Converting a nonprofit into an LLC allows for greater financial flexibility, expanded funding options, and reduced regulatory constraints. By transitioning to a for-profit business model, organizations can attract private investors, diversify revenue streams, and operate with increased autonomy.

To turn a nonprofit into an LLC, you must dissolve the nonprofit, file conversion documents, draft a new operating agreement, and comply with state regulations. This process ensures legal compliance while repositioning your organization for sustainable growth and operational efficiency.

In this guide, we’ll explore:

- The key legal steps to transition from a nonprofit to an LLC.

- Tax and financial implications of converting your nonprofit.

- Best practices to maintain stakeholder trust and organizational stability.

Follow this structured approach to navigate the conversion process seamlessly.

Why Convert from Nonprofit to LLC

Many organizations explore transitioning from a nonprofit organization to a profit business or limited liability model. Understanding at what point do I need an LLC can help determine the right timing for restructuring your organization. This shift can present a competitive advantage by broadening funding options, simplifying business strategy, and opening doors to new profit corporation opportunities. For some groups, adopting a for-profit business structure enhances company culture around innovation and positions them for growth, tapping into private investments or attracting talent eager to shape the strategic direction. Furthermore, becoming a legal entity that fosters personal liability protection encourages more flexible business plan choices. Ultimately, an LLC may better serve evolving missions and allow for a renewed company reorganization process that balances operational independence and revenue potential, while still honoring core aims of public service.

Assessing Your Organization’s Readiness

Before deciding on company restructuring, it’s crucial to determine whether your group has the capacity for change. Evaluate if your current organizational structure aligns with the strategic and legal entity status you desire. If you’re prepared to shift from a tax exempt status to operating under a new business entity, you must also ensure stakeholders, such as the board of directors, employees, and donors, fully grasp the implications of converting to a profit organization.

Evaluating Mission Alignment and Long-Term Goals

Determine if transitioning to an LLC aligns with the overarching mission and future direction of your nonprofit. Looking at LLC purpose statement examples can help craft a mission that supports your new business goals. Will this new operating model facilitate growth, or will it pose conflict with your original charitable objectives? Reviewing how your organizational change might affect both immediate outcomes and long-term resilience ensures you can create a successful path forward.

Financial Health and Stakeholder Impact Analysis

A thorough business structures review is vital for gauging readiness. Scrutinize existing business assets, donor commitments, and personal tax liabilities. Ascertain whether shifting to a profit corporation model will sustain your funding streams or upset key backers. Evaluate how this shift will influence leadership culture, volunteers, employees, and strategic partners. This holistic approach helps you measure the gains against potential pitfalls.

Key Questions to Determine Conversion Viability

Converting from a nonprofit corporation to an LLC isn’t for every group. Ask yourself:

- Do we have a roadmap for scaling as a profit business?

- Will our board of directors agree on a shared business strategy moving forward?

- How do we address local tax implications and federal tax requirements post-conversion?

- Have we prepared for shifts in personal liability and responsibility of members?

- Does our leadership possess the skill set for a for-profit company restructure?

Answering these questions thoroughly clarifies how well-positioned you are to handle the transition.

Convert Your Nonprofit to an LLC

ZenBusiness simplifies the transition process, ensuring compliance while giving your organization financial flexibility.

Legal Framework and Compliance Essentials

Realigning your corporate status from a nonprofit corporation to an LLC can be complex. Changes range from re-filing forms and securing new business name registrations to altering your organizational structure. Each step demands full awareness of local governments policies and a careful approach to compliance with state and federal authorities. Preparation is key for a smooth, legally sound transition.

Understanding State-Specific Conversion Laws and Regulations

Rules vary widely by state, but they typically outline criteria for reclassifying a nonprofit organization into a legal entity such as an LLC. At times, you may need to file form documents or obtain court approvals. By 2025, many jurisdictions offer digital platforms to expedite transitions. Keep these points in mind:

- Research your state’s guidelines for company reorganization process

- Check if benefit corporation legislation applies

- Identify any special partnership agreement conditions for states that support LLC conversions

Following these directives ensures you meet stringent regulatory benchmarks without compromising your capacity for change.

