Thinking about renewing your LLC but unsure where to begin? Not clear on the difference between an annual report and a formal renewal? Worried about missing a deadline and risking penalties or dissolution?

To renew an LLC, you typically file an annual or biennial report with your Secretary of State, confirm your business details (such as address and registered agent), and pay a state-specific renewal fee, which ranges from $20 to $300 depending on the jurisdiction. Most renewals are done online in just a few minutes, and staying compliant ensures your LLC retains good standing, limited liability protection, and the legal right to operate.

In this article, we’ll explore:

- The state-by-state requirements and deadlines for renewal

- A step-by-step process to file your annual report correctly

- What happens if you miss the deadline and how to reinstate

- Tips to avoid late fees and keep your LLC compliant year after year

Ready to keep your LLC in good standing? Let’s dive into how the renewal process works in 2025.

Do You Need to Renew Your LLC? Understanding the Basics

Most states require limited liability companies to file a recurring report—annual or biennial—and pay a modest fee to remain in good standing. The exact process is sometimes referred to as “renewing” but typically involves verifying business details and, in some locations, paying a franchise tax. Staying on top of these deadlines is crucial. Missing them can lead to penalties or even administrative dissolution. This article unpacks how to renew your llc, what each state expects, and how to keep your entity active without complications.

What LLC Renewal Means (and Doesn’t Mean)

Renewing an LLC usually focuses on updating your business entity information with the state. It doesn’t mean you have to re-file your articles of organization or overhaul everything from scratch. This process is distinct from filing a DBA (Doing Business As), which allows a business to operate under a different name than its legal designation. Instead, it involves:

- Confirming your business name and principal address

- Listing or updating your registered agent for service of process

- Reporting current members or managers

- Paying any required annual registration fee

As of March 2025, most renewal processes happen online through a secretary of state website. Some states call this an annual llc filing, while others do it every two years or attach it to a separate business license renewal. Regardless of terminology, the objective is the same: ensuring the state has your latest data for compliance and tax return notifications.

Annual vs. Biennial Requirements

Not all states collect fees or reports on a yearly basis. Some follow a biennial system:

- Annual Report: Common in Florida, Illinois, and Texas, among others.

- Biennial Statement: Places like New York and California require one every two years.

- Anniversary Month vs. Set Date: A handful of states tie your due date to your LLC’s formation month, while others have a universal deadline for all business entities.

In 2025, fees can range from $20 to $300 or more, depending on the jurisdiction. Understanding the specific LLC annual fees in your state is crucial to budget appropriately and avoid surprises. Some states, like Arizona, have no routine renewal forms, though others might still require a minimal statement. For instance, understanding the LLC cost in Nevada reveals a total formation expense of $425, encompassing various mandatory fees. Check your specific rules to avoid confusion and missed deadlines.

What Is Considered “Good Standing”

“Good standing” means your LLC has complied with state obligations, including filing your report on time and paying any fees. If you’re in good standing, you can legally operate, sign contracts, and maintain your limited liability protection. In many states, you can confirm this status by looking up your business on the secretary of state’s online database. Conducting an Illinois business search exemplifies how to verify an entity's standing and compliance within that state. Falling behind on payments or failing to file a report can compromise good standing, leading to potential dissolution or fines. That’s why it’s crucial to stay current on all renewal requirements.

Need help renewing your LLC on time?

ZenBusiness can handle your LLC annual report filings and keep your business in good standing year after year.

What’s Required to Renew an LLC

Before you renew business credentials, know your state’s exact checklist. Additionally, understanding how to check LLC names ensures your business name remains unique and compliant during the renewal process. Typically, it’s straightforward—fill out a short form, pay a fee, and confirm any changes to your LLC info. Some states will prompt you to review your operating agreement or update company law details if needed. For example, appointing a registered agent in Mississippi is a critical component of maintaining compliance in that state.

What Information You’ll Need

At a minimum, you’ll provide:

- LLC Name & Address: Must match records on file with the state. Ensuring your registered agent information is current is vital, as they are responsible for receiving legal documents on behalf of your LLC.

- Registered Agent Contact: Full name and address for official notices.

- Ownership or Management Data: If the state tracks managers or members.

