Forming a Texas LLC typically costs $300 to file the Certificate of Formation, plus any optional services you choose. Ongoing costs are modest—most owners budget $0–$125/year for a registered agent and file an annual franchise tax report (often $0 owed if under the state threshold). There’s no separate annual LLC report with the Secretary of State. Use the quick snapshot below to budget accurately and avoid surprise fees.

Overview of Texas LLC Expenses

Launching an LLC in Texas involves specific fees and ongoing obligations that every entrepreneur should understand. From paying the state filing fee for your certificate of formation to maintaining compliance with annual report and franchise tax requirements, it’s essential to plan your budget thoroughly. If you’re new to this, a quick look at how to form an LLC in Texas will make the cost breakdown below easier to follow.

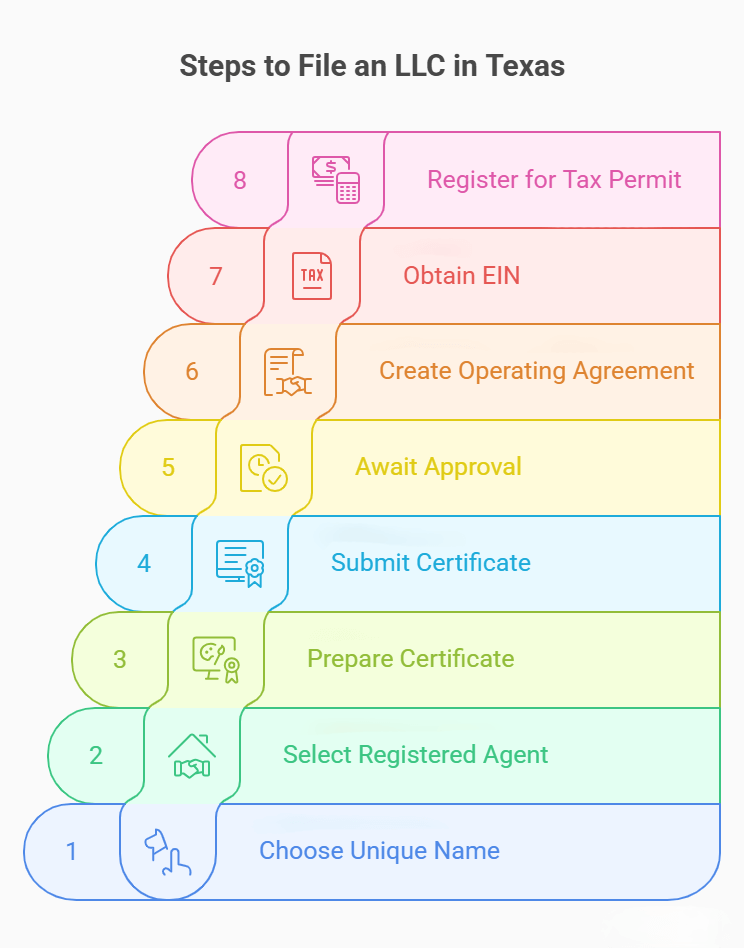

How to create an LLC in Texas (step-by-step)?

- Check name availability on SOSDirect; if needed, reserve the name for 120 days (Form 501).

- Appoint a registered agent with a Texas street address and get their written consent; keep it with your records.

- Decide management (member-managed or manager-managed) and gather organizer/governing authority details.

- Prepare and file the Certificate of Formation (Form 205) via SOSDirect, SOSUpload, or mail; then track status online.

- After approval, download your file-stamped certificate and set up your company records.

- Create a company (operating) agreement to define ownership, voting, and profit allocations (kept internally).

- Get an EIN from the IRS (free) for banking, hiring, and tax filings.

- File your Beneficial Ownership Information (BOI) report with FinCEN — entities created on or after March 26, 2025 have 30 days from effectiveness.

- Register state accounts as needed: Sales & Use Tax Permit (if you sell taxable goods/services) and Texas Workforce Commission unemployment tax (if you have employees).

