Starting an LLC in Virginia is straightforward and affordable, making it a popular choice for entrepreneurs. The process involves filing Articles of Organization, appointing a registered agent, and paying a modest $100 fee. From there, you’ll maintain compliance with a simple $50 annual registration fee—no annual reports required. This guide walks you step by step through the process, costs, and timeline so you can launch your business with confidence.

Why Choose an LLC in Virginia

Virginia blends low ongoing costs with a streamlined, fully online formation process. A Virginia LLC gives you limited liability protection plus flexible tax treatment, so you can scale without unnecessary administrative drag.

Beyond mechanics, the Commonwealth offers serious business advantages: a top-tier talent pipeline, world-class logistics, and a mature government-contracting ecosystem. Those strengths make Virginia compelling for startups and expanding companies alike.

- Low, predictable upkeep. File Articles of Organization for $100 and budget a $50 annual registration fee, there’s no annual report for LLCs (annual reports apply to corporations). Due date: last day of your anniversary month.

- Fast online filing + optional expedite. Form and manage your company in the SCC’s CIS; add Next-Day ($50–$100) or Same-Day ($200) processing when timing is tight.

- Talent & training edge. Virginia’s workforce ranks at the top nationally, and VEDP’s Talent Accelerator provides customized training for qualifying projects.

- Infrastructure built for growth. The Port of Virginia (deep-water terminals + inland intermodal) and Northern Virginia’s “Data Center Alley” give you global connectivity and digital scale.

- Government-contracting ready. Register in eVA (state procurement), pursue SWaM certification for set-aside opportunities, and tap the Virginia APEX Accelerator for no-cost guidance.

What to Prepare Before You File

Before you jump into CIS (Clerk’s Information System), gather the basics so your Virginia LLC filing takes 10–15 minutes instead of an hour. Think of this as your pre-game checklist—clear, simple, and designed to prevent last-minute scrambling.

Here’s exactly what you’ll need (and why it matters):

- A business name that’s distinguishable on SCC records and includes “LLC” (or the long form). Optional: reserve it for 120 days for $10—helpful if you’re not filing today. (The state notes reservation is not required.)

- Your registered agent details: individual or company with a Virginia physical address (no P.O. boxes) who’s available during business hours to accept legal notices.

- A principal office address (can be inside or outside Virginia) and a contact email/phone—CIS asks for these during filing.

- Your management choice: manager-managed vs member-managed (Virginia defaults to member-managed unless you choose otherwise).

- Organizer info and e-signature for the Articles of Organization (you can be the organizer even if you won’t be an owner).

- Optional: your drafted Operating Agreement (internal document—not filed with the state—but allowed and recognized under Virginia law).

Pro tip: If you’ve already reserved a name, have the Reservation ID/PIN ready—CIS lets you plug it in and proceed.

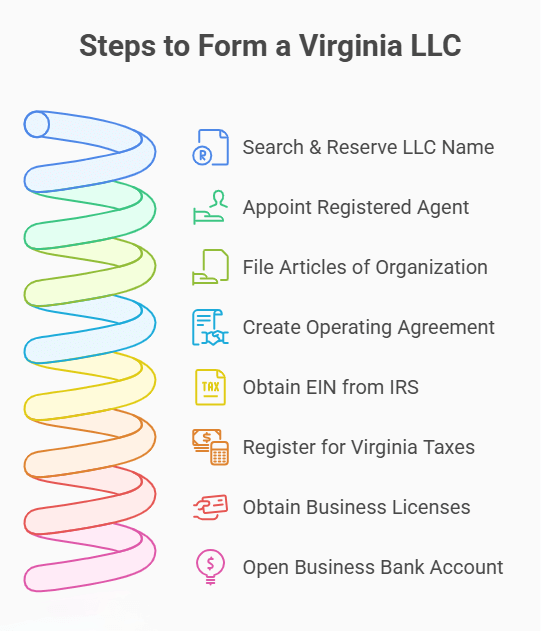

Steps to Form a Virginia LLC

Here’s the simple path for how to form an llc in virginia, no legalese, just what to do and why it matters. You’ll handle nearly everything online in the State Corporation Commission’s Clerk’s Information System (CIS). In order: pick a compliant name, appoint a registered agent, file Articles of Organization to create your Virginia LLC, set ground rules in an Operating Agreement, get an EIN from the IRS, and register for any Virginia taxes (plus local licenses) your business needs. Each action is short and predictable when you know the information the state will ask for. In the next steps, I’ll walk you through each item—with direct links to the official pages—so you can file confidently and avoid avoidable delays.

