Starting an LLC in Mississippi is fast, affordable, and 100% online through the Secretary of State’s portal. With a $50 filing fee and a free annual report, it’s one of the most cost-effective states for small business owners. The process takes just a few steps: choose a name, appoint a registered agent, file your Certificate of Formation, and register for any required taxes or licenses. This guide breaks down each step in plain English so you can form your LLC smoothly, avoid common mistakes, and stay compliant from day one.

Overview: Why a Mississippi LLC?

An LLC is a flexible business structure that shields your personal assets and, by default, treats business profits as pass-through to your personal tax return (you can elect a different tax status later). That mix of liability protection and simple taxation is the core appeal of an LLC in Mississippi.

When it makes sense: choose a Mississippi LLC if you want protection and operational flexibility without corporate formalities. A sole proprietorship is simpler but offers no liability shield; a corporation can be better for complex equity raises but comes with stricter governance and potential double taxation unless an S-corp election applies. For context, Mississippi’s economy leans heavily on entrepreneurs, our Mississippi small business statistics report shows how much local companies contribute to jobs and growth across the state.

How the journey works (often searched as “start llc mississippi”): Mississippi requires online filing, you’ll set up an SOS account, then choose a name, appoint a registered agent, and file the Certificate of Formation. After approval, adopt an operating agreement, get an EIN, register for any state taxes, and handle local licensing. We’ll detail costs and timelines next: Certificate of Formation $50, domestic LLC annual report $0 (due April 15 each year).

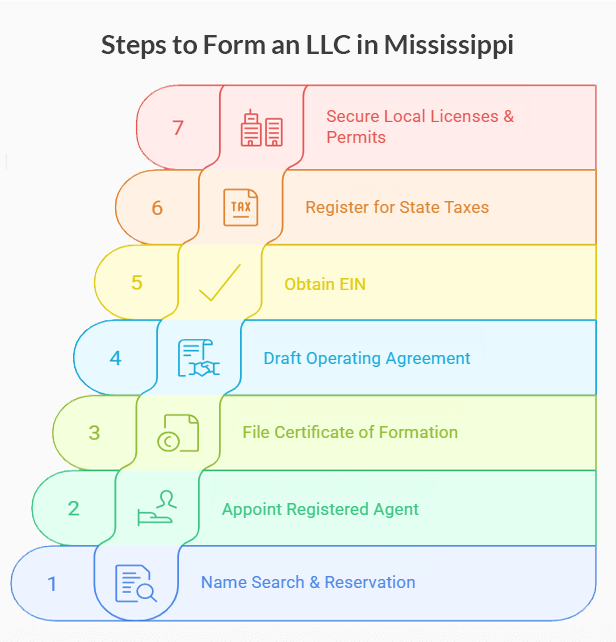

Steps to Form an LLC in Mississippi

Here’s the game plan for how to start an llc in mississippi, no paper, no guesswork. You’ll do everything in the Secretary of State’s online portal: choose a compliant name, appoint a registered agent, and file the Certificate of Formation (state fee $50). After approval, you’ll adopt an operating agreement, get a free EIN from the IRS, register for any state taxes (sales/use or employer withholding), and handle local permits if required. Think of it as Mississippi LLC registration in four moves: file → organize → identify → comply.

What you’ll need on hand: your chosen name/designator, registered agent details, member/manager structure, principal business address, and a contact email. Most online submissions process quickly; we’ll flag realistic timelines and common mistakes in the steps below.

Step 1: Name Search & (optional) Name Reservation

Your LLC name must be “distinguishable” on the Secretary of State’s records and include a designator such as “LLC” or “L.L.C.” (certain words like “bank,” “trust,” or “insurance” are restricted). Start by searching the state’s free Business Entity Search to spot conflicts and near-matches (see our Mississippi LLC name search guide for filters, statuses, and reservation tips). If a result looks close, tweak spelling, add a unique word, or change word order—punctuation or designators alone won’t make it unique.

If you’re not filing today, you can reserve the name online. Mississippi holds a reservation for 180 days, renewable once, and charges $25 (you’ll see that fee again in the Costs table). Use reservation when you need time to prep filings or branding, but skip it if you’re ready to form now.

