rules with up-to-date legal anchors so you don’t overpay for the wrong feature set.

Anonymous/privacy-first formations (state options; organizer/RA shielding)

If privacy tops your list, target states where owners aren’t listed on public formation docs and ongoing reports don’t expose them. Delaware requires only the company name and registered agent on the Certificate of Formation (members/managers aren’t public); Delaware’s public lookup shows agent info, not owners. Wyoming likewise doesn’t require owner/manager names on Articles, and New Mexico has no LLC annual report, helping keep owners off recurring filings. Nevada is privacy-friendly but usually requires a manager/“managing member” list (non-managing owners stay private). Many founders also use an organizer (the filer) plus a commercial registered agent service address to shield their home address.

Publication states (NY, AZ, NE) and cost impact

Three states still impose newspaper publication that can change your budget and timeline:

- New York: Publish in two newspapers for six weeks, then file the Certificate of Publication ($50 to NY DOS). Costs vary widely by county (often $600–$2,000 total).

- Arizona: Most new LLCs must publish for 3 consecutive runs within 60 days, unless your statutory agent address is in Maricopa or Pima (automatic ACC notice; no newspaper).

- Nebraska: Publish a “Notice of Organization” for 3 weeks and file proof with the Secretary of State (Neb. Rev. Stat. 21-193).

Non-US founders (EIN without SSN, apostille, mailing/RA setup)

You can get an EIN without an SSN/ITIN, just don’t use the online tool. File Form SS-4 by fax or mail (international applicants may also apply by phone via the IRS International unit). IRS confirms the “responsible party” requirement and phone eligibility for international applicants; the online EIN wizard requires a U.S. TIN. If you’ll use documents abroad, plan for an apostille (U.S. State Dept. guidance; many states, e.g., California, also issue apostilles for state documents). Set up U.S. mail handling and an in-state registered agent service address for your chosen state.

Beneficial Ownership Information (BOI) reporting: what services do vs what you must do

As of March 26, 2025, FinCEN exempted domestic companies from BOI reporting; foreign reporting companies still must file within set windows. Expect providers to offer reminders or filing help for foreign entities, but if you’re domestic you generally don’t file BOI under the current rule. Always re-check FinCEN’s page before you launch because deadlines and scope can change.

Multi-state, Series LLC, and PLLC nuances (who supports them)

If you’ll sell or hire across states, you’ll “foreign-qualify” your LLC wherever you’re “doing business” (SBA overview + state portals explain steps). Series LLCs are allowed in some states (e.g., Texas) but not in others (e.g., California doesn’t allow domestic Series LLCs though it recognizes foreign series). Provider support varies: some handle series filings and registered series naming; others don’t. PLLCs (for licensed pros) require extra approvals/forms in many states (e.g., Washington PLLC Certificate of Formation); check your licensing board + SoS checklist.

- Best LLC Services in Montana

- Best LLC Services in Wyoming

- Best LLC Services in Colorado

- Best LLC Services in New Mexico

- Best LLC Services in Arizona

- Best LLC Services in Utah

- Best LLC Services in Idaho

- Best LLC Services in Washington

- Best LLC Services in Oregon

- Best LLC Services in California

- Best LLC Services in Nevada

- Best LLC Services in Alaska

- Best LLC Services in Hawaii

Step-by-Step: Using an LLC Service

Here’s the exact sequence most founders follow (from name check to first compliance dates) plus where a service actually saves you time vs. what you should DIY (like the IRS EIN if you have a U.S. TIN).

Name availability check

Search your state’s database, then lock your domain/socials. Many state portals and the SBA guide explain how to check name rules and restricted words. If your name is “close,” expect a rejection, some services include a re-file at no charge.

Choose registered agent

Pick a commercial registered agent service with public address shielding, scan/forwarding, and a clearly posted renewal. If you plan multi-state activity, prefer nationwide RA coverage so you can add states without switching providers. (Delaware’s public record shows only the RA, not owners – illustrating the privacy benefit.)

File Articles

Your service prepares and submits Articles/Certificate of Formation with your state. If timing matters, pay for internal rush and, where available, a state expedite (e.g., Delaware offers 1-hour to Next-Day tiers; Florida publishes live backlog pages).

Operating Agreement

Even single-member LLCs should adopt an OA. Many services include a basic template; you can also DIY and later upgrade. Read a reputable primer to understand member/manager powers and transfer restrictions before you sign.

EIN

If you (or a responsible party) have a U.S. SSN/ITIN, get the EIN free online from IRS.gov (instant). No SSN/ITIN? International applicants apply by phone, fax, or mail with Form SS-4; the online wizard won’t work.

BOI filing

Under current rules (Mar 2025), domestic companies are exempt from FinCEN BOI reporting; foreign reporting companies must file in set timeframes. Double-check FinCEN before assuming you’re exempt, especially if your structure or status changes.

Licenses/permits

Use SBA + your state/city portals to identify professional and local permits (zoning, sales tax, health, contractor, etc.). Services can point you to links, but licensing is inherently local, start with SBA’s “Register” overview and your state SOS or revenue portal.

