Think you’re done once your business is up and running? Not in Illinois. Failing to file your Illinois annual report is one of the fastest ways to lose your legal protections—even if your LLC or corporation is thriving.

The State of Illinois requires every LLC, corporation, and nonprofit to submit an annual report to the Illinois Secretary of State before the anniversary month of formation. Miss the deadline and you’ll face $100 penalties, noncompliance status, or even administrative dissolution.

This guide shows you exactly how to meet your Illinois annual report obligations in 2025—who must file, what documents and business records to prepare, which filing method to choose, and how to avoid costly mistakes. Whether you're filing online or by mail, this step-by-step overview will help you stay in good standing with the state and avoid any penalties.

Illinois Annual Report Requirements and Overview

It’s essential to understand your illinois annual report obligations to maintain legal status with the state. It doesn't matter how big or small, every business running in Illinois must adhere to these yearly requirements. When you don’t file on time or if you leave out information or filing required by law, penalties can be assessed to you or your business — or could even face administrative dissolution. That’s why it’s vital to know what’s expected and when.

What Business Entities Must File Annual Reports

In Illinois most formal business entities must file an annual report. Includes llcs, corporations (c-corps and S-corps), and nonprofit organizations. All corporations must comply with the Illinois Filing Rules whether domestic (formed in Illinois) or foreign (formed in another state but operating in Illinois). Every entity type has its own requirements, but none are exempt from this crucial obligation. If you manage LLCs in multiple states, here’s an in-depth annual report filing guide for LLCs that compares how other states handle the process.

Required Information and Documentation

In order to file your annual report in illinois, you will need appropriate business records, current information, and company details. This will keep the state informed about your entity’s details. The particulars that are required to be provided may differ a bit depending upon business types. However, the basic components remain the same. Here is a list of information you will typically need to prepare your Illinois annual report.

- Legal name of the entity

- Illinois Secretary of State file number

- Principal business address

- Names and addresses of officers, directors, or managers

- Name and address of your registered agent

- Authorized signature from a member, officer, or representative

In addition to these details, you may need to attach supporting documents depending on your entity status (e.g., foreign vs. domestic) or changes made during the year. Make sure all company information is accurate and up to date before submitting. And if you’re still not sure whether an LLC is right for your business or just need a name for branding, check out this clear LLC vs DBA comparison guide to understand the difference before you file.

LLC vs Corporation Annual Report Differences

If you operate an illinois llc, your annual report process is simpler than for corporations. While both LLCs and corporations must file an annual report, their filing processes in Illinois have key differences. LLCs generally face a simpler, more streamlined submission with fewer form fields and no officer listings. In contrast, corporations must disclose more detailed corporate structure data, including officers, directors, paid in capital information, and typically file using the BCA 14.05 form. Additionally, corporations may need to calculate and submit franchise tax payments as part of their report.

Avoid late fees and dissolution

ZenBusiness files your Illinois annual report on time—accurately and without stress.

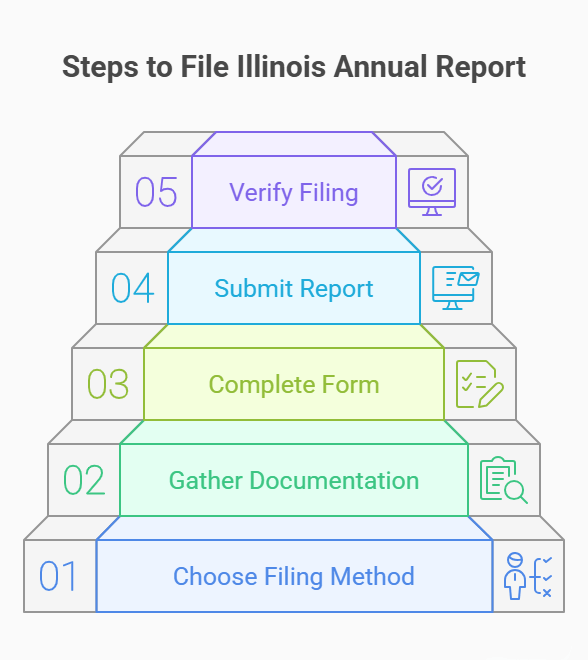

How to File Your Illinois Annual Report

Multiple options are available for filing your Illinois Annual Report. You can choose the best method that suits your business. Filing online or by mail is meant to be easy, if you follow the steps. It is important that you choose the method that fits your business’s needs, timeline, access to documentation, and maintaining your state registration, every method has its own advantages.

Filing Online Through Illinois Secretary of State

The fastest way to complete your Illinois Annual Report is to file online. To begin, first go to the ilsos website (Illinois Secretary of State) and enter your business file number or name. Please check or confirm your entity information when prompted. Upload any documents if required and make payment. Once you submit the report, you’ll receive a confirmation email so you can verify that your Illinois annual report was filed successfully.

