Conducting a North Carolina business entity search is essential for entrepreneurs, investors, and professionals looking to verify company details, check name availability, or review compliance records. Whether you’re registering a new business or researching an existing one, understanding how to use the Secretary of State’s online search tool ensures accuracy and efficiency.

To perform a business entity search in North Carolina, visit the Secretary of State’s official database and enter a company name or document number. This free tool allows you to verify business registration, confirm active status, and access public records such as annual reports and articles of organization.

This guide will help you:

- Conduct an effective business entity search using official state resources

- Verify name availability and avoid conflicts when registering a business

- Access public records and compliance documents for due diligence

Let’s explore the best practices for using North Carolina’s business registry to streamline your search process.

Introduction to North Carolina Business Entities

North Carolina offers a dynamic environment for entrepreneurs, with a robust system for registering and maintaining various types of legal structures. In this guide, we explore what constitutes a business entity in the state, explain why conducting thorough business searches is critical, and discuss the role of the North Carolina Secretary of State in maintaining accurate records. Whether you’re looking to verify an existing enterprise or plan to start your business, understanding the nuances of North Carolina’s business registry is essential for success.

Defining Business Entities in North Carolina

A business entity in North Carolina refers to any officially registered organization—such as a limited liability company (LLC), corporation, or partnership—recognized by the state. These entities must comply with specific formation and reporting standards, which include filing documents like articles of organization or incorporation. Establishing a proper entity provides legal protection, separates personal assets from business liabilities, and supports a structured management system. Forming an LLC without a business plan in North Carolina is central to protecting intellectual property and ensuring compliance with state guidelines.

Importance of Business Entity Searches

Conducting a business entity search in North Carolina is crucial for several reasons:

- Due Diligence: Verify that a prospective partner or supplier is an officially registered entity.

- Name Protection: Ensure your chosen business name complies with state naming rules and is not already in use.

- Risk Management: Review the compliance and filing history of a potential competitor.

- Strategic Decision Making: Access detailed business filings to inform your market entry strategy.

These steps help safeguard your investment and support informed decisions when you start my business or seek to expand an assumed business.

Overview of the North Carolina Secretary of State's Role

The North Carolina Secretary of State serves as the primary authority for business registration. This office maintains the official business register, oversees filings, and ensures that all entities comply with state laws. Through its online platform, you can access detailed records, conduct a Carolina business name search, and verify registration status. The Secretary of State business portal is a vital resource for those looking to conduct a North Carolina business entity search and obtain reliable, up-to-date public records.ple product lines can similarly tailor each line with unique identities, all while maintaining the overarching legal entity.

Register Your Business Name with Ease

ZenBusiness simplifies LLC formation and ensures your business name is available and compliant with North Carolina regulations.

Conducting a North Carolina Business Entity Search

Performing an effective business entity search in North Carolina is essential for verifying legal status and ensuring compliance. With advanced online tools available, the process is now more accessible than ever. Whether you are researching a competitor or checking the status of your own company, this guide provides you with step-by-step instructions and advanced techniques to help you find accurate and comprehensive information.

