How much does it cost to form an LLC in Massachusetts is a crucial question for entrepreneurs — and in 2025, the answer is higher than almost anywhere else in the U.S. While forming a limited liability company brings valuable legal protection, the LLC fees in Massachusetts are notably steep compared to other states.

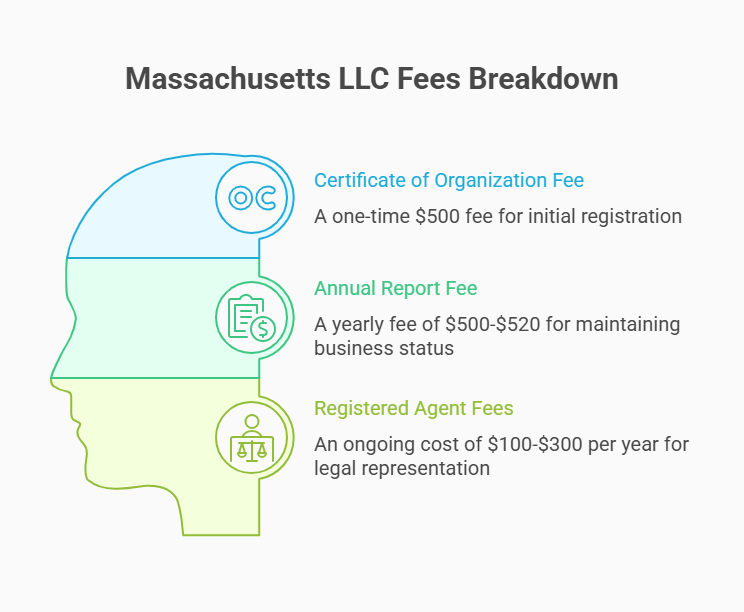

The base cost to form an LLC in Massachusetts is $500 to file your Certificate of Organization, followed by a $500 annual report fee each year. Optional costs include $100–$300 for a registered agent service, $50–$300 for local permits or business licenses, $65 for a DBA filing, and $30 to reserve a business name for 60 days—while some businesses may need legal or tax help, pushing first-year expenses to $1,300 or more.

This guide gives you a full breakdown of every Massachusetts LLC fee you might face — from mandatory filings to optional services and hidden expenses. Whether you’re budgeting your first year or deciding if Massachusetts is worth the price, this 2025 cost overview lays out what to expect.

Understanding the Total Cost of an LLC in Massachusetts: A Quick Overview

Massachusetts startup costs are among the highest in the U.S., and many entrepreneurs are shocked by the price to form an LLC in Massachusetts. But the high price tag isn’t just from the initial filing fee—it’s the result of recurring state charges and hidden costs that quickly add up.

What Is the Initial Formation Fee to Start Your LLC?

To start your LLC in Massachusetts, you must file a Certificate of Organization with the Secretary of the Commonwealth. This is the major filing requirement and has one of the highest state fees in the country. This is a cost we can’t avoid, and marks the official start of your llc.

Apart from the base filing fee, other potential formation costs depend upon the structure you choose to create. Some are optional but some are essential for compliance or operating efficiently. Here's a breakdown of initial startup costs:

- $500 – Filing fee for Certificate of Organization (required)

- $100 –$300 – Registered agent service (if you hire one)

- $0 – EIN application through the Internal Revenue Service (required for taxes and banking)

- $0–$250 – Name reservation or DBA registration

- $100–$500 – Legal help for Operating Agreement drafting

- $50–$300 – Business licenses or permits depending on industry and city

Factoring in both required and optional expenses, the average startup total ranges from $500 to $1,300.

Launch Your Massachusetts LLC with ZenBusiness

Form your LLC in minutes with ZenBusiness. Enjoy step-by-step guidance, fast processing, and built-in compliance tools – no legal guesswork required.

Essential Recurring Annual Fees in MA

The state requires a $500 fee for an annual report from every Massachusetts-based LLC. One of the highest recurring costs for an LLC corporate in the USA. You are required to submit this report every year on the anniversary date of your initial filing of the Certificate of Organization. The cost of a registered agent service typically ranges anywhere from $100 to $300 an annum. All those annual fees are the minimum costs to keep your LLC in compliance with the Secretary of the Commonwealth and maintain good standing.

