Most LLC owners don’t fail because of bad business—they fail because they miss deadlines that look insignificant on paper. The Florida annual report is one of those small things with big consequences. Although Florida imposes strict penalties for late filings, the Division of Corporations helps you stay on track by emailing reminder notices before May 1 and sending a confirmation once your report is processed.

To maintain active status, every Florida limited liability company must file an annual report by May 1st through the Florida Department of State’s online portal. Miss it, and you’ll owe a $400 late fee—and risk administrative dissolution.

From checking your document number to updating your office address, the process is faster than people assume—especially online. Whether you use a check or debit card, filing is the only way to avoid complications with the Internal Revenue Service, future bank dealings, or certificate of status requests. Think of this as renewing your LLC’s license to operate in a state that treats compliance as currency. The true cost isn’t the filing fee—it’s being erased from Florida’s business ecosystem without appeal.

What Is the Florida LLC Annual Report and Why Is It Required?

Have you ever wondered why the state requires your business to file paperwork every year? The Florida LLC annual report is a mandatory filing that updates your company's information with the state government. This crucial document helps maintain your LLC's active status and ensures the Florida Department of State has current information about your business entity.

Purpose of the Annual Report for Florida LLCs

The annual report serves as an important administrative function for the state of Florida. It allows the government to track active businesses, maintain accurate public records, and ensure businesses are properly registered with current information on file. This process helps the state monitor business activity within its jurisdiction.

The report also benefits business owners by confirming your company's good standing with the state. This standing is essential when seeking business loans, entering contracts, or working with vendors who may verify your status. Regular filing shows your commitment to maintaining legal compliance with state requirements.

Legal Requirement Under Florida Statutes

The filing of an annual report is mandated by Florida law and enforced by the Secretary of State. According to Florida Statutes, all registered limited liability companies must file this report yearly to maintain active status. The state legislature established this requirement to ensure transparency in business operations and to maintain accurate records of all business entities operating within Florida's jurisdiction.

Consequences of Non-Compliance

Failing to file your annual report has serious consequences for your business. The state takes this requirement seriously and imposes significant penalties on non-compliant businesses. Missing the deadline puts your company at risk in several ways.

- Legal challenges when attempting to conduct business transactions

- Late fee of $400 added automatically after the deadline

- Risk of administrative dissolution if not filed by the third Friday in September

- Loss of good standing status and certificate of status

Don’t risk a $400 penalty

ZenBusiness helps you file your Florida annual report on time—fast, accurate, and stress-free.

How to File Your Florida LLC Annual Report Online

The most efficient way to file your Florida annual report is through the state's online portal. If you're looking to start an LLC in Florida, you can follow our detailed walkthrough on our guide. This digital process provides immediate confirmation and faster processing compared to paper filings. Completing your filing online ensures your business information is promptly updated in the state database, maintaining your compliance status without delay. You can access the official filing system directly through the state's website.

Step 1: Access the Florida Division of Corporations (Sunbiz)

To begin the filing process, visit the official Florida Division of Corporations website, commonly known as Sunbiz. This state-managed portal handles all business filings, including annual reports. You'll need to navigate to the “File Annual Report” section, where you can access the electronic filing system. The site requires no special login credentials to start the filing process, making it accessible for all business owners. You can also perform a quick FL SOS business search to verify your LLC status.

Step 2: Locate Your LLC Using the Document Number

Finding your business in the state system requires your company's document number, which serves as a unique identification number for your LLC. This number was assigned when you first registered your business and appears on your formation documents and previous filings. If you don't have this number readily available, you can search for your business by name on the Sunbiz website to retrieve it before proceeding with your annual report filing.

The document number ensures you're updating the correct business record in the system. Always double-check this number before submitting any information to avoid filing errors that could affect another business or create compliance issues for your company.

