Are you forming an LLC in 2025 and wondering if a registered agent is really necessary? Do you want to avoid missed lawsuits, tax notices, or state reminders that could jeopardize your company? Curious how appointing the right agent can protect your privacy and ensure uninterrupted compliance?

In 2025, every state requires your LLC to designate a registered agent—a person or service with a physical address available during business hours—to accept legal and governmental notices on your behalf. Without a valid agent, you risk default judgments, administrative dissolution, and frozen bank accounts. While you can serve yourself, this exposes your personal address and demands constant availability. Opting for a professional service not only maintains your privacy but also provides time-stamped digital alerts, nationwide coverage, and automated compliance calendars to keep your LLC in good standing across jurisdictions.

In this guide, you’ll discover:

- How state laws define and enforce the registered agent requirement

- Risks of self-appointment versus benefits of professional services

- Key criteria for choosing the right registered agent provider

- Steps to appoint or change your registered agent seamlessly

Ready to secure your LLC’s future? Let’s dive in and explore why a registered agent matters in 2025!

What Is a Registered Agent and What Do They Actually Do?

Every LLC must designate a registered agent—a real person or service—authorized to receive lawsuits, tax notices, and state reminders at a publicly listed address. Knowing what that role covers (and what it does not) helps you choose wisely, budget accurately, and avoid compliance gaps that can torpedo growth. In 2025 regulators continue sharpening penalties for missed mail, making the decision more critical than ever. For a deeper dive into every duty and detail, check out our guide about Registered Agent.

Definition and Legal Purpose of a Registered Agent

A agent for service—often called a registered agent—is the state-mandated point of contact for your limited liability company. Their sole legal purpose is to ensure the government and courts can always locate your business, even if you are traveling, working off-site, or running an entirely remote team. If you need clarity on those initials, see our article explaining what does LLC mean. The agent must maintain a physical street address within the formation jurisdiction and be available during normal business hours to accept service of process, certified tax letters, and other compliance notices. Once documents arrive, they must timestamp delivery, scan or forward the originals, and log the event so you create an auditable paper trail. This seemingly simple back-office task preserves due-process rights for plaintiffs, protects your right to contest claims timely, and keeps your LLC in good standing by proving the state successfully reached you.

Types of Documents They Receive on Your Behalf

Most legal documents flow through the agent’s desk before you ever see them, and missing even one can freeze bank accounts or trigger default judgments. That makes the mailbox more than clerical; it is the legal nerve center linking your company to every regulator and courtroom across local, state, and federal lines.

- Service of process (lawsuits, summons, subpoenas)

- Annual report reminders and delinquency notices

- Franchise-tax assessments and revenue department letters

- Secretary of State correspondence, including rejection slips

- Certified mail from creditors or government agencies

By centralizing these notices, an agent gives you peace of mind that time-sensitive papers will never sit unopened on a receptionist’s desk or bounce between shift-based employees. Instead, you receive instant digital copies, clear compliance checklists, and early warnings that let you cure defects before penalties mount. This predictable flow is particularly valuable for home-based founders who prefer to keep a private residence off public record while still meeting every statutory requirement.

State-by-State Requirements and Differences

Every state demands an in-state registered office, yet the fine print—acceptable address types, publication rules, and late-fee schedules—varies dramatically. For a concrete example, see our breakdown for the registered agent California requirements and fees. Compare New York’s newspaper publication requirement with Wyoming’s silence on the issue or Florida’s electronic reminders versus California’s steep reinstatement costs, and you’ll see why researching registered agent requirements first saves money.

| State | Extra Requirement | Late Fee | Publication Needed |

|---|---|---|---|

| NY | Newspaper publication within 120 days | $50 + county fees | Yes (2 newspapers, 6 weeks) |

| FL | Online annual report by May 1 | $400 | No |

| CA | Statement of Information biennially | $250 reinstatement | No |

| TX | Address can be commercial office | $0 | No |

| WY | Accepts PO Box + physical address | $25 | No |

Is It Mandatory to Have a Registered Agent for an LLC?

Most entrepreneurs assume every state treats a registered agent the same way, yet the reality is nuanced. In most jurisdictions, designating a point of contact is not just good practice; it is a statutory legal requirements baked directly into each LLC act. Learn more about Do I need a registered agent in every state and when foreign qualification kicks in. Understanding which states mandate an agent, and what happens if you skip the appointment, keeps your company safe from surprise penalties. The answer depends on where you form, but in most cases the obligation is absolute.

States That Require It by Law

All fifty states require an agent in some form, but enforcement intensity differs. Below is a snapshot of how each business entity statute frames the obligation, so you can plan your filing strategy before the clock starts running:

- Delaware – Agent must be on file before Articles are accepted.

- California – Agent must consent; Statement of Information due within 90 days.

- New York – Agent listed plus publication in two newspapers within 120 days.

