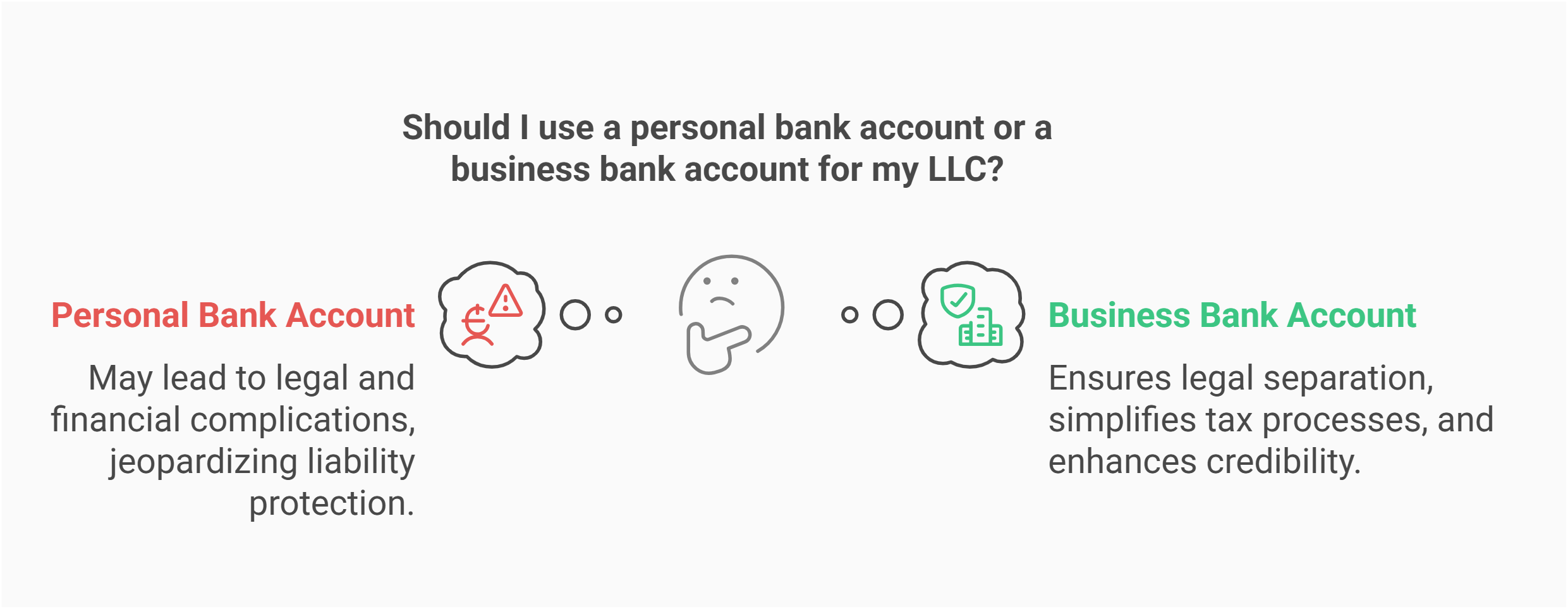

A business bank account is essential for any LLC, ensuring financial protection, compliance, and professional credibility. Many new business owners assume they can use a personal account, but this mistake can expose their personal assets and make tax filing complicated.

Yes, an LLC needs a dedicated business bank account to maintain liability protection, separate personal and business finances, and comply with banking regulations. Without one, you risk legal exposure, tax issues, and credibility concerns that can impact your business growth.

In this guide, we’ll cover:

- Why a business bank account is necessary for an LLC.

- The risks of using a personal account for LLC transactions.

- How to open a business bank account step by step.

Let’s dive in and ensure your LLC is set up for financial security and long-term success.

Why an LLC Needs a Business Bank Account

Opening a dedicated business bank account for your limited liability company is vital in the United States. By creating a separate business bank account for all company transactions, you preserve liability protection and reduce risks associated with mixing business and personal finances. This step is even more critical when you’re managing bank accounts for LLCs that aim to build business credit or secure future loans. For cost-effective solutions, explore our cheapest LLC formation options to minimize your initial setup expenses.

