To start a Tennessee LLC in 2025, choose an available name, appoint a Tennessee registered agent, and file Articles of Organization (Form SS-4270) with the Secretary of State. After approval, get an EIN, create an operating agreement, and register in TNTAP for any Franchise & Excise or sales tax obligations. Most owners also need a local business license based on receipts and must file an annual report each year. This guide gives you the exact steps, costs, and deadlines so you can launch quickly and stay compliant.

Why Form an LLC in Tennessee? Key Advantages & Tradeoffs

An llc in tennessee provides liability shielding, flexible management, and real-world credibility with banks and vendors. But balance the benefits against recurring state costs (per-member annual report) and Tennessee’s Franchise & Excise (F&E) taxes, plus local business license thresholds. For local market context, see our Tennessee small-business statistics to gauge opportunities and challenges.

Limited Liability Protection (what it is / what it isn’t)

A limited liability company helps separate business debts from your personal assets, classic asset protection for owners. If the LLC is sued, your home, car, and savings are generally outside the reach of business creditors. However, the “veil” isn’t absolute. Banks may require personal guarantees for loans, and owners can still be liable for their own wrongdoing (e.g., fraud) or if they commingle funds and ignore records or operating agreement rules. Keep a separate bank account, sign contracts in the LLC’s name, and follow your operating procedures to maintain the shield (General principles; see Tennessee’s official forms/FAQs for fees/compliance details). For advanced risk separation (e.g., parent-and-subsidiary structures), review our LLC holding company basics before you talk to a tax or legal pro.

Management Flexibility & Pass-Through Federal Taxation

You can choose member-managed or manager-managed structures without corporate formalities. For federal purposes, most LLCs are taxed as pass-throughs (single-member: disregarded; multi-member: partnership; S-corp election optional). That means profits generally pass to owners and are reported on personal returns. Important for Tennessee: federal pass-through treatment does not exempt most LLCs from state F&E filing—Tennessee imposes excise tax (6.5% of net earnings) and franchise tax (0.25% of net worth, $100 minimum). We’ll detail registration and returns in the Taxes section below.

Tennessee-Specific Considerations (Costs & Compliance)

Before you launch your tennessee llc, it’s important to understand that the state has its own recurring costs and compliance rules beyond the one-time formation filing fee. These obligations affect nearly every LLC, so you’ll want to plan ahead for them in your budget. The three big items are your annual report, state Franchise & Excise (F&E) taxes, and potential local business licenses depending on your revenue.

- Annual Report: $50 per member; $300 minimum; $3,000 maximum. Due annually; online filing available via the Tennessee Secretary portal.

- F&E Taxes: Excise 6.5% of net earnings; Franchise 0.25% of net worth (minimum $100). Register/file with the Tennessee Department of Revenue (TNTAP).

- Local Business License: $15 fee; no license if gross ≤ $3,000; Minimal Activity License for $3,000–$100,000; Standard license when > $100,000 (links explain 2023+ threshold changes).

Quick visual:

Costs stack = state filing fee (one-time) → annual report (recurring) → F&E (most tennessee llc must file) → local license (based on revenue).

Tennessee LLC Formation Requirements (What You Need Before You File)

Before filing your articles of organization with the tennessee secretary, there are a few key requirements you’ll need to prepare. You must choose a compliant business name, decide if you want to reserve it, appoint a registered agent with a physical Tennessee office address, and determine the management structure of your LLC. These steps ensure that when you do submit your paperwork, it will be accepted quickly and without costly mistakes. In the next sections, we’ll walk through each requirement in detail, with direct links to the state’s official rules and forms.

Business Name Rules & Availability Search (Free)

Tennessee requires that your LLC name be “distinguishable on the records” of the Tennessee Secretary of State. In other words, your business name can’t be identical or deceptively similar to an existing LLC, corporation, nonprofit, or partnership already registered in the state. You can confirm this easily using the Business Name Availability search tool on the SOS website (free to use). For a step-by-step walkthrough, see our Tennessee business entity search guide.

By law (Tennessee Code § 48-207-101), your name must also include an LLC designator such as “Limited Liability Company,” “LLC,” or “L.L.C.” Certain words—like “bank,” “insurance,” “trust,” or terms suggesting a government agency—are restricted and require extra approvals from the appropriate regulator before you can use them.

Checking both availability and legal compliance before filing prevents costly rejections and ensures your LLC name meets all state rules. If you’re new to name vetting, this LLC name check guide shows how to confirm availability and avoid conflicts.

Optional Name Reservation — $20

If you've found a great name but aren’t ready to file your LLC just yet, you can reserve it in advance. Use Form SS‑4228: Application for Reservation of LLC Name and pay a $20 filing fee, which secures the name for 120 days (four months). That holds it off the record from being taken by others. If you haven’t filed your Articles of Organization yet, name reservation is optional and serves only to hold your chosen name. You can submit the form online, by mail, or in person—no rush, but it gives you protection while you prepare to launch.