Required Documentation and Filing Procedures

Preparing and filing the proper paperwork is pivotal. You may need to dissolve your nonprofit before re-forming as an LLC or embark on a direct statutory conversion, depending on jurisdiction. Be ready to revise or create:

- Articles of Amendment or conversion documents

- Newly drafted operating agreement to govern the LLC

- Evidence of board or member approval

Swift action on these documents keeps your timeline on track and helps maintain clarity across the transition.

Engaging Legal Counsel and Professional Advisors

An attorney well-versed in company restructure law can simplify what might otherwise be a complicated process. They’ll detail timelines, orchestrate needed filings, and streamline tax implications analyses. Meanwhile, accounting professionals help parse out income tax changes or potential liability pitfalls. Seeking advice early prevents missteps, easing your pivot from charitable to for-profit.

The Conversion Process: A Detailed Roadmap

Transitioning from a nonprofit organization to an LLC isn’t merely a single event; it’s a series of carefully executed steps. If you're ready to move forward, explore the steps on how to get an LLC started to ensure a smooth transition. Each stage requires open communication, thorough planning, and attention to how various stakeholders—from team members to government regulators—may interpret this organizational change. By mapping your strategy carefully, you’ll minimize disruptions and safeguard your nonprofit’s legacy.

Define how transitioning to an LLC supports growth, structure leadership roles, and assess cultural shifts.

Outline the transition timeline, financial impact, and operational changes, ensuring tax and compliance readiness.

Submit required paperwork, including updated operating agreements and tax status modifications, to state authorities.

Notify donors, employees, and partners, ensuring transparency about the mission shift and operational updates.

Implement internal process changes, update compliance frameworks, and ensure smooth governance under the LLC model.

Step 1: Strategic Planning and Decision Making

Establish a firm business strategy for how an LLC structure can bolster your mission and drive new growth. Gather leadership, including your board of directors, and assess any shifts in company culture or leadership culture that may emerge. Develop a clear vision for the organizational structure post-conversion, highlighting how members will collaborate. Analyze how your “why” and “how” will change—for instance, focusing on revenue generation versus purely philanthropic pursuits. A thorough plan includes identifying potential risks to personal assets and clarifying the future role of volunteers or donations if you plan to maintain social impact initiatives.

Step 2: Drafting a Comprehensive Conversion Plan

Once you’ve aligned leadership on the need for a company restructuring, detail the conversion plan. Clarify timelines, major milestones, and roles. Incorporate a business plan focusing on strategic direction and competitive advantage. If your current nonprofit engages donors or offers programs like a professional organizing business, outline how these activities will adapt. Factor in operating model changes—such as shifting from tax exempt status to paying corporate tax or income tax. Plan for budget fluctuations, especially if philanthropic grants or contributions dissolve post-conversion. This blueprint guides operational progress, ensuring no element gets overlooked amid the culture change.

Step 3: Filing Articles of Amendment and Legal Documents

As you approach the formal pivot, complete all necessary paperwork to legitimize the new entity:

- Articles of Amendment or Conversion: Explains the change to state authorities

- Updated Operating Agreement: Outlines membership, voting rights, and distribution of profits

- Partnership Agreement or limited liability partnership details if multiple owners are involved

Thoroughly file form documents with the appropriate local governments or state agencies. Keep copies of every document for compliance and tax return filings. Remember that each state may impose its own fees or require a public hearing to finalize your corporate status change.

Step 4: Communicating Changes to Stakeholders and the Public

Next, inform donors, partners, employees, and the greater public. Emphasize that leadership remains dedicated to maintaining core programs or services, even under a profit business model. Update official documents—like your website and marketing materials—to highlight the new business name and legal entity. Address concerns about how charitable efforts or subsidies might shift. Consistent, open dialogue builds trust and ensures people understand your motives and how to engage with the revitalized organization.

