Are you planning to start a business in Wisconsin? Wondering how to verify your business name and ensure compliance with state regulations? A thorough name search is essential for a smooth registration process.

A Wisconsin SOS Business Search lets you check the availability of your proposed LLC or corporation name using the state’s official database—ensuring your brand is unique, compliant, and ready for registration.

In this guide, you'll learn:

- How to use the Wisconsin SOS online search tool

- Key steps to analyze and confirm business name availability

- Tips for resolving conflicts and reserving your name

Ready to secure your business identity in Wisconsin? Read on to master the process!

What Is the Wisconsin SOS Business Search?

A Wisconsin SOS Business Search is an online process that lets you investigate details about organizations officially recognized by state authorities. Whether you need to confirm registration status, check ownership details, or simply learn more about a wisconsin dfi filing, this service streamlines your inquiry. By locating accurate records, entrepreneurs and community members can make informed decisions, verify legitimacy, and ensure they’re interacting with trustworthy companies and nonprofits.

Purpose of the WI SOS Business Search

The main goal of the Wisconsin SOS Business Search is to present a clear snapshot of business entities operating within the state. This resource offers a convenient method to assess public data, such as ownership structure, formation date, and relevant filings. In turn, users can cross-reference any changes or compliance requirements. Ultimately, the platform aids in boosting transparency and helps individuals or companies confirm that they’re dealing with a legitimate, legally recognized enterprise.

Who Can Use the Wisconsin Business Search?

Almost anyone can access this business search feature, from small-business owners to large corporations looking to vet new partners. In fact, it’s open to real estate professionals, attorneys, and financial institutions who require up-to-date information about a desired business. Even individuals curious about a neighborhood shop’s legitimacy can benefit.

Because it’s publicly available, the search helps prospective investors, future employees, and out-of-state entrepreneurs confirm they’re not overlooking critical legal details. Whether you’re an existing stakeholder or a prospective collaborator, conducting a simple lookup can save time, mitigate risk, and facilitate better decision-making.

Types of Businesses Listed in the WI SOS Database

The Wisconsin Secretary of State’s database contains an assortment of business services that operate or have filed in the state:

- Limited liability companies

- Corporations

- Nonprofits

- Partnerships

- Sole proprietorships (with formal registrations)

These records often include contact data, formation dates, and historical filings. Additionally, if you’re looking for specific records tied to compliance, you can find notes on whether an existing business is active, delinquent, or has undergone name changes. Reviewing this information can help you see if a wisconsin company aligns with your project goals and meets Wisconsin’s naming guidelines.

ZenBusiness Search Wisconsin Business Names

ZenBusiness helps you verify name availability and navigate the Wisconsin Department of Financial Institutions database.

Wisconsin Secretary of State Business Search Contact Information

If you need further assistance or have questions about the secretary of state business lookup tool, the Wisconsin Secretary of State’s office can provide support. They can advise on technical issues or clarify how to use the portal:

- Address: Office of the Secretary, 30 W. Mifflin Street, Madison, WI 53703

- Phone: (608) 266-8888

- Email: send email

- Official Website: https://sos.wi.gov

How to Conduct a Wisconsin Business Search (Step-by-Step Guide)

Looking up a company’s credentials helps you stay informed, avoid potential scams, and confirm legitimacy. The search process is straightforward once you know which route to take. Follow the steps below to make the most of Wisconsin’s business entity search system.

Step 1: Access the Wisconsin Business Search Portal

Begin by visiting the official Wisconsin search tool. For those expanding beyond Wisconsin, a Tennessee business entity search provides a similar way to verify corporate details in that state. This is maintained by the wisconsin department of financial Institutions and includes comprehensive records of local organizations. Once there, you’ll see options to start your query based on multiple criteria. Make sure you have your target name, ID number, or agent information ready for quick results.

Step 2: Select the Appropriate Search Method

Different paths let you focus on the exact information you need. If you only know the business name, type it in to see matching entities. Alternatively, use the entity number or agent name to streamline your process. Select the most suitable approach to narrow your results.

Business Name Search

For those seeking a basic wisconsin business name search, simply type in the exact or partial name. The system will pull any matching results, displaying details on formation date and status. If multiple records come up, be sure to compare addresses or ID numbers to identify the correct listing.

