Forming an LLC can protect your personal assets, but the state you choose makes all the difference. Delaware is renowned for its strong legal system, Wyoming offers unmatched privacy, and Nevada provides tax-friendly incentives. Meanwhile, Texas, Florida, and Georgia make formation fast and affordable. The “best” state ultimately depends on your priorities: privacy, taxes, cost, or growth potential.

Top 10 States for LLC Formation in 2025

Choosing where to launch your limited liability company often depends on taxation, ease of registration, selecting structure, and legal framework. Below are the best states to open an LLC, each offering unique perks for entrepreneurs. Furthermore, for those eager to launch, discovering how to start an LLC can provide you with a streamlined roadmap to success. Whether you prioritize privacy or lower fees, evaluating these options can streamline your progress and cut down on unnecessary red tape.

| State | Key Benefit | Best for | Formation Complexity | Tax Climate |

|---|---|---|---|---|

| Delaware | Strongest legal protections (Court of Chancery) | Corporations, startups seeking investors | Moderate | No sales tax; franchise & gross receipts taxes; corporate income tax on in-state income |

| Wyoming | Top-tier privacy, low fees | Small businesses, asset protection | Easy | No personal or corporate income tax; low annual report fee |

| Nevada | No state income tax; pro-business regime | Scalable businesses, tax efficiency | Moderate | No personal/corporate income tax; Commerce Tax on high gross receipts; state business license fees |

| Texas | No personal income tax | Entrepreneurs looking to scale | Moderate | Franchise (margin) tax applies to entities |

| Florida | Quick, online-friendly formation | Service-based businesses | Easy | No personal income tax; corporate income tax applies to C-corps/LLCs taxed as corporations |

| California | Access to the CA market & talent | Venture-backed businesses | Hard | Annual franchise tax for most LLCs + additional LLC fee at higher gross receipts |

| Montana | No statewide sales tax | Local businesses, retail | Easy | No statewide sales tax; corporate income tax applies |

| New York | Global business exposure | Finance, media, large enterprises | Hard | High state + NYC business taxes; LLC publication requirement |

| Alaska | No state-level sales tax | Small businesses, low-cost ops | Moderate | No state sales tax; local sales taxes common; corporate income tax; no personal income tax |

| New Mexico | Privacy-friendly filings | Freelancers, asset holding | Easy | No annual/biennial LLC report; gross receipts tax applies |

Delaware: Preferred for legal protections and corporate laws

Delaware remains legendary for robust corporate law and a specialized court system that’s well-versed in business structure disputes. Companies worldwide flock here for consistent rulings and a flexible environment. By forming an LLC in Delaware, you typically gain recognized legal advantages that can reinforce credibility with investors.

- Numerous legal entities find simplified resolution through the Delaware Court of Chancery, a nationally respected equity court with deep corporate case law.

- A straightforward fee setup: Certificate of Formation filing fee $110; ongoing LLC Franchise Tax $300 due June 1; no annual report required for LLCs. Expedited filing options are available.

- Clear regulations that prioritize fast, efficient compliance; Delaware has no state or local sales tax, but businesses with in-state activity may owe gross receipts tax on sellers.

Because the state’s laws cater to high-level corporate disputes, many large brands build a holding company in Delaware for added security. However, if you won’t be operating within the state, you could face extra costs managing out-of-state compliance (e.g., foreign qualification where you actually do business, plus maintaining a Delaware registered agent). Before making your decision, it’s crucial to understand precisely what an LLC means in terms of legal protection and business flexibility.

Wyoming: Privacy and low maintenance costs

If you want maximum privacy and manageable expenses, an LLC in Wyoming is often praised for minimal disclosure requirements. By staying quiet on ownership details, Wyoming’s system helps smaller entities protect personal data. Wyoming also has no personal or corporate income tax, and the annual report license tax is $60 minimum based on in-state assets.

Key features of its privacy benefits:

- Owners/managers aren’t required on the public Articles of Organization (the form focuses on the registered agent and company addresses).

- Streamlined annual renewal: due each year on the first day of your anniversary month; most pay the $60 minimum.

- Requirements are stable, and you must keep a Wyoming registered agent with a physical address.

Business owners focused on safeguarding personal info can find Wyoming appealing; note that since March 26, 2025, domestic companies are exempt from BOI reporting to FinCEN (privacy strengthened further).

Nevada: Tax advantages for businesses

Many entrepreneurs choose Nevada for favorable tax policies and a pro-business stance. There’s no state corporate or personal income tax, but Nevada does impose the Commerce Tax on Nevada gross revenue over $4,000,000 per fiscal year, plus state business license fees.

In addition, you’ll see:

- No traditional corporate “franchise” income tax; however, the Commerce Tax and license fees still apply.

