Curious about how much it really costs to form an LLC in Arizona? Wondering if there are hidden fees beyond the $50 filing? Or if Arizona is truly one of the cheapest states for LLC formation?

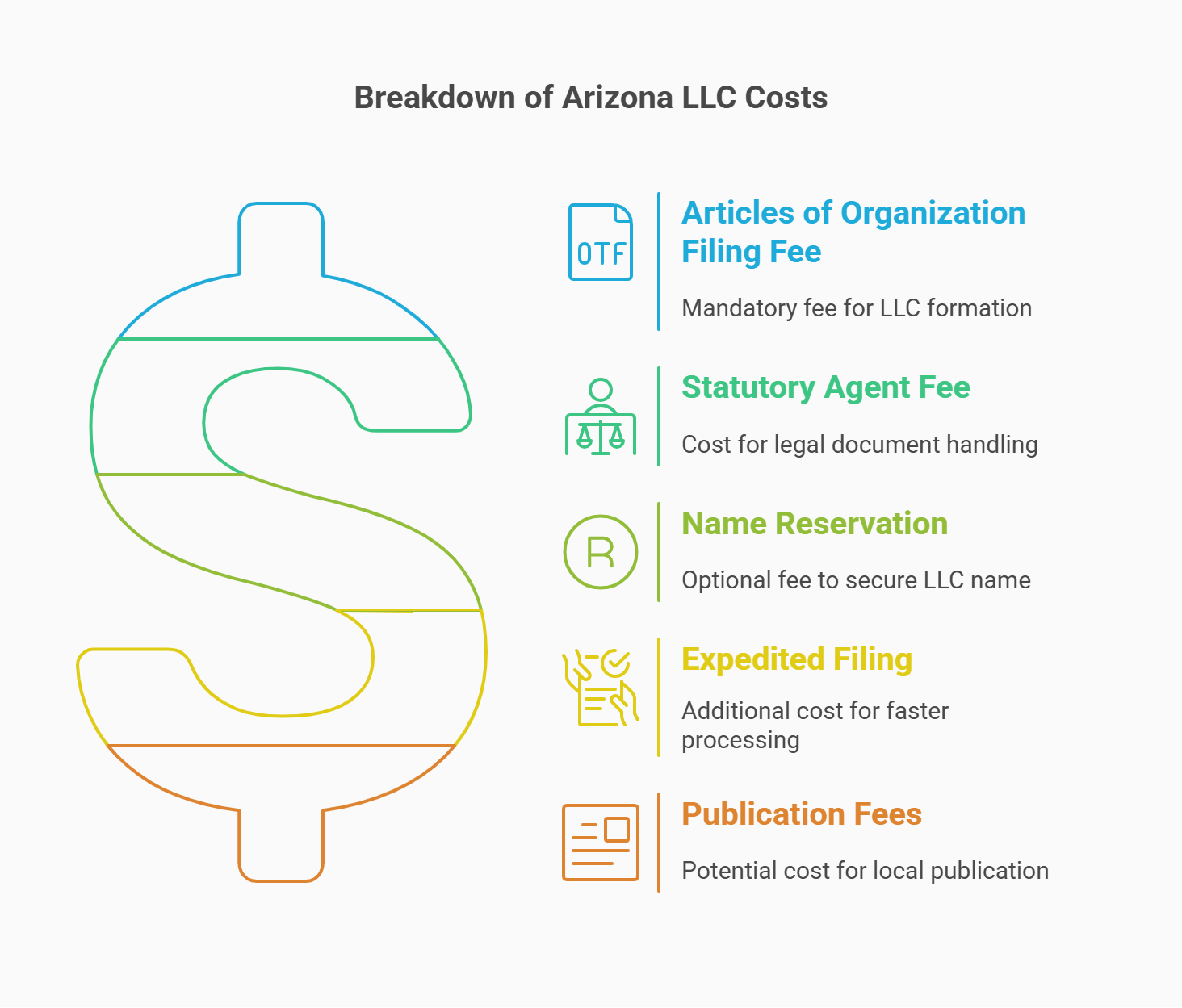

The cost to start an Arizona LLC is as low as $50 when filing online through the Arizona Corporation Commission. Optional costs may include a $100–$200 statutory agent fee, $30–$150 publication fee (if required by your county), and $35 for expedited processing. Unlike many states, Arizona does not require an annual report or franchise tax, keeping ongoing fees minimal. By handling tasks yourself—like serving as your own agent and using free resources—you can keep your total startup costs under $100.