Quick clarity: a DBA (fictitious business name) is optional branding; it doesn’t change your LLC’s legal name or grant trademark rights. We’ll cover DBAs later.

Mini checklist (pass these before you file):

- Clear the SOS entity search (no confusingly similar matches).

- Use an acceptable designator: LLC or L.L.C.

- Avoid restricted words unless you’re authorized.

- Check your domain/social handles and consider trademark conflicts (USPTO).

- Decide if you need a DBA for public-facing branding later.

Step 2: Appoint a Mississippi Registered Agent

Every Mississippi LLC must list a registered agent with a real Mississippi street address (no P.O. boxes). The agent can be you, another adult, or a company, as long as they’re located in Mississippi and consent to serve. Their job is to accept legal papers and official mail for your company and forward them promptly. If you’d rather not put your home address on public record, a registered agent service is the easy button. For more options, you can explore our guide to the best Mississippi registered agent providers, where we review top services and highlight the pros and cons of each.

Availability matters. Your agent must be able to receive service of process at the listed Mississippi address (practically, this means being reachable during normal business hours). Whether you’re forming in the Delta or filing an llc jackson ms, pick someone reliable who actually checks and forwards what arrives. If you’re unsure why the role is legally required, see our breakdown on why every Mississippi LLC needs a registered agent for context and compliance details.

You can switch agents later in the SOS portal. Mississippi treats it as a simple amendment, and the state fee is $10, we’ll point back to this in the Maintain section.

DIY vs Service (quick take):

- DIY: $0 for the role, but your name/address go public and you need to stay available for deliveries.

- Service: Privacy, mail scanning, and compliance reminders for a modest annual fee, handy if you travel or work irregular hours.

Step 3: File the Certificate of Formation

Where to file (and what to expect): Create an account in the Mississippi Secretary of State (SOS) business portal, then choose “Form a new company” and complete the Certificate of Formation online. Your email becomes the username; the system validates most fields and emails you a stamped copy and receipt once accepted—often the same day or within about 24 hours.

Core fields you’ll enter: your LLC’s exact name with an acceptable designator (“LLC” or “L.L.C.”), a Mississippi registered agent with a physical street address, a business email, an optional delayed effective date (up to 90 days), and the organizer’s name/signature. Some users will also see prompts for a principal office address and NAICS activity code (the portal includes a lookup).

Fees & speed: The state filing fee is $50. Online filings are typically fast; many approvals arrive within 1–2 business days (times vary). If you print and mail instead of paying online, expect slower processing.

After you submit: You’ll receive a confirmation email. Download the filed Certificate (with SOS filing number) from your dashboard and save it for your bank, landlord, and license applications.

Avoid these common mistakes:

- Using the wrong name format—your name must be distinguishable and include “LLC”/“L.L.C.”.

- Listing a P.O. Box as the registered office—Mississippi requires a physical street address in-state.

- Typos in the name or address—fixes require an Amendment (state fee $50).

- Choosing a delayed effective date beyond 90 days—the statute caps this window.

You can form today even if your operating agreement isn’t finished, you’ll adopt it next. Mississippi recommends having one, but it isn’t filed with the state.

Step 4: Draft & Adopt an Operating Agreement

Think of your Operating Agreement as the LLC’s owner’s manual—how decisions are made, who owns what, and what happens when things change. Under Mississippi law it’s an internal contract (written, oral, or implied) that binds the members; it isn’t filed with the Secretary of State. The SOS recommends having one, but it’s not required by statute.

Why bother? Two big reasons: clarity and proof. Without an agreement, state default rules apply; with one, you set your own. And many banks ask to see it when opening a business account.

What to include (customize to fit your LLC in Mississippi):

- Ownership percentages & capital contributions

- Management model (member-managed vs manager-managed) and voting rules

- Profit/loss allocations & distribution timing

- Duties of managers/members; compensation & reimbursements

- Admitting/buying out members; transfer restrictions

- Dispute resolution & deadlock procedures

- Record-keeping, tax matters partner, and e-signature block

Single-member? Keep one anyway—it shows separation for liability hygiene and satisfies bank requests. Keep the signed copy with your company records; do not upload it to the SOS portal.

Step 5: Get an EIN

An EIN is your business’s federal ID number—needed for banking, payroll, and most permits. Get it directly from the IRS: the online application is free and usually issues an EIN immediately once approved. Beware of third-party “EIN services”—you never pay the IRS for an EIN.