Registered Agent & Registered Office Requirements

Every llc in tennessee must designate a registered agent and a registered office when filing the articles of organization. The agent can be an individual Tennessee resident or a business authorized to operate in the state, but they must maintain a physical street address (no P.O. boxes allowed). The registered office is where official mail and service of process are delivered.

The agent must also be available during normal business hours. You can serve as your own agent at no cost, but most business owners hire a professional registered agent service (typically $100–$300/year) to maintain privacy and ensure compliance. If you’re deciding between DIY and hiring, read our Tennessee registered agent requirement explainer.

If you need to change your registered agent or office later, file the appropriate form (Change of Registered Agent/Office, Form SS-4527) with the Tennessee Secretary of State.

Decide on Company Structure & Special Elections

When forming an LLC, you must decide how it will be managed and whether any special elections apply. By default, LLCs are member-managed, meaning all owners (members) share management duties. Alternatively, you can elect a manager-managed structure, appointing one or more managers to handle daily operations while members act more like passive owners. This choice must be indicated in your articles of organization.

Tennessee also recognizes specialized LLC types:

- PLLC (Professional LLC): Required for licensed professionals such as doctors, lawyers, or accountants. You’ll need to submit proof of state licensing with your filing.

- Series LLC: Allows for multiple “series” under one parent LLC, each with separate assets and liability protection. Useful for investors or multi-unit businesses.

- One-Member Exempt (OME) Election: A simplified option available to certain single-member LLCs to reduce reporting requirements.

Each structure offers different benefits and compliance rules, so it’s important to choose carefully based on your business requirements.

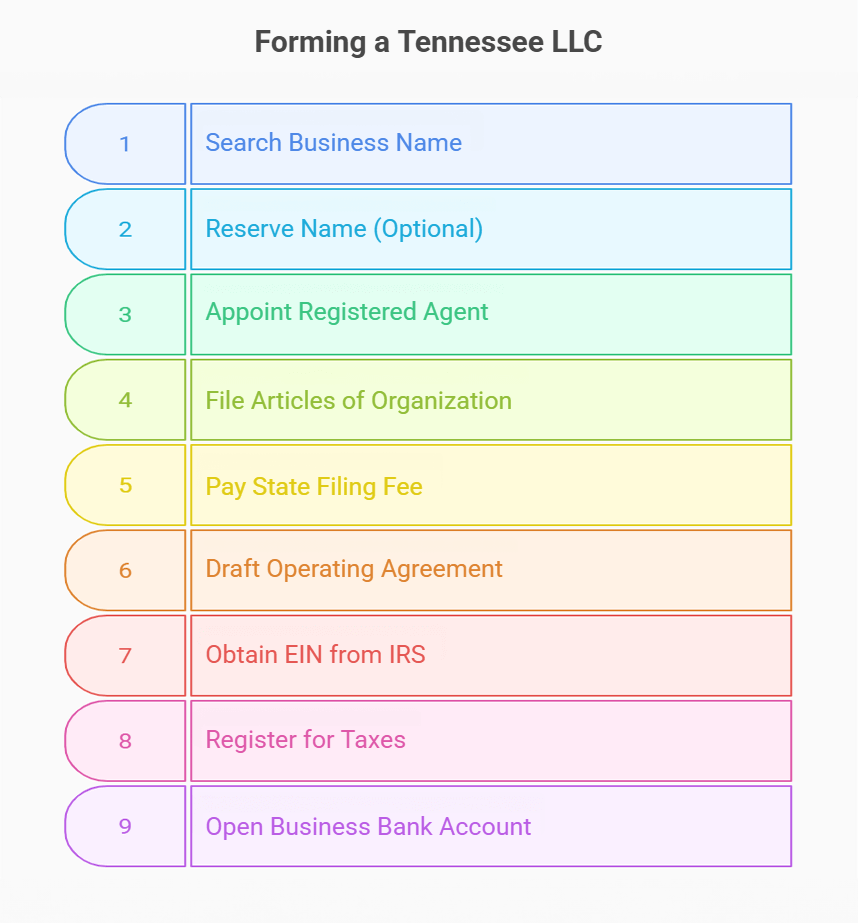

9 Steps to Form Your Tennessee LLC (Your Action Guide)

Forming an llc in tennessee is straightforward if you follow the state’s official process in order. The fastest and most reliable way to complete these steps is online through the Tennessee Secretary of State’s Business Services portal, where most filings are approved within one business day. You can also file by mail, but that usually takes 3–5 business days. Each of the following steps explains exactly what to do, what it costs, and which state form or link you’ll need to use—so you can set up your LLC quickly and stay compliant from the start.

Step 1 – Search the Business Name (Free)

Your first task is to confirm that your LLC name is available in Tennessee. Use the Business Name Availability Search Tool on the Tennessee Secretary of State website to see if your choice is free. The system checks against all existing entities and tells you instantly if your name is distinguishable.

If the search shows your name is available, you’re safe to move forward. If not, adjust it by adding unique words or abbreviations until it passes. As a best practice, also check whether your chosen name is available as a domain name and on key social media platforms, this protects your brand identity beyond state records.

