Starting a nonprofit requires careful planning, legal registration, and financial management to ensure long-term success. Unlike for-profit businesses, nonprofits focus on serving a mission rather than generating profits, relying on grants, donations, and fundraising to operate.

To start a nonprofit, you must define your mission, register your organization, apply for tax-exempt status, and establish a governance structure. Proper documentation and financial planning are essential to maintaining compliance and securing funding.

In this guide, we’ll cover:

- Key differences between nonprofit and for-profit organizations.

- The step-by-step process for registering and structuring a nonprofit.

- How to secure tax-exempt status and explore funding options.

Let’s dive into the nonprofit formation process and how to set up a legally compliant, mission-driven organization.

Understanding the Nonprofit Landscape

Understanding the landscape of nonprofit organizations and their unique role in providing public benefit is essential. Unlike typical profit organizations, nonprofits focus on community impact rather than shareholder returns. These insights are essential for starting a nonprofit that creates lasting impact. This guide helps you navigate key differences, operational challenges, and opportunities to drive positive change in your community.

Nonprofit vs. For-Profit: Key Differences

Comparing nonprofits with for-profit entities reveals distinct operational, regulatory, and financial frameworks. For further insight into how different legal structures operate, explore our review of florida pllc vs llc, which highlights key distinctions in governance and compliance. Nonprofits, by nature, prioritize mission over money. For instance, while commercial enterprises concentrate on profit maximization, nonprofits adhere to values that support community enrichment. Understanding how to start a non profit involves recognizing these differences—from funding sources to accountability measures. This comparison underscores the importance of transparency and reinvestment in community projects. Unlike profit corporations, nonprofits reinvest surplus funds into their mission. The table below, updated for 2025, highlights key distinctions:

| Aspect | Nonprofit | For-Profit |

|---|---|---|

| Purpose | Mission-driven, community-focused | Profit-driven, market-oriented |

| Revenue | Donations, grants, fundraising | Sales, investments |

| Tax Benefits | Eligible for tax exemptions | Taxed as standard businesses |

| Governance | Volunteer board and strict oversight | Executives and shareholders |

| Regulation | Rigorous reporting and compliance | Standard business regulations |

Common Types of Nonprofit Organizations

Nonprofits come in various forms, each designed to serve distinct community needs. It’s important to understand the types of nonprofit available, learn how to create a nonprofit effectively, and meet nonprofit organization requirements. Consider factors such as mission focus, scope, and operational model. Common types include:

- Educational institutions

- Healthcare and social services

- Arts and cultural organizations

- Environmental advocacy groups

- Community foundations

Defining Your Mission and Goals

Clearly defining your mission and goals lays the foundation for lasting impact. A compelling mission statement articulates your organization’s core values, while it’s essential to define purpose and set measurable objectives. Reviewing nonprofit mission statement examples can inspire you to craft a vision that resonates. Align your goals with community needs and sustainable practices to guide strategic planning. This clarity not only directs program development but also inspires trust among supporters and beneficiaries.

Planning and Documentation Essentials

Effective planning and thorough documentation are cornerstones of a successful nonprofit. To further ensure robust compliance, consider reading harbor compliance reviews for best practices in maintaining regulatory standards. By utilizing a comprehensive business plan and establishing clear records, you can outline your strategy, goals, and operations. Detailed documents support transparency and ensure compliance with legal requirements. This phase sets the stage for streamlined operations and long-term sustainability.

Creating a Nonprofit Business Plan

Developing a robust business plan is crucial for strategic success. If you're curious about whether you can launch your venture can i start an llc without a business, our detailed guide offers expert insights on getting started without a formal business plan. Begin by write a business plan that outlines your vision, target market, competitive landscape, and financial projections. For added structure, refer to a comprehensive nonprofit business plan template that guides your planning process and reinforces your organizational roadmap.

Organizational Structure and Operational Framework

Establishing a clear organizational structure is essential for efficient operations. Define roles, responsibilities, and reporting lines to ensure your nonprofit is organized and operated exclusively toward its mission. Incorporate a solid nonprofit legal structure to support decision-making and accountability, and implement strict operational policies to streamline processes.

Financial Projections and Sustainability Strategies

Sound financial planning is pivotal for long-term viability. Implement robust nonprofit financial management (F30) practices alongside forward-looking nonprofit sustainability strategies that secure steady funding and resource allocation. Detailed financial projections and strategic planning not only prepare you for uncertainties but also position your organization for resilient growth.

Important Documents and Records to Maintain

Maintaining accurate documentation is critical for transparency and compliance. Key records validate your nonprofit’s legitimacy and ensure you meet required to file standards. Important items include:

- articles of incorporation

- nonprofit corporation

- form 990

- application for recognition

Keeping these records updated reinforces accountability and facilitates smooth operations.