On the application (Form SS-4), you’ll provide your legal LLC name, the responsible party (line 7b), why you’re applying, and basic LLC details (lines 8a–8c). Keep this info current—if the responsible party changes, file Form 8822-B within 60 days.

Non-U.S. owners: the online tool may not work for you. Apply by phone (international applicants only, +1-267-941-1099), or submit Form SS-4 by fax (855-641-6935) or mail to the IRS. Faxed applications are typically returned within about 4 business days.

Step 6: State Tax Registrations

Mississippi doesn’t auto-register new LLCs for taxes, you’ll add the accounts you need in the Department of Revenue’s TAP portal. If you’ll collect sales tax or buy wholesale, register for Sales & Use Tax; if you’ll cut paychecks, add Withholding. Expect your sales tax permit packet by mail after online registration.

Sales & Use Tax

Register in TAP, then file on the cadence DOR assigns based on your annual remittance: monthly if > $3,599, quarterly if $600–$3,599, annually if < $600. Sales tax returns are due the 20th of the month after the period (next business day if it falls on a weekend/holiday).

Employer Taxes

If you hire employees, you’ll need:

- A Withholding account with DOR, returns are due the 15th of the month following the period.

- A Unemployment Insurance (UI) employer account with MDES (quarterly wage reports and contributions through its employer portal).

PEO Note

You can outsource payroll/compliance to a Mississippi PEO. As of 2025, Mississippi has no statewide PEO registration law (a 2022 bill to create one died in committee), but employers still must ensure UI reporting is handled properly via MDES. Review your contract to confirm who files/pay taxes. For a deeper look at leading providers, see our breakdown of the best Mississippi PEO companies and how they support payroll, benefits, and compliance.

3-row checklist (what to register):

- If you sell taxable goods/services: Add Sales & Use Tax in TAP; watch the 20th-day filing deadline.

- If you hire employees: Open Withholding (DOR, due 15th) and UI (MDES, quarterly).

- If you buy wholesale or resell: Register for Sales & Use to document exempt purchases and collect/remit properly.

Step 7: Local licenses & Permits

Quick reality check: there’s no single statewide “LLC license Mississippi”. In practice, most companies need a city or county business/privilege license, plus activity-specific permits. For example, Jackson requires a Business Privilege License (renewed annually), while Jackson County licenses businesses operating in unincorporated areas. Biloxi and Hattiesburg run similar “privilege license” programs.

Zoning comes first. Check your city or county planning department for permitted uses or a home-occupation permit if you’re working from home (Jackson publishes zoning and home-occupation fees online). Keep approvals handy—landlords and banks often ask for them.

Food or personal-service businesses? The Mississippi State Department of Health issues food facility permits and provides the process and contacts; apply before opening or remodeling. Trade contractors (e.g., general/residential, roofing) are licensed at the state level by the Mississippi State Board of Contractors.

Launch your Mississippi LLC easily with ZenBusiness

ZenBusiness streamlines the entire process—from name reservation to filing—all while keeping your business compliant with Mississippi laws.

Mississippi LLC Costs & Fees

Here’s the clear view of Mississippi LLC cost items, what you’ll pay to form, keep good standing, and order common documents. State fees are set by statute and published by the Secretary of State (SOS); always confirm the latest schedule before you file. As of 2025, the Mississippi LLC filing fee for a Certificate of Formation is $50, and the domestic LLC annual report is $0 (due April 15 each year). Foreign LLCs pay separate registration and annual report fees.

One-time vs. ongoing fees:

| Filing / Service | Amount | When / Notes |

|---|---|---|

| Certificate of Formation (domestic LLC) | $50 | File online in SOS portal to create your LLC. |

| Annual Report (domestic LLC) | $0 | Due April 15 each year; filed online. |

| Name Reservation (optional) | $25 | Hold a name before you file. |

| DBA / Fictitious Business Name | $25 | Registers your public-facing trade name; doesn’t replace the legal name. |

| Registered Agent/Office Statement of Change | $10 | Update agent and/or registered office for an existing LLC. |

| Amendment to Certificate of Formation | $50 | Name change, management updates, etc. |

