Starting an LLC in Minnesota is the fastest way to protect your personal assets while you build your business. To do it right, file Articles of Organization with the Secretary of State ($155 online or $135 by mail), appoint a Minnesota registered agent, then complete the essentials—operating agreement, free IRS EIN, a separate business bank account, and any required state tax or license registrations. This guide walks you step-by-step through each requirement so you can launch correctly the first time in 2025.

Minnesota LLC Overview and Benefits

Starting a limited liability company (LLC) in Minnesota seems overwhelming due to legal jargons and the state rules. This guide cuts through the confusion, offering Minnesota entrepreneurs a clear roadmap. In this article, we’ll discuss some key structures, protections, and why to form an LLC in Minnesota.

What Is a Limited Liability Company in Minnesota?

A limited liability company is a legally recognized entity that provides limited liability to its owners (referred to as members) while permitting flexible management and taxation as a corporation or partnership, respectively. Forming an LLC in Minnesota creates a separate legal entity. This will protect your personal assets from business debts or lawsuits. After you submit your formation paperwork to the Minnesota Secretary, your LLC will be officially formed and permitted to operate throughout the state, subject to ongoing compliance and reporting.

Key Advantages of Forming an LLC in Minnesota

By choosing to form a limited liability company, the entrepreneurs from Minnesota are assured smart legal and financial protection. This business structure protects owners without being overly complex, allowing for flexibility and control. When you start a business alone or with partners, having an LLC in Minnesota lets you run your operations your way without the formalities of a corporation. It is especially suitable for those wishing to minimize personal risk but who still wish to gain legitimacy, tax efficiency, and easier compliance with local and federal laws.

Here are five key benefits of forming an LLC:

- Liability Protection – Keeps your personal assets safe from business debts and lawsuits.

- Tax Benefits – Enjoy pass-through taxation and avoid double taxation.

- Flexible Management – Design your management structure to fit your needs.

- Professional Credibility – Adds legitimacy and trust to your brand.

- Simplified Compliance – Less paperwork than a corporation.

Single Member vs. Multi Member LLC in Minnesota

A single-member LLC is a business entity owned and operated by one person or member with sole control over the entity, which is taxed as a sole proprietorship. This is perfect for a freelancer, consultants, or small business owners who need liability protection without corporate hassle. If you're considering a structural upgrade, this guide outlines how to switch from sole proprietorship to an LLC with clarity and compliance in mind.

A multi-member LLC consists of two or more owners and is generally taxed like a partnership. They are perfect for teams or co-founders who want joint decision-making and a collaborative strategy to running the business in Minnesota.

Step‑by‑Step Guide: How to Start an LLC in Minnesota

It is not difficult to start a limited liability company. This step-by-step guide makes the process of registration easy so that you can easily move from an idea to a legal entity. Every section outlines a necessary step that will ensure that your LLC in Minnesota is legally compliant and operational.

What You Need Before You Start Your Minnesota LLC

Before you officially form an LLC in Minnesota, make sure to gather the necessary details so there are no mistakes during the filing process. Getting everything together for online registration makes it smooth and you will meet all the state requirements from the start. Taking this step will also shield you from any delays and rejections by the Minnesota Secretary of State. Having your essentials prepared will allow you to quickly submit your legal documents and be in the game of running your business.

Here’s what you’ll need:

- A unique business name that meets Minnesota guidelines

- Your registered office and mailing address

- Name and contact details of your registered agent

- A designated LLC organizer

- Business purpose (optional but recommended)

- Preferred management structure (member-managed or manager-managed)

Step 1 – Choose a Business Name That Meets State Requirements

Your first step in starting a business is to choose a business name that meets Minnesota’s legal naming rules. The name must be distinguishable from the names of existing entities as well as include the designator “LLC”, or “Limited Liability Company”. Also, it must not contain a word that is prohibited by state law such as “bank” or “insurance” unless you have authorization to use such a word.

