Starting a business in Georgia is an exciting opportunity, but before you begin, you must choose the right legal structure. Many entrepreneurs opt for an LLC because it provides liability protection, tax flexibility, and a straightforward registration process. However, understanding the steps—from selecting a business name to filing the necessary documents—is crucial to ensuring compliance with state laws. Missing key details can lead to delays, additional fees, or even rejection of your application.

To form an LLC in Georgia, you must file the Articles of Organization with the Secretary of State, appoint a registered agent, and obtain an EIN from the IRS. Additionally, depending on your industry, you may need to apply for state or local business licenses to operate legally.

This step-by-step guide will walk you through the Georgia LLC formation process, covering everything from name registration to tax requirements. Whether you're a solo entrepreneur or planning a multi-member LLC, we’ll help you navigate the requirements efficiently so you can focus on building your business. Let’s get started!

Understanding LLC formation in Georgia

Many entrepreneurs consider a limited liability company when establishing a business in georgia thanks to its flexible structure and asset protection. This guide covers every crucial step to help you start an llc successfully. By following the outlined process, you can streamline everything from paperwork to tax considerations and fees for a smooth launch. For a comprehensive overview of llc in Georgia, explore our detailed formation guide.

What is an LLC and how does it work?

An LLC operates as a separate business entity that combines the protection of limited liability with the operational simplicity found in less formal structures. By default, profits often pass through to members without being taxed at the business level, though you can elect corporate taxation if desired. This arrangement is particularly appealing for small enterprises seeking to avoid the complexities of a general partnership or corporation model. To gain a deeper insight into what does llc mean in business, refer to our comprehensive explanation. Many entrepreneurs choose this route to balance personal asset security with manageable administrative demands.

A company with multiple owners can structure membership interests, responsibilities, and profit-sharing within an llc formation designed for adaptability and control. Because an LLC is recognized by the internal revenue service, entrepreneurs gain benefits like easier compliance and fewer formalities than a limited liability partnership. In many cases, you can further customize governance rules through an internal operating agreement that clarifies voting rights, financial distributions, and dissolution procedures, making this structure especially appealing for a wide range of ventures.

Why form an LLC in Georgia

Many entrepreneurs decide to operate a company LLC in the Peach State due to its business-friendly climate, strategic location, and efficient filing processes with the state. Georgia’s robust economy supports industries from agriculture to technology, and its stable tax policies foster a sense of security for new ventures. Beyond basic liability protection, an LLC offers a flexible structure that can adapt to changing markets and expansion plans, ensuring your entity remains agile. In addition, interactions with the department of revenue tend to be straightforward, helping business owners better manage tax obligations and reduce taxes through thoughtful planning. Whether you plan to stay small or scale nationwide, the ongoing costs remain manageable, enabling you to reinvest profits into operations rather than bureaucracy. And because Georgia welcomes various enterprise types, your LLC can partner easily with local suppliers and government programs, further boosting growth opportunities.

- Substantial market size and growth potential

- Access to diverse industries and skilled workforce

- Cost-effective registration and annual compliance measures

- Streamlined processes that encourage new start-ups

Step-by-step process to start an LLC in Georgia

Establishing your LLC in Georgia involves several key actions, from name selection to official annual registration. By following each requirement carefully, you can form an llc in GA in a matter of days or weeks. In the sections below, we break down each phase in detail so you can file all paperwork with the Georgia secretary properly and begin operations swiftly.

Ensure uniqueness by checking Georgia’s official database. Consider reserving the name for added security.

Designate a Georgia-based registered agent to receive legal notices and compliance documents.

Submit official LLC formation documents to the Georgia Secretary of State online or by mail.

Define ownership, responsibilities, and financial agreements among members.

Register for an Employer Identification Number (EIN) with the IRS for tax and banking purposes.

Comply with Georgia tax regulations and apply for necessary business licenses based on your industry.

Keep personal and business finances separate by setting up a dedicated account.

Step 1: choose a business name and check availability

Before you choose a name, explore Georgia’s official database to confirm uniqueness. Because two entities may not share identical titles, a quick lookup prevents conflicts that could delay registration. You should also consider future branding and domain availability to maintain consistency across online platforms. Taking this first step seriously can save you headaches down the road.

