Are you planning to register a business in Maryland and need to check if your desired name is available? Want to verify whether a company is active, legitimate, or in good standing before partnering or signing a contract? Curious how Maryland’s business database can help you avoid legal or branding issues?

The Maryland Business Entity Search is a free, state-run online tool that lets you check the legal status, ownership, registration details, and filing history of any company registered in Maryland. By entering a business name or charter number into the system, you can instantly verify if an entity is active, forfeited, or dissolved, confirm its registered agent, and ensure your desired business name is still available. This helps entrepreneurs make smarter decisions and stay compliant with Maryland law.

In this guide, you’ll learn:

- How to use the Maryland Business Entity Search step by step

- What legal and ownership information is publicly available

- How to verify name availability before registration

- Common issues and how to avoid search errors

Ready to explore Maryland’s business landscape with confidence? Let’s dive into how this powerful search tool works—and how to use it to your advantage.

Maryland Business Entity Search: A Tool to Investigate & Validate Companies

Anyone looking to start or grow a venture in Maryland should first tap into the maryland business entity search platform. This online business search tool empowers you to verify whether an organization is active, access public filings, and check compliance records. When scouting potential partners or researching your next move, it’s crucial to confirm that a business is properly registered and in good standing with the maryland state authorities.

Here’s what makes the search so valuable:

- Transparency: Glimpse an entity’s official data, including its physical address and registered agent.

- Risk management: Gauge if a business is delinquent or dissolved before finalizing deals.

- Name availability: Identify if your desired company name is open or taken to avoid trademark conflicts.

- Due diligence: Confidently gather evidence of compliance, especially if you plan to register your business or sign contracts in Maryland.

- Historical records: Track any changes an entity has undergone, such as amendments or rebranding.

Performing a quick lookup through Business Express can offer invaluable insight into a company’s stability and legitimacy, saving you from unnecessary risks down the road.

Start your Maryland LLC today

ZenBusiness simplifies LLC formation in Maryland starting at $0 + state fees. Easy filing, name checks, and fast approval.

What You Can Actually See in the Entity Search Results

Using Maryland’s official database reveals a wealth of data essential for anyone who needs to check the authenticity of a local business. Whether you’re a potential client, vendor, or competitor, these details give you a clear snapshot of the entity’s current standing.

Legal name, status, and formation date

Each record shows the entity name as filed with the maryland secretary. This might match the brand’s everyday name or differ if the business is using a trade name. You’ll also find the date the company was first established and whether it’s still active or in good standing. This status ensures you know if the company is functioning legally or if it’s dissolved or forfeited due to non-compliance.

Registered agent and business address

Maryland requires each limited liability company or corporation to appoint a registered agent, someone authorized to receive official documents on the entity’s behalf. The listing reveals this agent’s name and physical address, making it straightforward to locate a contact point for legal notices. Verifying that a business has a valid agent offers reassurance they’re following mandated protocols and not operating under the radar.

Charter number and public filings

Every recognized Maryland entity has a unique charter number assigned by the state. This identifier ties all recorded details together, such as annual report submissions or changes in company name. If needed, you can reference the charter number to cross-check data across multiple state databases, verifying accuracy and authenticity.

Entity type: LLC, Corporation, trade name, etc.

Because maryland has many possible structures—like a maryland llc, corporation, limited liability company, or sole proprietorship—this information is crucial. You’ll see precisely how the entity registered with the maryland department. Understanding the structure clarifies potential liabilities, ownership responsibilities, and even personal property tax obligations. Each type has distinct legal ramifications, so confirm the classification before forming any partnership.

Difference between active, forfeited, and dissolved entities

An entity in “active” status meets its compliance obligations, meaning it files required documents on time and pays any property tax or registration fees. “Forfeited” implies the business lost its charter due to missed filings or fees, rendering it non-operational unless it’s reinstated. “Dissolved” typically signals a voluntary shutdown or a completed wind-up process. Knowing these distinctions helps you avoid deals with defunct entities.