- Business Purpose or NAICS Code: Some states require a brief description of what you do.

- Federal Income Tax ID (EIN): In many cases, the renewal form includes a field for it.

As of March 2025, the fee is typically paid by credit card if you file online. If your details have changed, you’ll update them during this renewal application.

State-Specific Renewal Forms

While some states label their renewal document an annual report, others might call it a “biennial statement” or “periodic report.” A few use a more generic name like “Annual Registration.” Regardless of wording, the form’s intent is consistent: confirm that your LLC data is up to date. You’ll find it on your state’s official business filing portal or request a paper form if digital filing isn’t available. Double-check deadlines and fees, which can vary significantly from one place to another.

Where and How to File (Portals, Mail, In-Person)

Most states encourage filing online through their secretary of state or york department of state website. The steps are usually straightforward:

- Online Portal: Enter your LLC’s unique ID, verify details, and submit electronically.

- Mail Filing: Download the form, complete it, and mail it with a check or money order.

- In-Person: Some states allow (but rarely require) you to bring documents to an office, though this is less common in 2025. In South Carolina, selecting a reliable registered agent is essential for efficient handling of official correspondence.

Whichever method you choose, confirm receipt or track delivery to ensure your submission is properly recorded.

Step-by-Step: How to Renew Your LLC

Renewing your LLC doesn’t have to be a headache, provided you track deadlines and gather the right info. If you're considering rebranding, exploring the best cleaning business name ideas can provide inspiration during the renewal process. Here’s a concise roadmap that applies in most states, though specifics differ slightly depending on local regulations.

Verify if your state uses an anniversary month system or universal due date. Set reminders to avoid late fees or dissolution of your LLC.

Review and update your operating agreement, registered agent details, business name, and address if changes occurred since last filing.

Complete the annual report or statement with details about managers/members and business license status. Keep a copy for your records.

Submit payment ($20-$300 range) via credit card for online filings or check for mail submissions. Be aware of additional charges like franchise taxes.

Verify your filing was processed and store all acknowledgments from the Secretary of State for loan applications, tax returns, or audits.

Step 1: Check Your State’s Deadline

Find out if your jurisdiction follows an anniversary month system or if there’s a universal due date like April 15 or June 30. Many states send reminders by mail or email, but it’s risky to rely on these alone. By 2025, most maintain an online search tool where you can confirm due dates. Missing a deadline can incur late fees or even dissolve your LLC, so marking it on your calendar or setting a digital alert is crucial.

Step 2: Update Business Info (If Needed)

Before filing, review your LLC’s data. If the operating agreement changed or you appointed a new registered agent, you’ll update those details in the renewal form. Some states require a separate amendment filing for major changes, so clarify which documents must be updated. Also confirm your current business name and mailing address. Ensuring accurate data avoids complications with service of process or official notices.

Step 3: File the Required Document (Annual Report, Statement)

Each state’s renewal form can vary, but typically you’ll see an “annual report” or “statement” heading. Complete the fields carefully, including details about managers or members and your business license status if applicable. Some states allow you to skip certain fields if nothing has changed since last year. Once you finish, sign electronically (if online) or by hand, then prep to pay any fees. Keep a digital copy before submission; it’s your proof if issues arise later.

Step 4: Pay the Applicable Renewal Fee

Fees range from about $20 to $300, with certain states charging more. Being aware of the overall LLC cost helps in budgeting for both formation and renewal expenses. Payment is usually made via credit card if you file online. Some states still accept checks if you mail your form, though that may delay processing. If your LLC operates in multiple states, you’ll handle each jurisdiction’s fee separately. Don’t overlook combined charges—for instance, an annual report fee plus a franchise tax can happen in states like California or Delaware.

Step 5: Confirm Filing and Keep Proof

After submitting, verify that the state’s website shows your filing as received or processed. If you mailed it, keep delivery confirmations and copies of your paperwork. Store any official acknowledgement from the secretary of state to prove you’re current. This record might be needed if you apply for loans, file a tax return, or go through audits. Having immediate access to proof of renewal can save serious headaches, especially if disputes arise about your LLC’s status.

