Choosing the right name for your business isn’t just about creativity; it’s about strategy. Whether your current name no longer aligns with your goals or you’re testing new markets, a DBA (Doing Business As) offers the flexibility you need. By allowing businesses to register under trade names while maintaining their existing structure, this simple process is perfect for entrepreneurs and companies looking to adapt and grow.

A DBA provides a cost-effective way to rebrand or expand without creating a new legal entity. It lets businesses and sole proprietors file for a DBA to legally operate under alternate names, enhancing branding and market testing while ensuring privacy for owners.

In this guide, we’ll break down everything you need to know about DBAs, including how to file for one, the legal requirements to register your business, and the benefits of using trade names. Whether you’re focused on building content strategies, protecting your privacy, or simplifying compliance, this tool can give your business the edge it needs. Let’s explore how a DBA can unlock new opportunities for your venture.

Understanding DBA (Doing Business As)

Many entrepreneurs use a fictitious business name to project an alternate brand identity without creating a whole new legal structure. This approach, known as a DBA, helps distinguish your enterprise from your personal name or existing company details. By operating under a separate title, you can expand into new niches, test markets, or boost marketing appeal.

What does DBA stand for and when is it required?

The acronym DBA, meaning “doing business as“, allows companies to operate under a fictitious name that differs from their legal or registered one. Whether you’re a sole proprietor wanting to distinguish your personal identity from your business structure, or a company exploring new product lines, a DBA simplifies this transition.

In many states, filing for a DBA is legally required if the name you use doesn’t match your official records. For example, if John Smith runs a consulting firm as “Smith Innovations,” he would likely need to file a DBA to ensure compliance. This step not only prevents confusion for customers but also ensures public records accurately reflect who’s behind each venture.

Register Your DBA Hassle-Free

ZenBusiness makes filing a DBA simple, allowing you to operate under a new business name while staying legally compliant.

How a DBA differs from a business’s legal name

A DBA is simply an alias, while your official legal name is what’s listed in state documents or on your initial formation paperwork. For a sole proprietorship or partnership, that often means your personal name, but for an LLC or Corporation, it’s the one used in your articles of organization.

Using a DBA doesn’t create a separate legal entity, so the underlying owner remains legally responsible for the obligations and debts of the enterprise. If you’re curious about naming inspiration, check out these company names examples to spark fresh ideas.

DBA vs. trade name vs. trademark: Key distinctions

Although many use “DBA” and trade names interchangeably, they serve different purposes. A DBA (Doing Business As) is the registered process that legally allows your startup or business to operate under a name other than its legal or limited liability structure. It ensures compliance with local regulations and enables you to use the name in commerce.

On the other hand, a trademark offers a higher level of protection for your brand. It safeguards unique identifiers like logos, slogans, or brand names, preventing competitors from using anything similar within your industry. While a DBA or trade name is more about formalizing your business's public identity, a trademark secures exclusive rights to your intellectual property, adding a critical layer of protection for long-term growth.

Below is a quick table summarizing these differences:ations, income tax return submissions, and any relevant compliance checks.

If you need nationwide safeguards, you’ll likely move beyond basic DBA filings to full trademark registration.

Who Should Register a DBA?

Certain entrepreneurs find a DBA especially helpful, whether they want to differentiate their brand or keep personal details separate. Before you commit, consider how your sector might benefit from multiple identities or if you aim to test fresh markets under a distinct name.

Entrepreneurs and small business owners looking for brand flexibility

Often, a business owner wants to launch new product lines or rename portions of the company without altering the main entity. Filing a DBA helps them keep the original structure intact while exploring new angles. You might do this to introduce specialized services or to rebrand quickly in different regions.

That said, typical reasons for pursuing a DBA include:

- Trying out a new marketing concept with minimal risk

- Creating a more approachable identity for your consumer base

- Maintaining cohesive branding across online and offline channels

Because a DBA is simpler than reincorporating, many find it a user-friendly path to adaptability. Additionally, if you are based in Pennsylvania, you might benefit from understanding how to start an LLC in Pennsylvania to expand your operational flexibility.