Step 1: Search & (Optionally) Reserve Your LLC Name

Start by choosing a name that’s distinguishable on Virginia’s records and ends with “LLC” (or the long form). Run a quick availability check in the SCC’s Clerk’s Information System (CIS). If you’re not filing today, you can reserve the name for 120 days for $10 — handy if you’re still finalizing branding. For extra help, see our step-by-step Virginia business search guide. Also remember: state name approval doesn’t equal trademark protection, so consider a basic USPTO search later.

Step 2: Appoint a Virginia Registered Agent

Every LLC must keep a registered agent with a physical Virginia address (no P.O. boxes) to accept legal notices during business hours. Your agent can be a qualifying individual (e.g., an LLC member/manager or a Virginia attorney) or a registered-agent company; the “registered office” must match the agent’s business address.

If you prefer privacy or can’t be at one location all day, hire a commercial provider. We’ve reviewed the best registered agent services in Virginia to help you compare options. If you serve as your own agent, keep the address current and staffed—state law expects continuous availability for service of process.

Step 3: File Articles of Organization (Online or Mail)

This is the moment your Virginia LLC becomes real. File Articles of Organization (Form LLC-1011) online in CIS and pay the $100 state fee. The form is straightforward: LLC name, registered agent/office, principal office, and organizer’s signature. Paper is allowed, but online filing is fastest and avoids common errors (the SCC’s own instructions even say “do not include attachments”, the form covers everything needed).

Need speed? Add Next-Day ($50 or $100) or Same-Day ($200) expedited service when available; submit by state cut-off times for a same/next-day response.

Step 4: Create an Operating Agreement

An Operating Agreement sets ownership, roles, voting, profit splits, and exit rules. Virginia law recognizes Operating Agreements (and even allows them to be oral), but treat this like seatbelts, use a written agreement so expectations are clear and enforceable. You don’t file it with the SCC; keep it with your records and share with members, your CPA, and your bank when asked.

Solo founders: Single-member LLCs benefit too. A short agreement helps prove separation between you and the company.

Step 5: Get an EIN from the IRS

Apply for your EIN directly with the IRS, free and usually instant online if you’re eligible. The IRS recommends forming your LLC first, then applying for the EIN, so your federal record matches your state record. Keep the Confirmation Notice for banks and payroll.

Step 6: Register for Virginia Taxes & Payroll Accounts

After you have an EIN, register with Virginia Tax for any taxes you’ll owe—commonly sales and use tax (if you’re a taxable “dealer”) and employer withholding if you’ll run payroll. Since July 1, 2024, new businesses must register online; during that process you can also register with the Virginia Employment Commission (VEC) for unemployment insurance.

Employers must file returns and pay withholding to Virginia Tax; the VEC separately administers unemployment tax/returns. Keep both accounts in good standing.

Step 7: Business Licenses & Local Registration

Virginia has no statewide general business license. Instead, most cities/counties require a local BPOL license and tax that’s based on gross receipts. Thresholds, rates, and deadlines vary by locality, so check where you operate (e.g., Fairfax, Richmond, Alexandria) and register on time to avoid penalties.

If you’re home-based or opening a storefront, confirm zoning/occupancy rules with your locality before you sign a lease or start renovations. Local sites usually publish checklists and contact info.

