Forming an LLC for your rental properties is a smart move to safeguard your investments while simplifying financial management. Whether you’re a new landlord or an experienced investor, this structure offers substantial benefits.

An LLC protects your personal assets from potential lawsuits or debts tied to your rental properties, ensuring your home, savings, and other personal assets remain secure. Additionally, it centralizes ownership and simplifies tax reporting, making it an ideal choice for property investors.

This guide explores:

- Key benefits and drawbacks of LLCs for rental properties.

- Steps to form an LLC and transfer ownership.

- Tax implications and state-specific guidelines for landlords.

Let’s dive into how an LLC can enhance your real estate strategy.

What Is an LLC for Rental Property?

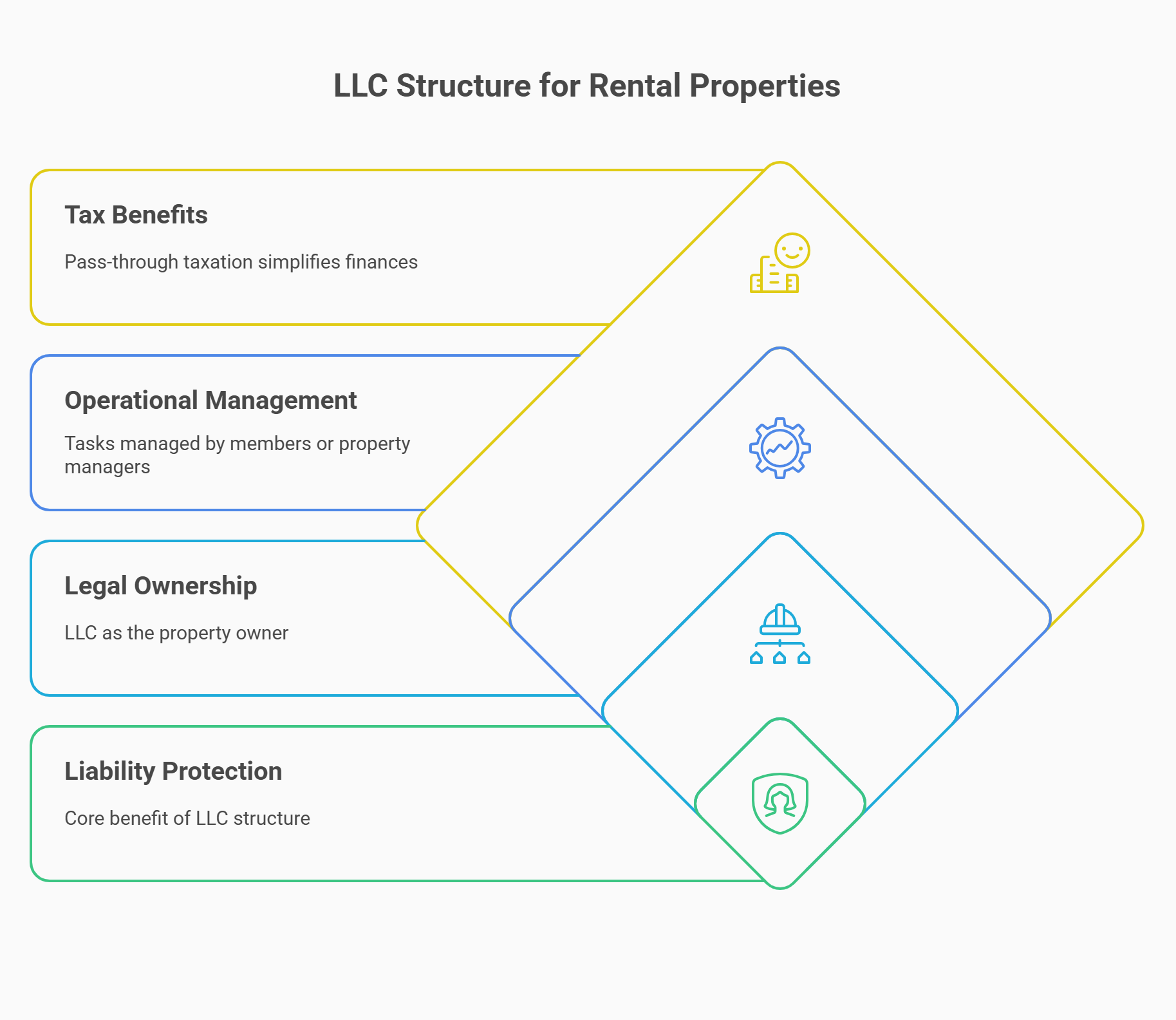

When you form a limited liability company specifically to hold and operate a rental unit or multiple properties, you gain an additional layer of liability protection. Essentially, the LLC acts as the landlord on paper, isolating your personal wealth if a lawsuit or debt arises. Below, we examine how such a structure works.

