Whether you’re filing taxes, starting a business, or applying for a loan, you’ll need the correct identification number. The two most common are TINs (Taxpayer Identification Numbers) and SSNs (Social Security Numbers)—but they serve different purposes depending on your immigration status and tax obligations.

A TIN covers tax-related identification for individuals and businesses, while an SSN is required for U.S. citizens and permanent residents for employment and benefits. Choosing the right one depends on your tax status and filing needs.

This guide will explain when to use a TIN or SSN, the application process, and which one fits your situation. Whether you're an individual taxpayer or a business owner, understanding these numbers will help you stay compliant with federal regulations. Let’s break it down!

SSN vs TIN: Understanding the Differences

Navigating personal or business tax details can be confusing, especially when deciding between a TIN and an SSN. Although both track financial and legal data, each serves a distinct function. Knowing how they work and who qualifies can help you avoid complications when you file taxes and manage official documentation.

What Is a Taxpayer Identification Number?

A TIN, or tax identification number, is an umbrella term for the unique codes the internal revenue service uses to associate individuals or organizations with tax obligations. Sometimes, it refers to an individual taxpayer identification used by those who cannot get an SSN, but it also covers EINs for businesses.

Because TINs are assigned for tax purposes, they help the federal government gather correct financial data from all filers, including nonresident alien taxpayers and companies. This system streamlines verifying tax returns, enabling the IRS to validate each person or entity’s compliance while simplifying cross-checks with local or state agencies.

What Is a Social Security Number (SSN) and Why Is It Required?

A social security number is a nine-digit code that identifies individuals for benefit programs and tax-related matters. As explained by the official Social Security Number article, the SSN has become the primary personal ID for most U.S. residents. It plays a critical role in tracking social security program contributions, confirming immigration status for work eligibility, and supporting certain financial transactions.

Since the administration uses SSNs to calculate retirement benefits, it’s essential for all citizens and permanent residents living in the country. In addition, if you’re looking to leverage extra support, consider obtaining minority owned business certification which can provide added recognition and resources for underrepresented entrepreneurs. You also typically need an SSN to access credit, open accounts, and comply with standard job paperwork. This number often stands at the core of an individual’s financial and legal footprint in the United States.

Get the Right Identification for Your Business

ZenBusiness simplifies EIN registration, ensuring your business has the proper tax identification number for compliance and growth.

Key Differences in Tax Reporting and Legal Identification

There’s a noticeable contrast between TINs and SSNs when sorting through tax details or proving identity. Below are the main distinctions:

- A TIN covers broader contexts, from foreign status verification to EINs for businesses.

- An SSN is closely tied to personal data and social security taxes.

- TIN holders may qualify for different treaty benefits compared to those with SSNs.

Essentially, SSNs blend tax and personal identity management, whereas TINs focus more strictly on tax-related tracking.