In many states, having a distinct account is effectively required for llc compliance. Some entrepreneurs think they may not need additional banking tools, but the benefits of a business checking account go beyond mere convenience. With a separate setup, your record-keeping and accounting become more accurate. Lenders also view your LLC more favorably if you demonstrate organized finances when applying for a line of credit.

- It helps shield personal assets from potential lawsuits.

- It streamlines tax preparation and fosters easier tracking of income and expenses.

- It builds credibility with clients, suppliers, and financial institutions.

Without a proper account for an LLC, you risk losing liability protection if courts decide the company is just an extension of you personally. Ultimately, it’s a cornerstone for growing a small business responsibly and professionally. Learn more at My Laundry Locker official website.

Secure Your LLC’s Finances Today

ZenBusiness makes it easy to form your LLC and set up a dedicated business bank account. Protect your assets and stay compliant effortlessly.

What Happens If You Use a Personal Bank Account for Your LLC?

Relying on a personal bank account to manage LLC funds can undermine many advantages of a company with a formal structure. First, you may also blur important lines between personal and business operations, which erodes the LLC’s distinct identity as a legal entity. As a result, a plaintiff or creditor might argue your LLC does not stand independently, exposing your personal assets to liability claims.

Additionally, taxes become harder to handle. You could mix your own spending with LLC transactions and create confusion in your income tax filings. Bookkeepers and CPAs might charge higher fees for sorting out combined statements, raising operational costs.

- Credibility issues: Vendors or clients may distrust an LLC that only has a personal account.

- Difficult expansions: If you plan on opening a business line of credit later, a lack of professional banking history complicates approvals.

Ultimately, commingling funds strips away the formalities that a business license or LLC status provides, leaving you with fewer protections and more hassle.

How to Open a Business Bank Account for an LLC (Step-by-Step Guide)

Establishing a separate bank account for llc transactions helps avoid confusion, simplifies tax filing, and fortifies your liability protection. Below is a four-step method that breaks down how to how to open a business bank account effectively, from gathering the documents needed for a business bank account to making your first deposit.le territory, Homegrown’s flexible approach suits novices. Check Homegrown Pet’s official site for licensing details.

Prepare your LLC’s EIN, Articles of Organization, and Operating Agreement.

Review fees, transaction limits, and online banking features.

Select a local, national, or digital bank based on your LLC’s needs.

Submit documents, verify ID, and make an initial deposit.

Step 1 – Gather the Required Documents

Before you open a business bank account, you will need some official paperwork. Among these key documents needed for a business bank account are your LLC’s operating agreement, Articles of Organization, and your Employer identification number (EIN). If you’re a single member llc, the bank may request limited paperwork, but multi-member LLCs often supply details on more than one account signer. If you’re in Texas, learning how to start an LLC in Texas can help you navigate state-specific requirements.

In some areas, you might also present a business license if the state or county demands it. Confirm that the business name on every document matches exactly—typos or mismatches with your official LLC formation papers can stall the process. If you’re considering an LLC without business, our guide can help you navigate the process effectively. Always have valid photo IDs (driver’s license or passport) for each authorized user.

Consider creating a folder for digital or printed copies to keep them at hand. Since different financial institutions vary in requirements, contact them beforehand to confirm what they need. Gathering everything upfront can save you multiple branch visits or phone calls, allowing your small business to run smoothly from day one.

Step 2 – Research and Compare Business Bank Accounts

Choosing the right bank accounts for LLC owners requires a bit of legwork. Larger banks such as bank of america offer a vast branch network, while regional banks and a credit union might provide more personalized service. Evaluate monthly fees, minimum balance requirements, and whether the bank packages any special offers for a merchant account or credit card integration. Also check if they have strong digital platforms to handle business banking tasks quickly.