In this guide, you'll discover:

- The mandatory and optional fees when forming an Arizona LLC

- How to save money with DIY filing tips and smart shortcuts

- A complete year-by-year cost breakdown to plan ahead

- Whether Arizona is the best choice compared to other states

Ready to launch your business without overspending? Let’s dive into what makes Arizona LLCs a smart and affordable option!

| Cost Element | Fee (as of 2025) | Timing/Notes |

|---|---|---|

| Articles of Organization (Online) | $50 | One-time fee when filing online |

| Articles of Organization (Paper) | $85 | One-time fee if filing by mail or in person |

| Statutory Agent Services | $0–$200/year | Depends on choice: self-service vs professional |

| Name Reservation (Optional) | $10–$45 | 120-day reservation; not mandatory if you file immediately |

| Expedited Filing (Optional) | $35 | Speeds up processing from ~2–3 weeks to a few days |

| Publication Fees | Varies by County | $30–$150 on average; must be done within 60 days in most counties |

| Annual Report | None for AZ LLC | Not required by Arizona; verify local regulations |

| Franchise Tax | None for AZ LLC | Arizona does not impose a traditional franchise tax |

| Local Business License (If Needed) | $0–$150+ | Depends on city/county requirements |

| Operating Agreement | $0–$500+ | Free templates vs attorney drafting |

| EIN (Employer Identification Number) | Free (DIY) | Optional paid services exist; direct IRS application is no cost |

| Certificate of Good Standing (Optional) | $10 | Often needed for banking, loans, or foreign registration |

Total Cost to Start an Arizona LLC

Understanding the total outlay for setting up your Arizona LLC is crucial for new business owners. You’ll face some mandatory fees, along with optional expenses that can influence your startup’s bottom line. The llc cost can vary depending on the filing method, urgency, and added services you might use. In this section, we’ll break down every upfront charge you can expect, highlight common pitfalls, and provide actionable tips to keep your investment minimal while ensuring compliance.

Articles of Organization Filing Fee ($50 Online, $85 Paper)

Filing your LLC’s articles of organization with the Arizona Corporation Commission (A.C.C.) is your first official step. As of March 2025, the online fee remains $50, while mailing a paper form or filing in person costs $85. Most entrepreneurs prefer the online route for its quicker turnaround and reduced cost. However, some still choose paper filing if they’re more comfortable with traditional documents.

Key points to keep in mind:

- You must include essential details like your LLC’s name, principal address, and statutory agent information.

- If you make an error or leave out critical information, you could face delays or need to refile, incurring additional expenses.

- Once approved, your LLC is officially recognized under Arizona law.

By submitting these forms correctly the first time, you’ll save both money and time, ensuring your business can move forward without unnecessary administrative hurdles.

Statutory Agent Fee (Free vs Paid)

Every Arizona LLC must designate a statutory agent, who accepts legal documents on the company’s behalf. You can serve as your own agent for no cost, but many entrepreneurs opt for a paid service, which typically ranges from $100 to $200 per year in 2025. Choosing a professional service can offer greater convenience and privacy, especially if you don’t want your address listed publicly.

Consider the following before deciding:

- Handling agent duties yourself requires regular availability during business hours.

- A professional provider may help you avoid missing critical legal notices.

- Some services bundle compliance alerts and extra features, making the annual fee worthwhile.

Ultimately, the choice depends on your comfort with public listings and your schedule. If confidentiality and peace of mind matter, a reputable agent service can simplify your administrative load. Choosing the best llc service in Arizona can also ensure smoother compliance and faster setup.

Form your Arizona LLC fast—starting at $0 + state fees

ZenBusiness makes launching your LLC affordable with a streamlined process and optional worry-free compliance.

