Finding the best PEO services can make a huge difference for small and mid-sized businesses. A Professional Employer Organization (PEO) takes on critical HR functions such as payroll, employee benefits, compliance, and risk management, allowing you to focus on growth. With dozens of providers available, knowing which ones stand out can save you both time and money. This guide reviews the top 10 PEO services in the U.S. and explains how to choose the right one for your business.

Top 10 Best PEO Services in the USA (2025) – PEO Reviews & Ratings

Before we dive into our top-rated providers, if you’re unfamiliar with how PEOs operate, here’s a quick guide on what a PEO is and how it works. It explains the co-employment model, payroll outsourcing, and compliance benefits in simple terms.

Choosing the best PEO services requires more than scanning price lists — it’s about finding the right expertise, payroll and compliance capabilities, and proven results that match your business needs. Our ranking of the top peo providers offers a comprehensive analysis of leading peo companies using verified client reviews, transparent pricing of peo services, and overall service quality. Each peo company was evaluated for its ability to streamline HR, improve operations, and deliver strong customer experiences while ensuring full compliance with employment laws across industries.

| Provider | Rating | Starting Price | Best For | Key Strengths |

|---|---|---|---|---|

|

Justworks

|

$79-109/employee/month

|

SMBs seeking simplicity & premium benefits

|

All-in-one platform, 24/7 support, competitive health plans, intuitive interface

|

|

|

ADP TotalSource

|

$85-200/employee/month

|

Mid to large businesses with complex needs

|

Industry leader, extensive payroll expertise, comprehensive compliance

|

|

|

Paychex (Oasis)

|

$100-150/employee/month

|

SMBs, franchises, multi-location businesses

|

Advanced technology, national presence, wide service range

|

|

|

Papaya Global

|

$25/month (Payroll)

$599/month (EOR) |

International companies & global teams

|

Best-in-class EOR, multi-country management, rapid onboarding

|

|

|

TriNet

|

$80-208/employee/month

|

Industry-specific needs & multi-state operations

|

Sector specialization, customized offerings, enhanced compliance

|

|

|

Flexible PEO

|

Contact for pricing

|

SMBs wanting personalized service

|

Customized approach, human-centered support, scalable solutions

|

|

|

CoAdvantage

|

$80-120/employee/month

|

SMBs without dedicated HR department

|

Complete HR solutions, competitive benefits access, user-friendly tech

|

|

|

Infiniti HR

|

$100-150/employee/month

|

Franchises & cost-conscious businesses

|

Franchise expertise, cost reduction focus, multi-state management

|

|

|

Insperity

|

$125-167/employee/month

|

Mid-sized to large growing companies

|

Exceptional customer service, scalable solutions, strategic HR support

|

|

|

Deel

|

$95/month (PEO)

$599/month (EOR) |

Distributed teams & international operations

|

Next-gen platform, global coverage, transparent pricing, rapid setup

|

1. Justworks: Best All-in-One PEO for Startups

Justworks is a leading option for tech startups and small business owners because of its simplicity, scalability, and compliance reasons. Justworks is famed for its peo services, transparent pricing and premium benefits packages help companies tracking and hiring top talent, payroll management and HR demands. Due to its focus on automation and clarity, it is perfect for startups wanting to expand without excess bureaucracy.

Key Features & Pricing:

- All-in-one human resources and payroll platform

- Transparent pricing: $79–$109 per employee/month

- 24/7 customer support with dedicated specialists

- Access to premium health insurance and wellness programs

- Streamlined employee onboarding and compliance guidance

A Top-Rated PEO for Small Businesses

Known for its clean interface, transparent pricing, and full-service HR tools, Justworks is a favorite among growing companies.

Visit Justworks’ official site to learn more.

2. ADP TotalSource: Most Comprehensive for Growing Companies

ADP TotalSource is one of the leading peo companies for mid-sized and expanding enterprises, delivering unmatched payroll and compliance expertise backed by decades in the HR industry. As a full-service peo provider, it helps business owners navigate regulatory compliance, manage risks, and scale efficiently with comprehensive HR tools and services.

This solution stands out for its customer service, advanced HR technology, and deep compliance management capabilities. With nationwide coverage and industry-specific expertise, ADP TotalSource is ideal for companies seeking a reliable peo for growing companies that can support long-term operational and workforce goals.