Key points to compare before you apply for a business bank:

- Transaction limits (some accounts charge after a set number of deposits or checks)

- Fee waivers or sign-up bonuses

- Integration with accounting software for easier tracking of revenue

- Additional services like loan access or lines of credit for building business credit

Below is a quick table summarizing your potential picks:th existing franchise owners, and confirm the brand’s stability in your targeted region.

| Bank | Monthly Fee | Key Feature | Link |

|---|---|---|---|

| Main Street Bank | $10 (waivable) | Low required balance; local, personal approach | Visit Site |

| Metro Online Bank | $5–$15 | Virtual banking app, unlimited checking accounts | Visit Site |

| HighGrowth Savings | $0–$20 | Fee-free deposit quotas, robust mobile integration | Visit Site |

With these considerations, weigh which account for your llc truly matches your transaction volume and operational style.

Step 3 – Choose the Right Bank and Account Type

Your LLC’s size and business and personal finance goals determine whether a local bank, national chain, or digital-only institution best suits your needs. For instance, a sole proprietor converting to an LLC might prefer minimal fees, while a rapidly scaling enterprise may favor advanced business bank account benefits such as remote deposit or payroll integration.

Assess the importance of in-person support. If your region sees a strong presence of friendly tellers or specialized financial institution advisors, that advantage could outweigh a slightly higher monthly fee. However, if you rarely deposit checks physically or do more than 90% of your banking online, an app-based approach may prove more cost-effective.

Consider whether you need overdraft protection, a debit card with extensive ATM access, or interest-bearing options. Some specialized accounts cater to certain industries—like e-commerce or general partnership—making it simpler to handle frequent micro-transactions. Ultimately, the best pick supports your LLC’s mission while preserving capital.

Step 4 – Submit Your Application and Fund the Account

Once you’ve identified the perfect institution, it’s time to move forward with opening a business account. Typically, the bank will ask for your identification number (EIN or SSN if your LLC is a disregarded entity) and your operating agreement. If you’re a multi-member LLC, gather all member IDs. Certain banks demand an in-person visit, but many now accommodate fully digital applications.

Steps to finalize the process:

- Fill out the form with your legal business name, address, and ownership details. Choosing the best company name is crucial for your LLC’s branding and recognition.

- Present or upload your official state LLC paperwork: formation certificate and any local business license.

- Provide personal identification for signers, such as passports or driver’s licenses.

- Review monthly fees, special promotions, or conditions for waived fees.

Once approved, you can deposit an initial sum to activate the account. This deposit can vary—some banks require $100, while others does not require a minimum. Then you’ll get a debit card, checks, and online banking credentials. Depending on the bank, you might also set up a credit card or additional lines of credit. By funding and finalizing your separate bank account for llc, you maintain the formality that ensures strong liability protection for your enterprise.

What You Need to Open an LLC Bank Account

Before heading to the branch, confirm you have the right materials. You’ll almost always present your LLC’s Articles of Organization or comparable evidence that the limited liability company is formed. If local law deems it required for llc operations, bring a valid business license. For multi-member entities, clarify each member’s share in the operating agreement or resolution, so the bank knows who can sign.

Additionally, an identification number such as an EIN is crucial to prevent confusion around your taxes. To ensure compliance, consider hiring a Florida registered agent. Some smaller LLCs try substituting a Social Security number, but it’s best to keep them separate for liability protection and straightforward tax tracking. Also, many banks require a designated contact email and phone number, plus personal IDs for each signer. If your bank extends business bank account benefits, expect to produce proof of bank accounts for llc compliance or existing relationships with the bank. Gathering everything ensures a smooth, single application process with minimal back-and-forth.

Protect Your Business with the Right Setup

Northwest Registered Agent helps you establish your LLC with proper financial separation. Ensure compliance and maintain liability protection from day one.

Can a Single-Member LLC Use a Personal Bank Account?