- Florida – No consent form, but annual report verifies active agent each spring.

- Wyoming – Commercial agent or individual with a physical office in state.

Skimming the chart shows that while the requirement itself is universal, consequences and filing deadlines vary wildly. Missing a single rule can trigger late fees, administrative dissolution, or worse—a default judgment because service of process never reaches you. Take time to match your budget and workflow to your home state’s expectations before you file. When in doubt, assume your chosen jurisdiction insists on continuous in-state coverage and plan accordingly.

What Happens If You Don’t Designate a Registered Agent?

Fail to list an agent and the secretary of state will reject your formation. If you let the appointment lapse, you lose good standing, forfeit the right to sue, and face hefty reinstatement fees. Worse, a plaintiff can win a default judgment while you remain unaware because no annual report reminder or lawsuit ever reaches your desk. In short, skipping the agent shifts every legal risk squarely onto the founders. Banks may freeze corporate accounts, and your charter can be revoked after only sixty days in many jurisdictions. Act quickly to restore compliance. Many founders find peace of mind by outsourcing to a professional registered agent service.

Get Reliable Registered Agent Services from ZenBusiness

Stay on top of compliance and never miss an important notice with ZenBusiness as your Registered Agent.

Can You Be Your Own Registered Agent in 2025?

Appointing yourself as registered agent sounds like an easy way to control mail and cut costs. However, acting as your own registered agent carries obligations many founders overlook—chief among them being constant availability at a public address during business hours. Let’s explore who qualifies and when a service makes more sense. Failing to weigh these factors often leads entrepreneurs to change course mid-year.

Who Qualifies to Serve as a Registered Agent

Any adult with a physical address in the state and willingness to accept service during business hours can serve as a resident agent. That means you, a trusted employee, or a friend could fill the role, provided the person is at least eighteen and not using a PO Box. Some states also require written consent filed with the formation documents. Remember, the address will be displayed on the secretary of state site and can be harvested by marketers.

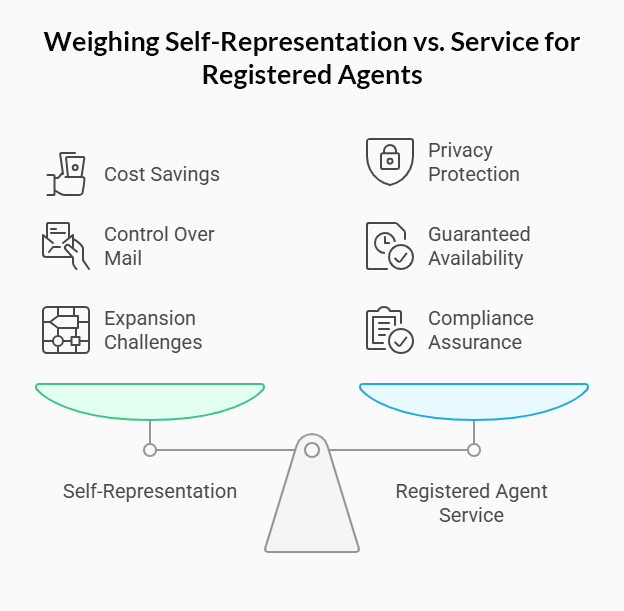

Advantages and Risks of Acting as Your Own Agent

Handling agent duties yourself can save money and keep sensitive mail in house. You control when papers are opened and avoid yet another annual fee. The downside is privacy loss—your home address appears on every public record. You must sit tight from nine to five, which is tough for traveling founders, and missing one delivery can cost far more than a service fee. Finally, self-representation can complicate expansion; foreign states still need a local agent, which means juggling multiple addresses as your footprint grows. Moreover, self-appointment can scare off institutional investors who prefer dealing with a reputable commercial registered agent that guarantees documented delivery.

Common Mistakes and When to Avoid It

Many DIY founders list a coworking space, forgetting mailrooms close early, placing their public record at risk. Others leave town for a trade show without arranging backup coverage, so lawsuits land but never reach them. A few forward mail to a relative who unknowingly discards tax notices. To avoid these pitfalls, assign a backup, use tracked mail for moves, and set calendar alerts for compliance dates. If your state offers an email alert system, sign up to make sure you never overlook a statutory letter.

State Restrictions That May Apply

Some states forbid PO Boxes or virtual offices entirely, insisting on a physical street address where documents can be hand-delivered. A handful—like Arizona—let an agent use a rural route only if GPS coordinates are on file. California mandates agent consent, while Nevada fines any agent who fails to forward mail promptly. Always read your state statute before finalizing the appointment. Penalties for non-compliance include daily fines and administrative dissolution, so read the statute closely.