Service Offerings:

- Comprehensive payroll services and tax compliance

- Benefits administration and compliance support

- Employee training and development programs

- Workers’ compensation insurance

- HR technology with analytics and reporting

ADP TotalSource: Top Choice for Scalable PEO Solutions

ADP TotalSource offers robust HR tech, compliance support, and premium benefits for companies ready to scale confidently.

Visit ADP TotalSource’s official site for further details.

3. Paychex (Oasis): Strong Tech and Nationwide Presence

Paychex (Oasis) is a trusted peo provider known for its advanced HR technology and extensive U.S. coverage. Ideal for sized businesses and multi-location companies, it combines payroll management with compliance tools to help businesses stay aligned with employment laws. Its robust platform includes a mobile app, analytics, and applicant tracking to enhance workforce efficiency. For business owners seeking a tech-forward partner with consistent service delivery, Paychex offers both scale and personalization.

Technology Features:

- Cloud-based payroll processing and tax compliance

- Integrated applicant tracking system

- Employee self-service portal and mobile app

- Customizable reporting and analytics

- Compliance alerts and HR resource library

Visit Paychex’s official site for more details.

4. Papaya Global: Ideal for International Teams

Papaya Global is a modern peo provider built for companies managing cross-border workforces. It focuses on global payroll, eor services, and compliance services that help companies navigate complex employment laws across countries. With rapid onboarding, multi-currency support, and a scalable platform, it enables business owners to manage global operations efficiently while minimizing compliance risks.

Global Capabilities:

- Coverage in 160+ countries

- EOR services and contractor management

- Multi-currency payroll processing

- Localized compliance guidance

- Integrated HR and workforce analytics

Power Your Global Workforce With Papaya Global’s PEO

Manage international employees effortlessly with Papaya Global’s automated payroll, compliance tools, and expert support in 160+ countries.

Visit Papaya Global’s official site for details.

5. TriNet: Best for Industry-Specific Compliance

TriNet stands out among leading peo companies for its deep focus on industry-specific HR solutions and strong compliance management capabilities. It is especially valuable for business owners operating in sectors with strict labor laws and complex employment laws, helping them stay ahead of regulatory compliance while accessing specialized HR support.

This company has a tailored approach and provides PEO services to clients in different sectors which includes the finance sector, healthcare sector, and tech sector and others. TriNet’s dedicated account managers provide compliance assistance and risk guidance, making it a trusted partner for heavily regulated businesses that require high-touch service.

Specialized Industries Served:

- Financial services

- Healthcare and life sciences

- Technology and SaaS

- Nonprofits and education

- Professional services

Visit TriNet’s official site for details.

6. Employer Flexible: Customizable HR Support

Employer Flexible is a peo provider designed for business owners who want a personalized approach to HR. This company allows you to choose any scalable human resources solution for payroll and compliance, benefits and workforce management. This flexibility sets each peo service to align with distinct operational goals, whether for your small business or a large one. Employer Flexible’s experience in this Markets supports HR functions and contributes to the personal touch that builds long-lasting links with clients.

Customization Options:

- Modular HR and payroll services

- Custom benefits plan design

- Localized compliance guidance

- Dedicated HR account managers

- Scalable service packages for growth

Visit Employer Flexible’s official site for details.

7. CoAdvantage: Affordable PEO for SMBs

CoAdvantage is a peo provider trusted by business owners of small and medium-sized enterprises seeking affordable peo options without sacrificing quality. With transparent pricing of peo services, it offers benefits packages, payroll services, and HR support designed to help businesses control expenses while maintaining compliance. This cost effective approach is ideal for companies that want enterprise-grade resources on an SMB budget. If you're specifically looking for providers tailored to smaller operations, our guide on the best PEO services for small businesses in 2025 dives deeper into solutions designed to support lean teams and tighter budgets.

Beyond cost savings, CoAdvantage delivers personalized human resources assistance, employee benefits administration, and compliance support tailored for SMB needs. Their services enable peo for your business to reduce overhead, access better insurance rates, and improve efficiency. This makes them a standout choice for top peo for smb in competitive markets.

