Are you planning to start a business in Minnesota and want to make sure your company name is still available? Wondering how to verify if another business is active, dissolved, or in good standing before signing a contract or forming a partnership? Looking for official documents to confirm a company’s legal status?

The Minnesota Business Search is a free tool provided by the Secretary of State that lets you look up any registered business in the state by name or file number. You can check if a business is active, confirm its registered agent and address, view public filings, and verify compliance status—all in one place. It’s also the quickest way to see if your desired LLC or corporation name is available before filing.

In this guide, you’ll discover:

- How to perform a business entity search step by step

- The difference between name availability and entity lookup

- What information is included in Minnesota business records

- How to confirm if a company is in good standing or legitimate

Ready to navigate Minnesota’s business database like a pro? Let’s jump in and explore how the search tool works!

What Is the Minnesota Business Search and How Does It Work?

Minnesota provides an online business entity search tool through the Minnesota Secretary of State, allowing you to look up registered businesses quickly. Whether you want to confirm a company name, check if your desired LLC name is taken, or investigate an existing corporation, this system has you covered. By entering basic details—like a keyword or file number—you can see a list of relevant entities and review their current status. This simple step can save you major hassles if you’re planning to launch a minnesota llc or join forces with someone else’s venture.

Difference between business entity search and name availability

While both processes involve Minnesota’s online portal, they serve distinct purposes:

- Business Entity Search: Lets you look up all the registered organizations in the state. You can select search using their official company name, registered agent, or file details to gather background info, including physical address and formation date.

- Name Availability: Focuses on whether your desired moniker is free for new llc and corporation filings. This check helps you avoid picking a name that mirrors another active enterprise.

- Exact match vs. partial match: For entity lookups, you can enter all or part of a name. If you need only an exact match, refine your query to those specific words you entered.

- Assumed Name Verification: Some businesses register an “assumed name” or DBA, so double-check these records too if you suspect multiple brand identities.

If your goal is to see if someone already uses a certain label, stick to the name availability function. Conversely, if you want in-depth status or historical data on a known company, an entity search is more suitable.

Who needs it: entrepreneurs, partners, legal professionals

Many individuals and organizations rely on the minnesota business search for various reasons:

- Entrepreneurs: When forming a startup or a limited liability entity, verifying name availability is a must.

- Potential Partners: Before investing in or merging with another venture, confirm they’re in good standing and lawfully entered in their business records.

- Legal Professionals: Attorneys, paralegals, and even court administration staff consult these listings to check official statuses, discover ownership details, or gather evidence for legal proceedings.

- Marketers & Researchers: Some people mine the data to compile a list of all newly formed companies, analyzing trends or planning outreach campaigns. You can also conduct a Kansas business search to access similar data for entities registered in that state.

- Current Owners: If you already operate a firm, you might revisit your record to ensure the state’s listing matches your updated street suite address or newly added members.

Regardless of your role, understanding these public records can protect you from unknowingly partnering with defunct or fraudulent companies.

Start your Minnesota LLC today

Form your Minnesota LLC fast with ZenBusiness. Quick online filing, name availability check, and $0 starter plan available.

Step-by-Step: How to Search for a Business in Minnesota

Before entering a contract or picking a minnesota business name for your venture, it’s smart to confirm the company’s authenticity. Minnesota’s system is straightforward once you know where to go and what to input. Below is a quick guide to help you land on the right page and gather the info you need without any missteps.

Step 1 – Go to the Minnesota Secretary of State’s Business Filings portal

Begin by visiting the secretary of state business website for Minnesota. You’ll usually find a search page labeled “Business & Liens” or “Business Filings.” Look for the search bar or link directing you to “Search for a Business.” This portal is the official location to verify registered businesses and glean critical data like status, registered agent, and formation date. If you're setting up your company soon, consider choosing the best registered agent service to stay compliant from day one.

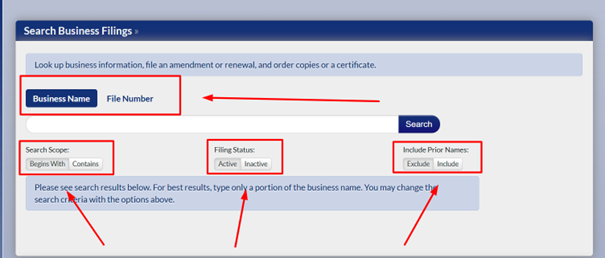

Step 2 – Choose your search method (name or file number)

The interface often offers multiple ways to proceed. You can type in a company name—either partial or exact match—in the search bar to locate potential results. Alternatively, if you have the entity’s file number, that’s typically more precise. Selecting “Select Search by File Number” helps you hone in on the exact record without sifting through multiple listings.

