Most LLC owners think getting paid is straightforward. The truth? It’s often a legal and tax minefield. Especially when a disproportionate distribution triggers income tax consequences that were never anticipated. That’s why understanding profit allocation isn’t a luxury—it’s essential to financial survival.

Current distributions from an LLC must align with each member’s ownership percentage and the terms of the LLC operating agreement. For 2024, the IRS expects members to report all ordinary income and capital gains on their tax return, even if the actual transfer of money hasn’t occurred yet.

Whether structured as a sole proprietorship, a general partnership, or a multi-member LLC, the disbursement of cash involves far more than moving funds between a business entity and its owners. Understanding the various LLC owner compensation methods helps you choose the most tax‑efficient way to get paid. The wrong distribution schedule can impact self employment obligations, create gain or loss, or turn appreciated inventory into a tax headache. Limited liability might shield personal income from business risk, but it won’t protect against missteps in how LLC members withdraw cash. The line between smart strategy and costly error is thinner than most realize.

What Are LLC Distributions and How Do They Work?

According to recent IRS data, over 68% of small business owners report confusion about the proper handling of LLC distributions from their companies. This widespread uncertainty highlights why understanding the mechanisms, requirements, and tax implications of taking money out of your limited liability company is crucial for entrepreneurs who want to maintain compliance while maximizing their income. If you’re just starting out, ask yourself do you need an LLC to start a business or if another structure makes sense.

Definition and Types of LLC Distributions

An LLC distribution refers to the payment of profits, assets, or other company resources from a business entity to its owners (members). These distributions represent the financial rewards of business ownership and typically flow from the company to individual members according to predetermined arrangements. Unlike corporations, LLCs enjoy significant flexibility in how they structure these payments. To launch properly, follow our detailed guide on how to get a LLC started and avoid common formation mistakes.

Distributions can take several forms depending on the company's needs and member preferences. The most common types include profit distribution, which involves sharing the company's earnings; current distributions, which occur during normal business operations; and liquidating distribution, which happens when dissolving the company or buying out a member's interest. For complex structures, consider an LLC holding company structure to centralize profits and distributions.

When Are Members Entitled to Receive a Distribution?

LLC members become entitled to distributions based on provisions in their operating agreement or, in the absence of specific terms, according to state default rules. Typically, distributions occur after the company has satisfied its obligations and determined there's sufficient cash flow to share. Most state laws specify that LLCs aren't required to distribute profits unless the operating agreement specifically mandates such payments, giving management considerable discretion over when and how much to distribute. If you began as a sole proprietor, see how to convert sole proprietorship to LLC before making distributions.

Disbursement of Cash vs. Property in an LLC

The disbursement of cash represents the simplest and most common form of distribution, allowing members to receive direct monetary payments that can be immediately used for personal expenses, investments, or other purposes. Members generally prefer cash distributions for their simplicity and liquidity, especially for regular profit-sharing.

Alternatively, LLCs can make distributions through payment of cash or property, transferring non-cash assets like equipment, inventory, or real estate to members. This approach may offer tax advantages in certain situations but requires careful valuation and documentation to ensure compliance with IRS regulations.

- Cash distributions provide immediate liquidity and are straightforward to account for

- Property distributions can help avoid selling appreciated assets and may provide tax benefits

- Cash distributions are easier to divide proportionally among multiple members

- Property distributions require professional valuation to ensure fair market value assessment

Real estate investors often benefit from the tax benefits of LLC for rental property when structuring distributions.

