Thinking about how to keep your LLC compliant year after year? Wondering what happens if you miss your annual report deadline—or if your state even requires one in the first place? Want to know how much it’ll cost and what information you need to file?

An LLC annual report is a mandatory filing that updates your state’s business registry with your company’s key details, including your address, registered agent, and ownership structure. Most states require LLCs to submit this report every year—or every two years—along with a fee ranging from $20 to $300. Filing your annual report on time keeps your LLC in good standing, avoids penalties or administrative dissolution, and ensures you're legally authorized to operate.

In this guide, you’ll learn:

- When and how to file your LLC annual report by state

- What information and documents you need to include

- Common mistakes that trigger penalties or revocation

- How to stay compliant and avoid losing your LLC status

Ready to protect your business and stay in good standing? Let’s walk through everything you need to know about filing your LLC annual report.

What Is an LLC Annual Report?

An LLC annual report is a mandatory filing that every limited liability company must submit to state regulatory agencies at regular intervals. Familiarizing yourself with the components of an LLC annual report can help in accurately compiling and submitting the necessary information. Often called a periodic report, it helps confirm the basic information about your business, including ownership details, registered agent, and contact information. The goal is to keep state authorities current on any changes within your LLC so they can maintain accurate public records.

Filing these annual reports on time allows you to:

- Maintain good standing: Keeping up with state rules prevents your business entity from being marked delinquent.

- Update records: If your ownership structure or principal place of business changed, this is your chance to report it.

- Ensure accuracy: Clean state records can simplify compliance checks and interactions with lenders or investors.

- Avoid penalties: If you skip this requirement, your business can be dissolved, dissolved or revoked, or face fines in some states.

Each jurisdiction has its own due date and filing instructions, so be sure to check your LLC’s requirements. Understanding the specific LLC annual fees by state is crucial, as these fees can vary significantly and impact your compliance budget. While some states call for an annual report, others may request a biennial report or a similar report is due every numbered year. Regardless, treating these filings as an essential compliance measure helps you stay compliant and protect your LLC’s standing.

General Steps to File an LLC Annual Report

Staying on top of your LLC’s reporting obligations is critical for long-term success. Understanding how long does it take to get an LLC approved can aid in better planning of your business operations and compliance timelines. The process varies by jurisdiction, but most states follow a similar pattern. Below is a quick overview of the essential stages, from checking local rules to finalizing your payment.

Step 1 – Determine your state's specific requirements

Before you start filing, confirm how often your annual report is due. Some states mandate you file an annual report due every year, while others opt for a biennial report. Also note if you must submit it on your registration anniversary day, the registration anniversary month, or by a specific due date like march 15th. Certain states let you file online, whereas others require a paper form. By clarifying these details, you’ll know whether you can handle it yourself or if you need professional help, such as an annual report service.

Step 2 – Gather necessary business information

Once you’re clear on your state’s rules, collect the required information. Typically, you’ll need your LLC’s legal name, principal office address, ownership structure, and the name of your registered agent. Utilizing professional registered agent services ensures that your LLC remains compliant with state requirements and that important documents are handled appropriately. Double-check for updates since your initial registration—for example, if you changed offices or revised the operating agreement. Having these details ready ensures a smooth filing process, especially if your report is due every numbered year on a fixed date.

Step 3 – Complete and submit the report by the deadline

Follow the official filing instructions provided by your state and submit your report filing 45 days prior if that’s a local requirement. Many states let you file annually either online or by mail. Be sure you adhere to the stated due date; missing it can lead to penalties or even risk of your business becoming administratively dissolved. If you plan to handle it personally, set a calendar reminder so you’re not caught off guard.

Step 4 – Pay the associated filing fees

Every state enforces a filing fee or annual report fee. In 2025, these costs can range from $20 to $300, depending on your jurisdiction. Some states, like Oregon, charge an oregon annual report fee of $100 for an oregon llc, while others may be higher or lower. Be sure to factor in any extra charges that might apply if you miss deadlines. You can typically pay the required fee by credit card, check, or online payment systems, depending on state options.

