Running an LLC isn't just about setting up your company—it also requires annual maintenance, compliance filings, and renewal fees. Depending on your state, these costs can range from a small annual report fee to hefty franchise taxes in places like California and Massachusetts. Without careful planning, these recurring expenses can add up and impact your business’s bottom line.

Most states require LLCs to file an annual or biennial report and pay renewal fees. Some states, like Delaware and Texas, have high franchise taxes, while others, like Wyoming and North Dakota, offer lower-cost options for LLC owners.

This guide will break down LLC annual fees across all 50 states, highlighting which locations are business-friendly, expensive, or tax-efficient. If you're looking for the best state to register your LLC or want to understand ongoing costs before expanding, this comparison will give you the insights you need to make a smart financial decision.

Understanding LLC Fees and Compliance Costs

Staying compliant with state laws is crucial for business owners who operate as an LLC. Maintaining this business structure can involve various costs beyond the initial setup. From ongoing paperwork to mandatory payments, understanding these fees ensures you preserve your company’s good standing and avoid penalties that might disrupt growth.

What Are LLC Annual Fees?

LLC annual fees commonly refer to recurring expenses required to keep your limited liability company in good standing. These charges often include annual report filings, franchise taxes, or other mandatory payments set by the state. The goal is to ensure that each entity remains properly registered and updated in government records.

Although these costs might seem minor at first glance, they can significantly impact your budget over time. Missing deadlines or underpaying can lead to penalties, interest, or even administrative dissolution of your LLC. By staying aware of the specific obligations in your state, you can factor these fees into your overall financial strategy.

The Difference Between Initial Filing Fees and Annual Costs

Many entrepreneurs confuse one-time registration filing fees with ongoing yearly expenses. The initial costs typically apply when you first register your LLC, covering official documentation such as articles of organization. By contrast, recurring charges are due annually or biennially, depending on the state. Failing to pay either type can jeopardize your business status.

- fee to file articles covers the processing of your LLC’s foundational documents.

- Franchise taxes or annual reports represent recurring obligations.

- Optional add-ons like expedited processing or certified copies may increase your total.

- Each state has unique rates, so research thoroughly before committing.

In short, recognizing which payments are one-time and which are periodic helps you plan for sustained compliance and avoid unexpected setbacks. For more information on can I run a business without an LLC, explore our detailed article.

Maintaining an LLC involves more than just filing papers once. You might need to hire a registered agent to handle legal notices, especially if you don’t maintain a physical presence in the formation state. These operational essentials can add up quickly, creating surprise bills that can strain new companies or those on a tight budget.

- Annual maintenance of an operating agreement

- Specific forms like form 568 in certain jurisdictions

- Potential reviews from the franchise tax board

- Additional filings required by evolving regulations

Keeping track of these elements ensures you stay compliant and avoid unexpected penalties or administrative hurdles along the way.

Lower Your LLC Fees

Find the most cost-effective states for LLC renewals and avoid excessive annual fees. Compare your options today.

LLC Formation and Annual Fees by State

Every state sets unique by state requirements for LLC creation and ongoing compliance. While some regions offer minimal costs and lenient filing schedules, others have more complex processes. Knowing these variations before formation helps you budget accurately and decide whether your home state or an alternative jurisdiction aligns better with your company’s goals.

State-by-State Breakdown of LLC Formation and Annual Fees

Each jurisdiction enforces distinct state filing fees, annual report requirements, and tax rates. Before deciding where to establish your LLC, research these cost factors thoroughly. Some states charge a flat yearly sum, while others calculate fees based on revenue or other variables. Failing to meet deadlines may result in late penalties. Understanding the difference between a dba vs llc can help you choose the right structure for your business.ure public safety and regulatory compliance across the entire organization.