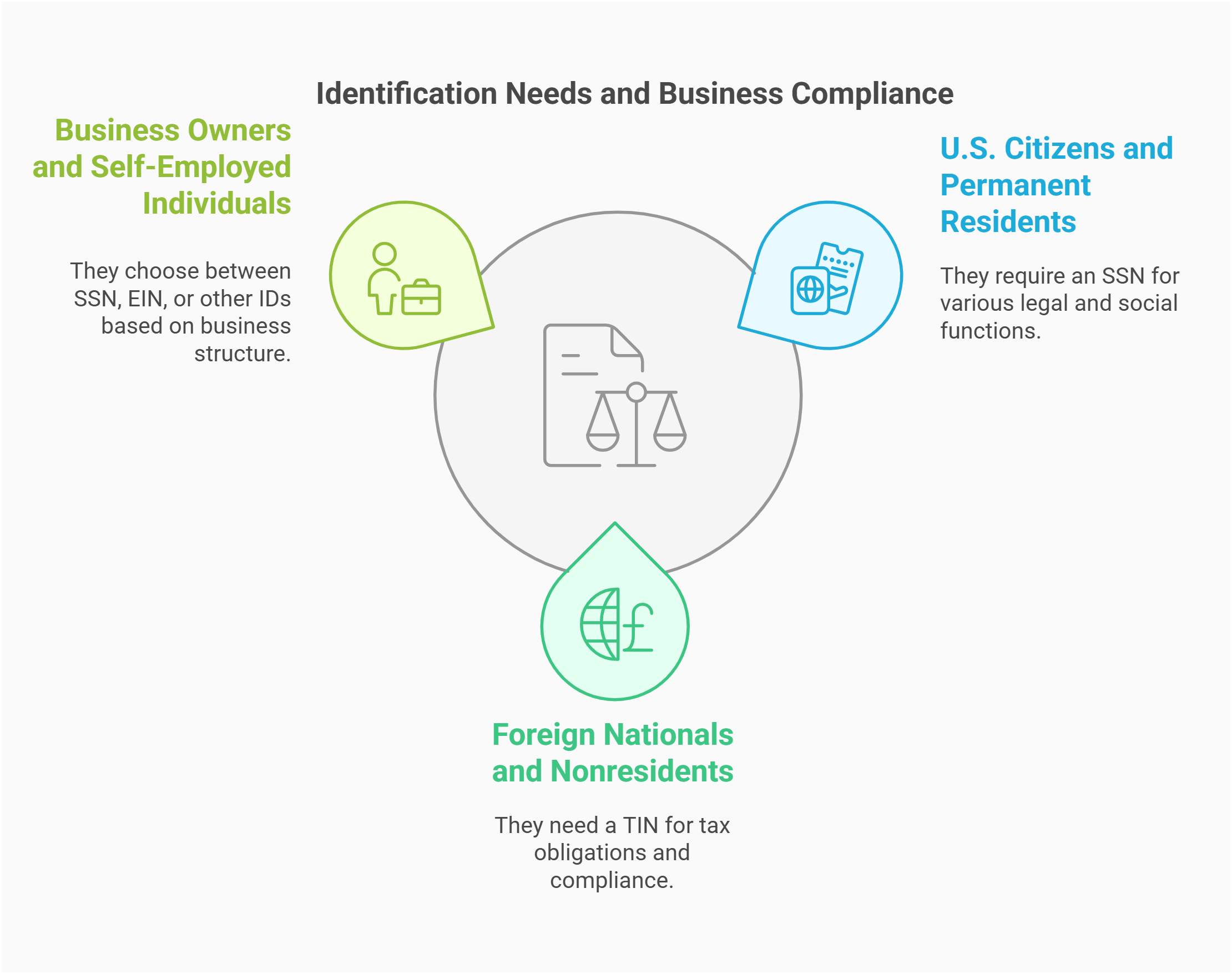

Who Needs a TIN vs. Who Qualifies for an SSN?

Whether you need a TIN or an SSN depends on background, legal standing, and specific filing goals. Deciding which identification code to obtain requires understanding of the eligibility criteria, plus any local guidelines that might apply. If you’re a business owner ready to formalize your operations, you might start your own LLC to gain added legal and financial benefits.

U.S. Citizens and Permanent Residents: Why an SSN Is Required

For every permanent resident or U.S. citizen, an SSN typically isn’t optional—certain services and functions depend on having one. Since it’s linked to the social security card, it plays a significant role in job eligibility, loan applications, and broader legal recognition. Individuals who fail to secure an SSN can find it tough to prove identity in various official transactions.

Beyond daily uses, an SSN also ensures access to retirement benefits later in life. The code ties your professional history to the social security benefits system, documenting years worked and wages earned. This data eventually helps the government determine how much you’ll receive once you retire or encounter disability challenges.

Foreign Nationals and Nonresidents: When a TIN Is Necessary

If you’re a nonresident alien or foreign national with no SSN, you usually need a TIN for filing obligations in the United States. For example, an overseas individual who earns income from U.S. investments or engages in local commerce often requires an ITIN to handle federal income tax matters. Such a number of signals to the local government and other agencies that you’re on file for tax treaty considerations, income tax return submissions, and any relevant compliance checks.

Business Owners and Self-Employed Individuals: Choosing the Right Number

For a business owner, the correct ID depends on legal structure and personal preferences. Some rely on an SSN, particularly if their operations are small-scale or structured as sole proprietorships. Others opt for an EIN (Employer Identification Number) if they have employees or form a corporation. Additionally, many business owners choose to use registered agent address for ein which can simplify your EIN application process.

- People who hire staff often need an EIN for payroll tax purposes.

- Single-member LLCs might use either an SSN or EIN, based on how the organization is set up.

No matter the size of your venture, evaluating business requirements is critical to picking an identification method that ensures proper compliance and secure record-keeping. For more detailed guidance on establishing your business, consider exploring best registered agent services which can help ensure compliance and efficiency.

How to Apply for a TIN or SSN

Acquiring the right identifier can feel daunting, but the process is simpler once you understand how each step fits together. Whether you must apply for the ssn due to your resident status or get an ITIN as a foreign national, the general approach follows a logical path of forms, documents, and official verifications.

Steps to Obtain a Social Security Number (SSN)

Applying for an SSN is a structured procedure overseen by the Social Security Administration. First, visit the official website to learn about required documents, including birth certificates or immigration papers. You often present these papers in person at your local SSA office.

Next, fill out the application carefully and submit all proof of eligibility.

- Provide evidence of identity, age, and national identification if requested.