Cost-Saving Features:

- Competitive benefits administration and compliance

- Lower group health insurance premiums

- Payroll processing and tax compliance

- Workers’ compensation insurance

- Scalable service packages for sized businesses

CoAdvantage Earns High Marks for SMB PEO Support

CoAdvantage stands out in 2025 for delivering tailored PEO solutions that meet the unique needs of smaller, growing companies.

Visit CoAdvantage’s official site for more information.

8. Infiniti HR: Best for Franchises and Cost Optimization

Infiniti HR is a peo provider that specializes in serving franchises and multi-location business owners looking to cut costs without reducing service quality. With an expertise in franchises, it offers peo services that include payroll and compliance, recruiting support, and workforce management. This allows franchise networks to harmonise HR processes, ensure compliance with regulations and obtain group purchasing power for benefits and insurance. This is a strong option for client companies that want to save on finance.

Franchise-Specific Services:

- Centralized payroll processing and tax compliance

- Recruiting and employee onboarding support

- Benefits plan design for multi-location operations

- HR compliance audits and training

- Scalable HR technology for franchise networks

Visit Infiniti HR’s official site for further details.

9. Insperity: Excellent Strategic HR Partner

Insperity is a peo provider recognized for its role as a long-term strategic partner to business owners seeking more than basic HR support. Recognized for outstanding support for customers, it is a complete peo services organization that facilitates human resources management, optimizes risks and ensures compliance with regulations in all industries.

Insperity offers advanced HR technology, leadership training, performance management and other solutions to help organizations improve efficiency and employee engagement. This blend of technology with personalization makes it a valid partner for those businesses which are interested in sustainable growth.

Want to see how Insperity and other top PEOs compare based on real-world performance? Visit our in-depth PEO reviews and user score comparison to get side-by-side ratings from business owners like you.

Strategic HR Services:

- End-to-end human resources outsourcing

- Leadership development and coaching

- Risk and compliance management

- Benefits administration and compliance

- Workforce analytics and performance tracking

Visit Insperity’s official site for more information.

10. Deel: Best for Global and Remote Workforce Management

Deel is a next-gen provider of peos designed to efficiently manage remote and international teams. It integrates worldwide payroll, EOR offerings, and conformity devices to help firms use, repayment, and manage distributed workforces efficiently. Deel helps businesses expand their operations without borders through fast onboarding, knowledge of local employment laws, and a user-friendly platform. That said, if you're operating from a specific state like Connecticut, it's worth checking out our roundup of the top-rated PEO services for Connecticut businesses to ensure local compliance and optimized support for your region.

Similarly, businesses with a local focus in Oregon might prefer providers attuned to state-specific regulations. See our detailed guide to the best Oregon PEO companies for 2025 for tailored recommendations.

Remote Work Features:

- Global payroll in 100+ currencies

- EOR services and contractor compliance

- Automated employee onboarding and document management

- Localized employment laws guidance

- Workforce analytics and reporting

Visit IDeelnsperity’s official site for more information.