| State | Filing Fee (One-Time) | Annual Fee (Recurring) | Due Date | Payment Recipient & Required Form | Official Gov Website |

|---|---|---|---|---|---|

| Alabama | $200 | $50 minimum | 2.5 months after formation and annually by April 15 | AL Department of Revenue, Initial Business Privilege Tax Return | Alabama Secretary of State |

| Alaska | $250 | $100 | Biennial, January 2 | AK Department of CCED, Biennial Report | Alaska Division of Corporations |

| Arizona | $50 | $0 | No annual fee + no report due | N/A, N/A | Arizona Corporation Commission |

| Arkansas | $45 | $150 | Annual, May 1 | AR Secretary of State, Franchise Tax Report | Arkansas Secretary of State |

| California | $70 | $800 + $20 | Various | CA Franchise Tax Board – Form 3522 | California Secretary of State |

| Colorado | $50 | $10 | 5 month window surrounding anniversary month | CO Secretary of State, Periodic Report | Colorado Secretary of State |

| Connecticut | $120 | $80 | Annual, March 31 | CT Secretary of State, Annual Report | Connecticut Secretary of State |

| Delaware | $90 | $300 | Annual, June 1 | DE Dept. of State, Annual Franchise Tax | Delaware Division of Corporations |

| Florida | $125 | $138.75 | Annual, May 1 | FL Department of State, Annual Report | Florida Department of State |

| Georgia | $100 | $50 | Annual, April 1 | GA Secretary of State, Annual Registration Fee | Georgia Corporations Division |

| Hawaii | $50 | $15 | During quarter of anniversary date | HI Business Registration Division, Annual Report | Hawaii Business Express |

| Idaho | $100 | $0 | Annual, anniversary month | ID Secretary of State, Annual Report | Idaho Secretary of State |

| Illinois | $150 | $75 | Annual, anniversary month | IL Secretary of State, Annual Report | Illinois Secretary of State |

| Indiana | $95 | $30 | Biennial, anniversary month | IN Secretary of State, Business Entity Report | Indiana Secretary of State |

| Iowa | $50 | $30 | Biennial, April 1 of odd years | IA Secretary of State, Biennial Report | Iowa Secretary of State |

| Kansas | $160 | $50 | Annual, April 15 | KS Secretary of State, Annual Report | Kansas Secretary of State |

| Kentucky | $40 | $15 | Annual, June 30 | KY Secretary of State, Annual Report | Kentucky Secretary of State |

| Louisiana | $100 | $35 | Annual, anniversary month | LA Secretary of State, Annual Report | Louisiana Secretary of State |

| Maine | $175 | $85 | Annual, June 1 | ME Secretary of State, Annual Report | Maine Secretary of State |

| Maryland | $100 | $300 | Annual, April 15 | MD State Dept. of Assessments, Personal Property Tax | Maryland Business Express |

| Massachusetts | $500 | $500 | Annual, anniversary month | MA Secretary of the Commonwealth, Annual Report | Massachusetts Secretary of the Commonwealth |

| Michigan | $50 | $25 | Annual, February 15 | MI Dept. of LARA, Annual Report | Michigan Corporations Division |

| Minnesota | $155 | $0 | Annual, December 31 | MN Secretary of State, Annual Report | Minnesota Secretary of State |

| Mississippi | $50 | $0 | Annual, April 15 | MS Secretary of State, Annual Report | Mississippi Secretary of State |

| Missouri | $50 | $0 | No annual fee + no report due | N/A, N/A | Missouri Corporations |

| Montana | $35 | $20 | Annual, April 15 | MT Secretary of State, Annual Report | Montana Secretary of State |

| Nebraska | $100 | $13 | Biennial, April 1 of odd years | NE Secretary of State, Biennial Report | Nebraska Secretary of State |

| Nevada | $425 | $350 | Annually, anniversary month | NV Secretary of State, Annual List of Members + Business License | Nevada Secretary of State |

| New Hampshire | $100 | $100 | Annual, April 1 | NH Secretary of State, Annual Report | New Hampshire Corporation Division |

| New Mexico | $50 | $0 | No annual fee + no report due | N/A, N/A | New Mexico Secretary of State |

| New York | $200 | $9 | Biennial, anniversary month | NY Department of State, Biennial Statement | New York Department of State |

| North Carolina | $125 | $200 | Annual, April 15 | NC Secretary of State, Annual Report | NC Secretary of State |

