Looking to protect your assets and operate legally under a flexible structure? Starting an LLC in New Mexico is one of the best moves a new business owner can make — offering liability protection, pass-through taxation, and unmatched privacy with no annual report requirements.

To start an LLC in New Mexico, you’ll need to reserve your business name ($20), appoint a registered agent, and file your Articles of Organization with the New Mexico Secretary ($50). Then, draft an Operating Agreement, get a free EIN from the IRS, and register for licenses or taxes if required – with total startup costs typically ranging from $70 to $200 depending on whether you use a registered agent service.

This guide explains every step of the LLC formation process, from name search and legal paperwork to obtaining a tax identification number and business licenses. You’ll discover how long it takes, what fees apply, and why forming a limited liability company in New Mexico is a smart, affordable choice for both solo founders and multi-member companies. Let’s dive in and walk through how to start your LLC in New Mexico – the right way.

Why Form an LLC in New Mexico?

Starting an LLC in New Mexico offers business owners some of the greatest advantages in the U.S. These include low formation costs, complete privacy, and no annual reports required. If you are thinking about many states to form an LLC especially as a non-resident, this comparison of best U.S. states for non U.S. LLCs shows New Mexico is one of the best states. New Mexico LLCs are more than just cheap. They offer ease, simplicity, as well as privacy and protection. Launching locally? Running a remote operation? New Mexico’s LLCs don’t care. They fit in just fine. At every stage of business, the flexibility of New Mexico LLCs is unmatched.

Limited Liability Protection for Owners

A huge reason to form New Mexico LLC is protected personal assets from business debts and lawsuits. This “limited liability” means that if your company is sued or can’t pay its obligations, your home, car, and personal savings are protected under law.

Unlike a sole proprietorship or general partnership, an LLC creates a separate legal entity. That distinction is what limits your personal exposure. For a business owner changing from a sole proprietorship, a guide on changing from sole proprietorship to LLC will help you do the key steps as well as the benefits of New Mexico. Your assets are not at risk with an LLC even though the company borrows money.

If you are a freelancer, investor, small business entrepreneur or more, forming an LLC is the best way to protect your own personal financial safety while forming a company.

Pass-Through Tax Benefits & No Annual Reports

You can form an LLC New Mexico because it is advantageous in many ways in regard to taxation. As a default, your limited liability company is known as a pass-through entity. That is, it passes any profits directly to the owners, who report those on their return. This prevents traditional corporations from facing double taxation and makes tax filing easier on business owners.

You can also choose how your LLC is taxed. By making the appropriate tax election, you may choose to be taxed like an S corporation, which may reduce self-employment tax in certain situations.

In addition to tax flexibility, New Mexico does not require an annual report, saving you time, paperwork, and recurring state fees. As a result, it is one of the few states that offers low taxes and low long-term compliance obligations.

Privacy: No Owner Names Publicly Required

One of the most unique advantages associated with an LLC in New Mexico is the ability to keep your ownership anonymous. The state does not want to know the names of any members or managers in your Articles of Organization nor do they ask for annual disclosures.

In other words, you can create a legitimate business entity without your name appear in public databases, which is great for private entrepreneurs and digital nomads. All you need to supply is the name and address of your registered agent, who can be a third party.

For those seeking discretion and legal protection, New Mexico is one of the most privacy-friendly states in the U.S.

New Mexico LLC Formation Requirements

In order to be able to legally run the LLC in New Mexico, you must meet a few basic formation requirements. These involve naming rules, appointing a registered agent, and complying with licensing and documentation laws. By taking these steps, your business is recognized as a valid limited liability company and helps you avoid costly delays or rejections.

Business Name Rules & Availability Check

To become a legal entity, your LLC in New Mexico must have a name different from other businesses. The name of the limited liability company must include “Limited Liability Company” or “LLC” or similar abbreviation. The name may not be the same or too similar to a business with an active filing with the New Mexico Secretary.

You must conduct a name search on the state’s Business Search Portal before filing. To easily find out how to search business name availability in New Mexico, check this guide. You may reserve your name (provided it’s available) for 120 days by filling out the Name Reservation application and paying $20 fee.

Registered Agent Eligibility & Appointment

Every LLC in New Mexico must appoint a registered agent to accept legal documents, tax notices and other official correspondence for the business. The agent must have a physical address in New Mexico and be available during regular business hours.