There’s a debate among first-time LLC owners: if you’re a single member llc, do you need a business bank account or can you keep a personal setup? Let’s explore the legal angle, IRS perspective, and how financial institutions evaluate single-member entities.

Are There Any Legal Exceptions?

In most united states jurisdictions, having a distinct account does not appear as a direct law in every statute. Yet courts and legal experts argue that skipping a separate business bank account could jeopardize your liability protection. While a few states might ease the rules for a sole proprietorship or single-member LLC, ignoring best practices can lead to disputes over commingled funds. If your LLC faces litigation, failing to maintain professional banking steps can dismantle the legal entity’s shield.

IRS Guidelines on LLCs and Bank Accounts

According to the IRS, single-member LLCs can be “disregarded entities” for income tax. This classification, however, does not recommend merging personal and business finances. Separate bank records keep audits simpler and preserve clear boundaries between you and the LLC. Should your single-member LLC eventually expand, correct documentation ensures a smoother transition. The IRS strongly supports maintaining dedicated accounts to confirm your LLC stands apart from personal matters, especially come tax season.

How Banks View Single-Member LLCs

Banks largely treat single-member LLCs as legitimate business customers, no different from multi-member ones. However, establishing an account for an llc generally demands official paperwork: Articles of Organization, an EIN, and any local licensing. If you claim to be a simple sole proprietor or mention you may not have formal LLC documents, staff may direct you to personal banking. Ultimately, each financial institution has guidelines for verifying you as a company with formal structure rather than just an individual. Maintaining a business bank account for my llc fosters credibility, cements your LLC’s legal identity, and eases expansions like adding employees.

How Many Bank Accounts Should an LLC Have?

Some businesses flourish with a single business checking account. Others hold multiple accounts for payroll, tax reserves, and day-to-day expenses. Let’s explore which approach suits your LLC best.

The Role of Separate Accounts for Payroll, Taxes, and Expenses

Setting up individual checking accounts for each expense category provides easier tracking of every cash flow detail. Allocate a merchant account for sales, one for monthly overhead, and another for tax obligations. This segmentation not only clarifies your budgeting but also prevents accidental overspending or mixing different funds. Many CPAs recommend a separate bank account solely for collecting estimated tax payments, ensuring no shortfalls when taxes are due. Overall, a well-organized system keeps your finances transparent and your operations agile.

When Does an LLC Need a Business Savings Account?

A business savings account benefits LLCs wanting to stockpile emergency funds or build capital for expansions. If your income is seasonal or cyclical, a savings buffer ensures consistent cash flow. By placing surplus revenue in an interest-bearing account, you can handle sudden expenses—like equipment failures—without resorting to loans. Realistically, you can use it to safeguard big purchases or expansions. Some owners also use savings to hold partial tax funds. This approach fosters consistent budgeting and smooth bank accounts for llc usage.

Recommended Banking Strategies for LLC Owners

Many owners set up more than one account: a primary operating account plus specialized ones for payroll or taxes. Keep an eye on your minimum balance to avoid monthly fees. Choosing the best LLC service can further streamline your financial operations and ensure compliance. Doing so helps ensure you maintain professional boundaries between the LLC’s finances and personal spending while building trust with clients, vendors, and lenders.

Best Business Bank Accounts for LLCs in 2025

As global finance evolves, business banking options expand for LLCs. From big-name institutions with physical locations to online disruptors, you can find an account that suits your operational style and budget. Below are recommended picks to consider in 2025.