| North Dakota | $135 | $50 | Annual, November 15 | ND Secretary of State, Annual Report | North Dakota Secretary of State |

| Ohio | $99 | $0 | No annual fee + no report due | N/A, N/A | Ohio Secretary of State |

| Oklahoma | $100 | $25 | Annual, anniversary month | OK Secretary of State, Annual Certificate | Oklahoma Secretary of State |

| Oregon | $100 | $100 | Annual, anniversary month | OR Secretary of State, Annual Report | Oregon Secretary of State |

| Pennsylvania | $125 | $7 | Annual, September 30 (starting in 2025) | PA Department of State, Annual Report | PA Department of State |

| Rhode Island | $150 | $50 | Annual, February 1 – May 1 | RI Secretary of State, Annual Report | Rhode Island Department of State |

| South Carolina | $110 | $0 | No report due unless LLC files taxes as an S-Corp | N/A, N/A | SC Secretary of State |

| South Dakota | $150 | $50 | Annual, anniversary month | SD Secretary of State, Annual Report | South Dakota Secretary of State |

| Tennessee | $300 (min) | $300 minimum | Annual, April 1 | TN Secretary of State, Annual Report | Tennessee Secretary of State |

| Texas | $300 | $0 for most LLCs | Annual, May 15 | TX Comptroller, Public Information Report + Franchise Tax | Texas Secretary of State |

| Utah | $59 | $18 | Annual, anniversary month | UT Department of Commerce, Annual Report | Utah Division of Corporations |

| Vermont | $125 | $35 | Annual, March 15 | VT Secretary of State, Annual Report | Vermont Secretary of State |

| Virginia | $100 | $50 | Annual, anniversary month | VA Corporation Commission, Annual Registration Fee | Virginia SCC |

| Washington DC | $99 | $300 | Biennial, April 1 | DCRA, Biennial Report | Washington Secretary of State |

| West Virginia | $100 | $25 | Annual, July 1 | WV Secretary of State, Annual Report | WV Secretary of State |

| Wisconsin | $130 | $25 | Annual, anniversary quarter | WI Secretary of State, Annual Report | WI Department of Financial Institutions |

| Wyoming | $100 | $60 minimum | Annual, anniversary month | WY Secretary of State, Annual Report | Wyoming Secretary of State |

When you compare fees, keep in mind that states like west virginia can offer surprisingly competitive options. Meanwhile, regions with high corporate taxes or extra surcharges may diminish your profit margins over time. Balancing affordability with logistical considerations—such as proximity to your customers—usually leads to the best long-term solution. Take south carolina, for instance, which boasts straightforward documentation processes combined with relatively low recurring charges, attracting startups seeking efficient filings.

Which State Has the Lowest and Highest LLC Fees?

Comparing LLC fees across the nation can highlight significant cost differences. Some states charge minimal annual expenses, while others levy higher franchise taxes or additional compliance requirements. Pinpointing the cheapest state might save you money initially, yet it’s vital to consider overall business goals before finalizing where you’ll register your LLC.

- north carolina: Known for moderate rates and user-friendly filing procedures

- south dakota: Offers one of the lowest recurring obligations year after year

- north dakota: Charges slightly higher ongoing expenses but provides streamlined processing

- rhode island: Relatively small region with varied fees depending on revenue brackets

Ultimately, your state comparison should weigh both upfront and annual costs alongside tax structures, local regulations, and future growth plans.

Ongoing Costs and Compliance Requirements for LLCs

Even after you handle initial filings, each LLC faces ongoing costs to maintain active status. Regulatory demands can include annual reports, franchise taxes, and periodic filings. Overlooking these obligations risks penalties or administrative dissolution, so entrepreneurs must track deadlines and ensure each compliance step is accurately fulfilled.

What Is the Annual Report Requirement for LLCs?

Most states mandate an annual report to confirm your LLC’s contact information, ownership structure, and other basic data. Submitting this update on time keeps your company recognized by state authorities. While these documents generally seem straightforward, any mistakes or delays might lead to late fees or administrative complications.