Entity ID Search

If you have a unique filing ID, inputting it here can retrieve the right listing in seconds. Additionally, if you need to identify a business through its tax records, you can find a company with EIN using an official lookup tool. This company search tactic is useful if you already know the identification number assigned by the department of financial institutions, reducing the chance of confusion with similarly named companies.

Registered Agent Search

Use this approach if you know who represents the business for legal or official correspondence. Searching by registered agent is especially helpful if the same person or office manages multiple filings, letting you explore each entity tied to that agent’s name. Detailed results often show the principal office address or other compliance notes. the company’s official name, rely on the name-based lookup to zero in on possible matches.

Step 3: Enter Search Criteria and Interpret the Results

Input your chosen terms and hit enter. You’ll see a list of matches, each describing the entity type, registration status, and possibly the date of formation. If there are multiple entries with the same title, click on the specific record you need. Interpreting your findings involves confirming the business is indeed the correct one and noting whether it’s active or in good standing.

Step 4: View and Verify Business Details

Next, select the record to open a profile page, where you’ll see addresses, official contact data, and any relevant filing history. Checking these listings confirms if the desired llc or corporation is still valid under Wisconsin law. It’s also a good time to confirm alignment with your objectives, from verifying leadership to ensuring the entity meets local guidelines.

Step 5: Download Business Reports and Official Records

Finally, you can retrieve official documents like an annual report or articles of organization. These files often contain legal or financial details that could be crucial to closing a deal. Downloading them provides an offline record you can consult or share with partners. Always cross-check current documents against older versions to see if any changes might impact future decisions.

Wisconsin Corporation Search: What You Need to Know

When looking specifically for corporate data, keep in mind that Wisconsin categorizes business registration details according to legal structure. Whether you’re verifying compliance or exploring potential investments, it helps to understand the state’s approach to corporate records.

Difference Between LLC, Corporation, and Other Entities in Wisconsin

Wisconsin businesses can form under various structures, each with distinct governance and liability considerations:

- Corporation: Often has shareholders, a board of directors, and is subject to more formal reporting requirements.

- LLC (Limited Liability Company): Combines limited liability with flexible management, typically requiring fewer formalities.

- Nonprofits: Organized for charitable or public benefit, subject to special tax rules.

- Partnerships: General or limited partnerships that share profits and losses among partners.

No single form suits everyone. An llc in wisconsin might be ideal for entrepreneurs seeking flexibility, whereas a corporation may better accommodate larger expansions or investment strategies. If you're also considering business opportunities in nearby states, an Illinois company search can help confirm business registrations there.

How to Search Specifically for Corporations

A wisconsin corporation search focuses on entities registered as C-corps, S-corps, and other corporate forms. When using the portal, include terms like “Corp” or “Inc” alongside the name if you’re dealing with a large corporate entity. This approach filters out LLCs or partnerships, providing you with a curated list of corporations only. You can also filter by ID or agent details if you want to skip partial matches and jump straight to a verified record.

Understanding Business Status (Active, Dissolved, Delinquent, etc.)

When conducting a corporate records search, you’ll notice statuses indicating the organization’s legal standing:

- Active: Current on state filings and permitted to operate

- Dissolved: Formally ended operations or merged with another entity

- Delinquent: Missed key filings or fees, risking additional penalties

- Suspended: Temporarily barred from certain transactions due to noncompliance

Confirming this status helps you see if a based in wisconsin corporation is still viable. A delinquent or dissolved listing might require further investigation, especially if you plan to invest or partner with that business.this list of the best LLC names to choose a name that’s both unique and compliant.

Northwest Registered Agent Wisconsin Name Search Tools

Northwest Registered Agent provides expert guidance on Wisconsin business name searches and state compliance.

How to Verify a Business in Wisconsin

Confirming legitimacy often extends beyond a simple availability search in the state registry. If you want a more thorough background, consider multiple data points:

- Check the business’s license or permit records

- Contact the office of the secretary for formal documentation

- Review references or industry certifications

- Examine online reviews or professional networks

After validating a Wisconsin business register listing, you can compare findings to other government sites, like the local tax agency or city licensing board. To maintain compliance, selecting the best Wisconsin registered agent ensures proper handling of legal and tax documents. This extra effort ensures that the enterprise you’re examining meets regulatory criteria, maintains updated filings, and upholds ethical business practices. As a result, you minimize risk and gain peace of mind for any future collaboration.

