Mastering the NY LLC Lookup process is essential for entrepreneurs, investors, and professionals navigating New York’s business landscape in 2025. This indispensable tool allows you to verify the legitimacy, status, and ownership of any LLC registered in the state. By leveraging the New York Department of State's business database, you can access critical details like registered agents, entity standing, and name availability, empowering you to make informed business decisions.

What Is an NY LLC Lookup?

An NY LLC Lookup is the process of searching official records to confirm the existence, status, or specific details of a llc in new york. By tapping into the state’s business entity database, you can quickly verify ownership, check name availability, and gather basic data about an organization’s structure. This transparency is crucial for entrepreneurs, investors, and any party interested in forming partnerships or verifying legitimacy. Essentially, an LLC search ensures you’re dealing with a legitimate entity and helps you avoid costly legal pitfalls.

Definition and Purpose of an LLC Lookup in New York

A proper lookup involves querying a searchable database administered by the york division (often referred to as the State’s corporations registry). The goal is to find accurate info about a york business entity—such as its articles of organization, current standing, or past name changes. For anyone aiming to form an llc, an official record check is indispensable: it clarifies whether your desired llc name is already in use, and it reveals if an entity type is actively conducting business or has dissolved.

Who Can Use the NY Business Entity Database?

This business entity search system is open to a broad audience:

- Entrepreneurs and startups verifying potential brand conflicts or searching for a unique company name

- Investors and lenders assessing an entity’s credibility prior to financial agreements

- Legal professionals ensuring compliance with state rules

- Public agencies monitoring activities for regulatory reasons

The department of state division provides an online portal that simplifies these checks, offering key data at no charge.

Key Benefits of Conducting an LLC Search

Before you invest resources or collaborate with certain business entities, verifying details is crucial. Here are the main advantages:

- Preventing Name Conflicts: Check business names to ensure no duplication or infringement issues.

- Confirming Legal Standing: See if a legal entity is active, suspended, or dissolved.

- Reducing Fraud Risks: Validate that you’re dealing with a genuine business, not a phantom venture.

- Gathering Due Diligence Info: Understand the ownership or structure for sound negotiations.

Undertaking an llc name availability review or looking up an existing LLC fosters confidence and avoids potential pitfalls further down the line.per due diligence is key to ensuring you buy a strong foundation rather than a sinking ship.

Verify Any NY LLC Instantly

Check business legitimacy, ownership, and legal status with a quick NY LLC Lookup. Protect your ventures and avoid legal risks.

How to Perform an NY LLC Lookup Step by Step

Conducting a methodical business entity search in new york is more than just typing in a name. By following a clear structure, you ensure you’re pulling accurate records and sidestepping errors. First, confirm you have the right details—like an LLC’s official name or DOS ID—then select the appropriate search method in the state’s portal. You might also need to filter results or solve common technical hiccups. A well-planned approach saves time and offers complete data, letting you proceed confidently with your next business move. Below, we detail each stage so you can finalize your business registration or verification seamlessly.