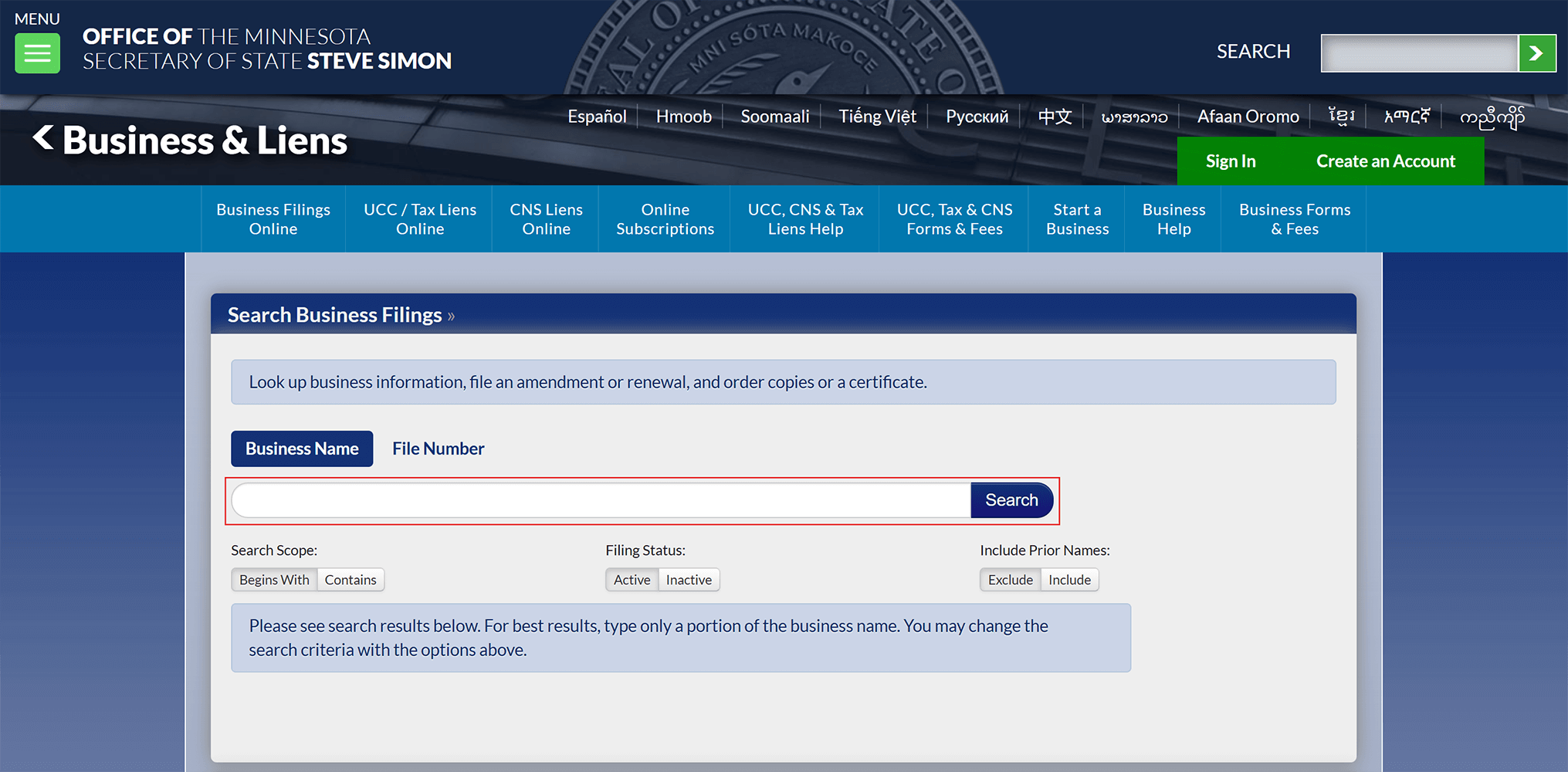

Before filing, do a business name search on the Minnesota Secretary of State Business Search page to ensure its availability. This prevents rejection and allows for smoother LLC registration procedures. You can use this walkthrough on how to check if your business name is available in Minnesota before filing anything with the Secretary of State.

Step 2 – Appoint a Registered Agent Located in Minnesota

According to Minnesota law, every LLC must appoint a registered agent to receive legal documents on behalf of the LLC. Here’s why every Minnesota LLC legally requires a registered agent, what their responsibilities include, and how they support your compliance long-term. Your registered agent can be an individual or a registered agent service. Your registered agent must have a physical registered office in Minnesota and be available during standard business hours. To help you decide which service is worth trusting, here’s a detailed breakdown of Minnesota’s most reliable LLC formation services, ranked based on performance, pricing, and customer experience. When you use a reliable agent, you can be sure that your business will remain in good standing with the Minnesota Secretary and that you will never miss important legal notices such as service of process or annual renewal reminders.

Start Your Minnesota LLC with ZenBusiness

ZenBusiness helps you form your Minnesota LLC without the guesswork – fast filing, compliance support, and a smooth start from day one.

