Isn’t paperwork supposed to protect a business, not end it? That’s the trap with the North Carolina annual report—miss one deadline, and a thriving limited liability company can vanish from public record. It’s not about intention, it’s about execution. One form, one mistake, and you’re suddenly no longer in good standing.

North Carolina requires all LLCs to file their annual report by April 15 or the 15th day of the 4th month after their fiscal year ends. The cost to file is $200 online or $25 by mail using the official paper form CD-479.

Choosing the wrong annual report service, ignoring filing instructions, or failing to download forms correctly can trigger penalties for late filing. This guide clarifies who must file, how to file your North Carolina report correctly, and why administrative dissolution happens more often than most business owners realize. Because in this system, the Carolina Department of Revenue doesn’t care how passionate the founder is—only how accurate the annual report filing was.

What Is a North Carolina Annual Report?

The north carolina annual report is a mandatory filing that keeps your business information current with the state of North Carolina. This crucial document ensures your company maintains its legal status and good standing with state authorities. Moreover, many founders wonder if can you start an LLC and not use it before committing to a full business plan, and the answer may surprise you.

Purpose of NC Annual Reports

Annual reports serve as official updates to the state about critical aspects of your business operations. They fulfill both legal requirements and provide practical benefits for business owners in North Carolina.

- Verifies and updates registered agent information

- Confirms current business address and contact details

- Updates officer/member/manager information

- Maintains accurate ownership records

Beyond compliance, filing your report demonstrates your commitment to transparency and helps maintain your business's legal protection status in the eyes of regulators and potential partners. Understand how the period of existence LLC designation affects your company’s longevity.

Who Must File an Annual Report in North Carolina?

Most business entities operating in North Carolina has the requirement to file periodic reports, though specific requirements vary by organization type. The North Carolina Secretary of State requires regular filings to maintain accurate business records and ensure compliance with state regulations.

| Entities Required to File | Entities Generally Exempt |

|---|---|

| Domestic LLCs | Sole Proprietorships |

| Foreign LLCs | General Partnerships |

| Domestic Corporations | Certain Nonprofits |

| Foreign Corporations | Some Professional Associations |

| Limited Partnerships | Specific Religious Organizations |

For those in health or legal fields, compare pllc vs LLC North Carolina to choose the right structure.

Differences Between LLC and Corporation Reports

When dealing with an LLC annual report versus corporation filings, you'll find several common elements. Both require current business address information, registered agent details, and must follow similar submission protocols to the Carolina Secretary of State office. Both entity types must adhere to state-mandated schedules.

The limited liability company report typically requires member or manager information, while a C corporation must provide details about directors and officers. Corporations often need more extensive financial disclosures, and the report fee structure may differ depending on your business structure and filing method chosen.

Key NC Annual Report Deadlines and Fees

Missing your annual report due date can trigger serious consequences for your business. Understanding the specific filing fee amounts and deadline requirements is essential to avoid costly penalties and maintain your company's legal status in North Carolina. To compare costs across jurisdictions, review typical LLC annual fees in other states to ensure you’re getting the best value.

Due Dates by Entity Type (LLC, Corporation, Nonprofit)

For most businesses, the due date for annual report submission depends on your entity type and formation date. Limited liability companies must file their reports by the April 15 deadline each year to stay compliant with state regulations.

| Entity Type | Annual Filing Deadline | Extended Deadline Options |

|---|---|---|

| LLCs | April 15 | None available |

| Corporations | 15th day of the 4th month after fiscal year end | Available with request |

| Nonprofits | May 15 | Extension possible |

| Foreign Entities | Based on NC registration date | Varies by situation |

For more detailed information about specific annual report due dates, you can visit the North Carolina Secretary of State's official due date page.

Corporations follow a different schedule, typically based on their fiscal year end date, while nonprofit organizations have their own specific requirements governed by both state agencies and federal tax regulations.

Annual Report Filing Fees and Payment Methods

The annual report costs vary by entity type and filing method. For standard LLCs, expect to pay $200 each year when filing through the Secretary of State's office. To save money, consider online submission which costs $20 online versus $25 mail for paper submissions. Most businesses find the online method more efficient, as it also provides immediate confirmation. The North Carolina Department of Revenue and Secretary of State accept credit cards, electronic checks, and bank transfers for online payments, while paper filings can be paid by check or money order. For detailed LLC fee information, check the official fee schedule.