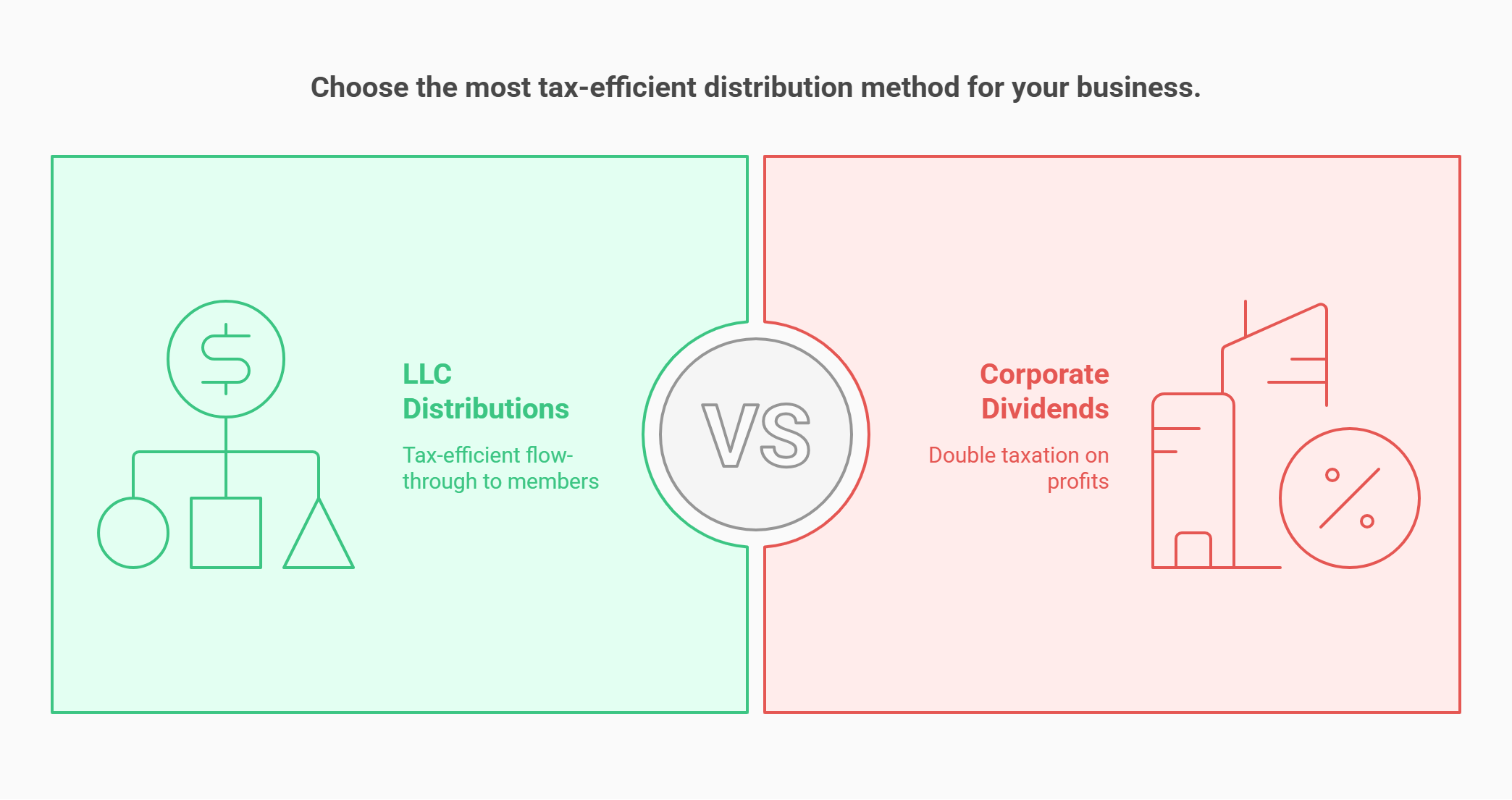

Difference Between LLC Distributions and Dividends

While often confused, LLC distributions differ fundamentally from corporate dividends in both legal structure and tax treatment. Corporations pay dividends from after-tax profits, creating a “double taxation” scenario where both the corporation and shareholders pay taxes on the same income. In contrast, LLC distributions typically flow through to members' personal tax returns without being taxed at the entity level, making them potentially more tax-efficient for small business owners and highlighting one of the key advantages of the LLC structure over traditional C-corporations. If you’re weighing entity choices, review corporation vs LLC to understand the pros and cons of each.ompliance requirements and help avoid costly mistakes that many new small business owners make.

Start your LLC the smart way

ZenBusiness simplifies formation and supports you with ongoing compliance.