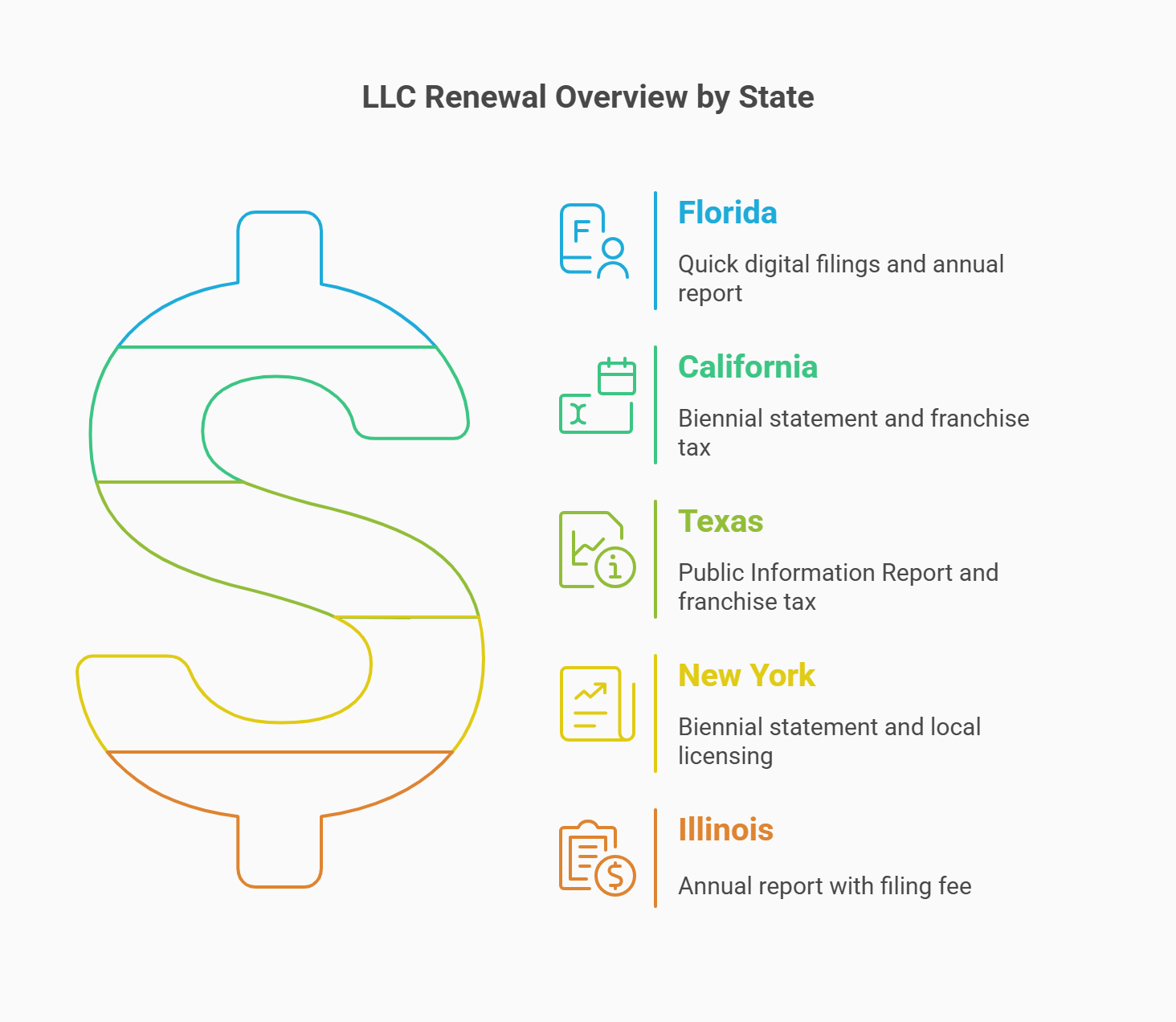

LLC Renewal Requirements by State

Not every state uses the same set of forms or deadlines. Choosing the right state to form llc can also influence your long-term renewal costs and compliance complexity. Some need an annual report, others are biennial, and a few have no direct renewal forms at all—just fees. Understanding these differences helps you plan ahead and avoid missed filings or unexpected penalties.