Definition of an LLC for Rental Property

An LLC formed for real estate rental invests in and manages rental business activities, such as collecting rent or paying for maintenance. By creating an llc for your rental, you separate your home and other personal assets from potential legal action. This approach counters issues like piercing the corporate veil, where courts can hold owners personally liable if they don’t maintain business formalities. Learn whether an LLC or DBA is the better choice to protect your personal assets and simplify your business structure.

How Does an LLC Work for Rental Properties?

The LLC becomes the legal owner of your property in an llc, shown in county records once you file a title transfer (often via quitclaim deed) from your name to the company’s. You or other members manage daily tasks—directly or via a property manager—but the limited liability structure shields you from personal lawsuits. Moreover, pass-through taxation means the LLC itself doesn’t pay federal income tax; instead, the profits or losses appear on your personal tax return. Although you must keep finances separate to preserve legal protection, the arrangement can simplify your finances when it comes to reporting income and deductible expenses for the property.

Should You Form a Separate LLC for Each Rental Property?

The separate LLC question divides real estate investors more than any other structural decision you'll face as a landlord. The right answer depends entirely on your portfolio size, risk tolerance, and state-specific filing costs—with each scenario demanding completely different strategies.

Single-Property LLC Strategy

For first-time landlords or those testing the rental market, a single-property LLC offers the perfect entry point into real estate investing. You'll gain essential limited liability protection while keeping formation costs manageable—typically $200-800 depending on your state. This approach lets you learn the administrative obligations of maintaining separate bank accounts and proper business structures without overwhelming complexity.

The downside? If you're planning to expand beyond one rental housing unit, you'll need to decide whether to add properties to this existing legal entity or create new LLCs for each acquisition.

Multiple LLCs for Mid-Sized Portfolios (2–10 Units)

Most property investors with 2-10 units find the sweet spot by putting each rental in its own LLC. This separation strategy prevents one tenant's lawsuit from threatening your entire portfolio—if someone gets injured at Property A, Properties B through J remain protected. The administrative cost runs roughly $300-1,200 per LLC annually depending on your state.

However, managing multiple entities requires discipline. You'll need separate bank accounts for each LLC, individual insurance policies, and meticulous record-keeping to maintain the legal protection. Many investors in this range hire a property management company to handle the operational complexity while preserving the asset protection benefit that makes multiple LLCs worthwhile.

Large Portfolio LLC Structure (10+ Units)

Once you own 10+ rental properties, the administrative burden of individual LLCs can become overwhelming. Smart investors often group 2-3 properties per LLC based on location, property type, or acquisition time. This approach balances liability protection with manageable paperwork—you're not dealing with 15 separate entities, bank accounts, and annual filings.

The key is strategic grouping rather than random assignment. Consider putting your highest-risk properties (older buildings, problematic neighborhoods) in separate LLCs while grouping your stable, well-maintained rentals together. Some investors create a holding company structure where a parent LLC owns multiple property-holding LLCs. At this scale, estate planning becomes essential too—discuss with your attorney how these business structures fit into your long-term wealth transfer goals.

LLC Cost Calculator for Rental Properties

Calculate the real costs of forming LLCs for your rental property portfolio. Get personalized recommendations based on your state and investment strategy.

Your Investment Details

Cost Analysis Results

California

Filing: $70 | Annual: $800

Protection Analysis

Your separate LLC strategy provides approximately 95% liability protection for your $150,000 portfolio value.

Ready to Protect Your Rental Property Investments?

Get expert help forming your LLCs with our trusted partners

Disclaimer: This calculator provides estimates based on current state filing fees and typical additional costs. Actual costs may vary. Additional services like registered agent fees ($125-200/year), bank account maintenance, and professional services are estimated. Consult with legal and tax professionals for personalized advice.

