Starting a limited liability company (LLC) is one of the most popular ways to protect your personal assets and legitimize your business. If you're planning to launch a new venture, expand an existing brand, or separate your personal and business finances, forming an LLC in Washington offers legal protection, operational flexibility, and zero state income tax.

To start an LLC in Washington, you must file a Certificate of Formation with the Washington Secretary of State ($200), appoint a registered agent with a Washington-based physical address, and file an Initial Report ($71). You’ll also need to apply for a business license through the Department of Revenue ($19), with optional costs like a $30 name reservation and a $50 expedited processing fee — bringing your total first-year cost to roughly $290–$450 depending on your selections.

This guide walks you through exactly how to start an LLC in Washington — including filing steps, legal forms, processing timelines, ongoing requirements, and key decisions like choosing a registered agent. Whether you’re a first-time founder or expanding across state lines, everything you need is here.

Why Form an LLC in Washington State? Key Advantages

Washington is a top-tier destination for entrepreneurs due to its pro–business climate and LLC-friendly laws. Whether you're launching a new venture or restructuring an existing one, forming a limited liability company in Washington offers real legal and financial advantages that set your business up for long-term success.

Limited Liability Protection for Owners

Personal asset protection is one of the most important benefits of llc that comes with forming an llc. Creating an llc in washington will protect your personal assets, savings, and home from liabilities arising from the LLC. This means if your company is sued or goes into debt, only the assets of your llc are at stake – not yours.

According to washington law, unlike sole proprietorships and general partnerships, an llc is its own separate business entity. This llc structure is very important for entrepreneurs in high-risk industries or those looking to protect long-term investments. Creating an llc can essentially set a barrier between your personal finances and your business’ finances, therefore you can take comfort in this long-term liability protection.

Pass-Through Tax Treatment & No State Income Tax on Personal Returns

One of the main financial advantages of llc in washington state llc is pass-through taxation. In a limited liability company, taxes are paid only once, on member tax returns, not at the company level. The income is instead “passed through” to their owners’ personal tax returns, avoiding double taxation, this is a crucial difference from corporations. If you have a one member LLC, it’s generally treated as a disregarded entity, meaning your business tax filings and personal tax filings are legally the same unless you elect to be taxed as a corporation.

Washington State has no personal income tax, so LLC members can enjoy more money from their business and investments. You will have to comply with internal revenue tax rules enforced by the IRS Quarters, besides that depending on your field B&O tax has to be paid at the state level (source). In general, a washington state llc allows for an easier tax strategy while still complying with state and federal laws.

Enhanced Business Credibility & Perpetual Existence

As soon as you form an llc in washington, your business entity will gain credibility. People like to trust registered, limited liability companies compared to unregistered setups like sole proprietorships. Such companies can easily enter into joint ventures with vendors, get loans from banks and financial institutions, and secure contracts from clients.

Another benefit is perpetual existence. A Washington LLC doesn't end when an owner dies or leaves. Unlike informal structures, it continues to operate unless dissolved. Corporate governance helps you maintain business continuity, which is important if you are aiming for a long-term brand, attracting investors or succession planning. When you form an LLC, you create a lasting respected structure that will operate smoothly.

Flexible Management Structure & Privacy

A limited liability company allows for a great deal of flexibility regarding how you manage your business. According to the washington secretary law, if you want your LLC to be member-managed or manager-managed, either option is supported. Now, it’s easier to customize your llc structure based on roles, voting rights, or decision-making power.

Privacy is another advantage. Washington state llcs do not have to disclose members or ownership in most filings as corporations do. This implies better privacy for owners and less public disclosures, specially relevant to offshore internet businesses, professionals’ practices or holding companies. An llc in washington offers both privacy and operational control, for those who find it important.