Tax Implications of Taking LLC Distributions

Are you aware that LLC distribution tax mistakes rank among the top five reasons small businesses face IRS audits? Understanding the tax implications of taking money from your LLC is not just about compliance—it's about protecting your business and maximizing your personal financial benefits through proper planning.

Are LLC Distributions Taxable or Nontaxable?

The taxation of LLC distributions follows the pass-through principle, meaning profits are generally taxed once at the member level rather than at both the entity and individual levels. The Internal Revenue Service treats LLCs as either disregarded entities or partnerships for tax purposes, requiring members to report their share of company profits on personal returns regardless of whether they actually receive distributions during the tax year. If you operate only within one state, learn what qualifies as a domestic LLC and how it differs from foreign registrations.

| Distribution Type | Tax Status | Key Considerations |

|---|---|---|

| Regular Profit Distributions | Taxable as ordinary income | Reported on Schedule K-1 and personal tax return |

| Return of Capital | Generally nontaxable until basis is recovered | Reduces member's basis in the LLC |

| Liquidating Distribution | Taxable if exceeding basis | May involve gain or loss calculations |

| Tax Distribution | Taxable as ordinary income | Specifically made to cover tax obligations |

| Distributions of Appreciated Inventory | Taxable as ordinary income | Special rules apply to inventory items |

Learn more about proper classification of distributions on the IRS website.

How LLC Distributions Affect Your Tax Return

LLC distributions directly impact your tax return through the Schedule K-1 form, which details your share of profits, losses, deductions, and credits from the business. This information flows to your personal return, typically Form 1040, where it's reported as business income.

Your distribution may affect your income tax liability differently depending on whether it's classified as ordinary business income, capital gains, or return of capital. Understanding these distinctions is crucial for proper tax planning and avoiding unwelcome surprises at tax time.

For single-member LLCs, distributions usually don't create additional self-employment tax obligations since members already pay these taxes on the total business profit. However, multi-member LLCs face more complex scenarios where the characterization of payments can significantly impact overall tax burden. When legal support is needed, compare the best online legal services for corporations to assist with compliance and operating agreements.

Single-Member vs. Multi-Member LLC Tax Treatment

A single-member LLC receives treatment as a disregarded entity by default, meaning the owner reports all business income on their personal tax return using Schedule C, similar to a sole proprietorship. The owner pays both income tax and self-employment tax on profits regardless of distributions taken. And if you form in California, find out how is an LLC taxed in California to anticipate state‑specific obligations.

By contrast, a multi-member LLC follows partnership taxation rules by default, requiring more complex reporting including the filing of Form 1065 and distribution of Schedule K-1 forms to all members. The IRS offers detailed guidance on these distinctions on their small business resource page.

Profit Allocation Among Members: How LLCs Divide the Money

Imagine your LLC as a freshly baked pie—how you slice it matters tremendously to everyone involved. The profit allocation method you choose doesn't just divide your company's earnings; it shapes member relationships, influences business decisions, and can even determine whether your venture thrives or faces internal conflict.

Proportionate vs. Disproportionate Allocations

Proportionate distribution represents the simplest allocation method, where profits are divided strictly according to ownership percentages. This straightforward approach minimizes disputes and administrative complexity, as each member receives an amount directly corresponding to their investment in the company.

- Proportionate allocations follow ownership percentages exactly (e.g., 30% owner receives 30% of profits)

- Disproportionate distribution arrangements must be explicitly documented in the operating agreement

- Special allocations require careful drafting to satisfy IRS “substantial economic effect” rules

Ownership Percentage and Distribution Rights

The relationship between ownership percentage and distribution rights forms the foundation of LLC financial structures. In standard arrangements, these percentages directly determine how profits flow to members, establishing clear expectations for financial returns based on capital contributions and creating a straightforward framework for decision-making.

However, some LLCs create deliberately uneven structures where distribution rights differ from ownership stakes. This approach might reward active managers with larger distributions despite smaller ownership positions or accommodate investors with specific cash flow needs. Such arrangements require clear documentation in the operating agreement to avoid disputes and ensure all members understand their economic rights. When membership changes, learn the steps for changing ownership percentage in LLC to update distributions correctly.