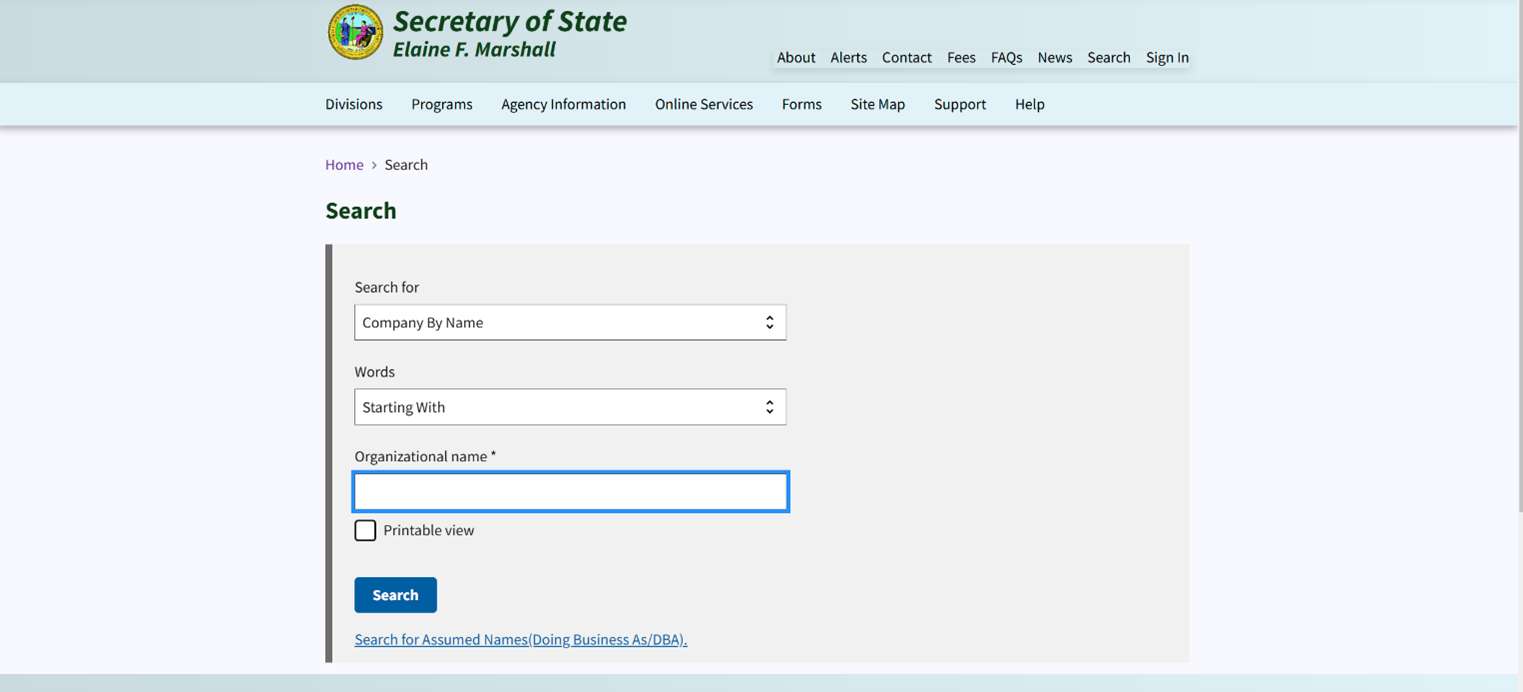

Accessing the North Carolina Secretary of State's Online Services

To begin your search, visit the official North Carolina Secretary of State website, which hosts an intuitive business search tool. This portal allows you to conduct a Carolina business entity search by entering a company name or document number. The online service provides access to vital information such as filing history, registration dates, and the current status of an entity. It also displays key documents like the articles of organization and any annual report filings. This platform is designed to help business owners verify details quickly, ensuring that every search is both thorough and reliable.

Step-by-Step Guide to Using the Business Search Tool

Using the North Carolina business search tool is a straightforward process. Follow these detailed steps to ensure you retrieve all necessary information:

- Visit the Official Website: Navigate to the North Carolina Secretary of State’s business registry portal.

- Select the Search Option: Choose to search by company name or document number.

- Enter Search Criteria: Input your desired business name, following the state’s naming rules, and click “Search.”

- Review Results: Examine the list of entities returned. Look for your target business among the results.

- Select a Record: Click on the business name to view detailed information, including registration date, status, and filing history.

- Download Documents: Access and download public records such as the articles of organization and annual reports.

- Cross-Reference Information: Use the tool’s filters to verify consistency with other public databases if needed.

This systematic approach ensures that you accurately identify and verify the details of any business entity. It also helps confirm whether the entity is in good standing, which is crucial if you plan to conduct business in North Carolina.

Advanced Search Techniques for Accurate Results

For more precise results, leverage advanced features of the search tool:

- Use Filters: Narrow your search by entity type, filing date, or explore LLC name ideas for better branding options.

- Keyword Variations: Try different variations of the business name to capture any discrepancies.

- Cross-Reference Data: Verify details by comparing records from the business registry with an Illinois entity search or other public filings.

- Utilize Boolean Operators: Refine searches by combining terms (e.g., “North Carolina LLC” AND “active”).

These techniques help improve accuracy and efficiency, ensuring that you obtain the most reliable data for your business research.