Step 8: Open a Business Bank Account

Separate your money from day one. A dedicated business bank account makes bookkeeping clean, supports liability protection, and most banks will ask for your Articles of Organization and EIN. Both the IRS and SBA encourage keeping business and personal funds separate—it’s basic but powerful protection.

What banks typically ask for: approved Articles, EIN confirmation, your Operating Agreement (sometimes), and a photo ID. If you’re a single-member LLC, separation still matters for record-keeping and taxes.

Note on federal BOI (beneficial ownership) reporting in 2025

FinCEN removed the Corporate Transparency Act BOI reporting requirement for U.S.-created companies via an interim final rule issued March 21–26, 2025. If this changes again, we’ll update the guidance, but as of Maret 2025, newly formed Virginia LLCs created in the U.S. are not required to file BOI reports. (Some foreign-formed entities registered in the U.S. may still have BOI obligations per FinCEN guidance.). Visit FinCEN.gov for more details.

Start your Virginia LLC with Northwest Registered Agent

Get expert support and top-notch privacy protection when you form your Virginia LLC with Northwest—no hidden fees, ever.

Virginia LLC Costs & Fees

How much does an LLC cost in Virginia? The core state cost is the Articles of Organization fee of $100 to create your company. After that, the ongoing annual registration fee is $50, due each year on the last day of your anniversary month (late payments add a $25 penalty, and the LLC is canceled if the fee still isn’t paid by the end of the third month after the due date).

A few optional costs may apply depending on your situation. You can reserve a name for 120 days for $10 (useful if you’re not filing today). If you’ll operate under a different brand, a Virginia “fictitious name” (DBA) filing is $10. Need proof of status for your bank or a partner? A Certificate of Fact of Existence/Registration costs $6 as an instant download. When time is tight, online expedited service is available: Next-Day ($50 or $100, depending on category) or Same-Day ($200) if you meet submission cutoffs.

If your LLC is ever canceled for nonpayment, you can reinstate it for $100 plus any unpaid fees. Routine housekeeping is inexpensive (e.g., change registered agent or principal office $0; amend or name change $25; cancel an LLC $25). These are all processed in the SCC’s CIS system.

Virginia LLC fee snapshot

| Filing / Service | State fee | When it applies |

|---|---|---|

| Articles of Organization (LLC-1011) | $100 | One-time to form your LLC. |

| Name reservation (120 days) | $10 | Optional hold before you file. |

| Fictitious name (DBA) | $10 | Optional if using a trade name. |

| Certificate of Fact of Existence/Registration | $6 | Optional proof of status. |

| Online expedited service: Next-Day | $50 or $100 | Optional; submit by 2:00 p.m. ET. |

| Online expedited service: Same-Day | $200 | Optional; submit by 10:00 a.m. ET. |

| Annual registration fee (LLC) | $50 | Due each year on the anniversary month’s last day. |

| Late penalty (LLC) | $25 | If annual fee isn’t paid by due date. |

| Reinstatement after cancellation | $100 + unpaid fees | If your LLC is canceled for nonpayment. |

| Change registered agent / office | $0 | File online any time. |

| Amend articles / change name | $25 | If you edit core records or rename. |

| Cancel (voluntarily) your LLC | $25 | If you close the company. |

For a complete breakdown of formation and ongoing expenses, check our detailed Virginia LLC cost guide

Maintain & Renew Your Virginia LLC

Keeping your Virginia LLC compliant is simple: pay the state each year and keep your records current. Your ongoing cost is the annual registration fee of $50—the Virginia LLC annual fee—due on the last day of your anniversary month. If you miss the date, a $25 penalty is added; if it still isn’t paid, the Commission cancels the LLC on the last day of the third month after the due date. You can pay in the Clerk’s Information System (CIS), and the SCC mails the assessment to your registered agent about two months before it’s due. There’s no annual report for LLCs (that filing applies to corporations).