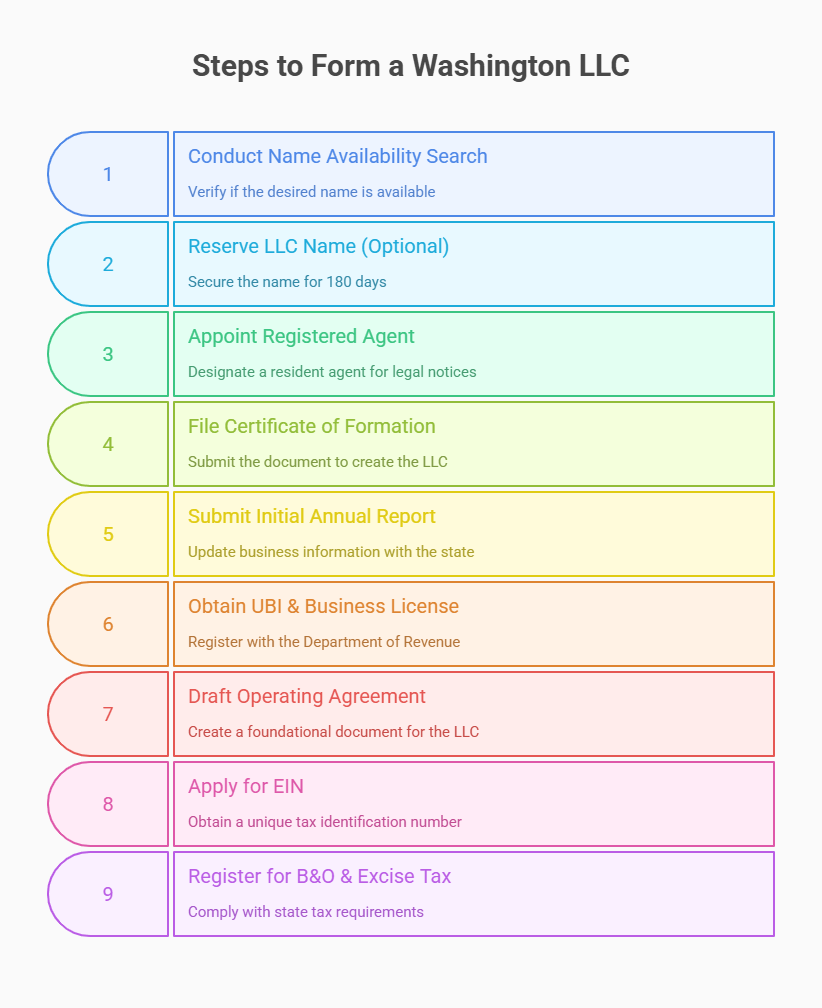

9 Steps to Form Your Washington LLC

Starting a limited liability company in Washington may sound complex, but the process is surprisingly straightforward when broken down step by step. From selecting your LLC name to securing your business license and filing your Certificate of Formation, Washington makes it easy to get your new business up and running quickly — whether you're filing online or by mail.

Step 1: Conduct a Name Availability Search – Free via WA SOS

You must make sure that your desired name is available before you can form an llc in washington. You can search for free, online and instantly to see if your name is registered by another entity in washington. Washington secretary of state provides this service. This washington llc name search guide includes information on interpreting the search results, restricted words, and reserving your name if necessary.

When you are conducting the search, ensure that your name meets the requirements of the state, which would need to include legal designator like “LLC” or “limited liability company” and be distinguishable from other existing business entities in washington. Stay away from names that are too similar to existing corps, LLCs or non-profits. If you have the name available you can go straight to formation or just reserve it for $30.

This quick, no-cost step helps you avoid delays, rejections, or re-filing later on, making it a smart first move in your LLC formation journey.

Step 2: Reserve Your LLC Name (Optional) – $30

In Washington, you don’t have to reserve your LLC name. However, it’s a smart option if you aren’t ready to file your certificate of formation. By filing a Name Reservation Application with the washington secretary of state along with the $30 filing fee, you may reserve your name for 180 days maximum.

This can be done either through online filing or paper filing by mail. The name you are reserving must meet all legal standards; this means it should be labelled with a proper business suffix, like “LLC” or ”limited liability company”. While this step is optional, it helps ensure that another business cannot take your chosen name while you draft your llc formation documents.

Step 3: Appoint a Washington-Resident Registered Agent

Every LLC in Washington must appoint a registered agent with a physical address in the state. This individual or company is responsible for receiving legal notices, government correspondence, and service of process on behalf of your LLC.

You can appoint yourself, a trusted individual, or hire a professional registered agent service. The agent has to be available during business hours and maintain an in-state address (P.O. boxes will not work). Choosing the right agent can help a company stay compliant and not miss documents. By using a commercial service, you can benefit from improved privacy and trustworthy mail forwarding. For help comparing the best LLC formation and registered agent services, this expert roundup evaluates 18 top-rated providers based on price, features, customer support, and long-term value.