Step 3 – File the Articles of Organization with the Minnesota Secretary of State

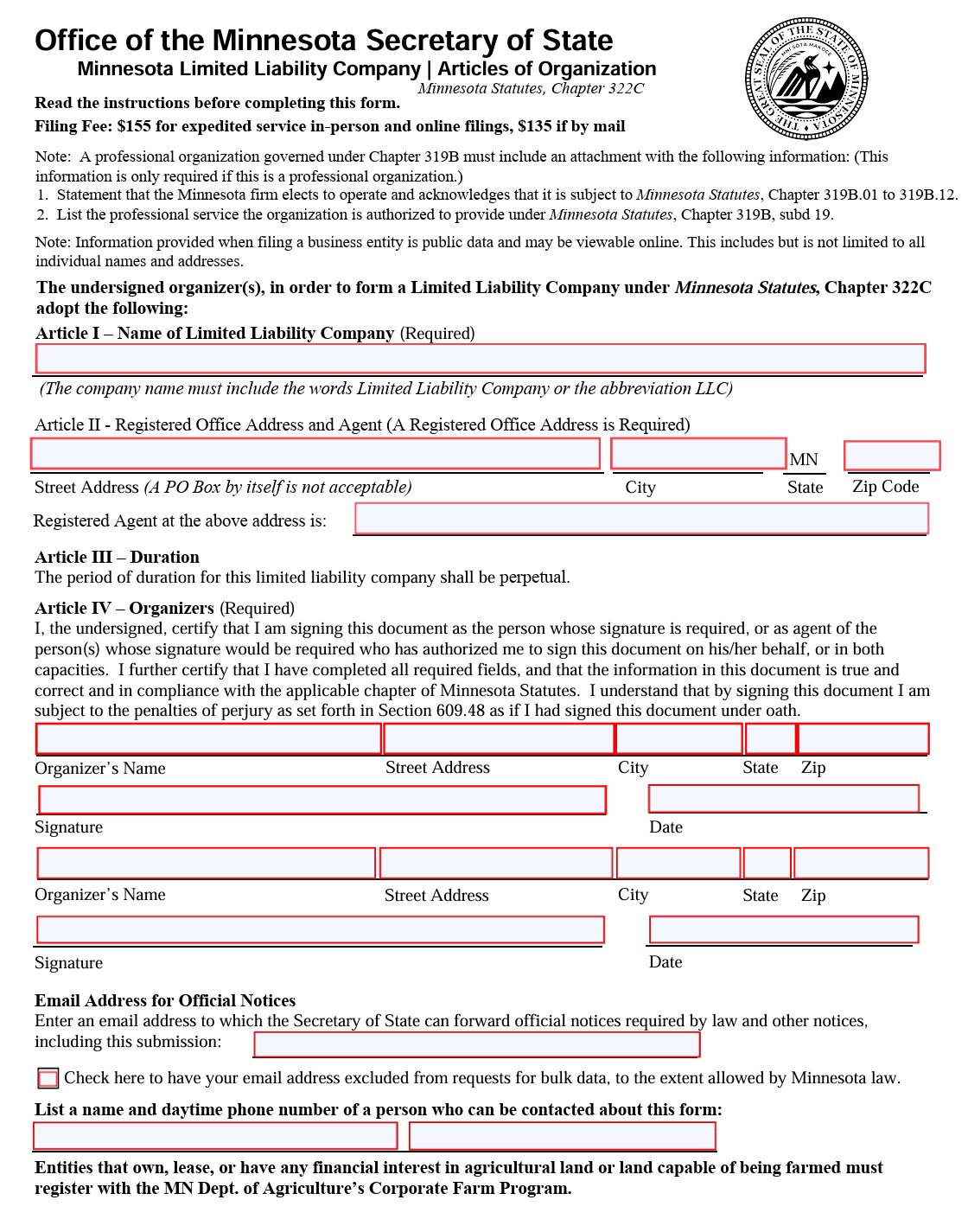

To start your business legally, you need to file articles of organization with the Minnesota Secretary of State. The document contains key information about your LLC, including its name, registered agent, business address, and whether it is member- or manager-managed. Accuracy here is crucial to avoid delays. If you’re wondering how long it typically takes to get an LLC approved in Minnesota, this guide explains the exact timelines based on filing method and how to speed up the process.