If you want extra assurance, opt for a name reservation through the state’s website. This grants you a window of exclusivity, giving you ample time to register without worrying about someone else claiming the same moniker. Make sure the name meets Georgia’s legal requirements, such as including designators like “LLC,” and avoids restricted words that demand special permissions.

Step 2: appoint a registered agent in Georgia

To maintain compliance, every LLC in the state must appoint an individual or registered agent service authorized to receive official documents on the company’s behalf. This agent in Georgia is responsible for handling lawsuit notices, government correspondence, and other legal paperwork. By choosing a Georgia registered agent, you ensure that critical mail reaches you promptly and discreetly, avoiding missed deadlines or legal complications. When you appoint a registered agent, consider availability and reliability, since an unresponsive agent could endanger your LLC’s good standing. Utilize registered agent services georgia to ensure your LLC remains compliant and receives all essential documents promptly.

- Must be 18 or older

- Maintain a physical Georgia address for document delivery

- Be available during standard business hours

- Legally authorized to function in that role

Step 3: file the articles of organization with the Georgia secretary of state

Once you’ve settled on a business name and agent, it’s time to file the articles of organization through the official portal. The Georgia secretary of state provides an online services page where you can complete these forms quickly. Alternatively, you may print physical copies and mail them in, though digital submission is typically faster. Most LLC applicants must include a transmittal form as part of the paperwork, ensuring all relevant details are captured. You can also choose to file articles of organization online if you want immediate confirmation of receipt.

Along with the completed articles of organization, you’ll pay a filing fee that does not vary widely for standard processing. However, if you prefer to submit online for accelerated handling, be aware that extra charges could apply. For step-by-step guidance, consult the official resource from the Georgia Secretary of State. Once your LLC is approved, it gains legal recognition, protecting your business and allowing you to operate throughout Georgia.

Step 4: create an LLC operating agreement

Drafting an LLC operating agreement is not mandatory by Georgia law, but it’s a crucial internal document that clarifies decision-making processes and prevents disputes. This agreement usually spells out membership percentages, voting structures, and how profits or losses are distributed. Even single-member LLCs gain clarity by putting critical terms in writing, eliminating guesswork and fostering smoother daily operations.

Key sections typically include:

- Management responsibilities for each member

- Ownership stakes and capital contributions

- Procedures for admitting new members

- Policies on dissolution and winding up

Start Your Georgia LLC Today

Form your LLC quickly and hassle-free with expert guidance. Ensure compliance and protect your business from day one.

Step 5: obtain an EIN (employer identification number)

To meet federal requirements, each Georgia LLC must secure an employer identification from the IRS, also known as an identification number, used for tax and banking purposes. Without an EIN, you may also find it difficult to open accounts or handle employee payroll. This unique numeric code helps the government track your entity’s financial activities and ensures you stay compliant with federal regulations.

- Go to IRS website

- Complete the online form by providing basic details

- Wait for immediate approval or confirmation

- Keep your EIN on file for reporting obligations

Step 6: register for Georgia state taxes and necessary business licenses

After receiving your EIN, you need to file relevant tax documentation with Georgia’s department of revenue, particularly if you’re collecting sales tax or have employees. Ensure you understand if your llc need a business license to comply with local regulations and avoid potential penalties.

Depending on your operations, you might owe state-level income tax or other obligations. Though an LLC is distinct from a sole proprietorship, you also need the appropriate permits to remain compliant and legally conduct business in the region. Failing to meet tax or licensing requirements can lead to penalties that derail your progress.

- Sales and use tax registration

- Employer withholding tax, if you have staff

- Professional or occupational business license, if applicable

- Local permits based on your location and industry

- You'll also need to secure the appropriate licenses and permits to operate legally in Georgia. Requirements vary based on your industry and location, so be sure to apply for the necessary licenses and permits to stay compliant and avoid potential penalties.

Step 7: open a business bank account and maintain compliance

Separating personal finances from your enterprise is vital when forming an LLC, so setting up a business bank account should be a top priority. This distinction prevents co-mingling of funds and maintains clear records, making tax season less stressful. It also adds credibility in the eyes of vendors and lenders, who often expect professional account management before extending credit or favorable terms.S

Staying current on state obligations helps avoid penalties that might jeopardize your LLC’s active status. Georgia requires routine updates to your corporate details, so you stay in compliance, preventing administrative dissolution. Unlike a structure that depends on a general partner, a well-managed LLC encourages transparency and ensures you remain in good standing year after year. Additionally, consistent adherence to state guidelines can help you attract investment and preserve credibility among clients.