Step 5 – Confirm submission and retain records

After you file and pay, keep confirmation of your submission—either an electronic receipt or a mail-in proof. Selecting the best registered agent for your LLC can streamline the process of handling official correspondence and maintaining compliance. Store this documentation safely with your other LLC records, such as your operating agreement, so you can show proof of compliance if questions arise later. Proper record retention protects you against failure to file disputes and makes it easier to track next year’s reporting process.

Stay compliant with ZenBusiness

Never miss another filing. ZenBusiness handles your annual report and keeps your LLC in good standing with automated registered agent service.

LLC Annual Report Requirements by State

Each state imposes unique guidelines on how and when LLCs must file. When considering business structures, it's important to weigh the differences between an LLC vs corporation to determine the best fit for your needs. Some states align with a firm deadline—like year by march—while others tie it to your anniversary date. The filing frequency also differs: some require a report every 12 months, while others might space it out over two years. Below is a quick comparison table covering five key states, including relevant deadlines and typical fees, all up-to-date for 2025:ns and need a more granular lookup.

| State | Filing Frequency | Standard Due Date | Typical Fee (2025) | Late Penalties |

|---|---|---|---|---|

| CA | Annually | Within 90 days of formation + annually | $20 – $25 | $250 + Delinquency Status |

| TX | Annually (Public Info Report) | May 15 or Anniversary | $0 – $300 | Possible Revocation |

| FL | Annually | May 1 | $138.75 | $400 late fee |

| NY | Biennially | Varies (Anniv. Month) | $9 | Potential Dissolution |

| IL | Annually | Prior to Anniversary Month | $75 – $250 | $100 late fee + Risk of Dissolution |

California LLC Annual Report

California refers to its LLC update as a Statement of Information. You must file within 90 days of initial registration and then renew annually.

- Due date: Generally aligned with the LLC’s formation month.

- Filing fee: Typically $20 for an annual report, plus $20 for any required changes if done separately.

- Online filing: Available through the California Secretary of State site.

- Penalties: Missing the submission can lead to a $250 penalty and potential “FTB Suspended” status, risking your LLC’s right to operate.

Ensure you keep your business address, contact information, and registered agent details current. Even small changes in ownership structure require an update.

Texas LLC Annual Report

Texas uses a Public Information Report (PIR) in conjunction with its Franchise Tax requirements. Many call it the corporation annual or LLC annual report, but the essence is the same.

- Due every year: Typically in May, unless your LLC is assigned a different schedule.

- Filing instructions: Submit the PIR along with any franchise tax fees to the Comptroller.

- Filing fee: Some LLCs pay no additional fee for the report itself, but a franchise tax may apply.

- Missed deadline: Failing to file can result in a penalty of 5% or more on owed taxes and eventual forfeiture of limited liability privileges.

Double-check your revenue service obligations to avoid confusion between annual reporting and tax filings. Being aware of potential risks with registered agent responsibilities can help mitigate compliance issues and ensure proper handling of legal documents.

Florida LLC Annual Report

Florida’s annual report confirms that the LLC’s key data remains accurate.

- Filing process: Must be completed online through the Florida Department of State.

- Due date: May 1 each calendar year.

- Annual report fee: $138.75 in 2025 for LLCs; more for corporations.

- Late filing: A $400 penalty applies if you miss the due date, and noncompliance can lead to dissolution by September of that same year.

Use Florida’s system to ensure you’re updating basic information like your principal office address and members’ details each year.

New York LLC Annual Report

In New York, LLCs file a biennial report every two years, not annually. This requirement often surprises newcomers who assume it’s every year.

- Filing window: Tied to your LLC’s registration anniversary month.

- Fee: $9 in 2025 for standard LLCs.

- Online filing: Available via the New York Department of State portal.

- Consequences: Failure to comply can risk being “delinquent” or eventually “dissolved or revoked,” limiting your ability to transact business.

Even though it’s less frequent, remember to mark your calendar so you don’t miss the due window.

Illinois LLC Annual Report

Illinois mandates an annual filing to confirm your LLC’s contact and ownership details.

- Deadline: The month before your anniversary date to stay in good standing.

- Standard fee: $75 to $250, depending on updates required.