Sole proprietorships and general partnerships needing a formal name

Owners who choose sole proprietorships or a sole proprietorship or partnership arrangement can find a DBA invaluable. Instead of relying on your personal name in ads, you can finalize a more professional image. This upgrade can boost credibility with clients, as it conveys that you’re not just an individual but a dedicated venture ready to serve customers’ needs. A DBA can also keep your personal brand distinct from your commercial persona. Additionally, many small business owners recommend using Incfile for efficient and reliable filing services.

LLCs and corporations testing new markets without a separate entity

If an LLC or corporation wants to roll out a new line of goods without forming another entity, registering a DAB might be the trick. Furthermore, if your business operates in Virginia, you may benefit from learning how to start an LLC in Virginia as a strategic next step for expansion.

This way, you can dabble in new arenas or rename certain divisions without spinning off a brand-new corporation. It’s an easy method to adapt to shifts in audience demand, especially when you’re uncertain if a new product or service will thrive.

In many cases, the state doesn’t require a DAB to test the waters, but going through a formal name registration often prevents confusion down the road. By clarifying your distinct brand, you avoid messy overlaps or challenges with existing trademark holders.

E-commerce sellers and online businesses creating different store brands

Digital sellers frequently juggle multiple store identities. By choosing separate DBAs, you can keep your main parent entity discreet while establishing unique storefronts. If you run various niches—like electronics and apparel—it can be simpler to maintain each brand’s presence under a stand-alone name. For businesses in Iowa venturing into multiple niches, exploring how to start an LLC in Iowa can streamline your brand organization.

Although it’s easy to skip the paperwork, remember that states can still demand certain steps for you to be fully legal. Set up a DBA in your location so you remain aligned with local laws, then manage day-to-day marketing or inventory under that chosen brand label.

Expand Your Brand with a DBA

Northwest Registered Agent helps you secure a DBA, protecting your business identity while giving you the flexibility to grow.