- No personal income tax at the state level.

- Clear registered-agent rules (an in-state agent with a physical address is required).

However, to maintain good standing you must budget for annual fees: an Annual List for LLCs $150 ) and a State Business License $200 each year (corporations: $500 for the license). Nevada also has a payroll-based Modified Business Tax in many cases.

Texas: Business-friendly and no state income tax

Texas is a favorite among entrepreneurs due to its business-friendly environment and the absence of state personal income tax, making it attractive for small business owners seeking to maximize profits. Note, however, that Texas imposes a Franchise (Margin) Tax on most entities: the standard rate is 0.75%, or 0.375% for retail/wholesale, with a no-tax-due threshold of $2.47 million in total revenue for reports due in 2024–2025. Reports (or information reports) are generally due May 15 each year.

Additionally, Texas simplifies the formation process with straightforward filing requirements (the standard LLC Certificate of Formation fee is $300), while maintaining clear compliance standards (Public/Ownership Information Reports even when below the threshold). Its robust infrastructure, diverse economy, and large consumer base create significant opportunities across industries from tech to energy.

Form Your LLC in the Best State for Your Business

ZenBusiness simplifies LLC formation, helping you choose the right state to maximize tax benefits and legal protections.

Florida: Easy registration and no state taxes

Florida continues to attract owners who appreciate an uncomplicated system and zero state-level personal income tax (Corporations, and LLCs taxed as C-corps, owe Florida corporate income tax). Setting up a domestic LLC is direct, with limited red tape and supportive agencies. The best part is that you can often handle everything online at your own pace.

Because Florida encourages new ventures, registration perks include:

- Reduced wait times for processing of Articles of Organization when filed online (typically processed within a couple of business days).

- Straightforward instructions from the Division of Corporations (Sunbiz) with full online filing.

- Minimal extra licensing if your sector doesn’t demand specialized permits, though many counties/cities require a local business tax receipt.

Although annual fees apply, many find the state’s approach more flexible than high-cost jurisdictions, formation is $125 ($100 filing + $25 registered agent designation), and the annual report is $138.75 due by May 1 each year (late fee $400).

California: High costs but strategic for local operations

Though California features hefty ongoing costs (rather than high filing fees), it remains a top marketplace for technology, entertainment, and emerging fields. If you need direct access to local clients or talent clusters, forming an LLC here might be inevitable. Balancing that, the state requires an $800 annual franchise tax (first-year waiver ended after 2023) and, at higher revenues, an additional LLC fee based on California-sourced gross receipts. Still, for those seeking a foothold in the massive West Coast market, the potential payoff can justify the steeper ongoing costs.

- Filing is straightforward: Articles of Organization $70 and the Statement of Information $20 due within 90 days of formation and every two years thereafter.

- Annual obligations: $800 franchise tax due by the 15th day of the 4th month of your tax year; additional LLC fee $900–$11,790 when CA income ≥ $250,000.

- If your LLC elects C-corp taxation, corporate income tax applies (generally 8.84%).

Montana: Affordable for residents with no sales tax

Montana stands out among popular states for LLC formation due to the absence of a general statewide sales tax and a relatively relaxed environment. This setting appeals most to local entrepreneurs or those running smaller-scale operations wanting minimal overhead. Lower living costs also translate into easier resource allocation for expansions.

On top of that, you’ll see:

- Straightforward compliance for those living and working in-state (annual report due April 15 each year; in 2025 the on-time filing fee was waived).

- Few hidden charges for everyday transactions thanks to no statewide sales tax, but note certain local resort/lodging/rental-vehicle taxes can apply in designated areas.

- No large-scale corporate demands from local agencies; standard business income taxes still apply depending on your federal classification.

Overall, local business entities can benefit from the region’s calm approach, though out-of-state owners might prefer more established corporate hubs (and will typically need to foreign-qualify where they actually operate).

New York: Complex but critical for business presence

Because New York has a major global influence, many founders still pick it despite intricate formation steps and higher fees. Navigating local processes can feel cumbersome, but the reward is a prominent address that carries weight on a worldwide scale. If your brand thrives in finance, media, or specialized industries, having a New York LLC can help you engage potential investors or clients.

Notes: Filing Articles of Organization $200; Biennial Statement $9 every 2 years.

Be aware that:

- The state requires a publication step for LLCs: publish in 2 newspapers for 6 consecutive weeks within 120 days of formation, then file a Certificate of Publication $50 (newspaper costs vary by county).

- Local taxes can be complicated. Many unincorporated businesses in New York City owe the UBT at 4% of taxable income; corporations face separate state and city corporate franchise taxes.