Step 2 – (Optional) Reserve the Name – $20

If you’re not filing your articles of organization right away, you can lock in your chosen name by filing Form SS-4228: Application for Reservation of LLC Name. The filing fee is $20, and the reservation lasts for 120 days (four months).

You can file the reservation online through the Tennessee Secretary of State portal for the fastest processing (usually within 1 business day), or submit it by mail to the SOS office in Nashville (processing about 3–5 business days).

This step is completely optional, most owners skip it and go straight to filing, but it’s useful if you want to hold a name while finalizing your LLC paperwork.

Step 3 – Appoint a Tennessee Registered Agent

When you file your articles of organization, you must list your registered agent and their registered office address. This can be:

- You (if you’re a Tennessee resident with a physical street address),

- Another individual Tennessee resident, or

- A commercial registered agent service authorized in the state.

On Form SS-4270, enter the agent’s full name and a street address in Tennessee (no P.O. boxes). The form also asks for the county of the registered office.

If you change agents later, you’ll need to file Form SS-4527: Change of Registered Agent/Office with the Tennessee Secretary of State. Most owners use a paid service (about $100–$300/year) for privacy and reliable compliance.

Step 4 – File Articles of Organization (Form SS-4270)

The Articles of Organization (Form SS-4270) is the official document that creates your llc in tennessee. File it online through the Tennessee Secretary of State’s Business Services portal (fastest, often approved the same day) or by mail to the Nashville office.

What you’ll include on the form:

- LLC name with a legal designator (LLC or L.L.C.)

- Registered agent’s name and physical street address (plus county)

- Principal office address

- Management type (member-managed or manager-managed)

- Number of members (this determines your state filing fee—explained in Step 5)

Mail filings usually take 3–5 business days to process, while online filings are typically approved within 1 business day.

What information goes in the Tennessee Articles of Organization?

Expect to provide: LLC name, principal and mailing address, registered agent and address, management type (member- or manager-managed), number of members, effective date (if delayed), and an authorized signer.

Step 5 – Pay the State Filing Fee

Tennessee charges a per-member filing fee when you submit your Articles of Organization. The fee is $50 per LLC member, with a minimum of $300 (for 1–6 members) and a maximum of $3,000 regardless of size (TN SOS – Fee Schedule).

Examples:

- Single-member or 6-member LLC → $300

- 10-member LLC → $500

- 50-member LLC → capped at $3,000

How to pay:

- Online filings: Pay by credit/debit card or e-check through the TNCaB portal.

- Mail filings: Pay by check or money order to Tennessee Secretary of State.

Processing is fastest online, with most approvals in 1 business day. Mail filings typically take 3–5 business days plus mailing time.

Step 6 – Draft & Adopt an Operating Agreement (Internal)

While Tennessee doesn’t legally require most LLCs to adopt a written operating agreement, having one is strongly recommended, especially for multi-member LLCs or those seeking to maintain clear internal structure and liability protection. Only director-managed LLCs are required by state law to have an operating agreement; most other LLCs may choose whether to create one.

A written operating agreement:

- Establishes ownership percentages, voting rights, and management structure

- Reinforces the separation between personal and business assets (limited liability)

- Clarifies default rules and prevents conflict by overriding Tennessee’s statutory defaults

- Is often requested by banks, investors, or partners during due diligence

Once drafted, members should sign it and keep a copy with official records—no filing with the state is needed.

Step 7 — Get an EIN from the IRS (Free)

An Employer Identification Number (EIN) is a nine-digit tax ID issued by the IRS. Even if your tennessee llc has no employees, you’ll need an EIN to open a business bank account, file federal and state tax returns, and handle payroll if you hire staff later.

The EIN is free and quick to obtain:

- Apply online at the IRS EIN Assistant for immediate issuance (irs.gov).

- Alternatively, file Form SS-4 by fax or mail (takes 1–4 weeks).

Keep your EIN confirmation letter with your LLC’s records, it’s often required by banks, vendors, and state tax registrations.

How much does an EIN number cost?

$0 — an EIN is free from the IRS when you apply directly. Avoid third-party sites that charge.

How long does it take to get an EIN number?

Online: immediate issuance once you finish the application.

Fax/mail: roughly 1–4 weeks depending on method and workload.

Step 8 – Register for Tennessee Tax & Local Licensing (Very Important)

Once your tennessee llc is officially formed, you’re not done yet, Tennessee requires most businesses to register for state taxes and, in many cases, obtain a local business license. You’ll handle both through the Tennessee Department of Revenue and your county or city clerk’s office. Not sure whether you need a license at all? Read Do LLCs need a business license? for a practical overview.

State-Level Tax Registration via TNTAP:

- Register your Tennessee LLC using your EIN through the Tennessee Taxpayer Access Point (TNTAP) to handle all state tax obligations.