Name Reservation (Optional – $10–$45)

Reserving your desired business name in Arizona is not mandatory but can safeguard you from potential naming conflicts. For a fee ranging from $10 to $45, you can hold a name for 120 days. This option is especially helpful if you’re still finalizing your LLC details but want to ensure no one else claims your preferred name. However, if you plan to file your formation documents immediately, name reservation isn’t really necessary. Most owners skip this step to avoid extra cost and streamline the formation timeline. This minimal expense can be worthwhile if you need extra time to gather information or finalize your business strategy.

Expedited Filing (Optional – $35)

For those who prefer a faster turnaround, expedited processing is available for an additional $35. Instead of waiting the standard two to three weeks, you could see approval in just a few business days. This option is beneficial if you’re working under a tight launch schedule or need to open a business bank account promptly. While not essential for every LLC, it can save valuable time. Evaluate whether the extra fee aligns with your operational goals before you opt for rush handling. To better anticipate timelines, learn how long does it take to get an llc in Arizona depending on your chosen filing method.

Startup Cost Summary for Year 1

Your initial expenses when you start an llc in Arizona generally include the $50 online filing fee (or $85 by paper) for the Articles of Organization and any statutory agent fee if you choose a professional service. You may also encounter optional costs like name reservation, expedited filing, and publication fees. Factoring in these elements helps you anticipate your total budget. To walk through the entire process, you can follow this complete guide on how to start an llc in Arizona with confidence.

Here’s a quick recap for Year 1:

- Mandatory: Articles of Organization filing ($50–$85)

- Statutory agent (if paid): $100–$200 per year

- Optional: Expedited filing ($35), name reservation ($10–$45), or other specialized services

- Publication (if required in your county): $30–$150 on average

By carefully selecting only the services you genuinely need, you can keep your first-year outlay manageable. Planning ahead also minimizes surprises, allowing you to focus on growing your LLC rather than worrying about last-minute fees or missing deadlines.

Required Arizona-Specific Publication Fees

In Arizona, certain newly formed LLCs must meet a publication requirement to ensure public notice of the company’s creation. This entails publishing a notice in an approved newspaper, generally within 60 days of formation. The cost and procedures can vary significantly by county. Failing to publish can lead to unwanted complications, so it’s vital to understand your obligations, typical fees, and which counties enforce these rules.

What the Law Requires (and When)

In most counties, you must publish your LLC’s Articles of Organization or a notice of formation in a newspaper recognized by the state. Publication should occur within 60 days of your approval date. However, maricopa county and Pima County no longer require publication thanks to electronic postings on the Arizona Corporation Commission website. Be sure to confirm your local guidelines, as these regulations can change. Missing this deadline could lead to administrative complications, potentially jeopardizing your LLC’s good standing or its ability to operate smoothly.

Publication Costs by County

Depending on the county where your arizona business is located, publication fees can range from $30 to $150. Rural counties often have fewer newspaper options, which can drive costs higher. Conversely, more populated areas sometimes offer competitive rates because multiple outlets vie for your notice. Before finalizing your LLC’s address, you might investigate which county’s fees and processes are most favorable. This is particularly relevant if you reside near a county line or have the flexibility to choose a different business address. Always verify that the newspaper is authorized by the Arizona Corporation Commission, ensuring your publication meets the legal standards for compliance.

What Happens If You Don’t Publish

Failing to publish if required can compromise your LLC’s liability protection and standing with state authorities. The Commission may eventually declare your company inactive or non-compliant, making it harder to enforce contracts or defend against lawsuits. Rectifying a lapse can involve re-filing and incurring additional costs. In short, skipping publication obligations puts your legal status at risk, so it’s crucial to understand whether your county mandates this step.

Annual and Ongoing LLC Fees in Arizona

While Arizona doesn’t impose a strict annual fee for LLCs, there are still costs to consider once your company is operational. These might include renewing local business licenses or maintaining a registered agent. Additionally, certain taxes and other recurring obligations could arise, depending on the nature of your enterprise and where you do business.

