Thinking about forming an LLC in Delaware and wondering what the real costs are? Curious whether it’s cheaper long-term than other states? Or if Delaware’s reputation for legal protection is worth the price?

The cost to form an LLC in Delaware starts at $110 for the Certificate of Formation. You’ll also pay a $300 annual franchise tax, and if you hire a registered agent, expect to spend $100 to $300 per year. Most LLCs also need a state business license, which ranges from $75 to $200+ depending on your industry. Optional expenses like name reservation or expedited filing can add to your budget. Altogether, your first-year cost typically ranges from $200 to $600, while yearly maintenance is around $400 to $800 for most businesses.

In this guide, you’ll find:

- A full breakdown of mandatory vs optional Delaware LLC fees

- How to minimize costs by handling key steps yourself

- What to expect in your first year vs future years

- How Delaware compares to other business-friendly states

Ready to see if a Delaware LLC is the right investment for your business? Let’s break it down together.

| Cost Category | Fee in 2025 | Key Details |

|---|---|---|

| Certificate of Formation | $110 | Mandatory state filing fee to officially form your LLC |

| Registered Agent (Required) | $100–$300/year | You must maintain a registered agent service with a physical Delaware address |

| Delaware State Business License | $75–$200+ | Varies by industry; renewed annually or quarterly, depending on business type |

| Annual Franchise Tax | $300 flat rate | Paid by June 1 each year; late payments incur penalties |

| Name Reservation (Optional) | $50 | Secures a company name for 120 days before filing |

| Certificate of Good Standing (Optional) | $50+ | Verifies LLC is active and compliant; often needed for financial transactions |

| DBA Registration (Optional) | $25–$100+ | Required if you operate under a name different from your formal LLC name |

| Other Add-Ons (Optional) | Varies | Includes expedited filings, legal consultations, or specialized license fees |

How Much Does It Cost to Form a Delaware LLC?

Creating an LLC in Delaware involves more than just a one-time filing. You’ll pay a delaware llc cost to submit official documents, secure a registered agent, and often obtain a state business license. In 2025, these obligations remain straightforward but can add up if you select premium services. By understanding every required and optional charge, you can plan a realistic budget and ensure your new entity is set up correctly from day one. For a comprehensive guide on how to start an LLC in Delaware, it's beneficial to consult detailed resources that outline each step of the process.

Certificate of Formation Filing Fee ($110)

The certificate of formation is the essential document that establishes your LLC with the Delaware Division of Corporations. As of 2025, the standard filing fee is $110. This includes a basic review and processing by the secretary of state. You’ll need to provide essential details, such as your LLC’s address, names of organizers, and the contact information for your chosen registered agent. If you need faster approval, Delaware offers expedited processing for an extra charge ranging from $50 to $1,500, depending on the turnaround time you require. Ensuring accuracy in your filing helps prevent costly rejections or delays.

Required Registered Agent Fee

Every LLC in Delaware must designate an agent to accept official notices on the company’s behalf. This can be you or a third-party service. While you can serve as your own agent if you have a physical address in the state of delaware, many business owners prefer a professional provider. Costs in 2025 typically range from $100 to $300 per year. These fees cover mail handling, compliance reminders, and immediate notification of any legal documents. It’s a crucial step to maintain good standing and avoid missing time-sensitive state correspondence.

State Business License Cost

Most LLCs must obtain a business license from the Delaware Division of Revenue to operate lawfully. Standard fees range from $75 to over $200, depending on your industry and estimated revenue. Certain sectors, like manufacturing or real estate, may have higher or specialized rates. Licenses often must be renewed annually or quarterly, so confirm your renewal schedule with the Division of Revenue. Failure to acquire or renew the license can lead to fines and potential closure of your LLC, so make it a priority in your financial planning.

Optional Name Reservation Fee

If you’re not ready to file your formation paperwork but want to hold onto a specific business name, you can reserve it for 120 days by paying $50. This fee is entirely optional—useful if you’re finalizing agreements or waiting for funding. Submitting a reservation form ensures no one else can use that name in Delaware during the reservation period. Once you’re ready, you can proceed with your formal formation documents. For many entrepreneurs with a unique brand identity, this reservation step can be an effective safeguard.

One-Time Setup Cost Summary

When you’re calculating the cost to form a delaware LLC, expect to pay at least $110 for filing, plus around $100 to $300 per year for a registered agent if you don’t act as your own. Industry-specific licenses can add $75–$200 or more to your initial expenses. Optional costs—like reserving a name or expediting filings—can further increase your outlay. On average, new LLCs spend anywhere between $200 and $500 for setup in 2025, depending on the level of professional help they enlist. By taking a do-it-yourself approach and skipping nonessential add-ons, you can keep these startup costs as lean as possible. Understanding the overall cost for LLC formation helps in planning your finances effectively and avoiding unexpected expenses.

