Navigating the business landscape in Virginia requires reliable resources and actionable insights. The Virginia SCC Business Search Tool is indispensable for entrepreneurs, investors, and professionals looking to verify legitimacy, confirm compliance, and avoid legal or naming conflicts. With this tool, you can confidently make informed decisions while safeguarding your business interests.

The Virginia SCC Business Search Tool provides users with access to accurate and up-to-date details on registered businesses, including their status, formation information, and compliance records. This transparency ensures smooth partnerships, prevents name conflicts, and supports strategic growth initiatives.

In this article, we’ll explore:

- The key benefits of using the Virginia SCC Business Search Tool.

- Step-by-step instructions to access and interpret search results.

- Tips to ensure compliance and leverage search data effectively.

Let’s dive in to master the Virginia Business Search process and streamline your journey to success!

Understanding the Virginia Business Entity Search Tool

When forming or verifying a business, you need fast, accurate data—like formation dates and legal statuses. That’s where the virginia business entity search tool comes into play. By consulting its up-to-date database, you can confirm vital information about any legal entity and avoid expensive missteps or name conflicts.

What Is the Virginia SCC Business Search Portal?

Virginia’s primary resource for business lookups is the virginia state corporation commission website. It hosts an easy-to-navigate interface for searching business entities. When you access it, you’ll see multiple options to refine your search—like entity name, unique ID, or even a partial match. This official channel ensures you get accurate, real-time details. Data typically includes an organization’s current standing, formation date, and principal office address.

Why Use the Business Search Tool: Key Benefits for Entrepreneurs

Whether you’re a seasoned investor or a first-time business owner, harnessing this search tool provides an edge. Among the advantages:

- Preventing Name Conflicts: Quickly check if someone has already claimed your business names.

- Confirming Compliance: Gauge whether a firm meets ongoing state requirements and isn’t delinquent.

- Gathering Contact Details: Uncover the identity of a registered agent or official office address.

- Verifying Credentials: Ensure the company is a recognized legal entity in Virginia before finalizing deals.

By consulting such reliable data, you sidestep potential legal headaches and keep your ventures in good standing.

Common Scenarios Requiring a Business Entity Search (Name Search, Verification, Legal Checks)

Countless situations call for quickly pulling official records. Maybe you want to confirm a partner’s legitimacy, check that your limited liability companies name is truly free, or see whether a newly formed competitor is in compliance. Even everyday tasks—like sourcing vendors or verifying a potential client’s corporate background—can hinge on these lookups. Ultimately, an informed approach fosters smoother transactions and safeguards your professional interests.

How to Conduct a Business Search in Virginia

A clear method is vital when researching any business entity search data. Without a systematic approach, you risk missing key points or receiving inaccurate results. Below, we cover the fundamental steps to locate essential details—from accessing the official site to troubleshooting frequent pitfalls. By mastering this process, you’ll secure the facts needed to form strategic partnerships, refine expansion plans, and remain compliant.