Key Differences Between States

In March 2025, the LLC renewal landscape can be summed up as follows:

- Annual Filing States: Yearly submission of forms and fees.

- Biennial Filing States: Every two years, with fees often equal to or slightly higher than annual states.

- No Routine Renewal States: Some states require no repeated LLC reports but may still need registered agent updates.

- Franchise Tax vs. Filing Fee: Certain locales call it a franchise or license tax, while others label it a report fee.

- Single Due Date vs. Anniversary Date: Deadlines might be a universal date (like April 1) or tied to your LLC’s formation date.

Always verify your home state’s rules, as well as any states where you’re registered as a corporation or llc doing business.

States With Annual Reports

Most states fall into this category, where you “file an annual” document. Examples include:

- Florida: Due between January 1 and May 1, with fees around $138.75.

- Texas: Requires a Public Information Report each year, plus a franchise tax filing.

- Illinois: An annual report plus a $75 fee, typically submitted before the LLC’s anniversary month.

In these jurisdictions, you’ll see standard forms on the state’s corporate filing website. If you miss the due date, late penalties can pile up quickly, and your LLC can risk losing good standing.

States With Biennial Requirements

A handful of states, like New York and California, follow a two-year schedule. You’ll usually pay a slightly higher fee, but only every other year:

- New York: Files a biennial statement with the new york department of state, with fees around $9.

- California: Files a Statement of Information every two years, plus an annual or minimum franchise tax.

Though less frequent, you still must mark your calendar. Skipping a biennial filing can lead to suspension, complicating everything from opening bank accounts to signing contracts.

States With No Renewal Obligations

A few states don’t require repeated LLC reports. However, that doesn’t mean you’re free from all fees. For instance:

- Arizona: No annual or biennial LLC reporting, but you must keep a current registered agent on file.

- New Mexico: Similarly no routine report, yet other obligations like tax return filings remain.

Even in “no-report” states, ensure you still comply with local business license laws or any county-level registrations that might apply.

Penalties and Deadlines That Vary State by State

Failing to file on time usually triggers a late penalty—ranging from $25 in some regions to hundreds in others. Some states offer a short grace period, while others immediately suspend your LLC’s good standing. If your LLC is revoked or dissolved, you might pay reinstatement fees or face additional taxes. Best practice: keep meticulous notes on your specific renewal date and file early to sidestep any last-minute mishaps.

Avoid late fees and keep your LLC protected

Northwest monitors your renewal deadlines and files for you—no missed reports, no surprises.

LLC Renewal Process by State: Florida, California, Texas & More

In addition to broad categories, you should be aware of specific renewal steps in major business-friendly states. Deadlines, forms, and fees can differ widely. Here’s an in-depth look at top US states with substantial LLC formation activity.

Florida

Renowned for quick digital filings and relatively low fees, Florida enforces clear annual requirements.

When and How to File the Annual Report

All Florida LLCs file online at Sunbiz.org between January 1 and May 1. You’ll verify or update your business name, principal address, registered agent details, and member/manager info. If you miss the May 1 deadline, a $400 late fee gets added to your account. By confirming your anniversary data early, you can avoid any last-minute rush or penalty.

How to Pay the $138.75 Annual Fee

You can pay online with a credit card. The standard fee of $138.75 applies to most LLCs in 2025, though changes are possible if the legislature updates company law. On payment, you’ll receive a digital confirmation—save or print it for your records. If you prefer mailing a check or money order, you can, but it might delay processing.

Missed the Deadline? What to Do

Failing to file by May 1 triggers an automatic $400 late penalty. You can still submit the annual report until the state administratively dissolves your LLC (around the 3rd Friday of September). If you’re dissolved, reinstatement costs an extra $100, so file promptly to minimize overhead.

California

California LLCs face both a biennial statement requirement and a mandatory $800 franchise tax. While it might seem high, the state also offers robust consumer markets that many find worthwhile.

Biennial Statement of Information Requirements

File a Statement of Information with the California Secretary of State every two years, updating members, managers, and contact addresses. The standard fee is $20, plus optional expedited fees if you need quick processing. The due date typically aligns with your LLC’s anniversary month, and skipping it can trigger fines or suspension.