For housekeeping, file changes online in minutes: use a statement of change to update your registered agent/registered office ($0), or update your principal office address ($0). If you rename the company or alter provisions in your articles, file a certificate of amendment (LLC-1014 or LLC-1014N) for $25. There’s no separate Virginia LLC renewal fee, the $50 annual registration fee is your yearly payment. If your company is canceled, you can reinstate it for $100 plus any unpaid fees. Don’t forget local and tax maintenance: renew any locality BPOL license if required and file Virginia Tax returns on time (e.g., sales tax returns are due by the 20th of the following month).

Other Filing Scenarios

Not every path is a brand-new filing. If you’re expanding into Virginia with an out-of-state company, you’ll register as a Foreign LLC (use Form LLC-1052 in CIS, no need to create a second entity). If you’re rebranding, you can operate under a fictitious name (DBA) for a small fee, or permanently rename the company with Articles of Amendment. Licensed professionals (like CPAs, architects, and health practitioners) may need a Professional LLC (PLLC) instead of a standard LLC, and those entities follow extra naming and licensing rules. In the sections below, we’ll show you when each route applies, the exact forms, and the current state fees so you can choose the cleanest, most compliant option.

Foreign LLC (Register to Do Business in Virginia)

Bringing an existing LLC into Virginia? File Form LLC-1052 (Application for Certificate of Registration to Transact Business in Virginia as a Foreign LLC) in CIS. The filing fee is $100. You’ll need a Virginia registered agent with a physical street address, plus a certified or otherwise authenticated copy of your LLC’s articles of organization (and any amendments) authenticated within the past 12 months by your home state. If your true name is unavailable here—or lacks “LLC/LC”—adopt a designated name for use in Virginia. After approval, budget the standard $50 annual registration fee; if unpaid, the foreign registration is automatically canceled after the third month following the due date.

Change Your LLC Name vs. Use a Fictitious Name (DBA) in Virginia

If you’re changing the company’s legal name, file Articles of Amendment in CIS ($25). The amendment updates your public record and is what banks, partners, and agencies will see as your true name. If you only need a marketing alias, file a fictitious name (DBA) certificate—$10—and keep your legal name as is. Since January 1, 2020, Virginia made the SCC the central filing office for all fictitious names (no more new filings at local courts). A DBA doesn’t change ownership or liability, and it doesn’t replace any locality licensing you may need.

Quick checks:

• DBA required if you’ll transact under a name other than the legal name.

• You can hold both: amend the legal name or run multiple DBAs under one LLC.

“LLC License” in VA (Local BPOL)

Virginia doesn’t issue a statewide general business license. Instead, most cities/counties require a local business license, the Business, Professional & Occupational License (BPOL), which is a local license and tax based on gross receipts. Exact rules, thresholds, and due dates vary by locality, but state law sets the framework (Code of Virginia § 58.1-3700 et seq.; BPOL regulations at 23VAC10-500).

What to expect (typical flow):

- Check zoning first. Many localities require zoning or a home occupation permit before issuing a license (e.g., Norfolk and Arlington).

- Apply with your locality soon after you start (some require filing within 30–75 days—see Newport News and Fairfax examples).

- Estimate year-one receipts. First-year BPOL is often based on your estimate; later years reconcile to actuals (see James City County).

- Fees vs. tax. Many places charge a small license fee at lower receipts (e.g., Fairfax: $0 ≤ $10k; $30 for $10,001–$50k; $50 for $50,001–$100k), and switch to a tax rate once you’re over the threshold.

- Renew annually. Many localities set renewal/filing around March 1 (examples: Fairfax, Alexandria, Falls Church, Loudoun, Herndon), but always confirm your city/county’s date.

Rates are capped by state law but chosen locally (e.g., up to $0.16 per $100 for contracting, $0.20 retail, $0.36 services, $0.58 professional/financial/real estate). Your locality’s schedule controls what you actually pay.

Professional LLC (PLLC)

Some licensed fields (e.g., law, medicine, architecture, accountancy) may need a Professional LLC (PLLC). File Articles of Organization for a Professional LLC (Form LLC-1103), the fee is $100, and make sure every professional is properly licensed with the relevant Virginia board. Virginia lets you include identifiers like “P.L.C.” or “P.L.L.C.” (or simply “LLC”) in the name; choose what fits your branding and board guidance. If converting an existing Virginia LLC to a PLLC or registering a foreign professional entity, review both SCC rules and your profession’s board requirements before filing.