You can submit your application online, by mail, or in person. Online filings are typically processed faster. Once approved, the state will issue a certificate of organization, making your llc registration official and allowing you to legally operate in Minnesota. To understand what a Certificate of Organization is and how it functions, you can refer to this guide that explains its role in the LLC formation process across states.

Step 4 – Create an LLC Operating Agreement

In Minnesota, it’s highly recommended for every LLC to have an operating agreement, even though it’s not legally required. This internal legal document outlines ownership percentages, profits-sharing rules, management duties, and dispute resolution procedures. Having a written agreement protects your personal assets, clarifies roles and helps avoid disputes. An operating agreement is smart whether you are a solo owner or in a team. Creating one will help you maintain structure and comply with long-term business obligations.

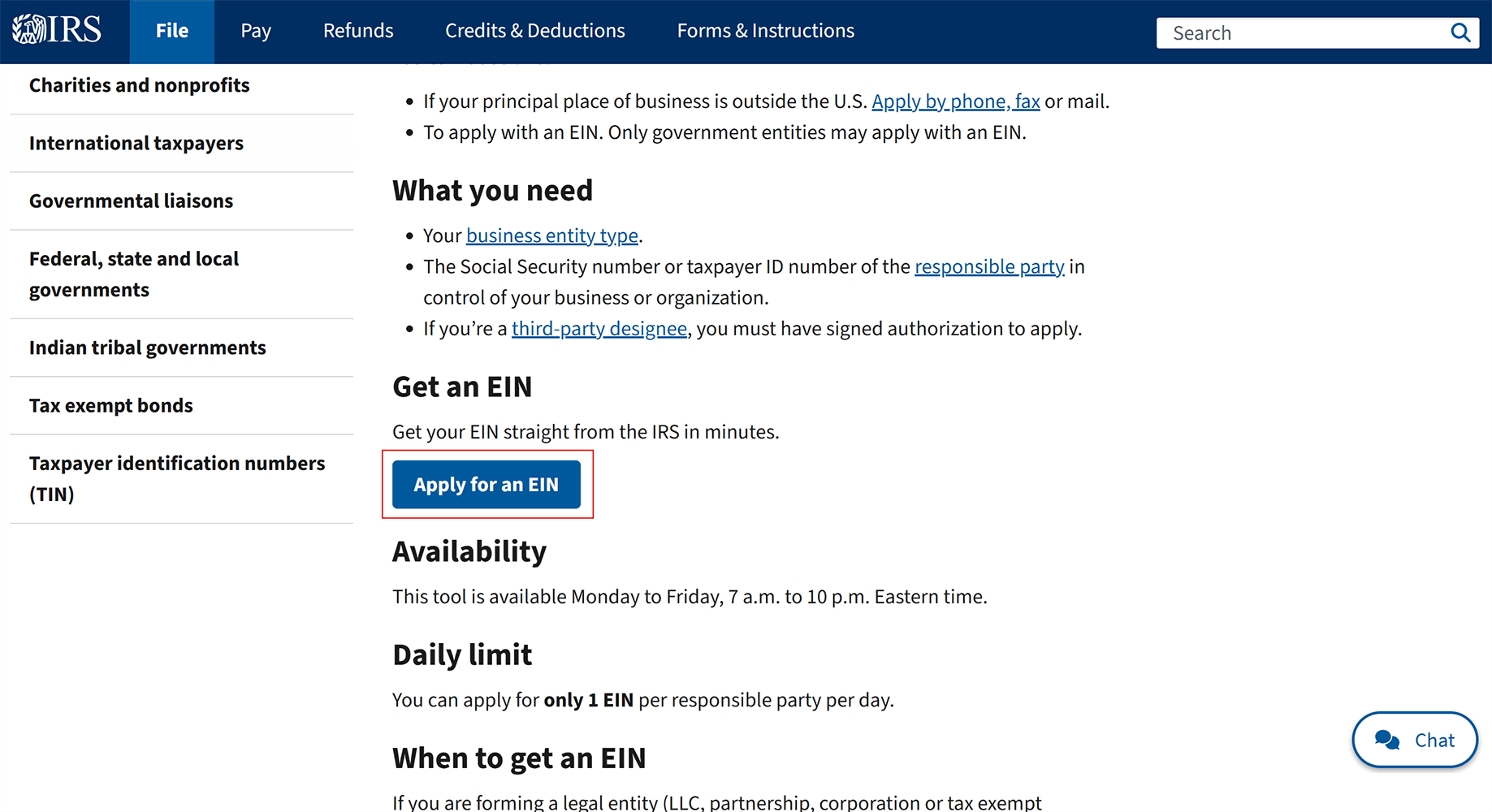

Step 5 – Apply for an EIN From the IRS

An Employer Identification Number, or EIN, is a nine-digit number the IRS assigns to businesses for identification purposes during federal tax time. A Minnesota LLC needs an EIN if it has employees, has more than one member, or will open business bank account. Even single-member LLCs often require an EIN to separate their personal and business obligations as well as to register with state agencies. See this federal and state tax ID guide from the SBA for a quick overview before applying.