- Most LLCs must file and pay Franchise & Excise Taxes:

- Excise tax: 6.5% of net earnings, subject to a $50,000 standard deduction for tax years ending on or after December 31, 2023.

- Franchise tax: 0.25% of net worth, with a $100 minimum on the calculated base (no maximum specified here).

- If you sell taxable goods or services, register for Sales & Use Tax via TNTAP. You'll collect the 7% state rate, plus your local jurisdiction’s rate (up to 2.75%).

Local Licensing Requirements:

- No business license is required if gross receipts are less than $3,000 in a jurisdiction.

- A Minimal Activity License (fee: $15 annually) is required for gross receipts between $3,000 and $100,000 per jurisdiction.

- Once your gross receipts exceed $100,000 within a jurisdiction, you must obtain a Standard Business License, and file the business tax accordingly. You’ll receive the renewed license automatically via TNTAP upon payment.

Step 9 – Open a Business Bank Account & Set Up Accounting

Once your tennessee llc is approved, open a dedicated business bank account to keep company and personal finances separate. This is essential for maintaining limited liability protection, mixing funds can risk piercing the corporate veil.

What you’ll need at the bank:

- EIN confirmation letter from the IRS

- Filed Articles of Organization

- Signed Operating Agreement (many banks require it)

- Valid photo ID for members/managers

Most banks in Tennessee (e.g., Regions, Truist, First Horizon) require a minimum opening deposit, usually between $25–$100. Some offer free business checking if you maintain a balance.

At the same time, set up basic accounting—whether through software like QuickBooks or a local CPA—to track expenses, prepare for annual taxes, and file your annual report on time.

Start Your Tennessee LLC the Easy Way with ZenBusiness

ZenBusiness simplifies every step, name reservation, Articles of Organization, and compliance — so you can launch your Tennessee LLC with zero hassle.

Tennessee LLC Costs & Ongoing Fees

Starting and maintaining an llc in tennessee requires both one-time filing fees and recurring annual costs. While forming your business is relatively affordable compared to other states, you’ll need to budget for state filings, annual reports, and other compliance fees. Below is a complete breakdown of the most common costs, based on current Tennessee Secretary of State and Department of Revenue information (updated 2025). For context beyond Tennessee, see LLC annual fees by state to benchmark ongoing costs.

One-Time & Recurring State Fees to Plan For

Before you dive into running your tennessee llc, make sure you budget for the state’s required filings. Some of these costs are one-time fees at formation, while others recur every year to keep your LLC in good standing.

- Articles of Organization (Form SS-4270): $50 per member; $300 minimum; $3,000 maximum. This fee is paid once when you officially file your LLC.

- Annual Report: Due every year by the first day of the 4th month after your fiscal year closes. Cost is $50 per member, with the same $300 minimum and $3,000 maximum (TN SOS Annual Report Filing).

- Certificate of Existence: $20, available online or by mail, often needed for banks, lenders, or registering your LLC in another state.

- Change of Registered Agent/Office (Form SS-4527): $20 filing fee if you update your registered agent or registered office after formation.

Tennessee LLC Fee Table (2025):

| Fee Type | Amount | When Due |

|---|---|---|

| Articles of Organization (SS-4270) | $50/member; $300 min; $3,000 max | One-time, at LLC formation |

| Annual Report | $50/member; $300 min; $3,000 max | Annually, by 4th month after fiscal year close |

| Certificate of Existence | $20 | As needed (e.g., banking, foreign registration) |

| Change Registered Agent/Office (SS-4527) | $20 | Whenever agent or office is updated |

How much does an LLC cost in Tennessee?

Tennessee charges $50 per member with a $300 minimum and a $3,000 maximum at formation and for each Annual Report.

- 1–6 members → $300

- 7 members → $350

- 10 members → $500

- 50+ members → capped at $3,000

See our full breakdown: Tennessee LLC cost.

Annual Report: Due Dates, Fees, & How to File

Every tennessee llc must file an Annual Report with the Tennessee Secretary of State to stay in good standing. Missing this filing can lead to administrative dissolution of your LLC, so it’s one of the most important recurring compliance steps.

Who must file:

All active Tennessee LLCs, domestic and foreign, must file an annual report.

Due date:

Due each year by the first day of the 4th month following your LLC’s fiscal year end. For most LLCs using a calendar year, the due date is April 1.

Fee calculation:

$50 per LLC member, with a minimum fee of $300 and a maximum fee of $3,000 (TN SOS Annual Report Instructions).

Processing times:

- Online filing (via TNCaB portal): Immediate confirmation/approval.

- Mail filing: About 5–10 business days plus mailing time.

Registered Agent in Tennessee (Duties, Options, and Changes)

Every tennessee llc must maintain a registered agent with a physical street address in the state. The agent’s role is crucial for compliance: they receive official mail, legal notices, and service of process on behalf of the LLC. Without a reliable agent, your company risks missing lawsuits or state notices, which could lead to penalties or even dissolution.