No Annual Report or Franchise Tax

Unlike some states, Arizona does not require an annual report or a franchise tax for LLCs. This makes Arizona particularly attractive when comparing llc annual fees by state, especially for long-term cost-conscious entrepreneurs. And this absence of recurring state-level fees can significantly reduce your long-term operating costs. However, it’s wise to stay informed about any changes in legislation or reporting requirements. Keeping up-to-date ensures you’re never caught off guard by new mandates, and it provides peace of mind as you focus on growing your business.

Registered Agent Renewal Fees

If you choose a commercial registered agent service in Arizona, expect to budget between $100 and $200 annually for ongoing support. This fee guarantees someone is always available to receive legal documents, even when you’re out of the office. While self-representation is free, a missed legal notice can lead to serious complications. Plus, some professional services offer extra compliance reminders or digital dashboards to help you stay on track. Before renewing, assess whether the convenience and added privacy justify the annual fee for your specific circumstances. That’s why many entrepreneurs choose registered agent services for added reliability and compliance support.

Local Business License Renewal (If Applicable)

Certain municipalities in Arizona mandate a business license for LLCs operating within their jurisdiction. The renewal process and cost can vary, typically ranging from $0 to $150 or more. If your city or county imposes such fees, remember to track renewal deadlines to avoid penalties or forced closure. Some localities also require an inspection or additional paperwork. Staying proactive about your license status not only keeps your LLC compliant but also fosters a trustworthy reputation in the community.

Tax Obligations: Sales Tax, Transaction Privilege Tax, Etc.

While Arizona lacks a traditional state-level sales tax, it does impose a transaction privilege tax (TPT). In many respects, TPT functions like a sales tax, but the legal incidence falls on the seller rather than the buyer. Rates vary based on your business’s activities and location. Additionally, certain municipalities layer on extra taxes or fees, so verify your city or county’s regulations.

Key tax considerations include:

- Determining if your product or service is subject to TPT.

- Registering for a TPT license with the Arizona Department of Revenue.

- Filing and paying TPT on time to avoid penalties.

- Monitoring changes in local tax rates, especially if you sell in multiple jurisdictions.

Some LLCs may also owe income tax or other obligations, depending on their profits and organizational structure. Consult a qualified tax professional for clarity on your responsibilities. Staying compliant helps preserve your good standing and avoid unexpected liabilities down the road.

Start your Arizona LLC with full privacy protection

Northwest includes expert support and transparent pricing—perfect if you want personal service and no hidden upsells.

Optional and Hidden LLC Expenses

Aside from the core filing requirements, there are additional costs that may catch new LLC owners by surprise. These often include fees for special permits, professional advice, or optional upgrades like expedited processing. Some expenses are fully elective, while others arise from industry-specific regulations. Being aware of these possibilities can help you budget accurately and prevent unwelcome financial surprises.

DBA (Trade Name) Registration

If you plan to operate under a name different from your LLC’s official designation, you’ll need to register a trade name with the Arizona Secretary of State. The process typically costs $10 to $15, depending on the filing method, and registration is valid for five years. This step helps protect your brand identity and ensures you remain compliant. Keep in mind, however, that a DBA or trade name does not offer the same legal protections as forming a separate business entity. Always confirm up-to-date fees before submitting your application.

Certificate of Good Standing ($10)

Often required for banking, loan applications, or expanding to other states, a certificate of good standing verifies that your LLC meets Arizona’s statutory requirements. The Arizona Corporation Commission charges $10 for this document as of 2025. You can request it online or by mail. While not mandatory for all businesses, it can expedite key transactions, including foreign LLC registration and obtaining certain licenses. If you anticipate needing it, factor this minor fee into your annual budget.

EIN Application: Free vs Paid Services

An employer identification number (EIN) is a unique tax ID assigned by the IRS. Obtaining it directly from the IRS website is free and usually takes only a few minutes. However, paid services often charge $50 to $100 to handle the application on your behalf. While this can be convenient, it’s generally unnecessary. Most Arizona business owners prefer the do-it-yourself approach. An EIN is vital for opening a business bank account, handling payroll, and filing taxes, so don’t skip this crucial step.