Step 3 – Filter by status or entity type if needed

If the search yields too many results, refine them by specifying filters like “Active Only,” “Inactive,” or “llc and corporation” type. This approach helps you focus on relevant data. If your interest is purely in active minnesota llc listings, you can zero in on those records. The tool also sorts by name or date, so use these features to see a list of entities that match your criteria more effectively.

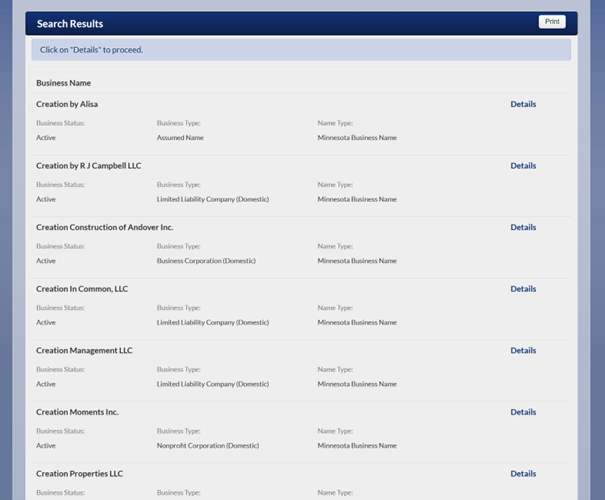

Step 4 – View business profile: status, agent, filings

Click on any matching record to access the entity’s full profile. Here, you’ll see their registered agent name and physical address, filing dates, renewal deadlines, and whether they’ve maintained good standing with the minnesota secretary of state. Reviewing these details ensures you know if the venture is compliant, or if it has missed key filings or fees with the Minnesota Department of official records. For deeper due diligence, you might also want to find a company EIN to validate tax information tied to the business.

Step 5 – Request documents or certificates if required

If you need more than a quick overview—like a copy of incorporation paperwork or a certified certificate—most pages let you order documents for a small fee. Having official paperwork can be crucial if you’re verifying ownership, presenting evidence to court administration, or building a client relationship. Keep these records organized as part of your business due diligence.

Information You’ll Find in a Minnesota Business Record

When you search a minnesota business entity, the result typically includes a robust snapshot of the organization’s fundamentals. This data offers insight into the company’s legitimacy and track record, ensuring you have the necessary facts before finalizing deals or proceeding with your own registration.

Expect to see:

- Official Business Name: The legal name as it appears on state filings, including any assumed name or DBA.

- Physical Address: May show a street suite address or principal office location.

- Registered Agent: Identifies who’s authorized to receive legal notices, plus that agent’s address.

- Filing History: Includes creation date, last renewal date, and any changes entered in their business details.

- Status & Standing: Indicates whether the entity remains active, inactive, or dissolved for non-compliance.

- File Number: A unique state-generated ID used to verify the entity.

With these pieces, you gain clarity on whether the company is legally in operation or if it’s missing essential steps to remain valid in saint paul or beyond.

