Thinking about forming an LLC in New York? Wondering how much more you’ll pay compared to other states? Curious if the publication requirement is really worth the cost—or if you can avoid it altogether?

The total cost to form an LLC in New York starts at $200 for the Articles of Organization, but the mandatory newspaper publication can add $300 to over $1,500, depending on your county. You’ll also pay a $50 Certificate of Publication filing fee and may spend $100–$300 annually for a registered agent if you hire one. Altogether, most entrepreneurs pay between $550 and $2,000+ in their first year, with lower ongoing costs like a $9 biennial statement every two years.

In this article, you’ll learn:

- A full breakdown of required and optional LLC fees in New York

- How to minimize publication costs without breaking compliance

- What your ongoing LLC expenses will be after formation

- How New York stacks up against other business-friendly states

Ready to launch your LLC with confidence? Let’s dive into what makes New York’s LLC structure unique—and how to manage its costs wisely.

| Cost Category | Fee in 2025 | Key Details |

|---|---|---|

| Articles of Organization | $200 (one-time) | Mandatory filing fee to form your LLC with the New York Department of State |

| Name Reservation (Optional) | $20 | Secures your chosen business name for up to 60 days |

| Registered Agent | $0–$300/year | You or a registered agent service must have a NY address |

| Publication Requirement | $300–$1,500+ | Notice must be published in two newspapers, plus $50 Certificate of Publication filing |

| Biennial Statement | $9 every 2 years | Keeps LLC in New York updated with state records |

| Local Business License | Varies ($50–$400+) | Cost depends on city/county regulations for your New York business |

| Other Add-Ons (DBA, Good Standing) | $25+ each | Sole proprietorship conversions, additional documents, or optional registrations |

How Much Does It Cost to Start an LLC in New York?

Forming a llc in new york can be more expensive than in many other parts of the United States. If you're unsure about the exact steps, this complete guide on how to launch an llc in New York will walk you through the entire process from start to finish. New York has a mandatory publication requirement that often inflates costs significantly, especially in major metropolitan areas. However, your basic expenses will begin with filing fees, potential name reservation, and—if you want privacy—a paid registered agent. By knowing each upfront charge, you can plan and avoid surprises down the line.

Articles of Organization Filing Fee ($200)

When creating your LLC, the first official step is filing the articles of organization with the New York Department of State. In 2025, this requires a $200 payment. You’ll submit basic details about your company, including its address and the name of your registered agent. Once processed, the state will send back a stamped copy confirming your LLC’s formation date. Make sure to review your documents carefully before filing to reduce the likelihood of errors or delays. The online platform allows faster processing, typically within a few days, while mail-in filings may take longer.

Registered Agent Fee (Free or Paid)

By law, each LLC in New York must have an agent on record to receive legal and state documents. You can act as your own agent if you have a physical address in the state, or hire a registered agent service for greater convenience and privacy. Costs range from $0 (self-service) to around $300 per year, depending on the provider. Many business owners opt for a paid agent to avoid listing personal addresses on public records. This also ensures availability during business hours, vital for time-sensitive legal notifications. For those unfamiliar with the concept, here’s a clear explanation of what registered agent services actually include and why they matter.

Optional: Name Reservation Fee ($20)

If you want to lock in a desired business name before filing your Articles of Organization, you may do so for $20. This reserves the name with the New York Department of State for 60 days. It’s a strategic move if you need extra time—perhaps to finalize partnership agreements or secure a domain name—but it’s not mandatory. Most entrepreneurs skip this step and file the Articles of Organization once they’re certain about their chosen name, saving both time and money.

Estimated Total Formation Cost (Excluding Publication)

While the publication requirement is a separate step, your initial cost to form an LLC typically lands between $200 and $500, depending on whether you hire a paid registered agent or reserve a name. This figure covers the Articles of Organization fee plus optional or administrative extras. If you choose do-it-yourself methods and act as your own agent, you can keep that number closer to $200. Once the state approves your filing, your LLC officially exists—though you’ll still need to tackle publication if you aim for full legal compliance in New York.dministrative load. Choosing the best llc service in Arizona can also ensure smoother compliance and faster setup.