LLC costs and processing time in Georgia

Every new venture wants a clear idea of startup expenses and the overall processing time for final approval. While Georgia’s baseline costs are relatively modest, you might pay additional fees if you request faster service. Understanding the total Georgia LLC cost ensures you can budget effectively from the outset. Learn how long does llc filing take in ga to better plan your business launch timeline.

How much does it cost to start an LLC in Georgia?

Starting an LLC in Georgia generally involves paying a basic filing fee, which is set by state agencies. Should you request rush-handling, the total might be more than the usual rate to cover expedited processing. If you choose a commercial registered agent service, that adds to your budget. Meanwhile, forming a foreign LLC to operate in Georgia requires an additional registration procedure that increases costs slightly. Some entrepreneurs also pay for professional help drafting documents or creating an internal agreement, though these items remain optional.

- Base state fee for initial filing

- Possible expedite costs labeled expedited for additional fees

- Professional service charges, if you outsource paperwork

- Ongoing maintenance, such as annual renewals or compliance tasks

How long does it take to form an LLC?

For a standard LLC in Georgia, processing typically ranges from one to two weeks. If you decide to register an LLC in person or by mail, you might experience slower turnaround times. However, online filing often speeds up results, provided you submit everything accurately and pay any required surcharges.

Keep in mind that peak seasons or state holidays can prolong reviews. Although Georgia’s system is relatively efficient, incomplete forms or missing information can result in additional delays. Overall, you can expect the entire registration to finalize within a couple of weeks, especially if you monitor updates regularly and respond promptly to state requests. Enhance your compliance efforts with a reliable registered agent georgia to manage all official correspondence efficiently.or workforce management solutions, explore the start an LLC in Texas to enhance your operational efficiency.

Appoint a Reliable Registered Agent

Stay compliant in Georgia with a professional registered agent. Never miss legal notices or important state documents.

Can you start an LLC in Georgia for free?

Forming an LLC without spending anything is virtually impossible because Georgia imposes a mandatory filing charge. While you might save on professional assistance by handling every step yourself, the state still requires essential fees for official documentation. Even if you skip optional services, you cannot bypass the core registration costs. Keep in mind that free resources exist for tasks like drafting basic documents, but the final paperwork and verification steps always involve at least a minimal payment. Ultimately, an LLC provides legal and financial benefits that offset these upfront expenses in the long run.

Legal and compliance requirements for Georgia LLCs

Georgia enforces various rules to protect both businesses and consumers, so it’s crucial to follow each directive precisely. From mandatory filings to operational guidelines, every LLC must align state protocols or risk penalties. Visit official website of GA to learn more about official requirements, documentation, and ongoing responsibilities at every stage of your venture.

Do you need a business license for your LLC in Georgia?

A statewide permit does not exist in Georgia, but your local authorities may require specific licenses for certain trades. Although no universal license is mandated at the state level, counties or municipalities can set their own regulations. If you operate in a regulated industry, check local guidelines to ensure lawful operation.

For instance, restaurants might face health inspections, while construction firms could need contractor credentials. Researching city or county requirements is essential before finalizing your registration. For naming tips and best practices, explore these LLC Name Examples to align your official records with branding objectives. Ultimately, compliance is easier when you stay informed about each layer of oversight.

Annual report filing and compliance fees

Georgia mandates an annual report so your LLC’s contact details stay up to date. Missing this filing can result in fines or administrative complications. Although the process is straightforward, you must pay attention to deadlines and remit the correct fee each year. Accurate submissions maintain your good standing and help avoid costly penalties.

Key compliance costs include:

