Thinking of forming an LLC and wondering if Wyoming is the most cost-effective option? Curious about hidden fees that might inflate your startup budget? Want to know if you really need a registered agent or annual reports?

The cost to form a Wyoming LLC in 2025 starts at $100 for filing the Articles of Organization, with an additional $60 minimum annual license tax. If you don’t have a physical Wyoming address, a registered agent service costs $50–$200 per year. Optional fees—like local permits or a DBA—can raise your total startup cost to $100–$500+, depending on your setup. Wyoming remains one of the cheapest and most business-friendly states, especially for remote entrepreneurs or asset-holding entities.

In this guide, we’ll break down:

- All required and optional Wyoming LLC fees

- How to avoid unnecessary services and upsells

- When you’ll need local licenses or a paid agent

- Whether Wyoming is the right state for your business model

Ready to launch your business the smart way? Let’s take a closer look at what forming a Wyoming LLC really costs.

| Cost Component | Fee | Key Details |

|---|---|---|

| Articles of Organization | $100 (one-time) | Filed with the Wyoming Secretary of State |

| Registered Agent | $0–$200/year | Can be you or a paid registered agent service |

| Name Reservation (Optional) | $50 | Reserves your LLC name for up to 120 days |

| Business License (Varies) | $25–$200+ | City- or county-specific; not all LLCs need one |

| Annual Report (License Tax) | Starts at $60/year | Based on total assets located in Wyoming |

| Other Optional Costs | Varies | DBA filing, expedited processing, or specialized legal help |

Total Cost to Start a Wyoming LLC

Forming a wyoming llc can be more affordable than in many other states, thanks to relatively low filing fees and minimal overhead for small operations. While you’ll pay $100 to register with the state, you may also need a local permit or a paid agent if you aren’t in Wyoming. Understanding each cost element up front ensures you don’t overspend on optional services or miss a mandatory step for compliance. For a full breakdown across all states, you can explore this detailed guide on the cost for llc to compare your options.

Articles of Organization Filing Fee ($100)

To form a wyoming llc, you must file official documents called the llc articles of organization with the Wyoming Secretary of State. As of 2025, this filing fee is $100 when submitted online or by mail. Expect standard processing in about one to two weeks. Within the form, you’ll specify key details such as your business address and proposed management structure. Double-check for accuracy before submitting; errors can delay approval or even require paying another fee. Once approved, your company becomes an official business entity recognized by the state.

Registered Agent Fee (Free vs Paid Options)

Many business owners choose to hire a wyoming registered agent, but it’s not mandatory if you have a physical address in the state and can reliably accept documents. Costs for an agent range between $50 and $200 per year. Here’s what you need to know:

- Free Option: Act as your own agent if you live in Wyoming and have a consistent schedule for receiving mail.

- Paid Service: A professional provider offers anonymity (your address stays off the public record) and ensures coverage during regular business hours.

- Why It Matters: If you miss important legal or tax notices, you could lose your liability protection or face penalties.

Carefully weigh privacy, convenience, and budget when deciding which route to pick. Here’s a quick explanation of registered agent services to help clarify when hiring one makes sense.

Optional: Name Reservation Fee

If you’re starting an llc but not ready to file all paperwork immediately, you can pay $50 to reserve your business name for up to 120 days. This step isn’t essential unless you anticipate a delay. Most business owners skip this fee and just file their Articles of Organization once they finalize the chosen name. If you’re developing a new brand or waiting for a specific product launch, though, it can be worthwhile to lock in that perfect name early.

Business License Fees (City/County Dependent)

While Wyoming doesn’t require a statewide business license for most LLCs, certain cities or counties may impose their own permits or taxes. You might pay $25 for a basic vendor permit or several hundred dollars if your industry is heavily regulated (e.g., construction or hospitality). Always check local rules in the county where you’ll operate. Failing to secure proper documentation can lead to fines and hamper your efforts to build a legitimate business in wyoming.

One-Time Startup Cost Estimate

After forming an llc, your initial outlay can vary based on optional add-ons. A typical new Wyoming LLC might face:

- $100 for state filing

- $0–$200 for a registered agent (if you opt for a paid service)

- $25–$200+ for any local license if your city or county requires it

- $50 for optional name reservation if you’re delaying formal registration

In total, your cost to start often ranges from about $100 (a barebones approach with no paid agent or additional permits) to $500+ if you require multiple local permissions or prefer professional services. Planning for this range helps avoid unpleasant surprises when launching operations.

