Thinking of launching a business in New Hampshire but unsure if your desired name is already in use? Need to verify if a company is active, compliant, or legally recognized in the state? Want to access official documents before signing a partnership or investment deal?

The New Hampshire Business Search is a free public tool offered by the Secretary of State that lets you look up registered businesses, check their legal status, view their filings, and confirm name availability. Whether you're forming a new LLC, verifying a potential partner, or checking if a trade name is still valid, this search helps you access reliable, up-to-date business records in just a few clicks.

In this guide, you’ll learn:

- How to search for a business using the QuickStart portal

- What information is revealed in an NH business profile

- How to check if your LLC name is available

- What to do if a business is inactive or delinquent

Ready to dive into New Hampshire’s business registry and uncover the details that matter most? Let’s get started.

What Is the New Hampshire Business Search?

New Hampshire allows anyone to quickly verify and explore official corporate details through its user-friendly hampshire business entity search. Whether you’re launching a startup, investigating a partner company, or checking the status of your own business in new hampshire, this search tool offers immediate transparency. It’s maintained by the hampshire secretary of state, ensuring records remain current and accurate for llc in new hampshire, corporations, and other legal structures. For entrepreneurs seeking assistance with LLC formation, exploring reputable llc services New Hampshire can be beneficial.

What you can search (LLCs, corporations, trade names…)

The state of new hampshire categorizes multiple entity types in a single public database. Through the online portal, you can look up:

- LLCs: From a standard limited liability company to a new hampshire llc name you’re curious about

- Corporations: Spanning C-Corps and S-Corps

- Nonprofits: To confirm their active status and filing dates

- Sole Proprietorships & Partnerships: Often listed by trade or business names

- Trade Names: If you’re verifying a DBA or alternative identity they use in the market

With a quick name search or filing number, you can confirm whether an enterprise is active, see its principal office address, or note any major amendments.

Why people use it: verification, compliance, research

Whether you’re a solo entrepreneur in new york or a local bank in Concord, verifying an entity’s legitimacy can save future headaches. This new hampshire business name lookup is ideal for:

- Due Diligence: Checking if a desired llc name is already taken before forming your own.

- Compliance Checks: Seeing if a firm is delinquent or has an up-to-date annual report.

- Market Research: Exploring competitor strategies or scope by glancing at incorporation documents.

- Legal Assurance: Confirming if a partner has maintained good standing under new hampshire secretary guidelines.

Accessing the QuickStart system: public vs registered users

The state’s QuickStart system offers both public and secure logins. Casual searchers—like someone verifying a new hampshire has entity—can log in as guests, while returning users might create accounts to store frequently accessed records. Registered users gain access to more filing tools and can file a trade name or do advanced tasks online. For basic inquiries, though, public mode is often enough to retrieve all needed data.

Name available in New Hampshire? Make it official.

ZenBusiness lets you form your New Hampshire LLC in minutes, starting at $0 + state fees, with automated filings and expert support.

How to Search for a Business in New Hampshire (Step-by-Step)

Before signing a contract or finalizing your new hampshire llc name, it’s wise to confirm any existing records. By following these steps, you’ll quickly uncover key facts like registered agent name, status, and original formation details. Additionally, if you need to find a company EIN, there are resources available to assist in locating this information.

Step 1 – Go to the NH Secretary of State’s QuickStart portal

Navigate to the secretary of state business website for New Hampshire. Search for “QuickStart” or a similar link that mentions corporate or LLC lookups. This gateway consolidates all business filings and ensures you’re working with the official, most up-to-date repository.

Step 2 – Enter a business name, business ID, or registered agent

Once inside the search interface, decide your approach. You can type an entity name, use a filing number, or plug in the registered agent name. If you’re unsure of exact spelling, try partial keywords; for a certain record, go with the precise company name.

Step 3 – Filter your results by status or type (optional)

Should your query yield multiple matches, refine the list. Look for drop-downs to isolate active, inactive, or “in good standing” listings. You could also limit your view to a certain structure—like limited liability company—if you know the company’s form. This helps focus on the entity you truly need. Similarly, conducting a Wisconsin business entity search follows comparable steps for verifying business information in that state.

Step 4 – Open the entity page and review business details

Once you see the relevant listing, click to open its summary. This page typically displays the formation date, principal office address, and any official alterations over time. It also shows whether the entity has kept up with mandatory filings—like an annual report—and if it remains compliant under new hampshire secretary rules.

Step 5 – Download filings, check reports, or request certificates

If you require deeper insight—like older amendments or a certificate of status—locate the download or “request document” options. Some items might incur a small fee, but you can retrieve digital copies of corporate filings. Maintaining these papers is beneficial if you’re forming a partnership or need to address possible legal matters in the future.

Visit the Secretary of State's official business search website.

Enter full or partial search terms depending on available information.

