Starting an LLC in Nevada open up powerful advantages for business owners like no personal income taxes, strong legal protections, low filing fees, total privacy, flexible structure, and strong asset protection. Nevada is one of America’s most pro-entrepreneur states. Opening a legal entity in Nevada is a good option for someone looking for a simple, controlled and compliant option.

To start an LLC in Nevada, you must choose a unique business name, appoint a registered agent with a Nevada street address, file your Articles of Organization ($75), and submit both your Initial List of Managers or Members ($150) and State Business License application ($200), for a total of $425 in mandatory state fees, with optional costs like name reservation ($25) and registered agent service ($100–$300/year) – all of which can be filed online via SilverFlume or by mail in just a few business days.

This simple guide explains exactly how to form an LLC, what to file, how to run your business in Nevada and stay totally compliant. Get everything you require for successful LLC formation right here, whether you are launching your first venture or expanding in states.

Why Form an LLC in Nevada? Key Advantages

Nevada stands out as a premier destination for LLC formation due to its unmatched combination of tax advantages, legal protections, and corporate privacy. Entrepreneurs from across the United States choose to form an LLC in Nevada (especially those in riskier business ventures like real estate, finance, technology, etc) because it provides strategic benefits that protect the business and the owner while keeping ongoing costs under control and compliance straightforward.

No State Income or Franchise Tax on LLC Profits

Nevada has a tax-friendly structure is one of the biggest reasons to form an LLC there. Nevada has no personal income tax and no corporate income tax. That means your LLC profits pass straight to the members without any state deductions. Also, there’s no franchise tax, which allows small businesses and startups to grow easily. Unlike places like California or New York which have heavy taxation, the tax policy of states like Nevada is such that it attracts the entrepreneur or investor class. To have this structure in place can mean thousands of dollars in savings every year, particularly high-revenue businesses or LLC owners with various incomes.

Strong Asset Protection via Charging Order Law

Nevada's legal system offers one of the strongest asset protection laws for LLC owners in the country. Under state law, the only remedy available to creditors is a charging order, which gives them access only to a member’s distributions, and not to management or ownership of the LLC. In other words, a member’s personal debt won’t affect your assets, voting rights, or operations of the LLC. Nevada is one of the few states that allows a charging order for a single member LLC. Having such legal protections gives business owners peace of mind. Furthermore, the enhanced legal protection shields the company from individual lawsuits.

Complete Privacy—No Member/Manager Names in Public Records

A unique advantage to forming an LLC in Nevada is a high level of privacy. Nevada does not require the names of members or managers to appear in public records as most states do. State filings only include the name and address of the registered agent, not the owner's. It assists business owners to be anonymous while legally and managing themself the company as 100% owner.

This can be helpful for business people who like to work quietly, unfortunately work in a profession where activity should be secretive, or simply want to keep personal identity separate from the business activity. Nevada is selected for confidentiality benefits by even the states and powerful people. With strong legal protection and low filing requirements, Nevada is an obvious choice for privacy-preserving entrepreneurs.

Flexible Management Structure & Business-Friendly Regulations

Currently, Nevada offers the most flexibility on how you run an LLC. Your company may be organized as member-managed or manager-managed, allowing you the flexibility to arrange decision-making at your sole discretion. This is great for all types of businesses including family businesses and startups.

One of the things that Nevada’s internal structure has lot of flexibility, red tape is low. There are no annual franchise taxes, and compliance deadlines are less complicated using SilverFlume, the state’s official business portal. When you combine other strong legal protections with powerful processing times, it makes Nevada one of the most business-friendly states for new and seasoned entrepreneurs.

