Performing an Illinois Business Search is a crucial step for entrepreneurs and professionals aiming to establish, grow, or partner with businesses in the state. This process ensures legal compliance, verifies the legitimacy of entities, and provides valuable insights into market trends and competition. Whether you're forming a new LLC or evaluating potential partners, accessing the Illinois business database offers the clarity and confidence needed to make informed decisions.

An Illinois Business Search involves accessing the state's official business database to verify the status, ownership, and compliance of entities, ensuring informed decisions and avoiding legal risks.

In this guide, you’ll discover:

- The key benefits of conducting a business search in Illinois.

- Step-by-step instructions for accessing and interpreting the Secretary of State's database.

- Strategies to leverage search results for legal and strategic business growth.

Let’s dive into the essential details to master the Illinois Business Search process!

Why Conduct an Illinois Business Search?

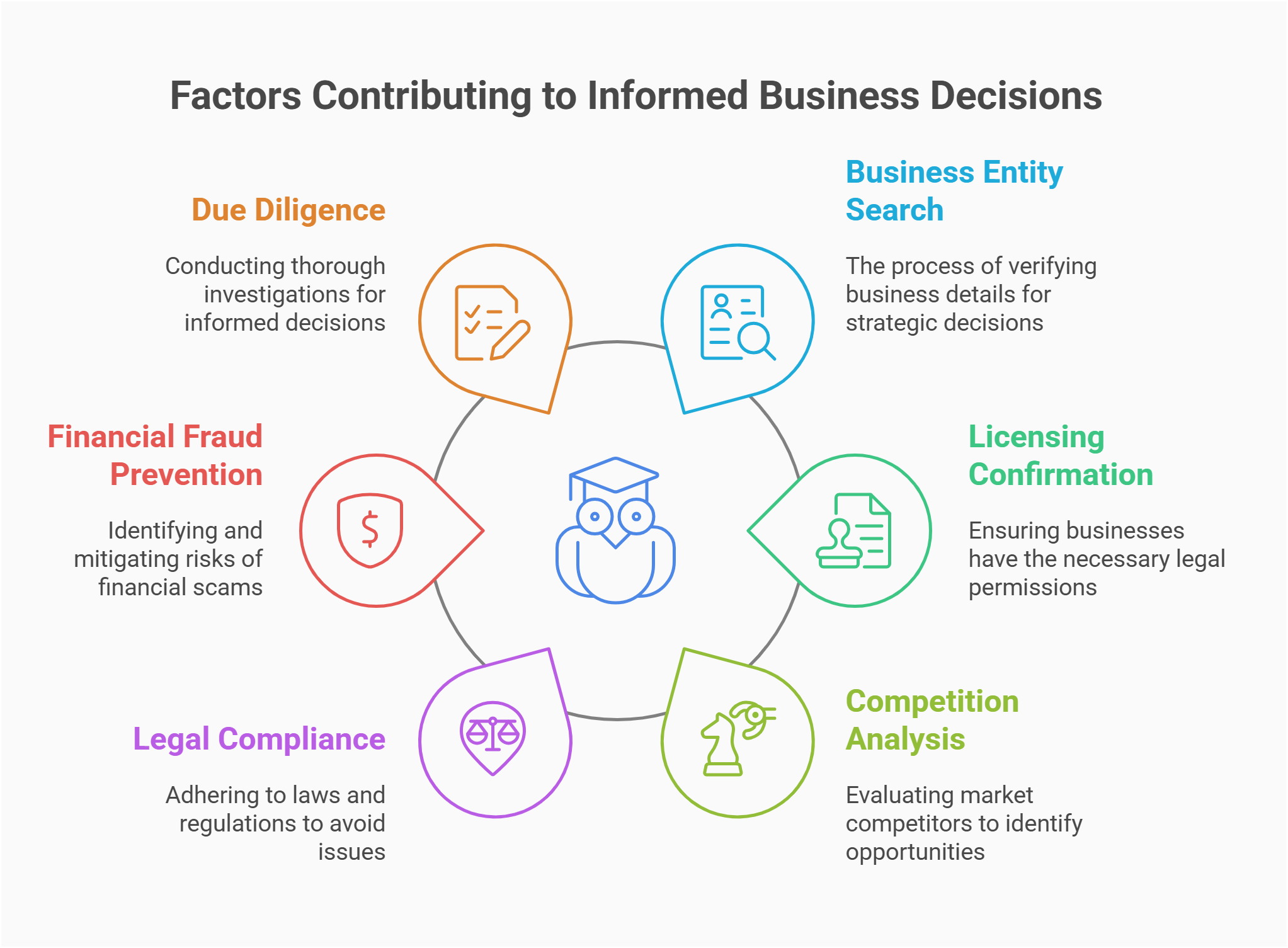

Performing a search for a business entity in Illinois isn’t just about verifying a name; it’s about safeguarding your interests and ensuring legal compliance. Entrepreneurs rely on these searches to confirm licensing, pinpoint potential competition, and reduce risks when negotiating deals. Whether you want to confirm the status of each business you plan to partner with or simply see if your desired name is still available, the results can guide your strategy. Below, we examine the top benefits and how you can apply this data in everyday business decisions.

Benefits of Verifying Business Entities

Investigating local business entities prior to any engagement is crucial. Not only does it clarify ownership, but it can also highlight red flags. Here’s why it pays to be proactive:

- It prevents brand conflicts by spotting identical business names.

- It confirms if an enterprise is legally registered with the secretary of state business system.