What If There's No Operating Agreement?

Without an LLC operating agreement, state default rules govern how profits are allocated—typically in proportion to capital contributions or equally among members regardless of investment differences. This one-size-fits-all approach frequently fails to reflect the true intentions of the business owners and can create significant inequities, particularly in businesses where member contributions vary in form or value. For planning purposes, compare LLC taxes by state to see how your jurisdiction affects your tax burden.

The absence of custom distribution provisions also eliminates valuable tax planning opportunities and may complicate business operations when cash flow issues arise. Creating even a basic operating agreement with clear distribution terms helps prevent member disputes, provides direction during financial decision-making, and ensures all participants share a common understanding of their economic rights within the company structure.er adequate for initial formation needs.

Build with privacy and real support

Northwest includes expert guidance and a full year of registered agent service.

Rules and Requirements for LLC Distributions

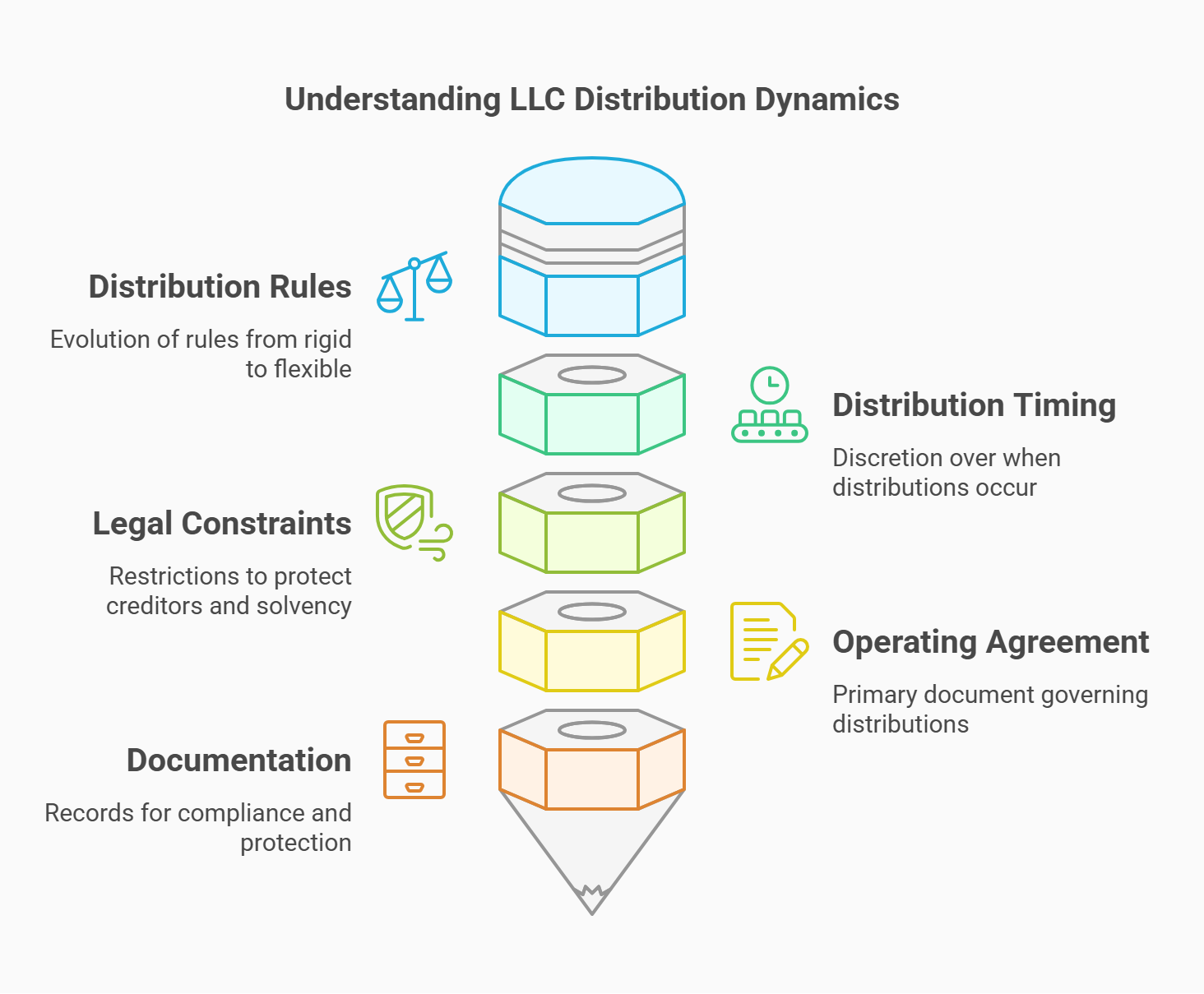

The governance of how LLCs distribute profits has evolved significantly since the entity form first appeared in Wyoming in 1977. Early distribution rules were rigid and closely mirrored partnership frameworks, but modern laws have adapted to provide greater flexibility while maintaining protections for creditors and members—reflecting the hybrid nature of LLCs as entities that combine the best aspects of partnerships and corporations.

When Are LLCs Required to Make Distributions?

Unlike certain other business types, LLCs generally maintain significant discretion over distribution timing and amounts. In most states, LLCs aren't automatically obligated to distribute profits to members unless specifically required by their operating agreement. This flexibility allows companies to retain earnings for growth, debt reduction, or reserves as needed.

However, tax considerations often create practical distribution requirements, particularly for pass-through entities where members must pay taxes on company profits regardless of distributions. Many operating agreements include “tax distribution” provisions mandating minimum distributions sufficient to cover members' tax obligations on allocated profits, preventing situations where owners face tax bills without receiving corresponding cash.

Legal and Contractual Constraints

Several legal guardrails restrict an LLC's ability to make distributions, primarily aimed at protecting creditors and maintaining the company's financial viability. State statutes typically prohibit distributions that would render the company insolvent or unable to meet its obligations, establishing what's known as the “balance sheet test” and the “cash flow test” for permissible distributions.