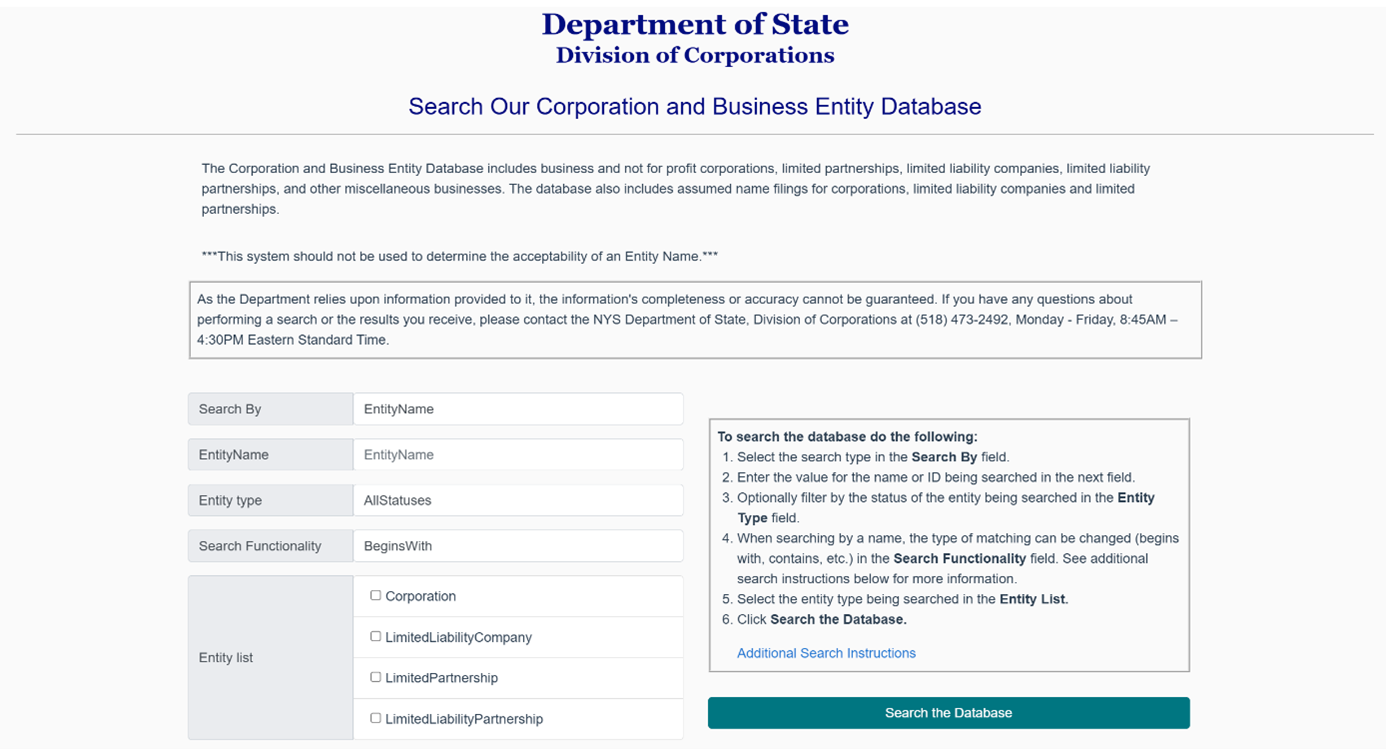

Accessing the Official NY Division of Corporations Database

The primary source for a llc lookup is the official website run by the york state department. Under the umbrella of the department of state, there’s a specialized interface for the search database. Once you navigate to this division of corporations webpage, you can type in relevant info such as the company name or DOS ID. The system will then retrieve the matching records, typically revealing the entity type, date of formation, and more. Keep in mind that some fields, like the registered agent, may not always be displayed if not mandatory for that entity.

Search Methods Explained: By Name, DOS ID, or Agent

Here are the most common approaches to query the department of state division:

- Business Name Search: Enter the LLC’s name or partial name; ideal for checking variations or finding similar business names.

- DOS ID Number: Use this unique identifier if you have it—it yields the most direct and specific result.

- Agent or Officer Search: If you only know the registered agent name, some advanced portals let you locate matching filings.

Remember to double-check spelling or spacing to avoid incomplete results. Using synonyms or partial words can broaden the scope, but might produce too many hits, so keep your queries balanced.timately, the goal is to create a purchase agreement aligning your perceived value with the seller’s, ensuring both parties walk away satisfied.

Troubleshooting Common Issues During Your Search

Sometimes, you may face hurdles. Potential problems include:

- Spelling Discrepancies: The system might not find a record if there’s a minor typo or name mismatch.

- Outdated Records: If the entity changed its name, you must query the new or old name.

- Server Downtime: The official site may occasionally be under maintenance; try again later.