Step 5: Finalizing the Transition and Restructuring Operations

Finally, turn your attention to organizational structure updates. Modify processes for how you register your business activities, handle personal tax obligations, and manage federal tax filings with the internal revenue service. Align any new goals with a more sustainable revenue model, identifying future partnerships or clients. If you plan to start an organizing business or another service-based new business under your LLC, define those offerings clearly. Revisit each department’s day-to-day tasks—finance, operations, programs—to ensure they mesh with an LLC’s accountability and governance demands. Ongoing training around the operating agreement fosters a cohesive company culture post-conversion.

Legally Transition to a For-Profit Business

Northwest Registered Agent helps you navigate the legal steps of restructuring your nonprofit into an LLC.

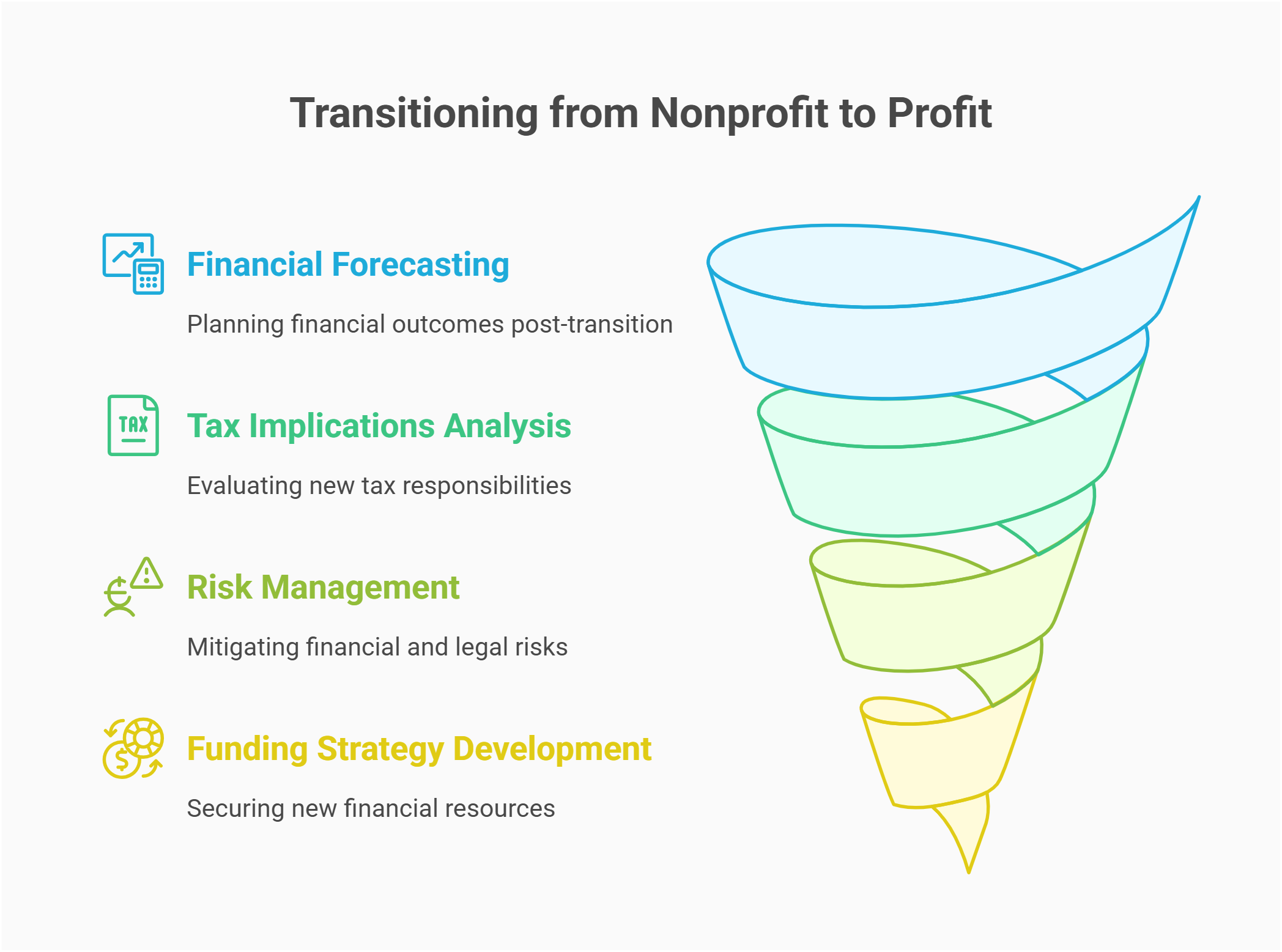

Addressing Financial and Tax Considerations

Transitioning from a nonprofit to a profit organization triggers big changes in cash flow, income tax liability, and general resource management. Whether you’re focusing on building new revenue streams or managing the tax implications of your newly minted limited liability partnership, it’s essential to strategize early. Proper financial forecasting and expert consultation minimize unpleasant surprises.

Analyzing Tax Implications Before and After Conversion

Before converting, revisit your tax exempt status and how dissolving it might impact existing assets or grants. Post-conversion, your new LLC faces corporate tax or personal tax obligations, depending on whether you’re taxed as a sole proprietorship, partnership agreement, or corporation. Carefully weigh the personal liability considerations—for instance, transferring large assets from the nonprofit might create tax events. A preemptive review saves time and ensures a smoother path to corporate status.

Managing Financial Risks and Capitalizing on Benefits

Switching to a profit corporation model carries both fresh opportunities and added responsibilities. You can tap investor funding, issue member shares, or even expand with close corporation structures. Counterbalance the potential of losing donor support by focusing on revenue-generating activities. Embrace robust bookkeeping that tracks shifts in company restructure costs and mitigates personal assets risk. Proper planning helps you sustain momentum and build a stable foundation in this new operational realm.

Funding Strategies and Impact on Profitability