Start your Delaware LLC for $0 + state fees

ZenBusiness makes it easy to launch your Delaware LLC with low upfront costs and step-by-step guidance.

What Are the Ongoing Delaware LLC Costs?

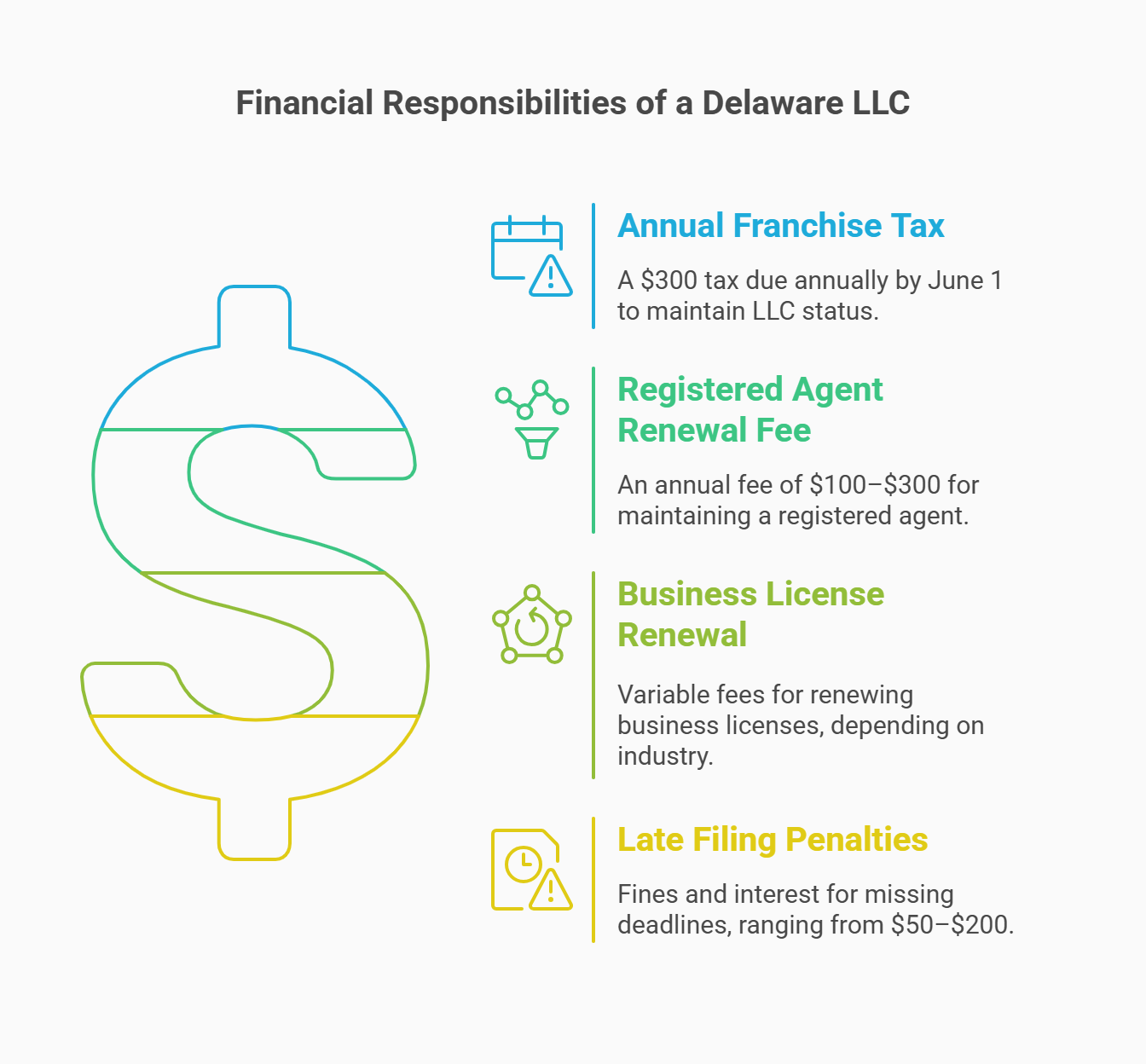

Forming an LLC is just the first step. To remain compliant, Delaware businesses face annual taxes, potential licensing renewals, and other recurring obligations. Missing these deadlines can trigger penalties and interest charges. Staying ahead of your LLC’s timeline helps you maintain good standing and avoid disruptive fines.