- Limited Historical Data: Certain older companies may not appear in the current digital index, especially pre-1980.

If you still have no luck, consider contacting the county clerk or referencing new york state archives for historical filings.

Exploring Business Name Availability in New York

Before submitting formal documents to form an llc, it’s crucial to check if your preferred brand name or corporate identity is already taken. Searching for llc name availability in city of new york or statewide helps you avoid legal disputes and builds a strong brand foundation. If you’re wondering can I start an LLC without a business, here are your options. Below, we’ll discuss why verifying business name compliance matters, how to secure your desired llc name, and which tools can speed up the process. For more inspiration, check out our best LLC names 2025.

Why Checking Name Availability Is Crucial

Imagine spending months polishing your brand’s image de marque, only to discover that someone else has a similar or identical name. This scenario can lead to confusion, trademark conflicts, or forced rebranding. By proactively doing a business name search, you ensure a distinctive presence for your legal entity. This also spares you from potential litigation or the frustration of losing momentum after a marketing launch. You can discover our article for check llc names.

How to Confirm Name Compliance with NY Rules

The department of state enforces certain guidelines to ensure clarity and avoid duplication. For instance, your business entity name must end with “LLC” or a recognized variant, cannot mimic government agencies like the chamber of commerce or the “york state department,” and must not be misleading. Reviewing the official guidelines or consulting an attorney helps you pick a compliant, professional name.

Steps to Reserve an LLC Name Online

Before finalizing, you can reserve an llc in new york name for a specific duration. Here’s how:

- Visit the New York Secretary of State’s official website.

- Head to the name-reservation section under “Business Filings.”

- Fill out the form, providing your proposed name, contact info, and any relevant details.

- Pay the required reservation fee using an accepted online payment.

- Await confirmation to ensure your chosen name is on hold. For professional assistance, consider the best LLC service in NY.

This reservation grants you a window of exclusivity, letting you prepare your articles of organization with confidence.

Tools and Resources for Name Availability Checks

Below is a quick overview of platforms that help confirm if your business names or brand ideas are free to use:

| Tool/Platform | Main Feature | Ideal For |

|---|---|---|

| NYS Corporation Search | Official state records | Verifying formal legal conflicts |

| Private Name Databases | Aggregated brand/trademark data | Checking across multiple categories |

| Online Generators | Suggest unique name variations | Brainstorming creative business names |

By combining official sources with extra resources, you can be certain your future llc name availability is guaranteed.

Verifying an LLC’s Legal Standing and Documents

Before you partner, invest, or proceed with a particular york business entity, it’s smart to confirm the firm’s legal entity status. Doing so helps you avoid entanglements with dissolved or non-compliant LLCs. Plus, verifying that all certificates of incorporation and legal filings are valid is an essential step toward safeguarding your business interests. The sections below detail how to interpret search database results, confirm an organization’s active standing, and ensure compliance with department of state regulations—so you can engage confidently, whether it’s for a joint venture or major supply contract.

What Legal Statuses Mean: Active, Dissolved, or Suspended

In the department of state division database, various labels indicate an LLC’s standing:

- Active: The entity meets its annual requirements (fees, reports) and is legally authorized to operate.

- Dissolved: The members or the state took formal action to terminate the entity; it’s no longer recognized.

- Suspended: Typically a sanction due to missed fees or non-compliance with publication requirements, restricting operations until resolved.

Understanding these statuses protects you from forging deals with a non-existent or uncertain partner.

How to Verify Certificates of Incorporation and Other Filings

Each limited liability company must have official files on record, such as the articles of organization or operating agreement. Confirming their validity involves:

- Checking the date of filing in the search database

- Ensuring the correct entity type is listed (LLC, Corporation, etc.)

- Matching the listed address with the known headquarters or registered agent location

Where discrepancies surface, contacting the business for clarification or requesting updated forms from the department of state can help.