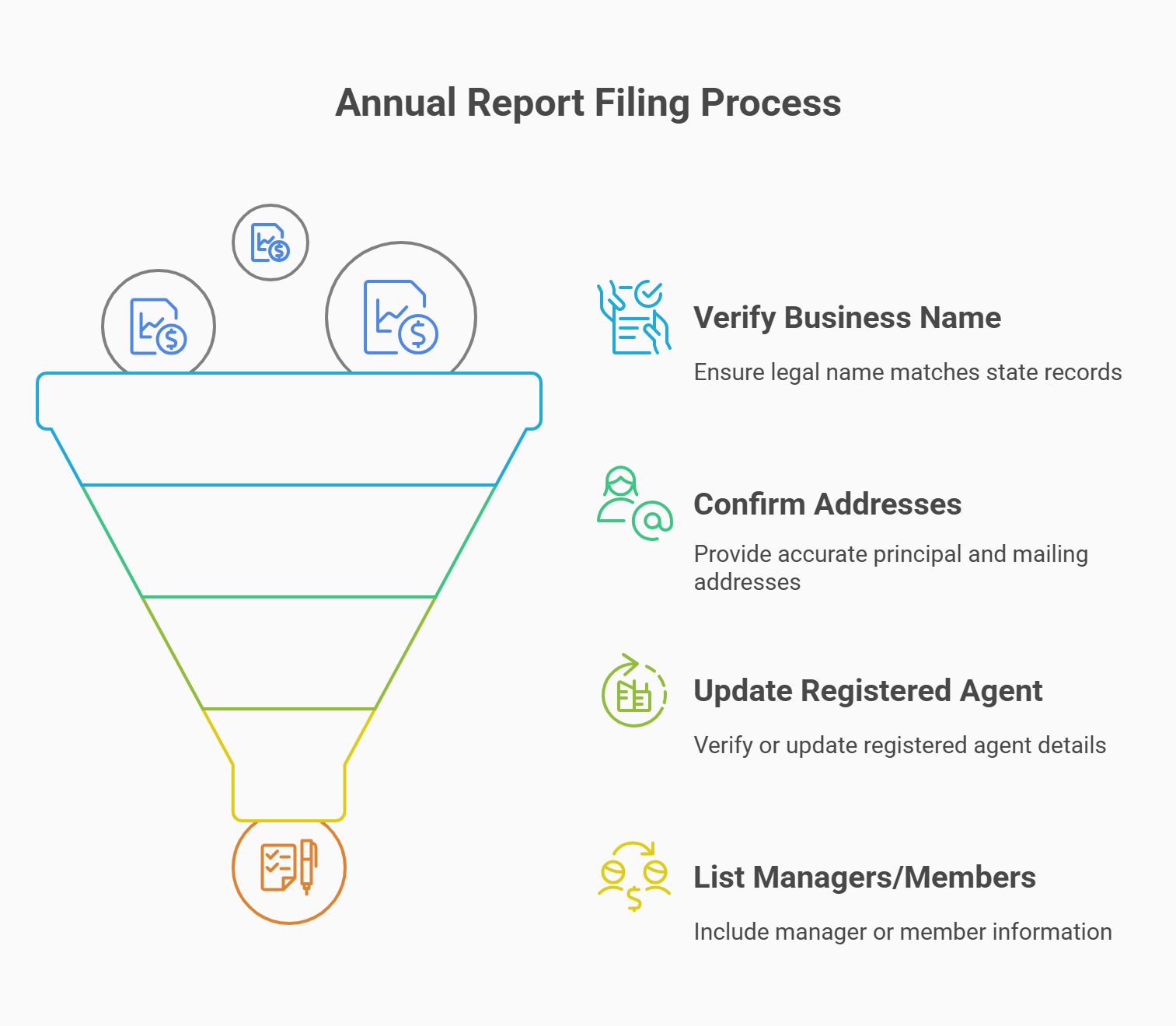

Step 3: Update Business Information and Submit

Once you've accessed your LLC's record, you'll need to review and update your business information as necessary. This is your opportunity to make any needed changes to keep your records current.

| Information Field | Description |

|---|---|

| Business name | Confirm your LLC's name is correctly displayed |

| Principal office address | Physical location where your business operates |

| Mailing address | Where you receive business correspondence |

| Registered agent information | Person/entity accepting legal documents |

| Member/manager details | Names and addresses of LLC owners/managers |

After verifying all information is correct, you'll proceed to the payment section. The state accepts credit card, debit card, or electronic funds transfer for the filing fee. Submit your report to complete the process and receive your confirmation. If you're curious about LLC processing time Florida, our detailed breakdown covers typical timelines.

Step 4: Confirm Filing and Download Certificate of Status

After successful submission, you'll receive an immediate confirmation page with a tracking number. This confirmation serves as proof of your filing until the state processes your report, typically within minutes for online submissions. It's advisable to save or print this confirmation for your records.

You may also want to purchase a certificate of status, which officially verifies your LLC is in good standing with the state. While not required, this certificate is often needed for business loans, opening bank accounts, or entering important contracts, making it a valuable document to obtain during the filing process. Refer to our guide on LLC certificate of organization to understand the formation documentation.

Deadline and Cost of the Florida LLC Annual Report

Each year, thousands of Florida businesses face penalties because they miss critical filing deadlines. The state imposes strict timelines and fees for annual reports, with substantial penalties for late submissions. Understanding these requirements is essential for maintaining your business in good standing and avoiding unnecessary expenses.

Filing Timeline and Important Dates

Annual reports must be filed between January 1 and May 1st of each year. This filing window gives businesses four months to complete their submission, though many companies wait until the deadline approaches. The state does not grant extensions to this deadline, making it crucial to calendar this important date well in advance. Newly formed LLCs registered after January 1 are not required to file until the following year. You can easily access the filing system to submit your report during this period.