Start your Wyoming LLC for $0 + state fees

ZenBusiness simplifies Wyoming LLC formation with transparent pricing and essential tools to launch fast.

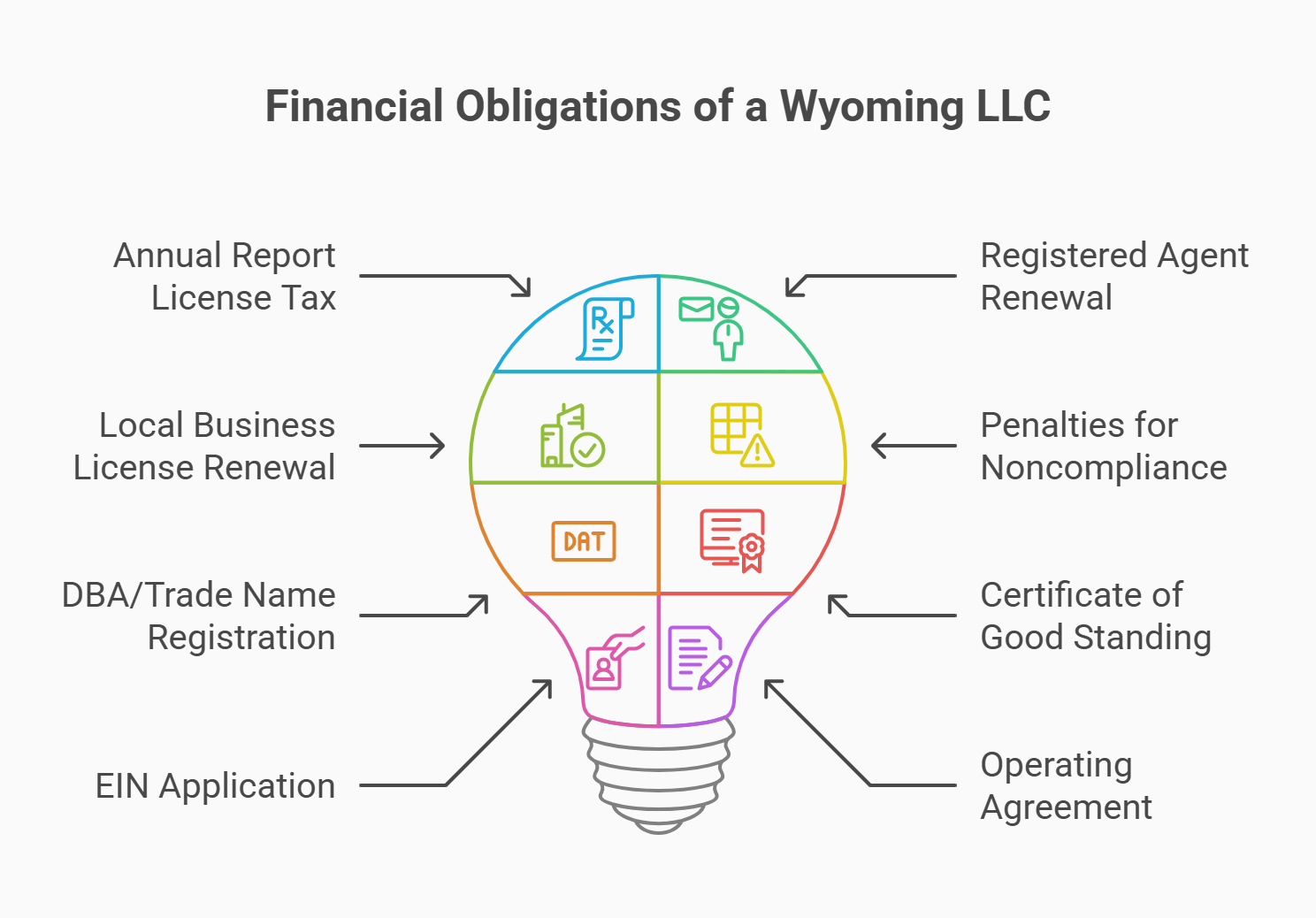

Annual and Recurring Fees to Maintain a Wyoming LLC

Wyoming is lauded for its low-maintenance requirements and straightforward compliance steps. Still, you’ll face certain recurring charges, especially the annual license tax. Skipping these obligations can result in penalties or even administrative dissolution, so it’s crucial to stay up to date. To better understand what other states charge annually, check out this overview of llc annual fees by state.