How to Conduct a Maryland Business Entity Search (Step-by-Step)

Whether you’re cross-checking a potential partner or checking your own compliance, following an organized approach to find relevant information saves you time and stress. Here’s a quick guide to making the most of Maryland’s public database.

Step 1 – Go to the Maryland Business Express Search Portal

Begin by navigating to the official Business Express website, managed by the maryland secretary. Look for a dedicated section for conducting an online company search. This user-friendly gateway lets you query all the registered entities quickly, filtering out irrelevant data.

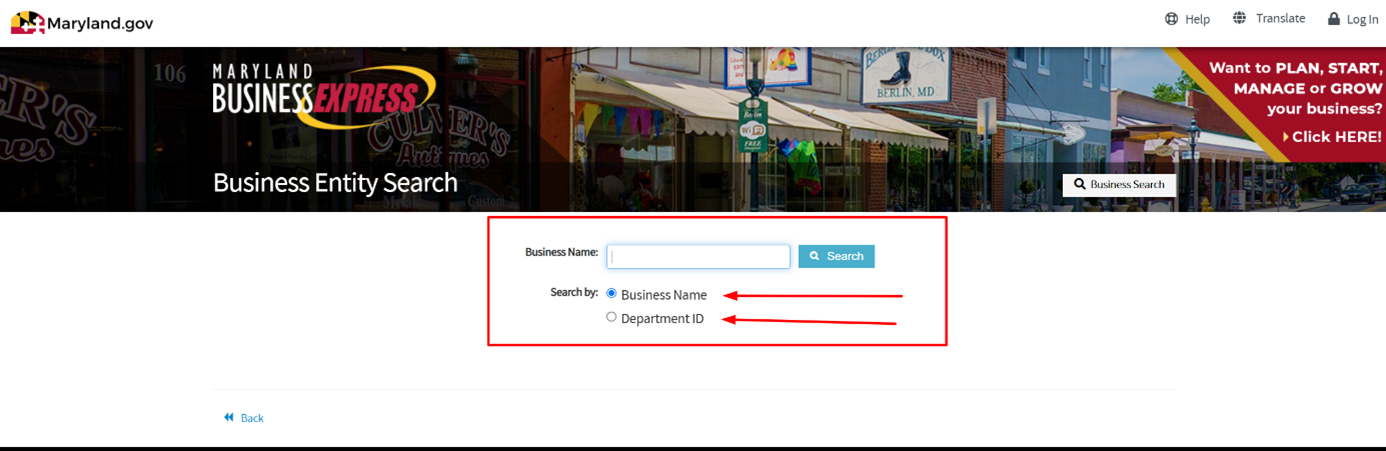

Step 2 – Choose Your Search Method

You can enter all or part of the entity name to see broad or exact match results. The portal might also let you filter by a charter number, which can be useful if you already know it. Some users prefer advanced searches that factor in location or registered agent data, but a simple name-based query often works well if you’re uncertain.

Step 3 – Enter Your Criteria and Launch the Search

In the text field, type the name you want to investigate. If you’re verifying your own LLC, an exact match is ideal. For exploring potential overlaps, a partial search helps you see a list of possible references. Double-check the spelling to avoid missing the correct record; small typos can yield no results.