Set first compliance dates (annual/biennial reports, RA renewal)

As soon as your Articles are approved, set calendar reminders for your state’s annual/biennial report and your registered agent renewal. If you formed in a publication state, block the 60–120-day windows. (Examples: NY Certificate of Publication $50; Nebraska 21-193; Arizona exceptions for Maricopa/Pima.)

FAQs About the Best LLC Services (2025)

Looking for the best value without hidden gotchas? These FAQs cut through noise and focus on pricing reality, registered agent service policies, turnaround time, and what’s actually included. Each answer starts with a straight, practical takeaway, then expands just enough to help you choose confidently. If you’re comparing $0 plans, privacy-first options, or speed, this section aligns with the same scoring logic we used in the reviews and comparison table above.

Which LLC service is best overall right now?

Northwest Registered Agent, it’s the most balanced mix of low upfront cost, privacy-by-default, and predictable RA renewal. You get straightforward checkout (few upsells), responsive humans, and clear state-by-state timing guidance. If you don’t need a $0 headline, this is the least stressful path for most founders: simple filing, first-year registered agent service bundled, and a renewal that won’t jump unexpectedly. It’s the “set-and-forget” choice when you want stability more than flashy bundles.

What’s the best truly cheap first-year option?

Bizee (Incfile), if your goal is the lowest upfront outlay, Bizee’s $0 formation plus free year-1 RA is hard to beat. Day-one costs usually equal only your state fee. The trade-off: checkout add-ons are plentiful, so buy only what you’ll use, and note the Year-2 RA renewal (about $119). Internal handling is quick (next-business-day submission), and their state expedite notes help you budget for speed without overpaying on provider “rush.”

Which service is best if speed is the priority?

IncNow for Delaware; SunDoc (CA) and Incorporate Fast nationally.

If you’re forming in Delaware, IncNow pairs clean next-day workflows with the state’s robust expedite menu (down to one hour). In California, SunDoc’s Sacramento presence helps with rush filings. For other states, Incorporate Fast offers same-day company processing. If you also want a $0 path with clear rush options, ZenBusiness’s “Rush” queue is a practical middle ground, fast enough for most launches without concierge-tier pricing.

What’s the best $0 plan, and the best $0 plan with RA included?

$0 plan value: ZenBusiness. $0 with RA included: Bizee.

ZenBusiness is the most flexible $0 Starter: add speed/compliance only when needed, with transparent RA pricing if you later want it. If you specifically want RA bundled in year one at $0 service fee, Bizee is the pick. LegalZoom is a fine $0 alternative if you want its broader legal ecosystem, but its RA is pricier. Choose based on whether you want modular add-ons (Zen) or bundled year-1 RA (Bizee).

Who’s best for legal ecosystem or complex/multi-state needs?

LegalZoom for legal tools; Harbor Compliance for concierge/multi-state.

If you want one roof for filing, contracts, and ongoing legal help, LegalZoom’s ecosystem is the most familiar. If your business spans multiple states or operates in regulated niches, Harbor Compliance earns its keep with hands-on coordination, predictable RA pricing, and state expedite planning. Both cost more than bare-bones shops, but they reduce friction when compliance and documentation (not just formation) drive your decision.

Which service is best for privacy-first or anonymity-leaning founders?

Northwest Registered Agent.

Northwest builds privacy into its workflows, minimizing personal info on public filings where the state allows and using its address for service of process. Pair this with privacy-friendly states (e.g., Delaware or Wyoming) to keep owner names off routine formation documents. You’ll still meet legal requirements, but strong policies and reliable registered agent service reduce exposure, junk mail, and missed notices. It’s the safest default when privacy matters.

What’s the best pick for non-US founders?

Northwest or ZenBusiness, depending on how much help you want.

Both work smoothly for non-US founders. Northwest is ideal if you want stable RA coverage, clear dashboards, and minimal upsells, then get your EIN yourself (free via IRS Form SS-4 by phone/fax/mail). ZenBusiness suits those who prefer a modular experience with optional rush and guided steps, including EIN assistance if you’d rather not DIY. In either case, plan ahead for apostille needs and a U.S. mailing/RA setup in your formation

- Internal Revenue Service (IRS): Get an Employer Identification Number (EIN) – free, online

- Financial Crimes Enforcement Network (FinCEN): Beneficial Ownership Information (BOI) reporting

- Northwest Registered Agent: Pricing note – $39 filing; Registered Agent $125/year

- LegalZoom: Registered Agent service pricing ($249/year)

- ZenBusiness: Registered Agent pricing ($99 first year; $199/year renewal)

- Harbor Compliance: Registered Agent pricing ($99 first year; $149/year renewal)

- Bizee (Incfile): Registered Agent pricing – free year 1; $119/year renewal

Form your LLC with expert help from Harbor Compliance

Harbor Compliance offers one-on-one support and professional-grade service for entrepreneurs who want peace of mind from day one.