Want to save more on taxes and protect your business income? Choosing a limited liability company (LLC) could be one of the smartest financial decisions you make. This structure delivers powerful tax benefits, helping business owners to reduce their tax liability, simplify filings, and stay flexible as the company grows.

LLCs offer pass-through taxation, flexible tax classification, and access to a wide range of deductible business expenses – helping owners avoid double taxation and reduce liability. By understanding these benefits, you can cut costs, increase savings, and stay compliant with the Internal Revenue Service (IRS).

In this guide, we’ll walk through how LLC owners are taxed, when to elect S corporation status, how to reduce employment tax, and what kinds of business expenses can lower your taxable income. You’ll also see how an LLC compares with other structures like a sole proprietorship or corporation. If you're aiming for greater tax flexibility and legal protection, this breakdown will help you get the most out of your business entity.

Pass-Through Taxation: How LLCs Avoid Double Taxation

One of the most valuable features of limited liability companies is their use of pass-through taxation where the business profits can completely skip corporate level taxes. Instead, profits are taxed once – on each member’s income tax return – allowing LLC owners to avoid double taxation to a significant extent and simplify their federal tax obligations.

What Is Pass-Through Taxation for LLCs?

Pass-through taxation means your LLC’s profits and losses don’t get taxed at the entity level. Rather than the firm being taxed, the money “passes through” to the owners who report it on their personal tax returns. This arrangement does away with corporate taxes and makes it easier for you to report your business earnings to the Internal Revenue Service. You can read the official IRS definition of an LLC to better understand how this structure operates under federal tax law.

If your company has only one member, then it is a disregarded entity. Therefore, it is not separate from its owner for tax purposes according to the IRS. You can read more about what it means for a single-member LLC to be a disregarded entity and how this classification affects your tax filing. In contrast, multi-member limited liability companies are taxed like a partnership, where each member receives a share of profits and losses based on ownership percentage.

Single vs. Multi-Member LLC Tax Treatment

LLCs are treated differently by the IRS depending on whether they have one or multiple members. A single-member LLC is a disregarded entity and is taxed the same way as a sole proprietorship. If you want to understand what a single-member LLC is and how it differs from other structures, it’s important to look at its tax treatment and liability protections. All business earnings will simply be reported on the owner’s personal tax return. On the other hand, a multi-member LLC is taxed as a partnership at the federal level. To report each member's share of profits and losses, it must file a separate IRS form and issue Schedule K-1 to each member. The way you set things up has a distinct impact on how you will report it, file it and ultimately pay tax.

Here’s how tax filing differs:

- Single-Member LLC

- Reported on Schedule C of your personal income tax return

- No separate federal form required

- Still responsible for self-employment taxes

- Multi-Member LLC

- Must file IRS Form 1065

- Each member receives a Schedule K-1

- Income is split based on ownership percentages

LLC Pass-Through Taxation vs Corporate Double Taxation

Unlike corporations, LLCs don’t face double taxation. The company doesn’t pay tax on its profit because of pass-through taxation, which generally follows the LLC tax rates set at the federal and state levels. As a result of this, the profits, which are typically double taxed, are not taxed at the corporate level. Rather, they are passed directly by the owners to their personal tax returns. They also pay federal tax based on their individual brackets. This model helps LLC owners retain more of their earnings.

On the other hand, a standard corporation pays corporate income tax at the entity level. After that, individuals pay taxes again when profits are paid out to shareholders as a dividend. One example is a C Corp, which pays 21% corporate tax. The shareholders pay another 15% tax on dividends, which erodes overall taxes.

Tax Flexibility: Choosing Your LLC's Tax Classification

The flexibility of the tax treatment of an LLC is one of its most powerful tax benefits. Unlike corporations that are forced to take default treatment, LLC owners can choose to be taxed as a sole proprietorship, partnership, S corporation, or even as a C corporation if this maximizes their savings.

Default IRS Tax Classifications for LLCs

The IRS generally classifies LLCs into tax classifications based on how many members it has. A single-member LLC is a disregarded entity and taxed like a sole proprietorship. Consequently, the profit and loss report on the owner’s personal tax return. Conversely, a multi-member LLC defaults to being taxed as a partnership. You must file IRS Form 1065 as a partnership structure and issue each member a Schedule K-1 to report their share of business income. The default options offer flexibility at baseline levels, which can be changed through proper submission of tax election forms to the IRS.