- State fee for late submission: $100 if you miss the deadline.

- Online filing: Encouraged via the Illinois Secretary of State website.

Plan ahead by tracking your registration anniversary month to avoid being administratively dissolved for non-compliance. For those looking to establish a new business, understanding how to form an LLC is the first step toward legal compliance and operational success.

Protect your business year-round

Northwest’s registered agent service ensures your annual reports are filed on time. Enjoy privacy, support, and peace of mind.

What Information Is Required in an LLC Annual Report?

The specifics can differ by jurisdiction, but most states ask for fairly similar details. Providing complete, up-to-date data is crucial to ensure there are no compliance issues or questions about your LLC’s legitimacy. If your LLC operates under a different name, it's essential to understand what is a DBA and its implications for your business identity.

Typically, you’ll need to include:

- LLC Name: The exact legal name, as registered with the state.

- Principal Business Address: Where your main operations occur.

- Registered Agent Details: Name and physical address for service of process.

- Member or Manager Information: Names and addresses for key individuals, matching your operating agreement if applicable.

- Ownership Changes: Any updates since your last report.

- Contact Information: A phone number or email for official notices.

Some states might ask for your LLC’s NAICS code, total assets, or other required information, so always read the instructions carefully.

What Are the Filing Fees for an LLC Annual Report?

Fees vary significantly based on state legislation. Some jurisdictions charge under $20, while others push into the hundreds. When establishing your LLC, exploring creative company names ideas can set the foundation for a strong brand identity. Knowing what you’ll pay avoids last-minute sticker shock and ensures you’re prepared to maintain your LLC’s good standing. Below is a quick reference table with sample costs in 2025, giving you the clearest possible overview:

| State | Standard Annual Fee (LLC) | Late Fee or Penalty |

|---|---|---|

| California | $20 – $25 | $250 + Risk of Suspension |

| Texas | $0 – $300 (Franchise Tax May Apply) | 5%–10% Penalty on Taxes Owed |

| Florida | $138.75 | $400 Late Penalty |

| New York | $9 (Biennial) | Dissolution If Unresolved |

| Illinois | $75 – $250 | $100 Late Fee + Dissolution Risk |

Filing fee variations by state

Each state sets its own annual report fee (or state fee), which can change periodically. You’ll want to verify the amount every year because legislative updates or inflation adjustments might shift the required fee. For example:

- Low-cost states: New York’s $9 biennial filing stands out as especially affordable.

- Mid-range: Many states fall around $50–$150 for LLCs.

- High-end: States like Massachusetts can approach $500 for standard filings.

- Zero-fee scenarios: Certain states only require an updated form without a financial obligation, although this is less common.

Always check your local statutes or official websites for the most current data.

Payment methods accepted

Most states allow online filing payments with major credit or debit cards. If you file by mail, you can often send a check or money order. Some also accept e-checks or direct transfers via secure portals. To avoid any missed deadline due to payment errors, confirm which methods are permitted and process your fees promptly.

Additional costs and service fees

Beyond the baseline filing fee, you could face:

- Expedited Processing: Pay extra to have your report reviewed faster.

- Annual report service fees: Third-party companies may charge if they handle the process for you.

- Penalties for Late Submission: Missing your official due date can trigger automatic fines.

- Reinstatement Charges: If your LLC is administratively dissolved, you’ll pay to get reinstated.

- Franchise or Business Taxes: Separate from the annual report, but sometimes due concurrently, such as in Texas.

Plan for these possible add-ons and include them in your budgeting to ensure no lapses in compliance.

What Happens If You Miss the Filing Deadline?

Delaying your LLC annual report can lead to multiple consequences, depending on your state. Some jurisdictions grant a grace period, while others start charging late fees immediately. Over time, repeated lapses or a severe delay can cause your LLC to be administratively dissolved.

Potential outcomes include:

- Late fees: Ranging from $25 up to $400 or more.

- Loss of good standing: Your LLC might no longer appear as active on state records.

- Reinstatement costs: You may have to pay extra to revive your entity once it’s been marked “Inactive.”

- Legal limitations: An LLC that’s dissolved or revoked cannot legally conduct certain transactions or enforce contracts.