- It uncovers any red flags, like inactive status or unresolved lawsuits.

Conducting these checks fosters trust and helps you avoid unnecessary headaches when you’re evaluating deals, merging assets, or pursuing a new market.

Legal and Financial Reasons for Business Searches

From a compliance perspective, an illinois business search ensures you’re following local rules and not infringing on existing trademarked or registered identities. Below are the top motivations:

- Compliance with state filing requirements

- Prevention of financial fraud or scams

- Due diligence for mergers and acquisitions

- Validation of physical address and contact details

- Assessment of certificate of good standing or other critical documents

Such background knowledge offers clarity on the entity’s structure, mitigating the likelihood of encountering hidden liabilities.

Using Business Searches for Competitive Intelligence

Beyond strict legality, you can leverage the business entity search tool for strategic insights. By checking how many businesses operate in your niche, you can map out major players and identify market gaps.

- Investigate directory of businesses to see competitor patterns.

- Analyze expansions or new filings within your field.

- Gauge how quickly certain companies in your industry are scaling.

When used correctly, these steps allow you to refine your marketing tactics, differentiate your offer, and position your brand for higher impact.

How to Perform an Illinois Business Search

Whether you’re a seasoned entrepreneur or new to the business formation process, a structured approach to perform an illinois business search is vital. By understanding the platform, search filters, and the meaning behind each result, you’ll save time and avoid confusion. First, figure out your search criteria—the name, file number, or registered agent. Then proceed with the correct search method to retrieve accurate data. Finally, learn to interpret the results so you can confidently proceed with your next steps, like compliance checks or evaluating a potential partner’s legitimacy.