Despite the consistent report requirement, certain jurisdictions switch to a biennial report format, meaning you file every two years. Always confirm specific deadlines and forms with local agencies or review official guidelines. For more details, refer to this resource from the SBA

How to File LLC Annual Reports and Pay State Fees?

Filing your LLC’s annual report typically involves accessing the state’s official website or mailing in a completed form. Most jurisdictions accept online submissions, which expedite processing times and reduce errors. Pay any associated fees promptly to avoid late penalties or potential suspension of your LLC’s good standing. Learn more about obtaining an LLC or business license first to ensure your business operates legally.

- Gather any required certificate of good standing, if applicable

- file annual report through your state’s designated portal or by mail

- Submit the correct payment method, whether credit card or check

- Retain proof of filing for your personal records

In many cases, meeting these legal deadlines preserves your right to operate without interruption.

What Happens If You Don’t Pay Your LLC Annual Fee?

Skipping your annual tax payment or neglecting periodic fees jeopardizes your LLC’s active status. Some states impose penalty charges and interest, while others may strip your business of its limited liability protections altogether. If you're unsure whether your LLC will need business license, check your state’s specific requirements.

In extreme cases, the government can dissolve your company, forcing you to re-file and pay additional amounts if you wish to continue operations. This lapse also discourages potential investors and partners, as they might perceive a neglected business as higher risk. Maintaining consistent payment schedules is the simplest way to protect your LLC from unnecessary trouble.

Stay Compliant, Avoid Penalties

Never miss an LLC renewal deadline. Get expert assistance to handle your filings and keep your business in good standing.

Choosing the Best State for Your LLC Based on Costs

Finding the right jurisdiction isn’t solely about the cost to form your LLC. While some entrepreneurs choose to register a business in California, others prefer more affordable regions. If you’re considering forming an llc California, be sure to check the state's specific costs and compliance requirements. Weigh local statutes, taxation, and industry presence. For more info on federal rules, see this guidance from the IRS.