Series LLC vs Multiple LLCs for Rental Properties: Which Is Right?

A Series LLC functions like an umbrella with separate "series" underneath—each series holds different properties while sharing one master filing. As of 2025, more than 20 jurisdictions recognize Series LLCs, including Alabama, Arkansas, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kansas, Minnesota, Missouri, Montana, Nevada, North Dakota, Oklahoma, South Dakota, Tennessee, Texas, Utah, Virginia, Wisconsin, and Wyoming. Consequently, Series LLCs are now broadly available to real-estate investors nationwide.

The appeal is obvious: file certificate of organization once, pay one set of annual fees, but maintain separate liability protection for each property series. However, the tax treatment remains murky, and many lenders won't finance properties held in series structures, creating significant disadvantages for most real estate investors.

| Aspect | Series LLC | Multiple LLCs |

|---|---|---|

| Formation Cost | $200–400 (one filing) | $200–400 × number of LLCs |

| Annual Fees | $300–800 (single entity) | $300–800 × number of LLCs |

| Liability Protection | Excellent (if properly maintained) | Excellent |

| Financing Availability | Limited lender acceptance | Standard mortgage options |

| State Availability | 8 states only | All 50 states |

| Tax Complexity | High (unclear IRS guidance) | Moderate (established rules) |

| Best For | Large portfolios in Series LLC states | Most rental property investors |

Benefits and Drawbacks of Using an LLC for Rental Properties

Many property owners consider forming an LLC for legal and financial reasons. Below, we outline the main upsides, plus some constraints you should weigh carefully before proceeding.

Key Benefits of an LLC for Rental Property

Before presenting a bullet list, note that these advantages can be game-changers when scaling a real estate portfolio or mitigating legal risks.

- Asset Protection – By creating an llc, you help insulate your house and personal bank accounts if a tenant sues or an accident happens on-site.

- Pass-Through Income – You avoid double taxation typically associated with C corporations, simplifying how rental income shows up on personal tax returns.

- Professional Image – Running your rental business under an LLC often appeals to tenants and lenders who see it as more organized than a sole proprietorship approach.

- Scalability – Owning multiple rentals under separate LLCs can further segment liability between each property, minimizing cross-exposure if one unit faces legal trouble.

A well-run LLC also fosters trust with prospective tenants or property managers, as they recognize formal structures for maintenance and accountability.

Potential Drawbacks to Consider

Despite the perks, forming an LLC isn’t a perfect fit for everyone. Here’s a quick breakdown, then a bullet list detailing the downsides:

Maintaining an LLC requires additional paperwork, fees, and sometimes extra insurance. Lenders might also treat an LLC differently, imposing stricter terms or higher interest rates.

- Annual Fees – Many states charge an annual report fee or franchise tax for each LLC.

- Financing Hurdles – Some banks won’t grant standard mortgage terms for an LLC, which can complicate your loan process.

- Complexity – Single-property owners may find a simpler route with an umbrella policy for personal liability.

Balancing these points against your risk tolerance helps you decide if the trade-offs are worthwhile. Explore business purpose for LLC examples to find practical applications for your real estate investments.

Northwest Ensures Hassle-Free LLC Formation

Safeguard your rental properties with a well-structured LLC. Northwest Registered Agent simplifies the process and provides reliable guidance to protect your investments.

When Should You Form an LLC for Your Rental Property?

While incorporating your investment early often streamlines the process, you can also create or switch to an LLC after purchase. Below are two pivotal moments to consider.

Before Acquiring Rental Property

If you’re confident in your long-term real estate plan, forming an llc operating agreement and organizational structure in advance can simplify closing. Lenders see the LLC as the buyer, and you avoid extra steps of transferring deeds later. Additionally, you establish corporate formalities from the start, reducing any chance of piercing the corporate veil. Define a clear business purpose for LLC to ensure compliance and align with your rental property goals. This approach often suits investment property expansions or if you want a “clean slate” for your new enterprise.

After Acquiring Rental Property

Property owners who initially hold rentals in their names can still transfer them into an LLC. However, you may need lender permission if you have a mortgage. The title transfer likely triggers additional fees or legal steps, and re-titling might impact your current insurance. Yet for those seeking to reduce personal liability after they’ve tested the rental market, this conversion can be beneficial, especially if they’re scaling up.