You can apply for an EIN online at the IRS using the online account system. The application is free and usually approved immediately. Request your EIN only after filing your articles of organization. Once it’s issued, use it to create a Minnesota Department of Revenue account or file federal tax forms.

Step 6 – Open a Business Bank Account

It is important to open a dedicated business bank account to separate your personal and business finances. By maintaining this separation, you will not only protect your personal assets but will also strengthen the shield for your liabilities, in case your LLC in Minnesota ever gets audited or sued. To open the account, most banks will ask for your EIN, articles of organization, and operating agreement. Compare the fees, digital features and customer support when choosing a bank. Having a well-managed account boosts your financial credibility and makes tax filing easier, thus your legal documents will always be in order throughout the year.

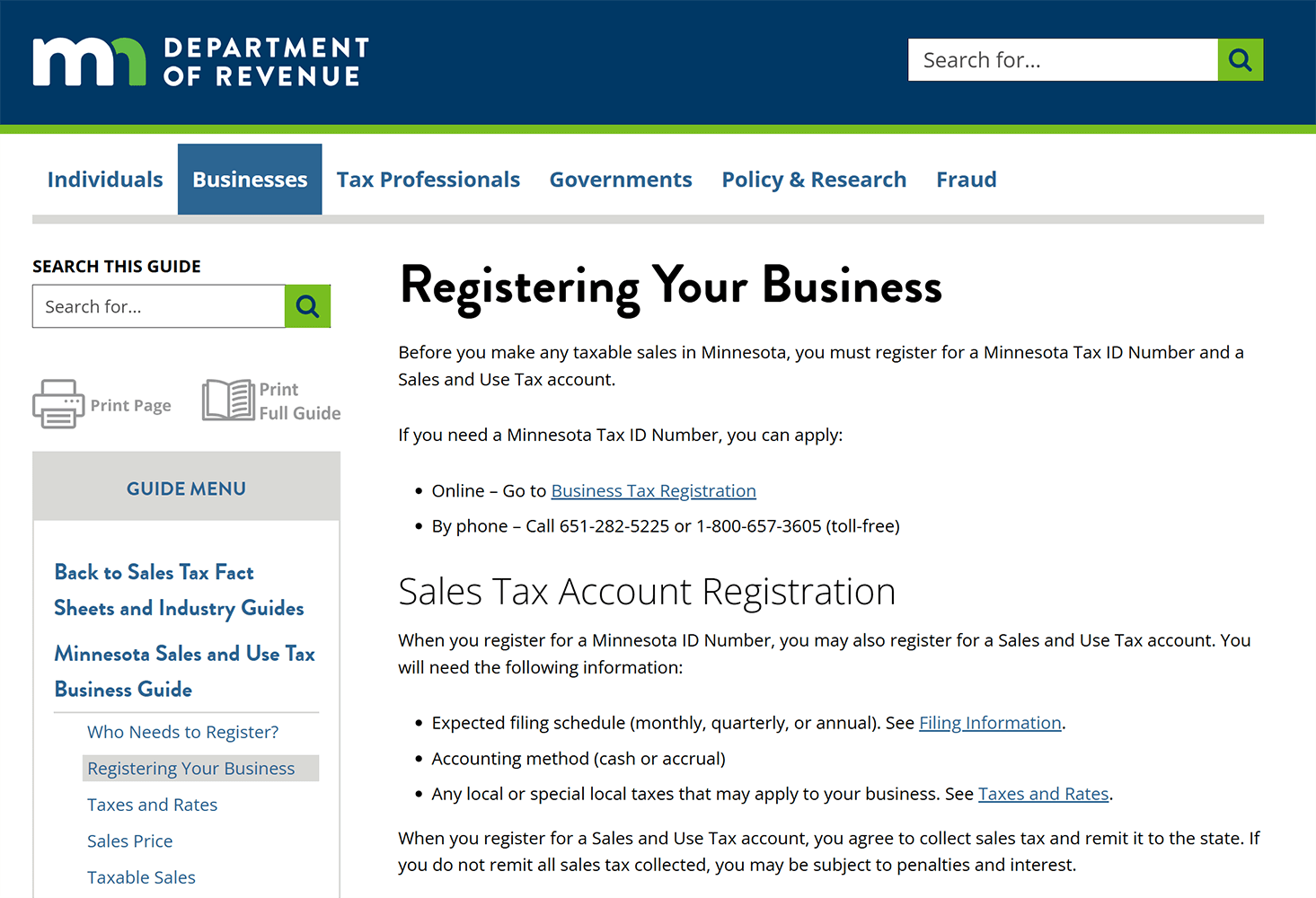

Step 7 – Register for Minnesota Taxes and Business Licenses

Once you form an LLC, the next step is registering for Minnesota taxes and getting the correct business license. Being registered legally help prevent penalties that could cost a fortune. All businesses in Minnesota need to register with the Minnesota Department of Revenue to collect sales tax, report employee wages or follow industry-specific licensing rules. During this process, you will need your EIN and a few other key business documents. Remember that the licensing requirements differ by the city and profession. Be sure to check the state and local regulations before getting started.

Here are four common registrations:

- Sales tax permit

- Employer withholding tax registration

- State unemployment insurance account

- Professional or local business licenses

How Much Does It Cost to Start and Run an LLC in Minnesota

There are real costs of starting and maintaining an LLC, some required, some optional. This section breaks down the cost to file, annual renewal fees, and any additional expenses like hiring registered agent service or filing amendments. It gives clear insight on how to fund your LLC in Minnesota really looks like.

Filing Fees for Articles of Organization (Online vs. Mail)

In order to create your business officially, you will have to file articles of organization with the Minnesota Secretary of State and pay a filing fee. The total cost and speed of approval will depend on how you choose to submit: online registration, by mail or in person. The simplest and most efficient way to file is to file online as it gets confirmed immediately and makes errors less likely. If you file by mail, you should be prepared for a longer turnaround and ensure that your legal documents are correct and complete.