You can serve as your own registered agent, designate a trustworthy person, or hire a registered agent service to maintain your privacy. Unsure which option works best for you? This guide on whether you need a registered agent in New Mexico breaks down the benefits and drawbacks of each.

If you choose to go with a professional service, you are probably looking to compare the best. This comparison of best registered agent services in New Mexico can help you decide based on prices, support, and other features offered. Prepare to shell out approximately $100–$150 annually but you will get more compliance aid and discretion. When you file your Articles of Organization, you will have to include the information about your registered agent. However, you can have your agent changed later on when you provide the state an update through formal means.

Assign a Registered Agent for Your NM LLC

ZenBusiness provides reliable registered agent services to help your New Mexico LLC stay compliant and meet legal requirements.

Recommended Operating Agreement

Creating an Operating Agreement, though not mandatory by law, is highly recommended for New Mexico LLCs. This internal document states the ownership structure, management functions, profit sharing rules and voting rights of members.

The Operating Agreement will help you contest any internal disagreement. It also provides legal protection in case of a lawsuit. Multi-member LLCs will find it particularly helpful, but it can also give a single-member firm more legitimacy and structure.

This document need not be filed with the state. However, it must be signed and kept in company records.

Statutory Compliance Obligations (Licenses, Permits)

Depending on the type and location of your business, you may need to apply for additional licenses or permits after forming your LLC in New Mexico. This might include at a state level business license, professional certification or local permit from the City of Albuquerque or other municipality.

To remain in compliance, check with the New Mexico Taxation and Revenue Department, your county clerk’s office as well as any relevant industry boards. Also, it will be a wise move to check with the New Mexico Economic Development Department for help on available incentives, industry licenses and business-friendly programs. Depending on the type of business they run may also require to register for gross receipts tax, sales tax, or other local taxes.

Not having the right licenses may attract fines or cause delays, so verify your obligations early in the formation process.

How to Start an LLC in New Mexico: Step-by-Step Process

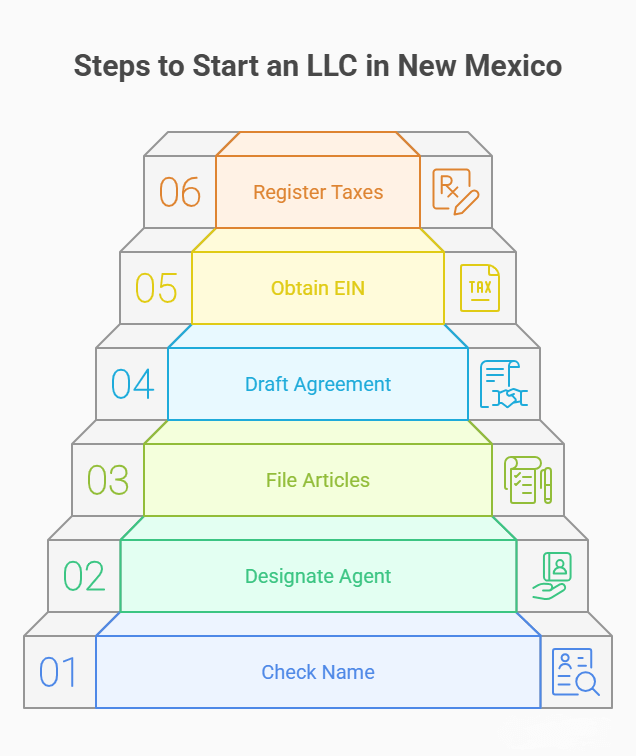

Starting an LLC in New Mexico is simple, affordable, and can often be done entirely online. Below is a clear breakdown of each required step, from name reservation to legal filings, tax registration, and internal agreements – so you can set up your business correctly the first time.

Step 1: Check and Reserve Your LLC Name – $20

Before you can create your LLC in New Mexico, you will need to check and make sure that the name you want for your business is available. It must be distinguishable from other names on record and must include “LLC” or “Limited Liability Company.”

To see if it’s available, visit the New Mexico Business Search Portal. If the name is available you could reserve it for 120 days by submitting a Name Reservation form along with a $20 form with the New Mexico Secretary.

Even though it is optional, name reservation is recommended if you’re not ready to file your Articles of Organization immediately.

Step 2: Designate and Consent Your Registered Agent

Every LLC in New Mexico must have a registered agent, an individual or business entity responsible for receiving legal notices and official mail on your behalf. The agent must have a physical address in New Mexico and be available during normal business hours.