When a nonprofit organization transitions into an LLC, securing the right financial resources can make or break its success. First and foremost, recognize that your previous reliance on grants or charitable donations might sharply diminish once you abandon tax exempt status. While you may retain philanthropic support if you maintain certain programs, new streams of capital typically replace grants, including investments, loans, and commercial transactions.

In this phase, a robust business strategy becomes vital. You’ll need to communicate effectively why your organizational change offers a competitive advantage worth funding. Draft a refined business plan that covers growth projections, business assets, and a route to profitability. Potential investors or lenders will look for clarity on how you’ll navigate uncharted territory—especially if your group’s track record is primarily philanthropic.

One compelling option is issuing equity in your newly formed LLC. This approach, common among for-profit legal entities, allows entrepreneurs to sell membership interests in exchange for capital. Before you proceed, consider any personal liability ramifications if you offer ownership stakes to external investors. While LLCs generally safeguard founders from direct liability, certain obligations can still emerge—particularly if you venture into a limited liability partnership or bring on multiple stakeholders.

Best Practices and Pitfalls in Conversion

Converting a nonprofit to an LLC can bring both highs and lows. Here are strategies to maintain momentum and avoid common traps:

- 1. Conduct Thorough Research: Examine your state’s regulations for company restructure steps and strictly follow compliance rules.

- 2. Engage Stakeholders Early: Keep donors, board members, staff, and volunteers in the loop to mitigate confusion.

- 3. Allocate Ample Resources: Budget for legal and accounting help so you can handle every logistical hurdle calmly.

- 4. Secure Board Buy-In: Resist forging ahead unless you’re certain leadership backs this organizational change fully.

- 5. Communicate Your Why: Clarify why you believe an LLC model ensures better longevity or broader impact.

With careful coordination and open communication, you can more easily sidestep pitfalls like donor alienation, unexpected costs, or compliance failures. A well-orchestrated transition safeguards your legacy and positions you for renewed success.

Post-Conversion Strategies for Long-Term Success

Once the official transformation is complete, the work isn’t over. Organizations emerging from company restructuring must refocus on their new identity, ensuring operations run smoothly and sustainable growth is within reach. Align your business structure with your fresh objectives, and nurture an environment of innovation that fuels ongoing expansion.