How to Check Business Name Availability in Minnesota

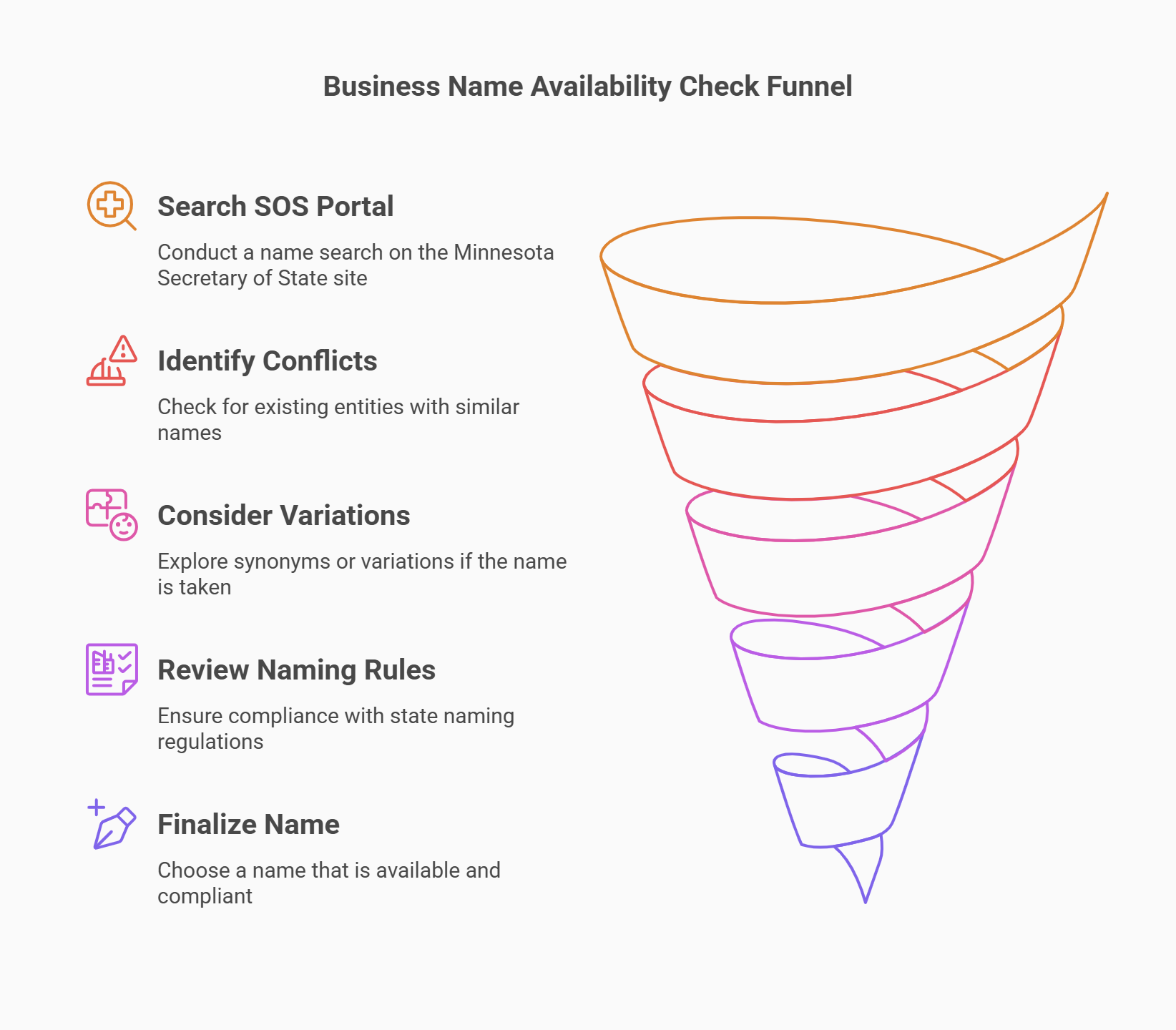

If you’re eyeing a fresh name for your minnesota llc or corporation, verifying that no other firm is using it is step one. Failing to confirm this can lead to confusion, rebranding expenses, or even legal disputes down the line.

Using the SOS portal to search for available names

You can perform a dedicated name availability lookup on the Minnesota Secretary of State site, separate from the typical business entity search. Once there, enter all or part of your proposed business name. If the system finds a conflict, you’ll see suggestions or an alert that words you entered match existing entities. For an exact match, you must pick a different moniker. Because minnesota has many registered businesses, consider variations or synonyms if your first choice is taken. You might also explore how naming checks work in other states, like the Wisconsin business entity search tool for comparison.

Naming rules and restricted terms for Minnesota entities

State rules exist to prevent misleading or duplicated business names. For example:

- Inclusion of Entity Type: If you form a limited liability entity, you usually need “LLC” or “L.L.C.” in the name. You can see how different naming laws apply by checking the California business lookup for stricter regional naming rules.

- Prohibited Language: Certain terms implying government affiliation or specialized licensing—like “Bank” or “Insurance”—require approval from relevant agencies.

- Unique Requirement: If your name is too similar to an existing company, the SOS may reject it. Even small differences might be insufficient if the resemblance causes public confusion. To avoid this issue, it’s smart to check LLC names across state lines before settling on your final brand.

- No Offensive Terms: Discriminatory or explicit words typically aren’t accepted for official filings.

Always read the official guidelines before finalizing your choice to ensure swift acceptance.

Reserving a Business Name Before Registration

If you discover your dream name is available but aren’t ready to file formal paperwork, Minnesota lets you secure it in advance. This approach offers peace of mind, ensuring no one else claims it while you handle the rest of your planning.