Annual Report License Tax ($60 Minimum)

Every Wyoming LLC must file an annual report—also known as a license tax—to remain in good standing. The fee starts at $60 for smaller companies with limited assets in the state, though it may increase based on total Wyoming-based assets. You’ll typically file this report online, disclosing basic financial figures. It’s a relatively simple process that keeps your llc in wyoming recognized and active. Ignore the deadline, and you risk late fees and the potential to close llc involuntarily.

Registered Agent Renewal

If you hire a paid registered agent service, expect to renew your contract every 12 months. Costs vary from $50 to $200 per year, often depending on the level of privacy or mail-forwarding capabilities offered. Should you opt to switch agents or move to a new address, update that information promptly with the wyoming secretary of state. Failing to maintain a valid agent can lead to default judgments or other legal headaches. To check whether your company or another is in good standing, you can use the Wyoming llc lookup tool available online.

Local Business License Renewal

If your city or county requires a local business license, you might have to renew it annually. Fees can run $25 to $200 or more, depending on local laws and your industry. Restaurants or heavily regulated fields often pay higher amounts than a simple home-based consultancy. Missing a renewal can result in fines or even revocation of your license, so track any municipal deadlines just as carefully as you do state obligations.

Penalties for Late or Missed Filings

While Wyoming is lenient in its approach, failing to file your annual license tax on time triggers late fees and potential suspension of your LLC status. Once suspended, you can’t legally operate until you pay all overdue amounts plus any penalties. Prolonged noncompliance can force the state to dissolve your LLC. If you rely on liability safeguards for asset protection, losing your good standing could open you up to personal financial risk. Timely compliance avoids these escalations altogether.

Hidden and Optional LLC Costs in Wyoming

Beyond standard startup and annual taxes, other expenses may crop up depending on your unique needs. These costs are usually optional or situational—like obtaining a new trade name or applying for specialized legal advice. Plan ahead so you can differentiate between mandatory fees and purely convenience-based extras.

DBA / Trade Name Registration

If you plan to operate under a name different from your LLC’s official designation, you’ll need to register a DBA (doing business as), also called a trade name in Wyoming. The filing usually costs around $100 and must be renewed every 10 years. This step is optional if you’re happy using your official LLC moniker, but it’s necessary for branding flexibility if you want to present a different public identity. If you want help getting started, some providers are ranked as the best llc service in Wyoming for simplicity and speed.

Certificate of Good Standing

Sometimes banks or investors request a certificate of good standing to confirm your LLC is active and up to date on fees. It costs approximately $10–$15 and can be obtained directly from the state’s online portal. While not required for everyday operations, having one ready can streamline financial arrangements or expansions into other states. Keep in mind some institutions refer to it as a “certificate of existence” or “status certificate.”

EIN Application (Free or Paid)

Every LLC that hires employees or needs a business bank account typically applies for an Employer Identification Number (EIN). You can get an EIN for free via the internal revenue service website in about 15 minutes, making paid application services unnecessary for most companies. If your LLC is more complex—perhaps it’s structured as a series llc—you might benefit from a professional’s help. Still, the direct approach is usually quick and cost-effective.

Operating Agreement Templates

Drafting an llc operating agreement is strongly recommended to clarify ownership stakes and member responsibilities. You can find free templates online or opt for a paid legal tool that includes editing features. In 2025, a basic template suffices for many single-member LLCs, while multi-member companies may need a custom document. It’s not filed with the state but can protect you in disputes and underscore your LLC’s liability protection.

Legal and Accounting Support (Optional)

A seasoned accountant or attorney can help with tax returns, especially if your LLC handles significant revenue or has unique complexities like foreign ownership. You might also need professional advice on topics like corporate income tax planning or drafting advanced contracts. Before hiring a legal expert, it’s worth reviewing what attorney fees for LLC typically cost based on your business complexity. Hourly rates range from $150 to $400 or more, so weigh the cost against your business’s scale. Often, smaller LLCs use do-it-yourself solutions for routine issues, consulting experts only for specialized guidance.alized returns. Failing to pay any required taxes could lead to fines, liens, or other penalties.

Year-by-Year Cost Breakdown

Whether you’re a first-time founder or a seasoned entrepreneur, planning out your expenses across multiple years helps avoid cash-flow surprises. Below is an overview of what you can expect from formation through ongoing compliance in Wyoming, current as of 2025.