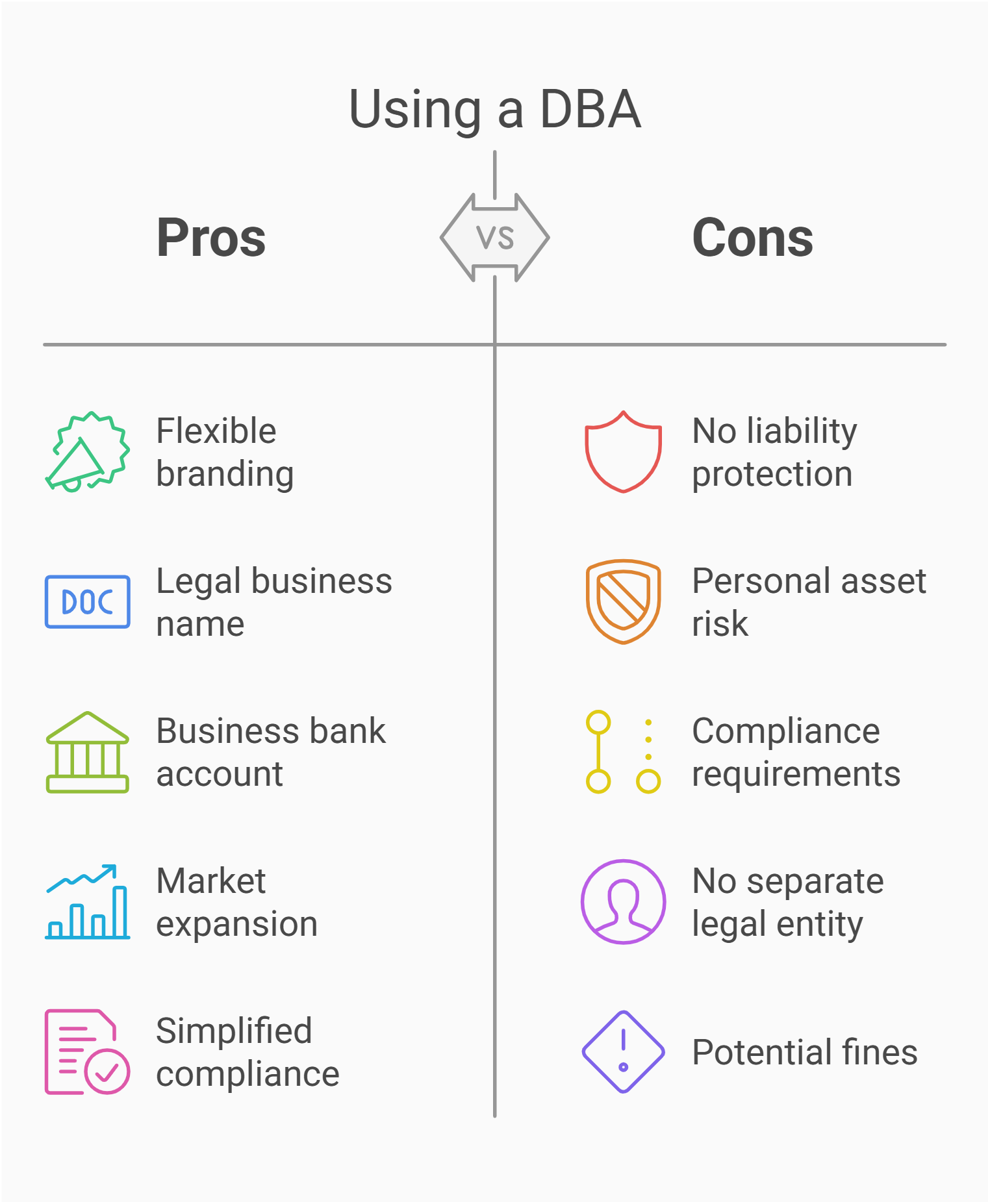

Advantages and Limitations of a DBA

Filing a DBA can save time and open doors for flexible branding, yet it doesn’t provide the same level of protection as forming a separate business entity. Whether you’re a micro-operation or a flourishing enterprise, balancing benefits and constraints helps you decide if this approach is the right fit.

Legal use of a business name without forming an LLC or corporation

Registering a DBA permits you to operate under a fictitious name even if you stick with a business as a sole trader. This solution is appealing if you prefer to avoid the complexities of an LLC or corporation right now. For instance, if john doe operates a small bakery on the side, he can adopt “Doe’s Delicious Pastries” as a public-facing brand.

It’s important to remember that using a DBA doesn’t shield personal assets. Because it lacks the liability protection that a formal structure offers, you’re still personally responsible for the enterprise’s debts. That trade-off might be acceptable if you’re comfortable with straightforward ownership and fewer compliance steps. For entrepreneurs considering professional assistance, exploring ZenBusiness reviews can offer valuable insights into service quality and support.

Ability to open a business bank account under the DBA name

Many banks require official documents to confirm that your brand name is legitimate. Hence, a properly recorded DBA can help you secure a business bank account labeled with your new identity. This measure might be critical for receiving credit cards or loans, as financial institutions often want proof of your official status.

Along with boosting credibility, having a separate account simplifies tracking finances. Whether you deposit sales or pay suppliers, the DBA name can appear on statements, preventing confusion among vendors and partners. Even large institutions like Bank of America often request a copy of the DBA certificate before opening specialized accounts.