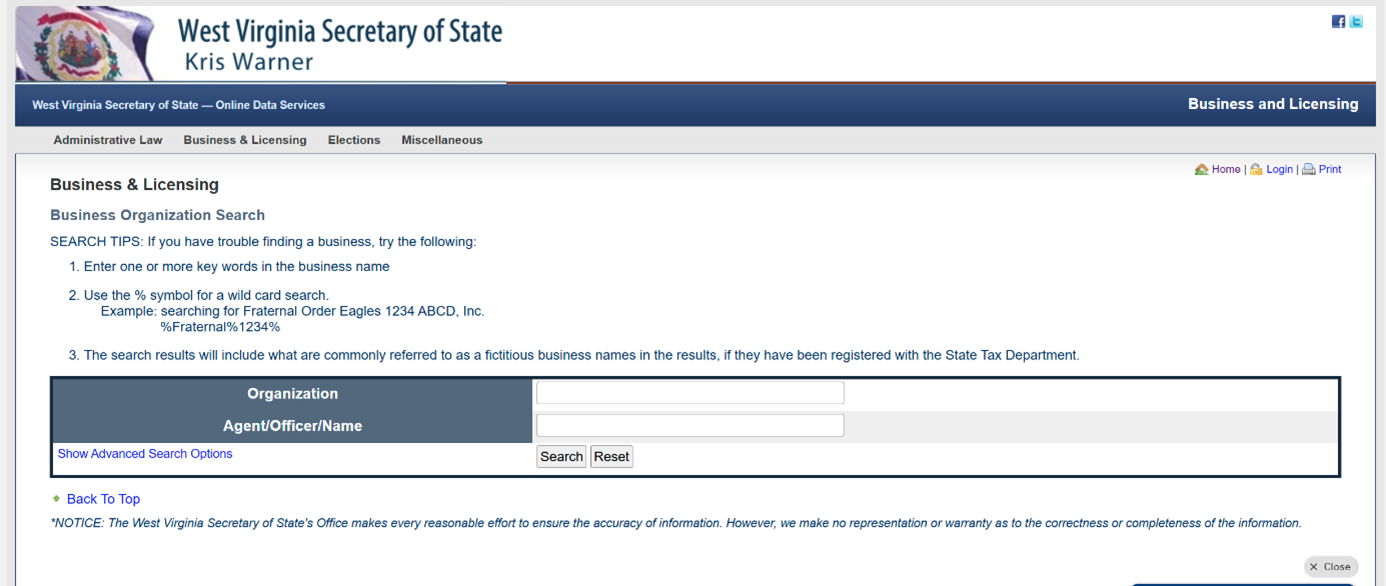

Accessing the Virginia State Corporation Commission (SCC) Website

Start by navigating to the SCC’s official webpage. Once there, locate the dedicated virginia business search portal link. This platform is your first stop for any look up requests—whether it’s a brand-new enterprise or older records. Upon arrival, you’ll find search fields allowing you to enter either partial or complete names. Using correct spelling and punctuation is crucial: the system often can’t interpret errors or missing text.

Step-by-Step Guide: Conducting a Name, ID, or Registered Agent Search

To streamline your efforts, consider these steps:

- Choose Your Search Criteria: Decide if you want to track by company name, ID number, or registered agent name.

- Enter Exact or Partial Details: If you have a partial name, the system might yield broader results. For an exact match, type the full spelling.

- Review Initial Listings: The search returns a list of registered businesses. Each line typically shows the official name, entity ID, and status.

- Click to See More: Select a result to access in-depth data, such as date of formation and type of entity.

- Save or Print: For your records, you can typically download a PDF or print the info if needed.

These five points ensure you gather the specifics without confusion or missed entries.

Find Business Info Instantly

Use the Virginia SCC Business Search Tool to verify LLC status, avoid conflicts, and stay compliant.

How to Interpret the Search Results for Business Insights

You might wonder how to decode certain terms or status flags. Often, results will display the entity type (LLC, corporation, or something else) plus a status like “active” or “inactive.” If the status is active, it’s generally meeting state obligations. Inactive could indicate a lapse, dissolution, or name reservation. If you see a mention of “limited partnerships,” it’s referencing a different structure than an LLC. Ultimately, reading these entries carefully reveals essential compliance and ownership cues.

Common Errors in Searches and How to Avoid Them

Even a small glitch can derail your findings. Below are frequent issues:

- Misspellings: Always verify that “Corp.” isn’t typed as “Crop.” or such.

- Omitting Suffixes: Failing to add “Inc.” or “LLC” might yield empty results.

- Filtering Too Broadly: Using minimal data can lead to hundreds of hits.

- Using Outdated Browser: Some older software might not display the website fully.

- Neglecting Punctuation: In names with hyphens or apostrophes, ignoring them can hamper your search.

By double-checking each detail and updating your browser, you’ll bypass these hurdles and secure the data you need.

Checking Business Name Availability in Virginia

One of the earliest steps toward forming your desired llc or corporation is confirming that no one else already uses your chosen brand. Conducting a business name search through the SCC helps keep your registration smooth and prevents forced rebranding down the road. Below, we’ll explain why verifying name availability is a must, walk you through the online reservation steps, and outline crucial naming rules so you stay fully compliant.