Virginia LLC Timeline

Good news: Virginia moves fast—especially if you file online and avoid extras that trigger reviews. There’s no guaranteed “standard” clock, but the SCC posts clear expedited options (Same-Day/Next-Day) with hard cut-off times. For everything else, timing depends on daily volume. Two levers you control: (1) file through CIS, and (2) don’t upload non-required attachments (those add a review delay).

If your launch date is tight, pay for SCC expedited service—the cut-offs are firm and the response windows are posted publicly. For non-expedited filings, keep expectations flexible and avoid avoidable delays (attachments, errors, or missing registered-agent details).

For more details on approval times and expedited filings, see our Virginia LLC processing time guide

DIY vs Best Virginia LLC Formation Services

If you like clear checklists and don’t mind a little paperwork, DIY is straightforward in Virginia: file Articles of Organization in CIS for $100, skip extra attachments, and you’re done in minutes. Then grab your EIN from the IRS for free. If timing is tight, the SCC offers Same-Day and Next-Day expedite options with firm cut-offs, so you can still control your launch date without paying a third party.

Formation services can be worth it if you want less inbox juggling and more privacy. A service can act as your registered agent (must have a Virginia physical address and daytime availability) and keep your personal address off routine state mail. They also tend to package reminders and document storage. Just remember: the state doesn’t require you to use a service, CIS is designed for self-filers. If you’re comparing providers, start with our review of the 10 best LLC services in Virginia (reviewed & ranked).

Quick comparison

| Factor | DIY in CIS | Use a formation service |

|---|---|---|

| State filing | $100 to form; you control data entry and timing. | They still file in CIS on your behalf; their fee is in addition to $100 state fee. |

| Speed | Instant online filing; optional Same-Day/Next-Day expedite via SCC. | Similar or slightly faster admin handling, but state expedite rules still apply. |

| EIN | Free directly from IRS (minutes). | Some upsell EIN for a fee—unnecessary if you can apply yourself. |

| Registered agent | You or someone you designate must meet VA requirements. | Many providers offer RA service and compliance reminders (check plan details). |

| Privacy & mail | Your registered office info is on file; you’ll handle your own notices. | Provider’s address receives legal mail; they forward it and log it for you. |

Conclusion

Forming a Virginia LLC is refreshingly doable. You pick a compliant name, appoint a registered agent, file your Articles online, and you’re in business — with real limited liability protection and the flexibility to grow on your terms. From there, keep your foundation tight: put rules in writing with an Operating Agreement, separate finances with a business bank account, and register only for the taxes and local permits you actually need (think BPOL license where required).

Day to day, compliance stays simple. Pay the annual registration fee on time, keep your addresses and agent current, and update your records if anything material changes. Prefer the hands-on route? DIY through CIS is fast and inexpensive. Want extra privacy and reminders? A reputable service can cover the admin while you focus on customers.

Frequently Asked Questions – Virginia LLCs

Below is a concise, SEO-friendly FAQ designed to answer the questions most people hit when forming and maintaining a Virginia LLC. Each response is short, plain-English, and based on current state guidance. Use it to sanity-check a step before you submit, or to double-back after approval when you need a quick, authoritative refresher.

How much does an LLC cost in Virginia?

$100 to file your Articles of Organization (Form LLC-1011). After that, every Virginia LLC pays a $50 annual registration fee in the anniversary month of formation. Late payments trigger a $25 penalty and your LLC can be canceled if unpaid by the last day of the third month after the due date.

Do I need a registered agent in Virginia? Can I be my own?

Yes, every LLC in Virginia must continuously maintain a registered agent with a Virginia street address. You can serve as your own registered agent if you’re a Virginia resident and meet the statutory qualifications, but the LLC itself cannot be its own agent. PO boxes and virtual offices aren’t acceptable for the registered office.

