Is forming a limited liability company really as straightforward as filing a few documents? Most entrepreneurs overlook a crucial figure in the process: the organizer. And yet, this role holds the keys to how your entire legal structure is born.

An LLC organizer is the person legally responsible for signing and submitting the formation documents to the Secretary of State. In 100% of states, this role can be held by a service provider, a family member, or even by the business owner themselves.

Some confuse the organizer with the registered agent—or even the owner—when in fact each plays a distinct part in LLC formation. The nuances between a single member LLC, a multi member LLC, or even a series LLC have direct implications on how your organizer is appointed. Whether the business entity is a professional LLC, a sole proprietorship turning legal entity, or a fast-growing startup, understanding the statement of LLC organizer could make or break compliance. Think of the organizer as the unseen architect behind your company's legal form—fail to recognize them, and the whole structure might wobble.

Role and Responsibilities of an LLC Organizer

Ever wondered who's legally responsible for bringing your business to life? An organizer of an llc plays a crucial initial role in the formation process, setting the foundation for your company's legal existence in the United States. If you’re ready to begin, follow our complete guide on how to set up an LLC step by step.

What Does It Mean to Be an Organizer on an LLC?

The organizer serves as the authorized individual who completes and submits the required formation documents to establish a limited liability company. This person is formally recognized by the Secretary of State as the individual who initiates the paperwork and shepherds the LLC through its birth as a legal entity.

The organizer's role is typically temporary and procedural rather than ongoing. Once the LLC is officially formed and operational, the organizer's formal duties generally conclude, unless they're also designated to fill other roles within the company structure. You may also ask what is an incorporator and how that role differs from your organizer duties.

Key Responsibilities of an LLC Organizer

An LLC organizer shoulders several critical functions during the business establishment phase, acting as the primary facilitator of the LLC formation process. Their responsibilities include preparing and filing the necessary documentation, ensuring compliance with state requirements, and laying the administrative groundwork for the company's operations.

- Filing articles of organization with the state

- Paying the required filing fees

- Obtaining necessary business licenses and permits

- Establishing the initial framework for business operations

- Arranging the first organizational meeting

To clarify these roles further, review the differences between an LLC organizer vs registered agent to ensure you assign each duty correctly.

Is the LLC Organizer the Owner?

Being an organizer doesn't automatically make someone an owner of the business entity. The organizer is simply the person who handles the formation paperwork and administrative requirements, while ownership rests with the LLC members who hold membership interests in the company.

In many cases, particularly with small businesses, the same person may serve as both organizer and member. However, this dual role isn't required by law—it's entirely possible for someone to organize an LLC without having any ownership stake. If you’re converting your existing business, learn how to transfer sole proprietorship to LLC smoothly without losing assets.

The distinction is important for legal and tax purposes, as membership interests determine rights to profits, voting power, and management authority, while the organizer role primarily concerns formation procedures.

Launch your LLC the right way

ZenBusiness simplifies the formation process and acts as your official LLC organizer if needed.

Who Can Be an LLC Organizer?

Surprisingly, almost anyone can serve as an LLC organizer—there are few legal restrictions on who can fill this role. The flexibility in choosing an authorized person to handle your business formation makes this initial decision both accessible and strategically important. But before you file, check if can you start an LLC under 18 in your state to avoid surprises.

Can I Be My Own LLC Organizer?

Yes, you can absolutely serve as your own LLC organizer. Many entrepreneurs choose this route for their single member LLC to maintain complete control over the formation process and reduce initial expenses. Self-organizing gives you direct oversight of all paperwork and filing procedures.

However, self-organizing requires understanding state-specific requirements and dedicating time to handle administrative details. For complex business structures or multi-state operations, weighing the benefits against the learning curve and time investment becomes an important consideration.

Can an LLC Have More Than One Organizer?