Narrow results by entity status or business structure if needed.

Access formation date, address, and compliance status information.

Download filings or request certified copies as needed.

What You’ll Find in a New Hampshire Business Record

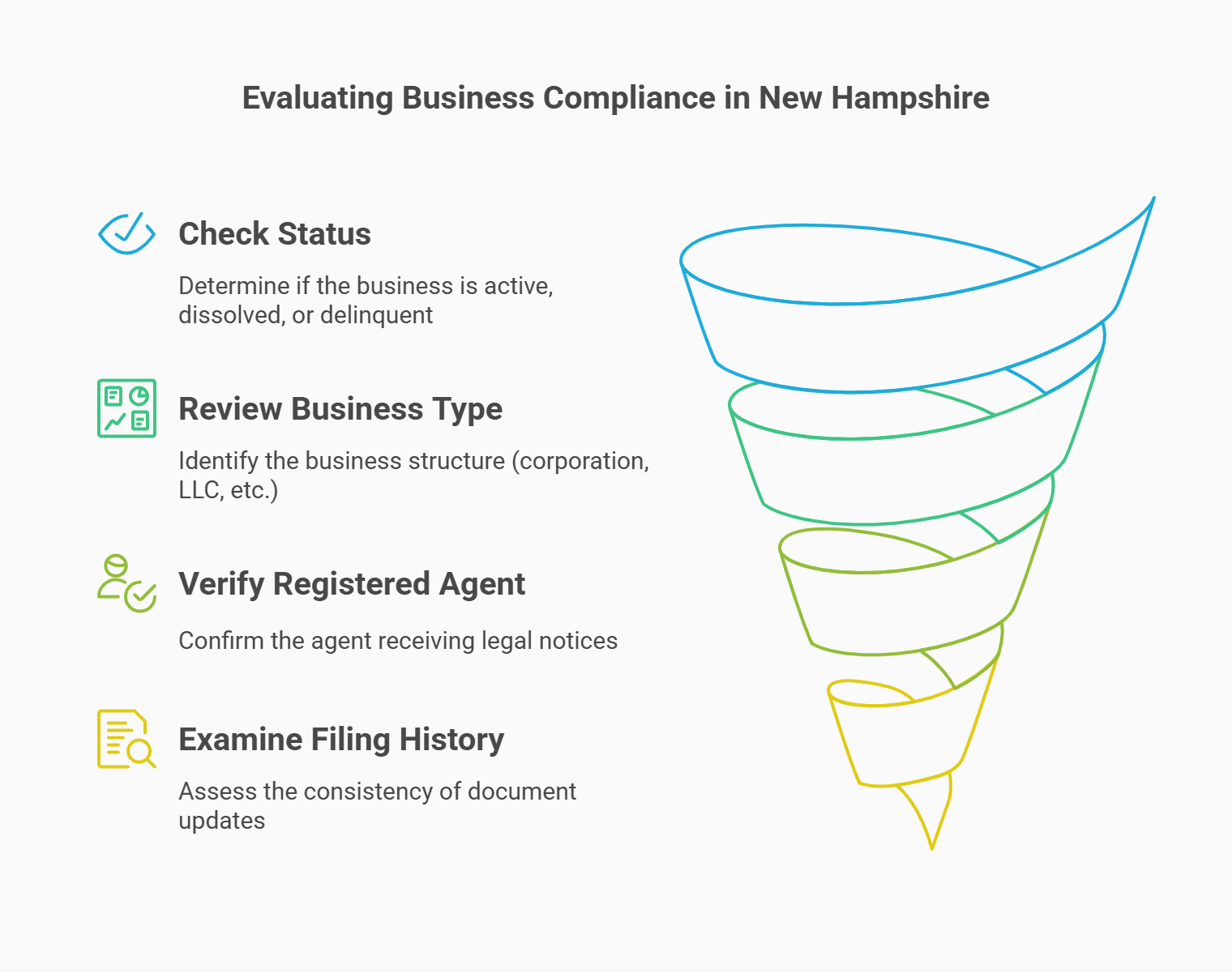

A successful hampshire business entity search retrieves an overview of the enterprise’s legal standing and organizational framework. This transparency allows you to evaluate whether the company is compliant and consistent with your expectations.

Status: active, dissolved, delinquent

When you click on a result, you’ll see a status indicator. Active means the entity is in good shape, having fulfilled filing obligations. Dissolved might be voluntary or forced, meaning the company no longer operates legally. Delinquent highlights missing paperwork or fees. Specifically, you can see:

- Active/Good Standing: Up-to-date with annual report and fees

- Dissolved: Closed by owner’s decision or by the state

- Delinquent: Overdue on essential filings or outstanding fees

- Merging/Pending: Possibly in transition, merging with another entity

Each label signals distinct compliance levels for the business.