Operating Agreement: Free Templates vs Attorney Drafted

Although not legally mandated, a well-crafted llc operating agreement is vital for laying out ownership interests, voting rights, and decision-making procedures. You can find free online templates or use a formation service, saving you hundreds in legal fees. However, a professionally drafted agreement—costing $300 to $1,000 or more—offers personalized guidance and can help prevent disputes. If your LLC has multiple members or a complex structure, paying for expert input may be worthwhile. Otherwise, a solid template often suffices for straightforward operations. If you’re budgeting for legal support, check the average attorney fees for LLC to make an informed decision.

Accounting, Legal & Compliance Support

Running a legal entity involves more than just filing paperwork. Many LLC owners hire accountants or attorneys to navigate compliance, tax strategies, and contract reviews. Hourly fees can range from $150 to $400 or more, depending on the professional’s expertise. While you can manage simple tasks on your own, professional guidance reduces the risk of costly errors. Some firms bundle services—like bookkeeping and annual compliance reminders—into a monthly retainer, which might be a smarter choice if your business requires ongoing support.

Year-by-Year Cost Breakdown

To better anticipate your outlay, it helps to view your LLC’s financial obligations over multiple years. While the first year typically involves higher setup fees, subsequent years focus on maintaining your business entity in good standing. From initial filings to optional add-ons, this breakdown shows which expenses to expect and how they may change over time.

Year 1: Formation + Initial Requirements

In your first year of running an llc in arizona, you’ll pay the mandatory $50 online filing fee (or $85 if you file via paper) for the Articles of Organization. Additionally, if you opt for a paid statutory agent service, budget around $100 to $200. Publication fees might apply unless you’re in Maricopa or Pima County, which can add $30 to $150 to your expenses.

Here’s a quick checklist for Year 1:

- File Articles of Organization

- Secure a statutory agent

- Meet publication requirements, if applicable

- Set up your EIN for free (or through a paid service if you prefer)

- Draft an operating agreement (template or professionally prepared)

Beyond these essentials, consider whether you need expedited processing, a DBA registration, or a name reservation. Each carries its own small fee. By focusing on only the services that align with your goals, you can keep initial expenditures in check. Many new entrepreneurs search for the cheapest llc formation methods to reduce unnecessary startup costs.

Year 2 and Ongoing: Maintenance Fees

From Year 2 onward, core responsibilities include maintaining a registered agent (if using a paid service) and renewing any local licenses. Arizona doesn’t require an annual report or special franchise taxes, which helps keep your costs lower compared to some other states. However, if you plan to register as a foreign llc in another jurisdiction, expect to pay additional filing and renewal fees there.

Common maintenance costs may include:

- Registered agent renewal: $100 to $200 yearly

- Local business license fees (if your city mandates them)

- Accounting or legal counsel for complex tax or regulatory matters

- Optional certificate of good standing requests for banking or expansion

Regularly reviewing these ongoing obligations ensures you remain in good standing and avoids surprises. Keep track of deadlines, use reminders, and reassess your service provider choices annually to optimize for both compliance and cost-effectiveness.

Total Cost Over 3 Years

Projecting your llc filing and maintenance expenses over three years can provide a clear picture of your financial commitment. In Year 1, you’ll likely invest between $50 and $350 (or more), depending on optional services like expedited processing or paid agent support. Year 2 and Year 3 costs primarily involve agent renewals and potential local license fees, typically ranging from $100 to $400 each year, assuming no major changes to your business structure.

Consider these potential add-ons:

- Publication costs, if applicable

- Attorney or accountant fees for specialized guidance

- Foreign state registrations for multi-state operations

- Periodic requests for certificates or additional documents

Over a three-year span, total expenses can vary from a few hundred dollars to well over $1,000, dictated by your specific needs. Monitoring these financial obligations upfront keeps you prepared and helps you allocate resources effectively.