Financing Rental Properties Through an LLC

Securing financing for LLC-owned rental properties requires understanding that lenders view these transactions as commercial deals rather than residential mortgages, even for single-family homes. Commercial loans typically carry higher interest rates (0.5-2% above residential rates) and require larger down payments—often 25-30% minimum versus 20% for individual buyers.

Most lenders demand personal guarantees, meaning you're still liable if the LLC defaults, which partially negates the liability protection benefit. However, some credit unions and portfolio lenders specialize in LLC financing and offer more favorable terms. Alternative financing options include seller financing, hard money lenders for fix-and-flip projects, and private money from individual investors.

The essential strategy involves building relationships with LLC-friendly lenders before you need financing. Portfolio lenders who keep loans in-house rather than selling them often provide more flexibility for real estate investors with multiple properties and complex entity structures.

How to Set Up an LLC for Rental Property: Step-by-Step Guide

Below is a concise overview for forming an LLC that holds rental assets. While specifics vary by state, these universal steps will help you navigate the process effectively.

Step 1: Choose a Name for Your LLC

Check that your LLC name is both unique and meets state naming rules, often requiring “LLC” or “Limited Liability Company” in the title. Looking to diversify? Learn how to start a cleaning business LLC and expand your portfolio with service-based ventures. Confirm the name’s availability through a quick search with the Secretary of State. This branding also fosters a professional identity for your property business. For inspiration on setting up other LLCs, see how a nanny LLC can streamline operations and ensure liability protection.

Step 2: File Articles of Organization

Submit official articles of organization to your state authority along with the filing fee. States differ in cost—some under $100, others exceeding $300. Make sure you accurately list your registered agent, who’ll receive lawsuits or legal action on behalf of the LLC. Timely and correct filing is crucial for obtaining state recognition.

Step 3: Draft an Operating Agreement

An operating agreement outlines the LLC’s governance, profit distribution, and managerial duties. Even if you’re a single member llc, having this document proves you treat your enterprise like a business entity, which helps maintain liability protection. For multi-member setups, clarifying each person’s role, capital contributions, and voting rights prevents disputes.

Step 4: Obtain an EIN (Employer Identification Number)

Get an EIN from the IRS if you’ll have employees or if you plan to open a business bank account under the LLC’s name. This step also simplifies tax filing. Federal forms from the internal revenue service are free and can be done online, ensuring your LLC manages finances distinctly from personal funds.

Step 5: Open a Business Bank Account

Keep a separate bank account for each rental-focused LLC, reinforcing the “corporate veil” around your investment. Mixing personal and LLC money could risk legal scrutiny, leading to potential lawsuits that compromise your personal assets. Maintaining distinct bank accounts also clarifies business expenses when reporting income on your tax return.

Step 6: Register for State Taxes

Depending on local laws, you may need a state tax ID or a sales tax permit (for certain goods or short-term rentals). Property management services also must ensure they comply with any city lodging taxes. This ensures you remain in good standing and avoid fines or revocation of your LLC’s right to operate.

Ensure the name is unique and meets state naming rules. Confirm availability through the Secretary of State for professional branding.

Submit official articles, list your registered agent, and pay the filing fee to establish your LLC with state recognition.

Define governance, profit sharing, and roles. This document ensures clarity and protects liability.

Apply for an EIN from the IRS to manage LLC finances, file taxes, and open a business bank account.

Separate your LLC finances to reinforce liability protection and simplify tax reporting.

Obtain state tax IDs or permits and comply with local regulations for rental properties.

How to Transfer a Rental Property to an LLC

Once you decide to hold real estate within an LLC, you might need to shift the deed from personal ownership to the company. The steps below walk you through that process.

Steps to Transfer Ownership

Converting a personally held property into an LLC is straightforward but must be done correctly:

- Notify Your Lender – If there’s an existing mortgage, confirm the loan terms allow for title transfer to an LLC.

- Draft a Deed – Usually a quitclaim or warranty deed naming the LLC as the new owner.

- Record the Deed – File with your county recorder’s office, paying any associated fees.

- Adjust Insurance – Update your liability insurance and any umbrella policy to reflect the LLC as the insured party.

By methodically following these four points, you preserve coverage and compliance during the ownership shift.