While you have the option to act as your own agent, many business owners prefer hiring a professional registered agent service for privacy and reliability. This service usually costs between $100 and $150 per year and will ensure timely handling of delicate documents.

The consent in writing of your agent must be on file before filing your Articles of Organization. It makes sure the state has a dependable contact point at your organization.

Step 3: File Articles of Organization – $50

In order to legally establish your LLC in New Mexico, you will have to submit the Articles of Organization to the New Mexico Secretary. Your business name, registered agent details and mailing address are in this document The state filing fee is $50.

Either you can file online by using the New Mexico SOS Enterprise portal or file paper forms by mailing them. Upon approval of your LLC, it becomes a legal entity and authorized to conduct business per state law.

Make sure all information is correct, as mistakes can slow processing down or get you rejected.

Online vs. Mail Filing Options

You can submit your Articles of Organization online or by mail in New Mexico. The New Mexico Business Services Portal is the quickest and easiest way to do this and takes you through the process step by step.

Submissions filed online are processed usually within 1-3 business days, while mail submissions may take longer. If you prefer mailing your documents, download the paper form from the Secretary of State’s website and send it with a check for the $50 filing fee.

Whether you choose either option, make sure your details are comprehensive and correct.

Processing Time (1–3 Business Days)

If you file your LLC in New Mexico online, the Secretary of State typically processes your Articles of Organization within 1 to 3 business days. Compared to many other states, this posses one of the fastest turnaround times.

Mailing filings can take maximum two weeks depending on the volume and delivery by mail. Check your document thoroughly before submitting it to avoid delaying the process

Step 4: Draft and Adopt an Operating Agreement

After establishing your New Mexico LLC, you should create an Operating Agreement that sets out how you intend to manage your company. This document describes who owns what, people’s roles and responsibilities, how voting takes place and sharing of profit or loss.

An Operating Agreement, while not state-filing, is a legally binding document that clarifies matters and avoids disputes bet members. It also reinforces your LLC’s credibility and separation from personal finances, especially if you're applying for a bank account or outside funding.

Keep a signed copy of this agreement in your internal business records.

Step 5: Obtain an EIN from the IRS (Free)

Once you’ve established your New Mexico LLC, you’ll need to apply for a tax identification number: a.k.a. an Employer Identification Number (EIN) with the IRS. You will need this number to do things like open a bank account, hire employees, and file an income tax return as well as those at the federal level.

There are no charges for applying and you can do it online through the IRS EIN application page. Your EIN will be sent to you as soon as you submit your application.

Even if you are a sole member LLC with no employees, getting an EIN bolsters your legitimacy and facilitates tax filings for your business.

Step 6: Register for State Taxes & Required Business Licenses

Your business industry and location will determine whether or not your New Mexico LLC is required to register with and/or pay the New Mexico Taxation and Revenue Department. Common requirements include gross receipts tax, sales tax and withholding tax for employers.

Using the state’s Taxpayer Access Point (TAP) portal, you can register online. You might also have to get a business license from your local city or county, especially if based in the City of Albuquerque or Las Cruces.

Your LLC must comply with the business registration requirement of your state and locality to avoid fees or delays. If you want a full rundown from a trusted source, BoostSuite offers a complete step-by-step guide to starting an LLC in New Mexico to reinforce everything you've learned here.

New Mexico LLC Cost Breakdown

Forming an LLC in New Mexico is one of the most affordable ways to launch a business. The state charges minimal filing fees, and there are no annual reporting costs. For a full picture, including step-by-step filing, registered agent details, and optional upgrades, check out this complete overview of forming an LLC in New Mexico. Below is a full breakdown of all required and optional expenses so you can plan your budget and avoid surprises.

Articles of Organization Fee – $50

To legally establish your New Mexico LLC, you must file the Articles of Organization with the New Mexico Secretary, a one-time filing fee of $50. This is the core formation cost required by the state.

You can submit your application through the mail or file online for faster processing. Payment is generally made by credit card for online filings, and check or money order for mailing filings. This fee must be paid at the time of filing and it’s nonrefundable.

Name Reservation Fee – $20

If you want to secure your desired business name before filing, New Mexico offers an optional name reservation service for $20. This holds the name for 120 days and ensures no one else can register it during that period.

To reserve a name, submit the application to the New Mexico Secretary either online or by mail, along with the $20 payment.