Form your New York LLC for $0 + state fees

ZenBusiness makes LLC formation simple and affordable—even with New York’s complex requirements.

Publication Requirement: A Unique and Costly Step in New York

Unlike most states, New York mandates that newly formed LLCs publish a notice in two local newspapers for six consecutive weeks. The price varies dramatically depending on your county. After publishing, you must submit proof, along with a $50 fee, to finalize your certificate of publication. This requirement can significantly increase your startup expenses, especially if you’re located in high-cost regions like Manhattan or Brooklyn.

Where and How to Publish Your LLC Notice

After your LLC is formed, the york department of state designates the county where you must publish your notice. You’ll need to contact two newspapers in that county—one daily, one weekly—and run the notice for six weeks in each. The notice includes details such as your LLC’s name, formation date, and registered agent address. Once publication is complete, the newspapers will provide affidavits confirming the run dates. You’ll then compile these affidavits and file them, along with a $50 fee, to obtain the Certificate of Publication. Although time-consuming, it’s a necessary step to keep your LLC in good standing.

Average Newspaper Costs by County (NYC vs Upstate)

Your filing time and expense often hinge on your chosen or assigned county. In major metropolitan areas, like New York City, a single newspaper notice can surpass $600. By contrast, upstate counties often have lower circulation fees, sometimes well under $300 for both newspapers combined. If you haven’t yet formed your LLC, you might consider establishing it in an upstate address (such as Albany) to reduce your total publication bill. However, ensure you still meet all legal requirements, including having a valid address for service of process.

Filing the Certificate of Publication ($50)

Once your newspapers have printed the announcement for six consecutive weeks, you’ll submit a formal document called the Certificate of Publication. This process costs $50 and can be completed online or by mail. In this form, you’ll confirm that you’ve met the forming an llc publication requirements and include both newspaper affidavits. Keep duplicates of every document in your records. Failure to file the certificate promptly can jeopardize your LLC’s compliance status, leading to potential fines or legal complications. You can always verify your entity’s status using the official NY llc lookup tool to ensure it’s active and compliant.

Total Cost of the Publication Step ($300–$1,500+)

Fees vary widely depending on your LLC’s location and the newspapers you choose. Here’s what you can expect in March 2025:

- Rural Counties ($300–$500): Typically more affordable due to lower circulation costs.

- Suburban Counties ($500–$900): Mid-range pricing, but still can be lower than NYC.

- NYC Boroughs ($900–$1,500+): Highest rates, especially in Manhattan.

- $50 State Filing: Required to finalize the Certificate of Publication.

The total expense may top $1,500 if you’re in an expensive metro area. To keep costs down, some entrepreneurs use an upstate address for registration, though you must still comply with local laws regarding a genuine business presence.