What Happens If You Miss the North Carolina Filing Deadline?

When you miss the deadline to file your North Carolina annual report, immediate penalties for late filing begin to accrue. Your business will first be marked as delinquent and may incur financial penalties that increase with time, potentially adding hundreds of dollars to your standard annual report fee.

If left unresolved, your company risks being administratively dissolved or revoked by the state. A dissolved entity loses its legal protections, cannot legally conduct business, and may face additional complications with contracts, banking, and licensing. To restore your standing, you'll need to file a delinquent annual report and pay all outstanding fees before applying for reinstatement.

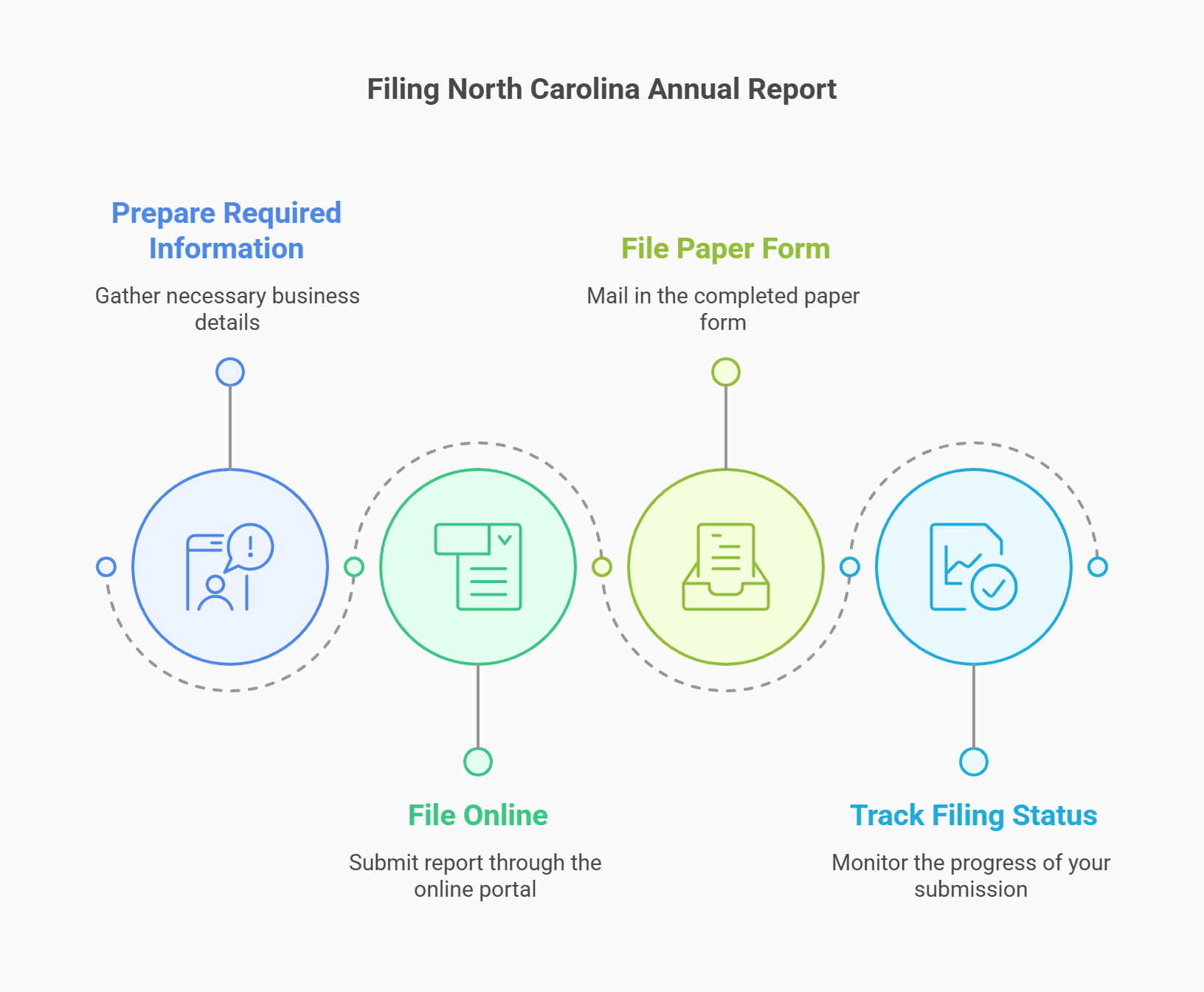

Step-by-Step Guide to Filing Your NC Annual Report

Following a proper step-by-step guide ensures you'll complete your North Carolina annual report accurately and efficiently. This methodical approach helps avoid common errors that could delay processing or create compliance issues for your business. For statistical information about filings, the NC Department of Revenue provides helpful insights.

Step 1: Preparing the Required Information

Before starting the actual filing process, gather all essential information required by the North Carolina Department of Revenue and Secretary of State. If you need a step‑by‑step walkthrough, check out the best way to start an LLC for beginners.

This preparation step saves time and prevents frustrating interruptions during the submission process.

- Current business name and identification numbers

- Registered agent name and address

- Principal office address

- Names/addresses of members, managers, or officers

- Business activities description

Having this information organized and verified ensures your annual report filing will proceed smoothly, whether you choose online or paper submission methods. You can also perform an ein search by company name if you’ve misplaced your EIN documentation.

Step 2: How to File Your North Carolina Annual Report Online

To file a North Carolina annual report electronically, start by visiting the Secretary of State's official website and navigating to the business registration section. Create an account or log in to your existing profile to access the filing portal.

Enter your business information in the required fields, following the filing instructions carefully. The system will guide you through entering your company details, registered agent information, and other required data based on your business type. If you’re unfamiliar with this role, learn exactly what is a registered agent service and why it matters.

Review all information for accuracy before submitting payment of your cost to file, which is typically $20 online for most entities. Upon completion, you'll receive an immediate confirmation that serves as proof of your filing.

Step 3: Filing a Paper Annual Report Form