Additional constraints may arise from loan agreements, investor rights provisions, or other contractual obligations that limit distribution amounts or establish reserve requirements. Members with general partnership responsibilities must understand these restrictions or risk personal liability for improper distributions that damage the company's financial position or violate its contractual commitments.

Operating Agreement Governance and Distribution Schedule

A comprehensive LLC operating agreement serves as the primary authority governing distributions, typically establishing a distribution schedule, calculation methodology, and decision-making process. Well-drafted agreements address timing questions (monthly, quarterly, or annual distributions), handling of tax obligations, and procedures for determining distributable amounts.

The agreement should specify whether management has discretion to retain earnings, circumstances requiring mandatory distributions, and any waterfall provisions giving distribution priority to certain member classes. Some agreements include complex formulas that account for preferred returns, capital account balances, or performance metrics that influence how profits flow to different members.

Find guidance on crafting effective operating agreements on the Small Business Administration blog.

Required Documentation and Recordkeeping

Proper distribution documentation forms a critical component of LLC compliance and member protection. At minimum, companies should maintain thorough records of all distributions including amounts, recipients, dates, and formal approval by authorized parties in accordance with the operating agreement provisions.

- Distribution authorization forms approved by managers or members as required

- Updated capital account balances reflecting distributions

- Minutes from meetings where distribution decisions were made

- Annual reconciliation of distributions against allocated profits

- Tax documentation including Schedule K-1 forms showing allocated profits

These careful documentation practices help demonstrate compliance with operating agreement terms, support tax filings, and provide protection if distributions are later questioned during disputes or economic downturns.

Getting Paid from Your LLC: Draws, Salaries, and Transfers

Think getting paid from your LLC is straightforward? Think again. The method you choose to extract money from your business carries significant legal, tax, and administrative implications that many business owners discover only after making costly mistakes. Understanding the distinct options and their consequences is essential for optimizing your personal income while protecting your company's integrity.

Owner's Draw vs. Salary: What's the Difference?