Using Public Records to Confirm Ownership and Licenses

Many business entities must maintain additional documents in public repositories. Whether it’s permits for real estate development or specialized licenses, these records are accessible at local offices or through the new york state archives. They can reveal changes in ownership, expansions, or relevant compliance data.

| Type of Dossier | Purpose | Access Method |

|---|---|---|

| Operating Agreement | Internal governance details | Often internal but occasionally filed |

| Licensing Records | Sector-specific credentials | County clerk or relevant agency |

| Publication Affidavits | Proof of required announcements | Division of corporations or local newspapers |

Cross-referencing these documents ensures you’re dealing with a legitimate enterprise.

Ensuring Compliance with NY State Regulations

An LLC based in new york must align with local requirements. Below are some regulations to check:

- Annual or Biennial Statements: Confirm the LLC hasn’t missed filing deadlines

- Registered Agent: Must have a physical presence in the city of new york or a recognized agent service

- Tax Obligations: Payment of state fees and any county-level taxes

- Intellectual property compliance: Ensure the brand name isn’t infringing on existing trademarks

Maintaining up-to-date compliance fosters trust and avoids crippling fines down the line.

Advanced Insights for NY LLC Search Users

Beyond simply verifying a limited liability company name or certificate, a thorough lookup can feed into broader strategies. Many seasoned entrepreneurs use these insights to gauge market competition, spot expansion opportunities, or confirm alliances. If you handle multiple business entities, the records gleaned from an llc lookup can shape your business plan and refine your approach to economic development. Check out the following tips on deploying this data to elevate your decision-making and keep your organization ahead of the competition.

How to Use LLC Search Results for Competitive Research

When scanning the business entity database, you uncover a variety of details: formation date, entity type, or registered agent info. Analyze competitor patterns—did they recently switch operating agreement, or incorporate extra licenses? If they expanded quickly, that might signal a profitable niche you can also explore. Additionally, repeated name patterns or new entrants might hint at a saturated segment or an emerging trend.

Preventing Trademark and Legal Conflicts Before Registration

An llc lookup can highlight names too close to yours. By reviewing the business name search, you avoid accidental duplication that leads to legal friction. If the desired llc name is already taken, it’s time to refine your brand identity. Also, check for intellectual property claims, ensuring no hidden obstacle disrupts your business registration process.

Case Study: How Businesses Use NY LLC Data for Growth

Imagine a midsize tech startup scanning the searchable database for newly formed limited liability companies in the same sector. By monitoring the york division listings, they notice a competitor adopting a new brand or registered agent, suggesting a rebranding push. Armed with this knowledge, they adapt their marketing strategy, reinforcing key differentiators to keep existing customers loyal.

- By promptly identifying competitor movements, they adjust product releases.

- They also confirm no direct name conflict arises, preventing brand confusion.

This real-world approach shows the strategic value of timely business entity search analysis.

Leveraging Data for Strategic Business Decisions

If used correctly, the information uncovered via an llc in new york search can guide your planning. Here’s how:

- Gather all relevant search data (owner info, operating status, etc.).

- Map out competitor profiles to spot overlaps or open niches.

- Check for synergy or partnership potential if certain LLCs could complement your offerings.

- Incorporate findings into your roadmap, adjusting marketing or expansion goals accordingly.

- Review outcomes quarterly to keep pace with market changes.

This integrated approach transforms raw data into actionable insights.

Register Your NY LLC Easily

ZenBusiness streamlines your LLC formation in New York. Secure your business name and stay compliant effortlessly.

Comparing LLCs to Other Business Entities in NY

If you’re still deciding on the most suitable structure for your venture, you’re probably comparing an LLC to other business entities, such as corporations or sole proprietorships. Each arrangement offers unique legal protections, taxation rules, and managerial frameworks. Below, we’ll break down the core differences so you can confidently pick the model that aligns with your ambitions.

LLC vs. Corporation: Which Is Better for Your Business?