The best strategy is to stay vigilant, mark your due date, and submit everything on time—some states even allow you to file an annual report filing 45 days prior to the deadline, ensuring you meet requirements ahead of schedule.

How Annual Reports Help Maintain Good Standing

Staying on top of these filings isn’t just about avoiding penalties—it’s also vital to your company’s credibility. Lenders, investors, and clients often check whether a business is active and compliant before sealing any deal.

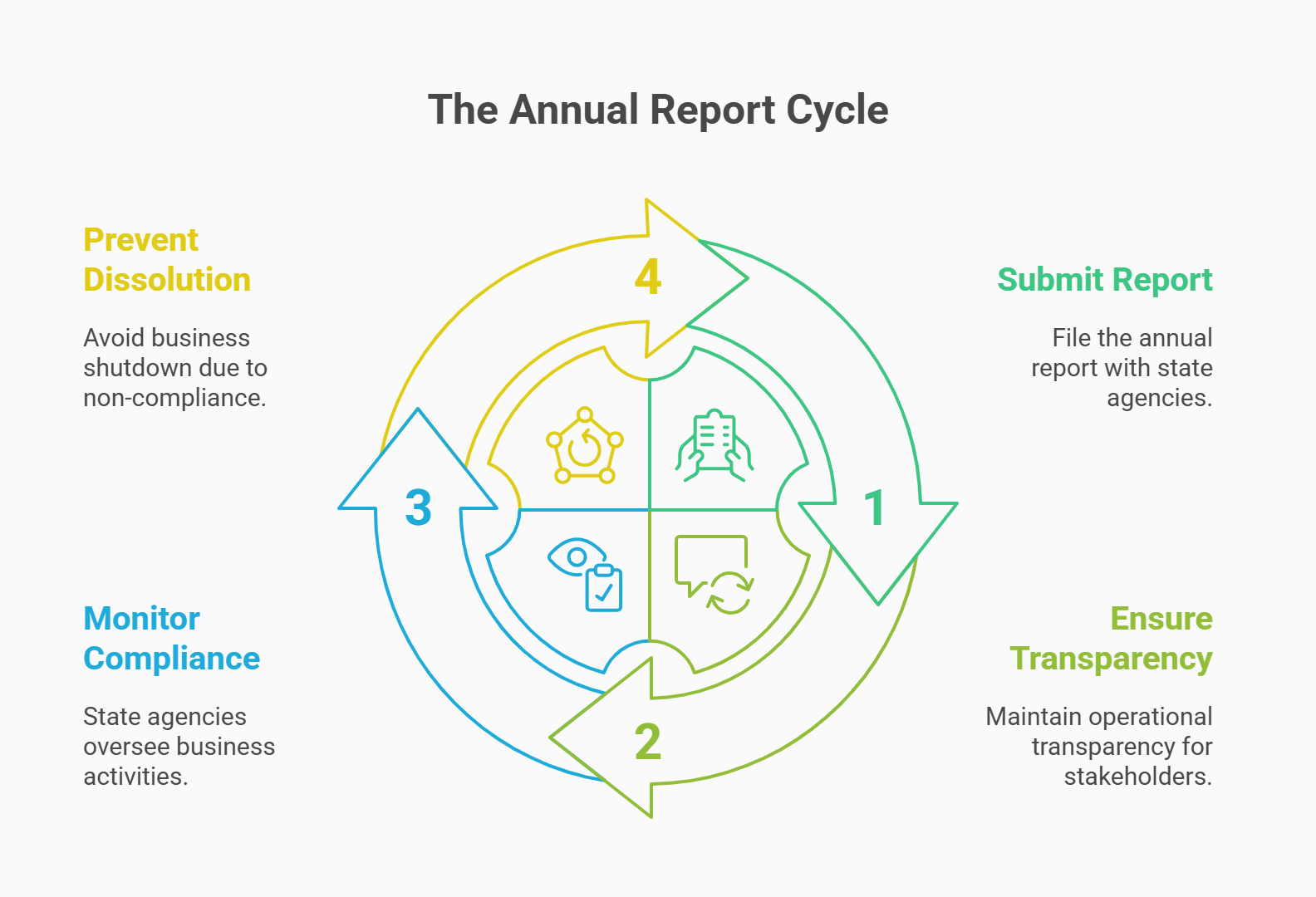

Legal compliance and operational transparency

Submitting an annual or biennial report ensures that state regulatory agencies know exactly who’s running the business and where they can send official notifications. This level of operational transparency safeguards both you and the public by maintaining current data in a government database.