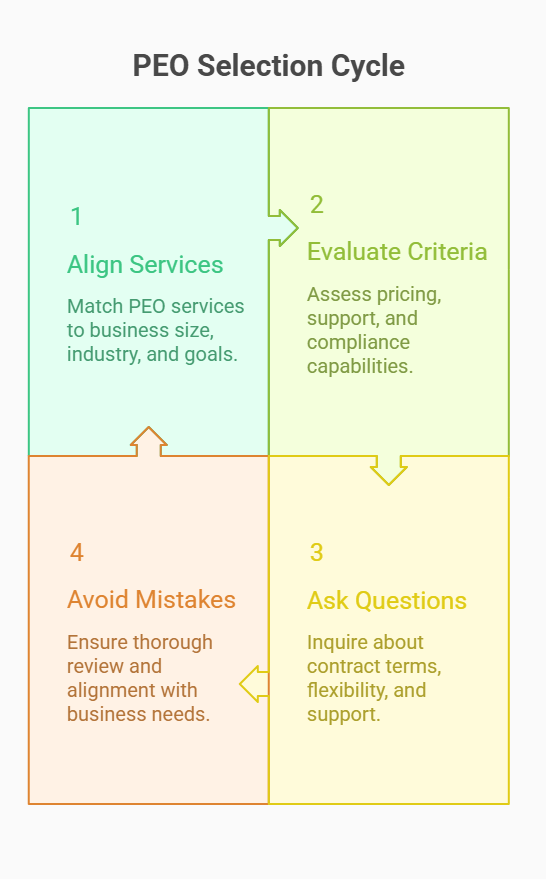

How to Choose the Right PEO Provider for Your Business

Selecting the right peo provider starts with aligning services to your company’s size, industry, and goals. This structure enables business owners to evaluate pricing, payroll and compliance capability, and quality of support to make sure any vendor they choose meets operational needs and future expansion plans.

Key Criteria to Evaluate (Pricing, Support, Compliance)

When owners of businesses are selecting the right peo, it’s essential that they look beyond marketing claims to measurable performance factors. A good PEO provider should have transparent pricing of PEO services, good customer support, and reliable compliance management to reduce risks and ensure smooth of operating.

Our evaluation process reviews both short-term and long-term. For instance, can the organization’s payroll services handle regulatory compliance? What strategic advice does the organization require from human resources? Through this approach, companies can effectively compare options and choose a professional employer organization that fits specific size, industry, and growth objectives. To explore some providers, read our comprehensive PEO company directory featuring 45 top-rated firms across the U.S.

Key Criteria:

- Transparent pricing and contract terms

- Quality and accessibility of customer service

- Payroll and compliance expertise

- Scalability and service flexibility

- Industry-specific knowledge and track record

For Wyoming-based companies, achieving these goals is easier with providers familiar with its regulations and market conditions. Our guide to the top PEO firms in Wyoming highlights trusted local partners who can help your business streamline HR, payroll, and compliance. Similarly, businesses in Idaho can benefit from partnering with providers who understand the state’s specific compliance requirements and market trends. Our roundup of recommended Idaho PEO firms can help you find a service that fits both your operational needs and budget.

Questions to Ask Before Signing a PEO Contract

Before committing to a peo service, business owners should prepare a clear list of questions to assess value, pricing of peo services, and payroll and compliance capabilities. Ask about contract terms, exit clauses, service flexibility, and how the peo provider handles customer support. Confirm whether benefits, insurance, and regulatory compliance are included, and request recent client reviews to gauge satisfaction. Well-prepared questions help ensure you choose a partner aligned with your company’s needs and growth plans.

Mistakes to Avoid When Selecting a PEO

When business owners select a peo, hurrying the process and focusing only on the price could cause big problems later. If you ignore the provider’s history in areas like payroll and compliance, the quality of its customer support and industry expertise, it may result in service gaps and compliance issues.

Business owners often overlook careful review of the contract. The contract may have some hidden peo service fees, termination clauses, and limits on scaling up (and down). If you do not assess benefits offerings, human resources support, and technology tools, your peo company may not be able to align with evolving operational needs. Make sure to do your homework and compare peo providers to your size, industry, and growth plans. On top of that, they often do not appreciate the value of legal protections for small businesses. If you're not already using one, consider exploring the top legal services for small business owners to ensure you’re protected from contract disputes, employee issues, and IP theft.

The Pros and Cons of Using a PEO Service

Partnering with a PEO company offers business owners valuable benefits, from lightening administrative responsibilities to improving payroll and compliance efficiency. However, like any business decision, peo services also come with potential drawbacks. This peo advantages and disadvantages section will help you determine if it’s suitable for your operations.

Advantages of PEO Partnerships: Beyond Basic HR

A strong peo provider offers far more than basic HR outsourcing. As outlined by ADP’s guide to PEOs, businesses can leverage peo services to access premium benefits packages, improve payroll and compliance efficiency, and reduce administrative tasks. PEOs help business owners, allowing them to streamline operations, attract talent, and focus on growth, through compliance support, HR experts, and scalable solutions. As a result of these advantages, PEOs have become essential for many such companies. According to the National Association of Professional Employer Organizations (NAPEO), businesses that partner with a PEO grow faster, retain employees longer, and face fewer risks of closure.