Electing S Corporation Status for Tax Savings

Choosing to have your LLC taxed as an S corporation can result in significant self-employment tax savings. You only have to pay these tax on your salary, and not the whole business income. The remainder may be classified as distributions, which are not subject to employment tax, allowing many LLC owners to reduce their overall tax burden while complying with the Internal Revenue Service. Learn more about how to pay yourself from an LLC correctly based on your structure and classification.

To execute the switch, you will have to fill out IRS Form 2553 and ensure you are paying yourself a “reasonable salary” for the work performed. This election does not change the structure of your business but does change how your earnings are taxed, giving you more control.

When to Consider C Corporation Election

Some owners of LLCs might benefit by electing to be taxed as a C corporation if they would like to keep the profits in the company. A C Corp structure offers a larger range of expenses which can be deducted such as health insurance and fringe benefits; C Corporations also often have a lower corporate tax rate. Nevertheless, it also causes double taxation, so this choice makes the most sense for companies with higher income or long-term capital strategies.

The 60-Month Rule and Tax Election Changes

After your LLC makes a choice for its tax classification, the IRS will restrict how often you can change it. According to the 60-month rule, switching tax elections again for the next five years isn’t possible unless a qualifying event occurs, such as a significant change in ownership or structure of the business. This rule prevents entities from switching tax treatments to reduce tax liability.

The IRS may agree to the exception if your company has a legitimate reason for the change, such as the addition of new members or a shift in long-term strategies. To start a new election, the appropriate IRS form must be submitted with clear documentation justifying the reason for the change of entity.

Business Tax Deductions Available to LLC Owners

With smart use of tax deductions, you can significantly reduce LLC owners’ taxes to the IRS. A limited liability company can write off a wide variety of costs throughout the year, including day-to-day business expenses, equipment purchases, office space, and more. When deductions are claimed properly, it can help lower the LLC’s taxable income and improve profitability at the end of the year.

Unlock Tax Savings with ZenBusiness

ZenBusiness helps you structure your business the smart way—whether that means forming an LLC or electing S Corp status to cut down self-employment taxes.

Common LLC Business Expense Deductions

As long as the expenses are ordinary and necessary in carrying on the business, LLC owners can reduce their taxable income with a wide range of deductions. Deductible expenses such as renting workspace and paying contractors will often lower your tax liability and improve your financial outcomes.

Accurate documentation is critical. The IRS requires LLCs to track and support every deduction by receipts, logs or other electronic records. Using the right techniques for deducting qualified expenses whether you are starting your own business or scaling an existing one gives you a practical and legal approach to ensuring you optimize your income tax return.

Here are common deductible business expenses for LLCs:

- Rent or lease payments on office or equipment

- Wages, salaries, and contractor payments

- Advertising and marketing costs

- Business insurance premiums

- Professional services (legal, accounting, etc.)

- Office supplies and materials

- Utilities and internet services

- Travel and lodging for business purposes

- Education and training related to your trade

- Depreciation on qualified business assets

Home Office and Equipment Write-Offs

If you run your LLC from your home, the IRS lets you deduct home office expenses if that space is used totally for business. There is a simplified method (a flat rate per square foot) and an actual expenses method (a percentage of your rent, utilities, and insurance). You may also deduct equipment depreciation for larger items such as computers or machinery and other bigger purchases. These strategies allow llc owners to reduce their taxable income, while also complying with IRS rules.