Here’s what to know:

- Reservation Duration: You can typically reserve a name for a designated period—often 12 months—before forming an LLC or corporation.

- Reservation Fee: A nominal charge applies for name reservations, paid online or by mail.

- Extend or Renew: If time runs out, you might request an extension, though some states limit how many times you can renew.

- Cancellation: If you decide on a different name, you can cancel the reservation and free it up for others. Similar processes apply in other states too—for example, reserving a name while choosing the best registered agent California for West Coast compliance.

- Proof of Reservation: Keep the reservation certificate or confirmation email on file as evidence you have exclusive rights to that name in Minnesota.

This safety net helps you avoid last-minute scrambles, giving you breathing room to finalize partnerships, secure funding, or refine your branding strategy.

Verifying If a Business Is Legitimate and in Good Standing

Many entrepreneurs check more than a name—they also need to confirm a venture’s credibility. In Minnesota, you can quickly see if a company is meeting state mandates, thanks to public listings and official certificates that reflect compliance.

What “good standing” means and how to check it

When a Minnesota enterprise is in good standing, it means they’ve filed required documentation—like annual renewals—and paid relevant fees to the Minnesota Secretary of State or Department of Revenue. They’re also up to date on any potential backlog from prior years. To verify, use the minnesota business search:

- Locate the Entity: Key in the name in the search or the file number.

- Review Status: Check if it says “Active / In Good Standing.”

- Check Filings: Confirm there are no overdue reports or fees flagged on the profile.

This process ensures the business can legally operate, contract, and maintain liability protections within the state.

How to obtain a Certificate of Good Standing online

A formal certificate can be helpful when opening bank accounts, bidding on projects, or proving compliance to outside parties. Here’s how to get one:

- Visit the Website: Go to the Minnesota Secretary of State’s official page.

- Search for a Business: Enter the entity’s company name or file number.

- Select the Certificate Option: Look for an icon or link offering official documents.

- Pay the Fee: A small cost often applies. Payment is usually via credit card or e-check.

- Download: Access the generated certificate or have it mailed to you.

Keep this record handy, especially for major transactions or expansions that require validated proof of standing.

What You Need to Register a Business in Minnesota

Launching a new firm in Minnesota requires more than just an idea—it also demands filing the correct forms and meeting all statutory conditions. Whether you’re forming a limited liability entity or a corporation, having a checklist ready can streamline the process.

Required documents for LLCs and corporations

Depending on your chosen structure, you’ll need to submit official articles and related forms to the Minnesota Secretary of State. Common essentials include:

- Articles of Organization (for an LLC) or Articles of Incorporation (for a corporation).

- Business Name Verification: Proof that the minnesota business name you want is available.

- Registered Agent: A designated individual or service with a physical address in Minnesota.

- Principal Office Address: Where official mail goes (can be a home or commercial office).

- Ownership Details: Number of authorized shares for corporations, member/manager info for LLCs.

Submitting these properly ensures your application is swiftly approved.

How to file Articles of Organization or Incorporation

Complete the relevant form—either for an llc and corporation—and ensure all fields match the info from your name reservation (if applicable). You can file online or mail in the documents with the required fee. Online filing often gives faster approval. Once processed, the state recognizes your business as official, letting you open bank accounts, hire staff, and operate under your chosen structure. Here’s a step-by-step guide if you’re ready to start an LLC in Minnesota and want to make sure every box is checked.

Registering for taxes and obtaining an EIN

After forming your entity, you’ll likely register with the Department of Revenue to handle state tax obligations. If you plan to have employees, you must also get an Employer Identification Number (EIN) from the IRS. With that EIN, you can manage payroll taxes and meet federal compliance. Keep all these records accessible if you update ownership or relocate your principal office.

Launch your Minnesota LLC with privacy

Get expert support and registered agent service included. Northwest helps you form a compliant LLC in Minnesota with zero upsells.

Available Business Resources in Minnesota

Minnesota invests in supportive infrastructure to help new and established companies thrive. Beyond the business entity search, multiple organizations and programs exist to guide you on taxes, permits, or expansions.

Tools offered by the Secretary of State and DEED

Both the Secretary of State’s office and the Department of Employment and Economic Development (DEED) offer a variety of handy resources:

- Guides & Checklists: Step-by-step documents that clarify part of your business setup tasks.

- Workshops & Webinars: Educational sessions on marketing, digital presence, and compliance.

- Customized Consultations: In some cases, small businesses can get one-on-one support regarding local regulations.