Registered Agent Service – $0 (Self) or ~$120/Year (Professional)

Every LLC in New Mexico needs a registered agent with a physical New Mexico address. If you act as your own agent, there’s no cost. However, many business owners prefer hiring a registered agent service, which typically charges around $100–$150 per year.

Using a service can provide added privacy, mail handling, and compliance alerts — especially if you don’t have a physical office in the state.

Reliable Agent Services for Your NM LLC

Northwest’s professional registered agent services keep your New Mexico LLC in good standing, while protecting your personal info.

Certificate of Good Standing – $25

A Certificate of Good Standing states that your New Mexico LLC has a legal existence and is registered with the state. While banks, investors or government agencies do not requires it for day-to-day, they may ask for it during business transactions.

You can request the certificate from the New Mexico Secretary for a fee of $25. Pay the fees online or by writing a request and sending it via mail.

Optional DBA Registration & Licensing Fees

If your LLC in New Mexico will use a name other than its legal name, you may need to file a DBA (Doing Business As) name with the county clerk. The cost to register a DBA depends on the city and varies from $25-$50.

If your business operates in a specific industry, then you may also pay for a business license, professional certification or local permit. You should check licensing needs with your city or county before you operate.

LLC Formation Timeline in New Mexico

New Mexico offers one of the fastest LLC formation timelines in the U.S. Whether you file online or by mail, most applications are processed quickly and without the need for expedited services. Here’s what to expect based on your filing method.

Standard Filing Time – 1–3 Business Days

If you file your LLC in New Mexico online, the typical processing time is just 1 to 3 business days. For more context and examples of processing scenarios, check out this resource on how long it takes to get an LLC in New Mexico. This makes it one of the fastest and most efficient filing systems in the country.

Mail filings are slower and can take up to 2 weeks depending on postal delivery and volume. For most entrepreneurs, online filing through the New Mexico Secretary portal is the preferred option due to its speed, convenience, and real-time tracking.

No Expedited Filing Option Available

New Mexico does not present an option for expedited filing to form an LLC. Nonetheless, most filers find the turnaround time adequate since regular online processing only takes 1 to 3 business days.

If you file by mail, do it early as it can take a week or two. Submitting your Articles of Organization online is the fastest way to ensure your LLC in New Mexico is approved quickly and without delay.

Registering a Foreign LLC in New Mexico

If your LLC is already formed in another state but plans to do business in New Mexico, you’ll need to register as a foreign LLC. This ensures legal compliance and allows your out-of-state company to operate officially within New Mexico’s jurisdiction. To get a better sense of the local business environment, check out this New Mexico small business statistics overview for data on how many companies like yours are thriving here.

The process involves submitting a foreign registration form, appointing a registered agent, and paying the required state fee. Below, we’ll explain the full requirements and costs.

Qualification Requirements for Out-of-State LLCs

If you want to register a foreign LLC in New Mexico, then the company must be legally formed in another state in the U.S. To get registered as a foreign entity in New Mexico, you must file an Application for Certificate of Registration with the Secretary of New Mexico, include a Certificate of Good Standing from your home state, and appoint a local registered agent who has a physical New Mexico address.

In New Mexico, the name of your LLC must comply with naming rules. If it’s already in use, you may need to register a DBA to operate under a different name.

Foreign Registration Fee – $100

To register your foreign LLC in New Mexico, you need to pay a filing fee of $100 only once. You must submit this fee to the New Mexico Secretary with your application for a Certificate of Registration.

Filing can be done online or by mail, but online filing is usually much faster and convenient. Credit card (online) and check/money order (mail) are accepted.

Once approved, your LLC will be allowed to operate legally in the state.

Ongoing Compliance & Registered Agent

When you register a foreign LLC in New Mexico, you must have a registered agent that has a physical address in New Mexico. This agent will receive legal documents, tax notices, and state correspondence on your behalf.

New Mexico does not have annual requirements for LLCs like other states, reducing your long-term administrative burden. Make sure that your business information is current and ensure compliance with any licensing and tax obligations for your business.

Maintaining an LLC in New Mexico: Ongoing Requirements

Maintaining your LLC in New Mexico requires less effort than in most states. If you’re considering which states offer the easiest long-term compliance, this overview of the best states to start an LLC covers how New Mexico stacks up in terms of taxes, fees, and legal requirements. There’s no annual report or state franchise tax, which keeps compliance easy and inexpensive throughout the years.

However, you still need to stay current with tax obligations, such as gross receipts tax, withholding tax, or income tax, depending on how your LLC is structured. Your registered agent information must also be kept up-to-date and other local or industry-specific business licenses must be renewed.