- The standard annual report filing fee

- Any county-level licensing charges, if applicable

- Late penalties if you miss deadlines

- Optional expedited processing to handle urgent updates

- Additional surcharges for entities needing specialized permits

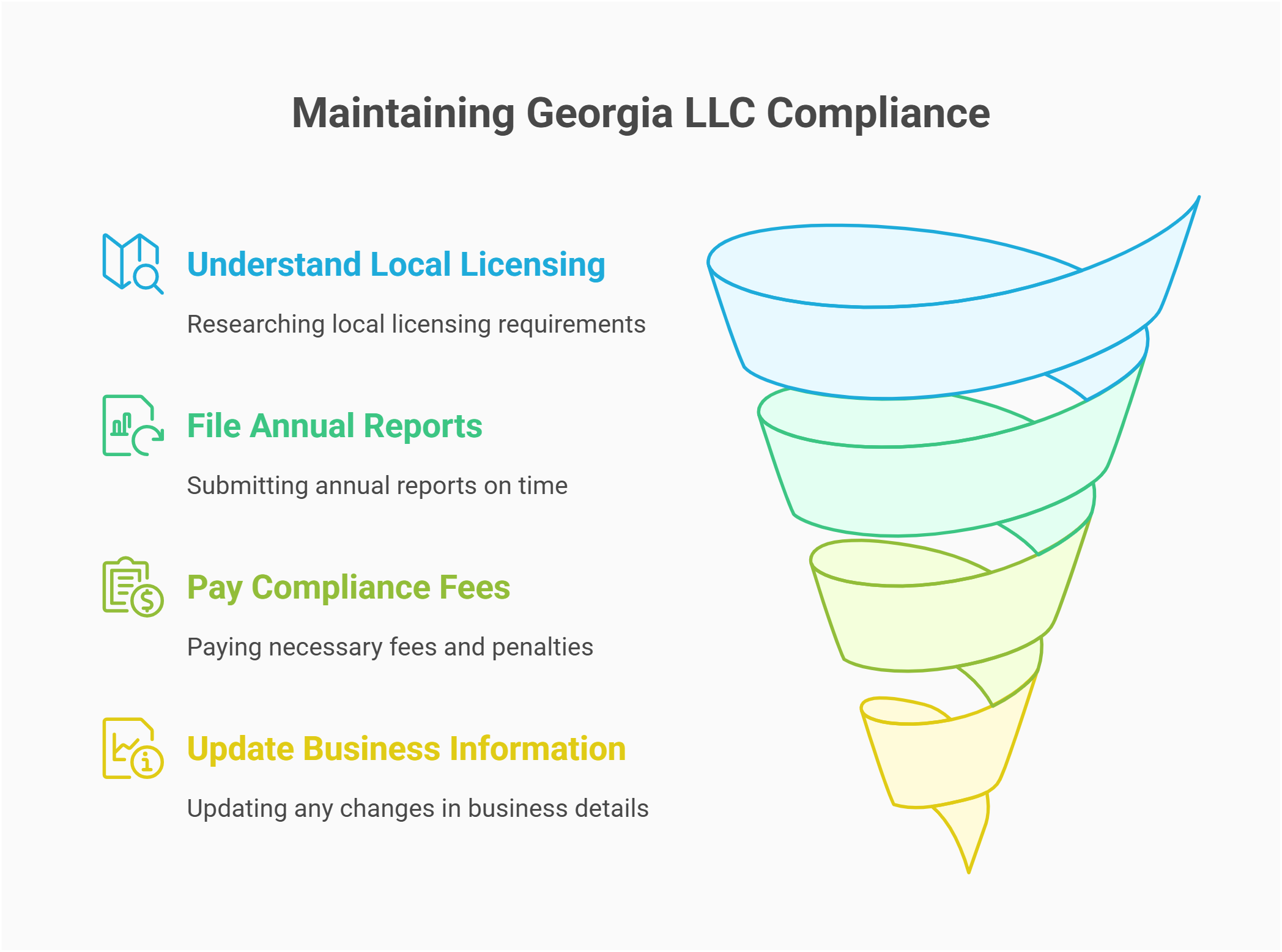

How to keep your Georgia LLC in good standing

Retaining active status means keeping your business name current and promptly addressing any state requests. Mark important dates on your calendar, especially for annual filings or changes in your contact information. Many owners find that quick digital updates are both convenient and reliable, minimizing errors or late submissions.

If you want to streamline the process, you can register an llc online for swift handling of amendments and renewals. Regularly review your internal documentation, including your operating agreement and financial records, to ensure accuracy. By staying organized, you preserve your company’s credibility, avoid costly penalties, and maintain a stable foundation for growth.

Choosing the best state for your LLC

Though Georgia offers clear advantages, you might wonder if another state better suits your situation. Different jurisdictions impose varied regulations, tax structures, and filing costs. Consider the best states to form an llc to find the most advantageous location for your business. Evaluating your target market, expansion plans, and geographic reach will help determine the optimal place to establish your LLC.

Is Georgia a good state to form an LLC?