- Grant Opportunities: Certain Minnesota public funding streams target innovation or underserved regions.

- Licensing Assistance: If you’re unsure whether your field needs special credentials, DEED or the Secretary of State can point you in the right direction.

Leveraging these tools can save you time, money, and miscommunication as you scale.

Where to get help with tax registration or licensing

Local offices, including city-level admin in Saint Paul or other hubs, can advise on municipal regulations. If you’re unsure who to appoint, you can explore trusted registered agent Minnesota providers to ensure legal compliance. The Minnesota Department of Revenue has online portals to ensure you’re paying the right sales, income, or property taxes. If you’re unsure, talk to a CPA or a small business mentor for clarity before making any major moves. Another key requirement is appointing a compliant registered agent service to handle legal notices on your behalf.

Using Minnesota’s One Stop portal for new businesses

Minnesota’s One Stop site streamlines the entire process of launching a company. You can handle name reservation, entity formation, licensing inquiries, and tax registration in a single workflow. This reduces the chance of error and ensures you meet every requirement in a timely manner. It’s especially useful for first-time entrepreneurs navigating complexities for the first time.

Common Issues During a Minnesota Business Search

Sometimes, looking up an organization isn’t as straightforward as typing its name in the search bar. Inaccuracies, old addresses, or missing data can impede your efforts. Here’s how to sidestep typical mistakes and interpret results correctly.

No results found: common mistakes and how to fix them

Occasionally, you’ll type in their business name and see zero matches. Here’s why:

- Spelling Errors: A single letter off can derail your query. Double-check you used the exact spelling.

- Abbreviations: If a company operates under “Co.” or “Inc.”, confirm whether the official record includes those suffixes.

- Assumed Name: Some companies keep a distinct “doing business as” label separate from the legal moniker.

- Lapsed Filings: If they lost good standing, the system might show them as inactive or never updated.

If you’re still stuck, try searching partial terms, or confirm with the SOS office whether a recent filing is pending.

Misinterpreting business status or filing dates

Seeing an entity with an “Inactive” or “Dissolved” note could mean different scenarios:

- Voluntary Dissolution: Owners closed the business intentionally, so it’s no longer operative.

- Administrative Action: The state shut them down after non-compliance or unpaid fees.

- Renewal Overdue: They may have missed an annual renewal but are planning to reinstate.

Check the date of last activity. If it’s been years, the entity may be defunct. For more clarity, compare the official “renewal due date” with the date they last updated their file. This helps you avoid forging alliances with an expired enterprise.

FAQ – Minnesota Secretary of State Business Search

Below is a concise FAQ covering the most pressing questions about searching and verifying companies in Minnesota. Each answer aims to address your needs quickly so you can move forward with confidence.

Yes. The Minnesota Secretary of State offers a no-cost platform where you can search for a business using partial or exact names, or a file number. It’s open to the minnesota public, so anyone—from potential investors to curious consumers—can verify data about registered businesses. Paid services apply only when you request official documents or certificates. Otherwise, you can freely access and review statuses, addresses, and other essential business details.

Yes, though results vary. You can often enter all or part of an individual’s or registered agent’s name in the search page. The system will attempt to match listings that mention those details. However, if the agent or owner changed over time, older entries may not reflect the current info. Also, some entries might not capture every associated person, especially if they serve as a silent partner. Double-check with official filings if your initial search yields incomplete answers.

Minnesota has a relatively prompt update cycle, typically refreshing within a few business days of new filings. Still, if a company only recently entered in their business changes, it can take a short window before the system reflects them. If you suspect missing or outdated info, wait a week and try again, or contact the Secretary of State’s office for confirmation. Large spikes in filings—like year-end or tax deadlines—might slightly delay updates.

An entity search shows the status, history, and contact details of an existing business. You’ll see if they’re active, dissolved, or in good standing. By contrast, name availability checks if your desired llc name is still up for grabs or already claimed by an existing venture. Both features live on the same secretary of state business site but serve distinct functions: one is to research established firms; the other is to confirm you can use a particular label.

Yes, in many cases. Once you locate the relevant record, you’ll typically see a link to order or download official documentation—like articles of incorporation or annual renewal forms. Some documents might incur a small fee, especially if you need a certified copy. However, the platform often provides basic details at no charge, letting you confirm a company name, standing, and physical address without paying anything.

Looking for an overview? See Minnesota LLC Services

Create a Minnesota LLC stress-free

Harbor Compliance offers turnkey LLC formation in Minnesota with full support and compliance tracking from day one.