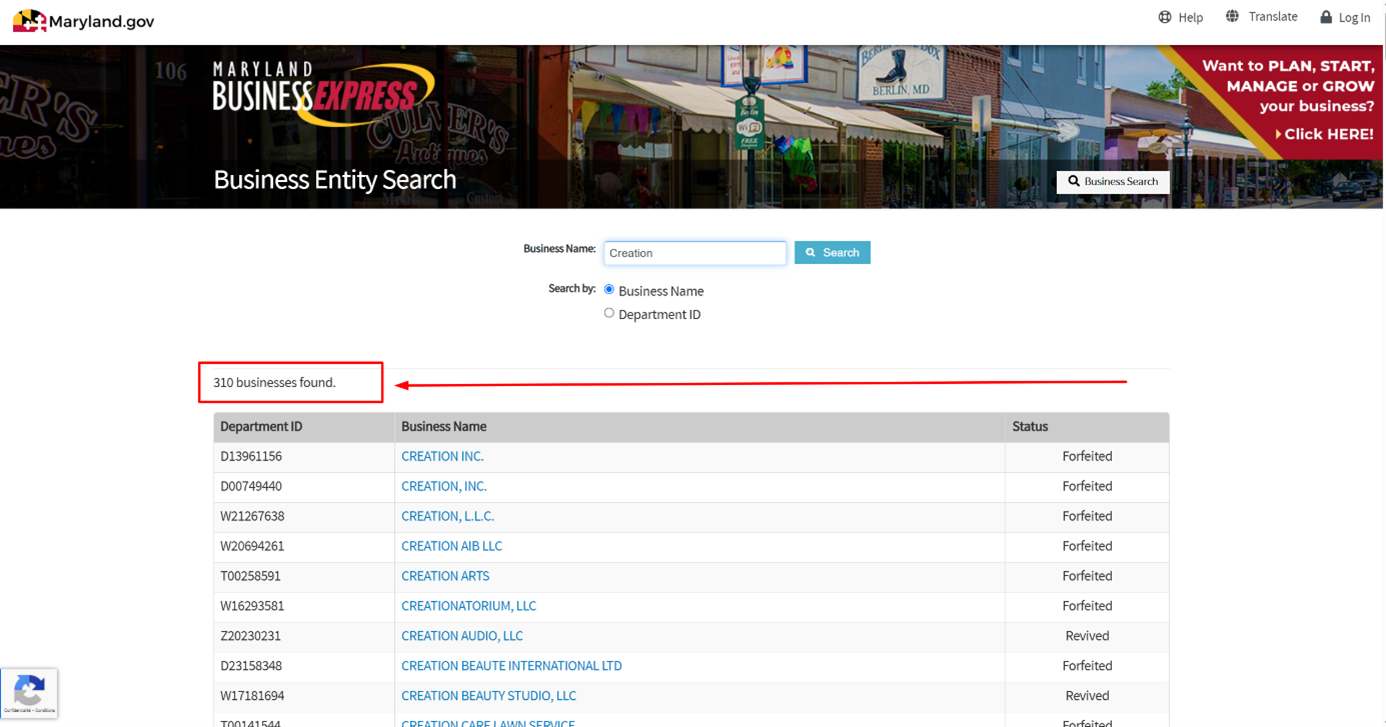

Step 4 – Review the Results Page (status, type, ID)

Once the system populates with matches, examine the short summary for each record. You’ll typically see the company name, entity type, and current status. Decide which record aligns best with the business you’re researching—particularly if multiple entities share a similar name.

Step 5 – Click to Access Full Entity Details

Select the relevant listing to access more comprehensive data, such as the physical address on file, annual report history, or the listed registered agent. This in-depth view clarifies if the business has complied with business registration obligations in Maryland.

Step 6 – Download Public Records if Needed

If necessary, you can often retrieve scanned documents—like formation papers or amendments—to confirm specific details. Keep these on hand if they’re a part of your business due diligence or if you suspect something amiss in how the entity was formed.

Verifying the Legitimacy of a Maryland Business

Quickly spotting a business record in a maryland business name lookup doesn’t always guarantee legitimacy. For more robust checks, follow these steps:

- Check “Good Standing” Status: If the record shows active or good standing, the entity meets state requirements.

- Confirm Registered Agent: Ensure they list a valid person or service with a real physical address.

- Review Filing History: Look at recent forms, especially if any show forfeiture notices or compliance gaps.

- Cross-Check Websites & Social Media: Entities with an online presence often link to official pages, reinforcing trust.

- Request Additional Proof: If you’re signing major contracts, ask for updated personal property tax receipts or official certificates from the maryland secretary.