Who Can Serve & What They Must Do

Your registered agent can be:

- Any Tennessee resident over 18 with a physical street address (no P.O. boxes), or

- A business entity authorized to provide registered agent services in Tennessee.

By law, the agent must:

- Be available during normal business hours

- Accept service of process (lawsuits, subpoenas) and official state correspondence

- Forward all documents promptly to the LLC

Many business owners list themselves or a trusted associate, but this reduces privacy since the address becomes public record. Using a professional registered agent service helps keep personal information off state databases while ensuring reliable compliance. If you prefer a professional provider, start with our shortlist to compare Tennessee registered agent services before you decide.

DIY vs. Commercial Service – Pros & Cons

Not sure whether to serve as your own registered agent or hire a professional? Here’s a quick side-by-side to weigh cost against convenience, privacy, and reliability.

DIY Registered Agent (yourself or a member):

- Pros: Free, simple to set up, full control of mail.

- Cons: Must be available during business hours; your personal address goes on public record; risk of missing documents if you’re away.

Commercial Registered Agent Service (professional provider):

- Pros: Privacy protection (your home address stays private), consistent availability, reminders for compliance deadlines, mail scanning/forwarding, coverage if you expand into other states.

- Cons: Annual cost, typically $100–$300/year in Tennessee.

Best fit: If you’re comfortable using your personal address and are always available during work hours, DIY works. But most owners prefer hiring a professional service for convenience, privacy, and peace of mind.

Trust Northwest for Registered Agent Services in Tennessee

Northwest offers dependable Registered Agent services to help your Tennessee business stay in good standing.

How to Change or Resign a Registered Agent (and Fee)

To update your registered agent or registered office, file Form SS-4527: Change of Registered Agent/Office with the Tennessee Secretary of State (sos.tn.gov). The filing fee is $20.

How to file:

- Online: Fastest option, usually processed immediately through the TNCaB portal.

- By Mail: Processing takes about 3–5 business days after receipt.

If an agent resigns, they must notify both the SOS and the LLC. Your LLC must then promptly appoint a new registered agent to remain in compliance and avoid administrative penalties.

Tennessee Processing Times & (Lack of) Expedited Options

Filing times for a tennessee llc are among the fastest in the country. Most online filings are approved the same day or within 1 business day through the TNCaB portal. Tennessee does not offer a paid expedited filing option, but online submission essentially functions as instant approval. Mail filings, however, take longer, usually 3–5 business days plus mailing time. If you must file by mail, the best practice is to use overnight delivery envelopes and include a prepaid return mailer to reduce turnaround. For a method-by-method breakdown, see our Tennessee LLC approval time guide.

How long does it take to create an LLC in Tennessee?

Online filings: often approved the same day or within 1 business day (fastest route).

Mail filings: typically 3–5 business days plus mailing time.

Tennessee does not offer a separate paid expedite for LLC formation; filing online is effectively the fastest option.

Taxes for Tennessee LLCs (Plain-English Overview)

Running a tennessee llc also means staying compliant with state and local taxes. Tennessee imposes several business taxes, including Franchise & Excise (F&E) taxes, Sales & Use tax, and a Local Business Tax. These obligations apply differently depending on your business type and revenue. This guide gives a plain-English overview of each, but it is not tax advice, always confirm details with the Tennessee Department of Revenue or a qualified CPA. For federal treatment options and planning ideas, see LLC tax benefits explained.

Franchise & Excise (F&E) Tax Basics

Most Tennessee LLCs must file Franchise and Excise (F&E) Taxes each year, regardless of federal tax classification.

- Franchise Tax = 0.25% of net worth, with a $100 minimum tax.

- Excise Tax = 6.5% of net earnings, with a $50,000 standard deduction (applies for tax years ending after Dec. 31, 2023).

Returns are filed using Form FAE170 (standard return) or Form FAE174 (exempt entities). All accounts are opened and managed via TNTAP (Tennessee Taxpayer Access Point).

Filing is required for nearly all active LLCs, unless exempt under very narrow statutory rules. These taxes are a major recurring obligation, so it’s important to budget for them and stay current.

Sales & Use Tax Registration (if applicable)

If your tennessee llc sells taxable goods or services, you must register for a Sales & Use Tax permit through TNTAP before making sales.

- State rate: 7%

- Local rate: up to an additional 2.75% depending on county/city.

Common taxable categories include retail goods, certain digital products, restaurant meals, and lodging. Some professional services may also be taxable.

Once registered, you’ll collect sales tax from customers and remit it to the Department of Revenue on a monthly or quarterly schedule (depending on volume). Failure to register and collect can lead to penalties and interest.

Local Business Tax & Licenses (County/City)

Most Tennessee counties and municipalities impose a Local Business Tax. This requires an annual license, which you apply for through your county clerk or city clerk, then renew via TNTAP.

- No license: If gross receipts are below $3,000 in a jurisdiction.

- Minimal Activity License: $15 per year for gross receipts between $3,000 and $100,000.

- Standard Business License: Required once gross receipts exceed $100,000.