You must handle this step before filing your documents because you will provide the agent’s information when you file your certificate of formation with the washington secretary of state.

Step 4: File Your Certificate of Formation – $200 Filing Fee

To formally create an LLC in Washington, you must submit a certificate of formation to the washington secretary of state. This document establishes your limited liability company as a legal entity and includes essential information such as your LLC’s name, registered agent, and principal office address.

You can submit this form through online filing for faster processing, or use paper filing if you prefer mail. The standard filing fee is $200. Review your information carefully before submission, any errors or omissions could delay the approval of your llc formation. You can find all official instructions, forms, and options directly on the Washington Secretary of State’s LLC filing page. When approval occurs, you will get a confirmation for registering your business entity with the state.

Step 5: Submit Your Initial Annual Report & Pay $71 Fee

You need to submit an initial report with the washington secretary of state within 120 days of filing of your certificate of formation. The latest version of your Article of Organization updates some of your businesses’ information like your principal office address, members or manager, and your registered agent.

The filing fee for this report is $71. The same online filing system that you used for formation lets you file this. An annual report is required every year to remain compliant in the future. Our guide on filing LLC annual reports has full deadlines, fees and rules across the country for your perusal. If you don’t submit the initial report on time, you may incur late fees or your llc can be administratively dissolved in washington state. Finishing this early obligation keeps your business entity in good standing with the state.

Step 6: Obtain Your Unified Business Identifier (UBI) & State Business License – $19

Once your LLC gets approved, you need to register with the Washington Department of Revenue for a Unified Business Identifier (UBI) number. This special number or nine-digit number, is used by a variety of state agencies to track your business entity taxing, regulating.

You must complete the washington business license Application in order to apply for a state business license. The fee for filing will be $19 and you can do that through the online filing portal of the state. You may also need city or county permits, endorsements, or specialty licenses depending on your industry and location. For a broader comparison of business license costs by state, some licenses range from $25 to $500 or more depending on the business type and jurisdiction. To avoid penalties, ensure your Washington state LLC is fully authorized before operating business activities.

Step 7: Draft & Adopt an Operating Agreement

An Operating Agreement is a foundational document that outlines your LLC’s ownership structure, member roles, voting rights, and financial procedures. Since it’s not legally required, washington llcs are recommended to have an internal agreement, especially multi-member ones, to avoid disputes in the future and protect your limited liability.

An operating agreement should include the amount of money, property, and services contributed by each member, as well as their share of profits, losses and management responsibilities. It will also include the plan for resolving disputes or dissolving the company. To draft it you can do it your self, hire a lawyer, or use a reputable template. Once you finalize the agreement, you do not have to file it with the state, although you should keep it in your business records.

When you take the time to draft an operating agreement, you put a legal framework in place that keeps your business entity organized and legal.

Step 8: Apply for an EIN from the IRS (Free)

If you want to hire employees, open a bank account, and file federal taxes for the LLC, you need an Employer Identification Number (EIN). Issued by the Internal Revenue Service (IRS), this unique number identifies your business entity for federal tax purposes, similar to how a Social Security number works for individuals.

You can apply for an EIN online through the IRS. The process takes only a few minutes and provides instant confirmation. Even single-member LLCs should have an EIN to separate personal and business funds as well as for long-term compliance.

Step 9: Register for B&O & Excise Tax Accounts & Local Permits

Washington does not have a personal income tax, but most businesses must register for the Business & Occupation (B&O) tax and other excise taxes. You’ll complete this step through the Washington Department of Revenue after receiving your UBI number and securing your business license.

You may also be required to register for local business taxes and obtain permits specific to the city or county depending on where you are located. Regulated industries, such as food service, retail, and construction, have stricter measures for adherence. Be sure to review all state and municipal requirements to remain in good standing. The final registering step ensures your washington llc operates according to the law and avoids penalties.

Form Your Washington LLC with ZenBusiness

ZenBusiness makes starting an LLC in Washington easy, from filing to compliance – with tools and support to keep you on track from day one.