By ticking these boxes, you lower the risk of forming alliances with a non-compliant or fraudulent enterprise.

Is Your Business Name Available in Maryland?

If you’re planning to form a maryland llc or corporation, ensuring your desired llc name or brand is free to use is vital. The state’s database makes name availability checks straightforward. Still unsure how to proceed? This guide on how to check llc names will help you run a proper name clearance.

Before you finalize their business name, keep in mind:

- Exact matches are prohibited. If an entity has already entered in their business with the same legal name, you must adjust yours.

- Similar-sounding names could also face rejection if they risk public confusion.

- Trade name vs. legal name: You might operate under a trade name even if your legal name is different.

- Social media accounts: Claiming relevant usernames or URLs that match your official name can build brand cohesion. If you're still brainstorming, explore unique company name ideas that align with your brand vision.

Once you confirm a free name, be sure to move quickly. In some cases, you can reserve it briefly, but Maryland often has many new registered businesses each month, increasing the risk someone else might claim the same or a similar company name.

Understanding the Role of a Registered Agent in Maryland

Maryland demands that every corporation or limited liability company appoints a registered agent authorized to receive official documents. This requirement applies to local and out-of-state companies alike. Neglecting it can cause severe compliance issues or hamper your ability to operate legally in the state.

Who can act as a registered agent?

Any individual older than 18 with a Maryland physical address can fulfill the role, as can professional services dedicated to registered agent duties. Some businesses choose a manager or owner who resides in Maryland. However, using a professional service ensures consistent coverage—critical if you travel frequently or manage a fully remote venture. The agent’s details must appear in the state’s business register, so they’re publicly accessible through the maryland business entity search system. Choosing a reliable regsitered agent service can simplify compliance and ensure you never miss a legal notice.

What happens if your agent resigns or is non-compliant?

If your registered agent quits or fails to meet obligations, the company may receive a notice from the maryland department. You usually get a grace period to name a replacement. Failure to respond can put your business at risk of forfeiture, effectively stripping you of legal privileges to operate in Maryland. It also leaves you vulnerable if you don’t receive vital legal notices. Always stay on top of your agent’s status to remain in good standing.

How to appoint or change your registered agent

Designating a new agent or switching from one to another typically involves filing a specific form with the state. Here are common steps:

- Check forms: Acquire the correct “Change of Resident Agent” or similar document from the secretary of state business website.

- Fill out details: Provide the entity’s legal name, new agent’s address, and any required signatures.

- Pay a fee: Some states levy a nominal charge for these updates.

- Submit promptly: Delaying puts you at risk of losing your good standing.

Keep a record of the completed filing in case you need to prove your compliance down the line.

Form your Maryland LLC privately

Get unmatched privacy and compliance support with Northwest. Includes expert guidance and registered agent service.

How to Register a Business in Maryland (LLC or Corporation)

Starting a venture in Maryland requires clarity about legal requirements and available options. If you’re new to the process, this step-by-step guide on how to start an llc covers everything from formation to compliance. The state’s process can be straightforward if you follow each step methodically, from confirming your maryland business name to finalizing your official paperwork.

Step 1: Check name availability

Search for your desired entity name via the Maryland online database. If you find an exact match, pick a new option. If the results are close but not identical, you may proceed—but watch for potential public confusion. This is especially important if you're comparing across states—like when running a Texas llc name search for brand consistency. Remember, some words are restricted or need special authorization, so double-check name availability guidelines. You can also explore different llc names to get inspiration that meets state requirements.

Step 2: Choose your legal structure

Maryland recognizes a range of business forms, including llc and corporation setups. The best choice hinges on part of your business strategy—like ownership plans or liability preferences. Even if you haven’t finalized your business idea, you can still form llc without business to secure your name and protect your brand. If you want to minimize personal risk and handle pass-through taxation, a limited liability company might work. A corporation offers a different legal framework but can be advantageous for scaling and securing investors.