Corporations are known for more formal governance and the ability to issue shares widely, often appealing to those seeking private equity funding. Meanwhile, limited liability companies boast simpler management, pass-through taxation, and fewer recordkeeping demands. If you plan a large-scale operation needing many investors, a corporation might suit you. Conversely, an LLC benefits smaller teams wanting flexibility.

Key Differences Between Sole Proprietorships and Partnerships

- A sole proprietorship ties the business and owner as a single legal entity, meaning full personal liability.

- Partnerships share responsibilities and profits among multiple parties. Though simpler than corporations, partners might be jointly responsible for debts.

- An LLC can serve as a middle ground, offering liability protection akin to a corporation while retaining some partnership flexibility.

Advantages of Choosing an LLC in New York

Before finalizing how to form an llc, consider the top reasons entrepreneurs pick this structure:

- Reduced Personal Liability: Your personal assets remain separate from business debts.

- Tax Flexibility: Possible pass-through taxation to avoid double tax burdens.

- Less Formally Rigid: Fewer annual formalities than a standard corporation.

- Name Protection: Distinguish your brand from others in the region. To ensure you have the best support, compare registered agent services.

These perks position an LLC as a go-to choice for many small to mid-sized ventures seeking a robust yet adaptable framework.

Tax Implications of Different Business Entities

When it comes to taxation, each type of business entity in new york faces distinct rules. Compare the highlights below:nsures you keep the entire llc structure intact and ready to thrive.

| Type of Entity | Tax Treatment | Maintenance Complexity |

|---|---|---|

| Sole Proprietorship | Owner taxed on personal return | Low |

| Partnership | Pass-through taxation | Moderate |

| LLC | Pass-through or corporate option | Medium (operating agreement required) |

| Corporation (C-Corp) | Double taxation (corporate + personal) | High |

The best route depends on your scale, ambition, and risk d'investissement tolerance.