For optimal compliance, consider filing in January or February rather than waiting until April. Early filing eliminates the risk of technical issues or forgotten deadlines that could result in costly penalties. The state sends reminder notices, but ultimately, the responsibility for timely filing rests with the business owner. To budget for next year, review the projected Florida LLC formation cost 2025 on our site.

Standard Filing Fee for LLCs (Note: Filing fees are non-refundable)

The standard annual report fee for Florida LLCs is currently $138.75. This fee is established by the state legislature and may be subject to change in future years. It's important to understand that this is a mandatory expense for maintaining your business.

| Fee Type | Amount | Payment Method |

|---|---|---|

| Standard Filing | $138.75 | Credit/debit card, e-check |

| Late Filing | $538.75 ($138.75 + $400 late fee) | Same as above |

| Optional Certificate of Status | $5.00 | Added during filing process |

Remember that all filing fees paid to the Florida Division of Corporations are non-refundable, even if submitted in error. Always verify your information before submitting payment to avoid unnecessary expenses. To explore all annual LLC fees across different filing scenarios, visit our page.

Late Fee and Administrative Dissolution Risks

Missing the May 1 deadline results in an automatic $400 late fee added to your filing. You can compare LLC state filing fees to plan your budget effectively. This substantial penalty increases your total payment to $538.75 and cannot be waived or reduced under any circumstances. The state strictly enforces this penalty to encourage timely compliance.

If your report remains unfiled after the third Friday in September, your LLC will be administratively dissolved by the state. This dissolution effectively terminates your company's legal existence in Florida, preventing you from legally conducting business operations.

Once dissolved, reinstating your business requires filing a reinstatement application with the state and paying all outstanding fees, including a $100 reinstatement fee plus $138.75 for each year you failed to file. This process can be costly and time-consuming, potentially impacting your business relationships and operations. For step-by-step instructions on how to renew an LLC, refer to our renewal guide.

What Information Is Required When Filing Your Annual Report

When preparing to file your annual report, you'll need to gather several categories of information about your business. Having these details organized before starting the filing process will make the submission smoother and help you avoid errors. The state requires specific information to maintain accurate business records in their database.

Business Name and Florida Document Number

Your LLC's exact legal name must be included exactly as it appears in state records. Any discrepancies could cause processing issues or even rejection of your filing. Additionally, you'll need your document number, which is the unique identifier assigned by the state when your LLC was formed. This number can be found on your original formation documents or by searching the state's business database. Always double-check this information for accuracy, as it's the primary way the state identifies your business entity in their system.

Principal Office and Mailing Address

The principal office is the physical location where your company conducts operations. This cannot be a P.O. Box and must include a street address with city, state, and ZIP code. The state requires this information to maintain a record of where businesses physically operate within Florida.

- Street address (not P.O. Box)

- City, state, and ZIP code

- Phone number (optional but recommended)

- Email address for communications

Your mailing address may differ from your principal office if you prefer to receive official correspondence at another location. Unlike the principal office, this address can be a P.O. Box. Ensuring these addresses are current helps prevent missing important state communications.

Registered Agent Information

Your Florida registered agent is the person or entity authorized to accept legal documents and official correspondence on behalf of your LLC. This role is required by law and must be maintained at all times. The registered agent must have a physical street address in Florida (not a P.O. Box) and be available during normal business hours.

When filing your annual report, verify that your current registered agent information is accurate. If changes are needed, the annual report is one opportunity to update this important designation. Remember that your agent must have consented to this role, as they have specific legal responsibilities to your business.

Manager or Member Details

Depending on your LLC's management structure, you'll need to provide information about either your managers or members. Manager-managed LLCs list the appointed managers who handle day-to-day operations, while member-managed LLCs list the owners who directly manage the business. Ensure you have a current Florida LLC operating agreement outlining these roles.

For each manager or member, you'll need to provide their name and address. The state does not require personal information such as Social Security numbers, but addresses are part of the public record. Some business owners use their company address rather than home addresses for privacy reasons, though all information submitted becomes part of the public record through the Department of State Division of Corporations.

Managing Changes Through the Annual Report

Business doesn't stand still, and your annual report filing provides a convenient opportunity to update critical information with the state. Instead of filing separate forms throughout the year, many changes can be made during this annual process, streamlining your administrative requirements and saving time.

What Changes Can Be Made During Filing

The annual report allows you to update several important aspects of your business information without filing additional forms or paying extra fees. Taking advantage of this opportunity helps keep your records current.

- Update principal office and mailing address

- Change registered agent information (with consent)

- Add, remove, or modify manager/member details

- Update email addresses for state communications

- Correct typographical errors from previous filings

Using your annual report to make these changes is efficient and eliminates the need for separate filings throughout the year. This consolidation helps maintain accurate records with minimal administrative burden.