Registration and Tax-Exempt Status

The registration process and obtaining tax-exempt status are critical milestones. Securing legal recognition establishes your credibility and paves the way for financial benefits. For those exploring diverse business structures, our guide on best llc service texas offers valuable insights into efficient entity formation. Navigate the complexities by following proven guidelines for a tax exempt organization and familiarizing yourself with the 501c3 application process. Before proceeding, be sure to establish a nonprofit that meets all criteria.

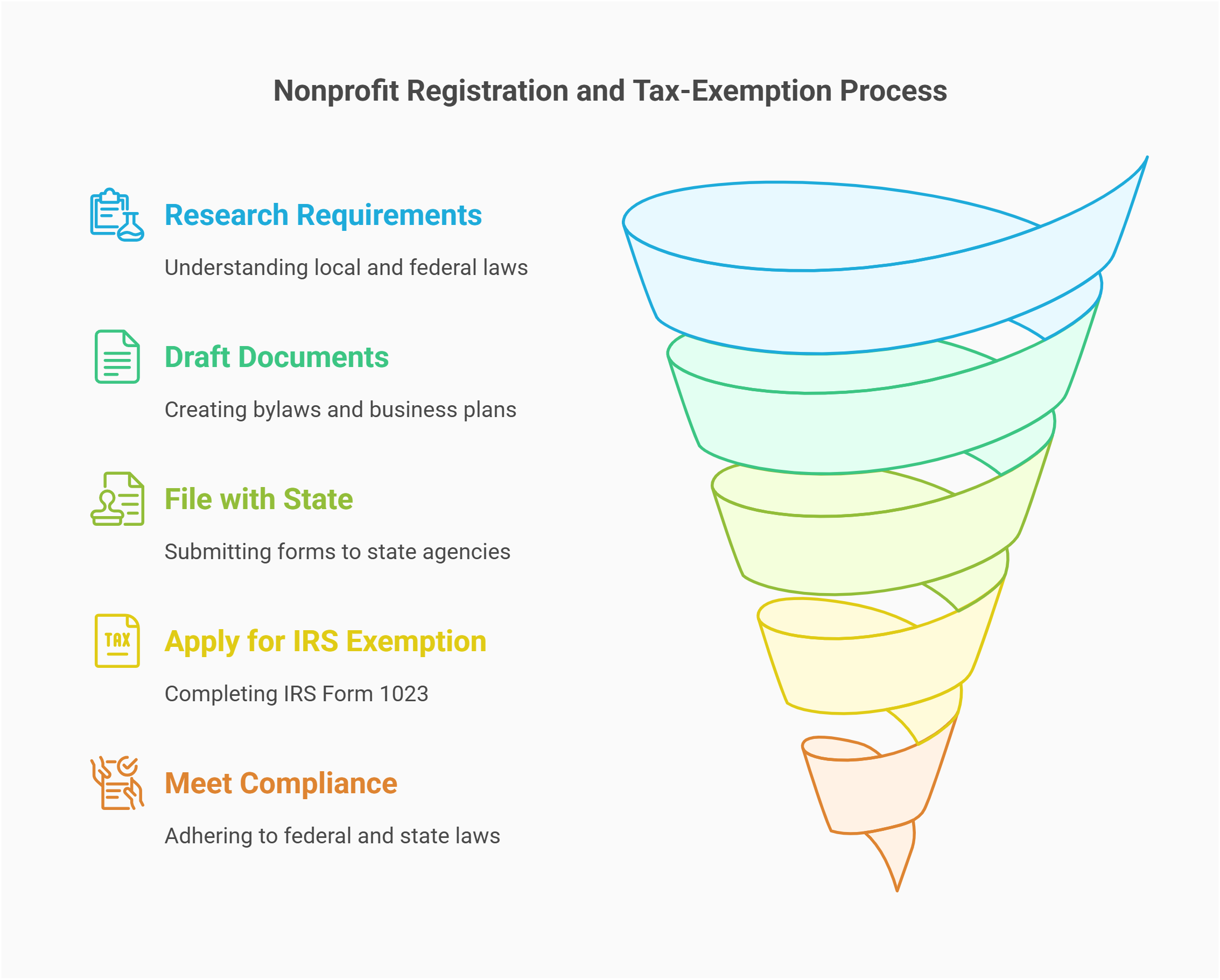

Steps to Legally Register Your Nonprofit

Understanding how to register a nonprofit and navigating the legal steps to start a nonprofit is essential. Before you create a nonprofit organization, gather all necessary documentation and consult a reliable nonprofit startup guide. Additionally, learn how to set up a 501c3 and understand how to incorporate a nonprofit. Consider the following steps to register a nonprofit and ensure you meet all requirements to start a nonprofit:

- Research and understand local requirements to start a nonprofit.