| Filing Method | Cost | Processing Time |

|---|---|---|

| Online | $155 | Immediate |

| $135 | 5–10 business days | |

| In Person | $155 | Same day (if early) |

Despite the mail being cheaper, most entrepreneurs prefer online filing which is faster. Check the current fee and requirements of the state website to make sure your LLC registration isn’t rejected before you file articles.

Optional Costs and Annual Renewal Fee

Aside from the first-time filing fee, your LLC might have optional costs depending on your needs. This may include hiring a registered agent service, ordering certified copies of documents, and/or paying for expedited processing. Though optional, such services can offer time savings and risk reduction. If you're curious how these ongoing costs measure up nationwide, here's a breakdown of how annual LLC fees compare across all 50 states.

The Minnesota Secretary of State requires you to file an annual renewal each year. The current fee is $0 if filed online and on time, but failure to file may result in administrative dissolution and interfere with your business obligations.

Extra Costs: Licenses, Agents, or Amendments

Apart from regular filings, your LLC might incur additional charges related to operations or other changes. This may involve applying for a specialty business licenses, paying the registered agent fee or submitting amendments if you change your business name or address. The amount charged varies based on your request type and urgency, especially expedited filings. To stay one step ahead of any surprises, include the following business obligations in your annual budget. Furthermore, review the fees that the state charges businesses through the Minnesota Secretary website.

Form Your Minnesota LLC with Northwest Registered Agent

Northwest makes LLC formation in Minnesota simple and private – with no hidden fees and expert support along the way.

Other Minnesota LLC Filing Scenarios

Not every Minnesota LLC follows the standard path. Some business owners need to register under a different name, others are expanding from outside the state, and some professionals or existing LLCs may need special filings. Below are the most common additional scenarios.

Assumed Names (DBA) in Minnesota

If you want to operate under a business name different from your LLC’s official legal name, Minnesota requires you to file an Assumed Name, often called a “DBA” (doing business as).

- Where to file: Minnesota Secretary of State – Business Filings Online.

- Fees: $50 if filed online or in person; $30 if filed by mail.

- Renewal: Assumed names must be renewed annually, but there’s no fee if filed on time.

This step is optional for most LLCs, but it’s required if you plan to market your business under a brand name that doesn’t exactly match your LLC’s registered name.