Key Benefits:

- Access to better employee benefits administration

- Lower health insurance costs

- Expert regulatory compliance guidance

- Payroll services with tax compliance

- Reduced risk management burden

If your business is located in Rhode Island, these advantages are even more impactful when working with a provider experienced in the state’s labor laws and market conditions. Our guide to Rhode Island’s top-rated PEO providers can help you find a trusted partner that aligns with your goals.

Potential Drawbacks and Challenges to Consider

Using PEO services helps business owners but may also add trade-offs in control of business. Outsourcing functions to a peo provider can feel restrictive to companies that prefer to have direct control over their human resources and decision-making processes.

Cost is another consideration. Some providers have higher peo service fees or pricing models that may not suit smaller sized businesses, especially if bundled services go unused. Evaluating the cost of payroll services and comparing options is crucial before committing.

Lastly, cultural alignment matters. A peo company must integrate smoothly with your internal team’s work style and values. Without the right fit, even the most advanced payroll and compliance systems can lead to friction, communication issues, and reduced efficiency in workforce management.

Is a PEO Right for Your Small Business?

Determining if a peo for your business is the right choice depends on your size, industry, and HR challenges. Business owners of sized businesses often find that peo services improve payroll and compliance efficiency, reduce administrative tasks, and provide better benefits access. However, evaluating costs, service scope, and cultural fit ensures the partnership supports long-term goals.

For business owners interested in securing their company’s future beyond HR, our complete business succession planning guide provides actionable steps to create a seamless leadership transition and protect your legacy.

PEO Reviews: Frequently Asked Questions

This FAQ section answers common queries from business owners exploring peo services. Covering topics from payroll and compliance to service costs, provider comparisons, and contract terms, it helps readers make informed decisions. Each question is addressed with practical insights so you can confidently evaluate peo providers for your company’s needs.

Can You Afford a PEO as a Small Business?

Yes, if the benefits outweigh the costs. Many sized businesses find a peo service affordable when factoring in payroll and compliance efficiency, reduced administrative tasks, and access to better benefits. Business owners should compare the pricing of peo services against potential savings in HR operations to see if it fits their budget.

Will a PEO Replace Your Internal HR Team?

No, a peo provider works alongside your internal human resources team, not as a replacement. While peo services handle payroll and compliance, benefits, and risk management, your staff manages culture, engagement, and strategy. This collaboration lets business owners boost efficiency while keeping control over people-focused decisions within the company.

How Long Will It Take You to Set Up a PEO?

Most peo providers can complete setup in 2–6 weeks, depending on contract complexity, payroll and compliance integration, and your company’s readiness. Business owners can minimize delays by preparing documents early and coordinating with the peo service team.

PEO Setup Timeframes by Provider

<TABLE>

Is Your Employee Data Safe With a PEO?

Yes, reputable peo providers use strict data security protocols, such as encryption, multi-factor authentication, and secure servers, to protect sensitive payroll and HR records. They also follow employment laws like HIPAA or GDPR. Business owners should confirm their peo service conducts regular audits and maintains updated compliance management practices to keep employee data safe.

Should You Use a PEO or an Employer of Record (EOR)?

Choose a peo service if your company has a U.S. legal entity and needs payroll and compliance support while retaining co-employment status. Opt for an employer of record (EOR) when hiring in countries where you lack an entity, as the EOR becomes the legal employer.

Can You Easily Switch from One PEO to Another?

Yes, but it takes planning. Ending with one peo provider and starting with another means reviewing termination clauses, transferring payroll and compliance records, and aligning benefits coverage. Business owners often switch at year-end to reduce reporting issues. The biggest challenges are onboarding costs, system changes, and avoiding service gaps with the new peo service.

- IRS: Certified Professional Employer Organization (CPEO)

- IRS: CPEO Public Listings

- IRS: List of CPEOs (PDF)

- ESAC: Find a PEO

- NAPEO: PEO Industry Overview

- NAPEO: Industry Research & Data

- SHRM: PEO Advantages & Disadvantages

- U.S. Chamber of Commerce (CO—): Professional Employer Organization (PEO)

- Forbes Advisor: Best PEO Services

See Why Oasis by Paychex Ranks Among the Best

With decades of HR expertise, Oasis delivers reliable payroll, compliance, and benefits services tailored to small and mid-sized businesses.