State monitoring and accountability

When you file annually, you give state authorities a snapshot of your LLC’s basic information, from ownership structure to contact details. This ongoing oversight helps state regulatory agencies intervene promptly if something seems amiss, like potential fraud or major irregularities. It also promotes accountability by aligning your business interests with compliance expectations.

Preventing administrative dissolution

A missed or overdue annual report filing can trigger serious consequences if the delay is prolonged. States have the power to shut down your LLC if you repeatedly ignore requirements. Timely submissions are your safety net against sudden dissolution, ensuring your business continues operating without risk.

Common Mistakes to Avoid When Filing

Filing errors not only jeopardize your LLC’s good standing but can also rack up costly penalties. Staying aware of these pitfalls gives you a better shot at smooth compliance.

It’s common for owners to:

- Enter incorrect data: A simple address or contact information mistake may trigger state follow-ups.

- Forget the due date: Overlooking deadlines is a surefire way to face late fees or even see your business entity forcibly dissolved.

- Use outdated forms: States periodically refresh forms and requirements, so confirm you have the latest version.

- Skip the fee: Attempting to file without the required fee means your submission is incomplete and potentially void.

- Rely solely on memory: Mark reminders in a calendar or set digital alerts to ensure you don’t slip up on the timeline.

Double-check everything before hitting “submit” or mailing documents, and keep proof of your filing process.

FAQ – LLC Annual Reports Simplified

Staying compliant with LLC annual report obligations is essential but often confusing for new entrepreneurs. Below are concise, direct answers to the most frequently asked questions.

Nearly all states demand some form of periodic report from LLCs, though the frequency differs. Some have annual reports, while others, such as New York, use a biennial report model. A few states might call it a statement or registration update. Regardless of terminology, these filings serve the same purpose: to keep state records current with your limited liability company’s data. Check your state’s specific rules to confirm how often you must submit.

Yes. Many states embrace online filing for convenience and faster processing. For example, Florida and California both encourage digital submissions, and some states even offer email confirmations. However, if you prefer traditional mail or if your jurisdiction hasn’t fully modernized, you may still be able to file paper forms. Always visit your state’s official website to see the up-to-date filing instructions and ensure you’re using approved methods.

Yes. Many states embrace online filing for convenience and faster processing. For example, Florida and California both encourage digital submissions, and some states even offer email confirmations. However, if you prefer traditional mail or if your jurisdiction hasn’t fully modernized, you may still be able to file paper forms. Always visit your state’s official website to see the up-to-date filing instructions and ensure you’re using approved methods.

Not exactly. Although certain states combine them—like Texas, where you submit a Public Information Report with any franchise tax—these are technically separate obligations. A franchise tax return calculates any dues owed based on the LLC’s revenue or value, while an annual report typically updates organizational details. Failing to file either can result in penalties or possible revocation of your LLC’s active status, so track both requirements carefully.

Typically, you can locate the due date on your state’s official corporate portal or in your LLC’s formation documents. Some states tie it to the registration anniversary date or month, while others fix a universal deadline—like year by march. If you’re unsure, contact the oregon secretary of state or equivalent office and provide your business ID number. Mark the date in your calendar to avoid a missed deadline and any associated fees.

Yes. A single-member LLC must still file an annual report or any required periodic report just like multi-member companies. The state regulations generally don’t distinguish between single-owner or multiple-owner structures when it comes to compliance. Neglecting this step exposes your business to potential fines, failure to file notices, or even being administratively dissolved. Regardless of membership count, timely reporting keeps you in good standing.

Simplify compliance with Harbor Compliance

From annual reports to mail forwarding, Harbor Compliance gives you a registered agent that ensures your LLC meets every deadline.