Yes, a multi member LLC can designate multiple organizers to share the responsibility of formation. This approach distributes the administrative workload and allows for collaborative input during the critical establishment phase of your business administration.

| Advantages of Multiple Organizers | Disadvantages of Multiple Organizers |

|---|---|

| Shared administrative workload | Potential communication challenges |

| Diverse expertise and perspectives | Possible disagreements on procedures |

| Backup if one organizer is unavailable | More signatures required on documents |

| Distribution of responsibilities | Coordination of schedules for filings |

The decision to have multiple organizers often depends on your business complexity and team dynamic.

LLC Organizer vs Member vs Registered Agent: What's the Difference?

Entrepreneurs frequently confuse these three distinct roles when establishing a new business name. Understanding the differences between an organizer, member, and registered agent service is essential for proper compliance and effective form an llc procedures.

LLC Organizer vs Member: Roles and Ownership

The organizer's role is transitory, focused specifically on forming the company and filing initial paperwork. Their responsibility generally ends once the formation is complete. In contrast, members maintain ongoing ownership stakes and participate in company governance for the life of the business.

Members have rights to company profits, voting privileges on major decisions, and potential management responsibilities depending on the LLC structure. While the same person can serve both roles, the legal distinction is significant—organizers create the company, but members own and operate it as a legal entity.

LLC Organizer vs Registered Agent: Legal and Administrative Duties

An organizer primarily handles the formation process, while a registered agent and organizer (if the same person) has distinct ongoing legal responsibilities. The registered agent must maintain a physical address during business hours to receive legal documents and official communications on behalf of the LLC.

| Organizer Duties | Registered Agent Duties |

|---|---|

| File formation documents | Receive legal notices and service of process |

| Pay initial filing fees | Maintain physical address in the state |

| Set up initial company structure | Forward important documents to LLC |

| Complete one-time formation tasks | Ongoing annual compliance requirements |

| May transition out after formation | Continuous role throughout LLC existence |

In some cases, organizations choose a non-commercial registered agent option to meet privacy or budget needs.

Can the Same Person Hold Multiple Roles?

Yes, one individual can simultaneously be the organizer, member, and registered agent of an LLC, particularly common in sole proprietorship conversions to LLCs. This consolidation of roles can simplify communication and reduce the number of parties involved in your business affairs.

However, strategic considerations may make separating these roles advantageous. Using professional services for certain functions, like registered agent duties, can provide privacy benefits and ensure compliance requirements are consistently met by specialists. To decide which setup fits you, compare registered agent vs business address and pick the best configuration.

What Documents Involve the LLC Organizer?

The LLC organizer's signature appears on several critical documents that establish your company's legal foundation. These paperwork requirements formalize the organizer's role in creating your series LLC and set the stage for its legitimate operation. When drafting your operating agreement, don’t overlook the purpose clause for LLC to clearly define your business objectives.