Importance of Name Availability Before Starting a Business

Nothing stalls business registration like a naming conflict. If the moniker you love is taken, you’ll have to pivot at the eleventh hour—wasting both time and resources. By confirming business name availability early, you ensure brand uniqueness. To ensure this, you can how to check LLC names before finalizing your selection. Plus, having a distinct name fosters a clear identity in marketing and social media campaigns. This clarity also reduces legal disputes, especially if two companies share near-identical phrases, sowing confusion among consumers.

How to Search for Available Names Using the SCC Portal

Visiting the SCC’s site remains the gold standard for name checks. You simply:

- Log on to the main search page.

- Insert your prospective name in the text field.

- If results appear, see whether those names are too close or identical.

- If none match, your brand is likely free to proceed.

This quick process means you avoid unwelcome surprises, especially once you’re finalizing your llc in virginia or corporation formation.

Steps to Reserve a Business Name in Virginia Online

Once you confirm the name is free, consider reserving it. Here’s how:

- Access your SCC account or create a new one if needed.

- Fill out the name reservation request, ensuring the intended business names are typed exactly.

- Pay any associated reservation fee.

- Note the timeframe for which the reservation is valid.

- Keep the confirmation email or form for your records.

With that done, your name is temporarily secure while you finalize everything else.

Rules and Restrictions for Naming a Business in Virginia

Virginia law includes guidelines to keep naming structures transparent and consistent. For instance:

- The name must accurately reflect the type of entity (like “Inc.” or “LLC”).

- Certain words—like “Bank” or “Trust”—require special permissions.

- You can’t create confusion by using a name too similar to an existing legal entity.

Abiding by these policies streamlines your look up results in the future and spares you from rejections at the official level.

Types of Business Entities in Virginia: What You Need to Know

Before you finalize a formation path, it’s wise to learn the distinctions among various business entities. From corporations to partnerships, each structure comes with unique tax, liability, and reporting obligations. In Virginia, you’ll frequently encounter limited liability companies, corporations, and more. The overview below provides clarity on each choice so you can pick the one that fits your goals.

LLCs, Corporations, and Partnerships: Key Features and Differences

To simplify your decision, here’s a table breaking down the top considerations:

| Entity Type | Liability Protection | Management Structure |

|---|---|---|

| LLC (Limited Liability Company) | Owners shielded from personal debts | Flexible: members or managers |

| Corporation (Inc.) | Strong liability shield | Formal board and officer system |

| Limited Partnerships | General partner fully liable, limited partners protected | Typically run by the general partner |

| Limited Liability Partnership | All partners have limited liability | Partners share responsibilities equally |

| Sole Proprietorship | No separate legal shield, personal assets at risk | Owner controls all decisions |

Each entity type suits different needs. If you’re considering a more formal structure, learn how to start a corporation efficiently. For instance, an LLC might be simpler to manage day to day, while a corporation can handle complex share structures.

Why Most Businesses Choose LLCs in Virginia

Although a corporation may be suitable for certain expansions, the llc in virginia format typically provides a balance of personal asset protection and operational flexibility. Meanwhile, it avoids the double taxation that many corporations face under state and federal rules (though income tax implications can vary). Plus, forming an LLC is relatively quick, and maintaining it often involves fewer mandatory formalities compared to a standard corporation.

Special Entity Types in Virginia: Nonprofits, Professional Corporations, and More

Virginia also recognizes specialized structures. Below is a second table detailing these niche variations:

| Special Entity | Definition | Key Advantages |

|---|---|---|

| Nonprofit Corporation | Formed for charitable or religious purposes | Tax exemptions, public funding eligibility |

| Professional Corporation | For licensed professionals like doctors or attorneys | Allows group practice under a single corporate entity |

| Benefit Corporation | For-profit entity aimed at social or environmental goals | Combines mission-driven approach with standard corporation benefits |

| B-Corp (Certified) | Granted by a private standard (B Lab certification) | Highlights ethical, sustainable operations |

Choosing the right structure can be pivotal for how you operate and brand yourself. Those in healthcare, law, or engineering might opt for professional corporations to meet licensing rules. Meanwhile, philanthropic entrepreneurs may prefer nonprofits.