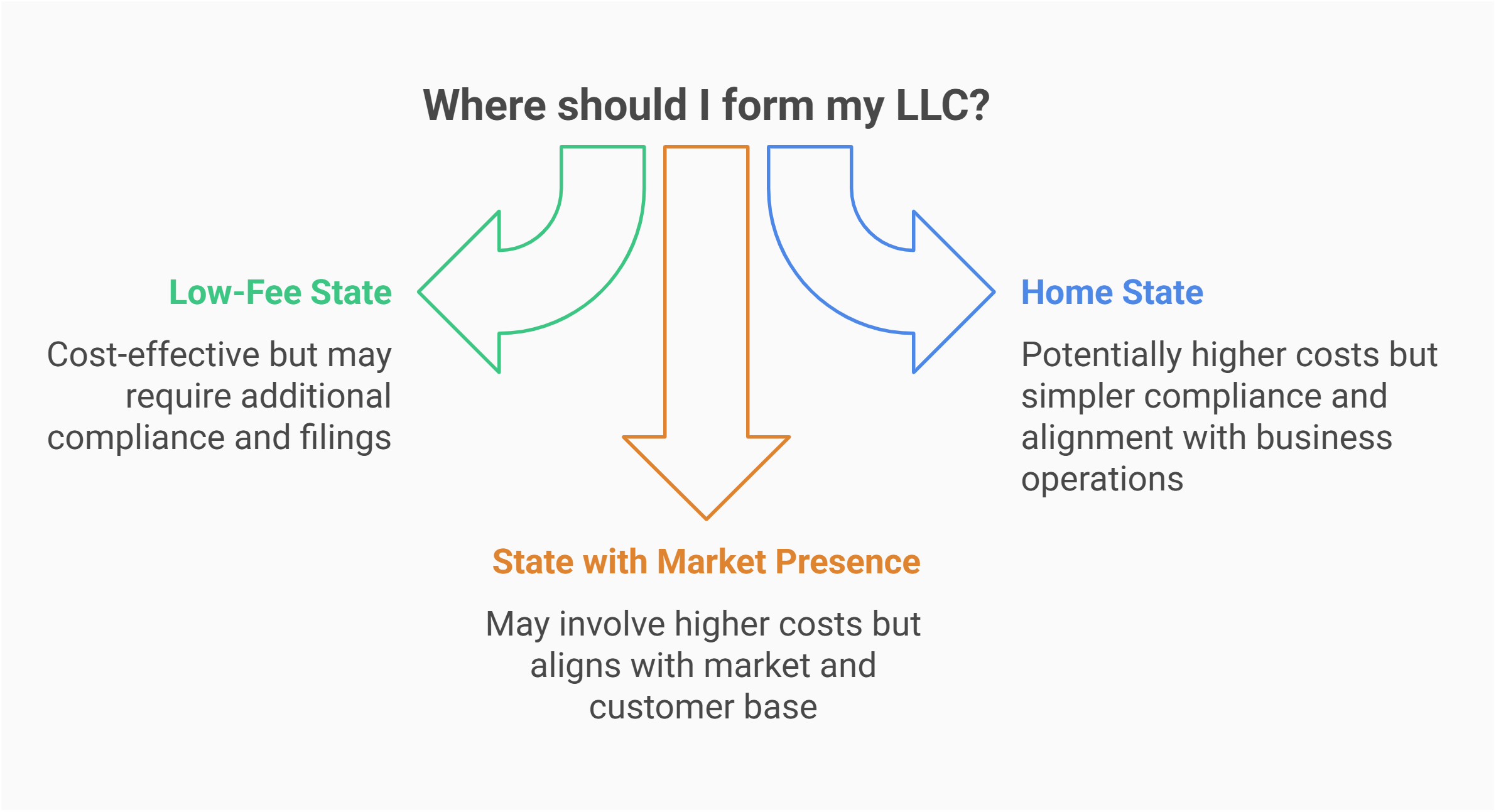

Should You Form Your LLC in a Low-Fee State?

Many entrepreneurs wonder if they should form a LLC in a state that advertises low registration or renewal fees. Although cost-effectiveness is appealing, such jurisdictions may impose other requirements like additional recordkeeping or industry-specific restrictions. Before you commit, verify whether your home state offers simpler processes that offset potential savings. Understanding the best way to start an llc can simplify your formation process and avoid unnecessary complications.

While you might start an LLC in a budget-friendly location, operating far from your market can complicate compliance. If you prefer to form your LLC where you primarily conduct business, you might avoid extra registrations. This scenario adds paperwork, extra expenses, and potential confusion for those unfamiliar with multi-state obligations.

What Are the Long-Term Implications of Choosing a Low-Fee State?

Forming a domestic LLC in one of the cheaper states might seem like a clear win, but the long-term picture can differ. Understanding the differences between a domestic vs foreign llc is crucial when deciding where to register your business.If your primary customer base or physical assets reside elsewhere, you could face extra filings or tax obligations. Evaluating both immediate and future needs is key.

- Potential requirement to register as a foreign llc in your actual location

- Challenges if you evolve from an LLC into a corporation or partnership

- Increased complexity for multi-state payroll and tax filings

Balancing minimal startup costs with sustainable growth strategies often proves more beneficial than zeroing in on the cheapest initial option alone. Comparing an llc vs corporation can help you determine the best structure for your business goals.

LLC Fees for Doing Business in Multiple States

Operating across several regions means adhering to each state’s rules and possibly paying extra. Even if one jurisdiction is quite business friendly, others may demand additional registrations or ongoing fees. Navigating multi-state intricacies can be time-consuming, so plan ahead to handle compliance effectively for every location you serve. Curious about how many llc can you have? Learn about the possibilities and limitations.

Do You Have to Pay Fees in Every State Where You Do Business?

Generally, if you transact or hold a bank account in a particular region, that state may view you as actively doing business and demand compliance. This could involve annual reports, extra taxes, or other duties. The rationale is that each jurisdiction wants to ensure companies contributing to their economy meet local legal obligations.