Step 3: File Articles of Organization or Incorporation

Filing formal documentation is a pivotal step to officially register your business under Maryland law. Depending on your chosen structure, you’ll submit either Articles of Organization (for an LLC) or Articles of Incorporation (for a corporation). This process ensures the Maryland State Department of Assessments and Taxation (SDAT) recognizes your enterprise as a legal entity.

In drafting your Articles, you must provide detailed information so that state authorities can confidently add your business to the business register and keep track of your future compliance. Let’s break down the core sections and considerations when filling these documents:

- Name of the Entity. For a detailed breakdown of the formation process, check out how to start an llc in Maryland before submitting your Articles.

- Purpose or Business Activity

- Principal Office Address

- Registered Agent Details

- Duration of the Entity

- Authorized Shares (Corporation Only)

- Initial Directors or Managers

- Signatures

- Filing Method

- Acknowledgment and Confirmation

Remember that the cost to file can vary, with standard fees generally ranging from $100 to $170 for Maryland, subject to occasional legislative updates. Additional charges may apply for expedited services. If your entity is time-sensitive—like you need it formed within days—pay the extra cost for priority handling. Here’s what to expect regarding the time for get an llc in Maryland so you can plan your launch accordingly. Once your filing is approved, your business gains formal recognition under Maryland law, which means you can proceed to open bank accounts, sign contracts, and operate confidently. You may also want to compare available llc services Maryland to simplify filings and post-formation tasks.

Overall, drafting and submitting your Articles of Organization or Incorporation is a critical milestone in your entrepreneurial journey. By diligently providing correct, thorough information, you reduce the likelihood of processing delays and set a solid foundation for compliance. Keep in mind that future steps—like filing annual report forms or personal property tax returns—will hinge on the data you present at this stage. Once your entity is on record, you’re officially in business.

Step 4: Pay fees and obtain registration confirmation

After finalizing the Articles, you’ll pay the standard filing fee, which often depends on the entity type and any rush processing. Once the maryland secretary acknowledges your application, expect to receive documentation confirming your business registration. Keep these records in a secure place; banks and prospective partners may want proof of your official status.

Step 5: Register for taxes, licenses, and annual reports

Maryland typically requires annual report filings that detail key data, like gross sales or property tax declarations. Also, confirm any specialized licenses linked to your industry, whether retail, contracting, or professional services. Keep your data current each year so your llc and corporation remain in good standing. Failing to file can result in forfeiture and hamper your day-to-day operations.ur venture in the Granite State.

Search Maryland's online database to verify your desired business name isn't taken.

Decide between LLC, corporation, or other entity types based on liability and tax preferences.

Submit Articles of Organization (LLC) or Articles of Incorporation with required business details.

Pay filing fees ($100-$170) and receive official documentation of your registration.

Obtain necessary permits, tax accounts, and prepare for annual compliance requirements.

Documents Needed to Register a Business in Maryland

Establishing an entity in Maryland isn’t just about submitting one form. You’ll likely gather and provide multiple documents to prove your credentials and keep state records accurate.

Expect to compile:

- Name Verification: Any proof you performed a maryland business name check or reserved the name if necessary.

- Articles of Organization/Incorporation: Formal declarations for LLCs or corporations.

- Registered Agent Agreement: If using a commercial agent service, a confirmation letter may be needed.

- Personal Property Tax Forms: Some entities might fill out initial “return” documents.

- Additional Permits: Depending on your sector, you might attach local or federal licenses.

Always confirm the exact list of required items through official Maryland State websites or consult an attorney if your case seems complex. Missing even one piece of paperwork can stall your new venture.

How to Access a List of Registered Maryland Businesses

Sometimes, you’ll want to see more than a single listing—you might need a list of all entities operating in a certain region or under specific categories. Maryland makes it possible to retrieve broader sets of data through official online resources.