Verifying Business Information

Accurate verification of business information is critical for informed decision-making. This process not only confirms that an entity is legally registered but also allows for an NY LLC lookup to verify compliance and operational history. Accessing comprehensive public records and understanding the nuances of the data provided is essential for establishing trust and ensuring that you engage with legitimate, well-maintained companies.

Verify and Protect Your Business Identity

Northwest Registered Agent helps you conduct a thorough business entity search and file your LLC with expert compliance support.

How to Check Business Name Availability

To check LLC names in North Carolina, use the online name search function on the Secretary of State’s portal. Enter your proposed business name and review the results to ensure no identical or confusingly similar names already exist. This check not only prevents potential trademark issues but also saves you time during the registration process. Ensuring that your chosen name meets state naming rules and checking business name availability in Virginia can help secure a unique identity for your business.

Accessing Public Records and Compliance Documents

Public records in North Carolina provide a wealth of information, including filing history, registration details, and compliance documents. These records can be accessed through the online portal and include critical documents like the articles of organization and annual reports. By reviewing these documents, you can assess whether a business is up to date with its filings and in good standing with the state. This information is invaluable for due diligence and verifying that a company meets all legal requirements before you decide to engage with or invest in it.

Understanding Business Status and Entity Details

When reviewing a business record, it is important to understand the entity’s current status and operational details. This includes whether the business is active, inactive, or has been dissolved. Look for indicators such as the date of the last filing, any changes in management, and the entity type. These details help you gauge the stability and reliability of the business. Comprehensive information on a North Carolina business entity enables you to assess its compliance, understand its business structure, and make informed decisions when considering partnerships or investments.

Registering a New Business in North Carolina

Registering a new business in North Carolina involves a clear, multi-step process designed to ensure legal compliance and smooth operation. Whether you are a startup or expanding your existing enterprise, understanding these steps and meeting state-specific requirements is crucial. This section provides an overview of the registration process, essential documentation, and key considerations to help you establish your business effectively.

Steps to Register a Business Entity

To register a new business entity in North Carolina, follow these detailed steps:

- Conduct a Name Search: Use the state’s online tool to ensure your desired business name is available and complies with naming rules.

- Prepare Your Registration Documents: Draft the necessary formation documents, including the articles of organization for an LLC or articles of incorporation for a corporation.

- File the Registration Application: Submit your documents online or by mail to the North Carolina Secretary of State, along with the required filing fee.

- Appoint a Registered Agent: Designate a registered agent with a physical address in North Carolina to receive legal documents.

- Obtain an EIN: Apply for an Employer Identification Number from the IRS for tax purposes.

- Submit Additional Documents: Depending on your entity type, you may need to provide additional information such as an initial list of managers.

- Receive Confirmation: Once processed, you will receive a certificate of incorporation or organization, confirming your business is officially registered.

Following these steps ensures that your business is legally recognized and ready to operate.

Choosing the Appropriate Business Structure

Selecting the right business structure is critical to your long-term success. North Carolina offers several options, including limited liability companies, corporations, and limited liability partnerships.

- LLCs provide flexibility and personal asset protection.

- Corporations are ideal for those planning to raise capital.

- Limited Liability Partnerships suit professional services firms.

Below is a comparative table to help you decide:

| Structure | Advantages | Best For |

|---|---|---|

| Limited Liability Company | Flexible management, liability protection | Small to medium-sized businesses |

| Corporation | Easier to raise capital, formal structure | Businesses seeking investment |

| Limited Liability Partnership | Shared management, professional expertise | Professional services firms |

Choosing the right structure affects tax obligations, management control, and overall operational efficiency.

Understanding State-Specific Requirements and Fees

Each business structure in North Carolina has its own set of state-specific requirements and fees. For example, filing fees vary by entity type, and some businesses may need additional licenses or permits.

- Filing Fees: Typically range from $125 to $250, depending on the entity type.

- Annual Report Fees: Usually required to maintain good standing.

- Additional Permits: May be needed based on industry.

Below is a concise table summarizing these fees:repreneurs automate these updates by using third-party services or email alerts.

| Requirement | Estimated Fee Range |

|---|---|

| Initial Filing Fee | $125–$250 |

| Annual Report Fee | $100–$200 |

| Additional Permits | Varies by industry |

Understanding these requirements ensures that you are fully prepared for all aspects of business registration in North Carolina.