Foreign LLCs Doing Business in Minnesota

If your LLC was formed in another state but you want to operate in Minnesota, you must register as a foreign LLC. This process ensures your out-of-state business has the authority to transact legally within Minnesota.

- Form needed: Certificate of Authority (apply online or by mail).

- Fee: $205 online/in person, or $185 by mail.

- Registered agent: Unlike domestic LLCs, a foreign LLC must appoint a registered agent with a Minnesota street address.

- Required documents: You’ll need a Certificate of Good Standing (or equivalent) from your home state, dated within 60 days of filing.

Once approved, your LLC is authorized to do business in Minnesota and must follow the same annual renewal rules as domestic LLCs.

Professional LLCs (PLLC) in Minnesota

Licensed professionals such as doctors, lawyers, architects, and accountants must form a Professional LLC (PLLC) instead of a standard LLC.

- Form: PLLC Articles of Organization

- Requirements: At least one owner must hold the appropriate Minnesota professional license

- Governing law: Minnesota Statutes Chapter 319B

- Purpose: Ensures only licensed professionals can provide regulated services under the PLLC structure

This structure combines liability protection with compliance for regulated professions.

Closing or Amending Your Minnesota LLC

At some point, you may need to make changes or close your LLC. Minnesota provides specific filings for these actions:

- Amendments: To change the LLC’s name, address, or other details, file an Amendment to Articles of Organization (Fee: $55 online/in person; $35 mail)

- Dissolution: To officially close your LLC, file Articles of Dissolution with the Secretary of State.

- Reinstatement: If your LLC is administratively dissolved for missing the annual renewal, you can apply for reinstatement and pay the applicable fees.

These filings keep your business records accurate and ensure compliance with state requirements.

How to Maintain Your LLC in Minnesota After Formation

After you form an LLC, you need to keep it in good standing. Learn what it takes to maintain your LLC, like filing an annual renewal, updating important records and other state requirements. Take these steps to protect your Minnesota business long-term.

File Your Annual Renewal with the Secretary of State

Minnesota LLCs must file an annual renewal with the Minnesota Secretary of State every year to remain in good standing. The renewal confirms your active business status and updates the records. The due date is December 31, and online filing is free of charge if submitted on or before the due date. Missing the deadline can lead to administrative dissolution and costly reinstatement. Mark your calendar and use your online account to complete this easy but crucial state filing requirement on time.

Update Key Information and Stay Compliant with State Law

Updating and maintaining your LLC records is a part of compliance with the state. If you change your address, registered agent, or company name, submit documents to the Minnesota Secretary of State as soon as possible. These updates help avoid missed notices and legal issues.

Your Minnesota business must continue to comply with ongoing rules beyond your filings. For example, you must display your business name, have a registered office, and maintain internal documents including your operating agreement. By staying ahead of these tasks, your entity will stay in good standing and reduce the risk of penalties or dissolution.

How LLCs Are Taxed and What Legal Protections They Offer

In Minnesota, LLCs are generally pass-through entities for tax purposes. Profits “pass through” to members, who report the income on their personal returns and avoid corporate-level income tax. Though, multi-member LLCs must still file informational returns, while some businesses will be subject to sales tax or local levies based on their services.

Beyond taxes, a major benefit of this structure is liability protection. A properly maintained LLC shields members’ personal assets from business debts, lawsuits, and obligations. This legal separation is key to reducing risk—especially when your LLC signs contracts, leases property, or enters partnerships with vendors or clients in Minnesota.

Minnesota LLC Taxes and Legal Protections

Establishing an LLC is not just about registration but also about protection and taxation strategies. The section explains how LLCs in Minnesota are taxed at the federal and the state level, as well as how the strong liability protection will keep your personal assets safe from unexpected business claims and losses.

LLC Taxation: Federal, State, and Local Obligations

LLCs in Minnesota offer a flexible tax structure, allowing owners to choose how the business is taxed. By default, a single-member LLC is treated as a sole proprietorship, and a multi-member LLC is taxed as a partnership. However, owners can elect to be taxed as an S corporation or C corporation by filing the appropriate forms with the IRS. Aside from federal obligations, most LLCs must comply with state and local tax rules, including sales tax collection, withholding tax, and filing income tax returns if applicable to their structure or industry.

Here are four key tax responsibilities for Minnesota LLCs:

- Federal tax filing with the IRS

- State income tax (if electing corporate treatment)

- Sales tax registration and payments

- Local or municipal tax filings, depending on business location

How an LLC Protects Your Personal Assets in Minnesota

Liability protection is one of the most important benefits of an LLC. When structured and maintained correctly, your LLC will separate your business from your personal life. In this manner, you will keep your personal assets (home, car, savings) separate and they will remain unaffected by business debts and legal claims.