How to Check Business Name Availability in Wisconsin

Making sure your prospective business name is unique is essential before you register your business with the state. Start by doing a preliminary lookup to see if any identical or closely related names are already taken.

- Perform an initial query in the official business entity search database.

- Consider synonyms or small variations if your first choice is unavailable. Looking for inspiration? This list of LLC name examples provides creative and compliant ideas to help you find the perfect business name.

- Confirm the name abides by Wisconsin’s naming guidelines, avoiding restricted words or misleading terms.

Once you find a name that’s not in use, you can move forward with an availability search to finalize your selection. To ensure your business name is unique across multiple jurisdictions, follow this guide on how to check LLC names for a detailed verification process. If the database confirms no conflicts, filing a reservation or forming your company helps lock in your chosen title. Promptly securing your name can prevent others from claiming it while you prepare other essential paperwork.

How to Register a Business in Wisconsin (Step-by-Step Guide)

Starting a venture in Wisconsin involves a few structured steps. By following the guidelines carefully, you’ll set up your operations properly, ensuring long-term success in the state’s market. For a complete guide, follow this step-by-step process to start an LLC in Wisconsin and ensure compliance with state regulations.

Step 1: Choose a Business Structure (LLC, Corporation, Sole Proprietorship, etc.)

Your choice of structure affects taxation, liability, and operational flexibility. For example, a limited liability company provides personal asset protection while requiring fewer formalities. Corporations can attract investors more easily but adhere to stricter governance. Meanwhile, sole proprietorships offer simplicity but no separation between personal and professional finances.

- Assess your growth goals

- Consult a professional if unsure

- Balance liability protection with administrative responsibilities

- Decide if local rules favor a corporation or other setup

Step 2: Perform a Name Search and Reserve the Business Name

Use the wisconsin business entity lookup to ensure the name you want isn’t taken. If it’s free, you can reserve it for a small fee to prevent others from registering it first. This step is crucial for branding and credibility, especially if you’ve already planned marketing campaigns. Once your desired business name is confirmed, proceed with formal formation.

Step 3: File Business Formation Documents with the Wisconsin DFI

Complete the relevant paperwork—such as articles of organization for an LLC—to legally form your enterprise. Submit these to the wisconsin department of financial Institutions. They handle the business register and will confirm your approval. Processing times may vary, but you can often expedite for an extra fee if you need a quicker response.

Step 4: Obtain Necessary Business Licenses and Permits

After formation, visit the Wisconsin One Stop Business Portal at https://openforbusiness.wi.gov to see if your industry requires special authorizations. Failing to comply with permit requirements can halt operations or result in penalties. Stay informed of any local or federal mandates that may apply to your sector.

Step 5: Register for Wisconsin State Taxes and Obtain an EIN

Register your company with the Wisconsin Department of Revenue if required, then secure an Employer Identification Number (EIN) from the IRS if you plan to hire employees or open a business bank account. This step ensures proper tax categorization and helps streamline financial reporting.

Step 6: Ensure Compliance with Ongoing State Requirements

Beyond initial formation, sustaining compliance is vital for long-term viability. Keep track of renewal deadlines and respond to state notices promptly.

- File your annual report

- Update any changes to your registered agent or business address

- Maintain accurate corporate records

- Stay current with evolving regulations

By consistently monitoring these details, you safeguard your standing and avoid costly reinstatement processes or penalties down the line.

Compare liability protection, tax advantages, and management requirements between LLCs, corporations, and sole proprietorships to find the best fit for your business goals.

Use the Wisconsin Department of Financial Institutions database to confirm name availability and consider reserving it for up to 120 days while you prepare other formation documents.

File your Articles of Organization (LLC) or Articles of Incorporation with the Wisconsin Department of Financial Institutions, either online or by mail with the appropriate filing fee.

Research industry-specific requirements through the Wisconsin One Stop Business Portal and obtain all necessary state, county, and municipal permits before commencing operations.

Apply for your Federal Employer Identification Number with the IRS and register with the Wisconsin Department of Revenue for state tax obligations including sales tax if applicable.