Business type, formation date, and duration

You’ll note whether it’s a corporation, llc in new hampshire, partnership, or other. The page also reveals when the entity originally formed and whether it’s perpetual or set to expire on a specific date. This info is crucial to gauge an organization’s tenure and stability.

Registered agent and principal address

By checking the registered agent name listed, you confirm who receives legal notices for the entity. The profile also displays a principal office address, essential if you want to contact them or confirm location data. This ensures transparency in all business dealings, a hallmark of the “live free” mindset in the Granite State.

Filing history and annual reports

Most results include a chronological log of important documents—like Articles of Organization for an llc in new hampshire—along with each annual report. Reviewing these helps you confirm if the entity consistently updates its records and pays fees. If older filings are missing, the business might be at risk of losing good standing.

Verifying a Business’s Legal Standing in New Hampshire

Even after a quick lookup, you may want thorough certainty that a company meets local and state regulations. This is especially crucial if you’re investing or partnering. Fortunately, new hampshire secretary records and public registries let you do a deeper dive.

To confirm legal compliance:

- Check Active Status: Look for phrases like “In Good Standing” or “Active.”

- Review Annual Filings: Confirm the last annual report is up to date.

- Cross-Verify Agent: Ensure the registered agent name is legitimate and has a New Hampshire address.

- Assess Formation Date: Longer operational history can signal stability, though new ventures can still be legitimate if they file properly.

- Search Social Media: A robust online footprint can back up an active presence, though not always mandatory.

If uncertainty remains, consult the new hampshire department or seek legal guidance. They can confirm if the business meets every requirement, including any specific rules outside the Secretary of State’s scope.

How to Check Business Name Availability in New Hampshire

Sometimes, the best next step is ensuring the desired llc name you want isn’t taken. Considering that new hampshire has a streamlined approach, verifying name availability can be completed swiftly, allowing you to get on with forming your new enterprise.

Real-time search process for LLC and Corp names

Head to the same online portal used for the new hampshire business entity lookup. Instead of pulling up an existing record, you’re essentially hunting for no matches. Input your prospective business names one at a time to see if any identical or confusingly similar results appear. It's advisable to check llc names thoroughly to avoid potential conflicts and ensure compliance with state regulations. If none do, your name might be open. Be thorough—try variations, abbreviations, or different spacing for a broad confirmation.

Naming rules and restrictions under state law

To comply with new hampshire secretary standards, your chosen name should:

- Include a designator if you plan a “limited liability company” or corporation—like “LLC,” “Inc.,” etc.

- Omit forbidden terms like “Bank” or “Insurance” unless you have proper licensing.

- Avoid misleading phrases that suggest government affiliation or illegal activities.

- Stay unique compared to existing names on record.

- Not replicate well-known brand names that might cause confusion or trademark conflicts.

Failing to meet these guidelines could lead the state to reject your filing request. Reviewing llc names examples can inspire and guide you in selecting a compliant and unique business name.

Optional step: reserving a name through QuickStart

If you’re set on a specific handle but aren’t ready to file, you can secure it temporarily. Through the QuickStart system, pay a modest fee to hold the new hampshire business name for a defined period. This precaution ensures no one else registers it while you finalize details. Evaluating the best states for llc can provide insights into favorable jurisdictions for your business.one else claims your intended name while you prepare your paperwork.

Found the perfect LLC name? Let’s lock it in.

Northwest helps you launch your New Hampshire LLC with built-in privacy, registered agent service, and top-tier compliance tools.

Starting a Business in New Hampshire: Key Requirements

Whether you’re forming a local shop in Portsmouth or aiming to bring your brand to Concord, the state of new hampshire outlines clear steps for new entities. To understand the process in detail, refer to this guide on how to start an llc in New Hampshire. While the details differ by structure—LLC, corporation, etc.—the overall process remains approachable. For a comprehensive overview, consult this guide on how to form an llc.

Step 1 – Choose your entity structure (LLC, Corp, etc.)

Review the pros and cons of each form. If personal liability is a concern, a limited liability company might be ideal, offering liability separation without the formalities of a full corporation. Traditional corporations work well for those seeking investors or more complex management hierarchies. Make sure you check local laws if you’re bridging from a different area, like new york, to ensure compatibility.

Step 2 – Appoint a registered agent in New Hampshire

The law requires a designated representative with a physical address in New Hampshire. Utilizing a professional registered agent service can fulfill this requirement efficiently. That person or company must be available during business hours to handle legal notices. Selecting the best registered agent service ensures that all legal documents are promptly and securely handled. By naming a registered agent name in your filings, you confirm a trusted point of contact so official documents don’t get lost in the shuffle. Choosing a reliable registered agent new hampshire is crucial for maintaining compliance and effective communication.

Step 3 – File Articles of Organization/Incorporation online

Completing these forms through QuickStart is straightforward:

- Log In: Access the portal as a guest or registered user.