Top Benefits of Hiring a Professional Registered Agent Service

When you outsource to a professional registered agent service, you gain a compliance team that never takes vacations, reroutes sensitive mail to secure portals, and shields your home address from curious competitors. See our comparison of the best registered agent service options for 2025. Below are the core advantages most founders notice within the first year.

- registered agents provide immediate legal document uploads with time-stamped alerts

- Nationwide address coverage that scales as you expand

- Built-in compliance calendars that auto-populate renewal dates

- Mail forwarding to any destination, plus on-demand scanning

- Privacy protection by keeping your name and home off public rolls

By partnering with a commercial registered agent, you transfer mundane paperwork to professionals who sit at their desks during regular business hours, letting you focus on revenue while knowing every state notice is handled on time. This arrangement also simplifies multi-state growth because you add new jurisdictions with a click instead of hunting down local contacts each time you register.

How to Choose the Right Registered Agent for Your LLC

Selecting among dozens of registered agent services boils down to trust and transparency. Start by clarifying your growth horizon, risk tolerance, and communication style so you can match those needs to a provider’s strengths. To narrow the field, compare turnaround times, data security protocols, and any guarantees posted in the service-level agreement.

Key Selection Criteria: Reliability, Availability, and Notifications

Begin with the basics: the provider must keep a real business address in each state where you operate and guarantee human presence from 9 a.m. to 5 p.m. local time. Next, examine the technology stack—do you get instant digital uploads or weekly mail batches?

- Same-day document scans and mobile push alerts

- Redundancies for power or internet outages

- Dedicated compliance calendar with auto-filled renewal tasks

- Clear escalation paths when you accept service of process

- No hidden fees for forwarding or storage

Finally, assess customer support. Ask how long it takes to reach a live agent, whether you receive end-of-day summaries, and how they separate junk from legal mail. Insist on written SLAs, not verbal promises, to ensure accountability when filings spike.

Comparison of 2025’s Best Services: Northwest, ZenBusiness, Harbor Compliance, LegalZoom

Our 2025 testing shows northwest registered agent leads on privacy and response speed, while ZenBusiness excels at bundled startups, Harbor Compliance dominates multi-state filings, and LegalZoom offers broad legal add-ons. All fees below are verified for June 2025 filings.

| Service | Annual Fee | Free Mail Scans | Specialty | Standout Feature |

|---|---|---|---|---|

| Northwest | $125 | Unlimited | Privacy | Same-day uploads |

| ZenBusiness | $199 | 5 per year | Bundles | Worry-free guarantee |

| Harbor Compliance | $99 | Unlimited | Multi-state | Compliance alerts |

| LegalZoom | $249 | Unlimited | Legal forms | Attorney network |

Changing Your Registered Agent: Everything You Need to Know

Whether you’re upgrading service levels or relocating headquarters, you’ll eventually change your registered agent. The switch is routine but time-sensitive, so understanding paperwork, fees, and statutory lead times keeps your LLC compliant during the hand-off. Knowing the checkpoints ahead of time prevents expensive delays and keeps third-party vendors, like payroll processors, confident your statutory contact is always reachable.

Reasons to Change Your Registered Agent

Common motivations include cost hikes, poor responsiveness, loss of coverage after expansion, or the need to consolidate filings across states. Switching can also restore confidence when auditors question your ability to maintain a registered agent. Other triggers include mergers that relocate headquarters, leadership disputes that make one partner uncomfortable acting as the face of the company, or stepping up to a provider with automated multi-state dashboards that slash admin time. Whatever your rationale, transparency with the state and both agents is essential.

Step-by-Step Process by State

Most jurisdictions follow a similar workflow, starting with internal resolutions and ending with filing a certificate of change.

- Board or member resolution approving the new agent and updated registered office

- Obtain written consent from the incoming agent

- Complete state-specific Change of Agent form online

- Pay filing fee (ranges $0–$50) and submit instantly

- Wait for approval email, then notify the outgoing agent

States like New York may add publication steps, while Arizona requires notarized signatures. Check your statute: some impose 30-day deadlines, others mark changes effective upon receipt. A diligent statutory agent will guide you through local quirks. If you operate in multiple states, stagger submissions so at no point does your LLC lack coverage. Always verify the new agent is visible in the public database before updating bank and vendor records.

Cost, Timeline, and Required Filings

Expect to spend $0 to $50 per state and wait one to three business days if you file online. Paper submissions may take two weeks. Most states let you update multiple articles of organization at once, saving postage. Mark calendars for immediate confirmation; until approval posts, both agents share liability for mishandled mail. Some secretaries of state waive fees if the change coincides with your annual report, while others add expedite surcharges if you need approval the same day. Budget extra for newspaper publication in New York or certified mail in Iowa, and always obtain stamped copies for your records.

Do You Need a Registered Agent in Every State Where You Operate?