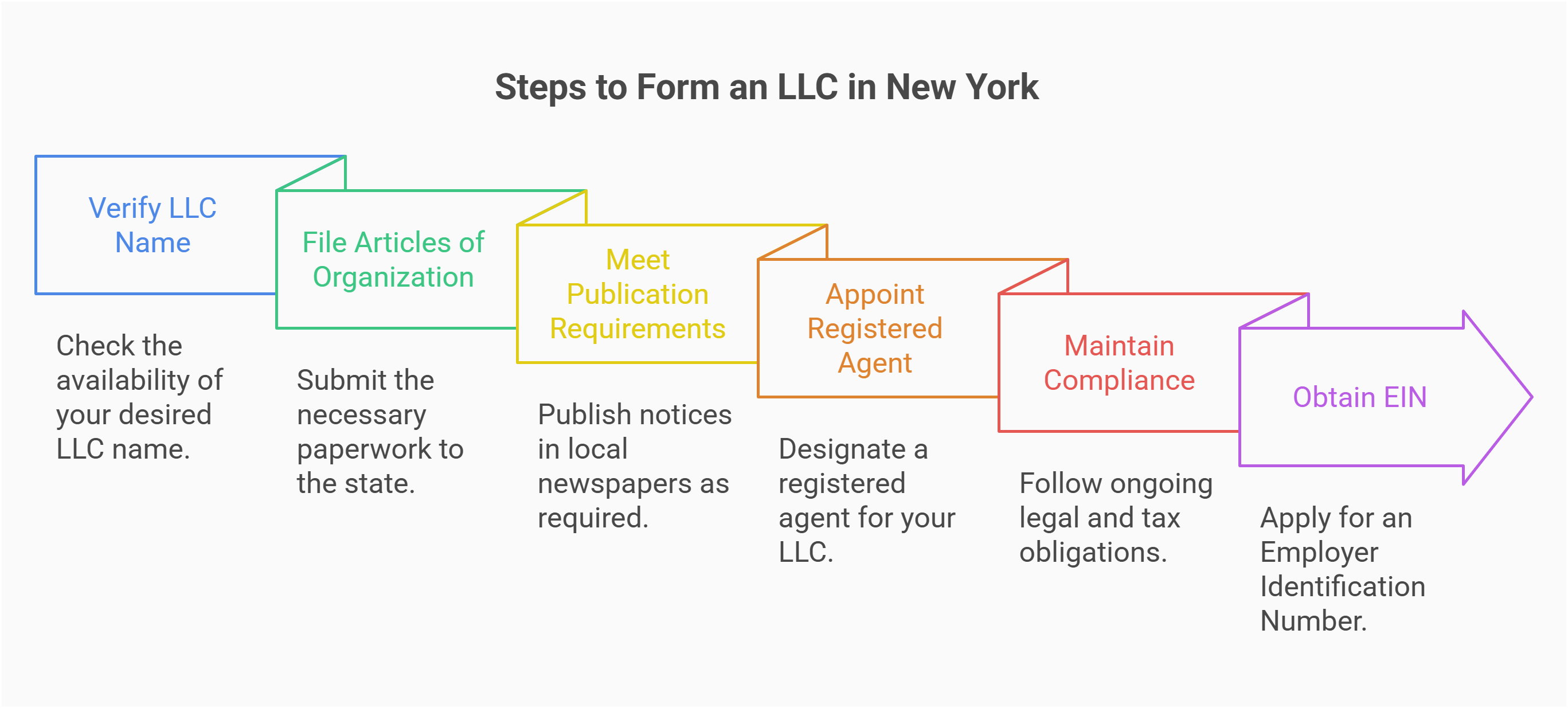

Next Steps: How to Start an LLC in New York After Your Search

Once you’ve confirmed that your desired llc name is available and verified any relevant business details via the business entity search, you’re poised to form an llc in the state. Below, we’ll show you how to file official paperwork, meet publication requirements, and comply with ongoing regulations. From drafting your operating agreement to designating a registered agent, establishing a limited liability company in NY can be straightforward—provided you follow each stage carefully. Let’s dive in so you can finalize your LLC smoothly.

Filing Your Articles of Organization

To formally create your llc in new york, submit the articles of organization to the department of state. If you’re budget-conscious, learn how to create a cheap LLC without compromising quality. The form typically requires:

- Your chosen LLC name (must match what you verified in the llc name availability check)

- The registered agent information

- The county of formation

- Any additional statements (e.g., professional licensing disclaimers)

Once accepted, you’ll receive a stamped copy signifying your new entity’s birth—an essential step for opening bank accounts or seeking funding.

Meeting NY Publication Requirements

New York mandates certain LLCs to publish notices in two local newspapers, designated by the county clerk, for a specific period (usually six consecutive weeks). After publication, you must file the affidavit of publication with the state. Failing to meet this rule could result in your LLC’s suspension of authority. Though some find this step cumbersome, it’s crucial for compliance, so budget both time and money to complete it properly.

Appointing a Registered Agent in New York

Every legal entity formed in the state must maintain a registered agent with a physical NY address. This agent accepts official documents—like lawsuits or tax notices—on behalf of the LLC. You can fulfill this role yourself if you’re based in new york, or hire a professional service for confidentiality and reliability. Find the New York registered agent that suits your needs. Agents typically must be available during normal business hours, ensuring your LLC never misses critical correspondence.

Understanding Ongoing Compliance Obligations

Stay in good standing by following these five rules:

- Maintain accurate corporate records (meeting minutes, operating agreement updates).

- Renew any necessary licenses or permits annually.

- File a biennial statement with the york state department if mandated.

- Keep the registered agent info updated.

- Pay state fees or taxes on schedule.

These regular tasks preserve your LLC’s active status and uphold your business entity protections.

Obtaining an EIN for Your New LLC

In most scenarios, you’ll need an Employer Identification Number (EIN) from the IRS to open a bank account, hire employees, or handle certain tax forms. You can also outsource these tasks to a best registered agent in Florida service to ensure compliance. Here’s how:

- Go to the official IRS website and select the “Apply for an EIN” option.