Required Documents for Washington LLC Formation

To start your llc in Washington, there are several required documents you need to prepare and submit accurately. The documents represent the legal and functional basis of your business entity. Missing items, or misfiled items, can cause delays and be expensive during llc formation. To understand how each of these filings affects your startup budget, review this detailed guide on how much it costs to start an LLC in Washington.

At a minimum, you'll need the following:

- Certificate of Formation – Filed with the Washington Secretary of State to legally establish your LLC.

- Initial Report – Lists basic company details and must be submitted within 120 days.

- Operating Agreement – An internal document outlining management structure and ownership terms (not filed with the state).

- Business License Application – Required for state-level registration with the Department of Revenue.

- EIN Confirmation Letter – Issued by the Internal Revenue Service (IRS) after successful application.

The required documents should be safely kept in your business records. Although not all are submitted to state, together the limited liability company articles of organization form a legally compliant, fully operational.

Washington LLC Fees & Annual Report Costs

To form and maintain an LLC in Washington, you will incur government filing fees and ongoing fees. If you know these upfront, you can more accurately plan your startup and annual business costs. If you are looking for a national perspective, you can explore LLC annual fees by state, which shows that annual fees vary substantially, from $0 in Arizona to $800 in California, depending on where you do business.

Here’s what you can expect to pay:

- Certificate of Formation – $200 (one-time, to establish your LLC)

- Initial Report – $71 (due within 120 days of formation)

- Business License Application – $19 (required by the Department of Revenue)

- Annual Report – $71 (recurring, due every year by your anniversary date)

- Optional Name Reservation – $30 (valid for 180 days)

- Expedited Filing Fee – $50 (optional for 1-day processing)

Please note that there are additional fees to incur if your business requires local permits or endorsements. Altogether, the total cost to start and maintain a Washington State LLC ranges from $290 to $450 in your first year, depending on the options you choose.

| Fee Type | Amount | Frequency |

|---|---|---|

| Certificate of Formation | $200 | One-time |

| Initial Report | $71 | One-time (within 120 days) |

| Business License | $19 | One-time |

| Annual Report | $71 | Annual |

| Name Reservation (Optional) | $30 | Optional |

| Expedited Filing | $50 | Optional |

Choosing & Working with a Registered Agent in Washington

Choosing a trusted registered agent is mandatory while forming an LLC in Washington but it is also a strategic choice. The agent that receives legal documents and notices will affect your business compliance and privacy. Whether you handle this in-house or use a registered agent service, understanding the duties, pros, and how to make changes is essential.

Registered Agent Duties & Legal Requirements

A registered agent in Washington is legally responsible for accepting service of process, legal documents, and state correspondence on behalf of your LLC. The agent must have physical address in Washington readily available during normal business hours to receive notices from the Washington Secretary of State and the courts.

The agent can be an individual resident of Washington or a commercial registered agent service. They must promptly send any documents to the designated contact for your LLC. Not having a valid registered agent could lead to penalties or administrative dissolution. Because of this, it’s essential to choose a registered agent as you form your llc and stay compliant.

If you're wondering whether this is optional or required, our overview of registered agent rules in Washington explains the legal requirement, acceptable agents, and what happens if you don't appoint one.

Pros & Cons: Self-Appointment vs. Commercial Service

When forming your LLC in Washington, one of the most important decisions is choosing your registered agent. You have two options: appoint yourself or hire a commercial registered agent service. To help you decide, here’s a side-by-side comparison of both approaches:

| Option | Pros | Cons |

|---|---|---|

| Self-Appointment |

• No annual service fees • Direct control over official documents • Works well for home-based or small businesses |

• Must be available during all regular business hours • Your physical address becomes public • Higher risk of missing legal notices |

| Commercial Registered Agent Service |

• Protects your privacy (your personal address stays off public records) • Allows flexible work hours and travel • Often includes compliance reminders and document storage |

• Costs $100–$300 per year • Adds a recurring business expense |

This comparison helps you align your choice with your privacy preferences, daily availability, and long-term business goals. Whether you want more control or more convenience, the right decision depends on what fits your operational style best.

How to Change Your Registered Agent

To change your registered agent, you must submit a Statement of Change to the Washington Secretary Of State. This document officially updates your agent information and must include the new agent’s name, physical address, and consent to serve.

The form may be filed online or through mail with the filing fee of $30. After processing, the public record of your business entity will change. This makes sure legal documents and state notices go to the right party so your llc stays in compliance with washington law.