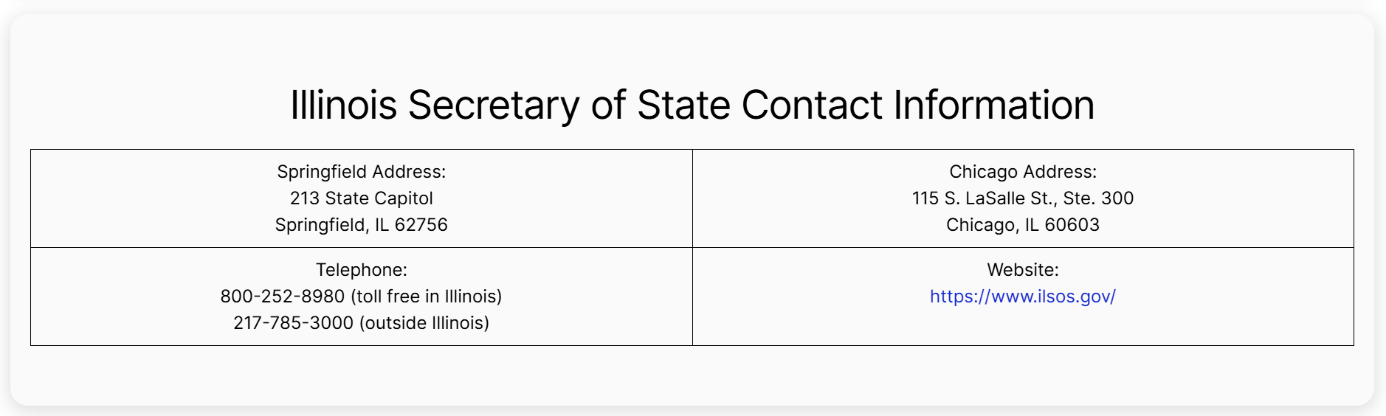

Accessing the Illinois Secretary of State Business Database

The official website of the Illinois Secretary of State offers an online search tool where you can look up a wide range of registered businesses. This is the primary source for status information for any business in the state. Once you land on their site, select the business services section and locate the entity search feature. With a few simple inputs, the system reveals essential data like filing dates, the license status (if relevant), and the entity’s principal office.

Types of Searches: By Name, File Number, or Registered Agent

Below are the main ways to search by corporation or llc name, file number, or agent details:

- Name-Based Search: Enter the exact or partial business name (avoid leading or trailing spaces). This works well if you only know the brand or are verifying list of companies.

- File Number Lookup: If you know the assigned identification code, this can yield a direct, exact match.

- Agent or Officer: Use the name of the registered agent or the principal officer’s identity. This helps if the terms you entered are tied to an individual rather than the corporate brand.

Assess your resources before picking your search route; using each approach might bring comprehensive results.

Interpreting Business Search Results

After you enter data into the search database, you’ll see multiple columns displaying the status of each business, plus relevant fields. Here are crucial details to analyze:

- Entity Name: Confirm if it aligns with the search method you used or if it’s a close variant.

- Status: Whether the LLC or corporation is active, dissolved, or in good standing.

- Filing Date: The year and month of formation, indicating how long the entity has operated.

- License Type: If available, see if the business is legally able to operate in a certain niche.

Review everything carefully. If you need deeper clarity—like verifying an address or clarifying active and inactive entities—try advanced filters or contact the state directly.

How to Register a Business in Illinois

If your search for a business entity yields a name that’s still free, you may decide to register a business under that brand. Proper registration not only ensures legal compliance but also helps customers and partners trust your operations. Below, we’ll outline the core steps to official business entity registration in Illinois, including the required forms, relevant fees, and compliance rules. By following these guidelines, you’ll avoid setbacks and maintain good standing from day one.

Key Steps for Registration

To register your entity with the state, you’ll typically:

- Choose an available name that meets state guidelines.

- Complete the required documentation, such as the Articles of Incorporation (for a corporation) or the Articles of Organization (for an LLC).

- Appoint a registered agent who has a physical address in Illinois.

- Submit your forms and fees to the Secretary of State. If you’re budget-conscious, learn how to create a cheap LLC without compromising quality

- Wait for confirmation, ensuring you keep copies of all records.

Adhering to these steps ensures your enterprise is lawfully recognized.

Filing Articles of Incorporation or Organization

When forming an llc and corporation, you must draft the correct articles. For an LLC, the state typically requests member details, the duration of the company, and the business names under which it may operate. Corporations have extra fields, like authorized shares or capital structure. Once completed, pay the filing fee, which varies depending on license type or entity type. Keep track of your submission date, so you can check status of submission promptly. To ensure you have the best support, compare registered agent services and select the best registered agent in Illinois.

Post-Registration Requirements

After you finalize the initial paperwork, remain compliant by:

- Maintaining updated contact info with the state.

- Filing an annual report or file an annual report (if your entity type requires it).

- Keeping up with local taxes or business license information relevant to your field.

By diligently following these post-registration tasks, you avoid penalties, keep your brand’s reputation intact, and ensure seamless growth in the Illinois market.resources you can use to confirm your prospective name is open for registration:

Verify name availability to meet Illinois state requirements.

LLCs file Articles of Organization; Corporations file Articles of Incorporation.

Designate an Illinois-based registered agent for official legal notices.

File your registration with the Illinois Secretary of State and pay applicable fees.