- New York State also imposes an annual LLC filing fee (Form IT-204-LL) for LLCs/LLPs not taxed as corporations, based on New York-source gross income (generally $25–$4,500).

Still, many see those hurdles as worthwhile trade-offs for establishing a serious presence in a global business hub.

Alaska: Minimal costs and favorable tax climate

Alaska is a unique pick thanks to no state personal income tax and no statewide sales tax (many municipalities levy their own local sales taxes). This environment appeals to smaller operations looking to save on overhead in sectors like tourism or resource extraction. Alaska does have a graduated corporate income tax (up to 9.4%) that applies if your LLC elects corporate taxation; pass-through LLCs aren’t taxed at the corporate level.

On top of that, you’ll see:

- Straightforward compliance for those living and working in-state: Initial Report due within 6 months; Biennial Report due Jan 2 in your cycle, $100 domestic (late fee after Feb 1/2).

- Few hidden charges for everyday transactions thanks to no statewide sales tax, but check for local resort/lodging or municipal sales taxes in certain areas.

- No large-scale corporate demands from local agencies; most businesses also need an Alaska business license ($50/year).

Overall, local business entities can benefit from the region’s calm approach, though out-of-state owners might prefer more established corporate hubs.

New Mexico: Anonymous LLCs for privacy

If you want confidentiality, forming an LLC in New Mexico keeps owners off the public record: the Articles list the registered agent and company address, not members/managers. The filing fee is $50, and LLCs have no annual/biennial report, which keeps ongoing costs low. If you sell in New Mexico, plan for gross receipts tax (GRT).

Because anonymity is a selling point, you’ll also see:

- Low annual upkeep at the Secretary of State level (no LLC annual report; keep a registered agent on file).

- Stable, online filing through the state portal.

Yet, consider whether your industry demands special disclosures. Banking and tax due-diligence can still require owner information despite public anonymity. And if you operate in other states, you’ll typically need to foreign-qualify there.

Protect Your Business with the Right LLC Location

Northwest Registered Agent offers expert guidance to ensure your LLC is set up in the most business-friendly state for your needs.