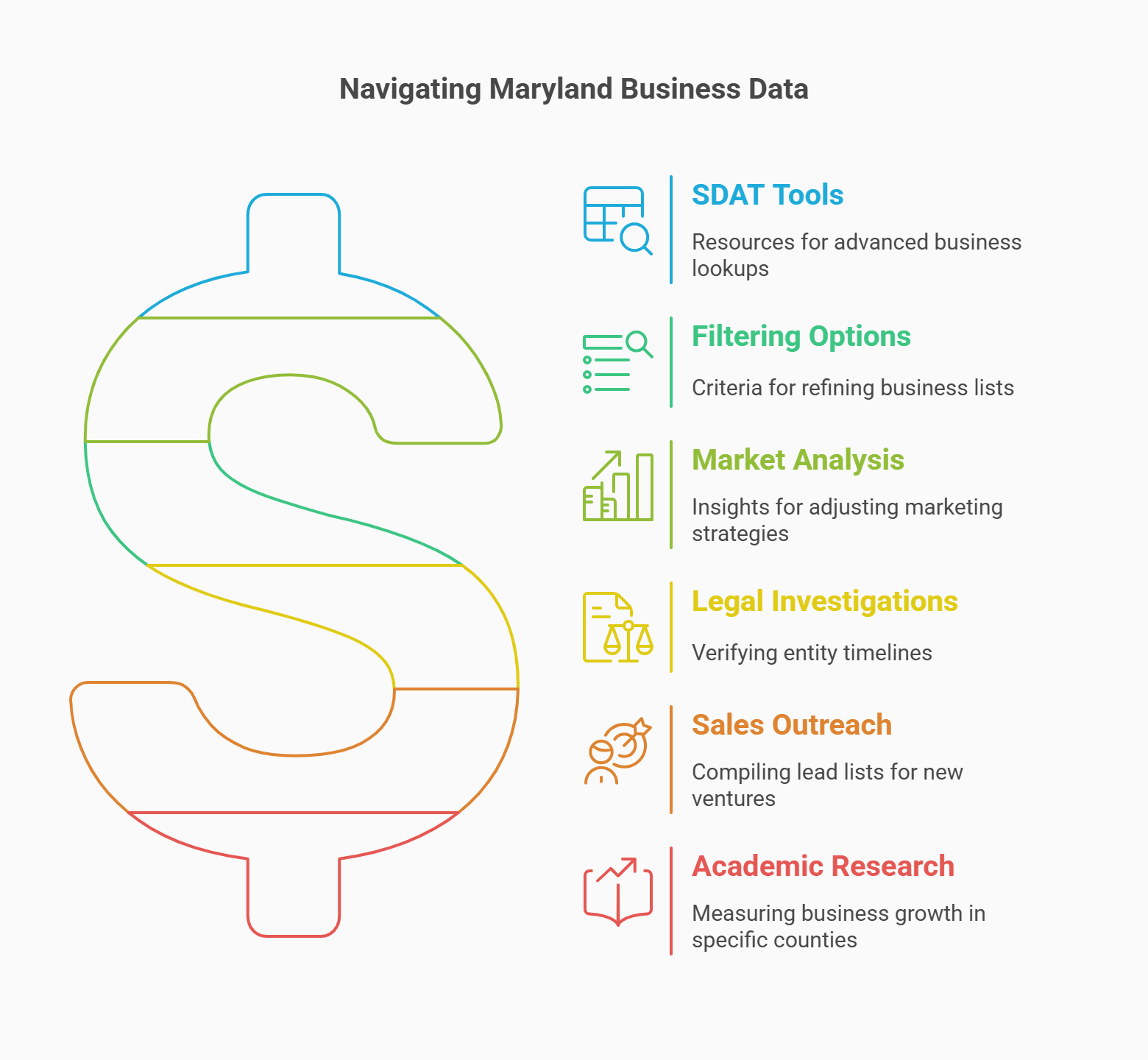

Using SDAT’s public data tools and exports

The Maryland State Department of Assessments and Taxation (SDAT) provides resources for advanced lookups. On their site, you may find bulk search options or downloadable spreadsheets. While it may not be a polished interface, it’s comprehensive, enabling in-depth queries to identify businesses by their formation dates or entity name patterns.