Update state records, file annual reports, and pay necessary taxes.

Tools and Resources for Illinois Business Searches

Performing a thorough illinois llc search or verifying a corporation’s credentials can be simpler if you know which resources to use. From the official government website to specialized third-party directories, each platform has unique strengths. Below, we’ll highlight the main searching tools you can rely on to confirm a business entity registration, check if the business is licensed, or gather advanced details like historical filings or name-change histories. With these digital solutions, you can speed up the process and make well-informed decisions for your projects.

Illinois Secretary of State Business Search Tool

This official portal is your prime destination when you need to perform an illinois business search. It allows you to run an entity search tool by name, file number, or partial matches. Additionally, it provides a quick snapshot of each entity’s standing. If your query demands more historical data, you can often expand the search to see prior names or old addresses. Official sites are typically up-to-date, ensuring that the data you see aligns with real-time records.

City of Chicago Business License Look-Up

For those curious about local compliance, the city’s business license lookup helps you check if the business is licensed within Chicago specifically. This database focuses on the license status and type—for instance, whether it’s a restaurant, salon, or finance office. Because Chicago is a major hub for businesses in chicago, having city-level data can provide clarity on local requirements like health permits or zoning approvals.

Recommended Third-Party Search Platforms

Below is a brief comparison of platforms that supplement the official secretary of state business site:

| Platform | Functionalities | Advantages |

|---|---|---|

| BizArchiver | Historical records, including older licenses | Great for genealogical or legacy data |

| CorpIntel | In-depth compliance monitoring, notifications | Ideal for companies doing large-scale checks |

| BrandCheck | Cross-reference with social media brand usage | Good for marketing + IP verification |

While these aren’t official sources, they can complement state data by providing specialized or additional context around newly formed or private legal entities.

Illinois LLC Formation Requirements

Starting an llc in illinois can be a strategic move, offering liability protection, tax flexibility, and brand credibility. However, each state enforces specific requirements for llc formation, and Illinois is no exception. From naming conventions to publication or annual reports, the compliance steps keep your entity in good standing. In this section, we’ll outline the official filing requirements for your prospective LLC, delve into why a reliable registered agent is key, and examine how to maintain compliance post-launch. Following these steps ensures your new venture thrives in the competitive Illinois market.

Steps to Form an LLC in Illinois

Here’s a concise path to get started:

- Choose a unique name that meets registering business names guidelines (check for exact match conflicts). Choose a unique name that meets registering business names guidelines by exploring our LLC names examples.

- Draft your Articles of Organization and submit them along with the required fee.

- Appoint a local registered agent with an office in Illinois.

- Consider drafting an Operating Agreement to outline ownership and management.

- File an annual report each year to maintain good standing with the state.

Completing these tasks is critical to formalizing your limited liability company. Before submitting formal documents to form an LLC, it’s crucial to check LLC names to ensure your desired name is available.

Importance of a Registered Agent

Illinois law mandates that all limited liability companies designate an agent for service of process. This person or entity receives legal documents and official notifications at a physical address in the state. Not having a reliable agent could cause you to miss critical deadlines or lawsuits, jeopardizing your entire operation. Many entrepreneurs use a professional service to ensure 24/7 coverage and privacy.

Maintaining Compliance for Illinois LLCs

Staying in compliance demands consistent monitoring. Here’s a quick checklist to keep your LLC in good standing:

- Renew or confirm your registered agent details annually.

- Submit any amendments to your Articles if changes occur.

- File an annual report by the due date specified.

- Pay all applicable state fees or taxes on time.

- Update your operating agreement if major membership shifts happen.

Adhering to these steps wards off penalties and preserves your business standing within Illinois.

Verify an Illinois Business Now

Check LLC status, ownership, and compliance with the Illinois Business Search tool. Ensure legal security before making business decisions.

Verifying Business Status in Illinois

Whether you’re forging a partnership or signing a contract, knowing that a company is validly operating—i.e., it’s in good standing—is essential. An official record check can confirm that a business is active, licensed, and meeting state mandates. By verifying the status of each business, you’ll safeguard yourself against unscrupulous entities or those at risk of dissolution. Below, we’ll unpack how to discern active from dissolved statuses, uncover potential red flags in their legal or financial background, and rectify discrepancies, if any arise.