Using a DBA for Branding and Market Expansion

A DBA (Doing Business As) is a versatile tool for startups and established businesses looking to expand into new activities or launch niche products without altering their main legal structure. For example, a company might want to introduce a global product line under a fresh design while maintaining its existing brand. This approach allows businesses to test new markets and benefit from greater flexibility without the need to form multiple registered entities. By keeping your core operating structure intact, you can adapt quickly to market trends and create a distinct presence in your industry. For those considering a transition to a more formal business structure in the future, exploring how to create an LLC can provide a clear roadmap for enhanced legal protection and growth.

Compliance with State and Local Regulations

To ensure accuracy in public records, many states require businesses to file a DBA. This often involves submitting documents to a county clerk’s office, placing notices in a local town newspaper, or meeting specific requirements outlined by state authorities. For instance, a sole proprietor named John Smith starting a landscaping business under the name “Green Town Solutions” would need to apply for a DBA to operate legally. Staying compliant prevents potential fines, disruptions, or complications when seeking banking services or acquiring licenses for respective business activities.

Does a DBA Provide Legal Protection or Liability Coverage?

It’s important to understand that a DBA does not create a separate legal entity or provide liability coverage. Unlike an LLC or corp, a DBA does not shield personal assets from lawsuits or financial claims. This means that while a DBA is ideal for branding or expanding into trading or franchise markets, it does not replace the protections offered by incorporated entities. For businesses with higher risk factors, consulting a legal expert or platforms like LegalZoom to determine whether an LLC is a better fit is often a wise decision.

How to Register a DBA: Step-by-Step Guide

Whether you’re starting fresh or expanding an existing endeavor, filing a DBA can add a layer of flexibility and brand clarity. Typically, the process isn’t daunting, though each state and county can differ slightly. Follow local rules carefully to keep your brand official and recognized.

Step 1: Checking name availability and legal requirements

Begin by ensuring that no other business entity is already using your desired name. For those operating in Arizona, it might be beneficial to examine Arizona LLC creation guidelines to further secure your business framework. Check with state databases or contact local offices for a quick verification. If you discover overlap, you may need to tweak your name or add unique wording to stand out. Keep in mind that certain states also demand no conflict with fictitious business names already on file.

Before finalizing your choice, consider obtaining an employer identification number (EIN) if you don’t have one, particularly if you want to manage employees or separate business finances. The SBA offers more guidance in these resources. Double-check city or county-level demands to ensure you won’t face unexpected hurdles.

Step 2: Filing at the state and county level

Once you confirm the name, you submit a dba application to the appropriate government office—often your secretary of state or a county clerk. Requirements can vary, but typically you complete a form, list your official name and address, and pay the filing fee. Some regions also request that you publish a notice in a local paper so the public is informed.

In places where an assumed name certificate is standard, you’ll fill out the details indicating your official identity and your chosen DBA. After that, hold on to your proof of acceptance in case you need it for future tasks like opening bank accounts or verifying brand credentials.

Step 3: Costs, renewals, and what happens if your DBA expires

Expect a modest filing fee for the initial registration, although fees can rise if you skip deadlines or handle multiple DBAs simultaneously. Over time, you may need to renew your DBA every few years, ensuring your brand name stays active. If you let it lapse, you might lose the right to conduct business under that name until you file again.

Should your DBA expire, you could face interruptions if vendors or customers rely on that brand identity. In certain cases, skipping renewal might lead the state to mark your name as available, allowing someone else to snag it. So track your deadlines carefully and keep reminders in place to avoid losing a valuable brand asset.

Ensure no other business is using your DBA name. Search your state’s database for conflicts.

Submit your DBA registration with the appropriate state or county office. Some states require public notice.

Most DBAs require renewal every few years. Missing deadlines can lead to business name loss.

Tax and Compliance Considerations

Registering a DBA doesn’t transform your tax obligations, but it can influence paperwork, especially for certain local rules. For an overview of relevant taxes, check the IRS site. Ensuring you handle these details correctly prevents confusion and potential penalties.

How does a DBA affect taxes and business accounting?