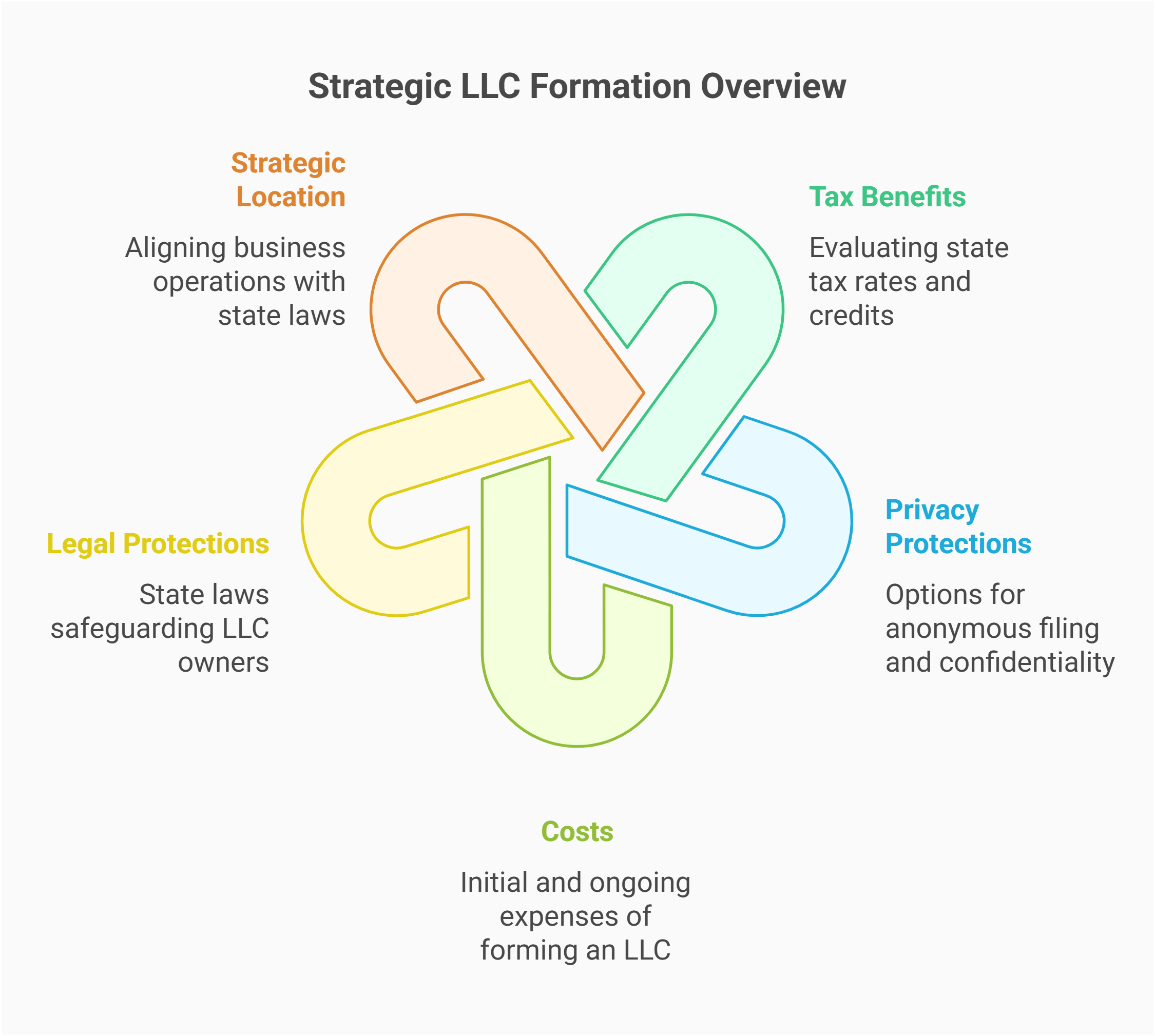

Choose the Best State to Form Your LLC: Key Criteria

The best state to form an LLC should fit how you plan to operate, spend, and grow, not just offer a catchy “business-friendly” label. Instead of chasing a generic top state, weigh a few core factors that shape your profit, risk, and day-to-day compliance. You can always refine your LLC name ideas and branding later, using practical LLC name examples and ideas as inspiration, but you’ll make a smarter decision if you start with the fundamentals below and, if needed, pair them with up-to-date data on LLC sizes and growth for deeper comparison.

- Costs of formation and maintenance: Compare initial filing fees, annual report charges, and recurring licenses so you know your real long-term cost to start an LLC and keep it active, and use a full breakdown of typical LLC costs to benchmark what you’re likely to spend in most states.

- Tax structure and benefits: Look at state income tax, franchise or gross receipts taxes, plus local add-ons together to see your true tax burden, instead of relying on “no state tax” headlines alone.

- Legal protections and liability shields: Prioritize states with strong LLC statutes, clear separation between personal and business assets, and courts that are experienced in handling business disputes.

- Privacy and public disclosure: Decide how much owner or manager information you’re comfortable putting into public records, and whether you prefer states that offer stronger privacy or more anonymous-style filings.

- Location and operational footprint: If most of your business happens in one state, forming there can help you avoid foreign registration, duplicate filings, and extra compliance costs as you grow.

Non-Residents and Foreign Business Owners: Choosing the Right State for LLC Formation

Expanding into the U.S. as a non-resident means dealing with new laws, tax rules, and practical hurdles like banking and documentation. The best U.S. states for non-resident LLC formation aren’t automatically the ones you see most often in forums, but the ones that fit how you’ll operate, get paid, and grow. Use the checklist below to compare popular options like Delaware, Wyoming, Nevada, or Florida and choose a state that truly supports foreign business owners rather than creating extra friction.

- State reputation and non-resident friendliness: Look for states with clear LLC laws, online filing systems, and a track record of working with overseas founders. Delaware, Wyoming, Nevada, and Florida are frequent starting points.

- U.S. tax exposure and treaty impact: Understand how your non-resident LLC will be taxed on U.S.-source income, when you must file with the Internal Revenue Service, and whether a tax treaty can reduce double taxation.

- Formation requirements and local support: Check what identification or documents you need from your home country and line up a reliable registered agent service, ideally one of the best registered agent services for LLCs, so you can form and maintain the LLC without a physical U.S. address.

- Banking, EIN, and payment flows: Confirm that you can obtain an Employer Identification Number, open a suitable U.S. or U.S.-friendly bank/fintech account, and receive payments smoothly from American customers.

- Long-term structure and business purpose: Clarify your business purpose for LLC, using clear LLC business purpose examples to express what you actually plan to do, where you expect to have customers or offices, and whether starting an LLC without a business as a “ready shell” makes strategic sense before a full launch. Or if it makes more sense to commit to a standard perpetual LLC structure from day one.

LLC Tax Basics When Choosing a State for Formation

Before you decide where to form your LLC, it helps to understand how your LLC will be taxed at the federal level and how your state choice can add extra layers like income, franchise, or gross receipts taxes. The IRS largely decides whether your LLC is taxed as a sole proprietorship, partnership, or corporation, but each state can still influence your total bill with its own rules and fees. Once you know whether you’ll run a single-member LLC, a multi-member LLC, whether it will be member-managed or manager-managed, or elect S Corporation or C Corporation status, you can match that plan with a state whose tax and fee structure won’t erode your profits. For deeper federal rules, you can always check the latest IRS guidelines on LLC classification.