Restructuring Operations Under the New LLC Model

As an LLC, you’ll likely shift staff roles and reporting systems to fit a more profit-oriented operating model. Clarify lines of authority and define accountability measures so that every team member understands their contribution to revenue and impact goals. Emphasize a progressive company culture that values efficiency, reinvention, and bold business strategy to remain competitive in the market. A solid business succession planning strategy ensures long-term sustainability after restructuring.

Ongoing Compliance, Reporting, and Legal Updates

By 2025, regulations continue to evolve, meaning consistent vigilance is key. Ensure all tax return filings and internal revenue service obligations are met on schedule. Any new additions or updates to your board of directors should be reflected in official records. Keep track of local, state, and federal policy shifts. This includes re-filing if your corporate status changes yet again, or if you’re planning to join forces with other business entities or establish a close corporation branch.

Leveraging Your New Structure for Growth and Innovation

Use your rebranded status to access novel funding sources, form partnerships, and expand networks. Exploring options for buying a business with no money could complement your new financial strategy. Reassess your business assets and personal assets separation to reduce risk and promote flexibility in project development. Seek out alliances within your sector—whether it’s a start an organizing business, consulting, or another field—and forge co-ventures that amplify your market presence. With a flexible LLC framework, you can more readily incorporate fresh ideas, test pilot programs, and adapt quickly to emerging trends.

FAQ: Nonprofit-to-LLC Conversion Essentials

Below is a concise FAQ designed to answer the top questions about shifting from a nonprofit organization to an LLC. Each response provides direct, evidence-based clarity to help you dominate SERPs and swiftly address your queries on this strategic organizational change.

Yes. The company reorganization process requires deliberate planning to retain your organization’s essence. First, articulate how the mission aligns with a profit business approach, ensuring stakeholders understand why a business structure shift supports sustainability. You may adapt services or recalibrate goals but can maintain core values by embedding them in your operating model and day-to-day operations. Transparency and inclusive leadership help preserve relationships with donors, volunteers, and clients, reinforcing your commitment to meaningful impact.

You must adhere to state rules regarding dissolving or reclassifying the nonprofit corporation. Typically, you’ll file form documents—like amendments to your articles—and prepare a new operating agreement. Engaging an attorney ensures you follow precise regulations, meet approval requirements from your board of directors, and address any obligations to local governments or the internal revenue service. Filing fees and compliance checks vary by jurisdiction. This thorough attention to each legal detail helps protect you from potential liabilities during the company restructure.

Once you relinquish tax exempt status, your new entity faces corporate tax obligations and possibly personal tax burdens if membership distributions occur. Depending on your chosen classification—like sole proprietorship or limited liability partnership—you may handle income tax via pass-through mechanisms or corporate returns. Professional guidance helps ensure you file the correct tax return forms and manage any outstanding liabilities. By crafting a detailed plan for paying taxes, you avoid penalties and minimize disruptions to cash flow during and after the conversion.

Organizations often grapple with organizational structure adjustments, stakeholder skepticism, and new business strategy directives. Staff may fear job losses or vision changes. Donors could question the rationale behind company restructuring to a profit organization. Financially, recalibrating budgets and funding models can be complex, especially if grants or donations decline. Addressing these hurdles demands transparent communication, structured training, and careful planning for potential culture shifts. Steady, inclusive leadership smooths the journey toward a successful new phase.

Start by evaluating your budget, mission, growth plans, and competitive advantage goals. Does the business entity framework of an LLC align with future expansion? Are you prepared to manage personal liability limits and tax implications? Analyze whether your donors or stakeholders are open to a more profit-driven model. If you foresee scaling or adopting new revenue streams, the LLC structure may be a strong fit—particularly if you value agility and better personal assets protection. Comprehensive research and stakeholder feedback lay the groundwork for an informed decision.

Ensure Compliance During Your Transition

Harbor Compliance provides expert guidance for dissolving a nonprofit and forming a compliant LLC.