Washington LLC Processing Times & Expedited Filings

Your LLC in washington is not official right after the filing of your Certificate of Formation. The Washington Secretary of State must review it and approve it. If you have wondered how much time it takes to file an llc in washington, this article will tell you all about its timings. The state has three ways to process: standard online processing, mail submission, and expedited processing. Every option comes with its own price and duration, so you need to determine how important urgency and cost are to you.

Standard Online Processing – 3-5 Business Days

Submitting your LLC formation documents through the online filing system is the quickest routine method that the Washington Secretary of State offers. Most submissions are processed within 3 to 5 business days, depending on filing volume.

Make sure that you checked through all the details for processing. Especially your agent’s details and business name. By filing online, you get confirmation quickly, you have access to digital records, and follow-up is easier in case something goes wrong.

Mail Submission – 7-10 Business Days

If you choose paper filing, you can submit your Certificate of Formation by mail to the Washington Secretary of State. It takes longer with this method, generally 7 to 10 business days, not counting mailing time or return processing.

Make sure to include the correct filing fee, a return address, and legible, accurate informatio. Though not as speedy as online filing, submitting by mail is still an option for those who prefer using papers or facing issues with e-filing.

Expedited Filing Option – 1 Business Day (+$50)

Washington offers expedited LLC filing for $50 if you need quick approval of your LLC in Washington. This improvement brings turnaround time 1 business day only, excluding weekends or holidays.

To make a request for an expedited service, you must state such on the Certificate of Formation and pay the filing fee plus the expedite charge. Whether you are filing online or using a paper application, this option is available. Suitable for time-sensitive launches or compliance deadlines.

Registering a Foreign (Out-of-State) LLC in Washington

If your company is already formed in another state and you want to operate in Washington, you’ll need to register as a foreign LLC. This process gives your out-of-state business entity the legal authority to do business in Washington while maintaining its original state of formation.

Qualification Requirements & Certificate of Authority

If you wish to run a foreign limited liability company or LLC in Washington, you must apply with the Washington Secretary of State for a Certificate of Authority. This registration allows your out-of-state LLC to operate while keeping your home state registration intact.

To register a foreign entity in Washington State, you must submit a Foreign Registration Statement, a Certificate of Good Standing from your formation state, and designate or list an agent with a Washington physical address. You will also have to submit general information regarding your business. For instance, you’ll have to provide the business’s legal name, principal office, and the jurisdiction in which it was originally formed.

To meet these qualifications, it can be proven that your business entity is authorized for conducting business in other states and is compliant with Washington law and taxes.

Foreign Registration Filing Fee – $200

The Washington Secretary of State charges a $200 filing fee for the foreign LLC registration, a one-time fee. This fee covers the examination and authorization of your Certificate of Authority for your foreign business to operate legally in Washington.

You can file on the internet for faster processing or paper file your documents by mailing them. To maintain realiable status , always confirm information accuracy and ensure your Certificate of Good Standing is valid. If you ask for expedited processing, it will cost $50. By filing properly, your business entity will not be penalized or rejected in Washington.

Ongoing Compliance & Registered Agent Obligations

Once your foreign LLC gets approved in Washington, you must meet the same ongoing compliance requirements as local businesses. This entails the filing of an Annual Report each year and the retention of an active registered agent with a valid physical address in Washington.

If there is a change in your registered agent, business address, or ownership structure, then your business entity must also update the Washington Secretary of State. If you fail to meet these obligations, your business could be administratively dissolved. You could face late fees or lose good standing. Keeping these updates current maintains your limited liability status and avoids disruption of your business activities in Washington.

How to Maintain & Comply with Washington LLC Requirements

Once registered as an LLC in Washington, it is essential to remain compliant to avoid any penalties and to protect the legal protection of your limited liability company. Every year, the state expects all active LLCs to be current on their filings, fees, and taxes.

Here’s what you need to do:

- File an Annual Report – Due each year by your LLC’s anniversary, the filing fee is $71 (View filing guide).

- Maintain a Registered Agent – Your agent must have a valid physical address and be present during business hours.

- Renew Your Business License – Department of Revenue requires it depending on your type of activity.

- Stay Current with Taxes – Register for and pay any applicable B&O, sales, or excise taxes at the state and local levels.