Calendar important deadlines for annual reports, license renewals, and tax filings to ensure your business remains in good standing with Wisconsin authorities.

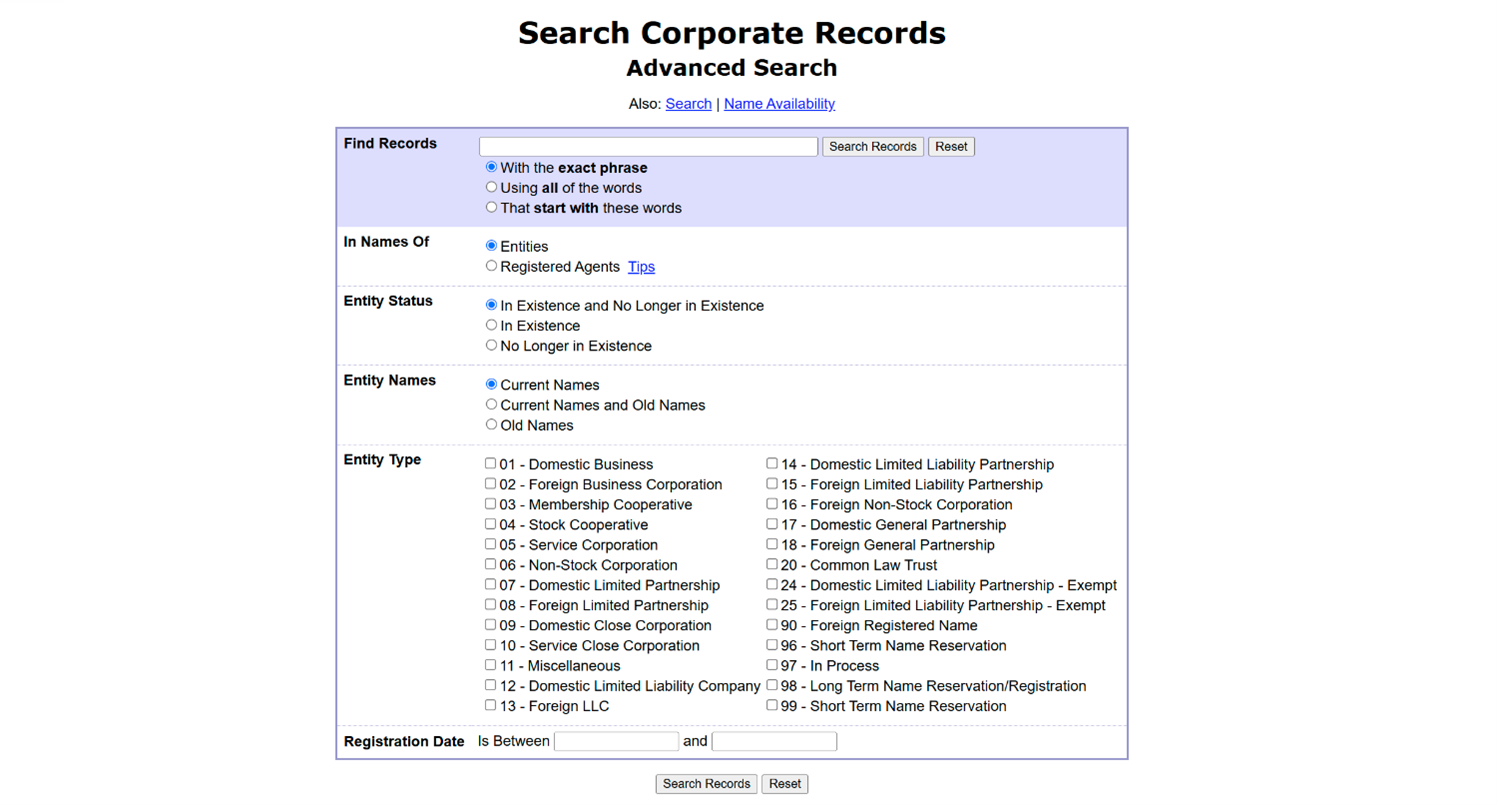

How to Perform an Advanced Wisconsin Business Search

An advanced search can be invaluable when you need deeper insights into an entity’s background or history. Rather than relying on basic name or ID lookups, you can target specific data points:

- Filter results by entity type, like domestic LLC or foreign corporation

- Narrow searches based on formation date or location

- Review corporate amendments to see if the organization changed names or statuses

With these added filters, you can pinpoint records that match your criteria without sifting through irrelevant listings. This approach is especially useful for investors evaluating multiple proposals, or for professionals checking if a business has merged with another. Conducting a meticulous investigation reveals hidden links, dormant connections, or other critical aspects. By leveraging these advanced features, you gain a well-rounded picture of any entity you’re considering, ensuring your decisions are based on the most current and comprehensive data possible.

Resources Available for Wisconsin Businesses

Wisconsin offers a range of tools and organizations to assist companies at each stage of development. Whether you’re new in town or an established player, utilizing these resources can help refine strategies and ensure regulatory compliance.

- Wisconsin Small Business Development Center (SBDC) for personalized consulting

- Wisconsin Economic Development Corporation (WEDC) for grants and funding

- Chambers of Commerce across various cities to foster networking

- Online training programs for skill enhancement and management tips

Beyond these entities, you can also visit the wisconsin official government websites for additional support materials. Taking advantage of every available channel not only improves your operational knowledge but also connects you with professionals who can offer guidance. This holistic approach paves the way for sustainable growth while aligning you with the state’s dynamic business ecosystem.

FAQ About Wisconsin SOS Business Search

Here are the most common questions about Wisconsin’s records lookup process. Each response aims to be succinct yet comprehensive, giving you straightforward insights and ensuring you can make informed decisions.

Yes. Anyone can access the official business registration database without paying a subscription fee. Some documents, such as certified copies or special filings, may involve nominal charges. However, basic information—like a business’s name, formation date, and current status—typically remains accessible at no cost. This user-friendly model encourages transparency, allowing entrepreneurs, investors, and consumers alike to confirm an entity’s legitimacy before entering contracts or partnerships.

Updates generally occur on a rolling basis as new filings, renewals, and changes reach the department of financial institutions. In most cases, the platform reflects these adjustments within a few business days. High-volume periods—like tax seasons or license renewals—can introduce slight delays. Despite this, the database is considered quite reliable for up-to-date corporate and limited liability company records. If you need immediate confirmation, try contacting the Secretary of State’s office or checking directly with the relevant DFI division.

First, double-check the spelling or any punctuation in the entity’s name, as slight variations can affect results. Next, try an alternative search approach—like the corporate records search via ID or agent details. If the business still doesn’t appear, it may be registered under a different legal name or might have dissolved. For those operating across multiple states, checking an entity’s status in another jurisdiction, like conducting a New York LLC status check, may provide additional insights. In some instances, records could exist in local licensing databases instead. When in doubt, contact the office of the secretary or consult legal counsel to ensure thorough verification.

To make changes, submit amended filings through the wisconsin department of financial Institutions website. Depending on your entity type, you may need to file specific forms—like Articles of Amendment or an annual update. Double-check any corresponding fees and deadlines, particularly if you’re modifying a registered agent or principal address. Once processed, the revised details should appear online. For critical updates, it’s advisable to confirm receipt with the DFI or follow up if you see no changes after a reasonable time frame.

Business owner data, like membership or shareholder names, often appears in initial formation documents but might not always be accessible through a standard company search. For deeper insights, you can review original filings, such as the Articles of Incorporation or articles of organization, which sometimes list key individuals. Nonetheless, not all ownership details are publicly available, especially for certain private entities. If the information is critical, you may need to request additional documentation or consult an attorney for more in-depth research.

Most newly formed ventures show up in the database within a few business days of finalizing their paperwork. Delays can happen if there’s an issue with the filing or if the state experiences high submission volumes. If you don’t see your listing within a week, it’s wise to reach out to the DFI and confirm that all documents were processed correctly. Ensuring prompt inclusion is essential so that clients, partners, and regulatory bodies can verify your legitimacy without confusion.

Looking for an overview? See Wisconsin LLC Services

Harbor Compliance Wisconsin SOS Search Support

Harbor Compliance offers comprehensive Wisconsin business entity searches and helps protect your business identity.