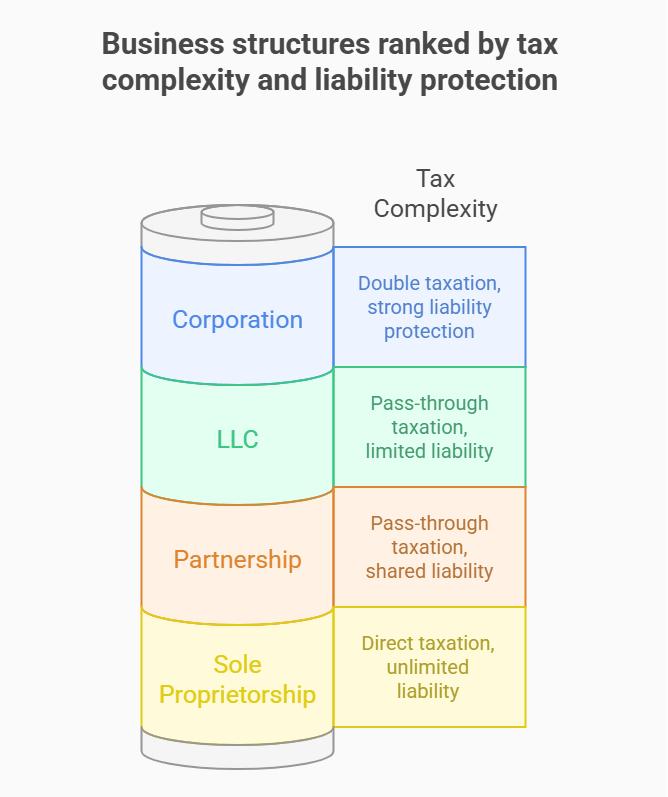

LLC vs. Other Business Structures: Tax Comparison

When you are going to choose a business structure, it is essential to understand tax treatment of various entities. LLCs are more tax flexible and give stronger liability protection compared to sole proprietorships or corporations. In the following sections, we will discuss the differences between the tax benefits of forming an LLC versus other formations to help you choose.

LLC vs. Sole Proprietorship Tax Benefits

A sole proprietorship is the simplest business structure. But it offers little personal liability protection or tax option flexibility. There is no differentiation of personal and business expenses, and all income is taxed as the owner’s income. Moreover, sole proprietors are personally responsible for all debts and lawsuits, which makes them financially riskier. If you're wondering whether forming an LLC is necessary for your new business, it's worth evaluating the long-term benefits of liability protection and flexibility.

When compared to an LLC, you will have limited liability and several more advanced tax deductions, including a home office write-off and equipment depreciation. It will also increase your credibility with banks, customers, and investors. For a deeper dive into how a single-member LLC compares to a sole proprietorship in practice, explore key tax and liability differences that can impact your long-term goals. This makes it a smarter decision for business owners who want to grow while protecting their personal assets.

LLC vs. Corporation Tax Advantages

LLCs and corporations both offer liability protections – but they differ significantly when it comes to taxes. LLCs benefit from something called pass-through taxation. This means that profits will go directly on the owner’s personal income tax returns. A corporation, however, pays corporate income tax and its shareholders must pay tax on dividends, which amounts to double taxation. If you're choosing between these two structures, here’s the LLC vs. S corp tax structure explained here to help guide your decision. When choosing a tax classification, your priority may be focused on minimizing taxes, retaining earnings, or maximizing flexibility (due to changing structure). You can explore a broader comparison between an LLC and a corporation to see which structure matches your business’s legal and financial priorities.

LLC vs. Corporation Tax Comparison:

| Feature | LLC | Corporation |

|---|---|---|

| Tax Structure | Pass-through taxation | Double taxation (C Corp) |

| Federal Tax Filing | Individual returns (Form 1040) | Corporate return (Form 1120) |

| Flexibility | High (can elect S or C Corp) | Low (C Corp unless S elected) |

| Self-Employment Tax | Yes (unless S Corp elected) | Only on wages |

| QBI Deduction Eligible | Yes | No |

| Dividend Taxation | No (unless C Corp elected) | Yes |

| Retained Earnings Option | Limited | Strong |

| Fringe Benefits | Limited | Broader and deductible |

LLC vs. Partnership Tax Differences

LLCs and general partnerships might look the same at first glance because they both use pass-through taxation and do not have to pay corporate income tax at the level of the entity. Each of the owners reports their respective share of profits and losses on their personal income tax returns. Thus, both options make a great choice for a small business with a preference for simplicity. However, if you’re also comparing these options to corporations, here’s the difference between an LLC and a corporation in terms of structure and compliance to help you evaluate all sides.

But, LLCs protect your personal assets better than C-Corps. In a traditional partnership each partner is responsible personally for the debts and legal issues of the business. An LLC, on the other hand, legally separates a business from its owners, making it more secure and flexible. For protection, it also needs more formal documents, such as an operating agreement and state filings.

Self-Employment Tax Considerations for LLC Members

Although LLC owners receive certain tax benefits, they are required to pay self-employment taxes on their share of business income. This section explains when and how these taxes that apply. Some tax classifications, especially electing S corporation status, can reduce your employment tax liability and increase your take-home profits.