Renewals are tied to filing the annual business tax return through TNTAP. Once paid, your new license is automatically issued.

These licenses apply per jurisdiction, if you operate in multiple counties or cities, you may need multiple licenses.

Post-Formation Checklist (Do These Next)

Forming your tennessee llc is only the beginning. To stay compliant and operate smoothly, you’ll need to complete a few critical tasks after approval. These steps cover legal documents, banking, employer obligations, and local permits, each one ensures your business is set up for long-term success.

Operating Agreement – What to Include

Your operating agreement should clearly define how your LLC will function. While not filed with the state, it is legally binding among members and often requested by banks or partners. At a minimum, include:

- Ownership percentages

- Initial capital contributions

- Profit/loss allocations

- Rules for membership transfers

- Voting rights and decision-making

- Dispute resolution procedures

- Dissolution triggers

Having this agreement in writing strengthens liability protection and helps prevent conflicts. Even single-member LLCs benefit, since it proves separation of business and personal assets.

Banking & Merchant Services

Opening a dedicated business bank account keeps your finances separate and protects your liability shield. Tennessee banks typically ask for:

- Your LLC’s EIN confirmation letter from the IRS

- Filed Articles of Organization

- Signed Operating Agreement

- A Certificate of Existence ($20 if requested by the bank)

Some banks also require a minimum deposit ($25–$100). Setting up merchant services or payment processors at this stage helps you accept credit cards and streamline cash flow. Keeping finances separate is critical for preserving your LLC’s liability protections.

Employer Setup (Payroll, Unemployment Insurance, Workers’ Comp)

If your tennessee llc plans to hire employees, you must register with the Tennessee Department of Labor & Workforce Development for unemployment insurance. Employers are also required to handle payroll tax withholding for the IRS and state.

Workers’ compensation insurance is generally required if you employ five or more employees, but special rules apply to the construction industry (coverage may be required even with fewer employees). Always confirm current thresholds directly on the Tennessee Dept. of Labor site.

Additionally, you’ll need to comply with federal employment requirements—such as verifying new hires with Form I-9 and reporting them to the Tennessee New Hire Registry. Setting up payroll software or a provider early helps avoid costly compliance mistakes.

Local Zoning, Signage, & Specialty Permits

Before opening your doors, check with your county or city clerk’s office about local zoning rules. Many municipalities regulate signage, parking, home-based businesses, and commercial property use.

You may also need specialty permits depending on your industry, for example, health permits for food service, liquor licenses for alcohol sales, or professional licenses for regulated trades.

Researching local rules early prevents delays and fines. Each county and city in Tennessee sets its own requirements, so start with your local planning or zoning office for guidance.

Special Tennessee LLC Variations (When They Make Sense)

While most businesses choose a standard tennessee llc, the state also allows several specialized LLC types. These variations are designed for unique professional, investment, or legal liability situations. Each option has extra rules and compliance requirements, so they should only be used when they clearly fit your business model. Below are the three main LLC variations recognized in Tennessee.

Professional LLC (PLLC)

A Professional LLC (PLLC) is required when licensed professionals—such as doctors, attorneys, accountants, architects, or engineers—form an LLC in Tennessee. The licensing board for each profession must approve your application before the Secretary of State will register the PLLC.

Naming rules apply: the name must include “PLLC” or “Professional Limited Liability Company” and meet all normal LLC naming requirements. Only licensed members of the profession may own or manage the PLLC.

Because PLLCs provide services tied to professional licensure, they do not shield individual members from malpractice liability, each professional remains personally liable for their own professional conduct.

Series LLC in Tennessee

Tennessee law permits the formation of a Series LLC, which allows one “parent” LLC to create separate protected series within the same entity. Each series can hold distinct assets, liabilities, and members, and debts of one series do not legally affect the others.

This structure is popular with real estate investors and businesses managing multiple product lines. However, each series must maintain separate internal records, and not all banks, insurers, or states outside Tennessee recognize the structure. Real-estate landlords should also review LLC for real estate agents to structure holdings and risk.

Before forming a Series LLC, consider the added administrative work and compliance obligations. For a deeper dive, our Series LLC guide breaks down pros, cons, record-keeping, and common pitfalls.

Obligated Member Entity (OME) Election (Advanced & Rare)

Tennessee also allows an Obligated Member Entity (OME) election, which is uncommon and typically used only in specialized business planning. With an OME, members voluntarily accept personal liability for the debts and obligations of the LLC, similar to a general partnership.

Why choose this? Sometimes for tax planning or when creditors demand stronger guarantees. However, it eliminates one of the primary benefits of an LLC: limited liability.

OME elections require filing an addendum with the Tennessee Secretary of State and are best considered only with professional legal advice.

Foreign (Out-of-State) LLCs: Registering to Do Business in Tennessee

If your company was formed in another state, you’ll need a Certificate of Authority to operate as a foreign llc in Tennessee. You can apply online through the Tennessee Secretary of State or by mail. Approval adds your company to Tennessee’s records, lets you open accounts, sign leases, and stay compliant while transacting business in the state.