- Write a business plan outlining your mission, structure, and funding strategy.

- Draft bylaws to guide governance and operations.

- File form with the appropriate state agency to form a nonprofit corporation.

- Submit your documents for recognition of exemption to the IRS.

- Await your determination letter confirming eligibility.

- Secure your tax exempt status to benefit from financial incentives.

- Obtain your employer identification for legal and financial operations.

Applying for 501(c)(3) or Alternative Tax Exemptions

Once your nonprofit is legally established, the next step is to secure tax-exempt status. To do so, you must apply for tax exempt status by completing the IRS form 1023 accurately. Consult a reliable nonprofit tax exemption guide to navigate the complex requirements of the internal revenue code. This process also impacts your federal income considerations and strengthens your credibility with donors and regulators, laying a solid foundation for future growth.

Start Your Nonprofit the Right Way

ZenBusiness guides you through the legal registration process, ensuring your nonprofit is structured for success.

Federal vs. State Compliance Requirements

Understanding compliance at both federal and state levels is crucial for sustaining your nonprofit. Federal regulations, such as a detailed nonprofit compliance checklist and adherence to federal tax obligations, differ from state-specific rules. States may require additional documentation and unique reporting standards, including aspects related to irs form compliance. The table below, updated for 2025, offers a clear comparison:

| Compliance Area | Federal Requirements | State Requirements |

|---|---|---|

| Registration | Standard incorporation and IRS filings | Additional state-specific forms |

| Reporting | Annual IRS filings and audits | Extra financial reports may be required |

| Tax Exemptions | Adherence to federal tax laws using IRS form | Specific state tax exemption criteria |

| Oversight | Rigorous compliance and transparency | Local regulatory oversight and periodic reviews |

Governance and Leadership

Strong governance and effective leadership are critical to your nonprofit’s success. Establish a robust framework that meets nonprofit board requirements while ensuring the entity is created a nonprofit organization with a clear vision. Consider also investing in nonprofit leadership development to build a resilient future.

Forming a Board of Directors

A committed board of directors is the backbone of your nonprofit. Carefully select members who bring diverse skills and perspectives to meet nonprofit board requirements and drive accountability. A strong board of directors fosters collaboration, promotes transparency, and enhances overall organizational effectiveness, setting a solid foundation for growth and community impact.

Establishing Bylaws and Governance Policies

Developing clear bylaws and governance policies is essential for operational consistency. Utilize a well-crafted nonprofit bylaws template as a starting point to outline roles, procedures, and decision-making processes. These guidelines serve as a roadmap for internal governance, ensuring compliance and fostering accountability.

Selecting Key Leadership Roles (Executive Director, Treasurer, etc.)

Defining key leadership roles is vital for organizational success and how to make a nonprofit successful. Identify positions that drive strategic initiatives and ensure effective day-to-day operations. Essential roles include:

- Executive Director: Oversees overall strategy and operations.

- Treasurer: Manages finances and budgeting.

- Secretary: Maintains records and ensures compliance.

- Program Manager: Coordinates projects and aligns with nonprofit board member responsibilities.

Each role is integral to sustaining a dynamic leadership team that supports mission delivery and growth.

Balancing Accountability and Strategic Oversight

Striking the right balance between accountability and strategic oversight is key. Adhering to nonprofit governance best practices ensures leadership remains transparent and effective. Regular evaluations, open communication, and defined performance metrics help maintain this equilibrium, allowing your board and leadership to steer the organization confidently toward its goals.

Protect Your Mission with Compliance

Northwest Registered Agent helps you register and maintain compliance for your nonprofit organization.

Funding, Costs, and Financial Management

Understanding funding, costs, and financial management is critical for your nonprofit's sustainability. Establish realistic projections for how much does it cost to start a nonprofit and consider essential budget considerations. Sound financial planning supports operational stability and builds donor trust, laying the groundwork for long-term success.

Estimating Startup and Ongoing Expenses

Accurate cost estimation is essential for launching and maintaining your nonprofit. For a comparative perspective on startup expenses, check out our guide on llc cost, which outlines typical formation fees and ongoing expenses. Factor in the cost to start a nonprofit, including legal fees and setup expenses, and account for filing fees along with recurring annual costs such as audits. A thorough forecast enables informed decision-making and funding security. For entrepreneurs looking to minimize startup costs, our guide on cheapest llc formation provides practical strategies for cost-effective setup.