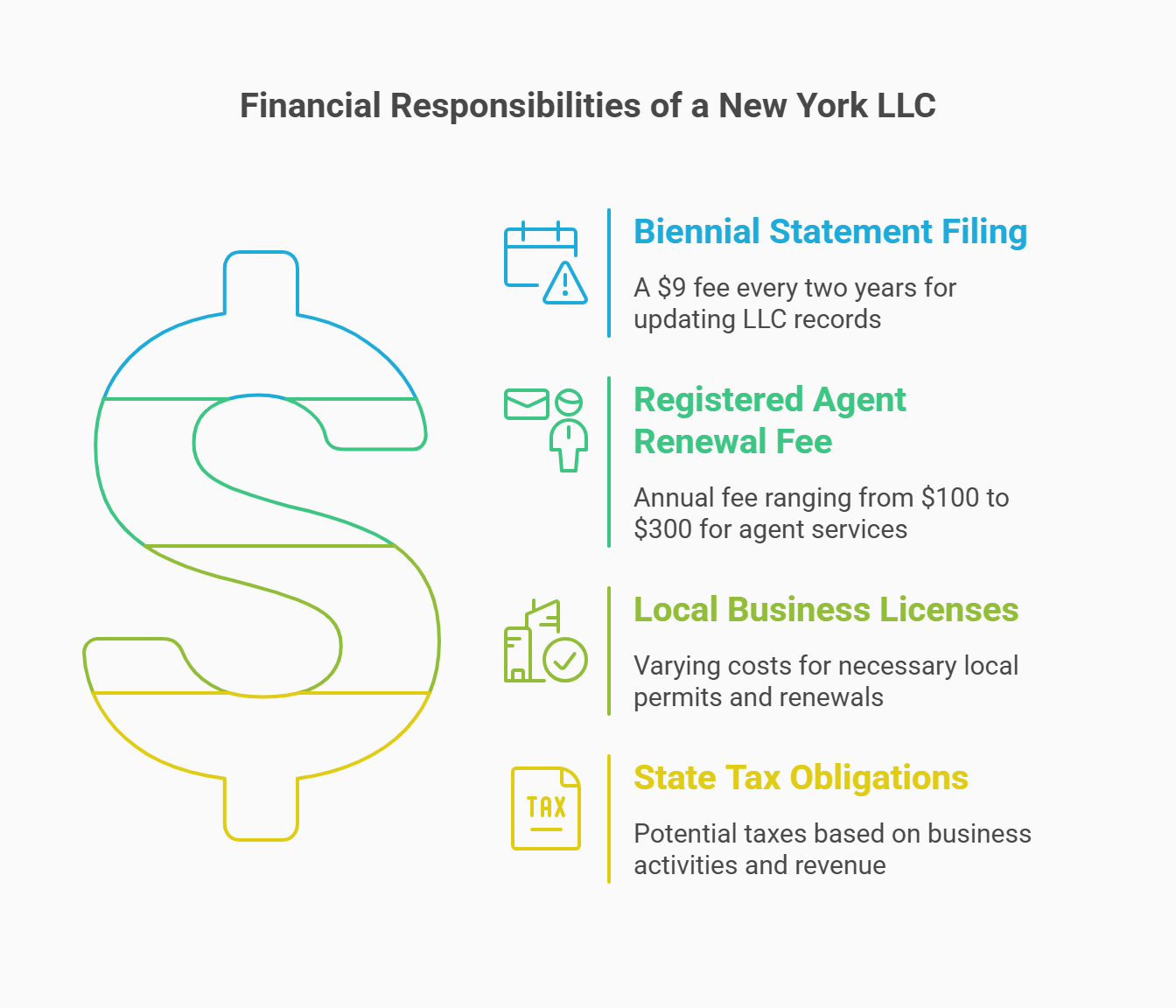

Ongoing Costs to Maintain a New York LLC

After your LLC is set up, you’ll have regular expenses to ensure it remains active and compliant. Some fees recur every two years, while others may depend on your industry or specific tax obligations. Staying on top of these mandatory filings is crucial to maintain an llc in good standing and avoid penalties.

Biennial Statement Filing ($9 Every 2 Years)

Every two years, you must file a biennial statement to update the state on your LLC’s address and any management changes. The fee remains $9 as of 2025, payable through the New York Department of State website. Although the sum is small, missing this filing can result in overdue penalties and potential dissolution of your LLC. Set a reminder or calendar alert to ensure you meet the deadline. Prompt submission keeps your LLC’s public records accurate and reaffirms your right to do business in the state.

Registered Agent Annual Renewal Fee (If Applicable)

If you hired a registered agent instead of acting as your own, you’ll likely face an annual renewal fee. This cost usually ranges from $100 to $300 a year, depending on the provider. Renewals ensure the agent continues to receive official mail and notify you of any legal or compliance documents. If you decide to change or discontinue the service, you must formally update your LLC’s records with the state. Failure to maintain a valid agent can jeopardize your LLC’s standing, leading to possible administrative dissolution.

Local Business Licenses and Renewals

Depending on your industry and location, you may need a business license or permit to operate. Costs vary greatly—some small towns charge a minimal fee of $50, while larger cities may require $400 or more. These licenses often expire annually and need renewal to stay valid. If you have multiple lines of business, you might need multiple permits. Research local ordinances in your city or county to confirm which documents are mandatory. Renewing on time prevents fines and ensures your LLC continues operating without interruption.