Year 1: Formation + Legal Requirements

Launching your LLC involves a few foundational costs. Typically, you’ll pay:

- $100 Articles of Organization Fee: Required to officially register with the state.

- $0–$200 Registered Agent: Depending on whether you serve as your own or hire help.

- $25–$200 Local Permits: If your city or county mandates a business license.

- $50 Name Reservation (Optional): Only needed if you’re delaying the filing.

- $0–$15 DBA Registration (Optional): If you plan to run under a different llc name.

You’ll likely also set up a management structure, open a business bank account, and decide how to handle taxes with the department of revenue. Expect to invest time in finalizing an llc formation plan and collecting any documents for your first year’s tax return.

Year 2 and Beyond: Maintenance & Compliance

Once you’ve completed the setup phase, your costs stabilize. Key recurring fees include:

- $60 Minimum License Tax (Annual Report): Could be higher if your LLC holds substantial assets in Wyoming.

- $50–$200 Registered Agent Renewal (If Paid): Yearly cost if you don’t act as your own agent.

- $25–$200 Local License Renewals: If required by your city or county.

- $10–$15 Certificate of Good Standing (Optional): If banks or partners request updated proof of compliance.

If you ever plan to close llc or restructure into a foreign llc for another state, separate filing fees and administrative steps may come into play. However, most basic operations simply revolve around paying the annual report fee on time.

Optional vs Required Expenses

Certain charges are unavoidable, while others depend on your preferences:

- Mandatory

- $100 Articles of Organization

- $60+ License Tax each year (aka annual fees)

- Conditional

- Registered Agent Fee ($0 if you serve yourself, or $50–$200 if hired)

- Local Permit Costs if you operate a regulated business in wyoming

- Optional

- Name Reservation, DBA Registration, or certificate of good standing

- Attorney or CPA support for advanced tax rates or multi-member complexities

Categorizing costs in this way helps you decide which extras truly benefit your operations and which you can skip without compromising compliance.

How to Start a Wyoming LLC on a Budget

Wyoming’s business-friendly environment makes it popular for entrepreneurs seeking to keep expenses low. If you’re new to the process, here’s a full guide on how to start an llc from scratch, regardless of your state. By handling certain tasks yourself and choosing cost-effective services, you can minimize outlay while still securing robust protections for your venture.

Submit directly with Wyoming Secretary of State online for $100, saving third-party markups. Processing typically takes 1-2 weeks.

Save $50–$200 annually by acting as your own agent. Requires availability during business hours and makes your address public.

Get your Employer Identification Number free in about 15 minutes from the IRS website. Essential for banking and tax purposes.

Utilize free online templates for your LLC operating agreement instead of paying for custom drafting. Covers most standard requirements.

Create calendar alerts for annual reports and license renewals to avoid penalties and maintain your liability protection.

Step 1: File Articles of Organization Yourself

You can file your LLC paperwork directly with the wyoming secretary of state online for $100. This approach saves you the markups charged by some third-party providers. Confirm your llc articles of organization details—like your business address—and pay with a credit or debit card. Processing usually takes a week or two, but expedited service is available if you’re on a tight deadline. For those curious about timing in other states, this online llc formation guide covers typical delays and options. Once approved, your LLC is officially recognized, letting you form an llc without unnecessary middleman costs. You can also follow this complete tutorial on how to form an llc in Wyoming if you're ready to begin the process.

Step 2: Be Your Own Registered Agent (Pros & Cons)

Acting as your own registered agent service can save $50–$200 annually. However, consider:

- Pros:

- No extra annual fee

- Immediate access to legal notices

- Full control over compliance timelines

- Cons:

- Your personal address becomes part of the public record

- You must stay available during standard business hours

- Missing important mail jeopardizes your asset protection

If privacy or consistent availability is a concern, using a wyoming registered agent company might be worth the yearly cost. For budget-conscious business owners, though, self-service often makes sense.

Step 3: Apply for EIN Directly on IRS Website

An employer identification number is essential for opening a business bank account, hiring employees, or filing certain federal income tax forms. Applying on the internal revenue service site is free and typically takes 15 minutes. Many paid services charge $50–$100 to do this on your behalf, but you can easily handle it yourself. Once issued, your EIN is permanent—keep the documentation safe for future tax returns and compliance checks.