Which Fees Are Required vs Optional

Unlike a sole proprietorship, where formal filings are minimal, an Arizona LLC has distinct mandatory and optional fees. At a minimum, you must pay for filing the Articles of Organization and possibly publication in certain counties. All other expenses—like expedited processing, agent services, or name reservations—are optional. While some costs, such as a professional statutory agent or an attorney-drafted operating agreement, can enhance your company’s compliance and legal safeguards, they’re not strictly required by law. Ultimately, your budget and preference for professional support will determine which fees are essential for your LLC’s success.

Step-by-Step: How to Start an Arizona LLC on a Budget

For entrepreneurs looking to minimize costs, forming an llc on a budget in Arizona is entirely feasible. By managing certain tasks yourself—like being your own statutory agent or completing IRS forms—you can save hundreds of dollars. Even optional steps, such as name reservation or expedited filing, can be skipped if they aren’t critical. The following walkthrough outlines each stage of the process, emphasizing practical tips to keep your expenses as low as possible.

Submit formation documents through the Arizona Corporation Commission website for $50 instead of $85 for paper filings. Include LLC name, address, and statutory agent details. Double-check all information to avoid amendments.

Save $100-$200 annually by serving as your own agent. Maintain regular business hours and an Arizona physical address for receiving official correspondence from the Secretary of State.

Obtain your EIN at no cost directly from the IRS website. Essential for opening a business bank account, hiring employees, and ensuring federal tax compliance. Save $50-$100 by applying yourself.

Find and customize free templates online for your limited liability company. Outline management structures, profit distributions, and member roles without legal costs.

Source cost-effective newspapers for required publications. Compare rates and choose an affordable option while ensuring it meets legal requirements for public notice and corporate income reporting.

Step 1: File Articles Online via A.C.C.

To begin, submit your formation documents through the arizona corporation commission (A.C.C.) website. The online filing fee is $50, compared to $85 for paper filings. You’ll need your LLC’s name, address, and statutory agent details. Double-check spelling and contact information to avoid delays or the need for amendments. Once the A.C.C. approves your articles, you’ll receive confirmation and an official effective date. By opting for online submission, you save $35 and typically enjoy faster processing times, making this the most budget-friendly approach for new LLCs.

Step 2: Be Your Own Statutory Agent

Instead of hiring a commercial agent, consider serving as your own. This approach not only saves $100–$200 annually but also gives you direct control over receiving official correspondence. However, keep in mind you must maintain regular business hours and an Arizona physical address. Failing to update this address with the secretary of state can lead to missed legal notices. If privacy or availability is a concern, switching to a paid service later is always an option, often with minimal paperwork.

Step 3: Get Your EIN Free from the IRS

Obtaining your EIN at no cost on the IRS website is straightforward. This unique number is essential for opening a business bank account, hiring employees, and ensuring federal tax compliance. Paid services charge anywhere from $50 to $100 to apply on your behalf, but most LLC owners find the do-it-yourself route just as quick. Once you have your EIN, keep it handy for license applications and other essential paperwork.

Step 4: Use Free Operating Agreement Templates

Even though an operating agreement isn’t legally required, it’s a smart move for any limited liability company. Free templates can be found online, allowing you to outline management structures, profit distributions, and member roles. Ensure you customize these documents to reflect your specific business operations. For multi-member LLCs or complex arrangements, you might still consult an attorney, but many smaller companies find a template sufficient for basic governance and dispute prevention.

Step 5: Handle the Publication Yourself (Smart Tactics)

If your county mandates publication, sourcing a cost-effective newspaper on your own can yield significant savings. You can compare rates or choose a publication in a nearby area if that’s permissible. Just make sure it meets the legal requirements for public notice. Handling this step yourself ensures accuracy and control over deadlines. Once completed, retain proof of publication for any corporate income or tax records, and stay organized for future reference.

Arizona vs Other States: Is It Really Cheaper?

For entrepreneurs deciding where to incorporate, Arizona’s advantages extend beyond cost. Its setup fees are relatively moderate, and the absence of annual reports can be appealing. Whether you’re launching a tech startup, investing in real estate, or running a consulting firm, comparing Arizona with alternatives helps ensure you pick the right location. Below, we weigh key differences to guide your choice. You might also want to explore what is considered the best state for LLC formation based on taxes, privacy, and legal requirements.