Additional State Tax Obligations (If Applicable)

While there’s no general statewide LLC tax, new york state imposes taxes in certain scenarios. If your LLC sells goods or employs staff, you may owe sales or withholding taxes. Businesses with higher revenue might also face additional corporate or partnership tax obligations. Industry-specific taxes, such as for restaurants or certain professional services, can apply as well. Always consult the Department of Taxation and Finance to see if you must file specialized returns. Failing to pay any required taxes could lead to fines, liens, or other penalties.

Additional and Hidden LLC Costs in New York

Establishing an LLC often involves a few extra steps beyond the core filings, especially if you need optional documents or want certain protections in place. These potential additional costs can sneak up on new business owners who aren’t aware of the full scope of legal and administrative requirements.

DBA (Fictitious Name) Registration ($25)

Some LLCs prefer to operate under a different title than their official name. This practice, akin to a sole proprietorship using a trade name, requires registering a “doing business as” (DBA) in New York. The fee is typically $25, though costs can climb if you must publish a notice in certain counties. For brand or marketing reasons, a DBA can be invaluable, but ensure you track any local regulations. Operating under an unregistered DBA risks confusion and legal complications if another business claims your chosen name.

Certificate of Good Standing ($25)

A business entity often needs to prove it’s active and compliant to banks, lenders, or potential partners. You can request a Certificate of Good Standing (also called a Certificate of Existence) from the Department of State for $25. This document verifies that your LLC has met its filing obligations and remains in good standing. It’s not required for routine operations but is frequently necessary when applying for large loans, entering certain contracts, or planning expansions beyond state lines.

EIN Application (Free via IRS or Paid Services)

Any LLC generating revenue needs an Employer Identification Number for federal tax reporting, payroll, and opening accounts. You can apply online at no cost through the internal revenue website (IRS.gov). Some third-party services charge $50–$100 for this simple step. Unless you want premium consultation about tax classifications, most entrepreneurs handle the EIN application themselves in under 15 minutes. Keep in mind, you’ll need an EIN before applying for certain business bank accounts or credit lines.

Operating Agreement Preparation (Free Templates vs Attorney Fees)

Every New York LLC is expected to have an operating agreement, though it doesn’t need to be filed with the state. This legal document outlines ownership shares, voting rights, distribution of profits, and more. You can draft a basic version using free online templates, but more complex businesses often seek an attorney’s help. Legal fees can range from $200 to $1,000 or higher, depending on the scope of your agreement. While not mandatory for state compliance, a thorough operating agreement can prevent costly disputes among members later on. To better understand how these expenses vary, here’s a helpful guide on typical attorney fees for LLC formation and support.

Year-by-Year Cost Summary: First Year vs After

Understanding the full financial picture can help you plan effectively. Costs during the initial formation and publication phase often dwarf maintenance expenses in subsequent years. Still, ongoing fees like the biennial statement or registered agent renewals can add up if overlooked, especially for a foreign llc doing business in multiple jurisdictions.

Total Cost to Form and Publish in Year 1

In your first year, you’ll face several charges beyond the baseline Articles of Organization. As of March 2025, the following typically applies:

- $200 Articles of Organization: Core requirement to establish your LLC

- $300–$1,500 Publication Fees: Dependent on your county’s newspaper rates

- $50 Certificate of Publication: Finalizes the publishing process

- $0–$300 Registered Agent (Optional): If you choose a paid service

- $20 Name Reservation (Optional): Secure your desired LLC name in advance

Altogether, your filing fee outlay may range from around $550 on the low end (upstate, minimal add-ons) to well above $2,000 if you’re in New York City and select premium services. Budget carefully to avoid unexpected shortfalls. To better plan ahead, it’s worth reviewing a detailed breakdown of the average cost for llc across different states and business types.