LLC tax treatment vs. other structures

| Structure / Election | Default federal tax treatment | Typical Pros | Typical Cons |

|---|---|---|---|

| Single-member LLC (default) | Disregarded entity (sole prop) | Simple, pass-through taxation; easy for micro-businesses | All profit subject to self-employment tax; still owe state fees/reports |

| Multi-member LLC (default) | Partnership | Flexible allocations; pass-through avoids corporate-level tax | Requires partnership return; more complex allocations and agreements |

| LLC taxed as S Corporation | S Corporation (by election) | Potential self-employment tax savings; still pass-through in many respects | Strict ownership limits and rules; extra payroll and compliance requirements |

| LLC taxed as C Corporation | C Corporation (by election) | Easier to reinvest profits; may appeal to certain investors | Possible double taxation on dividends; more formal compliance |

| Traditional Corporation (C Corp) | C Corporation (default) | Strong for fundraising, especially with larger investors | Double taxation risk; rigid governance compared to many LLCs |

LLC Start-up Requirements by State

Starting an LLC involves different costs, processing times, and tax obligations depending on the state. Some states offer fast and affordable formation, while others require higher fees and ongoing compliance. Understanding these key differences helps entrepreneurs choose the best state for their business and avoid costly mistakes. Below, you’ll find a detailed comparison of LLC start-up requirements by state to help you make an informed decision.

| State | Start-up Cost | Ease | Processing Time | Ongoing Compliance | Income Tax Rates |

|---|---|---|---|---|---|

| Alabama LLC | $228 (Certificate of Formation $200 + online name reservation $28) | Medium | Online usually immediate; mail up to ~14 days | Hard – Business Privilege Tax due annually | Personal: 2%–5% Corporate: 6.5% |

| Alaska LLC | $250 (Articles of Organization) | Medium | Online same-day; ~10–15 business days by mail | Medium – Initial report due in 6 months; biennial report $100 | Personal: 0% Corporate: 0%–9.4% |

| Arizona LLC | $50 (Articles; $85 with expedite). Publication may apply outside Maricopa/Pima. | Medium | ~20 business days standard; ~3–5 business days with expedite | Easy – No ACC annual report | Personal: 2.5% (flat) Corporate: 4.9% |

| Arkansas LLC | $45 online ($50 by mail) | Medium | Online ~3–7 business days; mail ~2–3 weeks | Medium – Annual franchise tax $150 | Personal: up to 3.9% Corporate: up to 4.3% |

| California LLC | $90 ($70 Articles + $20 initial Statement of Information) | Hard | ~5–15 business days; 24-hour expedite available | Hard – Annual $800 LLC tax + gross receipts fee (if applicable) | Personal: 1%–12.3% (+1% MHO over $1M) Corporate: 8.84% |

| Colorado LLC | $50 | Easy | Immediate online | Medium – Annual Periodic Report $25 due in the 5-month window around the anniversary month | Personal: 4.40% (flat; 4.25% for TY2024) Corporate: 4.40% |

| Connecticut LLC | $120 | Medium | ~1–3 business days online; expedited available | Medium – Annual Report $80 due each year by end of anniversary month | Personal: 2%–6.99% Corporate: 7.5% (10% surcharge may apply) |

| DC LLC | $99 | Medium/Hard | Up to ~15 business days online; expedited 3-day or 1-day | Medium/Hard – Biennial Report $300 due Apr 1; business license often required | Personal: 4%–10.75% Corporate (franchise): 8.25% |

| Delaware LLC | $110 | Easy | ~10 business days standard; multiple expedited options | Medium – Annual franchise tax $300 due June 1 (no annual report for LLCs) | Personal: 2.2%–6.6% Corporate: 8.7% |

| Florida LLC | $125 | Medium | Typically 1–3 business days online (varies; see state processing dates) | Medium – Annual Report due May 1; $138.75 (late fee $400) | Personal: 0% Corporate: 5.5% |

| Georgia LLC | $110 (online) | Medium | ~7–10 business days online; 2-day, same-day & 1-hour expedite available | Medium – Annual registration due Jan 1–Apr 1; $60 online | Personal: 5.19% (flat) Corporate: 5.19% |

| Hawaii LLC | $51 (AoO $50 + $1 archives) | Medium | ~3–5 business days; 1-day expedite available (+$25) | Medium – Annual report due each anniversary quarter; $15 online | Personal: 1.4%–11% Corporate: 4.4%–6.4% |

| Idaho LLC | $100 online ($120 by mail) | Medium | ~5–7 business days online; optional 8-hr (+$40) or same-day (+$100) expedite | Easy – Annual report due by end of anniversary month; $0 | Personal: 5.3% (flat) Corporate: 5.3% |