For those who prefer traditional methods, you can file in paper form by downloading the appropriate annual report form from the Secretary of State website. The form CD-479 is commonly used for many business entities, though specific forms vary based on your organization type. When completing the paper form, use black ink and print clearly to ensure readability. After filling out all required fields, include a check or money order for the filing fee (typically $25 mail submissions) and send your completed documents to the Carolina Department of Revenue or Secretary of State's office as directed in the instructions. For a broader perspective on expenses, see our guide on how much does an LLC cost per year to budget accurately.

Step 4: Tracking Your NC Annual Report Status

After submission, monitoring the status of your filing helps ensure nothing falls through the cracks. The North Carolina Secretary of State's office typically processes online submissions within 1-2 business days, while paper form filings may take 5-7 business days or longer during peak periods.

You can check your filing status through the Secretary of State's online portal using your submission confirmation number. If your filing status shows any issues or remains pending beyond the expected processing time, contact the business registration division promptly. They can provide updates and help resolve any potential problems before they affect your compliance status.

File your North Carolina report on time

ZenBusiness helps you avoid penalties by managing your annual report and registered agent service—all while keeping your LLC in good standing.

Staying Compliant After Filing or Reinstating Your NC Business

Maintaining compliance doesn't end with filing your annual report. As an expert advisor, I recommend establishing ongoing practices to maintain good standing with state authorities. Proactive management of your compliance obligations prevents unexpected issues that could disrupt your business operations.

How Do I Reinstate a Dissolved North Carolina Business?

If your business has been dissolved by the state due to missed filings, you can restore its active status through a reinstatement process. To revive a dissolved entity that faced administrative dissolution, you'll need to file all outstanding annual reports, pay any accumulated late fees, and submit a reinstatement application to the Secretary of State. Companies administratively dissolved for less than five years generally have a more straightforward path to restoration than those with longer periods of non-compliance.

What Are the Reinstatement Fees and Processing Times?

The reinstatement fees for a company that has been administratively dissolved include all unpaid annual report fee amounts, late penalties, and a specific reinstatement fee. For most LLCs and corporations, expect to pay a minimum of $200 plus $25-$35 for each missed annual report, with additional late penalties that can reach several hundred dollars.