Annual Maintenance Cost from Year 2 Onward

Once your LLC is set up, your recurring costs usually drop:

- $9 Biennial Statement: Due every two years

- $100–$300 Registered Agent Renewal: Only if you continue using a paid service

- Local License Renewals: Ranging from $50 to $400+, depending on city regulations

- Industry-Specific or annual report Filings: Potential extra fees for certain businesses

Most LLC owners can expect annual upkeep of $100–$400 or more, primarily if you outsource agent duties. Industries with specialized licenses or high revenue streams may pay additional state taxes, so confirm any sector-specific mandates early. If you're curious how this compares nationally, check out this breakdown of llc annual fees by state to put New York's costs in perspective.

Which Costs Are Required vs Optional

New York has some mandatory fees, but others depend on your preferences or business model. Below are the core distinctions:

- Required: Articles of Organization ($200), Publication ($300–$1,500+), $9 Biennial Statement

- Typically Required: Local business licenses, if you operate in a regulated field

- Optional: Name reservation ($20), registered agent service ($0–$300), DBA registration ($25)

- Sometimes Necessary: Attorney-drafted operating agreement, Certificate of Good Standing for loans or expansions

Determine how long you plan to operate in New York and how much personal privacy matters. That analysis will guide which optional services or documents you truly need.

Step-by-Step: How to Form a New York LLC Without Overspending

Even with higher fees and publication requirements, there are strategies to keep your out-of-pocket expenses in check. By performing some steps independently and choosing your county carefully, you can start an llc in New York while minimizing unnecessary add-ons or rushed services. If you're just beginning, you can also consult this step-by-step overview of how to start an llc to avoid missing critical steps.

Submit your LLC filing online through the New York Department of State website for $200. This is the fastest method and provides immediate digital copies of your approved documents for banking and permits.

Save $100–$300 annually by acting as your own agent. Requires a permanent New York address and regular business hours, but keeps you directly informed of all compliance deadlines and legal documents.

Form your LLC in an upstate county with cheaper newspaper rates if possible. Shop around for quotes from assigned publications to minimize printing fees and potentially save hundreds on your franchise tax obligations.

Get your Employer Identification Number at no cost directly from IRS.gov. Essential for opening a bank account and hiring employees. Receive approval immediately without paying third-party service fees.

Use free online templates to create the legally required operating agreement for your limited liability company. Cover ownership interests, voting rights, and dissolution protocols without additional legal costs.

Step 1: File Articles of Organization Online

Submitting an llc filing online is the fastest and most affordable way to form your LLC. You’ll create an account on the New York Department of State website, fill out essential details about your company, and pay the $200 fee via credit card. If you're wondering about processing time, this guide on online llc formation explains how long approval typically takes and what to expect. If everything is correct, approval often comes through in a matter of days. Download and store your stamped Articles of Organization immediately for your records, as you’ll need them for other tasks like opening a bank account or applying for any local permits.

Step 2: Act as Your Own Registered Agent (Pros & Cons)

Choosing a limited liability company to handle its own agent duties can save $100–$300 annually. However, consider the following:

- Pros:

- Zero external fees

- Immediate access to legal documents

- Keeps you directly informed of compliance deadlines

- Cons:

- You must have a permanent New York address and maintain regular business hours

- Personal details become part of the public record

- Missing deliveries could lead to default judgments or fines

If privacy or consistent office coverage is a concern, hiring a paid agent is prudent. Otherwise, many small businesses handle the role themselves to cut costs. You can also explore whether you truly need a registered agent NY depending on your business model and location.

Step 3: Use Strategic Newspapers to Lower Publication Costs

You may owe franchise tax in certain states, but in New York, your bigger worry is publication pricing. If possible, form your LLC in an upstate county with cheaper newspaper rates. While you still need a legitimate address in that county, some entrepreneurs rent affordable coworking spaces or virtual offices. After confirming your assigned newspapers, shop around for quotes—rates can vary even within the same region. By picking less expensive publications, you could save hundreds of dollars in total printing fees.

Step 4: Apply for an EIN for Free via IRS

Before you open a bank account or hire employees, apply for an Employer Identification Number. You can do this at IRS.gov at no charge. The form asks for basic details about your LLC, and you’ll typically receive approval immediately. Third-party companies may offer this service for a fee, but it’s rarely necessary unless you need specialized tax guidance. Having your EIN in hand streamlines payroll setup, tax filing, and business credit applications down the road.