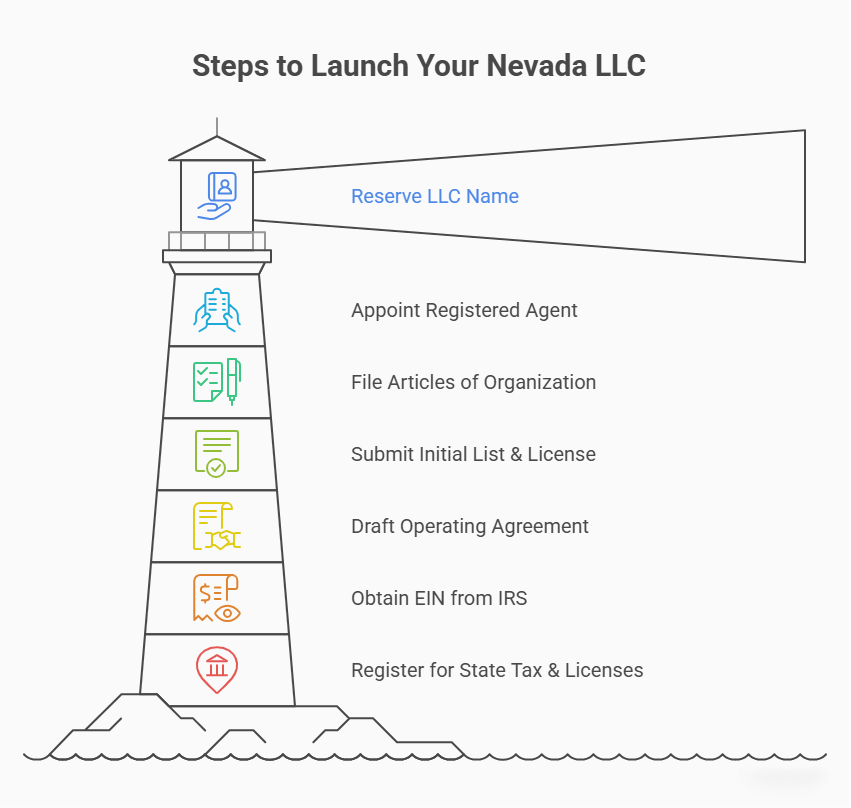

Step-by-Step Guide to Starting Your Nevada LLC

Starting an LLC in Nevada is a clear process with defined steps. But every step we take must be done correctly to stay compliant. Moreover, error-free paperwork ensures we don’t get delayed in processing. If you know what’s required, Nevada’s filing system is simple for everything from name selection through the receipt of your EIN. For an alternate breakdown with visuals and expert commentary, see this Nevada LLC formation guide. Below is a full breakdown of the seven essential steps to launch your business in Nevada.

Step 1: Reserve Your LLC Name – $25 (Optional, 90-Day Hold)

You may file a name reservation request to the Nevada Secretary of State to hold your desired LLC name in Nevada for 90 days. However, it is not mandatory. This step is great if you aren’t ready to file your formation documents but want to secure your business name early.

Reserving a name costs $25 to reserve and the application can be filed online through the SilverFlume portal or by mail. Your name must be distinguishable from other business entities registered in Nevada and must include a proper legal designator like “LLC” or “Limited Liability Company.” You can check if you can use a name with the Nevada Business Search tool.

Step 2: Appoint a Nevada-Resident or Commercial Registered Agent

According to Nevada law, every LLC must have a registered agent with a street address in Nevada. This agent receives service of process, legal notices, and compliance documents on behalf of your business. You can select yourself, another individual, or hire a professional registered agent business when appointing a registered agent.

The average cost of a commercial agent is $100 and $300 per year, but more reliable, confidential and compliant. If you're comparing options, this Nevada registered agent services guide highlights the most reputable providers, including details on features, pricing, and customer reviews. When you file your Articles of Organization, you must include the details of your agent and any changes to it with the Nevada Secretary of State to keep your business in good standing.

Step 3: File Articles of Organization – $75 Filing Fee

To form your LLC in Nevada you must submit Articles of Organization to the Nevada Secretary of State. This document defines your legal entity, along with your LLC’s name, registered agent, and business address.

You must submit your filing fee of $75 either online with SilverFlume or by mail. Once your LLC is approved, it is legally authorized to start doing business in the state. Make sure to keep a copy of your approved articles for your records, you will require it for opening a business bank account and registering for state tax accounts.