- Fill out the application with your LLC’s legal name, address, and structure.

- Provide the responsible party’s information (typically a managing member).

- Verify the data and submit.

- Receive your EIN confirmation immediately if done online.

With your EIN in hand, you can streamline bank setups, payroll, and tax filing demands.

Troubleshooting and FAQs for NY LLC Lookups

Even with a solid understanding of the search database and official procedures, users often have follow-up questions. This FAQ addresses the most common roadblocks and clarifies how to maximize the insights gained from an NY LLC search. From what to do if your search hits a dead end to privacy matters and data interpretation, find your clear, concise answers below.hts, perfect for entrepreneurs eyeing an efficient path to purchasing an existing llc.

If you run an llc lookup and come up empty, start by double-checking spelling or exploring alternate business names. Sometimes, small typos or abbreviations cause the system to miss a record. If the desired llc was recently formed, the department of state might not have updated it yet. In some cases, an older entity’s records are archived or exist under a previous name. If none of these fixes apply, you can contact the county clerk or the division of corporations directly, providing relevant details to confirm the LLC’s existence or status.

Should you spot incorrect information—maybe the registered agent or entity type is wrongly listed—reach out promptly to the department of state division. They can guide you on filing an amendment or a correction form. It might involve submitting a request with your official articles of organization or other supporting documentation. Remember, any mismatch in official records could lead to complications, especially with banking or legal entity verification. Correcting these errors helps ensure the business entity database stays accurate and that your LLC remains in good legal standing.

Yes. If an LLC formed outside New York registers to conduct business within the state, it appears in the search database as a foreign LLC. By performing the same steps as with a local york business entity, you can confirm whether that out-of-state company is authorized to operate in city of new york or anywhere in the region. This lookup also reveals the date they qualified in New York, the registered agent details, and other compliance data. It’s an essential step if you plan to collaborate with an LLC from another jurisdiction.

Typically, the department of state updates the business entity registry on a near-daily basis, though weekends or holidays might introduce delays. An LLC formed or modified on Monday could appear in the system by midweek, but sometimes it takes a few extra business days. For highly time-sensitive queries, consider verifying records multiple times or calling the york division directly. Also keep in mind that some changes—like name amendments—may require manual review, adding a bit more waiting time before you see them in the search database.

While the state-run business entity search is free, various third-party sites claim to offer “fast results.” However, many rely on partial or outdated data. If you want official, up-to-date info, stick to the state’s portal or contact the county clerk when official sources are temporarily offline. In certain cases, local chamber of commerce directories or third-party aggregator sites can provide an overview, but they seldom have the certificates of incorporation or the same thorough details. Ultimately, the department of state remains your best bet for reliable, no-cost searches.

Most states, including new york, consider an LLC’s core data—name, formation date, registered agent, etc.—as public record. This allows entrepreneurs to confirm authenticity or avoid duplications. Consequently, certain personal info might become discoverable, depending on how the LLC was structured. If you’re concerned about privacy, you could use a registered agent service to shield your home address from public view. Still, certain details are mandated by law to remain public for accountability. Balancing transparency and confidentiality is part of establishing a limited liability company in a regulated environment.

After you input a business name search, you might see columns with an LLC’s DOS ID, status, and filing date. “Active” or “Current” indicates it’s operational, while “Dissolved” or “Inactive” means it no longer has legal standing. Reviewing the entity type clarifies if it’s a standard LLC, a foreign LLC, or something else. Check if it’s based in new york or merely registered there for convenience. If you need deeper info, look for articles of organization references or contact details for the registered agent. This data forms the basis for your next step—collaborating, investing, or forming your own LLC.

Looking for an overview? See New York LLC Services

Stay Compliant with Expert Help

Harbor Compliance ensures your NY LLC meets all legal requirements. Get guidance on entity searches, filings, and compliance.