Step 5: Draft an Operating Agreement Using Free Templates

New York law requires an llc formation to have an operating agreement, though it doesn’t need filing with the state. Simple single-member LLCs often opt for free online templates. If your structure is more complex—with multiple members, unique profit-sharing, or real estate holdings—consider a brief legal consultation. Nonetheless, a basic agreement covering ownership interests, voting rights, and dissolution protocols can protect you from internal disputes, even at no extra cost.

How New York LLC Costs Compare to Other States

Entrepreneurs often evaluate whether forming an LLC in the Empire State is worth the unique publication requirement and city-level fees. By exploring how New York stacks up against other prominent markets, you’ll gain a sense of whether the extra complexity pays off in the united states’ business landscape. Some entrepreneurs prefer to explore options and compare what might be the best state for LLC formation depending on cost, privacy, and legal advantages.

New York vs Delaware: Privacy vs Publishing

Delaware is renowned for corporate-friendly courts, but it doesn’t force LLCs to publish formation notices. New York, by contrast, mandates the newspaper announcement, which can be expensive. Still, if you work in real estate or plan to run a local storefront in Manhattan, you might prefer the advantages of claiming an NY address:

- Delaware:

- No publication requirement

- Lower annual fees

- New York:

- Higher startup costs

- Strong local consumer base and business ecosystem

If anonymity is paramount, Delaware’s minimal disclosure can be appealing. For those whose clients, partners, or assets are in New York, the publication step may be an unavoidable expense.

New York vs California: Fees, Taxes, and Ongoing Requirements

California charges a franchise tax starting at $800 annually, which can outweigh New York’s publication fees over multiple years. Meanwhile, New York’s gross income thresholds for certain taxes may kick in sooner if you operate at a large scale:

- California:

- $800 minimum franchise tax each year

- Streamlined formation without mandatory newspaper ads

- New York:

- One-time publication costs

- Lower LLC fees afterward, but potential local licenses

High-growth startups in either state must consider local tax obligations and licensing. The bottom line often depends on whether you’ll pay more in annual taxes or prefer a single, upfront publication charge.

New York vs Florida: Simplicity and Startup Cost

Florida generally offers a more laid-back approach with fewer mandatory steps. Its income tax policies for LLCs are also more straightforward for most small enterprises:

- Florida:

- No publication requirement

- Low filing fees

- New York:

- Publication mandated within 120 days

- Could lead to over $1,500 in newspaper expenses

For budget-conscious owners seeking rapid market entry, Florida is often simpler. But if your target audience or property holdings are in New York, forming your LLC there can be more strategic despite the elevated cost.

Is the New York LLC Structure Worth the Price?

For certain sectors—like tech startups or those with ties to new jersey and beyond—New York can offer unbeatable networking and access to a massive consumer market. The added cost of publication may pay off if your brand thrives on a local presence or relies on the city’s business climate. However, if your operation is largely remote or purely online, you may question whether the higher fees justify forming in the Empire State. Evaluate both immediate overhead and long-term growth potential to determine if it’s truly the right fit. You can also compare the best llc services in New York to simplify the setup and ensure compliance from day one.

Protect your privacy while forming your New York LLC

Northwest offers registered agent services and personalized guidance to help you stay compliant from day one.

Benefits of a New York LLC Despite the Higher Cost

Despite the extra financial hurdles, a New York LLC can still be highly advantageous. The state is a global hub for finance, fashion, media, and technology, and offers a stable judicial environment for commercial disputes. Here are several reasons why working with the secretary of state in New York might be worthwhile:

- Prestige and Recognition: Operating in a world-famous market can enhance your brand credibility.

- Access to Capital: Home to numerous venture capital firms and financial institutions.

- Local Customer Base: Large, diverse population with significant purchasing power.

- Strong Legal Protections: Courts experienced with commercial cases, lending clarity to contract enforcement.

- Networking Opportunities: Frequent conferences, trade shows, and business events attract international participants.