Step 4: Use Free Tools for Legal Docs

Drafting an llc operating agreement or basic partnership contract doesn’t have to be pricey. Countless reputable websites offer free templates you can tailor to your needs. This approach works best for straightforward single-member or multi-member LLCs with minimal complexity. If you’re dealing with a series llc or specialized industry, you may still want an attorney’s input. Regardless, starting with a no-cost template often covers 80–90% of typical legal requirements.

Step 5: Set Annual Reminders for Renewals

Once your LLC is active, create calendar alerts for your annual report and any local license renewals. Missing these deadlines triggers fines or even dissolution. Digital tools like Google Calendar or a dedicated compliance platform can prevent oversights. If you have a paid registered agent, they may also send reminders. Ensuring timely submissions not only protects your wyoming llc cost advantage but keeps your liability shield intact.

Is Wyoming Still the Cheapest State for LLCs?

Wyoming has built a reputation as a low-cost hub for forming an llc, offering minimal annual fees and no state corporate income tax. Still, it’s wise to compare your home state or business-friendly alternatives like Delaware or Nevada. For some ventures, local compliance might be simpler than maintaining a foreign llc in Wyoming.

Wyoming vs Delaware: Startup & Annual Fees

Delaware is famous for large corporations, but an LLC there faces annual franchise taxes and more frequent filings. Wyoming, by contrast, charges a lower license tax and has simpler compliance.

- Wyoming Highlights:

- $100 to file initially

- annual report fee starts at $60

- No need for extensive corporate formalities

- Delaware Highlights:

- Higher annual franchise tax (varies by LLC size)

- Well-established business court system

For most small and medium LLCs, Wyoming’s cost structure is more attractive. Delaware might be better for large companies expecting rapid equity funding or complex structures.

Wyoming vs Nevada: Privacy, Cost, and Risk

Nevada offers strong privacy laws and no personal state income tax, akin to Wyoming. However, it typically has higher startup fees and annual filing charges.

- Wyoming Perks:

- Lower cost to start your LLC

- Minimal annual licensing obligations

- Nevada Perks:

- Robust business environment, especially for gaming or entertainment

- No personal income tax

In 2025, forming an LLC in Wyoming is generally cheaper and equally protective for asset-holding entities or online businesses. Nevada could be worth considering if you’re deeply tied to the region or require niche regulatory benefits. That said, Arizona is often mentioned for having the cheapest llc formation when comparing total startup costs.

Wyoming vs Your Home State: Tax & Compliance Traps

Some entrepreneurs consider registering in Wyoming even if they live elsewhere, aiming to leverage lower fees and no corporate income tax. This approach is common among those planning to build an llc without business activity right away. Yet, if you operate locally—owning real estate or employing staff in another state—you often must register as a foreign llc there. If you’re still weighing your options, this ranking of the best state for LLC can help you choose the most strategic location. That leads to double compliance and extra agent fees.

- Wyoming Pros:

- Minimal annual overhead

- Privacy for owners, often beneficial for digital startups

- Home State Pros:

- Simplified reporting since you’re physically located there

- Avoid the complexity of multi-state filing

Unless your business is truly location-independent, forming in Wyoming might not save as much as you’d hope. Evaluate local tax laws carefully before deciding.

When Wyoming’s “Cheap LLC” Isn’t the Smartest Choice

Wyoming’s low fees can tempt founders, but it may not make sense if you have zero presence in the state. You’ll face foreign registration in your actual operating location, negating any cost advantage. Additionally, certain industries need more robust local licensing that’s easier to handle in your home state. Finally, if you prioritize immediate investor recognition or specialized courts (like Delaware’s Court of Chancery), Wyoming’s cost savings won’t outweigh potential benefits elsewhere.

Protect your privacy with a trusted Wyoming agent

Northwest offers premium registered agent services and LLC formation support—all based in Wyoming.

Benefits of a Wyoming LLC (Even If You Pay More)

Forming an LLC in Wyoming is about more than just saving on annual fees. Some entrepreneurs opt for it even if the total expense is slightly higher than they’d face at home. The state’s strong legal protections and friendly filing environment make it appealing for a range of business models.

Strong Asset Protection and Privacy Laws

Wyoming’s unique statutes provide a high level of asset protection. Member identities can remain private, shielding them from public scrutiny. Additionally, the state’s charging order protections limit what creditors can claim if your LLC faces litigation. Even if you run a single-member LLC, Wyoming extends valuable safeguards that other jurisdictions might not. This can be crucial for high-liability industries or investments where personal exposure is a concern.