| Reinstatement (domestic LLC) | $50 | To return a administratively-dissolved LLC to good standing. |

| Certificate of Good Standing / Existence | $25 | Order online; typically available immediately after payment. |

| Foreign LLC Registration (out-of-state LLC) | $250 | Required before doing business in MS. |

| Foreign LLC Annual Report | $250 | Filed each year for foreign LLCs. |

Maintain & Renew Your Mississippi LLC

Staying compliant is mostly about light, predictable chores: file the annual report, keep your registered agent/office current, amend your record if anything material changes (like a name or management shift), and order a certificate of good standing when banks or other states ask. Mississippi keeps this simple, domestic LLCs file the annual report online for $0 by April 15 each year. We’ll also flag where federal BOI updates may apply and point you to the latest rules.

Annual report (due April 15; $0)

Every domestic LLC files an online annual report — there’s no state fee. You can submit any time on or after January 1; it’s due April 15. The report confirms your principal address, registered agent/office, and management info (member- vs. manager-managed). Skip it and you risk administrative issues, up to dissolution. The good news: it’s a two-minute chore if your details haven’t changed. File it in your SOS account dashboard.

Keep your registered agent & office current

If your agent changes or the registered office moves, update it in the SOS portal. Mississippi’s Registered Agent/Office Statement of Change costs $10 and takes just a few clicks. You’ll get immediate confirmation in your filings history. Update the state first, then refresh your bank, EIN/tax accounts, and any licenses so everything matches.

If you’re switching to a service, file the SOS change the same day your service activates so you don’t miss legal mail.

Reliable Mississippi Registered Agent Service by Northwest

Northwest protects your privacy and ensures full compliance with Mississippi regulations as your official registered agent.

Amendments & name changes

Certain updates require an Amendment to your Certificate of Formation — for example, a legal name change, switching between member- and manager-managed, or other foundational edits. The state fee is $50. After approval, ripple the change through your DBA (if any), licenses, bank, contracts, website, and payroll/tax accounts to keep records aligned. If you’re only changing your registered agent/office, use the $10 form instead of a full amendment.

Certificate of good standing (aka “existence”)

Banks, landlords, and other states often ask for proof your LLC is active and compliant. Order a Certificate of Good Standing/Existence from the SOS Order Documents page, delivery is typically instant after payment. The fee is $25. You’ll download a PDF that third parties can verify.

Use cases: opening/renewing bank accounts, registering a foreign LLC in another state, financing, or major contract bids.

Beneficial Ownership Information (BOI) updates

Federal BOI rules have shifted, Mississippi directs filers to FinCEN for the latest. If BOI applies to your company, be prepared to file an initial report and to update within 30 days when ownership or key details change (e.g., legal name, address, or control). Because deadlines vary by formation date and recent federal actions, always confirm current requirements on FinCEN’s site before filing.

Taxes & Hiring Basics

By default, a Mississippi LLC is taxed as a pass-through: the business doesn’t pay federal income tax — profits and losses flow to the owners’ returns. Owners typically make quarterly estimated payments (April 15, June 15, Sept. 15, and Jan. 15) to cover income and self-employment tax. You can elect S-corp treatment later if it fits your compensation/tax strategy (Form 2553, deadline: within 2 months + 15 days of the start of the tax year).

On the state side, register the tax accounts you actually need in DOR’s TAP portal: Sales & Use Tax if you sell taxable goods/services (returns due by the 20th after the period; filing frequency assigned by DOR) and Withholding if you have employees (returns due the 15th after the period). Hiring also triggers a UI account with MDES (quarterly wage reports).

For a broader explanation of deductions, flexibility, and election choices, see our guide on LLC tax benefits.

Beyond Formation: Names, Out-of-State Registration & Entity Alternatives

You’ve formed your Mississippi LLC, now it’s time to shape how it shows up, where it can legally operate, and whether another entity or tax setup fits better. If your public-facing brand differs from your legal name, a DBA (fictitious name) keeps marketing tidy without changing the company itself. Expanding across state lines? Foreign registration lets your LLC do business in Mississippi (or vice versa) without starting from scratch. And if your goals include outside investors or a stock plan, a corporation might be the cleaner tool—while an S-corp election can fine-tune how active owners are taxed. Below, each H3 walks you through what it is, when to use it, and the steps, fees, and timelines—so you can pick the right move with confidence.