Eligibility & Required Documents

Most out-of-state LLCs are eligible so long as they appoint a Tennessee registered agent with a physical street address and provide a recent Certificate of Existence/Good Standing from the home state. Be ready with this checklist when you apply:

- Exact LLC legal name (and an alternate “use name” if your name isn’t distinguishable in TN)

- Home-state formation jurisdiction and date

- Principal office address & mailing address

- Tennessee registered agent name and registered office street address

- Management structure (member-managed or manager-managed)

- Member count (used to calculate the filing fee)

- Signature/authorization by a proper company officer/manager

Applications may be filed online or by paper; certificates of existence must be recent (Tennessee practice uses a “no older than two months” rule on related filings).

Filing Fees & How They’re Calculated in Tennessee

Tennessee uses the same per-member fee model for foreign LLC registration as it does for domestic formations: $50 per member, with a $300 minimum and a $3,000 maximum. Your member count at filing determines the amount due. File online (fastest) or by mail using the state’s Application for Certificate of Authority (Foreign LLC). For forms and current fee details, see the Secretary of State’s Business Forms & Fees page and the COA application.

Ongoing Compliance After Registration

After approval, a foreign LLC must:

- File the annual report every year (same fee math: $50/member, $300 min, $3,000 max).

- Maintain a Tennessee registered agent and update changes promptly with the Secretary of State (changes can be filed online or by paper; a small filing fee applies).

- Meet local business license rules in each county/city where you operate: no license if under $3,000 gross receipts; Minimal Activity License ($15) for $3,000–$100,000; Standard Business License once receipts exceed $100,000 (renewal tied to filing business tax via TNTAP).

Foreign LLC – Quick Filing Reference (Tennessee)

| What You Need | Details (2025) |

|---|---|

| Form | Application for Certificate of Authority (Form SS-4233) |

| Where to file | Online via the TN SOS portal (fastest) or by mail to the Division of Business Services |

| Required documents |

• Certificate of Existence/Good Standing from home state (must be ≤ 2 months old) • Tennessee registered agent with a physical street address • Legal name (and TN “use name” if needed), home-state jurisdiction/date, principal/mailing address, management type, member count, authorized signer |

| Filing fee (TN model) | $50 per member; $300 minimum; $3,000 maximum (calculated on member count at filing) |

| Forms & fees hub | TN SOS Business Forms & Fees index (foreign filings, COA) |

Compliance Watch: BOI Reporting (FinCEN) Status in 2025

Here’s the federal snapshot for tennessee llc owners: On March 26, 2025, FinCEN published an interim final rule that removes the BOI reporting requirement for U.S. companies and U.S. persons and narrows the rule to foreign reporting companies only. Foreign companies still have BOI deadlines; domestic companies are exempt pending a final rule. Keep monitoring FinCEN for updates as the rule proceeds through notice-and-comment.

What changed:

- Rule status: The IFR revises “reporting company” to exclude domestic entities; only foreign companies registered to do business in the U.S. must report under new deadlines. Published March 26, 2025.

- FinCEN confirmation page: FinCEN’s BOI portal shows U.S. entities are exempt; foreign companies received a short deadline extension tied to the IFR’s publication.

- Federal Register text: Domestic companies are exempt and do not have to file, update, or correct BOI reports previously submitted. (The IFR does not state that previously filed domestic BOI was deleted.)

- Treasury notice: Treasury announced the IFR publication and exemption for U.S. companies/persons on March 26, 2025.

Official sources do not state that previously filed domestic BOI data was purged; they state domestic companies no longer need to report or update. We’ll continue to monitor FinCEN’s site for any data-retention updates.

Tennessee LLC Scams & Pitfalls to Avoid

Scams target new and busy business owners. Two common issues for an llc in tennessee are misleading mailers that sell overpriced state documents and missing your annual report—both can cost you time and money. Use the official Secretary of State channels and set calendar reminders so your tennessee llc stays in good standing.

Third-Party “Certificate of Existence” Mailers

A Certificate of Existence proves your LLC is active and compliant. Some private companies mail letters that look “official,” pushing unnecessary “rush” services for inflated prices. In Tennessee, the official certificate costs $20 when ordered directly from the Secretary of State—online, by phone, or by mail. If you receive a solicitation charging more, ignore it and order from the state instead. (You can request it yourself in minutes.)

Missing Annual Report (and Late Fees/Dissolution Risk)

Every active Tennessee LLC must file an annual report each year. Missing it can trigger administrative dissolution and loss of good standing. Set calendar reminders for your due date (the 1st day of the 4th month after fiscal year end, e.g., April 1 for calendar-year LLCs), and promptly update your registered agent/registered office if anything changes so notices reach you. File online for the fastest confirmation.

Frequently Asked Questions – Tennessee LLCs

Have questions about starting or running an llc in tennessee? Below you’ll find quick answers on costs, timelines, filings, taxes, licensing, and compliance, each grounded in official state and federal sources. Use it to jump straight to what you need, from articles of organization and registered agent rules to annual report deadlines and foreign llc registration.