Step 4: Submit Initial List of Managers/Members & State Business License – $150 + $200

Once you submit your Articles of Organization to Nevada, you are supposed to file the Initial List of Managers or Managing Members and a State Business License. To maintain a good standing, both documents must be filed within 30 days of the LLC formation. Not clear on the difference between a business license and LLC? This will show the legal and operational difference to help you avoid common compliance mistakes.

The initial list fee is $150, and the state business license costs $200 annually. You can submit both simultaneously using SilverFlume, Nevada’s official business portal. The list required must include the name and street address of each manager or managers member. You must complete this step, missing the deadline may result in documented late penalties, or administrative dissolution.

Step 5: Draft & Adopt Your Operating Agreement

An Operating Agreement is not filed with the state, but is an important internal document that governs how your LLC will be managed. For an overview of what an Operating Agreement is and why it’s important, check out this Wikipedia article on LLC operating agreements. It specifies the roles, capital contributions, profit sharing, and dispute, voting or dissolution processes of each member.

Even if you run a single-member LLC, you should still have an operating agreement because it shows that you are separating personal and business assets. It also shows that your LLC is a separate entity from you. This document is requested by banks, investors and courts for legitimacy.

Step 6: Obtain an EIN from the IRS (Free)

An Employer Identification Number (EIN) is basically a federal tax ID that is issued by the IRS. To open a business bank account, hire employees or agents, or file your federal taxes, your LLC needs an EIN. Even single-member LLCs should get one to keep personal and business finances separate and clear.

You can apply for your own EIN for free through the IRS website. The process takes very little time, and often it is instantly approved. Always keep the confirmation letter because you may need to provide proof of your application for registering for state tax accounts and your business license application.

Step 7: Register for State Tax Accounts & Local Business Licenses

Depending on where the business will be located, and the type of business operated, additional state tax accounts may need to be registered after the formation of the LLC in Nevada. Common registrations include sales tax, modified business tax, and use tax. You can do so through the Nevada Department of Taxation that offers the whole outline of necessary business registration.

Plus, it is also a requirement for many cities and counties, primarily Las Vegas and Clark County, to obtain a separate local business license in order to operate legally. Contact your local authorities to verify any specific business license application, fees, and necessary inspections for the business license. Not registering locally may lead to fines or delays in setting up your business.

Launch Your Nevada LLC the Easy Way with ZenBusiness

ZenBusiness walks you through every step, from name search to final filing, so your Nevada LLC is formed quickly and without stress.

Nevada LLC Annual Fees & Ongoing Costs

To run an LLC in Nevada, you’re not just taking care of the startup paperwork. You’ll also need to keep the company legally active by paying fees and making filings every year. You must anticipate these costs in order to comply with the Nevada Secretary of State. Here is a summary of every fee you will expect. From licensing renewals to optional services. Use this section to budget your LLC costs accurately.

Articles of Organization Fee – $75

To legally create your LLC in Nevada, you need to file Articles of Organization with the Nevada Secretary of State. It costs $75 to file your Articles of Organization. To see everything you’ll pay upfront and annually, including license, filing, and optional service fees, see this complete breakdown of Nevada LLC startup costs. This is an expense to set your business up as a legal entity as per the state. You have the option of filing your claim online through SilverFlume or by sending in a paper application via mail. It’s best to confirm that all particulars are correct as errors can lead to detaining of approval as well as attracting additional processing fees.

Initial List of Managers/Members – $150

Nevada asks for a new LLC to file an Initial List of Managers or Managing Members within 30 days of formation. This list gives the business administrators or controllers name and their street address. If you are looking to create an LLC in Nevada, the state requires you to pay an initial list fee of $150, which is mandatory and must come with your business license application.

If you don’t file this report on time, you may have to pay fines and your business may lose its good standing with the Nevada Secretary of State.