Tax Considerations When Transferring Property

Moving assets into an LLC could trigger certain local or state transfer taxes. Nonetheless, in many areas, no major capital gains event occurs if you remain the beneficial owner through the LLC. Be cautious about how the IRS treats the transaction: If you re-titled a mortgaged property, or if multiple members contribute different assets, the tax advantages might vary. Consult a CPA or attorney to confirm you don’t inadvertently create a taxable event.

Tax Implications of an LLC for Rental Property

An LLC can yield simpler tax returns than a corporation, but it’s not entirely free of complexity. Below, we’ll outline how your rental income is taxed and what deductions might lower your bill.

How Rental Income Is Taxed in an LLC

When you create a rental property under an LLC, net profits pass directly to you or other members, who then report them on personal taxes. You can reduce this burden through deductions and property management costs. In single-member LLCs, everything typically appears on Schedule E of your personal tax return. If multiple owners exist, you might file a partnership return (Form 1065) and issue K-1 forms to members.

Tax Deductions Available for LLCs

Before we share a quick bullet list, note that these potential write-offs greatly aid your bottom line:

- Mortgage Interest – Deduct interest on any loan held in the LLC’s name.

- Maintenance & Repairs – Ordinary fixes can reduce your year-end liability.

- Insurance Policy – Costs for liability insurance or property coverage are typically deductible.

- Professional Fees – Payments to accountants, property managers, and attorneys.

Organized record-keeping ensures each deduction holds up under scrutiny, maximizing your tax benefits with minimal risk.

How an LLC Protects Your Personal Assets

Forming an LLC can minimize personal exposure if lawsuits arise over a tenant’s injury or a contract dispute. Below are the fundamentals of how that shield works.

Limited Liability for Property Owners

By forming an llc, you place legal ownership in the entity rather than your name. If tenants file suit for damages, they generally sue the LLC, not you. This setup helps keep personal holdings—like your car or bank accounts—outside the reach of creditors. However, ensure you comply with state requirements and keep finances separate; mixing personal and business funds might cause courts to disregard the LLC, known as piercing the corporate veil.

Separating Business and Personal Finances

Keeping a separate bank account for your LLC not only proves you treat it as a distinct business entity, but also clarifies expenses come tax season. If the property is financed, hold the mortgage in the LLC’s name whenever possible. This precaution enforces that your real estate belongs to the entity, enhancing financial security if litigation emerges.

ZenBusiness Makes LLCs Easy

Manage your rental properties with ease and confidence. ZenBusiness offers seamless LLC formation services tailored to property owners like you.

State-Specific Guidelines for Setting Up an LLC for Rental Property

Each state has unique formation rules and annual fees. Below are short overviews for popular regions—especially relevant if you have multi-state holdings.

LLC for Rental Property in California

California is known for higher filing costs and possibly increased annual fees for businesses. Still, forming an LLC can yield strong liability protection for your real estate. Make sure to comply with local rent control laws if applicable and note that the first-year $800 franchise-tax exemption expired on January 1, 2024. New California LLCs must now pay the full $800 annual tax starting with their first taxable year. The Secretary of State’s website clarifies that you must keep a registered agent for service of process. Learn more about filing details by reading guides at calbar.ca.gov to ensure you meet local norms.

LLC for Rental Property in Florida

Florida’s flexible approach to tax purposes can benefit LLC owners by avoiding a state income tax. You’ll still need to follow local licensing or city-based regulations for short-term rentals. Check that your property insurance covers any changes in ownership. Florida’s Division of Corporations site clarifies that you must file articles of organization electronically. According to the official resource at flsenate.gov, property owners must also stay updated on county property taxes.

LLC for Rental Property in Texas

In Texas, no direct state income tax exists, but the margin tax might apply if your revenue surpasses certain limits. LLC filings occur with the Secretary of State’s office, and you should be mindful of how property deeds are recorded. Sometimes, forming a separate LLC for each property is wise if you have multiple units. Keep a close eye on the property’s homestead status if you once lived in it personally. Lenders might require rewriting your mortgage in the LLC’s name.