Filing by Mail Instructions and Process

If you prefer not to file online, Illinois allows annual report submissions by mail. This method is slower but still valid, especially for those who need to include additional paperwork or prefer to maintain physical records. Begin by downloading the correct form from the Illinois Secretary of State website. Complete the information manually and Prepare to send your documents to the Springfield office listed on the form.

Ensure you meet all requirements before mailing:

- Use the correct mailing address listed on the form

- Include payment via check or money order made payable to “Illinois Secretary of State”

- Attach any necessary supporting documents

- Sign the form with an authorized company officer or representative

- Mail it before the due date to avoid late penalties

Although slower than online filing, mailing provides a physical paper trail and may suit businesses that prefer paper documentation.

Required Documentation Checklist

Your illinois annual report documents will vary based on your business type and the way you file it. The system usually asks you to upload the required files for online submissions. Contrastingly, mail filings require you to attach the proper documentation physically before you send it.

For LLCs, expect to include updated member or manager information. Corporations should provide officer and director details, plus paid in capital and franchise tax calculations if applicable. Nonprofits may need to submit bylaws or IRS determination letters depending on changes made during the year.

Processing Times and Filing Confirmation

Once you submit your illinois annual report, the processing times depend on how you filed. Usually, online submissions take 1-2 business days, and an email confirmation will be sent. If you submit it by mail expect processing to take up to 10 business days. After processing is finished, go through the website of the Illinois Secretary of State to verify your filing.

Illinois Annual Report Fees and Due Dates

It is important to understand the illinois annual report cost as it helps you plan your finances and also fulfill requirements set by the state government. Businesses based in Illinois must make certain filings, with the fees depending upon its entity type. Also, you may face some penalties if you miss due date. If you are aware of what to expect, you can avoid surprise costs and remain compliant with the Illinois Secretary of State’s office. If you’re curious how your costs compare, check out this guide on LLC filing costs in other states for a broader view.

Annual Report Filing Fees by Business Type

The cost for submitting your Illinois annual report relies on the type of your business. Every year, the State of Illinois charges a fee based on whether you’re an LLC or a corporation or a nonprofit. The corporation also has to pay a franchise tax based on its paid-in capital. When you find out in advance what you will be required to pay, you can budget accordingly and avoid costly delays. Please remember to submit these fees with the filing, whether you are filing electronically or by mail.

| Business Type | Filing Fee |

|---|---|

| LLC | $75 flat fee |

| Corporation | $100 + variable franchise tax (based on capital) |

| Nonprofit | $10 flat fee |

Check the Illinois Secretary of State website for up-to-date fee schedules and entity-specific instructions.

When Is Your Annual Report Due?

Every year, your annual report for Illinois must be submitted before the first day of the anniversary month of the formation. If your LLC was registered on April 10, for example, your report must be filed by March 31 every year. It also applies to corporations, non-profits and foreign entities. Save the date for penalties for late filings.

Never miss your anniversary month again

Northwest offers automated reminders and seamless annual report filing for Illinois LLCs.

How to Calculate Illinois Franchise Tax for Corporations

In Illinois state, corporation needs to pay a franchise tax along with the annual report filing fee. This tax relies on the corporation’s paid-in capital, which is the amount of all shares issued plus any additional paid-in amounts. The higher your capital, the more tax you owe.

To calculate the tax, multiply your paid-in capital by the rate usually applied (0.0015). You should include this figure in your annual report and make payment to the Illinois Secretary of State. For accuracy, we recommend that you talk with your accountant or use the Illinois Franchise Tax Calculator Tool to get an official estimate.

How to Check Filing Status and Maintain Good Standing

After submitting your annual report, you need to confirm whether the State of Illinois has processed them. Keeping your business in good standing allows you to legally operate, access financing, and remain compliant. Illinos provides you tools to check your filing status, correct errors and avoid administrative setbacks.

Using the Illinois Business Entity Search Tool

To confirm your filing of an Illinois annual report, visit the Illinois Department of the Secretary of State Business Entity Search. To find your entity, enter the name of your business or file number. The tool shows you important status information, including your filing date, current status, and whether anything further is required.

Using this online tool lets you review previous filings for administrative issues or to check any updates to your registered agent or business address (and ensure all information on file is correct). It is a quick and easy way of keeping the business records compliant.

Understanding “Good Standing” vs. Administrative Dissolution

When your business is in good standing, it means that all Illinois filing and fee obligations have been met and the illinois annual report has been filed on time. This status is needed to obtain loans, renew licenses, or enter into contracts.

If you miss a filing deadline or don't pay necessary fees, you have the administrative dissolution. When your business’s legal status is revoked by the state, you must file for reinstatement to be able to operate again, usually with additional fees.

Late Filing Penalties and Consequences

If you don’t file your Illinois annual report on time, you will get automatic penalties and possibly administrative dissolution. These consequences can cost you money, legal standing and valuable time to rectify. It is wise to stay ahead of all deadlines by acting as soon as possible to avoid risks.