How much does it cost to start a Tennessee LLC?

Tennessee charges $50 per member, with a $300 minimum and $3,000 maximum, when you file your Articles of Organization. Most single-member and small multi-member LLCs pay $300 at formation. Optional costs can include a $20 Certificate of Existence if a bank asks, and local license fees depending on revenue thresholds. File online for the fastest approval via the state portal.

How are filing fees and annual report fees calculated ?

Both the initial Articles of Organization fee and your yearly Annual Report use the same model: $50 per member, $300 minimum, $3,000 maximum. The member count at filing (or at report time) sets your amount due. You can file and pay online through Tennessee’s TNCaB system.

How long does it take to form online vs. by mail?

Online filings through TNCaB are typically approved same day or within 1 business day. Mailed forms take longer due to processing and postal time. If you must mail, use overnight delivery and include a prepaid return label to speed things up. (The state doesn’t sell a paid “expedite,” so online is your de-facto fastest route.)

Can I be my own registered agent in Tennessee?

Yes, Tennessee law allows an individual who resides in Tennessee to serve as the registered agent, provided there’s a physical street address (no P.O. box) and availability during business hours. An in-state entity authorized to do business may also serve. Keep your agent and registered office up to date—state filings depend on it.

What information goes in the Articles of Organization?

Tennessee statute requires your LLC name (meeting naming rules), registered agent and registered office (street address and county), principal office address, management type (member-, manager-, or director-managed), and other basics set in T.C.A. §48-249-202. The state form SS-4270 tracks these statutory items. File online or by mail.

For help drafting a clear, concise purpose clause, use our business purpose statement examples.

Do single-member LLCs owe Tennessee franchise & excise taxes?

Usually, yes. Tennessee imposes Franchise & Excise (F&E) taxes on most LLCs regardless of federal tax classification. Excise is 6.5% of net earnings (with a $50,000 standard deduction), and Franchise is 0.25% of net worth (minimum $100). Register and file via TNTAP using FAE forms. See the Department of Revenue’s current F&E Tax Manual (June 2025).

When is the annual report due and how do I file it?

Your Annual Report is due each year by the first day of the 4th month after your fiscal year ends (e.g., April 1 for calendar-year LLCs). Fee math: $50 per member; $300 min; $3,000 max. File online through the TNCaB account for the quickest confirmation.

Do I need a county/city business license, and what are the revenue thresholds?

Most locations use Tennessee’s Local Business Tax thresholds:

– No license if under $3,000 gross receipts.

– Minimal Activity License ($15) for $3,000–$100,000.

– Standard Business License once receipts exceed $100,000.

Licenses are issued by your county/city clerk and renew through filing your business tax via TNTAP. Rules vary by jurisdiction, check your local clerk.

Do I need an Operating Agreement, and will banks ask for it?

Tennessee doesn’t require filing an operating agreement, but it’s strongly recommended to define ownership, management, and dispute rules. Banks often ask for it, along with your EIN, Articles, and sometimes a Certificate of Existence ($20), when opening a business account.

See SBA guidance and the SOS ordering page.

Do I need an EIN, and how do I get one for free?

Most LLCs need an EIN for banking, hiring, and tax filings. Get it free directly from the IRS online (instant for U.S. applicants). If you’re outside the U.S. or lack an SSN/ITIN, use Form SS-4 by fax or mail (or phone for international applicants). Avoid third-party sites that charge.

Can non-U.S. residents form a Tennessee LLC?

Yes. Tennessee law says “one or more persons” may form an LLC by filing Articles of Organization, no state residency or citizenship requirement. You must still maintain a Tennessee registered agent/office and handle federal requirements (like obtaining an EIN via SS-4 if you can’t use the online system).

How do I register a foreign LLC to do business in Tennessee?

Apply for a Certificate of Authority (Form SS-4233) and include a recent Certificate of Existence/Good Standing from your home state. Tennessee’s fee uses the same model: $50 per member ($300 min; $3,000 max). File by mail or through the state’s system and keep your registered agent current after approval.

- Internal Revenue Service: Publication 1635 — Understanding Your EIN (PDF)

- Financial Crimes Enforcement Network (FinCEN): Beneficial Ownership Information Reporting

- U.S. Small Business Administration (SBA): Apply for Licenses and Permits

- National Association of Secretaries of State (NASS): Corporate Registration

- Federal Deposit Insurance Corporation (FDIC): How to Pick a Bank Account — Checklist (PDF)

- Tennessee Secretary of State: Annual Report

- Justia (Tennessee Code): § 48-249-1017

- Tennessee Secretary of State: Business Forms & Fees

- Tennessee Department of Revenue: Franchise & Excise Tax

Looking for an overview? See Tennessee LLC Services

Launch Your Tennessee LLC Professionally with Harbor Compliance

From filing to compliance tracking, Harbor Compliance handles your Tennessee LLC formation with accuracy and speed.