Registering a Business in Virginia Made Simple

Once you’ve confirmed a suitable structure, it’s time for official business registration. Virginia’s process involves gathering key paperwork, appointing a registered agent, and filing forms. Below, we outline exactly which items you need, plus how to submit everything seamlessly online. By the end, you’ll be prepared to launch your new venture with minimal hiccups, setting a solid foundation for sustained growth.

Documents Required for Business Registration (Articles of Organization, Fees)

Essential docs vary depending on your chosen entity. For an LLC, you’ll file Articles of Organization, whereas corporations need Articles of Incorporation. Both forms demand core details, like your principal office address, ownership structure, and contact info. Additionally, expect a filing fee—often payable by card or e-check. If you’re budget-conscious, learn about the best cheap LLC service without compromising quality. Keeping digital backups of your final forms ensures that if any state query arises, you’ll have the records ready.

Appointing a Registered Agent: Legal Obligations and How to Choose One

A registered agent is someone or a service authorized to accept legal notices on behalf of your company. They must have a physical address in Virginia and remain reachable during normal business hours. Failing to maintain a valid agent can lead to compliance problems or missed lawsuits. Many business owners choose professional agent services for convenience; it removes the need to personally handle official mail or be physically present at all times. Choose the best registered agent in Virginia to handle your compliance needs effectively.

Step-by-Step Guide to Completing the Registration Process Online

Here’s how you can quickly handle the entire process:

- Visit the SCC eFile Portal: Create an account or sign in to your existing profile. If you’re ready to create an LLC in Virginia, follow our detailed steps.

- Select Entity Formation: Choose the relevant category: “Corporation” or “LLC.”

- Input Core Details: Fill out names, addresses, and entity type specifics.

- Upload Articles: Attach completed Articles of Organization or Incorporation.

- Pay Filing Fees: Process your transaction securely online.

Once finalized, you’ll receive a confirmation. Keep this, as it may be vital for opening bank accounts or applying for local licenses.

Navigating the Virginia SCC Database for LLC Information

After forming a new company or exploring an existing one, you may want to dig deeper into official records. The SCC portal offers an in-depth look at formation filings, limited liability partnership data, or amendments. Below, we detail what you can find in these records, how to refine your search, and methods for retrieving official certificates.

What Business Information Can You Find?

When you look up a firm, the SCC typically reveals:

- Date of formation

- entity type (LLC, corporation, etc.)

- Current standing (active, inactive)

- Principal office address for official mail

- business register references

This coverage ensures you understand who runs the company, how it’s structured, and whether it meets state mandates.

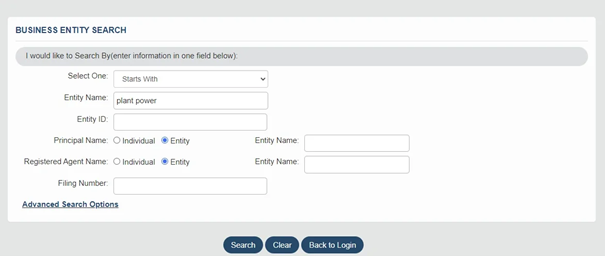

Advanced Search Filters: How to Narrow Down Results Efficiently

The basic query might yield dozens or hundreds of outcomes. To refine them, you can:

- Use partial name matches if uncertain about spelling

- Filter by status to see only active or only inactive records

- Specify the type (like “limited liability company” or “corporation”)

- Input a known ID or the registered agent name

Leaning on these filters saves time and uncovers the exact record you seek.

How to Download Certificates and Other Legal Documents

Occasionally, you’ll need official copies—like a certified statement of existence or dissolution certificate. Within the system, there’s often an option labeled “Download Documents” or “Order Certificates.” Follow the prompts, pay any associated fee, and wait for a digital copy or a mail delivery. Having these official documents is crucial if you must prove your status to banks or prospective partners.

Using Business Search Data Strategically

Beyond mere compliance, the SCC’s database can help you gauge competition, explore emerging trends, or verify an enterprise’s credibility. By systematically examining the records, you ensure your decisions—whether about forming partnerships, expanding your brand, or diversifying product lines—are based on factual data. The sections below highlight how you can harness search results to confirm legal standing, investigate rivals, and uncover hidden market potential.