Best Traditional Bank Accounts for LLCs

Traditional providers offer robust benefits of a business bank account, including in-person expertise and additional financial tools. If you want long-standing stability and diverse branch networks, check out these leading institutions. They often pair checking solutions with merchant services, credit lines, and specialized features.satisfied customers. The more visible you are, the faster you build a loyal fan base.

| Bank | Monthly Fee | Highlight | Link |

|---|---|---|---|

| Bank of America | $16 (waivable) | Extensive nationwide presence, flexible credit | Visit Site |

| Chase | $15–$30 | Wide range of services, deep business tools | Visit Site |

| Wells Fargo | $10–$35 | Competitive loans, strong local footprint | Visit Site |

Best Online Business Bank Accounts

Online solutions cater to small business owners craving convenience and speed. They typically have fewer overhead costs and pass those savings to you—no merchant account surcharges or strict in-person visits. Check out the top digital players below:

| Online Bank | Monthly Fee | Key Perk | Link |

|---|---|---|---|

| Novo | $0 | Zero hidden charges, app-based deposit | Visit Site |

| Bluevine | $0–$5 | High APY, quick approvals | Visit Site |

Business Bank Accounts with No Fees or Minimums

Some institutions let you open a business bank account with zero monthly charges and no minimum balance. This approach suits startups that want to preserve capital. Below are three recommended picks:

- Local Credit Union – Many local unions are known for cost-effective solutions and direct community service. For an LLC that values personalized support, a credit union can be ideal.

- Online-Only Banks – With minimal overhead, these providers often charge no monthly fees or transaction caps. Some also link to e-commerce tools for hassle-free expansions.

- Hybrid Fintech Solutions – Acting as both a bank and digital platform, these let you manage finances and apply for a business bank loan from one dashboard.

While no-fee accounts appear appealing, always read the fine print: some might have transaction limits or require minimum usage to remain free. If your LLC grows rapidly, re-check your plan to ensure it still meets your operational demands.

Frequently Asked Questions

Below are concise answers to pressing questions about do I need a business bank account for an LLC. Each query reflects common concerns—ranging from potential legal requirements to everyday money handling. Read on to clarify the ins and outs of establishing professional bank accounts.

Strictly speaking, federal law does not require a separate account for every LLC. However, attorneys generally advise it to maintain liability protection. Some states or localities might have rules for regulated industries, making dedicated accounts effectively required for llc compliance. Even if your jurisdiction has no explicit mandate, mixing personal transactions poses a big risk: it can blur your LLC’s corporate veil. Ultimately, while not always legally demanded, separate accounts defend your personal finances and streamline tax reporting.

You may not want to do so. Legally, it’s possible to deposit an LLC check into a personal bank account, but it threatens your liability protection by merging business and personal funds. If your LLC faces legal action, courts might rule you never treated the LLC as distinct, endangering private assets. It also complicates income tax filings, making it tough to track official documents needed for a business bank account or separate income streams. Avoid these pitfalls by depositing all LLC checks into a dedicated llc bank account.

First, ask the bank for clarity. They might flag your operating agreement as incomplete or have concerns about a credit score. In some cases, you can fix these issues—like updating your documents needed for a business bank account or adding signers—before reapplying. If repeated attempts fail, explore alternative financial institutions or a credit union with more accommodating policies. Presenting stable finances, valid IDs, and a cohesive business plan helps. You can also partner with a merchant account service if standard banks turn you down. Above all, keep your finances organized to prove you’re a credible entity.

Yes, but proceed carefully to preserve your LLC’s distinct status. If you consistently shuffle funds between accounts other than for legitimate distributions or reimbursements, you might forfeit the LLC’s liability protection. Document each transfer as an owner draw or capital contribution. This ensures a clear paper trail for the general partnership or multi-member scenario. Inadvertent, repeated commingling can cause an auditor or court to challenge the business’s separation, jeopardizing personal asset security. So keep transfers minimal, purposeful, and well-documented.

Timing varies, but most banks finalize an account within a few days once all documents needed for a business bank account are in order. Online banks might open accounts in under 24 hours if your details check out automatically. In-person visits often take an hour or two, but follow-up could stretch the process if your paperwork is incomplete. Expect potential slowdowns if you’re a new sole proprietor converting to an LLC or have multiple signers. Once approved, your new account is typically ready for deposits, card issuance, and digital access almost immediately.

Simplify Your LLC’s Banking & Compliance

Harbor Compliance streamlines LLC formation and business banking setup, so you can focus on growing your business with financial security.