Filtering by entity type, location, or date of formation

Once you’ve accessed the data, you can refine the list of all relevant records using filters—like region, date range, or type of structure (LLC, corporation, etc.). If you want newly formed LLCs in the last quarter, simply set your criteria to that time frame. The system shows potential matches with enough detail to evaluate whether they’re relevant to your project.

How researchers, lawyers, and marketers use this data

A broad company search has multiple applications:

- Market Analysis: Seeing new businesses enter your sector helps you adjust marketing strategies.

- Legal Investigations: Lawyers often confirm the timeline of an entity’s existence.

- Sales Outreach: Marketers might compile lead lists for newly registered ventures.

- Academic Research: Scholars studying economic trends can measure business growth in specific counties.

Always handle the information ethically. If you plan to contact these entities, follow privacy laws and standard best practices for outreach.

Common Issues with Maryland Business Entity Search

While Maryland’s search interface is user-friendly, it’s not perfect. A few challenges can arise when hunting for specific data or verifying multiple companies:

- Spelling Mistakes: If you incorrectly type the company name, you may fail to locate the record.

- Name Variations: Some businesses register with abbreviations or slight differences from their brand.

- Outdated Data: The system’s updates, though regular, might not reflect last-minute changes like a newly assigned registered agent.

- Forfeited vs. Dissolved: Entities may appear “active” even if they’re close to losing status due to missed filings or fees.

- Incomplete Public Filings: Some documents might be missing from older records, leading to partial results.

When confronted with these pitfalls, double-check your search criteria and remain flexible in your approach—like trying broader searches or verifying details externally. If crucial data is missing, contact Maryland’s SDAT for official clarifications.

FAQ – Maryland Business Entity Search

Exploring the nuances of verifying or registering a company in Maryland can lead to many questions. Below are concise answers that tackle the most frequent concerns head-on.

Yes. Maryland’s official business search tool—often found under Business Express or the SDAT website—lets anyone look up registered businesses without charge. You can enter all or part of a maryland business name to locate relevant results. Some advanced features or data exports may require nominal fees, but for a basic company search, there’s no cost. The open access ensures transparency, allowing entrepreneurs and consumers alike to see an entity’s status, formation date, and registered agent details.

Often, you can see key individuals (like members or directors) listed if they’re part of the public record—particularly in certain llc and corporation filings. However, not all data is always disclosed. Some owners remain behind holding companies or legal representatives. If the registered agent is a commercial service, you might not see personal names. You could also explore separate public filings, like the entity’s annual report, to uncover details about ownership structure or principal parties if they’re reported.

Typically, Maryland’s database reflects new filings and changes within a few business days. Yet exact turnaround can vary due to seasonal workloads or state holidays. The maryland department encourages digital submissions via Business Express, which often appear more quickly than mailed forms. If you recently formed an LLC or updated your charter, wait at least a week before expecting the record to show online. For urgent verification, contacting the SDAT directly can confirm if new data is processing.

Yes. In addition to standard corporations or limited liability company entities, you can locate trade name registrations—often referred to as “DBAs” (Doing Business As). Simply refine your query in the secretary of state business database. However, not every local sole proprietorship may appear if they haven’t officially registered a separate name. For deeper clarity, consider searching local or county-level registers, since some DBAs might be filed at that level rather than statewide.

If you want to stay abreast of updates—like a new registered agent or a change from active to forfeited—periodically revisit the entity listing in the state’s company search. There's no universal alert system, but you can manually check or use third-party services that monitor changes in public records. For large transactions or collaborations, it’s wise to confirm an entity’s standing right before signing major contracts, ensuring you know whether the business remains in good standing.

Looking for an overview? See Maryland LLC Services

Create a Maryland LLC stress-free

Harbor Compliance handles your Maryland LLC setup from start to finish with full compliance and dedicated support.