Active vs Dissolved Business Status

Most search database results highlight whether an entity is “Good Standing” or “Dissolved.” If the business is active, it meets all filing requirements (like annual reports). A dissolved or inactive listing indicates the entity is no longer recognized by the state, whether voluntarily ended or administratively shut down. Entering a partnership with an inactive company can bring serious complications—always verify the status information for any business before finalizing deals.

Checking Legal and Financial Records

It’s prudent to confirm more than just a single status indicator. Key items include:

- business license information from local municipalities

- any existing liens or judgments

- certificate of good standing if you require proof of compliance

Diving deeper into search criteria helps you see if the owners have faced bankruptcies or other issues. Cross-referencing multiple sources (e.g., county websites, the business entity database) ensures a full picture of their track record.

Resolving Discrepancies with State Records

Occasionally, you might find that details differ from what’s on the official site. For instance, a search by corporation or llc name could yield conflicting addresses or mismatch in owners. To fix such problems:

- Contact the Secretary of State’s office with documented proof.

- Have the company file an annual report correction or an amended statement.

- Retain copies of all updated forms.

- Monitor the records to confirm the changes have taken effect.

By clarifying such issues, you maintain legal clarity and consistent data across all platforms.

Common Mistakes in Illinois Business Searches

Even if you know the basics, it’s easy to slip up when you perform an illinois business search. Simple errors—like a wrong name or incomplete data—can lead to hours of confusion or even undermine your final decisions. This section spotlights the pitfalls to avoid, ensuring a smooth and accurate lookup. By handling these queries properly, you’ll bolster your confidence in the results and sidestep wasted time or missed opportunities.

Using Incorrect Search Parameters

A frequent mistake is typing partial or erroneous info and expecting the system to guess the right entity. Some official tools won’t handle fuzzy matches well. If the search method doesn’t allow wildcard entries, you could miss the correct data. Always double-check your business names, ensuring you use the official spelling. If you have a file or license number, prefer that for a more direct lookup, as name variations are less of a concern.

Overlooking Key Details in Search Results

Sometimes, the search reveals limited info like “Active” status, but you might fail to check the license type, search criteria correctness, or date of formation. Those details matter. For instance, a company might be “Active” but owe local taxes or have pending lawsuits. Thoroughly reading each row or column can spare you from forging misguided deals or entering a flawed partnership.

Relying Only on Free Tools

- Free search portals often have limited data or slower updates.

- They may lack advanced filters to verify business license details.

- No-cost resources sometimes skip the complete list of companies or exclude older records.

To avoid these pitfalls, consider leveraging official platforms (like the Secretary of State’s site) or paying for certain advanced searches. It’s a small investment to ensure complete accuracy.

Form Your Illinois LLC Hassle-Free

ZenBusiness streamlines LLC registration in Illinois. Get your business up and running with expert guidance.

Advanced Uses of Business Search Data

Beyond verifying an LLC’s existence or checking if a name is free, the insights gleaned from your search can power strategic plans. Data from the business entity database can guide market research, strengthen alliances, or highlight expansions. By analyzing who’s active in your region, how they structure their shareholding, or when they first entered in their business, you can refine your approach. Below, we’ll show how top companies harness these records for social media campaigns, competitor intelligence, and direct growth tactics. So, if you’re aiming to push boundaries or scale effectively, read on for advanced tips on data-driven decisions.

Leveraging Business Data for Market Research

Any directory of businesses or official listing you gather helps you see which sectors are thriving or oversaturated. Cross-reference that info with searching tools for brand presence. For instance, if multiple companies in your niche have formed within the last quarter, you can track trends: Are new players focusing on e-commerce? Are they offering specialized services? Understanding this can lead to more informed product lines or marketing angles.

Identifying Risks Before Partnerships

Reviewing official records can also reveal if a prospective partner has a history of dissolutions, frequent name changes, or unresolved compliance issues. If your search for a business entity indicates multiple active and inactive entities under the same leadership, it might point to potential risk. Thoroughly investigating reduces the chance of regrets post-deal.