DBA (“Fictitious Business Name”) in Mississippi

A DBA lets your LLC in Mississippi operate under a trade name that’s different from its legal name (handy for branding or separate product lines). In Mississippi, you register the DBA online with the Secretary of State; the filing is optional, doesn’t create exclusive rights, and doesn’t replace trademarks. The state calls it a “Fictitious Business Name Registration,” and the fee is $25. After you file, update your bank, invoices, and any licenses so the public-facing name matches your records.

How to register a dba in mississippi: search the business database for conflicts, prepare your legal entity info, then submit the Fictitious Business Name Registration in the SOS portal. If your branding evolves, you can amend or withdraw the DBA later (each action also $25). For trademark-level protection, consider a separate state or federal mark. (See Mississippi’s fee schedule and the Fictitious Business Name Registration Act.)

If you’re still weighing whether to form an LLC or just use a trade name, see our LLC vs DBA breakdown for the pros and cons of each option.

Foreign LLCs: Registering an Out-of-State Company

If your existing LLC expands into Mississippi, employees, an office/warehouse, or recurring in-state revenue, you’ll need Mississippi foreign LLC registration (called a “Certificate of Authority”). File online, appoint a Mississippi registered agent, and attach a recent Certificate of Good Standing from your home state. The registration fee is $250, and foreign LLCs owe a separate annual report fee of $250 each year (due April 15). After approval, open a bank account if needed and align DOR/MDES tax accounts with your Mississippi location.

Foreign corporations follow a similar path (“mississippi foreign corporation registration” via Certificate of Authority), but note the $500 filing fee for profit corporations and a $25 annual report. All filings run through the SOS business portal.

Corporation & S-Corp Alternatives

Prefer a classic share-based structure? A Mississippi corporation can be better for raising equity and issuing stock. You’ll file Articles of Incorporation online; the state fee is $50, and corporations file an annual report for $25 (also due April 15). Board/officer formalities and stock records are part of the package—good for cap tables, a bit more upkeep than an LLC.

Remember, S-corp is a federal tax election, not a state entity type. Eligible LLCs or corporations can elect S-corp by filing IRS Form 2553, generally within 2 months + 15 days of the start of the tax year you want it to apply. This may reduce self-employment taxes for active owner-employees, but payroll and reasonable-compensation rules apply. Talk with your CPA before flipping the switch.

DIY vs Using a Formation Service

If you enjoy checklists and control, DIY works great: you’ll pay only state fees (e.g., $50 to form, $0 annual report). If you’d rather outsource logistics, a provider can bundle a registered agent service, templates, and reminders, just watch for paid EIN upsells (the IRS issues EINs free). “Free LLC in Mississippi” usually means the provider waives their fee; you still pay the state.

| Factor | DIY | Use a Service |

|---|---|---|

| Speed | File online in minutes; you control timing. | Guided intake; some offer same-day prep. |

| Cost transparency | Only state fees (e.g., $50 formation, $0 annual report). | Service fee + required state fees; check add-ons. |

| Privacy | Your address shows on public record. | RA service keeps your home address off record. |

| Accuracy | You double-check names, RA, dates. | Specialist reviews reduce rookie mistakes. |

| Post-formation help | You handle bank/EIN/tax accounts. | Bundles may include OA templates & reminders; decline EIN upsells (EIN is free via IRS). |

To see which companies deliver the most value, read our ranking of the best LLC services in Mississippi, where we review and compare the top providers.

Conslusion

Forming an LLC in Mississippi is a clean, online-first process with low, predictable costs. You choose a compliant name, appoint a registered agent, file the Certificate of Formation, adopt an operating agreement, secure your EIN, and line up any tax accounts and local licenses. Ongoing upkeep is light: file the $0 annual report by April 15 and keep your agent and records current.

If you’re weighing how to start an llc in mississippi today, decide whether DIY control or a service’s convenience fits your style. Either way, Mississippi’s portal makes setup fast, while your operating agreement, bookkeeping, and calendar reminders keep the company healthy. When plans evolve—new locations, a DBA, foreign registration, or even a corporate/S-corp path—you’ve got straightforward next steps and clear fees.