Arizona vs California: Total Cost and Complexity

California often carries higher formation costs and more complicated compliance rules. Additionally, California’s income tax rates and annual LLC fees can significantly increase operating expenses. In contrast, Arizona’s one-time formation fee is lower, and no annual LLC taxes are imposed. While California offers a large market and extensive infrastructure, it also demands more rigorous filings and larger financial commitments. If keeping overhead low is a priority, Arizona’s simpler structure may be the better fit, especially for smaller or newly launched businesses with limited resources.

Arizona vs New Mexico: Privacy vs Publication

One standout feature of new mexico is that it does not require publication or public disclosure of LLC members, providing enhanced privacy. By contrast, Arizona mandates publication in many counties, though Maricopa and Pima are exceptions. Formation fees in both states remain relatively affordable, but New Mexico’s lack of annual reporting obligations and minimal filing requirements can be attractive to business owners prioritizing confidentiality. Arizona, however, generally has stronger commercial hubs, which may be advantageous for accessing local markets or resources, depending on your LLC’s operational focus.

Arizona vs Wyoming: Filing Simplicity vs Fees

Wyoming is renowned for its straightforward filing process and robust asset protection laws. Its annual fees are minimal, hovering around $50, with no publication step. Some formation platforms, including tailor brands, highlight Wyoming’s stable regulatory environment as a major selling point. In contrast, Arizona’s cost structure can be slightly higher initially due to publication requirements. However, for entrepreneurs residing in Arizona or targeting its markets, forming an LLC locally often simplifies compliance. Evaluating your expansion goals and budget will help determine which state aligns best with your objectives.

When Arizona Is the Right or Wrong Choice

If you reside in Arizona or anticipate significant in-state activities, forming your LLC there simplifies compliance and streamlines taxation. However, if you’re mainly doing business elsewhere—like new york or Texas—you might find fewer publication hurdles and different fee structures. Arizona suits local brick-and-mortar ventures and those seeking moderate filing costs without recurring annual reports. Conversely, if privacy or zero publication fees are your top priorities, states like New Mexico or Wyoming may offer better incentives. Always evaluate your company’s operational profile before choosing a jurisdiction.

Benefits of an Arizona LLC (Beyond the Fees)

Arizona’s welcoming business climate goes beyond low startup costs. Forming an LLC here means you can enjoy robust legal protections, flexible management structures, and no annual reporting burdens. There’s also a thriving entrepreneurial scene that fosters collaboration and access to local resources.

Key advantages include:

- Asset protection: Shield personal property from business-related liabilities.

- Flexible taxation: Elect to be taxed as a partnership, S-corp, or C-corp, depending on your needs.

- Professional agent service options: Ensure you never miss critical documents or court summons.

- Minimal red tape: Fewer ongoing filing requirements means less administrative hassle.

Additionally, Arizona’s favorable climate, growing economy, and proximity to major markets like California and Nevada make it an attractive hub for everything from tech startups to hospitality ventures. While other states might offer certain privacy perks or even lower initial fees, Arizona’s balance of straightforward regulations and healthy local demand has consistently drawn in entrepreneurs seeking both efficiency and opportunity.

Unique Insight: When You Should Avoid Forming an Arizona LLC

Although Arizona offers appealing benefits, certain situations make forming a single member or multi-member LLC here less ideal. High publication expenses and specific residency requirements can deter out-of-state entrepreneurs. Additionally, if your operations are entirely virtual or based in another region, you might find fewer logistical advantages. Understanding these drawbacks helps you determine whether Arizona is genuinely the best fit for your new venture.

You're an Out-of-State Online Business

If your LLC is purely digital and operates worldwide, forming in your home state might be simpler. When you register in arizona state, you’ll face publication rules, potential mailing expenses, and the need for a local statutory agent. If you rarely set foot in Arizona or have minimal in-state customers, the cost-to-benefit ratio may not favor an Arizona LLC. Instead, forming in a more convenient jurisdiction can save time and money, especially if you want to avoid multi-state registrations and added complexities.