Exploring Public Records for Networking Opportunities

Sometimes, the results of a business entity search tool highlight a physical address or the names of executives who share your field. That data can serve as a stepping stone for forging valuable contacts:

- Identify other individuals connected to your industry.

- See if they have similar target customers or distribution channels.

- Propose a collaboration that benefits both parties.

In short, scanning companies in illinois can become a powerful networking lever.

Data-Driven Decision Making for Business Growth

Comprehensive knowledge of the local business scene fosters more strategic moves. Below are the main steps to integrate your findings:

- Collect relevant data (status, formation date, areas served).

- Compare your own standing to see if you’re behind or ahead on compliance.

- Forecast potential expansions, guided by the region’s newest developments.

- Align marketing with the proven patterns of companies thriving in your space.

Armed with these insights, you can align your business formation process and expansions for maximum impact.

Comprehensive FAQs on Illinois Business Search

From verifying out-of-state entities to updating your own details in the state registry, many questions arise about how best to navigate the process of an Illinois business lookup. Below, we address the most common queries—providing direct, no-nonsense guidance so you can move forward confidently. Whether you’re an entrepreneur or a consultant, these answers aim to clarify each tricky aspect of the search. facts. Dive in to streamline your next query or update with confidence.

Yes, the state’s official business entity search tool is generally free to use. Through the Illinois Secretary of State website, you can check a company’s name, status, and other basic details without paying a fee. Some advanced features—like retrieving certified copies or additional historical data—may require a minimal charge. However, for straightforward tasks, the main online search tool remains costless. Bear in mind that certain private or third-party sites might charge for convenience or for pulling extended records, but the direct state portal is typically available at no cost.

If you don’t have a company’s official name but know the registered agent, you can still search for a business entity. On the Secretary of State’s platform, choose the “Agent Name” option if available. Then enter the agent’s first and last name (or company name if it’s a professional service). The system retrieves any matching results, showing all registered businesses linked to that agent. This method is handy when the exact match for the LLC name is unknown, or you only have partial info from an email or contract referencing the agent.

First, confirm your search criteria—are you certain about the spelling, spacing, or the entity type? Some names might differ from what’s used on social media. If you’re still hitting zero results, try an alternate approach: search by file number, physical address, or the registered agent. It’s also possible the business hasn’t been officially registered or it’s an older entity removed from the digital records. When in doubt, call the Secretary of State’s office or check the county clerk’s archives. Persistent “no result” messages could indicate an unregistered or inactive operation.

To correct or change any entry—like your business name or agent details—you’ll need to file an annual report or an amendment form. The procedure varies by the nature of the update. For instance, changing the license type might require different paperwork than editing your physical address. Typically, you log into the official online filing system, locate your entity profile, and fill out the relevant documents. Once approved, the new information overrides the old data. Keep a record of your submission receipt and check status of submission regularly to ensure it’s fully processed.

Absolutely. Many out-of-state companies register in Illinois for expansion or compliance purposes. By performing an illinois business search, you can locate these foreign entities if they’ve filed the required paperwork. The search tool allows you to see if they hold a foreign qualification, confirming they have authority to operate in the state. This helps you verify that an out-of-state partner truly meets local filing requirements. If the entity doesn’t appear in the database, they might not be formally recognized, raising questions about their business standing in Illinois.

If you’re worried about your personal address or phone number showing up in the business register, consider using a commercial registered agent service. That way, the public record will list the agent’s physical address instead of yours. Also, limit the personal details you include in your official filings if state law permits. The Secretary of State site typically doesn’t reveal sensitive data like Social Security numbers. However, double-check your search method or forms: any details entered in their business records might appear in public listings. Being mindful during each submission is key.

An Illinois enterprise is “compliant” if it meets all business entity registration standards. These criteria generally include:

- Filing or updating the appropriate formation documents (LLC or corporate).

- Keeping a registered agent with an in-state address.

- Paying annual fees, plus any taxes or additional surcharges.

- File an annual report with accurate data by the set deadline.

- Maintaining consistent usage of the business names under which it was registered.

When a company meets these benchmarks, it’s typically recognized as active and up to date in the official business entity database.