LLC for Rental Property in Georgia

Many choose a property llc in georgia for real estate holdings due to moderate filing fees and relatively straightforward compliance. The state does expect annual registrations, so plan on paying a regular fee to remain active. If you’re transferring ownership from personal name to an LLC, consult your mortgage provider to ensure no due-on-sale clause triggers. Georgia also imposes intangible recording taxes on mortgages. A well-structured LLC can mitigate risk if tenants face accidents or disputes.

LLC for Rental Property in Washington

Washington mandates annual report filings with the Secretary of State. The region’s robust landlord-tenant laws can shape your approach to screening renters or drafting lease terms. Keep records updated, or your LLC might face administrative dissolution. Mortgage lenders may require additional insurance policy endorsements if the property’s ownership changes. Because of strong consumer protections, an LLC can help separate your personal assets from potential disputes or eviction claims.

LLC for Rental Property in New York

New York’s filing fees and publication requirements can be pricier than in other states, especially in the NYC region. Once you create an llc, you might need to publish a notice in local newspapers—costing hundreds of dollars. Despite these hurdles, an LLC shields your personal wealth from major lawsuits, which is crucial in a tenant-friendly state. If you manage multiple properties, consider forming separate LLCs to keep liability quarantined.

LLC for Rental Property in Arizona

Arizona requires you to publish your newly formed LLC in a local newspaper in some counties, typically within 60 days. The state’s real estate laws are landlord-friendly, but that doesn’t negate the benefits of an LLC for personal liability. If you’re dealing with partial ownership or out-of-state partners, be sure to itemize details in your operating agreement. Lender terms can vary, so verify that your mortgage terms allow transferring the property to the LLC.

LLC for Rental Property in Massachusetts

In Massachusetts, forming an LLC is straightforward but has a relatively higher fee structure. Annual reporting is mandatory, so you’ll pay around $500 each year to keep your status. Still, if your property garners good rental income, this expense is minimal compared to potential lawsuit costs. The local government’s approach to real estate law means you must carefully manage tenant screening, lease terms, and property maintenance. The LLC can cushion your personal finances from any large legal claims or judgments.

| State | Official State Website | Key Considerations |

|---|---|---|

| California | ca.gov | Filing Costs: Higher initial and annual fees, including an $800+ Franchise Tax Board fee. Compliance: Maintain a registered agent; adhere to local rent control laws. Additional Info: Consult calbar.ca.gov for detailed filing guidelines. |

| Florida | myflorida.com | Tax Benefits: No state income tax; favorable for LLCs. Compliance: File articles of organization electronically; comply with local rental regulations. Additional Info: Refer to flsenate.gov for property tax updates. |

| Texas | texas.gov | Taxes: No state income tax; margin tax may apply based on revenue thresholds. Compliance: File with the Secretary of State; consider separate LLCs for multiple properties. Additional Info: Review property deed recording requirements and consult lenders about mortgage adjustments. |

| Georgia | georgia.gov | Filing Fees: Moderate initial and annual fees. Compliance: Annual registrations required; check mortgage terms for due-on-sale clauses when transferring property to an LLC. Additional Info: Be aware of intangible recording taxes on mortgages; an LLC offers liability protection for property owners. |

| Washington | wa.gov | Annual Reports: Mandatory filings with the Secretary of State. Compliance: Adhere to landlord-tenant laws; maintain updated records to avoid administrative dissolution. Additional Info: Lenders may require insurance endorsements upon ownership changes; LLCs help separate personal assets from business liabilities. |

Real Estate LLC Success Stories

Real investor experiences reveal far more than theoretical benefits and drawbacks ever could about LLC effectiveness for rental properties. These detailed case studies demonstrate how different LLC strategies play out in actual investment scenarios with measurable financial and legal outcomes.

Case Study: Single Property Protection

Sarah, a Denver-based real estate investor, purchased her first rental property through a Colorado LLC in 2019. When a tenant's guest slipped on icy steps in January 2023, the resulting lawsuit sought $85,000 in damages. Because Sarah had maintained proper LLC formalities—separate business bank accounts, adequate insurance, and clean financial records—the court treated the LLC as a distinct legal entity.

The lawsuit proceeded against the LLC rather than Sarah personally, protecting her primary residence and retirement accounts from attachment. Her insurance covered most damages, and the LLC's only asset—the rental property itself—satisfied the remaining judgment. Had Sarah owned the property individually, her personal assets would have been at risk for the full amount.