The Articles of Organization and the Organizer's Signature

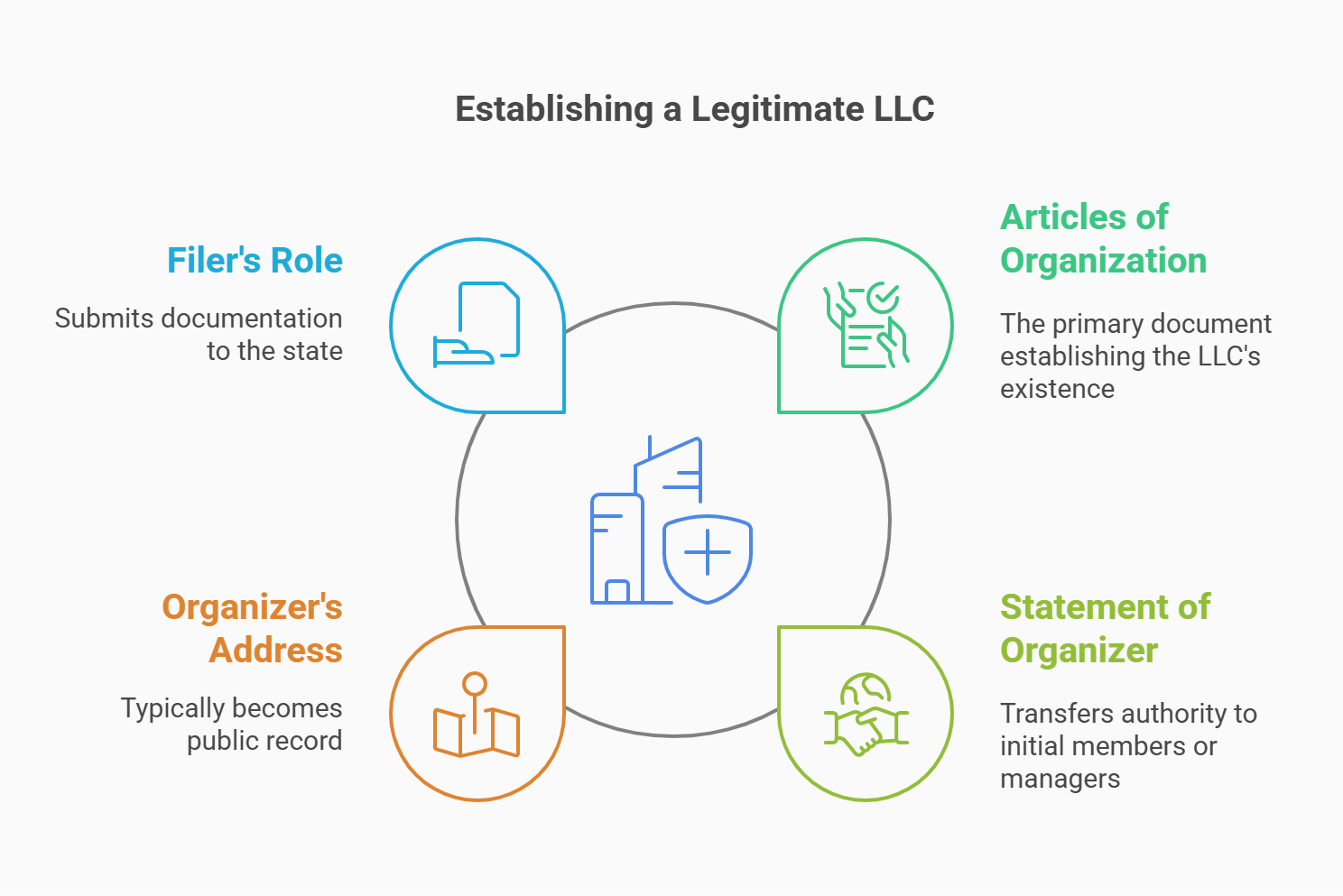

The articles of organization represent the primary formation document requiring the organizer's signature. This legal paperwork officially establishes your LLC's existence when filed with and approved by the state business authority.

The organizer's signature on this document carries legal weight, certifying that the information provided is accurate and that formation procedures comply with state requirements. Since these documents become public record, the organizer should be comfortable having their name associated with the LLC's formation in perpetuity.

What Is a Statement of Organizer?

A statement of LLC organizer is a formal document that transfers authority from the organizer to the initial members or managers after formation. This document officially concludes the organizer's role and confirms the transition to operational governance by the designated company leadership.

- Identifies the LLC's official name

- Names the appointed members/managers

- Confirms transfer of authority from organizer

- May include initial company resolutions

- Creates paper trail of transition for legal clarity

Is the Organizer's Address Public?

When filing certificate of formation documents, the organizer's address typically becomes public record, visible to anyone searching state business databases. This public disclosure raises privacy considerations, especially for organizers using their personal addresses.

To maintain privacy, many organizers use business addresses or employ formation services that provide address options. Some states offer additional privacy protections, but generally, organizers should assume information on formation documents will be publicly accessible.

Who Is Considered the Filer of an LLC?