- Verify your place of birth or foreign status if applicable.

Once processed, you receive your number, enabling you to work lawfully and link earnings to your future retirement benefit. For self-employed individuals looking to enhance their business structure, exploring best LLC formation services can be a valuable next step.

How to Apply for a TIN (Including ITIN and EIN)

Individuals who aren’t eligible for an SSN can apply for an itin through the IRS by submitting the proper form, often with assistance from an acceptance agent. You must attach documents showing your identity and reason for needing a TIN, like a visa or tax return proof.

A typical list of requirements includes:

- Original passport or certified copies

- Supporting explanation for tax filing

- Completed application forms, ensuring correct personal data

Business owners can also request an EIN for separate operations. In fact, many experts recommend that you LLC before Ein to establish a proper legal structure. While the methods differ slightly, the goal remains the same: verifying your existence for tax returns and associated government obligations.

Common Application Mistakes and How to Avoid Them

People sometimes misread instructions, leading to incomplete submissions. Others send expired IDs or overlook required translations, causing delays. Double-check the application for clarity and sign each section as directed. Verifying deadlines and confirming the correct place to mail forms prevents lost paperwork and ensures you don’t miss any crucial follow-up steps. Furthermore, for those considering LLC formation in Massachusetts, check out how long to get llc in Massachussetts which can help you better plan your timeline.

Secure Your Business Identity with an EIN

Northwest Registered Agent helps you obtain an EIN quickly, so you can file taxes, open accounts, and stay compliant.

Tax and Financial Implications

Different identifiers carry different effects on how you manage finances or submit returns. Whether you hold a TIN or an SSN, it determines certain liabilities, eligibility for benefits, and claim protocols when dealing with official agencies or institutions. For example, if your business operates in California, you might benefit from california llc registration, which is known for its efficient online process.

How TINs and SSNs Impact Tax Filing and Financial Records

Both numbers show up on essential documents, but an SSN usually connects to personal data, including a business bank account if you operate as a sole proprietor. Moreover, setting up an llc business bank account ensures clearer separation between your personal and business finances.

By contrast, TINs can represent business structures or permanent residents who do not hold SSNs. Based on the guidelines at the Taxpayer Identification Numbers page, each code helps the federal government confirm reported earnings.

When you file taxes, the IRS cross-references your ID to confirm social security tax payments or potential social security program entitlements. This mechanism also supports verifying withholding for social security taxes or confirming if a business is recognized as a legitimate entity.

Can a TIN Replace an SSN for Tax Purposes?

While some TINs cover legal filing needs, they cannot replicate an SSN’s broader functionalities. An ITIN, for instance, works only for tax matters, so it won’t let you access social security benefits or other privileges. Therefore, although it can fulfill official reporting, it doesn’t override standard SSN obligations for those who are truly eligible to obtain the latter. Additionally, for entrepreneurs looking for a low-commitment entry, consider that you can open an LLC without a business which can serve as a stepping stone in formalizing your business structure. In essence, an ITIN is a targeted solution, not a complete substitute.

FAQ – Common Questions About TIN vs SSN

Many people wonder which number to use or if both are necessary. Here are the most frequent queries to help you navigate these identification processes and avoid identity theft or other hassles. industry.

Yes. Individuals who don’t qualify for an SSN because of immigration status or other restrictions can request an ITIN instead. This approach is common among international residents who must pay U.S. taxes but lack a social security number. Just remember that an ITIN only satisfies tax identification requirements, not broader tasks like applying for national identification credentials or receiving certain government benefits.

Generally, no. Once you’re deemed eligible for an SSN, you typically surrender the ITIN, ensuring you aren’t juggling multiple IDs for the same purpose. However, some people with changing statuses may have used an ITIN initially and then shifted to an SSN upon gaining new rights. In such cases, you notify the IRS so they can merge your historical data with the new ID.

An EIN is one type of TIN used exclusively by businesses, allowing them to separate financial activities from their owners’ personal details. Think of the EIN as the ID for your organization, distinct from personal codes like an SSN or ITIN. While all EINs count as TINs, not every TIN is an EIN, since TIN is a broader category that encompasses multiple identifiers under IRS guidelines. Additionally, for small businesses, remember that you small business need an LLC to ensure you have the proper legal structure in place.

Whether you misplaced your social security card or can’t recall your ITIN details, the first step is to contact the issuing agency. The SSA can guide you on how to reapply or retrieve your SSN info, while the IRS can help locate ITIN documents. Additionally, you might report the loss to prevent fraud or unauthorized use. Acting fast ensures you maintain accurate records and protects your data from unwanted complications.

Navigate Tax ID Requirements with Ease

Harbor Compliance streamlines EIN registration and tax compliance, making sure your business operates smoothly and legally.