| Illinois LLC | $150 | Medium | Standard ~10 business days; 24-hour expedited available | Medium – Annual report $75; due each year (can file up to 45 days before anniversary month) | Personal: 4.95% (flat) Corporate: 9.5% (7% + 2.5% replacement) |

| Indiana LLC | $95 | Medium | Online: ~1 business day; mail: ~2–3 weeks | Easy/Medium – Biennial Business Entity Report: $32 online / $50 mail (anniversary month) | Personal: 3.00% (flat, 2025) Corporate: 4.9% |

| Iowa LLC | $50 | Medium | Online: usually 1 business day (often same day); mail: ~1–3 weeks | Easy – Biennial Report: $30 online / $45 mail; due odd-numbered years by Apr 1 | Personal: 3.8% (flat, 2025) Corporate: 5.5% (flat) |

| Kansas LLC | $160 | Medium | Online: minutes (immediate approval); mail: a few business days | Medium – Biennial information report: $100 online / $110 mail; due Apr 15 (odd/even years by formation year) | Personal: 3.1%–5.7% Corporate: 4% + 3% surtax over $50k (top effective 7%) |

| Kentucky LLC | $40 | Easy/Medium | Online: immediate (often same day); mail: ~1–5 business days | Easy/Medium – Annual report $15; due by Jun 30 each year | Personal: 4% (flat) Corporate: 5% |

| Louisiana LLC | $100 | Hard | Online: ~3–5 business days; expedited: 24-hour ($30) or while-you-wait ($50) | Hard – Annual report $30; due each year by formation anniversary date | Personal: 3% (flat, 2025) Corporate: 5.5% (flat, 2025) |

| Maine LLC | $175 | Medium | ~15–20 business days standard; 24-hour (+$50) or while-you-wait (+$100) expedite | Medium – Annual report $85 due June 1 | Personal: 5.8%–7.15% Corporate: 3.50%–8.93% |

| Maryland LLC | $100 | Medium | Online ~7–10 business days; mail 6–8 weeks (rush options available) | Medium/Hard – Annual Report & Personal Property Return $300 due Apr 15 | Personal: 2%–6.5% Corporate: 8.25% |

| Massachusetts LLC | $500 (online $520) | Medium | Online typically 1–2 business days; mail about 1 week | Medium – Annual report $500 due on anniversary date | Personal: 5% (+4% surtax over threshold) Corporate: 8% |

| Michigan LLC | $50 | Medium | Online ~7–10 business days; mail ~4 weeks (expedite tiers available) | Easy – Annual statement $25 due Feb 15 | Personal: 4.25% Corporate: 6% |

| Minnesota LLC | $135–$155 | Medium | Online immediate; mail ~5–7 business days | Easy – $0 annual renewal due by Dec 31 | Personal: 5.35%–9.85% Corporate: 9.80% |

| Mississippi LLC | $50 | Easy | ~3–5 business days online | Easy – Annual report due Apr 15; $0 (online) | Personal: 0% on first $10,000; 4.4% above (TY 2025) Corporate: 4%–5% |

| Missouri LLC | $50 (online) / $105 (mail) | Easy | Immediate online; 4–6 weeks by mail | Easy – No annual report for LLCs | Personal: up to 4.7% (TY 2025) Corporate: 4.0% |

| Montana LLC | $35 | Medium | ~5–6 business days online (24-hour / 1-hour expedite available) | Medium – Annual report due Apr 15; fee waived for 2025 (normally $20) | Personal: 4.7%–5.9% Corporate: 6.75% |

| Nebraska LLC | $100 online + required newspaper publication (~$40–$250) | Hard | ~2–3 business days online; 1–2 weeks by mail | Medium – Biennial report due Apr 1 in odd years; ~ $25 online | Personal: 2.46%–5.20% (TY 2025) Corporate: 5.20% |

| Nevada LLC | $425 (Articles $75 + Initial List $150 + State Business License $200) | Medium/Hard | ~1 business day online; 24-hour / 2-hour / 1-hour expedite options | Hard – Annual list $150 + business license $200 due each year | Personal: 0% Corporate: 0% (Commerce Tax may apply > $4M receipts) |

| New Hampshire LLC | $100 | Medium | ≈1 week online; 2–3 weeks by mail; same-day in person | Medium – Annual Report $100 due Apr 1 | Personal: 0% Corporate (BPT): 7.5% |

| New Jersey LLC | $125 | Medium | ≈1 business day online; 5–7 days by mail | Medium – Annual Report $75 due by end of anniversary month | Personal: 1.4%–10.75% Corporate: 9% |