In Minnesota, you can take advantage of this protection as long as you maintain corporate formalities, keep accurate legal documents and avoid mixing personal and business funds. This protection is one of the major reasons why many small business owners choose an LLC in Minnesota.

Frequently Asked Questions About Minnesota LLCs

Starting a business comes with questions—and we’ve got answers. This section covers the most common concerns about forming and managing an LLC in Minnesota, from startup costs to timelines and legal steps. Use this quick reference to stay informed and avoid missteps in your journey.

What Are the Downsides of Starting an LLC in Minnesota?

While forming an LLC offers flexibility and liability protection, it’s not without drawbacks. Minnesota requires an annual renewal, and businesses must keep up with state filing and tax obligations. Some owners may also face higher filing fees compared to other states. Plus, LLCs don’t offer the same tax planning options as S or C corporations. You can also review these LLC basics across all 50 states to better understand how formation and compliance requirements vary depending on location.

Can You Form a Free LLC in Minnesota?

No, you can’t legally form an LLC in Minnesota without paying the required filing fee. The minimum cost is $135 if you file by mail, or $155 for online registration. While some platforms advertise “free” LLC formation, they often charge for add-ons like registered agent service. To minimize costs, file directly through the Minnesota Secretary of State and handle basic filings yourself. That said, it’s worth comparing which states offer the best overall advantages for LLCs, some may have lower fees, fewer regulations, or more favorable tax treatment depending on your business type.

How Do You Look Up an Existing Minnesota LLC?

To search for an existing LLC, visit the Minnesota Secretary of State’s Business Filings Search. Enter the business name or file number to view official records. This business name search lets you confirm status, ownership, and filing history – useful for due diligence, partnerships, or checking if your desired LLC registration name is already taken. If you’re also evaluating service providers, here’s a full comparison of the top registered agent services reviewed for Minnesota LLCs to help you choose wisely based on support, pricing, and reliability.

How Long Does It Take to Form an LLC in Minnesota?

The timeline to form an LLC in Minnesota depends on your filing method. Online registration is processed immediately, while mail submissions take 5–10 business days. In-person filings may be approved the same day if submitted early. Always confirm timing on the Minnesota Secretary website before you submit documents.

Do I need a registered agent in Minnesota?

No, a registered agent is not required for a domestic Minnesota LLC, but a registered office address is. Every LLC must list a registered office with a Minnesota street address. A registered agent is optional for domestic LLCs but mandatory for foreign LLCs. Many businesses still use a professional agent service for privacy and reliable document handling.

What Is the Annual Renewal Requirement in Minnesota?

You must file an annual renewal by December 31 each year, and it costs $0 if filed on time. The renewal can be submitted online in minutes. Missing the deadline may lead to administrative dissolution, which means your LLC loses good standing. Reinstating requires additional filings and fees, so it’s best to submit the free renewal before year-end.

Do I need an operating agreement?

No, Minnesota does not legally require an operating agreement, but it’s strongly recommended. An operating agreement clarifies ownership, management, and profit distribution. It proves separation of business and personal assets, helps avoid disputes, and is often required by banks when you open a business account. Even single-member LLCs benefit from having one in writing.

Do I need a business license in Minnesota?

No, Minnesota does not issue a statewide general business license, but certain industries require permits. Sectors like food service, construction, and healthcare often need specific state or local licenses. Cities and counties may also have their own requirements. After forming your LLC, check with the Minnesota Department of Revenue and your local government to confirm which licenses apply to your business.

- Minnesota SOS: How to Search Business Filings (official walkthrough)

- Minnesota SOS: Articles of Organization — PDF form (mail filing)

- Minnesota SOS: Business Filing Fee Schedule (PDF — online/in-person $155; annual renewal $0)

- Minnesota SOS: Renewing Your Business (annual renewal due by Dec 31)

- Minn. Stat. § 322C.0110: Operating agreement (scope & limits)

- MN Dept. of Revenue: Registering Your Business (MN Tax ID / sales & use)

- IRS: About Form SS-4

- FinCEN: BOI Reporting — current status & e-filing

Looking for an overview? See Minnesota LLC Services

Let Harbor Compliance Handle Your Registered Agent Needs

With Harbor Compliance as your Minnesota Registered Agent, you’ll never miss an important notice or deadline again.