When LLC Members Pay Self-Employment Tax

LLC members who show an active role in running the business activity are regarded as self-employed and are liable to pay self-employment taxes. These taxes cover Social Security and Medicare contributions. Importantly, these taxes will be applied to the member’s full share of business income, so not just distributions. The default rate is 15.3%, which includes the employer and employee portions.

Investors or members who do not materially participate may be exempt from this requirement. Nonetheless, that will depend on your tax classification, level of involvement, and the structure of your business. Knowing these thresholds is important in order to remain compliant with IRS guidelines and to avoid an unexpected tax liability.

Strategies to Minimize Self-Employment Tax

LLC owners can take specific steps to reduce their self-employment taxes without stirring up the Internal Revenue Service. These strategies are especially useful for business owners with increasing profits who want to legally manage their employment tax exposure. Selecting the correct tax classification is important but so is planing deductions and income. Learn how LLC distributions affect self-employment tax and reporting to avoid costly surprises. Whether you run a single-member LLC or have a growing team, planning allows you to keep more of your business income and invest back into your business instead of overpaying on taxes.

Here are effective ways to reduce self-employment tax:

- Elect S corporation status and take a reasonable salary

- Maximize deductible business expenses

- Use retirement plans like a Solo 401(k) or SEP IRA

- Split income between wages and distributions

- Track all eligible home office and equipment write-offs

Asset Protection Benefits Beyond Tax Savings

In addition to tax benefits, LLC formation also provides strong legal protection. A limited liability company protects your personal assets from business debts or lawsuits. If you’re still unsure what an LLC actually is and how it works, it helps to understand its hybrid structure, offering corporate-style protection with sole proprietorship-style taxation. This separation between your business and personal finances offers an added layer of financial security; more so with high-risk businessmen.

How LLCs Shield Personal Assets from Business Debts

One of the most important features of an LLC is that it separates personal assets from business obligations. Owning a limited liability company generally protects your personal savings, home and vehicle from any lawsuit or company debt. This protection allows people to take risks without fear of losing everything.

However, this protection isn’t absolute. If you mix funds, commit fraud or fail to keep proper records, a court may “pierce the corporate veil”. That is, LLC owners may be found personally liable. In that case, the liability barrier disappears, exposing the owners’ personal assets to business claim or judgment.

Corporate Veil Protection for LLC Members

LLC members are offered what’s called corporate veil protection, shielding their personal assets from liability. To ensure the viability of the barrier, the company must be treated as a separate legal entity. It means that you need to keep clear financial records, use dedicated business bank account and follow the state filing and compliance rules. If the standards are not met, courts may expose the members of a company to personal liability for debts or claims against the business by piercing the veil.

Charging Order Protection Against Creditors

A creditor could target the owner’s interest in the business if the LLC owner is personally sued. However, most states offer charging order protection that limits the creditor to the owner’s share of distributions — not control or management over the company. This means that the creditor cannot compel the LLC to sell off assets or property to pay the debt.

Rather, the creditor will get paid only if and when the LLC pays out profits. In many cases, this makes aggressive legal action less appealing, as the creditor could be left waiting indefinitely. The level of this protection differs from state to state, so business owners must understand the local laws and structure their LLC properly.

Qualified Business Income Deduction for LLCs

Can you give us a moment to consider potential deductions? One of the more important tax benefits LLC owners receive is the Qualified Business Income (QBI) deduction as part of the Tax Cuts and Job Act. This provision lets qualifying pass-through businesses deduct up to 20% of their business incomewithout changing their business structure and saving a significant amount of tax.

Understanding the Section 199A QBI Deduction

The Section 199A deduction, also known as the Qualified Business Income deduction, was created under the 2017 Tax Cuts and Jobs Act. With this provision, specific LLC owners can take a deduction of as much as 20% from their qualified business income. As a result, this lowers their total taxable earnings without requiring them to change their overall business structure. This applies to most pass-through entities, like sole proprietorships, partnerships, and S corps.

To qualify, the enterprise must earn domestic income and not be in a restricted service group above certain income thresholds. If eligible, the deduction is taken directly on the owner’s personal tax return, which can greatly reduce their federal income tax liability.