No State Income Tax on LLC Earnings

Wyoming doesn’t impose a federal income tax equivalent at the state level, giving LLCs a break from additional tax rates. While you may still owe federal taxes or obligations in another state where you operate, your business in wyoming won’t encounter added state-level tax burdens. This structure can be especially helpful for e-commerce sellers, remote consultants, or those seeking to minimize overhead in retirement or side-hustle ventures.

Minimal Annual Filing Requirements

Outside of the yearly license tax, your LLC doesn’t have to file a detailed annual or biennial report. You’ll provide basic asset information online, pay the minimum $60 (or more if your assets are significant), and remain compliant. The state keeps the process streamlined, so you won’t spend excessive time on routine paperwork. This ease of compliance is a key reason many business owners form an llc in Wyoming, focusing more energy on growth and less on bureaucratic tasks.

Unique Insight: When You Should NOT Choose a Wyoming LLC

While Wyoming is often a top contender for forming an llc, it’s not universally the best option. Certain circumstances make another state or even a sole proprietorship arrangement more logical. If your everyday operations, staff, or customer base are solely located in a different region, you’ll probably need to register as a foreign LLC anyway—losing some of Wyoming’s cost advantage. Plus, if you’re aiming for local investor credibility, states like Delaware may resonate more strongly.

- Physical Operations Elsewhere: You’ll face multiple filings if you have an office or warehouse outside Wyoming.

- High-Touch Industries: Licenses and inspections might be easier to handle in your home state.

- Local Tax Incentives: Some states offer credits or breaks that surpass Wyoming’s savings if you operate regionally.

- No Real Need for Privacy: If anonymity and public record confidentiality don’t matter, simpler might be better.

Ultimately, weigh the administrative and tax pros against the risk of double compliance. If you rarely interact with Wyoming in any practical sense, the “cheapest” state can quickly become a costly detour.

FAQ: Wyoming LLC Fees and Costs

Wyoming’s affordable, business-friendly environment prompts plenty of questions. Below are concise answers designed to claim top visibility on Google for quick reference.aims to give you the clarity needed for a successful LLC launch.

Expect $100 for llc formation when filing with the state. If you need a paid registered agent service, add $50–$200 per year. Some counties charge $25–$200+ for specific permits or a business license. Optional expenses include $50 for name reservation or $10–$15 for a certificate of good standing. Altogether, many entrepreneurs can launch an LLC in Wyoming for as little as $100, though higher expenses can arise depending on local rules and personal preferences. If speed matters, here’s what to expect in terms of time for get an llc in Wyoming using the state portal.

Wyoming requires an annual report license tax with a $60 minimum, increasing if your LLC holds more assets within the state. Paid agent renewals often cost $50–$200 per year. Local licenses may also need yearly or periodic updates, typically in the $25–$200 range. Missing these deadlines can result in late penalties and potentially losing your good standing, so plan ahead to avoid extra charges.

Not usually at the state level. Wyoming is transparent about its $100 filing fee and annual fees. Common surprises involve paying for optional services you might not need, like expedited filings or specialized legal advice. If you operate in a heavily regulated industry, city or county permits could add to your llc cost. Always confirm local requirements where you’ll do business; ignoring them can lead to fines or forced closure.

No. Even if you handle all tasks yourself, you must pay the state’s $100 cost to start for your Articles of Organization. That’s the mandatory baseline. You can act as your own agent to skip professional fees and use free templates for your llc operating agreement, but the state won’t waive the filing charge. Some online promotions advertise “free LLC formation,” but they often add hidden upsells like agent or compliance fees.

Yes, but it doesn’t have to be a paid service. Every LLC in Wyoming must list a wyoming registered agent with a physical address in the state for receiving legal and tax documents. If you live or work locally, you can act as your own agent at no extra cost. If you’re out-of-state, prefer privacy, or lack consistent availability, a paid registered agent service typically costs $50–$200 a year to handle official correspondence.

Failing to file your license tax on time triggers late fees and jeopardizes your LLC’s standing. If you remain delinquent, the state can administratively dissolve your company, stripping you of liability protection and preventing legal operations. You’ll need to pay any backlog plus additional penalties to reinstate. Setting calendar reminders or hiring an agent to track deadlines helps you avoid such costly disruptions.

Looking for an overview? See Wyoming LLC Services

Launch your Wyoming LLC with full compliance

Harbor Compliance handles filing, agent service, and licensing—perfect for serious entrepreneurs.