Franchise Tax and Renewal Obligations

Each year, you’ll pay the $800 minimum franchise tax to the Franchise Tax Board. Even if your LLC makes zero revenue, the charge applies unless you qualify for a narrow exemption. Filing your biennial statement on time helps ensure the state recognizes your LLC’s good standing. Missing either obligation can complicate your ability to do business or raise capital.

Texas

In Texas, LLCs file a Public Information Report and handle franchise tax obligations to stay in good standing.

- Public Information Report (PIR): This annual document verifies your business address, manager names, and other required data.

- Due Date: Typically May 15 for most LLCs.

- Franchise Tax: Calculated based on revenue, with a no-tax-due threshold around $1 million as of March 2025.

- Gather Revenue Data: Confirm your gross receipts to see if you owe any taxes.

- Complete PIR Online: Texas Comptroller’s website provides a user-friendly submission process.

- Pay Required Taxes or Fees: If above the threshold, you’ll pay a franchise tax. Otherwise, mark no tax due.

Failing to file either form can result in a forfeited right to transact business in Texas and potential reinstatement fees later.

New York

New York demands a biennial statement, plus potential local licensing if you operate within city limits.

- When to File: Typically every other year in your LLC’s anniversary month, with a $9 filing fee.

- Where to File: The new york department of state handles submission, which you can do online or by mail.

- Additional Requirements: If you changed your business corporation address or members, update them here.

- Penalties for Late Filing: While fees might be small, ignoring this step can cause the state to label your LLC as delinquent.

- Local Add-Ons: Some localities or boroughs require special business license filings, so confirm with city authorities.

Missing the biennial date leads to noncompliance, blocking your LLC from receiving official notices or filing lawsuits if needed.

Illinois

Illinois maintains an annual LLC report with a $75 fee. The state charges extra for missing or late documentation, so it’s wise to file on time.

Annual Report + $75 Filing Fee

Due by the end of your LLC’s anniversary month, the annual report is submitted via the Illinois Secretary of State’s website. You’ll confirm your registered agent, business address, and any significant ownership changes. As of 2025, the standard filing fee remains $75. Payment methods include credit or debit cards, and processing time is generally swift if done online.

Penalties for Late Filing

If you surpass the deadline, a $100 penalty is tacked on. Continued failure to file can lead to involuntary dissolution. Reinstating an administratively dissolved LLC adds more fees, plus potential complications when you try to conduct banking or sign contracts. Keeping track of that anniversary date is critical in Illinois.e unsure where to begin, here’s a complete guide on how to start an llc step by step.

What Happens If You Don’t Renew Your LLC on Time

Forgetting or ignoring your LLC renewal invites legal and financial headaches. Fines, administrative dissolution, and extra red tape to reinstate your business can become severe obstacles. States vary in how lenient they are with late submissions, so know your local grace period if you’re close to the deadline.

Grace Periods and Late Fees

Most states allow a brief grace period—often 30 to 60 days—before revoking your LLC’s good standing. During this window, you can still file but face a late charge ranging from $25 to $400, depending on the state. Some states immediately impose penalties after the due date, so rely on official guidelines rather than guesswork. Paying on time is always cheaper and simpler.

Administrative Dissolution Risks

If too much time passes, the state may administratively dissolve your LLC, meaning you lose the limited liability shield and the right to operate under that business name. Access to business banking, loans, and contracts becomes problematic or outright blocked. Reinstatement is typically possible but can involve hefty fees, additional forms, and possible scrutiny from the internal revenue service if you missed relevant federal income tax obligations.

Steps to Reinstate an Inactive or Revoked LLC

Reversing an administrative dissolution often requires a formal process:

- Check State Reinstatement Rules: Each jurisdiction’s secretary of state or corporate division provides instructions.

- Clear All Outstanding Fees: This includes late penalties and any annual report fees you didn’t pay.

- Submit Required Paperwork: Some states mandate a “Reinstatement Form” or updated renewal.

- Update Your Registered Agent (If Needed): If your previous agent dropped you, get a new one.

- Wait for Approval: Processing times vary; once the state confirms reinstatement, you can resume normal operations.

Stay proactive—if you let your LLC languish, you risk losing the business altogether or needing a fresh formation, which complicates taxes and contracts.