Verifying the Legal Standing of an Entity (Active, Inactive, or Dissolved)

When results show an organization’s standing, “active” means it meets Virginia’s ongoing requirements. “Inactive” could indicate closure or missing reports. Meanwhile, “dissolved” often signals a deliberate cessation. Confirming these statuses helps you avoid finalizing deals with companies that no longer exist or face compliance issues. Always re-check periodically if you’re working on a major partnership over several months.

Conducting Competitor Research Using Search Results

Savvy entrepreneurs use the SCC’s listings to see how local rivals evolve. If you notice multiple expansions or new registrations under similar brand names, it might hint at a boom in your sector. Checking an opponent’s social media feed alongside the official database can give you a clearer sense of their growth timeline. This synergy of public data can guide your strategy on pricing, location, or marketing angles. For more inspiration, check out our LLC names examples.

Identifying Market Opportunities with Business Insights from Virginia’s Database

If you see fewer registered businesses in a certain region or niche, you might step in to fill that void. For instance, if no limited liability companies are operating in an emerging local tech sector, you could become the first mover. Similarly, if a newly formed competitor is attracting investors, analyzing their corporate documents may reveal a gap in the market that you can exploit. All it takes is diligence in reading the search results. Additionally, for workforce management solutions, explore the start an LLC in Texas to enhance your operational efficiency.

Register Your Virginia LLC

Start your business with ease—get expert guidance for fast and compliant LLC formation in Virginia.

Tools and Resources for Virginia Business Searches

While the SCC’s system covers official data, other tools can supplement or cross-reference that info. From free websites offering broad searches to paid services delivering deep analytics, each resource has pros and cons. In this section, we’ll explore alternative platforms, weigh the merits of paying for advanced features, and discuss when professional assistance is worthwhile.

Exploring Alternative Search Platforms Beyond the SCC Database

Though the SCC is the most authoritative option, some third-party websites compile data from multiple states. This helps if you suspect cross-state expansions or if you prefer a consolidated approach. Keep in mind these services might not update as frequently as the official site. Still, they often offer user-friendly dashboards or alerts when changes occur in a record, saving you from manual re-checks.

Free vs. Paid Search Services: What’s Worth Paying For?

Below is a table contrasting free searches with premium solutions:

| Service Type | Key Features | Ideal For |

|---|---|---|

| Free Databases | Basic listing info, standard updates | Occasional checks, single-entity queries |

| Paid Tools | Extended analytics, multi-state coverage | Frequent verifications, competitor tracking |

| Official SCC | Direct data from the source | Business owners needing real-time accuracy |

Paid platforms may expedite processes like batch searching or name conflict monitoring. However, the SCC remains the top reference for definitive records.

Using Professional Services to Simplify Complex Searches

If you’re regularly searching for data—maybe you’re a consultant or an attorney—outsourcing can be a game-changer. Professional services handle advanced queries or unravel complex structures. They interpret ambiguous statuses and highlight compliance gaps. Although you’ll pay fees, the resulting time savings and reduced error risk can be invaluable, especially when dealing with high-stakes partnerships or multi-entity expansions.

Unique Scenarios: Solving Business Search Challenges

Even the best systems sometimes present complications, from elusive records to out-of-state credentials. Below, we tackle typical scenarios in which the standard approach hits a snag. Whether your name check fails or you find contradictory data in the official listings, these solutions will help you adjust. Plus, we cover how to research entities that might be registered beyond Virginia’s borders.

What to Do If Your Business Name Search Fails

If your business name search yields no results, first confirm you haven’t made a minor typo. Also, remember that the official name might differ from the brand the company uses. If you’re seeking your own newly registered venture, it might not appear yet if filing was ultra recent. Try partial words, or check synonyms. If all else fails, connect with the SCC directly for personalized guidance.

Correcting Errors in Business Entity Search Results

Occasionally, you may see outdated addresses or a misspelled name in your listing. If so, contact the SCC to request an update. You might file an amendment or correct your Articles of Organization. Keep digital proof that you submitted these corrections, as the changes may take days or weeks to appear publicly. Ensuring your listing is accurate reduces confusion for customers, lenders, and prospective partners.