Detailed Explanation of Mandatory Massachusetts LLC Fees

Understanding the required fees for forming and maintaining an LLC in Massachusetts can be confusing. From the steep certificate of organization charge to recurring filing fees, many entrepreneurs underestimate the true cost. This section breaks down each mandatory component so you can plan your business budget accurately.

The $500 Certificate of Organization State Filing Fee

The certificate of organization is the foundational document you must submit the Secretary of the Commonwealth’s online portal when forming your LLC in Massachusetts. This filing fee is nonrefundable and required whether you file online or by mail. It formally registers your business with the state and allows you to begin operations.

At $500, this is one of the highest formation fees in the country. In most other states, the cost ranges from $50 to $200. Massachusetts sets a premium price, and you’ll need to pay this fee again if you ever need to refile due to an error or amendment.

Understanding the $500 Massachusetts LLC Annual Report

Every Massachusetts LLC must file an annual report with the Secretary of the Commonwealth; the state charges $500 for filings submitted by mail and $520 for filings submitted online (which include a $20 expedited-service fee). This report confirms basic business information, including your principal office address, registered agent, and ownership structure.

Each year, you must file reports on the anniversary of your certificate of organization approval date. You can file it with the state government either online or through traditional mail, however, the cost to file is the same for either method. Failing to submit this on time can incur a penalty or could even lead to administrative dissolution of your business.

There is no monetary penalty assessed for late LLC annual report filings in Massachusetts; however, failure to file for two consecutive years leads to administrative dissolution. Staying on top of this annual obligation is essential for keeping your limited liability company in good standing with the state.

Registered Agent Fees: A Necessary Ongoing Expense

Every Massachusetts LLCs must have a registered agent with a physical Massachusetts address, per law. As the owner of a business, you can choose to act as your own registered agent, or you may choose to hire a registered agent service for the LLC. This would generally cost you anywhere between $100 and $300 per year. Even though you will be charged an additional fee, having a reliable agent guarantees that you will receive your legal paperwork on time. In this way, your limited liability company can stay in good standing with the Secretary of the Commonwealth. For help choosing, visit our guide to the best options for registered agents in Massachusetts.

Tax Obligations and Fees for Massachusetts LLCs

Many entrepreneurs overlook the tax side of forming an LLC in Massachusetts, but it's just as important as your filing fees. Beyond federal obligations, the Commonwealth of Massachusetts imposes specific tax requirements on LLCs. This section explains your income tax duties, corporate tax options, and how to file properly to stay compliant.

Annual Minimum Excise Tax for LLCs

In Massachusetts, limited liability companies (LLCs) that are classified as a corporation for income tax purposes must pay an annual minimum excise tax of $456. The Massachusetts Department of Revenue enforces this tax irrespective of the business’s income generation capacity.

An LLC that is treated as a partnership or disregarded entity means that the members report the earnings on their individual returns. But the entity itself may have other forms or taxes to pay based on the source of income. You should determine your LLC’s classification with the IRS as well as theCommonwealth of Massachusetts so you know what taxes will apply.

When and How to File State Taxes for Your LLC

Massachusetts LLCs have certain state tax filing requirements. However, the specific requirements depend on how the IRS designates the business. Depending on how your LLC is taxed, you will file differently than if you entity taxes as a corporation. The Massachusetts Department of Revenue require all entities, regardless of structure, to meet annual dates and minimum payment obligations.

Follow these steps to correctly file your taxes:

- Confirm your federal tax classification (disregarded entity, partnership, or corporation).

- Register with the Massachusetts Department of Revenue for a state tax ID.

- Use MassTaxConnect to submit your annual return electronically by the appropriate deadline (usually April 15).

- Pay the $456 minimum excise tax if your LLC is taxed as a corporation.

- Keep all filings current to maintain good standing and avoid penalties.

Impact of S Corp Election on LLC Costs

Choosing S corporation classification for your Massachusetts LLC may give rise to savings, but it also creates new filing and compliance costs. If they pay themselves a reasonable salary, owners can avoid paying self-employment tax on the entirety of the profits, thus potentially reducing the amount subject to the tax.

However, this strategy comes with trade-offs. You’ll need to file IRS Form 2553, run payroll, and possibly hire a bookkeeper or accountant—services that increase your annual operating fees. Additionally, your business must still meet Massachusetts excise tax obligations. For some LLCs, the S corp route makes sense, but for others, the extra administrative work outweighs the financial benefit.