To learn more about why the state requires one, see our guide: Do you need a registered agent in Virginia?

Is an Operating Agreement required?

Virginia doesn’t require you to file an Operating Agreement, and it may be oral, in a record, or implied. Still, a written agreement is smart for banking, tax, and liability clarity.

Do I need a business license?

There’s no statewide license, but many localities require a BPOL license (Business, Professional and Occupational License) and tax based on gross receipts. Check your locality (examples: Arlington and Alexandria).

Does Virginia have a franchise tax on LLCs?

No, Virginia doesn’t impose a general franchise tax on LLCs. (Banks have a separate bank franchise tax.) You’ll still owe the $50 annual SCC fee and any applicable state/local taxes.

Can an out-of-state (foreign) LLC do business in Virginia?

Yes, File Form LLC-1052 (Application for Certificate of Registration) and provide certified formation documents (certification dated within the last 12 months). Filing is $100; online filing is available.

Do I have to file a federal Beneficial Ownership Information (BOI) report?

As of March 26, 2025, U.S.-created companies (domestic entities) are exempt from BOI reporting under FinCEN’s interim final rule. Only certain foreign reporting companies must file, with deadlines starting April 25, 2025 or within 30 days of registration. Always check FinCEN for updates.

- Virginia SCC: Business Home

- Virginia SCC: New Business Resources (start here)

- Virginia SCC: Virginia LLC — Forms & Fees (all filings, costs)

- Virginia CIS: Business/Name Search

- Virginia SCC: Reserve/Renew Business Name (120 days, $10)

- Virginia SCC: Fictitious Names (DBA) — FAQ

- Virginia SCC: Maintaining Your Business → LLC

- Virginia SCC: Expedited Services (same-day/next-day fees)

- Virginia SCC: Order Certificates & Certified Copies

- Virginia SCC: Registered Agent FAQs

- Virginia SCC: Professional LLC (PLLC) info & filing

- Code of Virginia: Virginia LLC Act (Title 13.1, Ch. 12)

- §13.1-1024: Manager-managed LLCs

- §13.1-1050.2: Automatic cancellation (missed annual fee)

- §13.1-1050.4: Reinstatement after cancellation

- §59.1-69: Fictitious (assumed) name certificate

- Chapter 5: Transacting Business under Assumed Name

- Title 58.1, Ch. 37: BPOL enabling law (local business license tax)

- 23VAC10-500: BPOL Guidelines (Admin Code)

- Virginia Tax: Register a Business

- Virginia Tax: Business Taxes — Overview & Rates

- Virginia Employment Commission: Employers (UI tax)

- Virginia Workers’ Compensation: Employer Info

- Virginia Business One Stop: Start & Manage a Business

- Fairfax County: BPOL Overview & Deadlines

- City of Alexandria: Business License Tax

- Loudoun County: Business License Tax (first-year flat fee)

- City of Norfolk: Business License Info

- IRS: Get an EIN (Online)

- IRS: About Form SS-4 + Instructions

- IRS Pub. 1635: Understanding Your EIN (PDF)

- FinCEN: BOI Reporting — Status & Guidance

- Federal Register: FinCEN Interim Final Rule (Mar 26, 2025)

- USPTO: Trademark Basics

- USPTO: Trademark Search

- USPTO TSDR: Trademark Status & Documents

- eVA: Virginia’s e-Procurement Portal

- SBSD: SWaM & DBE Certification

- Virginia APEX Accelerator: Gov Contracting Help

- Virginia SBDC: Counseling & Training Network

- VEDP: Virginia Talent Accelerator

- Port of Virginia: Global Logistics Hub

- Loudoun County: “Data Center Alley” Overview

- Ballard Spahr: Law Firm Analysis — BOI Exemption Context

Looking for an overview? See Virginia LLC Services

Form your Virginia LLC fast with Harbor Compliance

Harbor Compliance streamlines Virginia LLC formation with personalized support and tools to keep your business legally sound.