Even under a new name, your entity remains the same for tax reporting. This means you still declare income and expenses under your existing structure, whether you’re a sole proprietor or a formal company. The DBA simply changes what brand name appears on receipts or marketing. From an accounting standpoint, it’s wise to keep separate logs or even open a distinct bank account for the DBA to simplify recordkeeping. This might prompt some entrepreneurs to consider why start an LLC without a business as an alternative strategy to simplify tax and legal obligations.

Occasionally, a business administration office might require an additional license for each DBA if you’re running multiple lines. Nonetheless, standard federal and state taxes remain tied to your original entity. The DBA only modifies brand appearance, not your underlying tax ID or obligations.

Can multiple businesses operate under the same DBA?

In some states, multiple ventures can share a single DBA name, but it can complicate your management if each product line or store location has different service offerings. If you want clarity and brand distinction, it’s often better to create separate DBAs for each concept. Overlapping everything under one name might cause confusion or hamper targeted marketing campaigns. Ultimately, it’s typically simpler to keep each brand identity separate for easier tracking and improved credibility.

DBA restrictions and compliance challenges by state

Every region has distinct policies on DBAs, from mandatory newspaper publications to sign-offs by the local clerk. Some states might impose extra conditions if you’re in a specialized field, like medical or legal services. For instance, entrepreneurs in Utah may consider reviewing how to form an LLC in Utah to align with state-specific requirements and further secure their business identity.

Meanwhile, certain counties want more frequent updates, or they’ll purge your registration from their systems. If you plan to expand into multiple regions, research each area’s legally required steps. This ensures your brand name doesn’t conflict with existing ones or violate local naming laws. Missing these details can lead to fines or even forced rebranding, so verifying compliance is worth the effort upfront.

FAQ – Common Questions About DBA Registration

Whether you’re an established entity or just starting out, the concept of “doing business as” triggers plenty of queries. For further help with launching a venture, see these guidelines.

It depends on whether you use a name different from your official credentials. If you call yourself “Sunrise Creative Solutions” but your legal name is something else, you might have to set up a DBA. Some states demand it if you’re using distinct fictitious business names for your services or marketing. Meanwhile, if you’re comfortable just using your personal name, you may not need the extra step. Either way, a DBA can polish your brand image, especially for online sales or digital consulting.

Yes, many states permit an LLC or corporation to adopt several DBAs simultaneously. This approach works best if you want to run separate brands under one umbrella without forming new business entities for each. It helps if you ensure each name meets distinct marketing or operational goals. Just confirm each meets your local or state’s guidelines, so you don’t accidentally infringe on another brand or skip an essential step in the registration process. For those seeking robust liability protection at minimal cost, exploring cheapest way to get LLC and EIN could be a smart move.

In numerous regions, the registration stands until it’s canceled or revised, but some require periodic renewals. If your state demands an update, you might renew every few years or whenever major changes occur. Here are the core points to remember:

- Stay alert for expiration dates set by local rules

- Re-file if you change addresses or ownership details

Failing to do so might lead to losing legal status for the DBA or incurring penalties.

Yes. You can shift from a DBA to a formal entity when you’re ready for additional legal structure or want liability protection. For entrepreneurs in Illinois looking to upgrade their business structure, consider exploring how to start an LLC in Illinois for detailed guidance on forming your new entity. At that point, you’d form the entity officially, then transfer brand assets from the DBA arrangement to the new entity. If you choose that path, confirm each step so the transition is seamless and consistent with your region’s guidelines.

That choice often hinges on your growth plans and legal protection concerns. A DBA can suffice if you’re launching a side gig or a small-scale operation that doesn’t demand the full liability shield of an LLC. For a deeper comparison, see DBA under LLC pros and cons. If you expect rapid expansion or risk exposure, though, forming a separate entity might be smarter to preserve personal security.

Stay Compliant with Your Trade Name

Harbor Compliance streamlines DBA registration, ensuring your business operates legally under its new name.