Can You Make Changes During Renewal?

Yes. Renewal season is an ideal moment to update crucial details about your LLC. Think of it as an annual or biennial tune-up rather than a nuisance. You typically can’t alter your LLC’s legal form (like converting to a private limited company) during renewal, but smaller adjustments are fair game.

- Registered Agent Address: If you switched to a new agent or changed offices, you can update this info.

- Manager or Member Details: Add or remove individuals, or change roles for new partners.

- Business Address: Update if you moved to a fresh location or expanded.

- Contact Emails or Phone: Some states allow you to modify official contact fields during renewal.

- Operating Agreement Reference: If your internal structure evolved, use the renewal to confirm publicly accessible data aligns with your in-house operating agreement.

Check if significant changes demand a separate “Articles of Amendment.” Often you can do both steps around the same time to keep official records accurate.

Pro Tips to Never Miss an LLC Renewal Again

Staying current on LLC renewal is mostly about organization. By adopting simple measures, you can sidestep penalties and keep your company law compliance up to date, freeing you to focus on growth instead of paperwork.

Create an Annual Compliance Calendar

Mark all relevant deadlines on a digital or paper calendar at the start of each year. Include reminders for 30, 15, and 5 days before the actual due date. Many owners also track personal anniversary month alerts for states that tie renewal to the LLC’s formation date. Sync with smartphone notifications or project-management apps. This layered approach ensures you’re not blindsided when it’s time to file.

Use a Registered Agent With Auto-Notifications

Hiring a professional registered agent often includes timely email or text alerts regarding renewal. They keep track of deadlines for the annual report or biennial statement in each state where you’re registered, reducing your administrative load. As of 2025, agents typically offer online dashboards so you can see at a glance which states are due for renewal soon. The service cost is frequently outweighed by the convenience and peace of mind.

Sign Up for State Email Alerts or Monitoring Tools

Most secretaries of state and business corporation divisions let you subscribe to automated email alerts. Additionally, third-party compliance software can watch your LLC’s status, sending red flags if deadlines approach. Some states also offer a text reminder service. If your state lacks this option, you can set up personal recurring tasks in platforms like Google Calendar or Trello. The more reminders you have, the safer your LLC stays from lapses.

FAQ: LLC Renewal and Filing

Every business owner wants quick, accurate answers to common renewal questions. Below, we clarify top concerns so you can proceed confidently.

That depends on your state. Many states require an annual report, while others mandate a biennial filing. A few have no routine reports but still collect a franchise tax or minimal fee. Check your secretary of state’s official website to confirm. Even if the state only needs a report every two years, you may have annual tax return obligations or local business license renewals to manage. Missing these deadlines can jeopardize your LLC’s good standing.

In most cases, yes. Filing your annual report (or biennial statement) is the primary way to renew your llc. States use the document to verify current information about your registered agent, ownership structure, and mailing address. This process is sometimes referred to as “renewal,” but you’re not re-creating your LLC from scratch—just updating details and paying any required fee. Timely submission keeps your LLC active and legally recognized.

States typically ask for basic details like your LLC’s official name, service of process address, and the names of managers or members. You’ll also provide a mailing or principal address. You usually won’t have to submit full articles of organization or an operating agreement unless a major change occurs. Keep your records handy, though; if you’re altering key facts, you might need proof of the amendment. Each state outlines the needed data on its filing portal.

You can often pay online via credit card, especially if you file electronically. Some states still accept checks or money orders if you mail a paper form. Double-check the final amount and any additional costs—like a local business license fee or a franchise/privilege tax. Once payment is processed, the state typically sends a receipt or online confirmation. Save that as proof in case any dispute arises about your compliance status.

Yes. If you miss a renewal deadline, you can usually file a late report and pay extra penalties. If your LLC was administratively dissolved, you can apply for reinstatement. The process often involves clearing overdue fees, filing back reports, and sometimes submitting a special reinstatement form. Be aware that repeated tardiness or long gaps can create complications with vendors, banking, and the internal revenue service. Acting quickly minimizes any risk of permanent LLC revocation.

Reliable compliance tracking, done for you

Harbor Compliance offers full-service support for LLC renewals, so you never risk falling out of good standing.