Utilizing Third-Party Tools for Enhanced Searches

Leveraging third-party tools can enhance your business entity search by offering additional features and comprehensive data. These services often provide more advanced filters, detailed reports, and a broader range of public records than the basic state portal. Using these tools can save time and improve the accuracy of your search results, helping you make well-informed decisions about partnerships, investments, or competitor research.

Benefits of Using Third-Party Business Search Services

Third-party services often consolidate data from multiple sources, making it easier to obtain a complete picture of a business’s status. They provide additional search filters, historical data, and enhanced document retrieval options. This can be invaluable for due diligence and strategic planning.

Top Third-Party Tools for Comprehensive Business Searches

Several reputable third-party platforms specialize in business entity searches. These tools typically offer user-friendly interfaces and advanced features for a more in-depth analysis of North Carolina business filings. Evaluating options based on cost, ease of use, and data accuracy will help you choose the best service for your needs.

How to Integrate Third-Party Tools with State Resources

To maximize your search effectiveness, consider using one of the best registered agent services alongside official North Carolina Secretary of State records. Start by verifying key details using the state portal, then supplement your findings with the enhanced search features provided by third-party services. This integration ensures comprehensive, accurate, and up-to-date business information.

Best Practices and Common Pitfalls

When searching for business entities, following best practices can ensure accuracy and efficiency.

Best Practices:

- Always cross-check data from the official state portal and third-party tools.

- Maintain organized records of your searches and findings.

- Stay updated on changes in state filing requirements and fee schedules.

A few common pitfalls include:

- Relying solely on one data source, which may lead to incomplete information.

- Overlooking minor compliance updates that could affect your entity’s status.

- Failing to verify the registered agent details, resulting in missed legal notices.

By adhering to these practices and being aware of potential mistakes, you can navigate the search process more effectively and confidently verify a business’s legitimacy.

North Carolina Secretary of State Contact Information

For any inquiries or further assistance, contact the North Carolina Secretary of State’s office. This office handles business registrations and maintains the official records for all North Carolina business entities.

- Office Address: 2 East Martin Luther King Jr Blvd, Raleigh, NC 27601

- Phone Number: (919) 814-5400

- Online Contact Form/Email: Accessible via the official Secretary of State website

- Office Hours: Monday – Friday, 8:30 AM to 4:30 PM; appointments available for detailed consultations

Frequently Asked Questions: North Carolina Business Entity Search FAQs

Below is a curated FAQ section addressing common queries about conducting a business entity search in North Carolina. These clear, concise answers will help you quickly understand the process and make informed decisions.

A North Carolina business entity is an officially registered organization—such as an LLC, corporation, or partnership—that is recognized by the state government. These entities are recorded in the state’s business registry and must comply with filing requirements, including submission of articles of organization or incorporation. This legal structure provides liability protection and is essential for conducting business in North Carolina.

To perform a business entity search, visit the North Carolina Secretary of State’s online portal and use the search tool provided. Enter the company name or document number to retrieve public records, including filing history, current status, and registered agent details. This process ensures that you verify the legitimacy of the business and review its compliance with state regulations.

Business name availability and registration details can be checked through the North Carolina Secretary of State’s website. The online search tool allows you to verify if your desired business name is already in use and access important filing information, including articles of organization and annual reports. This information is essential for ensuring that your chosen name is unique and compliant with state regulations.

Registering a business in North Carolina involves several steps: perform a name search, prepare and file the necessary formation documents (such as articles of organization), appoint a registered agent, and pay the required filing fees. Once the documents are submitted and approved, you will receive official confirmation and can proceed to obtain an EIN, open a business bank account, and fulfill any additional local licensing requirements.

To verify a registered agent, use the North Carolina business entity search tool to review the registered agent information listed on the company’s record. Additionally, contact the registered agent directly using the details provided on the Secretary of State’s website. This ensures that the registered agent meets state requirements and can reliably handle legal documents on behalf of the business.

Looking for an overview? See North Carolina LLC Services

Stay Compliant with North Carolina Regulations

Harbor Compliance offers full support for entity registration, name searches, and compliance tracking to keep your business in good standing.