Processing times vary based on submission method and current state workloads. Online reinstatements typically process within 3-5 business days, while paper submissions may take 7-10 business days. For urgent situations, expedited processing is available for an additional fee, potentially reducing the wait to 24-48 hours.

How to Confirm That Your Annual Report Was Successfully Filed

Verifying that the state has properly processed your annual report service submission provides peace of mind and documentary proof of compliance. After filing, you should receive a confirmation receipt that serves as temporary evidence. For permanent verification, check the North Carolina Secretary of State's business search portal, where successfully filed reports appear in your business record, typically within 2-3 business days for online submissions and 7-10 days for paper filings. And before you form a new entity, see how to check LLC names to ensure your desired name is available.

Stay compliant in North Carolina

Northwest handles your NC annual report and provides a registered agent who ensures your LLC never misses a deadline or notice.

What Records Should You Keep After Filing an Annual Report?

Maintaining proper records after filing is crucial for your business's legal protection and operational continuity. Always preserve your filing confirmation and payment receipts as proof of compliance with state requirements.

- Confirmation of filing receipt

- Copy of the submitted annual report

- Payment confirmation

- Correspondence with state agencies

- Amendments or corrections filed

These records should be kept for at least seven years, though many businesses opt to maintain them permanently as part of their corporate recordkeeping. Proper documentation helps demonstrate your ongoing compliance efforts and provides critical evidence should any questions arise about your filing history.

Best Ways to Set Up Reminders for Future NC Filings

Establishing a reliable reminder system prevents missed deadlines and helps you avoid potential administrative dissolution. Calendar alerts set 30, 60, and 90 days before your annual report due date provide ample time to prepare necessary information and complete your filing.

Consider using a professional annual report service that provides automated notifications and compliance tracking. These services typically cost $50-$150 annually but can save significant money by helping you avoid late fees and reinstatement costs. Many registered agent services include annual report reminders as part of their standard offerings, providing an additional layer of compliance protection. If your business expands to the Southeast, find the top registered agent in Florida for seamless support.

FAQ About the NC Annual Report

Business owners frequently have questions about North Carolina's annual reporting requirements. This section addresses the most common inquiries to help clarify your obligations and streamline your compliance efforts.

Not every business entity in North Carolina has filing requirements. While most registered business entities must file, including LLCs and corporations, some organizations are exempt from the annual report requirement. Sole proprietorships and general partnerships typically don't need to file, while certain nonprofits may have different reporting schedules or requirements. The who must file determination depends on your specific business structure and registration status with the state.

Yes, you can access previously filed reports through the Secretary of State's online business search portal. This searchable database allows you to review past annual reports for most businesses registered in North Carolina. Simply enter your company's name or ID number to locate your business record and view filing history, which can be particularly useful for verifying past compliance or gathering historical business information.

The time required to complete your report submission varies by method. Online filings typically take 15-20 minutes if you have all information prepared and can be processed by the state within 1-2 business days. Paper submissions require additional time for form completion, mailing, and processing, which can extend to 2-3 weeks total from preparation to final state processing.

Yes, you can authorize another person to file an annual report on behalf of your business. Common authorized filers include your company's registered agent, attorney, accountant, or a specialized filing service. When delegating this responsibility, ensure the person has accurate company information and proper authorization. Remember that despite delegation, the business owners ultimately remain responsible for timely and accurate filing compliance under North Carolina law.

Initial filings establish your business with the state, while annual reports maintain your ongoing compliance. When you first form a business in North Carolina, you submit Articles of Organization (for LLCs) or Articles of Incorporation (for corporations) along with initial fees. This one-time process creates your legal entity. In contrast, your annual report updates existing information and demonstrates continued operation. The initial filing is more extensive and establishes your business structure, while annual reports primarily update information and confirm active status.

Yes, North Carolina annual report filings are public records available for review by anyone. The Secretary of State's business search function makes these documents easily accessible online. This transparency means information about your business address, registered agent, and company officials becomes public knowledge when you file. Consider this public accessibility when deciding what optional information to include beyond the minimum required fields.

Looking for an overview? See North Carolina LLC Services

Simplify your North Carolina filings

With Harbor Compliance, you get professional help to file your NC annual report accurately—plus trusted registered agent service to stay protected.