Case Study: Multi-State Holdings

Marcus built a portfolio of 12 rental properties across Texas, Florida, and Georgia over eight years, forming separate LLCs in each state to avoid foreign LLC registration requirements. In 2022, a major plumbing failure in his Houston duplex caused $40,000 in damage to neighboring units, triggering multiple lawsuits.

Because each property sat in its own state-specific LLC, the litigation only threatened the Houston property and its associated LLC assets. His Florida beach rentals and Georgia college-town properties remained completely insulated from the Texas legal proceedings. The strategic state-by-state LLC structure, while requiring more paperwork and annual fees, ultimately preserved $1.2 million in real estate equity that could have been vulnerable under a single-entity approach.

Advanced Strategies for Real Estate Investors

Sophisticated investors eventually outgrow basic LLC structures and need more complex arrangements to optimize tax benefits, estate planning, and liability protection. These advanced strategies typically make sense for portfolios worth $2+ million or investors with complicated family or business situations requiring specialized legal structures.

The key is timing—implementing these strategies too early creates unnecessary complexity, while waiting too long makes restructuring more expensive and complicated.

Advanced Real Estate LLC Strategies:

- Holding Company Structure - Parent LLC owns multiple property LLCs, centralizing management while maintaining asset separation

- Trust + LLC Combination - Irrevocable trusts own LLC interests for estate tax reduction and generation-skipping benefits

- Management Company Setup - Separate LLC provides property management services to rental LLCs, creating additional income streams

- Delaware Statutory Trust (DST) - Allows multiple investors to own fractional interests in large commercial properties

- Opportunity Zone Investing - LLCs hold qualified Opportunity Zone investments for significant capital gains deferral

- Conservation Easement Strategies - LLCs donate development rights for substantial tax deductions while maintaining property ownership

FAQs About LLCs for Rental Property

Below are concise answers to top queries about forming an LLC for real estate. Each response aims for position-zero ranking on Google, streamlining your path to informed decisions.

How much does it cost to form an LLC for a rental property?

Formation fees vary by state, typically between $50 and $300. You’ll also pay annual report fees ($10–$100) and registered-agent fees (around $100/year). If you hire legal help or expedited processing, budget an extra $200–$500 in the first year. Overall, expect total first-year costs of $200–$800, with lower ongoing costs thereafter.

Should I form a separate LLC for each rental property?

Using a distinct LLC for each property maximizes liability protection—issues on one asset can’t threaten your others. However, formation and maintenance fees add up. For small portfolios (2–5 properties), grouping similar units in one LLC may balance cost and protection. Large investors often choose a holding-company structure to streamline administration while preserving asset isolation.

How does forming an LLC affect my ability to finance rental properties?

Lenders may require you to sign a personal guarantee when an LLC borrows, which can slightly raise interest rates. That guarantee helps separate your personal and business liabilities. In most cases, financing terms remain competitive, and using an LLC can improve asset protection without significantly impacting loan approval or pricing.

Can I transfer a property with an existing mortgage into an LLC?

Yes, but check your mortgage’s due-on-sale clause—it can trigger full repayment if ownership changes. To avoid acceleration, you can refinance the loan in the LLC’s name or secure written lender approval before transferring the deed. Always review your mortgage agreement and consult your lender to prevent unintended consequences.

Do I need to hire a registered agent for my rental property LLC?

Yes. All U.S. states require an LLC to designate a registered agent—a person or company with a physical address in the state—who accepts official documents on behalf of the LLC. You can serve as your own agent if you meet residency and address requirements, but many choose a professional service for privacy and reliability.

What is an LLC for rental property?

A rental-property LLC is a legal entity that holds real estate investments. It combines pass-through taxation, so profits and losses flow directly to the owner’s personal tax return, with liability protection that shields personal assets from tenant claims or lawsuits. This structure simplifies tax reporting while safeguarding your personal wealth.

How is rental income taxed in an LLC?

By default, a single-member LLC is taxed like a sole proprietorship: rental income and expenses appear on Schedule E of your individual return. Multi-member LLCs file Form 1065 and issue K-1s to members, but income still flows through to Schedule E. This pass-through system avoids corporate tax and keeps accounting straightforward.

Harbor Compliance Simplifies Compliance

From LLC setup to ongoing compliance, Harbor Compliance supports landlords every step of the way to keep their rental business secure.