Annual Franchise Tax ($300 Flat Rate)

Delaware imposes a single annual franchise tax of $300 on most standard LLCs. This is due each year by June 1. If you miss that deadline, a $200 penalty plus 1.5% monthly interest on the outstanding amount applies. The tax funds state services and underpins Delaware’s well-respected corporate law framework. Payment can be made online via the Delaware Division of Corporations website. Even if your LLC doesn’t earn significant revenue in a given year, you’re still responsible for this flat rate to keep your entity in good standing. This flat rate is consistent, but it's essential to compare LLC annual fees by state to understand how Delaware's fees align with those in other jurisdictions.

Registered Agent Renewal Fee

If you hire a professional delaware registered agent, you’ll likely pay an annual renewal fee, typically $100–$300. This covers the agent’s ongoing responsibility to receive official correspondence and legal summons. Failure to maintain a valid agent puts your LLC at risk of losing its active status. If you want to switch providers or act as your own agent, be sure to notify the state promptly and fill out any required change forms. Confirm your renewal window early so you don’t incur late fees or unexpected cancellations.

Business License Renewal (If Applicable)

Certain industries in Delaware require regular renewal of licenses, which may take place annually or quarterly. Fees range widely—from as low as $25 for small-scale ventures to several hundred dollars for higher-volume operations. Paying these renewals on time is critical for legal compliance. The Delaware Division of Revenue can impose penalties or suspend your license if you ignore renewal notices. Check the schedule that applies to your LLC’s specific business category to plan ahead and avoid last-minute financial stress.

Late Filing Penalties and Interest

Delaware is strict about meeting filing deadlines. Whether it’s the delaware franchise tax, your business license renewal, or required updates to your LLC records, missing a deadline can trigger penalties. Expect flat-rate fines starting around $50–$200, plus interest charges that may accrue monthly. In extreme cases, the state can revoke your LLC’s right to do business or dissolve the entity. Staying organized with reminders or hiring a compliance service reduces your risk of incurring these extra costs.

Hidden or Unexpected Costs You Should Know About

Beyond the core fees, you may face additional expenses that catch new LLC owners off guard. Whether it’s an optional document you didn’t know you needed or a charge for an extra service, these costs can add up over time. Proactively budgeting for them helps avoid surprises down the road.

EIN Application Fees (Free vs Paid)

An Employer Identification Number (EIN) is free if you apply directly with the internal revenue service at IRS.gov. Some formation companies bundle EIN services into premium packages, charging $50 to $100 for something you can do at no cost. An EIN is essential for opening a bank account, hiring employees, or filing certain taxes. Unless you need customized tax consultations or have a highly complex structure, applying yourself typically suffices. You’ll usually receive your EIN immediately upon completing the online form.

Certificate of Good Standing

A certificate of good standing confirms that your LLC is active and compliant with state requirements. While optional in most cases, banks or prospective investors may request it. The fee in 2025 typically starts around $50, plus additional charges for expedited processing if you need it fast. If you’re seeking investment, applying for credit, or partnering in a larger deal, having this official document on hand can streamline the process and provide external parties with confidence in your LLC’s status.

Operating Agreement Creation Tools

Drafting an llc operating agreement is strongly recommended, though not mandated by Delaware law. Simple online templates may be free, but advanced or specialized agreements can cost $50–$200. Some entrepreneurs also hire an attorney to tailor the contract for complexities like series llc structures or multi-member arrangements. While it’s an extra step, having a clear agreement helps minimize disputes and clarifies how profits, liabilities, and decision-making authority are shared among members. Engaging legal counsel can add to your startup expenses, so it's advisable to research typical attorney fees for LLC formations to budget accordingly.

DBA Registration Fees (If Using a Trade Name)

If you intend to do business under a name different from your formal LLC name, you may need a DBA (“doing business as”) registration. Delaware’s process typically runs $25–$100 or more, depending on the county and any publication requirements. This step is critical if your marketing or brand strategy differs from the official LLC designation listed in your delaware certificate. Failing to register a DBA can lead to legal complications and confuse your customers about who they’re actually dealing with.

Full Delaware LLC Cost Breakdown (First Year vs Following Years)

While your first year involves setup fees, subsequent years come with recurring expenses. Factoring in both categories is crucial for an accurate budget. Many new entrepreneurs underestimate ongoing taxes and license renewals, which can lead to unpleasant surprises later.

First-Year Total Estimate

Delaware’s startup costs can be straightforward or complex, depending on your needs. Expect to cover the following:

- $110 Certificate of Formation Fee: Required to legally establish your LLC.

- $100–$300 Registered Agent: If you opt for professional service instead of serving as your own.

- $75–$200+ State Business License: Varies by industry and revenue.

- $50 Optional Name Reservation: Not mandatory, but helpful for securing a unique name in advance.

- Potential Additional Licenses: Sector-specific permits or professional registrations.

In total, you’re likely looking at $200 to $600 or more in your first year. This figure may rise with expedited services or specialized legal counsel. Thorough research and selective add-ons can keep the delaware llc formation cost manageable.