Why Is a Massachusetts LLC So Expensive Compared to Other States?

In most other states, forming an LLC Massachusetts is quite expensive. The filing fee is $500, which has a matching $500 annual report requirement. So, it’s upwards of $1,000 upfront and recurring each year. Many start-ups aren’t used to such high rates because most states have friendly prices.

So why the premium? The Commonwealth of Massachusetts imposes higher fees to support its robust regulatory infrastructure. From maintaining public business databases to enforcing compliance, the state’s fee structure reflects its hands-on approach. Unlike minimal-cost states, Massachusetts places more emphasis on business transparency and administrative oversight.

To understand how Massachusetts stacks up, compare its costs to five other popular states for LLC formation:

| State | Formation Fee | Annual Fee | Total Year 1 |

|---|---|---|---|

| Massachusetts | $500 | $500 | $1,000 |

| Delaware | $90 | $300 | $390 |

| Florida | $125 | $138.75 | $263.75 |

| Texas | $300 | $0 | $300 |

| California | $70 | $800 | $870 |

| New York | $200 | $9 (biennial) | $209 |

This pricing gap reflects not just policy choices, but also a higher standard of business regulation and public service investment by the Massachusetts Secretary’s office. For additional comparisons across all 50 states, check out our full LLC fee comparison by state resource. You can also explore how formation costs stack up in other major states like our LLC in Texas guide or review detailed Connecticut small business statistics for more regional context.

Potential Additional Costs When Starting Your Massachusetts LLC

When starting an LLC in Massachusetts, there may be additional unexpected fees, depending on your type of business and where you’re located. There are costs that you do not pay for before you start the business; like licensing and legal service fees.

Business License and Permit Costs by Industry

A lot of new business owners don’t realize their LLC in Massachusetts may need a business license or permit to operate legally. These costs vary by industry and locality, with cities like the City of Boston often imposing additional fees or registration steps beyond state requirements.

Depending on the industry and required approval, fees tend to range between $50 and over $500. If your company is in a regulated industry (food service, construction, child care), you will probably need one or more licenses. Check on the local, state and sometimes even federal level what is required.

Typical license and permit costs by industry:

- Retail – $50 to $150

- Food Service – $100 to $500+

- Construction/Trades – $150 to $400

- Healthcare – $200 to $500+

- Childcare Services – $100 to $300

- Transportation/Logistics – $100 to $250

- Real Estate – $75 to $200

- Professional Services – $50 to $150

EIN Application and Tax Registration Expenses

It does not cost anything to apply for an Employer Identification Number or EIN through the IRS online application portal. In Massachusetts, most LLCs will need one. Open a bank account, hire employees, and register Massachusetts Department of Revenue for tax purpose require an EIN. Before registering, it’s a good idea to check availability with the Massachusetts business search tool. The EIN itself is available free of charge, however, some formation services will charge $50 to $100 if you request that they file on your behalf.

LLC Formation Services: Optional Help at an Additional Cost

LLC formation in Massachusetts can be done on your own. However, many Massachusetts entrepreneurs prefer to hire a professional service to do the paperwork. The costs of these companies can vary between $50 and $400 based on the level of support they offer along with whether any extras are added such as an operating agreement, EIN application, or expedited filing.

For first-time business owners who don’t know how to form their business, the extra fee can be worth it. Services such as Northwest & ZenBusiness ensure your documents are filed properly with the Secretary of the Commonwealth. These services also offer compliance tools to keep your LLC in good standing.

How Processing Times Can Affect Your Total LLC Cost

Timing matters when forming an LLC in Massachusetts. It takes about 10 business days to process standard state, and any delay could affect when you can officially start operating. At times, the speedier processing is worth the extra fee – more so when your business plans rely on speedy setup.

What Is the Standard Processing Time for a Massachusetts LLC?

After you submit your certificate of organization to the secretary of the Commonwealth, most LLCs in Massachusetts will take 5 to 10 business days to process. Online filings are usually processed more quickly than those that are mailed. During peak period like year-end or tax deadlines, processing may take longer. If your company has to get up and running with a short turnaround time, keep this in your timeline. You can find more details in our guide to LLC Processing Times in Massachusetts. If approvals are not given on time, it could lead to delays in opening a bank account or getting a license or permit.