- Open a business bank account, set up bookkeeping, and calendar annual compliance (franchise tax + PIR/OIR due May 15).

Want a deeper dive? See our complete Texas LLC formation walkthrough.

How long does it take to create an LLC in Texas?

Online is fastest. The Secretary of State encourages electronic filing via SOSDirect or SOSUpload. Timing varies with state volume, but recent practitioner guidance indicates:

- SOSDirect (online): typically about 10–12 business days to approval; some reports show as fast as 3–5 business days.

- SOSUpload (online): commonly around 13–15 business days (sometimes 7–12 business days).

- Mail filings: usually slower—often 4–8 weeks including mail time.

Expedited handling (+$25 per document): moves your filing ahead of the same-day queue. The state does not guarantee a specific turnaround for business formations, but expedite shortens wait time relative to standard processing. You can also track status online after submission.

The type of business you run may also influence additional charges, such as getting a business license or meeting specific insurance mandates. Below, you’ll find a detailed exploration of each key cost, as well as insider tips for making the process as smooth—and affordable—as possible.

Base Filing Fee and State Charges

In 2025, the primary filing fee for forming an LLC in Texas remains $300, payable to the Texas Secretary of State. Entrepreneurs often ask how long for a Texas LLC, and processing times typically range from about 3–5 business days online via SOSDirect (or 7–12 business days via SOSUpload), with mail filings taking longer; expedited handling is available. This fee covers the Certificate of Formation you’ll submit online or via mail. If you prefer expedited service, expect an additional $25. Certain specialized LLC structures, such as a series LLC or foreign LLC, may face additional fees (e.g., $300 per registered series; $750 to register a foreign LLC). Keep in mind that if you’re transitioning from a nonprofit corporation or another business entity, you might pay extra for a certificate of amendment (typically $150; $25 for nonprofits). Always confirm current rates on the Texas Secretary of State’s official website before filing. Errors may lead to extra costs, so review documents carefully before submission. Before proceeding, it’s crucial to understand all requirements to properly start an LLC and avoid errors that could lead to extra costs.

Start Your Texas LLC for $300

ZenBusiness helps you register your LLC while ensuring compliance with Texas filing fees.

What’s Included in a Formation Package

Many online platforms bundle essential features into all-in-one packages to form your llc. Comparing the best LLC services in Texas can help you find affordable and reliable options for registration. Offerings typically cover the cost to file your certificate of formation and address compliance basics for a limited liability company. By 2025, you’ll see more digital efficiency and better support:

- Preparation of Articles/Certificate: Ensures correct details for your texas filing fee

- LLC Operating Agreement Drafting: Spells out ownership percentages, voting rights, and management structure

- Registered Agent Service (1st Year): Accepts legal documents on your company’s behalf

- Federal EIN Filing: Some packages help secure your Employer Identification Number from the internal revenue service

- Ongoing Reminders and Alerts: Many providers offer notifications for compliance deadlines, annual franchise tax filings, and more

Depending on your chosen service, these bundles may cost $50–$300 plus state charges, allowing you to simplify the initial steps of starting an llc.

Detailed Cost Breakdown

In Texas, the overall llc cost depends on various elements, from your initial filing fee to ongoing franchise tax obligations. Creating a clear roadmap of these expenses helps business owners stay on budget. Below, find a comprehensive table summarizing typical 2025 costs.