| New Mexico LLC | $50 | Easy | 1–3 business days online; ~2–3 weeks by mail | Easy – No annual/biennial LLC report | Personal: 1.7%–5.9% Corporate: 5.9% |

| New York LLC | $200 (state filing) + mandatory publication (varies by county) | Hard | Online: immediate to ~7 business days; mail: 2–3 weeks; expedited available | Medium – Biennial Statement $9 every 2 years (anniversary month) | Personal: 4%–10.9% Corporate: 6.5% (7.25% > $5M base through 2027) |

| North Carolina LLC | $125 | Medium | 2–5 business days online; 2–3 weeks by mail; 24-hour ($100) or same-day ($200) expedite | Medium – Annual Report $200 due Apr 15 | Personal: 4.25% (flat) Corporate: 2.25% |

| North Dakota LLC | $135 | Easy | ~30 days (online; no expedite available) | Easy – Annual report $50 due Nov 15 | Personal: 0%–2.5% (2025) Corporate: 1.41%–4.31% |

| Ohio LLC | $99 | Medium | ~3–7 business days standard; expedited 2-day / 1-day / 4-hour options | Easy – No state LLC annual report; maintain statutory agent | Personal: 0%–3.125% (2025) Corporate: None; CAT 0.26% on gross receipts > $6M |

| Oklahoma LLC | $100 | Medium | Online ~1 business day; 7–10 days by mail | Medium – Annual certificate $25 due each year (anniversary month) | Personal: 0.25%–4.75% Corporate: 4% |

| Oregon LLC | $100 | Medium | Online ~1–3 business days; mail ~2–3 weeks | Easy – Annual report $100 due each year | Personal: 4.75%–9.9% Corporate: 6.6%–7.6% |

| Pennsylvania LLC | $125 | Medium | ~5–10 business days online (typical) | Easy – Annual report $7 due Sept 30 | Personal: 3.07% (flat) Corporate: 7.99% (2025) |

| Rhode Island LLC | $150 | Medium | Online: ~3–4 business days; mail: ~2 weeks | Medium/Hard – Annual report $50 due Feb 1–May 1 + $400 annual entity-level tax | Personal: 3.75%–5.99% Corporate: 7% |

| South Carolina LLC | $110 | Medium | Online: ~24 hours; mail: ~2–3 business days | Easy – No SOS annual report for LLCs (unless taxed as a corporation) | Personal: 0%–6.0% (TY 2025) Corporate: 5% |

| South Dakota LLC | $150 | Easy | Online: Immediate; mail: ~1 week | Easy – Annual report $55 due by last day of anniversary month | Personal: None Corporate: None |

| Tennessee LLC | $300–$3,000 (member-based) | Medium | Online: Immediate; mail: 3–5 business days after receipt | Medium – Annual report due 1st day of 4th month after FY end; $300 min + $50/member over 6 (max $3,000) | Personal: 0% Corporate (excise): 6.5% |

| Texas LLC | $300 | Medium | Online: ~10–15 business days (typical); expedited available; mail: ~2–3 months | Easy – Annual franchise tax & PIR due May 15; no-tax-due threshold ~$2.47M; rates 0.375%–0.75% | Personal: None Corporate: None (franchise tax applies) |

| Utah LLC | $59 | Medium | 7–10 business days (state guidance) | Easy – Annual renewal $18 due by last day of anniversary month | Personal: 4.50% (flat) Corporate: 4.50% (flat) |

| Vermont LLC | $125 | Medium | ~1 business day online; ~2–3 weeks by mail | Medium – Annual report $35 due each year (often by Mar 31 for calendar filers) | Personal: 3.35%–8.75% Corporate: 6%–8.5% |

| Virginia LLC | $100 | Medium | ~2–3 business days online; ~2–3 weeks by mail | Medium – Annual registration fee $50 due by last day of anniversary month | Personal: 2%–5.75% Corporate: 6% |

| Washington LLC | $290 | Medium | ~2 business days online; ~2–3 weeks by mail | Medium – Annual report $60 (anniversary month); B&O gross-receipts tax may apply | Personal: None Corporate: None |

| West Virginia LLC | $130 | Medium | 5–10 business days standard; expedited (1-hour/2-hour/24-hour) options | Medium – Annual report $25 due by June 30; one-time $30 Business Registration Certificate | Personal: 2.22%–4.82% (2025) Corporate: 6.5% |

| Wisconsin LLC | $130 online ($170 by mail) | Medium | Immediate online; ~2 weeks by mail; optional $25 next-business-day expedite | Medium – Annual report $25 online ($40 mail) due by end of anniversary quarter (Mar 31 / Jun 30 / Sep 30 / Dec 31) | Personal: 3.50%–7.65% Corporate: 7.9% |

| Wyoming LLC | $100 (Articles of Organization; +$3.75 online convenience fee) | Medium | Immediate online; up to ~15 business days by mail | Medium – Annual Report License Tax: minimum $60 or 0.0002 × WY assets; due 1st day of anniversary month | None |

Privacy and Asset Protection: Which States Are Best?