If you do not meet these stipulations, you could incur a late fee, suffer administrative dissolution, or lose your good standing. By maintaining proper business records, and setting reminders for compliance, you can avoid problems in the future.

Frequently Asked Questions: Washington LLC Formation

Looking for quick answers about forming and managing an LLC in Washington? Below are concise, reliable responses to the most common questions business owners ask when starting or maintaining their LLC in the Evergreen State.

What documents are required to form an LLC in Washington State?

To form an LLC in Washington, you need to prepare and file the Certificate of Formation with the Washington Secretary of State. You'll also need to complete an Initial Report, obtain a business license from the Department of Revenue, and apply for a federal EIN through the IRS. Although not submitted to the state, an Operating Agreement is also strongly recommended to structure your business entity and protect your limited liability status.

How much does it cost to start an LLC in Washington?

The total cost to start an LLC in Washington typically ranges from $290 to $450 in the first year. Key expenses include a $200 filing fee for the Certificate of Formation, $71 for the Initial Report, and $19 for the state business license. Optional costs like a $30 name reservation or $50 expedited processing fee may also apply depending on your needs.

How long does the filing process take?

The filing duration for an LLC in Washington depends on your chosen method. Online filings are usually processed within 3-5 business days, while paper filings sent by mail take 7-10 business days. If you select expedited processing and pay the additional $50 fee, your formation can be approved in as little as 1 business day.

Can non-residents form a Washington LLC?

Yes, non-residents can form an LLC in Washington without living in the state. There’s no residency requirement for LLC members or managers. However, you must appoint a registered agent with a physical address in Washington to accept legal documents and official notices on your behalf.

If you're a foreign entrepreneur or non-U.S. resident, this guide on how to open an LLC in the U.S. as a non-resident walks you through everything from EIN applications to choosing the best state and tax treatment options.

Do I need a physical Washington address?

You don’t need to have a personal physical address in Washington to own an LLC. However, your registered agent is legally required to maintain a physical street address in the state. This address is used to receive legal documents and government correspondence. P.O. boxes are not accepted, the Washington Secretary of State mandates a valid street address for official filings.

What ongoing fees and taxes apply each year?

Each year, your LLC in Washington must file an Annual Report with a $71 filing fee. You may also need to renew your business license through the Department of Revenue, depending on your business activity. While there’s no personal income tax in Washington, most businesses are subject to the B&O tax, as well as local sales and excise taxes based on location and industry.

Resources for Starting and Managing an LLC in Washington

Forming a Washington LLC becomes easier when you rely on the right state portals and tax tools. These trusted resources help you stay compliant, reduce mistakes, and grow your business with confidence.

- Washington Secretary of State – Corporations Division

(sos.wa.gov): File your Certificate of Formation, reserve a business name, appoint a registered agent, and access all LLC forms. - Washington Business Licensing Service (BLS)

(bls.dor.wa.gov): Register your UBI number, state business license, and city-specific licenses in one streamlined system. - Washington Department of Revenue – B&O & Excise Taxes

(dor.wa.gov): Understand Business & Occupation (B&O) taxes, excise tax obligations, and annual reporting requirements. - WA Secretary of State – Business Search Tool

(ccfs.sos.wa.gov): Check business name availability or research existing LLCs before formation. - IRS – Apply for an EIN Online

(irs.gov): Secure your EIN in minutes — required for tax filings, banking, and hiring. - Wikipedia – Limited Liability Company

(en.wikipedia.org): Learn how LLCs function across different jurisdictions, including taxation and legal protections. - Wikipedia – Operating Agreement (LLC)

(en.wikipedia.org): Understand why this internal document matters, even though it’s not required in Washington. - 2023 SBA Washington Small Business Economic Profile

(advocacy.sba.gov): Explore statistics and economic impact data for small businesses and LLCs statewide. - Washington Small Business Development Center (WSBDC)

(wsbdc.org): Free business coaching, licensing assistance, and legal structure guidance for Washington entrepreneurs.

Bookmark these official tools and sources to form your LLC accurately, stay compliant, and plan for long-term growth in Washington State.

Looking for an overview? See Washington LLC Services

Form a Compliant LLC in Washington with Ease

Harbor Compliance ensures your Washington LLC meets every legal requirement, without the stress or confusion.