How LLC Owners Qualify for the 20% Deduction

In order to get the QBI deduction, the owners of the LLC must run a domestic business that runs like a pass-through entity. This includes LLCs, partnerships, and S corporations, where the income passes to the tax return of the owner.

Eligibility is also tied to income limits. For 2024, full deductions apply to single filers earning under $191,950 and joint filers under $383,900. Above those thresholds, specified service trades like law, consulting, and healthcare may face partial deductions, or none at all.

Frequently Asked Questions About LLC Tax Benefits

LLC tax rules can get confusing, especially for first-time business owners. This FAQ section answers the most common questions about how LLCs save on taxes, how deductions work, and what to expect with IRS compliance. Clear answers here can help you make more confident tax decisions.

What Is the Biggest Tax Advantage of an LLC?

The biggest tax advantage of an LLC is pass-through taxation, where profits go directly to the owner’s personal income tax return. This allows the business to avoid double taxation, unlike C corporations, which pay both corporate tax and shareholder tax on dividends—saving LLC members significantly on annual tax obligations.

If you’re ready to launch your own LLC, here’s a complete guide on how to start one in 2025, from state registration to compliance tips.

Do LLCs Pay Federal Income Tax?

LLCs typically don’t pay federal income tax as separate entities. Instead, the business income passes through to the owner’s personal tax return, and each member pays taxes on their share of the profits. This structure avoids double taxation and simplifies the process compared to traditional C corporations with corporate-level tax obligations.

Can LLCs Be Tax-Exempt?

LLCs themselves cannot be tax-exempt, since they are considered pass-through entities. However, an LLC can be owned by a tax-exempt organization such as a nonprofit or charity. In those cases, special rules apply, such as limitations on activities and income types to maintain the parent organization’s tax-exempt status under IRS regulations.

If you’re confused between forming a legal entity or just using a trade name, this breakdown of the differences between an LLC and a DBA can help you clarify the right choice for your business model.

How Do LLC Tax Rates Compare to Personal Tax Rates?

LLC income is taxed at the owner’s individual tax rate, not a separate corporate rate. This means your profits are added to your personal income and taxed accordingly. In addition to federal and state income tax, most LLC members must also pay self-employment taxes, which cover Social Security and Medicare contributions.

Are There LLC Tax Loopholes to Consider?

While LLCs offer several legitimate tax strategies, there are no “loopholes” in the shady sense. Structuring as an S corporation, maximizing deductions, or splitting income can legally lower taxes—but must follow IRS rules. Pushing gray-area tactics can trigger audits or penalties. Always seek guidance from a qualified tax professional to stay compliant while making the most of your tax benefits. You can also review the SBA’s official guide to choosing the right business structure if you're still deciding between an LLC, corporation, or another setup.

How Are Foreign Members of an LLC Taxed on U.S. Income and What Withholding Rules Apply?

Foreign LLC members earning U.S. business income are subject to U.S. tax and withholding requirements. Under FIRPTA and other IRS rules, non-resident members must report and pay tax on their U.S.-source income. Withholding rates typically start at 30%, though tax treaties may reduce that amount. Proper EIN registration and Form W-8BEN are required to ensure compliance and apply treaty benefits where available.

Resources for LLC Tax Benefits

Want to stretch your profits further? These authoritative guides and official resources explain how LLCs deliver tax flexibility, legal protection, and strategies to keep more of what you earn.

- SBA – Choose a Business Structure (sba.gov)

Explains how LLCs enable pass-through taxation and limited liability protection in contrast to other business structures. - Shopify Business Blog – 4 Tax Benefits of an LLC (shopify.com)

Easy-to-follow list of benefits: pass-through taxation, QBI deduction, flexible income allocation, and deductible operating costs. - Finally – LLC Tax Benefits Overview (finally.com)

Highlights key advantages: avoiding double taxation, QBI deductions, and reducing self-employment tax liability. - FileForms – Benefits of Forming an LLC (fileforms.com)

A deeper dive into how LLCs offer tax advantages through default versus elective tax classifications and actionable savings strategies.

Choosing an LLC isn’t just a legal safeguard, it’s a smart financial move. These resources walk you through how to capture tax savings legally, make strategic elections like S corp status, and structure deductions that fit your business.

Harbor Compliance Helps You Build Tax-Efficient Structures

Get expert help choosing the right entity for your tax goals—Harbor Compliance supports LLCs, S Corps, and more.