Owner's draws represent the simplest method for LLC members to extract funds from the business. This approach involves directly withdrawing company assets based on membership interest without triggering payroll taxes or withholding requirements. Draws reduce the member's capital account but don't constitute business expenses for the company.

In contrast, salaries establish formal employer-employee relationships that require tax withholding, payroll tax payments, and compliance with labor laws. Single-member LLC owners typically can't pay themselves salaries unless they've elected corporate taxation, while multi-member LLCs may need to pay guaranteed payments (similar to salaries) to active members. The distinction carries significant implications for both taxes and liability protection as detailed by the Securities and Exchange Commission.

How to Legally Transfer Money from an LLC

To maintain the separate legal status that protects personal assets, members must follow proper procedures when moving money from business to personal accounts. The most straightforward method involves initiating a formal distribution from the LLC's bank account to the member's personal account with appropriate documentation.

For regular, ongoing payments, many businesses establish systematic distribution schedules with consistent documentation processes. These systematic transfers help demonstrate the distinction between company and personal finances while creating clear audit trails for tax purposes.

When considering larger or irregular distributions, consult with financial advisors to ensure the transaction won't compromise the company's financial stability or violate any operating agreement provisions. Maintaining formality in these transfers helps preserve the liability protection that represents one of the primary benefits of operating as an LLC.

How Each Method Impacts Your Taxes

The method you choose for extracting funds from your LLC significantly impacts your tax situation. Owner's draws typically don't affect how profits are taxed, as members pay taxes based on their allocated share of profits regardless of distributions. However, timing distributions strategically can help ensure members have cash available when tax payments come due.

Guaranteed payments to partners and formal salaries generate employment taxes including Social Security and Medicare contributions, potentially increasing overall tax burdens compared to distributions that may qualify for lower capital gains rates or avoid self-employment taxes in certain situations.

LLC Distribution FAQs: Taxes, Shares, and Member Rights

Last month, a client called in a panic after discovering his business partner had been taking unauthorized distributions for personal expenses. “I thought our 50/50 ownership meant all money movements required both our signatures,” he explained. This common misunderstanding highlights why clarifying distribution rights and processes is essential before problems arise.

Dividing an LLC between owners involves establishing each person's share of LLC in the operating agreement, which governs both ownership rights and profit entitlements. Most commonly, ownership percentages correspond to initial capital contributions, though some companies allocate membership interests based on expertise, role responsibilities, or other non-financial criteria that reflect each member's value to the business.

To transfer a percentage of your LLC to another person, you must amend the operating agreement, update membership records, and potentially file changes with state authorities. This process may involve transferring an LLC interest from existing members or issuing new membership units, sometimes requiring unanimous consent from current members depending on your operating agreement's transfer restrictions and state law requirements.

Yes, LLC owners typically pay taxes on their allocated share of company profits through their personal income tax returns, regardless of whether they actually receive distributions. The pass-through nature of LLC taxation means profits flow directly to members' personal returns based on their ownership percentages or special allocation provisions, though the specific treatment depends on whether the LLC files as a partnership or disregarded entity.

Technically, LLCs don't have “shares” like corporations—they have membership units or percentage interests. To distribute these interests, you must follow your operating agreement's procedures for admitting new members or transferring existing interests. This process typically involves documenting the transfer with a formal assignment of membership interest, updating the company's records, and potentially filing changes with state authorities to maintain proper registration of the legal entity.

When an LLC withholds distributions despite having distributable profits, members have several potential remedies based on the operating agreement and state law. These may include initiating dispute resolution procedures outlined in company documents, requesting access to financial records to verify available funds, or pursuing legal claims for breach of fiduciary duty if managers are acting in bad faith or engaging in self-dealing.

Yes, members can choose to reinvest potential distributions back into the business rather than receiving them as personal income. This approach, sometimes formalized as capital contributions, can help grow the business while potentially creating future tax advantages associated with increased ownership basis. Members should document these decisions clearly to distinguish reinvestment from normal operations.

Stay compliant from day one

Harbor Compliance helps you launch and scale with precision in every state.

Very well written. Scope and content of advise covers all of the bases.