If privacy is a priority, not every state will work the same way for your LLC. Some states keep owners off public records, which can reduce unwanted attention and help protect your personal assets when choosing the best state to start an LLC with anonymity in mind.

- Top privacy-focused states: Wyoming, New Mexico, and Nevada are often chosen for “anonymous-style” LLCs, where public records usually show the registered agent and company details, not the individual owners.

- State rules differ: Other states may require members or managers to be listed on public filings, which limits your anonymity and can expose more personal information than you expect.

- Always confirm current law: Before you file, review the latest requirements for articles of organization and annual reports so you do not accidentally lose privacy through a mandatory public disclosure rule.

FAQ – Common Questions About LLC Formation

Below are concise answers to frequent queries from prospective LLC owners. Use them as a springboard while you weigh deciding factors like location, cost, and operational goals.

Which state is the cheapest to form an LLC?

It’s often said that Wyoming or Kentucky stand out for affordability, though actual LLC cost by state varies once local permits and miscellaneous fees enter the picture. If you only factor in a basic filing fee, you might save in certain places, but always check if there’s an ongoing business license or extra compliance step that inflates the total.

Which state is the most expensive for LLCs?

Many consider California to be among the priciest, largely due to its recurring franchise taxes and steep annual charges. You might also find states like New York have multiple mandatory steps, including newspaper publication, so watch for details that bump your overhead beyond the standard baseline.

What happens if I do business in multiple states?

You’ll generally need to form an LLC in one state, then file as an LLC as a foreign entity in other regions. This might impose added annual fees or separate licensing demands, so approach multi-state expansion carefully. Also note that each location has distinct laws regarding operating agreement requirements, so adapt your plan accordingly if you’re crossing state lines for marketing, warehousing, or service delivery.

Do I need to set up an LLC in each state where I do business?

You don’t typically launch a brand-new entity in every single state, but you do register your existing LLC whenever you cross into new territory for official operations. That ensures you maintain legal standing for forming an LLC across borders. If you skip it, local agencies can penalize you or restrict your ability to enforce contracts there.

Which states in the U.S. are tax-free for an LLC?

While no region is entirely “tax-free,” a few states skip key levies such as sales tax or personal income obligations. Wyoming, South Dakota, and Nevada sometimes get called “zero tax states,” but owners must still pay taxes at the federal level. Additionally, local conditions like franchise tax might apply, so dig deeper to confirm you’re not incurring hidden costs.

Which state is best for non-US LLC?

Wyoming often tops the list for foreign founders seeking minimal disclosure, while Delaware remains favored for well-defined corporate law. Nevada, too, draws international entrepreneurs with its straightforward approach. Ultimately, weigh asset protection, fees, and your prospective client base to see which region’s rules accommodate your global strategy effectively.

Nevada LLC vs. New Mexico LLC: How to Choose the Best State for Your Business?

A New Mexico domestic LLC stands out for anonymity, letting you form an entity without listing owners publicly. Nevada, on the other hand, is known for lenient tax rules and a pro-business stance that fosters expansions. If you crave secrecy above all, pick New Mexico’s approach. Alternatively, if you prioritize minimal burdens for compliance or more flexible rules for forming an LLC with advanced benefits, Nevada usually wins out for many organizations.

Colorado vs. Delaware LLC: Which State is Ideal for Your Business Needs?

Colorado tends to offer moderate LLC cost by state plus an active local economy that supports diverse ventures. Meanwhile, Delaware stands unmatched in its tested corporate law, ensuring swift conflict resolution if disputes arise. For smaller local operations, Colorado’s relaxed vibe can suffice. If you anticipate searching for big investors or want recognized legal protection, you might lean toward an LLC in Delaware for peace of mind.

- Internal Revenue Service: Single-Member LLCs (disregarded entity)

- Internal Revenue Service: Form 8832 – Entity Classification Election

- U.S. Small Business Administration: Pick your business location

- U.S. Small Business Administration: Register your business

- Delaware Division of Corporations: How to form a business entity

- Wyoming Secretary of State: Annual Report License Tax Rules

- Texas Comptroller: No Tax Due Reporting For Report Year 2024 And Later

- Florida Division of Corporations (Sunbiz): Florida Limited Liability Company

- California Franchise Tax Board: Limited liability company

Stay Compliant No Matter Where You Incorporate

Harbor Compliance provides tailored LLC formation services, ensuring you meet state-specific regulations effortlessly.