Key ongoing responsibilities include:

- Staying compliant with local and state tax requirements

- Renewing necessary permits or licenses

- Keeping a valid registered agent on file

- Updating your company records as needed

By keeping your LLC in good standing, you’ll avoid penalties, maintain legal protection, and ensure uninterrupted business operations.

New Mexico LLC Frequently Asked Questions

Here are clear, concise answers to the most common questions about starting and maintaining an LLC in New Mexico. Whether you're wondering about costs, required documents, or how long it takes to file, these FAQs offer direct, reliable guidance to help you move forward with confidence.

How much does it cost to start an LLC in New Mexico?

Starting an LLC in New Mexico typically costs between $70 and $200. The required fees include $50 to file the Articles of Organization and $20 for optional name reservation. If you use a registered agent service, expect to pay an additional $100–$150 per year. Other potential costs may include a business license or a Certificate of Good Standing, depending on your needs.

What documents are required for formation?

To form an LLC in New Mexico, you must file the Articles of Organization with the New Mexico Secretary. This document includes your LLC’s name, business address, and registered agent details. You’ll also need a written consent form from your agent and, optionally, a Name Reservation form if you plan to hold your business name in advance. While not required for filing, an Operating Agreement is highly recommended for internal governance.

How long does the filing process take?

If you file your LLC in New Mexico online, approval typically takes 1 to 3 business days. Mail filings take longer—usually up to 2 weeks, depending on postal delivery and processing volume. New Mexico does not offer an expedited filing option, but its standard timeline is faster than many states. For the quickest results, submit your Articles of Organization through the online portal provided by the New Mexico Secretary.

Can foreign LLCs register in New Mexico?

Yes, a foreign LLC can legally register to do business in New Mexico. You’ll need to file an Application for Certificate of Registration with the New Mexico Secretary, submit a Certificate of Good Standing from your home state, and appoint a registered agent with a physical address in New Mexico. The filing fee is $100. Once approved, your out-of-state LLC can operate legally within the state and must stay compliant with New Mexico’s local laws.

Is an operating agreement mandatory?

An Operating Agreement is not legally required to form an LLC in New Mexico, but it’s strongly recommended. This internal document defines how your business will be managed, how profits are shared, and what happens in case of disputes or changes in ownership. Even for single-member LLCs, having an Operating Agreement helps protect your limited liability status and can be useful when opening a bank account or applying for financing.

Still deciding whether forming an LLC is better than sticking with a sole proprietorship? This comparison of sole proprietorship vs LLC helps break down legal liability, taxation, and control in plain terms.

Resources for Starting and Managing an LLC in New Mexico

Starting an LLC in New Mexico offers simplicity and privacy—but only if you use the right official tools. These trusted resources guide you through name reservations, filings, taxes, and long-term compliance in one of the most business-friendly states.

- New Mexico Secretary of State – Business Services (sos.nm.gov): File Articles of Organization, request a Certificate of Good Standing, and access all official LLC formation documents.

- New Mexico Business Search Portal (enterprise.sos.nm.gov): Confirm business name availability and verify existing LLCs before filing.

- New Mexico Taxation and Revenue Department (tax.newmexico.gov): Register for gross receipts tax, sales tax, or withholding accounts through the state’s Taxpayer Access Point (TAP) system.

- IRS – Apply for an EIN Online (irs.gov): Apply online to receive your federal tax ID for free—essential for banking and hiring.

- New Mexico Economic Development Department (edd.newmexico.gov): Explore small business incentives, licensing guidance, and economic support for LLC owners.

- Wikipedia – Limited Liability Company (en.wikipedia.org): Learn how LLCs function in the U.S. and internationally, including structure, taxation, and legal protection.

- Wikipedia – Operating Agreement (LLC) (en.wikipedia.org): Understand the role of an operating agreement and why it's essential—even for single-member LLCs.

- 2023 SBA New Mexico Small Business Economic Profile (advocacy.sba.gov): Gain insights into the economic impact of LLCs and small businesses across New Mexico.

These resources ensure you start your LLC the right way – compliant, informed, and ready to grow in New Mexico.

Looking for an overview? See New Mexico LLC Services

Get Your LLC Formed Right, New Mexico Made Easy

Harbor Compliance ensures your LLC is filed properly with the New Mexico Secretary of State, no guesswork, just results.