| Expense Category | Cost Range (2025) | Frequency |

|---|---|---|

| Filing Fee (Certificate of Formation) | $300 | One-Time |

| Name Reservation (Optional) | $40 | One-Time |

| Operating Agreement (Optional) | $0–$200 | One-Time |

| EIN (Self-Filing) | $0 | One-Time |

| Registered Agent Service | $0–$125/year | Annual |

| Franchise Tax & Public Info Report | Varies by Revenue | Annual |

| Business License/Permits | $0–$200+ | Varies by Location |

| Periodic/Annual Reports (SOS for LLCs) | $0 (Not required) | N/A |

One-Time Expenses

Your initial outlay when establishing an LLC in Texas revolves around creation and setup charges. The most obvious cost is the state filing fee associated with submitting your Certificate of Formation (Form 205) — $300 payable to the Texas Secretary of State. Additional services, like drafting an LLC operating agreement or obtaining a registered agent service, may also incur extra fees. Keep in mind, some providers bundle these services at discounted rates, which can lessen your total out-of-pocket. If you plan to reserve your chosen LLC name for up to 120 days, you can file a Name Reservation (Form 501) for $40. Beyond that, many business owners choose to self-file for an EIN with the Internal Revenue Service, which is free when done directly through the IRS.

Filing Fees and Certificate of Formation

In 2025, the core cost to form an LLC in Texas remains $300. The Texas Secretary of State accepts online filings via SOSDirect or SOSUpload, which typically expedite processing. Entrepreneurs often ask how long it takes: about 10–12 business days via SOSDirect (and roughly 13–15 business days via SOSUpload), while mail takes longer; exact timing can vary. If speed is a priority, expedited service is $25 per document. This fee covers the Certificate of Formation (Form 205) you submit online or by mail; once approved, you’ll receive a file-stamped Certificate of Formation confirming your company’s LLC status. Remember that foreign LLCs register in Texas for $750 (Application for Registration).

Optional Services (Name Reservation, Operating Agreement, EIN)

In Texas, you don’t have to reserve your LLC’s name before filing—unless you’re still finalizing details:

- Name Reservation ($40): Optional if you want to lock your LLC name for up to 120 days.

- LLC Operating Agreement ($0–$200): Some entrepreneurs draft it themselves, while others hire pros.

- EIN (Free if Self-Filing): You can apply through the IRS website at no cost; some companies charge if you want help.

Overall, these optional extras depend on your preferences and knowledge base. By 2025, many formation services bundle them into multi-tiered packages for convenience. If you’re wondering whether you can form an LLC without an active business yet, some states allow it as a placeholder for future ventures.

Recurring and Annual Costs

After the initial setup, your limited liability company must satisfy ongoing responsibilities. These encompass franchise tax, annual report fees, and a registered agent service if you need continued coverage. Additionally, you might need to file a periodic report depending on your LLC’s classification. Although some of these obligations have minimal cost, overlooking them can lead to penalties, which, in turn, inflate your llc cost in the long run.

Franchise Tax and Renewal Fees

By 2025, Texas retains the Texas franchise tax, overseen by the Texas Comptroller. This tax applies to eligible businesses whose annualized total revenue exceeds the No Tax Due threshold of $2,470,000 (reports due in 2024–2025). For most LLCs, tax rates remain 0.375% (retail/wholesale) or 0.75% (all others) of taxable margin.

You must also file a Public Information Report (PIR) annually; beginning with 2024 reports, entities under the threshold no longer file a No Tax Due Report, but they still must file the PIR/OIR by the franchise tax due date (generally May 15).

If you have lower revenues, the franchise tax may be zero, but the PIR/OIR filing still applies. Missing these filings can trigger a $50 late-report penalty and, if unresolved, forfeiture of corporate privileges/right to transact business until reinstated.

Registered Agent and Compliance Expenses

A registered agent service is vital for maintaining compliance and receiving legal documents in Texas. Most professionals charge roughly $99–$125 per year (e.g., Northwest $125/yr), and some companies waive the first year when you form through them (e.g., Bizee/Incfile: first year free, then $119/yr). If you change providers later, Texas charges $15 to file Form 401 (or $5 for nonprofits).

Northwest Registered Agent

Known for offering robust support, Northwest charges $125/year and emphasizes Privacy by Default®. They provide same-day digital scans, online document storage, and annual-report reminders, helping you sidestep compliance issues. The company is admired for personalized customer care (their Corporate Guides®) and transparent, flat pricing with no hidden fees.