Several searching tools integrate with state databases to streamline the process. For instance, some software solutions can monitor new business entity registration logs or notify you if specific terms you entered match new filings. Tools like BizNotify or GovWatch offer real-time alerts whenever a change occurs, saving you from manual lookups. This helps if you must track competitor expansions, newly formed LLCs in your sector, or updates to your own records. While official online search tools remain core, these automated platforms add an extra layer of convenience and timeliness.

Lenders and investors often request an illinois llc lookup or verify business license records when assessing creditworthiness. If your prospective backer sees that your company’s data is inconsistent or out of date, it can erode trust. Conversely, presenting updated, official state documentation can expedite loan approvals or attract new partners. Essentially, clarity about your business standing—including its formation date, active status, and compliance—strengthens your credibility. This fosters better negotiations, potential lower interest rates, or an increased chance of securing the funds you need.

A specialized agent or legal firm streamlines your search in the business entity database, ensuring nothing is overlooked. They can interpret complicated data sets, handle advanced search filters, or identify hidden red flags in your results. Beyond searching, these experts can update official records, confirm a certificate of good standing, or manage your annual reports. Such a service saves time, particularly for larger companies needing frequent checks on multiple registered businesses. Ultimately, professional help provides peace of mind, reducing the odds of missteps during critical expansions or acquisitions.

Next Steps: How to Start an LLC in Illinois After Your Search

Once you’ve harnessed the illinois llc lookup to confirm that your chosen name stands unused—or verified the business entity you plan to acquire—there’s still a path to formalize your venture. In Illinois, you’ll need to tackle tasks like preparing organizational documents, adhering to publication requirements, and designating an agent for service of process. Below, we explore each step in detail, from the moment you decide to found your LLC through the obligations you’ll meet year after year. By following these guidelines, you’ll set up a robust structure and sustain success.

Filing Your Articles of Organization

The core part of registering business names for an LLC is filing the Articles of Organization with the Secretary of State. Make sure to provide:

- Desired LLC name (complying with state naming norms)

- Principal location or physical address

- Search database references if needed to confirm no conflict

- Managerial structure or member details

Await official approval, which typically arrives by mail or email. Keep digital copies of these records, as you’ll need them for licensing or banking.

Meeting Illinois Publication Requirements

Certain localities within the state may obligate newly formed LLCs to publicize their creation in a newspaper. While not every county enforces it, those that do typically require:

- Publishing the LLC name, formation date, and registered agent info

- Running the ad for a set number of weeks

- Filing proof of publication with state authorities

Check local rules to see if your region calls for it. Neglecting this step can jeopardize your compliance and hamper future expansions.

Appointing a Registered Agent in Illinois

State law demands every limited liability company have a dedicated agent for service of process. This individual or entity must maintain a valid address in Illinois, ensuring official correspondence is handled promptly. The advantage of a professional agent: they handle any legal documents discreetly, letting you focus on growth. If you’re physically present in the state, you can self-appoint, but it’s often wise to engage a third party for consistency if you plan frequent travel. For professional assistance, consider the best LLC service to streamline your registration process.

Understanding Ongoing Compliance Obligations

After the business formation process completes, you must remain compliant with state rules:

- File an annual report each year to renew your good standing.

- Update your business register with any ownership or address changes.

- Renew any local business licenses if your sector requires them.

- Maintain thorough records for potential audits or expansions.

- Track deadlines for any assumed business name registration if operating under different labels.

By adhering to these tasks, you ensure your LLC remains legitimate and open to new opportunities.

Obtaining an EIN for Your New LLC

Most newly formed companies need an Employer Identification Number (EIN) for tax and operational needs. Here’s how to secure it:

- Navigate to the official IRS website and select the EIN application form.

- Provide basic details: your LLC’s name, address, and formation date. Choose the best registered agent service to handle your compliance needs effectively

- Indicate the responsible party for the LLC.

- Submit the form; approval often comes instantly online.

- Record your EIN in internal documentation for accounts, payroll, or credit lines.

With this number in hand, you can handle financial transactions, open business bank accounts, and streamline tax procedures.

Looking for an overview? See Illinois LLC Services

Stay Compliant with Expert Help

Harbor Compliance ensures your Illinois LLC meets state regulations. Get professional support for filings, registered agents, and compliance.