Worried about missing deadlines?

Northwest keeps your Florida LLC in good standing with automatic reminders and annual report filing services.

Changes That Require Additional Filings

Some significant changes to your LLC structure cannot be made through the annual report process. These more substantial modifications require separate filings and associated fees. For instance, changing your LLC's name requires filing Articles of Amendment, not just updating your annual report.

Similarly, major structural changes like converting from a member-managed to manager-managed LLC require specific amendment filings. These changes affect the fundamental organization of your business as defined in your Articles of Organization.

Mergers, acquisitions, or adding a new business classification also require separate filings with the Internal Revenue Service and state authorities. These changes have tax implications and broader legal effects beyond simple information updates.

Updating Registered Agent Information

While you can update your registered agent information in your annual report, there are specific requirements for this change. The new agent must have provided written consent to serve in this capacity, as they take on legal responsibilities for your business. When making this change, you'll need to indicate that you have this consent on file, though you don't submit the actual consent form with your annual report.

If you need to change your registered agent outside the annual report period, you must file a separate Change of Registered Agent form with the state and pay a $25 filing fee. This separate process ensures the state always has current information about who is authorized to receive legal documents on behalf of your business, which is critical for maintaining proper service of process and legal notifications.

Florida LLC Annual Report FAQs

We've compiled answers to the most common questions Florida LLC owners ask about the annual report process. Understanding these key points will help you navigate your filing responsibilities with confidence and avoid common pitfalls that lead to penalties or compliance issues.

Do All Florida LLCs Need to File an Annual Report?

Yes, all limited liability companies registered in Florida must file annual reports regardless of size, revenue, or activity level. This requirement applies to both domestic LLCs (formed in Florida) and foreign LLCs (formed elsewhere but registered to do business in Florida). If you're considering launching a small business in Florida, our startup guide can help.

The only exceptions are LLCs formed after January 1 of the current reporting year, which don't need to file until the following calendar year. Even inactive businesses must file as long as they remain registered with the state. For professionals in Texas, check the differences in our PLLC vs LLC Texas analysis.

Can I File My Annual Report by Mail Instead of Online?

No, the Florida Department of State requires all LLC annual reports to be filed electronically through their online system. Unlike some other state filings that accept paper submissions with a check or money order, annual reports must be submitted through the official Sunbiz website. This electronic requirement helps ensure faster processing and immediate updating of your business records in the state database. If you have difficulty with online access, consider asking a trusted advisor or using a public computer at a library to complete your filing.

What If My Florida LLC Is No Longer Active?

Even if your business is no longer operating, you're still required to file annual reports as long as your LLC remains registered with the state. To eliminate this obligation, you must officially dissolve your LLC by filing Articles of Dissolution with the Florida Division of Corporations. Until dissolution is complete, your business remains liable for annual report filings and associated fees. If you're still evaluating your options, our expert advice on do you need an LLC to start a business can guide your decision.

If your LLC has already been administratively dissolved due to failure to file reports, you must decide whether to reinstate it or let it remain dissolved. Reinstatement requires payment of all past-due fees and reports, while remaining dissolved eliminates future filing requirements. Learn how to how to dissolve an LLC in Florida properly to avoid future fees.

Is My LLC Exempt from Filing?

Very few entities are exempt from Florida's annual report requirements. Professional associations and certain non-profit organizations have different filing requirements, but standard LLCs must file regardless of their tax classification with the Internal Revenue Service or activity status. Even single-member LLCs and those with minimal business activity must comply with annual reporting requirements to maintain their legal status in Florida. If you've received any communication from the state about your filing obligation, it should be treated seriously.

Can I Correct a Mistake After Filing?

Yes, errors in your annual report can be corrected by filing an amended annual report through the same online system. For LLCs, the fee for filing an amended report is $50, and it must be submitted after your original report has been processed. The amended report allows you to correct information such as addresses, registered agent details, or manager/member information. However, some changes like business name modifications require different filings altogether. It's best to carefully review all information before submitting to avoid the need for amendments and additional payment voucher fees.

How Can I Reinstate a Dissolved LLC?

If your LLC has been dissolved due to failure to file annual reports, you can reinstate it by submitting a reinstatement application to the Department of State Division of Corporations. This process requires:

– Complete reinstatement application form

– Payment of $100 reinstatement fee

– Payment of $138.75 for each year a report wasn't filed

– Current year's annual report

– New registered agent designation if needed

The reinstatement process effectively restores your LLC to active status as if the dissolution had not occurred, preserving your original formation date and business name. However, reinstatement must be completed promptly, as another entity could register your business name if you delay too long.

Looking for an overview? See Florida LLC Services

Need help with recurring filings?

Harbor Compliance manages your Florida annual report and keeps your LLC compliant all year long.