Entrepreneurs in industries like finance, hospitality, and tech often find these advantages outweigh the initial publication fees and administrative tasks. Even if the overall expense is higher than in other states, the exposure and potential revenue from New York’s robust economy can offset the difference. Additionally, stable consumer demand means you can scale more confidently without constantly relocating your headquarters or dealing with uncertain regulations.

Unique Insight: When NOT to Choose a New York LLC

A New York LLC provides many advantages, but that doesn’t mean it’s the best choice for every venture. If you operate purely online or have no plans for a physical presence, the additional requirements can feel burdensome and unnecessary. Likewise, the publication mandate can strain a tight budget. Understanding new york drawbacks ensures you form your business in the right location from the start.

If You Don’t Operate Physically in New York

If your company has no local address, workforce, or in-person sales, you might form an llc in a different jurisdiction. New York’s fees and publication rules can become a needless headache if you never utilize the local infrastructure. Online-only or fully remote ventures often pick states like Wyoming or Delaware for simpler processes, unless their primary customer base is firmly rooted in New York. Others go even further to reduce costs by choosing options like Arizona, known for having one of the cheapest llc formation processes in the country.

If You Want to Avoid Publication and Local Filing

Other states don’t impose newspaper notices for LLCs. If you strongly dislike the idea of printing your formation details or paying hundreds for publication, choosing a jurisdiction without such mandates is easier and cheaper. Many entrepreneurs skip New York to dodge the printing expense altogether, though you still need to register as a foreign LLC if you later conduct real operations in the Empire State.

If You’re Launching a Budget-Driven or Online-Only Business

A tight budget can be eaten up quickly by publishing fees, especially in NYC counties. Online entrepreneurs with minimal overhead might prefer a state with lower administrative barriers. While local marketing advantages exist, they’re less critical if your core revenue streams are national or international. In 2025’s digital climate, building a brand online can overshadow physical location, making less costly states a more appealing choice.

FAQ: New York LLC Formation and Maintenance Fees

Navigating the costs of starting and running an LLC in New York can feel overwhelming. Below are concise answers to the most frequent questions asked by entrepreneurs.o-date responses. Each explanation aims to give you the clarity needed for a successful LLC launch.

Expect $200 for the Articles of Organization and $300–$1,500+ for publication, depending on your county. Add a $50 certificate of publication fee after your notices run for six weeks. If you opt for a paid registered agent, budget an extra $100–$300. In total, first-year expenses typically land anywhere from $550 in lower-cost counties to over $2,000 in New York City.

The biggest surprise is often the newspaper publication requirement, which can exceed $1,500 in certain boroughs. Some industries also require specialized local permits or professional licenses, adding $50–$400+ to your expenses. If you miss deadlines for filings like the biennial statement, late fees and penalty charges can accumulate quickly. Careful planning and research help you avoid nasty financial shocks.

Not entirely. New York law mandates publication for all LLCs formed in the state. You can potentially reduce the cost by forming the LLC in an upstate county where newspaper fees are lower. However, you must have a legitimate address and operation in that county. Skipping publication can result in your LLC losing its authority to do business in New York, which can cause legal and financial complications.

New York’s formation fees are moderate, but the required publication step makes it pricier than most states. By contrast, Delaware doesn’t require newspaper notices, and Florida or Wyoming may have simpler or cheaper filings. California has a higher annual tax but no publication rule. Your final decision should weigh the immediate publication expense against potential legal, branding, or networking benefits in New York.

You can form your LLC in an upstate county with cheaper newspaper rates, but you need a valid local address. Some entrepreneurs use an office or coworking space outside New York City to cut publication expenses by hundreds of dollars. Keep in mind that misrepresenting your location can raise compliance issues down the road. Always ensure your registered address genuinely fits your business operations.

Failing to publish and file proof within 120 days puts your LLC at risk of suspension or losing its authority to conduct business in the state. That can jeopardize contracts, loans, and legal protections. Moreover, you can incur penalties and have difficulty reinstating your LLC later. Publication is mandatory to remain in good standing under New York law.

Looking for an overview? See New York LLC Services

Tackle New York’s LLC rules with expert support

Harbor Compliance handles formation, publication, and compliance—ideal for entrepreneurs who want zero guesswork.