Is There an Expedited Filing Option for an Additional Fee?

Massachusetts offers expedited processing when forming an LLC in Massachusetts for entrepreneurs who need to launch quickly. Approval through standard means takes a maximum of 10 business days. But, if your business is going to make use of it straight away (closing a lease/contract etc.) you can pay a fee when submitting your application for your certificate of organisation to request faster service.

Expedited processing options are available whether you file online or by mail. The Secretary of the Commonwealth offers two service levels, allowing you to choose based on urgency and budget. While expedited services add to your total LLC filing cost, they may save you time-sensitive losses or missed opportunities.

| Processing Speed | Additional Fee | Estimated Total Time |

|---|---|---|

| 24-Hour Processing | $20 | 1 business day |

| Same-Day Processing | $50 | Same business day (if filed before 1 p.m.) |

Massachusetts LLC Cost FAQs

Starting and maintaining an LLC in Massachusetts can raise plenty of cost-related questions. From payment deadlines to cheaper alternatives and late penalties, this FAQ section answers the most common concerns. Use it as a quick reference to avoid confusion—and stay compliant. For a broader overview beyond Massachusetts, see our General Guide on Starting an LLC

What Is the Cheapest Way to Start an LLC in Massachusetts?

The most affordable way to form an LLC in Massachusetts is to file the certificate of organization yourself through the Secretary of the Commonwealth’s online portal. This limits your total cost to the $500 filing fee, avoiding extra charges from third-party services. If you want to compare tools and services, explore our Massachusetts LLC Reviews. Skip add-ons unless absolutely required for your business.

Are There Penalties for Paying Massachusetts LLC Fees Late?

Yes. If your LLC in Massachusetts fails to file its annual report by the due date, the state adds a $25 late fee. Continued noncompliance may result in administrative dissolution by the Secretary of the Commonwealth, which can jeopardize your business status and lead to reinstatement costs or legal complications.

What Is the Minimum Tax for an LLC in Massachusetts?

An LLC in Massachusetts taxed as a corporation must pay a minimum excise tax of $456 each year, regardless of how much income it earns. This tax is collected by the Massachusetts Department of Revenue. LLCs taxed as sole proprietorships or partnerships avoid this specific charge but still owe income reporting for tax purposes at the individual level.

Can You Avoid the High Filing Fees with a Different Business Structure?

Yes, but there are trade-offs. Choosing a sole proprietorship or general partnership avoids the $500 filing fee and annual report required for an LLC in Massachusetts, but you also give up the limited liability company protections. These alternatives are cheaper to start, but they offer less legal separation between your business and personal finances—making them riskier long term.

Can You Pay Your Massachusetts LLC Fees Online?

Yes. The Secretary of the Commonwealth allows all major LLC in Massachusetts fees—including the filing fee and annual report—to be paid online via its official corporations portal. Payment methods include credit card, debit card, or ACH bank transfer, making the process fast, secure, and convenient for business owners.

Resources for Launching Your Massachusetts LLC

Starting a business in the Bay State? These official and expert-backed resources will walk you through each step – from filing your Certificate of Organization to staying tax compliant year-round.

- Secretary of the Commonwealth – LLC Filing Center (sec.state.ma.us)

The state’s official site for submitting your Certificate of Organization, checking filing requirements, and accessing downloadable forms. - Massachusetts LLC Formation Guide (mass.gov)

A beginner-friendly guide covering the $500 state filing fee, BOI compliance, and annual report obligations for MA-based LLCs. - Massachusetts Business Resources Hub (mass.gov)

A one-stop portal with links to licensing, legal forms, tax registration, and support services for new businesses. - MassTaxConnect – Business Tax Portal (mass.gov)

Register your LLC for sales tax, corporate income tax, and other obligations via this Department of Revenue portal.

Don’t let paperwork or price tags slow you down — these resources are here to guide and support you as you take the leap into business ownership in Massachusetts.

Looking for an overview? See Massachusetts LLC Services

Massachusetts Compliance Made Easy with Harbor’s Agent Service

From lawsuits to state notices, Harbor Compliance handles sensitive documents securely — so you stay in good standing.