If you originally registered as a business entity in one location but expand into new territories, you might need to file articles of incorporation for corporations or comparable LLC documents. Each jurisdiction’s definition of “doing business” can differ, meaning a one-size-fits-all strategy may not apply. Thorough research is essential before venturing into multiple markets.

How Foreign LLC Registration Affects Annual Costs?

Registering as a foreign LLC typically means meeting multiple sets of regulations. If your company is an llc in california but also operates elsewhere, you’ll have to reconcile California’s standards with additional state rules. This approach can raise overall expenses, as each region imposes its own annual fees and documentation demands.

- Certain states may tax corporate income differently

- The internal revenue service requires accurate tracking for multi-state tax reporting

- Reconciling each region’s rules can complicate your yearly filings

Planning for these added steps and expenses can smooth the path to broader business operations.

FAQs – Common Questions About LLC Fees

Many entrepreneurs have questions about recurring fees, tax implications, and how location choices affect the bottom line. Below, we address the most common concerns, including whether a series LLC influences these costs and how local cost of living factors into your overall strategy.

Exact pricing varies, but a typical LLC filing fee can range from $50 to several hundred dollars. To get a complete breakdown of how much to start an llc, check out our in-depth guide. These state fees often depend on local regulations and optional services like expedited processing. Keep in mind that annual fees may apply after your initial registration, and these totals add up over time. Some LLC fees are also scaled based on revenue. Researching requirements before you commit is essential for smooth LLC formation.

Most states offer multiple payment methods, from credit cards to mailing checks, and may also require a business license based on your business structure. Some allow you to pay in person at the relevant agency, though digital transactions typically streamline the process. If you’re in a rush, an expedite fee might guarantee faster processing, but that convenience comes at an extra cost. Remember to confirm any deadlines or due dates to avoid late penalties. Keep copies of all confirmations to prove you settled the fee in a timely manner.

Ongoing expenses often include mandatory state charges, franchise taxes, and fees for additional documents. If you run a single member llc, you might handle these obligations through your personal tax filings, but complexities can arise if you shift to a multi-member setup. Always verify state requirements to ensure accuracy.

For tax purposes, an LLC can opt for pass-through taxation or choose corporate status, potentially affecting income tax liabilities. Make sure to file a tax return reflecting the most advantageous classification for your operations. If your total income surpasses a certain threshold, some states impose an annual report filing fee in addition to standard obligations. One common question is about perpetual llc meaning, which refers to how long an LLC remains active without renewal.

Failure to file LLC annual payments or paperwork may result in administrative dissolution, meaning the state revokes your limited liability company status. You lose liability protection, and your company reverts to being treated as a sole proprietorship or partnership. If you delay forming an llc again, it can involve extra fees, documentation, and added effort to regain compliance. If renewal is delayed, banks may freeze accounts or refuse services, hampering growth. For step-by-step instructions on how to pay $800 llc fee online, check out our guide.

Is Your State Too Expensive?

Discover states with low or no franchise taxes and annual fees. Optimize your LLC’s financial strategy now.

We will quitclaim our title in rental investment real estate to an LLC to be formed.

We do not care or have a preference as to the state of formation.

Our investment real estate is in Oregon State.

Our residence state is Washinton State. It could become Arizona State.

In which state should we form the LLC? WY, OR, WA, AZ (no annual fee and no annual filing), or ???

Thank you!

Thank you for your question. Because your rental property is in Oregon, the state requires that the LLC owning it is registered to do business there. The simplest way to handle this is to form the LLC directly in Oregon.

If you form the LLC in another state like Wyoming or Arizona, you would still need to register it in Oregon as a foreign LLC. That means paying fees and filing reports in two states instead of one, which is usually more expensive and complicated over time.

Your residence — Washington now, Arizona in the future — doesn’t change this. What matters most is where the property is located. Unless you also start running business operations in your home state, Oregon remains the key jurisdiction.

In most cases, investors in your situation form the LLC in Oregon to keep things straightforward and compliant. If you want a tailored answer based on your taxes or long-term plans, it’s best to confirm with a CPA or attorney before filing.