The filer is technically the person who submits the LLC documentation to the state, which is typically the organizer. However, if a professional LLC uses an attorney or formation service to submit paperwork, that third party may be listed as the filer while the official organizer remains the person named in the documents. This distinction matters for communication purposes, as the state will direct questions and notices about the filing to the designated filer. Understanding who holds this responsibility ensures that important correspondence about your forming an llc process won't be missed or misdirected during the critical establishment phase. To select the right provider, learn how to choose a registered agent based on reliability and service offerings.

How to Choose the Right LLC Organizer for Your Business

Selecting the right person to serve as your LLC organizer can significantly impact how smoothly your formation process unfolds. Whether you're establishing a traditional LLC or a specialized professional LLC, this decision deserves careful consideration before you initiate your name search and other formation steps. And if you’re still choosing jurisdiction, explore our analysis of the best states for LLC to find your optimal home base.

Delegate the legal paperwork

Northwest handles Articles of Organization and gives you a registered agent for free.

Choosing Between Yourself and a Formation Service

Serving as your own organizer gives you direct control over the formation process and can be cost-effective for straightforward business structures. This approach works well for entrepreneurs who have time to research requirements and manage paperwork.

Formation services offer expertise that can be valuable for complex situations or when establishing LLCs across multiple states. These professionals understand the nuances of different jurisdictions and can navigate potential pitfalls that might not be obvious to first-time organizers.

Cost considerations should balance immediate expenses against potential long-term implications. While self-organizing saves initial service fees, mistakes might lead to costly corrections or compliance issues that professional services help prevent. For unbiased feedback, read registered agent reviews to compare real user experiences.

Key Criteria When Selecting an Organizer

When evaluating potential organizers, consider their knowledge of state-specific requirements, availability to handle paperwork promptly, and willingness to provide the necessary personal information for public filings. The ideal organizer should also understand the LLC operating agreement requirements that will follow formation.

- Experience with business formation processes

- Knowledge of state-specific requirements

- Reliability and attention to detail

- Availability during the formation period

- Privacy considerations and public record comfort

- Understanding of your industry-specific needs

Selecting a family member as organizer may seem convenient, but ensure they're comfortable with the legal responsibilities.

FAQ About LLC Organizers and Formation Requirements

Entrepreneurs frequently have questions about the specifics of LLC organizer roles and responsibilities. These clarifications help navigate the formation process correctly and avoid common pitfalls when establishing business entities.ems arise.

No, an LLC organizer is not automatically a company official. While a board of directors governs corporations, LLCs typically have members and managers who serve as officials. The organizer's role is primarily to file formation documents, whereas company officials have ongoing operational authority and fiduciary responsibilities to the business. This distinction is important for understanding the chain of authority in your newly formed company.

In Georgia, any person, corporation, partnership, or other existing legal entity can serve as an LLC organizer. Georgia law allows for significant flexibility in who may organize an LLC, but the organizer must be clearly identified on the Articles of Organization filed with the Georgia Secretary of State's office. Georgia's requirements include providing the organizer's name and address, and the organizer must sign the formation documents to certify compliance with state law.

When filing amendments to your articles, you generally don't need a new organizer. Amendments are typically signed by an existing LLC member or authorized representative rather than by the original organizer. This reflects the fact that once an LLC is formed, governance transitions from the organizer to the established membership structure.

The organizer may apply for the Employer Identification Number (EIN), but it's not required that they do so. Any person authorized to act on behalf of the LLC can complete the EIN application with the IRS. What's most important is that the person applying has a valid U.S. Social Security Number or Individual Taxpayer Identification Number and is authorized to represent the company on tax matters.

After filing the statement of organizer, the LLC transitions to operational governance under its members or managers according to the structure outlined in the legal form. This marks the formal handoff from formation to ongoing business management.

The company can then proceed with other essential setup tasks like opening bank accounts, obtaining business licenses, and implementing its operating agreement. This transition represents the LLC's evolution from a legal concept into a functioning business entity ready to conduct its affairs in the marketplace.

Full compliance, zero confusion

Harbor Compliance assigns a dedicated specialist to act as your LLC organizer and guide every step.