State Business License Fee – $200 (Annual)

All limited liability companies registered in the state of Nevada must have an active State Business License that is renewed each year through the Nevada Secretary of State. Every year your annual list will be required to submit with the $200 renewal fill-in. Curious how this compares nationally? ThisLLC annual fee comparison chart breaks down yearly LLC costs across all 50 states so you can see how Nevada’s compliance costs rank.

Your business in nevada license shows that your corporation is authorized to conduct business and in good standing to do business in Nevada. To track deadlines and obtain a receipt digitally, you can complete the renewal process online through SilverFlume. If you miss the renewal deadline you can face penalties of administrative dissolution of your LLC.

Registered Agent Service – $0 (Self) or $100–$300/Year (Professional)

In Nevada, it is mandated for all LLCs to appoint a registered agent with an actual street address. If you serve as your own agent, there’s no cost. But many business owners opt to use a professional registered agent service instead for more reliability, more privacy and year-round compliance help.

The cost for commercial registered agent services in Nevada typically ranges from $100 to $300 per year. Whichever option you choose, the agent must be available during normal business hours to receive legal documents and service of process on behalf of your LLC.

Name Reservation (Optional) – $25

You can reserve your business name by filing a name reservation with the Nevada Secretary of State even if you are not ready to form your LLC in Nevada. The filing fee is $25, and the reservation will hold your name for 90 days.

You can file online through SilverFlume or submit a paper application. Although you don't have to do it, this step is useful if you are waiting on documents, partners or funding and do not want to lose your name to another filer.

Certified Copies, Amendments & Expedited Filing Fees

Nevada levies extra charges for optional filings including certified copies of documents, LLC amendment, expedited service, etc. A certified copy of your Articles of Organization or other state-filed document typically costs $30–$50 per copy. Changing your business name, address, or registered agent generally costs $175 to file an amendment.

If you need it quickly, Nevada allows expedited processing for an additional filing fee. 24 hours costs $125 while one hour is $1,000. Any of these applications may be completed online through the SilverFlume portal or through the mail.

Registering a Foreign LLC in Nevada

Have you already created an LLC in a different state but wish to operate in Nevada? In order to stay compliant with state law, you must register as a foreign LLC. This procedure allows LLCs formed in other states to legally operate in Nevada. We’ll take you through the requirements, costs, and continued compliance obligations below.

Eligibility & Qualification Requirements

In order to register as a foreign limited liability company in Nevada, your LLC must be active and in good standing in its home state. To form a corporation or an LLC in Nevada, you must appoint a registered agent, who must have street address in nevada; also, your name must not conflict with any other entity registered in nevada.

The documents you will typically need include a Certificate of Good Standing from the state where you were formed, a Certificate of Authority application, and payment of filing fees. You are also required to comply with local licensing requirements if you plan to conduct business in a certain county or city like Clark County or Las Vegas.

Certificate of Authority Filing Fee – $75 + Initial List & License

To be legally allowed to operate business as a foreign limited liability company in Nevada, you must submit a Certificate of Authority to the Nevada Secretary of State. This application certifies your LLC’s intent to conduct business in the state. The base filing fee is $75.

Furthermore, you must file your initial list of managers or members, as well as pay the state business license fee, just like a Nevada domestic LLC. The total startup cost for most foreign LLCs is $425. You can file these documents together online through the state’s business portal, SilverFlume.

Ongoing Reporting & Registered Agent Obligations

A foreign limited liability company must meet Nevada’s annual requirements after registration. Filing an Annual List of managers or members and renewing the State Business License annually is included. To avoid penalties or suspension of your business, these reports must be submitted in a timely manner to the Nevada Secretary of State.

Your business must also have a registered agent in Nevada with a street address that is active. File an update if your agent changes or resigns.If one does not comply then they may lose their good standing status and may be legally vulnerable for receiving service of process or claims correspondence.

Nevada vs. Other Top LLC States

Nevada is often among the best states to form an LLC, alongside Delaware and Wyoming. That said, the right choice largely depends on your business objectives. LLCs in Nevada benefit from no personal income tax, strong asset protection and unmatched privacy which makes the state a haven for owners who want legal safeguards and minimal disclosure.