Ready to move? Open your SOS account, follow the steps, and keep this guide handy. Your LLC can be official in less time than it takes to brew a second cup of coffee.

Frequently Asked Questions About Starting an LLC in Mississippi

Thinking about forming a Mississippi LLC but still have a few loose ends? This FAQ wraps up the most common questions with straightforward, plain-English answers so you can make decisions quickly. From costs and filing timelines to ongoing compliance, each response is designed to give you the facts without jargon. Wherever possible, we link directly to the official state or IRS source, so you can double-check details and move forward with confidence.

How much does it cost to start an LLC in Mississippi?

$50 to file the Certificate of Formation online with the Secretary of State. Good news: the domestic LLC annual report costs $0 and is due April 15 each year. Optional extras (not required to form) include a $25 name reservation and $25 DBA filing. Third-party “formation” fees are separate and optional. Always check the current SOS fee schedule before paying.

How long does approval take online?

Mississippi processes most online filings quickly. If you pay online, some filings are approved immediately and emailed back to you; others that need staff review are usually returned within about 24 hours with either the stamped filing or a note describing what to fix. You’ll receive confirmation and can download copies from your SOS portal account. Timing can vary with filing volume and the type of document (see our detailed guide on LLC approval time in Mississippi for filing speed comparisons and extra context).

Do I need an operating agreement if I’m solo?

You’re not required to file an operating agreement with the state, but Mississippi recommends keeping one as an internal contract that governs ownership, management, and payouts—even for single-member LLCs. The LLC Act recognizes operating agreements, and the SOS welcome packet explains they’re kept internally, not filed. Banks and partners often ask for it when opening accounts or closing deals, so it’s smart to have.

Is there a statewide “LLC license”?

No single statewide general business license exists in Mississippi. Licensing is local (city/county) and activity-specific. After you form your LLC, check your city or county for a business/privilege license, zoning/home-occupation rules, and any health or fire permits tied to your industry. The SOS welcome materials point business owners to local governments for these approvals—each locality sets its own process and fees.

How do I register a DBA in Mississippi?

File a Fictitious Business Name Registration (DBA) online in your SOS account. The fee is $25; amendments, withdrawals, and assignments are also $25. A DBA is a trading name for branding and banking—it doesn’t replace your LLC’s legal name or grant trademark rights. After approval, update your bank, invoices, and any local licenses so your public-facing name stays consistent.

How do I change my Mississippi LLC name?

Log in to your SOS account and file a Certificate of Amendment to change the legal name; the state fee is $50. The SOS FAQs walk you to the “File an Amendment on an Existing Business” option in the portal. After approval, update any DBAs, licenses, bank accounts, contracts, and tax registrations so your records match the new name.

Can my out-of-state LLC operate in MS?

Yes, register as a foreign LLC to get authority to do business. File online through the SOS, appoint a Mississippi registered agent, and provide a recent Certificate of Good Standing from your home state. The registration fee is $250, and foreign LLCs file an annual report for $250 (due April 15). After approval, align banking and any state/local tax accounts for your Mississippi operations.

Do I need to file Beneficial Ownership Information (BOI)?

Most LLCs must report BOI to FinCEN, unless exempt. As of 2025, companies created before March 26, 2025 had to file by April 25, 2025; those created on/after March 26, 2025 generally have 30 days after formation approval to file. BOI isn’t annual, but you must update within 30 days if key details change. Use FinCEN’s official guide and FAQ to confirm your status and deadlines.

- Mississippi SOS: Services & Fees Schedule (PDF)

- Mississippi SOS: Order Certificate of Good Standing / Documents

- Mississippi SOS: Revised Mississippi LLC Act (PDF)

- Miss. Code §79-29-201: Certificate of Formation

- Mississippi SOS: Commercial / Registered Agents – Rules & Guidance

- MS Department of Employment Security: UI Employer Accounts

- City of Jackson: Business Privilege License

- IRS: Form SS-4 & Instructions (Apply for EIN)

- Federal Register (Mar 26, 2025): BOI Interim Final Rule & Deadlines

Looking for an overview? See Mississippi LLC Services

Start your Mississippi LLC the right way with Harbor Compliance

Harbor Compliance handles every detail of your Mississippi LLC formation with expert guidance and ongoing support.