Your County Has Expensive Publication Costs

Not all counties offer the same publication rates, and some can be significantly higher than others. If your llc name is tied to a county with steep newspaper fees, expect inflated costs that may rival or exceed any savings you’d gain from Arizona’s lack of annual reports. Relocating your business address to a more affordable county, if feasible, could help. However, if you’re locked into a high-cost area, another state’s formation rules might serve you better, avoiding recurring publication headaches and expenses.

You Prefer States with No Publication Requirement

If you want a streamlined llc formation without mandatory newspaper ads, Arizona might not be your top pick—unless you fall under the Maricopa or Pima County exceptions. States like Delaware, Wyoming, and New Mexico skip publication entirely, which can simplify the process. Compare overall filing fees, privacy options, and tax obligations before deciding. If avoiding any form of publication remains a priority, another jurisdiction may better accommodate your preferences.

FAQ: Arizona LLC Fees and Filing Costs

Many prospective owners have similar questions about the fees, timeframes, and obligations tied to launching an LLC in Arizona. Getting precise answers can help you avoid missteps and make smarter budget decisions. Below are the most frequently asked queries, along with concise, up-to-date responses. Each explanation aims to give you the clarity needed for a successful LLC launch.

Filing the Articles of Organization online costs $50, while mailing or delivering them in person is $85. If your county requires newspaper publication, expect an additional $30 to $150. Hiring a commercial statutory agent can run $100 to $200 annually, although you can serve as your own agent for free. Optional add-ons like expedited filing ($35) or name reservation ($10–$45) further affect your total. On average, you can anticipate a minimum investment of $50–$100 for a bare-bones filing, rising based on your optional choices.

Most costs are straightforward, such as the Articles of Organization fee and publication expenses. However, some entrepreneurs overlook local business license requirements or the potential need for a Certificate of Good Standing ($10). If you choose expedited processing or a professional statutory agent, that adds to your bill. While none of these fees are genuinely hidden, they can catch you off guard if you don’t research county-specific rules or specialized service charges. Planning ahead helps you avoid unwelcome financial surprises.

Arizona does not impose an annual fee or require a yearly report for domestic LLCs. This absence of recurring state-level charges differentiates Arizona from states that collect franchise taxes or demand annual filing fees. That said, you may still owe local renewal costs, such as municipal business licenses, depending on where you operate. Additionally, if you hire a commercial registered agent, you’ll likely pay an annual renewal fee for their services. Keeping track of these smaller obligations ensures you maintain good standing.

Yes, unless you’re located in Maricopa or Pima County, which have electronic posting exemptions. Arizona generally mandates publishing a notice of your LLC formation or the approved Articles of Organization in a state-recognized newspaper within 60 days of approval. Costs vary from $30 to $150, depending on the paper and county. If you fail to comply, you risk administrative penalties or an inactive status. Always confirm current rules, as publication requirements are sometimes updated or waived for specific regions.

While you can’t entirely skip mandatory state fees, you can minimize expenses by filing your own paperwork online ($50), acting as your own statutory agent, and bypassing optional services like name reservation or expedited filing. Publication costs may be unavoidable if you’re outside Maricopa or Pima County, but you can shop for the most affordable newspaper. Handling your EIN application yourself also saves money. Ultimately, while not free, forming an LLC in Arizona can be done at a relatively low cost.

Ignoring mandatory filing fees or publication requirements can lead to serious repercussions. The Arizona Corporation Commission may revoke your LLC’s good standing, hindering your ability to secure loans, open bank accounts, or enter legally binding contracts. In some cases, your LLC could be administratively dissolved, forcing you to refile and pay additional costs. Noncompliance also heightens legal and financial risks, leaving you exposed if you’re sued or face state penalties. Fulfilling each requirement on time safeguards your business’s operations.

Looking for an overview? See Arizona LLC Services

Launch your LLC in Arizona—backed by real professionals

Harbor Compliance offers advanced support and compliance tools for entrepreneurs who want to do it right the first time.