Nevada is simpler and more flexible for small businesses compared to Delaware which mainly caters to larger corporations. In the event you’re debating whether to incorporate or create an LLC, this guide to the advantages and disadvantages of a corporation outlines ownership rules, taxes, and compliance obligations to ease your decision. Compared to Wyoming, Nevada has a little high, but a stronger legal precedent and infrastructure. It makes sense to form your LLC in Nevada, rather than register out of state, if you plan on actually conduct business in Nevada.

| State | Privacy | State Income Tax | Annual Fees | Best For |

|---|---|---|---|---|

| Nevada | Excellent | None | $350–$425 | Asset protection, privacy |

| Delaware | Moderate | None (out of state) | $300–$500 | Corporations, VC-backed startups |

| Wyoming | Strong | None | $100–$150 | Low-cost, simple LLCs |

Would you like to learn more about how LLCs and corporations differ when it comes to liability protection, management and tax treatment? For a quick overview, go through this academic overview from the entity guide of Harvard law.

Managing & Maintaining Your Nevada LLC

Choosing to form your LLC in Nevada is only the first step. To keep your LLC in good standing, you will have certain obligations you must meet on an ongoing basis. Nevada requires timely renewals, updates to business records, and proper filings with the Nevada Secretary of State. This section outlines everything you need to know for maintaining status, avoid penalties, and keep your company fully compliant.

Annual List & State Business License Renewal Process

Every year, a Nevada LLC must submit an Annual List of managers or members and renew its State Business License. You must file them before the end of the anniversary month of your LLC’s formation. The annual list fee is $150 and the business license renewal is $200. To get a sense of how this filing stacks up against standard practices in other states, check out this summary of LLCs’ annual report requirements (including what’s typically required and why missing the deadline could cost you).

You can file these documents simultaneously online through SilverFlume. Failing to meet deadlines can lead to late fees or you might lose your good standing with the Nevada Secretary of State. If you miss the due date, your LLC may not have the right to conduct business in Nevada, homeowners association fees, licenses, and permits involved.

If you’re unfamiliar with what annual reports typically include, and how they differ from tax filings, this overview of LLC annual report essentials walks through deadlines, contents, and compliance risks in plain English.

Updating Your Registered Agent or Principal Office Address

If your LLC in Nevada changes its registered agent or principal office address, you must file an official update with the Nevada Secretary of State. This ensures that your business receives legal notices, state mailings, and important compliance documents without interruption.

The update can be submitted online via SilverFlume or by mail using the appropriate form. There is a filing fee of $60. It’s crucial to act quickly — failing to maintain an active street address or agent on record can result in penalties or suspension of your company’s good standing.

Filing Amendments, Conversions & Dissolutions

As your LLC in Nevada grows or changes, you may need to file an amendment to update your business name, ownership, registered agent, or management structure. Most amendments in Nevada have a filing fee of $175, which can be filed online through SilverFlume.

You can also change your entity (from sole proprietorship to LLC) or file for voluntary dissolution if ceasing the business. Every action has paperwork, with other relevant fees or tax filings possible too. Always make sure these steps are done through the Nevada Secretary of State to ensure clear legal closure of your business.

Frequently Asked Questions About Starting an LLC in Nevada

Starting an LLC in Nevada can raise a lot of questions, especially if you're new to business formation. Below are answers to the most common queries — each one tailored to give you direct, accurate information so you can move forward with clarity and confidence.

What are the steps to form an LLC in Nevada?

To form an LLC in Nevada, follow these steps:

(1) Choose a unique business name;

(2) Appoint a registered agent with a Nevada address;

(3) File Articles of Organization and pay the $75 filing fee;

(4) Submit your Initial List and pay the state business license fee;

(5) Draft an Operating Agreement;

(6) Get an EIN from the IRS; and

(7) Register for any necessary tax accounts or local licenses.

What documents do I need to file my Articles of Organization?