Exploring Funding Options (Grants, Donations, Fundraising)

Diverse funding options are available to fuel your mission. Learn how to get funding for a nonprofit by exploring grants, donations, and innovative methods. Leverage creative nonprofit fundraising ideas and tap into emerging funding opportunities to diversify revenue streams and support growth.

Managing Budgets and Tracking Financial Performance

Robust financial oversight is vital. Implement streamlined nonprofit financial reporting and adopt effective financial management practices. Regular budget reviews and performance tracking enable proactive adjustments, ensuring optimal resource allocation and long-term stability.

Internal Controls and Fraud Prevention

Implement strong internal controls to safeguard your assets. Utilize advanced nonprofit technology solutions to monitor transactions and prevent fraud. Clear guidelines and regular audits mitigate risks and maintain the integrity of your financial operations.

Daily Operations and Growth

Efficient daily operations are at the heart of effective nonprofit management. Mastering how to run a nonprofit involves leveraging modern tools and innovative approaches. Ensure your online presence adheres to nonprofit website best practices while utilizing nonprofit email marketing to engage supporters. Explore nonprofit digital fundraising and employ compelling nonprofit storytelling techniques to inspire donor confidence. Strategic nonprofit event planning and a robust nonprofit social media strategy further amplify your message. Regular nonprofit program evaluation and monitoring of diverse nonprofit funding sources enable adaptive improvements. Embrace effective nonprofit advocacy strategies and track progress through nonprofit impact reporting. Adopting innovative nonprofit growth strategies ensures continuous development. For sustained outreach, implement nonprofit marketing strategies and consult a nonprofit grant writing guide while regularly assessing nonprofit impact measurement. Enhance community engagement by ensuring effective nonprofit volunteer management and integrating comprehensive nonprofit risk management. Utilize a nonprofit branding guide to maintain identity and review progress with a nonprofit annual report template.

For organizations serving vulnerable populations, regular testing for public safety is crucial. Additionally, collaborate with local charitable organizations and always strive to manage a nonprofit organization in a manner that advances broader social welfare initiatives.

FAQ: Frequently Asked Questions About Starting and Managing a Nonprofit Organization

Below are answers to common questions on starting and managing a nonprofit. This FAQ addresses key concerns for exempt organizations and offers insights to develop programs that drive community impact. Each response is designed to provide clear, actionable guidance.

The basic steps involve careful planning and adherence to legal protocols. Begin by researching how to start a nonprofit to understand the landscape. Learn how to start a nonprofit organization and also consider how to start a not for profit if applicable. Follow clear steps to start a nonprofit outlined in a reliable nonprofit startup guide. Review nonprofit organization requirements and determine what is needed to start a nonprofit using a comprehensive nonprofit formation checklist. Additionally, remember to start a nonprofit and ensure you're starting a nonprofit with a solid foundation.

To apply for tax-exempt status, first understand the timeline to establish a 501c3 as part of your planning. Ensure compliance with nonprofit IRS compliance guidelines by gathering necessary documents. You must secure tax exemption by completing the appropriate irs form and demonstrating adherence to income tax regulations. This process requires careful preparation to meet all federal criteria and secure your organization’s future benefits.

Essential documents for registration include legal and financial records. You must complete the application for recognition and submit evidence that your entity qualifies as a nonprofit organization. If you're exploring various business entity options, review our resource on best llc service in oklahoma for additional guidance. Additionally, prepare detailed financial records showing gross receipts and charitable contributions. A well-developed nonprofit strategic planning document can also support your registration by outlining long-term goals and operational procedures, ensuring compliance and transparency throughout the process.

Nonprofits vary widely, with options including public charity, groups recognized as public charities, and private foundations. You might also consider forming a charitable organization tailored to specific community needs. Additionally, research the best states to start a nonprofit to determine which legal environment suits your mission. The choice depends on your goals, funding strategy, and desired level of control.

Startup and operational costs can vary significantly. Assess your nonprofit financial sustainability by developing a detailed budget and engaging in nonprofit annual budget planning to forecast expenses and revenue. Invest in strategies that boost nonprofit donor retention and enhance nonprofit volunteer recruitment to manage expenses. Additionally, explore cost-effective methods like nonprofit growth hacking to maximize impact while minimizing expenditures.

Effective financial management is key to success. Utilize robust management software to streamline budgeting and reporting. Implement strong nonprofit donor management systems and adopt strategies such as nonprofit influencer marketing to boost fundraising. Monitor progress through nonprofit social impact measurement and refine your approach using targeted nonprofit donor engagement tactics and nonprofit corporate giving strategies. Additionally, prepare for unexpected challenges with proactive nonprofit crisis management.

Secure Tax-Exempt Status with Ease

Harbor Compliance simplifies nonprofit registration and tax-exempt filing, so you can focus on your mission.