Many find Georgia appealing for its balanced approach to taxes and business regulations. In comparison to states with heavier levies, Georgia provides cost-effective compliance steps that keep overhead low. The state government also fosters a pro-business climate, encouraging startups to develop roots and scales with minimal red tape.

Nonetheless, businesses needing a high level of privacy or specialized legal frameworks might lean toward places like Delaware or Nevada. Local requirements in Georgia remain fairly straightforward, yet each entity’s goals differ. If your focus is on local markets or Southeastern expansion, establishing here could yield time and cost savings that set your LLC on a path to longevity.

Benefits of forming an LLC in Georgia

Choosing Georgia for your LLC can lead to significant perks, both financially and operationally. The state’s moderate tax environment allows many owners to retain more profits, while direct access to major highways and ports simplifies logistics. Discover more about llc georgia and how it can benefit your business operations.

Entrepreneurs often appreciate the wide array of incentives, such as workforce development programs, which foster growth and innovation. Additionally, local support networks help new businesses navigate compliance, marketing, and mentorship. Balancing a robust economy with relatively low living expenses, Georgia stands out as a prime destination for those seeking stability and opportunity.

Key advantages include:

- Manageable filing procedures and fees

- Diverse industries and broad customer base

- Reputable environment for attracting partnerships or funding

- Strong infrastructure that eases day-to-day operations

When should you consider forming a LLC in another state?

Sometimes, forming your business entity in a region beyond Georgia makes sense, particularly if you serve a national or international customer base. High-growth enterprises seeking specialized legal protections or privacy laws might gravitate toward jurisdictions like Delaware. The chosen location can affect banking relationships, investment prospects, and overall compliance. Explore can you start a business without an llc to understand the potential risks involved.

Additionally, if you anticipate significantly lower tax rates or unique incentives in another state, it could be worth investigating. Keep in mind, however, that operating across borders often triggers multiple registration requirements, meaning you may end up paying fees in more than one place. Evaluating all factors ensures your LLC thrives, regardless of where you ultimately file.

FAQs – common questions about starting an LLC in Georgia

Below are concise answers to frequent queries that arise when planning an LLC in the Peach State. By clarifying these points, you can smooth out any uncertainties and launch your venture with added confidence.

To officially register an LLC, you’ll typically file articles of organization and complete a transmittal form with the Georgia Secretary of State. These documents outline fundamental details such as your LLC’s name, business purpose, and registered agent. Expect to submit a filing fee alongside these materials.

Most businesses also create an internal operating agreement to define ownership and governance. While it’s not an official requirement, having a written agreement can prevent misunderstandings among members. Depending on your niche or location, certain licenses or permits might be necessary before you can open your doors to customers.

You absolutely can. Georgia’s official website allows you to set up an LLC through digital forms and secure payment portals. This convenience saves you time otherwise spent on mailing physical documents or visiting state offices in person. Many applicants find that online submission accelerates approval, especially if all details are accurate and fees are promptly covered. Nonetheless, keep an eye out for any extra charges associated with faster processing. The straightforward interface makes it easy to upload necessary paperwork, ensuring a smooth experience from start to finish.

Once the state confirms your registration, you’ll receive a certificate or notice verifying your LLC’s existence. At that point, you can open a dedicated bank account, apply for any industry-specific licenses, and secure your Employer Identification Number if you haven’t already. It’s also wise to finalize your operating agreement and store all official documents in a safe place. With your LLC recognized by Georgia, you can legally conduct business, hire employees, and begin establishing a brand presence within your chosen market.

It depends on your industry, overhead costs, and projected timeline for profitability. Some entrepreneurs only need a few hundred dollars to cover filing fees and basic setup, while others require significant capital to invest in equipment or staffing. Always outline a realistic budget to sustain operations for at least several months, ensuring you’re prepared for any initial hurdles.

Even if your LLC remains unprofitable, you must still meet reporting obligations and renew any required licenses. Georgia usually requires you to keep the entity active unless you choose to dissolve it formally. Failing to file mandatory paperwork could lead to administrative dissolution, complicating matters if you want to relaunch in the future. While a lack of revenue might influence your tax return, maintaining compliance ensures you retain the flexibility to pivot or resume operations when conditions improve.

Looking for an overview? See Georgia LLC Services

Simplify Your LLC Formation

Avoid paperwork headaches—let trusted experts handle your Georgia LLC setup while you focus on growing your business.