How to Find a Business Entity Registered in Another State

If your target firm is formed outside Virginia but does business locally, they might have a foreign entity registration. The SCC site could list them, but sometimes an out-of-state group uses only their home-state database. In that case, try searching the other state’s official portal or call that jurisdiction’s agency. Confirm the entity’s presence in Virginia by verifying they hold the necessary credentials if they claim to operate here. If you’re wondering can I form an LLC without a business, here are your options.

Frequently Asked Questions About VA Business Search

Below are concise, SEO-optimized answers to frequently asked queries about the SCC’s virginia business search portal. Each response is crafted to be direct yet informative, ensuring you gain immediate clarity on forming, verifying, or managing a business in virginia. Whether you’re uncertain about costs, name rules, or the database’s update schedule, the following points should steer you right.

Yes. The official Virginia SCC database is publicly accessible, and you won’t pay a fee for basic lookups. You simply visit the website, enter relevant details (like the business name) in the search bar, and browse results. While core features are free, some specialized services—like requesting certified documents—might cost a nominal amount. This means you can check for business name availability, confirm an entity’s status, or see if an enterprise is in good standing at no direct charge. Such transparency fosters trust among local entrepreneurs, consumers, and investors.

The SCC typically updates its records daily, with changes reflecting newly formed entities or modifications to existing ones. Once your filings are processed, it may take a short window—often a few business days—for the listing to appear or refresh online. In high-volume periods, updates might happen slightly slower. If you need immediate clarity, you can contact the SCC by phone or email to confirm if your transaction or correction has been posted. Still, in most cases, the database is current enough for timely decisions on a day-to-day basis.

A standard LLC listing typically shows the entity’s formation date, its current standing (active, inactive, or dissolved), the official “limited liability company” designation, and the registered agent’s details. You can also see the principal office address and note if any outstanding fees or compliance issues exist. The system might provide mention of prior amendments or name changes, too. While it doesn’t offer every confidential detail (like ownership percentages or financial data), it’s a reliable snapshot of a firm’s public record. This info aids everything from routine verifications to deeper due diligence checks.

First, ensure your target name is free by performing a business name search on the SCC site. If no conflicts arise, log in to the SCC eFile system and file a name reservation request. Provide the prospective name exactly how you intend to use it—punctuation and suffixes included. Pay the reservation fee, and wait for official confirmation. Your name then becomes protected for a set window (often 120 days), letting you finalize Articles of Organization or Articles of Incorporation. Keep that confirmation in your records to avoid disputes or unintentional release of the name.

Initial fees vary by entity type, but forming an LLC or corporation generally involves a filing fee—often in the range of $100. Additional costs may include annual registration dues, specific county taxes, or licensing fees for regulated sectors. If you need specialized certificates or to expedite a filing, expect to pay extra. Keep in mind that while forming a limited liability partnership or limited partnerships might have similar base fees, your ongoing income tax obligations differ based on structure. Summarily, plan for both one-time charges and yearly upkeep to keep your enterprise legitimate.

Yes. Under state law, limited liability companies must include certain indicators—like “LLC,” “L.L.C.,” or “Limited Liability Company”—in their official name. This requirement helps the public distinguish your legal entity from other structures, such as corporations or nonprofits. If you fail to add an appropriate suffix, the SCC may reject your formation documents. This naming rule ensures clarity for consumers and government agencies. Once accepted, you can still use a DBA or trade name for branding purposes, but your legal identity must contain “LLC” or an approved variant.

A DBA (doing business as) is optional if you want to operate under a name different from your official LLC name. So, no, it’s not mandatory unless you wish to brand yourself differently in the marketplace. For example, you might have “Example Solutions LLC” as the legal name but want “Example Tech Solutions” for marketing. In that scenario, you’d file an assumed or fictitious name with the county or state. This ensures transparency, letting customers or creditors know which entity they’re dealing with while preserving your official name for legal documents.

Looking for an overview? See Virginia LLC Services

Stay Legally Compliant

Ensure your business meets Virginia’s legal requirements with reliable compliance support.