Penalty Fees for Late Annual Report Filing

If you don’t file your illinois annual report on time, you will face financial penalties and possibly even administratively. The Illinois state takes compliance seriously, and just a delay—whether intentional or not— can put your business at risk. These penalties apply to limited liability companies (LLCs), corporations (C-corps and S-corps), as well as some nonprofit organizations, regardless of their size or industry. For comparison, review Florida’s LLC filing system, which also imposes firm deadlines.

The longer you wait to file your report, the higher the late fees. Moreover, delays can change your status, which can prevent you from getting funding, license renewals, or even being able to operate legally.

Here’s how the penalty schedule works:

- Day 1 past due – $100 late fee added

- 30 days past due – Business marked as noncompliant

- 60 days past due – Risk of administrative dissolution begins

- 90+ days past due – Entity is officially dissolved by the state

To avoid further fees and reinstatement filings, submit your report as soon as possible if you’ve missed the deadline.

Administrative Dissolution and Reinstatement Risks

If your Illinois business does not file the annual report, the state may dissolve it administratively, which means your company will lose its legal right to operate. Due to this status, you cannot do business or enter contracts or liability protections. To fix this, you will need to file with a reinstatement application, pay back fees and bring all filings up to date—often with penalties. For a step-by-step breakdown, here’s a guide on renewing your LLC after missed deadlines.

It can take a long time to reinstate a business and be costly. If you're not sure where to start, this guide to reinstating a dissolved LLC in your state can walk you through each step. So, it is best to stay compliant and file your annual report on time.

This guide offers a clear summary of each step in filing the your llc annual report in Illinois, from gathering business records to submitting payments and verifying status—helping you stay compliant without confusion.

Frequently Asked Questions About Illinois Annual Reports

Business owners have questions before filing their illinois annual report due to changing deadlines or changing requirements. This section covers the most common problems, allowing you to file clearly and confidently. Use these tips on costs, registered agent updates and more to ensure that you avoid mistakes and stay in good standing.

Does Illinois require an annual report for all business types?

Yes. Each year in Illinois, all registered LLCs, corporations, and nonprofit organizations must file an annual report. Whether your business is domestic (formed in Illinois) or foreign (formed somewhere else and doing business in Illinois), it doesn't matter. Sole proprietorships and general partnerships usually get a free pass because they don’t register with the state.

If you’re new to business or haven’t filed before, understanding the basics of starting your own LLC can make the annual reporting process a lot easier. Knowing your structure, formation date, and required filings sets you up for compliance from day one.

How much does it cost to file an Illinois annual report?

To file an annual report in Illinois, an LLC will pay $75. A corporation pays $100 plus any franchise tax based on paid in capital. A nonprofit pays just $10. You will get additional penalty fees for missing your deadline. Depending on the submission method, and timing, expedited processing can also increase your overall cost. If you’re also budgeting for formation, be sure to explore common LLC startup expenses across the U.S.

Can you change your registered agent when filing your annual report?

Yes, in Illinois, you can change your registered agent while filing the Illinois Annual Report. Just change the agent name and address on the annual report form, whether you are filing online or by mail. Ensure that the new agent complies with all state requirements and has accepted the appointment before filing your report.

For reference, see how registered agent laws differ by state, using Washington as an example.

How to Check If Your Illinois Annual Report Was Filed Successfully?

To confirm your illinois annual report was filed, visit the Illinois Business Entity Search. Enter your company name or file number, then review the latest filing status. A “good standing” label typically means successful processing. You can also check for confirmation emails or contact the Illinois Secretary of State directly for verification.

Resources for Illinois LLC Annual Reports

Looking to keep your Illinois LLC in good standing? These official and expert-reviewed resources provide everything you need – fees, deadlines, filing options, and late‑penalty guidance, so you can file with confidence.

- Illinois SOS – LLC Annual Report Portal & Instructions (ilsos.gov)

Official step‑by‑step on how to file the LLC Annual Report online or by mail, who’s eligible, and filing limitations (e.g. changes to registered agent require a separate form). - TailorBrands – Illinois LLC Annual Report Overview (tailorbrands.com)

Covers required information (e.g. address, members/managers, registered agent), filing ineligible cases, and what happens after a late filing—up to eventual dissolution. - Illinois Secretary of State – File Annual Report Online (ilsos.gov)

Direct portal accessed via “File an Annual Report”—where LLCs can begin the online filing process using their File Number and pay via credit or ACH.

Stick to these trusted references—starting with the SOS portal for filing and forms, and you’ll be set to maintain compliance year after year. Whether you file early, on time, or even recover from a late report, these tools keep you moving forward with clarity.

Looking for an overview? See Illinois LLC Services

Let compliance run on autopilot

Harbor Compliance handles your Illinois annual report and keeps your LLC in good standing year-round.