Expanding across state lines comes with an often-overlooked rule: each jurisdiction wants a local point of contact for its business entities. If your LLC registers as a foreign company, you must appoint an in-state agent before you can open bank accounts, sign leases, or sue in that court. For a step-by-step elsewhere, check how to start an LLC in Ohio and designate your first agent. Knowing when the requirement triggers—and when it does not—prevents accidental non-compliance.

Rules for Domestic vs. Foreign LLCs

Your home state filing makes you a domestic limited liability company, and the agent you listed there handles all notices within that border. Discover the specifics of forming a domestic LLC before you expand beyond your home state. The moment you do business elsewhere—own property, hire staff, or cross a revenue threshold—you become a foreign registrant and must name a new agent in that state. Failing to do so can void contracts and rack up back taxes, so file a foreign qualification before you invoice out-of-state customers.

Multi-State Business Operations Explained

Multi-state growth often creates a patchwork of filing dates, fees, and registered agent requirements. Smart founders keep a master compliance calendar that tracks every renewal window and assigns responsibility to one consolidated service provider. Centralizing tasks means fewer invoices, faster uploads, and consistent audit trails that satisfy lenders. It also ensures you never overlook a dormant jurisdiction whose agent quietly resigned, keeping every state authority satisfied.

Registered Agent Costs Explained in 2025

Rates vary widely, but most providers charge between $99 and $299 per year, with higher tiers bundling annual report filing or mail forwarding credits. Understanding how registered agent costs break down helps you compare quotes without overpaying for bells and whistles you may never use. A transparent fee schedule also prevents nasty renewal surprises.

Typical Price Range and What’s Included

Premium providers justify their fees by including compliance calendars, unlimited scans, and multi-state discounts, while budget firms may bill extra for each upload. Always ask whether same-day digital delivery, SOC-2 data encryption, and document storage are included before committing; those features separate an average vendor from a truly commercial registered agent service.

| Tier | Annual Fee | Scans Included | Extras |

|---|---|---|---|

| Budget | $99 | 10 | Pay-per-mail forwarding |

| Standard | $149 | Unlimited | Compliance reminders |

| Premium | $199 | Unlimited | Annual report filing |

| Enterprise | $299 | Unlimited | Multi-state dashboard |

Is the Fee Tax-Deductible for Your Business?

For most business owner taxpayers, registered agent fees qualify as ordinary and necessary administrative expenses under IRC Section 162. That means you can deduct them in the year paid, lowering taxable income. Keep invoices on file in case the IRS asks for substantiation, and record prepaid multi-year contracts proportionally if you use accrual accounting. Consult your CPA for state-specific rules on apportioning deductions if you operate in multiple jurisdictions.

FAQs – Registered Agent Requirements for LLCs

Below you’ll find fast answers to the questions more popular. Bookmark this page so your next legal notices don’t derail productivity. And if you’re ready to form from scratch, our full guide on how to start an LLC walks you through every step.

Can I Change from Myself to a Service Mid-Year?

Yes. File your state’s Change of Agent form at any point during the year, pay the small fee, and obtain written consent from the incoming professional registered agent services provider. The switch is effective upon state approval, and there’s no gap in coverage as long as both agents overlap until records update. Most entrepreneurs complete the transition online in under ten minutes. This ensures your company’s public record stays accurate and responsive parties know exactly where to serve documents.

What If I Move or My Address Changes?

Update your agent or provide a new business address immediately—most states give only thirty days before fines accrue. Submit the amendment online, then check the public database to verify the update before printing new invoices or marketing materials. Prompt action keeps lenders and suppliers confident in your contact details. This ensures your company’s public record stays accurate and responsive parties know exactly where to serve documents.

Do Sole Proprietors or Corporations Need One Too?

Sole proprietors operate under personal names, so they aren’t required to appoint an agent. By contrast, every corporations division nationwide mandates a registered agent for C-corps, S-corps, nonprofits, and benefit corporations to ensure service of process never goes astray. Failing to list one can void contracts and block access to the courts. This ensures your company’s public record stays accurate and responsive parties know exactly where to serve documents.

Can I Use a Virtual Office Instead of a Registered Agent?

No. A virtual office lacks statutory authority to accept service of process and may close outside postal hours. States require a human or commercial provider at a real street address during business hours. Using a virtual address could lead to default judgments and administrative dissolution. This ensures your company’s public record stays accurate and responsive parties know exactly where to serve documents.

What If My Registered Agent Resigns or Becomes Unavailable?

You must change your registered agent within the statutory grace period—often thirty days—or risk administrative dissolution. File the Change of Agent form immediately, and choose a provider that notifies the state of acceptance up front. Until the update posts, both the outgoing and incoming agents share liability for misdirected mail. This ensures your company’s public record stays accurate and responsive parties know exactly where to serve documents.

Stay Compliant with Harbor Compliance Registered Agent

Stay Compliant with Harbor Compliance Registered Agent