- Select Your Entity: LLC, corporation, nonprofit, etc.

- Provide Required Details: Entity name, principal office, agent info, and member/stock details as needed.

- Upload or Sign: E-sign the document or attach a signature file if required.

- Pay the Fee: Each filing demands a fee—commonly $100–$150 for LLCs—though rates can vary. For a detailed breakdown of llc cost, consider consulting comprehensive resources that outline potential expenses.

Your submission typically receives confirmation via email or mail once approved. Understanding how long to get llc in New Hampshire can help you plan your business launch timeline effectively.

Step 4 – Register with the NH DRA (tax accounts)

After forming, coordinate with the new hampshire department of Revenue Administration to handle sales tax (if applicable) or business profits tax. Not every company faces the same obligations, so learn which taxes apply by reading official DRA guidance or consulting a professional.

Step 5 – Stay compliant with annual filings and fees

Even after launching, you’ll submit an annual report or similar renewal to remain active. Keep track of deadlines, fees, and any address or ownership changes. Falling behind can lead to dissolution or expensive penalties, which you want to avoid for smooth growth. Knowing how long to get an llc helps in setting realistic expectations for your business formation timeline.

Accessing State Resources for NH Businesses

New Hampshire offers a range of tools and programs to help owners navigate everything from taxes to social media marketing. Whether you’re just beginning or scaling up, these services ensure you remain informed and compliant:

- QuickStart Portal Guidance: In-depth FAQs and tutorials on filing or retrieving official documents.

- Business Support Programs: Grants, loans, or mentorship schemes aiming to boost local entrepreneurship.

- Licensing Directories: Some industries need specialized permits; check the official listing to confirm if that applies.

- Network Events: Workshops, meetups, or conferences where you can learn from other NH business owners.

- Online Help Desks: Multiple state websites host real-time chats or email Q&A features for immediate queries.

By leveraging these resources, you build a robust foundation for your venture in the Granite State.

Troubleshooting Common Issues in Business Search

Even with an intuitive portal, you may hit bumps when looking up or registering a new hampshire business entity. Staying aware of typical mistakes helps you find quick solutions:

- Spelling Variations: Searching “LLC in New Hampshire” incorrectly or missing an apostrophe can yield zero results.

- Outdated Info: If an owner never updated the principal office address, the system might list older data.

- Wrong Status Filters: Checking only “Active” might miss recently inactive or dissolved records if you need a full historical view.

- Misunderstanding Jurisdiction: Occasionally, out-of-state entities operating in NH don’t appear as local.

- Pending Filings: Just-submitted records can take days to reflect in the system.

When issues arise, try refining your keywords or contacting the new hampshire secretary for manual verification. Patience and thoroughness usually fix most search hiccups.

FAQ – New Hampshire Business Search Simplified

Below is a concise guide to the most commonly asked questions about verifying and registering a business in new hampshire. Each response is designed to be clear, direct, and reliable, helping you find answers quickly.

Yes. The new hampshire secretary makes the name search and entity lookup accessible at no cost. You can check for existing businesses, confirm whether a desired llc name is available, or view public filings at no charge. Fees typically apply only when you request official documents, certificates, or proceed with formal registrations. This free option encourages transparency and compliance, letting entrepreneurs and the public alike verify companies without financial barriers.

Yes, in many cases. While most people search by entity name or filing number, the online portal often permits advanced queries, including registered agent name or physical address. If you’re uncertain about the company’s correct name, agent data can help you locate its record. Keep in mind that older filings might not reflect changes if the agent switched recently. Always confirm the data is current by reviewing the most recent annual or updated filing.

New hampshire has a reasonably prompt update cycle, typically incorporating new filings and changes within a few business days. However, peak seasons—like year-end or major deadlines—may cause slight delays. If you can’t find a newly formed LLC or a recent status change, wait a week and check again. The hampshire secretary of state aims to keep records accurate, but paperwork processing can occasionally result in short lags before the system refreshes.

Conducting a business search means you’re looking at existing records—verifying an established entity or checking name usage. Registering a business goes further, requiring you to file formation documents (like Articles of Organization) with the state, choose a registered agent, and pay associated fees. While a business entity search is purely informational, registering legally creates your LLC or corporation under new hampshire secretary authority, granting official rights and responsibilities.

Yes. The QuickStart portal typically displays past records, including companies that dissolved, forfeited, or merged. Though no longer active, these entries remain part of the historical archive, letting you track corporate lineage or see if someone previously used your desired llc name. Just note that inactive records might contain outdated addresses or agent data, so verify any critical info through official or current channels if needed.

Looking for an overview? See New Hampshire LLC Services

Your LLC name is clear—now launch with confidence

Harbor Compliance provides full-service LLC formation in New Hampshire, including name registration, legal filings, and compliance tracking.