To file your Articles of Organization in Nevada, you’ll need your LLC’s name, the name and street address of your registered agent, your business address, and details about whether your LLC will be member-managed or manager-managed. You must also include a valid signature from the person forming the LLC. These details can be submitted online through SilverFlume or by mail with the appropriate filing fee.

How long does Nevada processing take?

Standard processing for LLC filings in Nevada typically takes 5 to 7 business days. However, if you use SilverFlume to file online, approvals are often faster. For urgent needs, Nevada offers expedited processing options for an additional filing fee, including 24-hour, 2-hour, and 1-hour service levels. Choosing expedited service can significantly reduce delays and get your LLC active sooner.

Can non-residents form a Nevada LLC?

Yes, non-U.S. residents and out-of-state individuals can legally form an LLC in Nevada. Anyone can own an LLC in the United States. You must appoint a registered agent, whose street address is in Nevada, and file the required documents with the Nevada Secretary of State. Many international business owners choose Nevada for its favorable laws, privacy protections, and no personal income tax policies.

For hands-on assistance, new entrepreneurs can also explore support programs through the SBA Nevada District Office, which provides localized resources, business counseling, and startup guidance.

Do I need a physical Nevada address for my LLC?

No, you don’t need to live in Nevada or have a physical office there, but you must appoint a registered agent with a street address in the state. This address is where official documents and service of process will be delivered. You can use a registered agent service to meet this requirement. Your business mailing address can be located in another state or country.

What ongoing fees should I budget for annually?

Every LLC in Nevada must budget at least $350 annually to stay in compliance. This includes the $150 annual list fee and the $200 State Business License renewal. If you use a registered agent service, add $100 to $300 depending on the provider. You may also incur fees for amendments, certified copies, or expedited filings if needed. For help understanding the full renewal cycle, and how to avoid penalties or lapse in good standing, see this LLC renewal process guide. Always file on time to avoid late penalties or suspension.

Resources for Starting and Maintaining an LLC in Nevada

Nevada offers a business-friendly environment, but staying compliant requires reliable tools and official references. These trusted resources will help you start, manage, and grow your Nevada LLC the right way.

- Nevada Secretary of State – Start a Business (nvsos.gov): Official guide to forming your LLC, filing the Articles of Organization, and obtaining your business license and Initial List.

- Nevada SilverFlume Portal (nvsilverflume.gov): Centralized system to register, renew, and manage your business filings securely.

- Nevada Business Search Tool (nvsos.gov): Verify LLC name availability, status, and business registration history.

- Nevada Department of Taxation – Business Registration (tax.nv.gov): Register for state tax accounts such as sales/use tax or the Modified Business Tax (MBT), and learn local licensing rules.

- IRS – Apply for an EIN Online (irs.gov): Instantly apply for your Employer Identification Number (EIN) — required for tax filings, banking, and payroll.

- U.S. SBA – Nevada District Office (sba.gov): Connect with resources for business planning, funding, and legal help for Nevada and out-of-state entrepreneurs.

- Nevada SBDC – Small Business Development Center (nevadasbdc.org): Free consulting, market research tools, and startup guidance tailored to Nevada business owners.

- Harvard Law – LLCs vs Corporations Overview (hls.harvard.edu): Learn the legal distinctions between LLCs and corporations in terms of liability, taxation, and control.

- Wikipedia – Operating Agreement (LLC) (en.wikipedia.org): Understand the role of an operating agreement, even for single-member LLCs in Nevada.

- Wikipedia – Limited Liability Company (en.wikipedia.org): General legal and financial overview of how LLCs function in the U.S. and globally.

- 2023 SBA Nevada Small Business Economic Profile (advocacy.sba.gov): Dive into economic data about small business growth, employment, and impact in Nevada.

These resources simplify every step of the process—from filing your LLC to staying tax-compliant and scaling confidently in Nevada.

Looking for an overview? See Nevada LLC Services

Get Your Nevada LLC Filed Correctly—From Day One

Harbor Compliance takes care of all legal steps so your Nevada LLC meets state rules and launches with full compliance.