Second-Year and Ongoing Costs

Once you enter year two, focus shifts to maintaining compliance:

- $300 Annual Franchise Tax: A flat fee due by June 1 each year.

- $100–$300 Registered Agent Renewal (Optional): If you outsource, expect a yearly bill.

- Business License Renewal ($25–$200+): Dependent on your specific industry.

- Late Penalties: If you miss the tax or license deadlines, fines can accumulate quickly.

Plan on $400 to $800 or more each year to handle all annual delaware llc fees. If your industry requires extra permits or you need advanced legal support, ongoing costs may exceed this baseline.

Which Costs Are Optional vs Mandatory?

Not every expense is a must-have. Some are crucial for legal compliance, while others depend on your specific circumstances:

- Mandatory

- Certificate of Formation Filing

- Franchise Tax

- Registered Agent (can be yourself if you have a Delaware address)

- Strongly Recommended

- llc operating agreement (for clear internal rules)

- Business License for most commercial activity

- Optional

- Name Reservation

- Expedited Filings

- DBA Registration if your business entity uses a different trade name

By focusing on essential fees, you can establish a legitimate, fully compliant LLC without overspending on nonessential extras.

How to Form a Delaware LLC Without Overpaying

Although Delaware LLCs have a reputation for flexibility and strong asset protection, you don’t have to break the bank. With proper planning and a willingness to handle some tasks on your own, you can reduce initial and ongoing costs without compromising compliance or professionalism. Learning the step-by-step process of you to manage formations independently and save on service fees.

Submit directly to Delaware Division of Corporations for $110. Complete the simple form online for faster processing and keep copies of all submissions.

Save $100-$300 annually by serving as your own agent. Requires a Delaware address, availability during business hours, and willingness to have personal information public.

Evaluate each add-on's real value before purchasing bundled packages. Many extras like expedited shipping or custom binders aren't necessary for basic compliance.

Apply for your Employer Identification Number directly on IRS.gov at no cost. Avoid paying $50-$100 to third-party services for this simple task.

Step 1: File Formation Documents Yourself

Filing your initial documents directly with the delaware division of corporations is straightforward and costs $110. You’ll fill out a simple form, providing the LLC’s address and basic member information. If your minimum capital or resources are tight, doing it yourself is ideal. You can submit paperwork online or by mail—online is faster and often more reliable. Understanding the time for create Delaware's LLC can help in planning your business launch schedule effectively. Be sure to double-check all details, as inaccuracies can delay approval. Keep copies of every submission, especially your certificate of formation fee receipt, to track when your LLC officially becomes active.

Step 2: Be Your Own Registered Agent (Pros & Cons)

Choosing a registered agent fee plan from a provider can run $100–$300 annually. Serving as your own agent eliminates this recurring cost. However, utilizing professional registered agent services can provide convenience and ensure compliance with state requirements. However, consider these factors:

- Availability: You must be present at a Delaware address during normal business hours.

- Privacy: Your personal information appears on public records, which may concern some owners.

- Accountability: Missing legal mail can lead to negative consequences for your LLC.

If you have a stable location within Delaware and don’t mind public listings, self-representation could be a solid money-saver. Otherwise, a third-party delaware registered agent is worth the annual fee for consistent compliance support.

Step 3: Avoid Upsells from Formation Services

Numerous commercial providers promise “all-in-one” packages for a limited liability company setup. While convenient, these bundles often include extra services—like expedited shipping or customized binders—you might not need. Evaluate each add-on’s real value, especially if it increases your filing fee significantly. If you understand the steps, you can form your LLC independently, paying only the direct costs to the state. Opting for an online LLC formation can streamline the process and reduce formation time significantly. That said, specialized legal or tax advice might be worth it if your LLC has intricate structures or multiple owners. It's important to evaluate and choose the best LLC service in Delaware to ensure quality assistance without unnecessary costs.

Step 4: Use Free EIN Application with the IRS

An EIN is essential for tax filing, opening business accounts, and hiring employees. The internal revenue service grants EINs at no charge if you apply online at IRS.gov. Some third-party formation services charge $50–$100 to handle this simple step. If you’re comfortable completing a short form on the IRS website, there’s no reason to pay extra. You’ll typically receive your EIN immediately after submission. Keep that official notice on file to simplify tasks like setting up payroll or opening a bank account under your LLC’s name.

Delaware LLC Costs Compared to Other States

Though Delaware is known for strong legal precedents and business-friendly regulations, entrepreneurs often compare it to other states that offer lower or different fees. Each jurisdiction has unique tax laws, filing requirements, and compliance structures. For instance, some states offer more affordable options, and exploring the cheapest LLC formation states can be beneficial for cost-conscious entrepreneurs. Evaluating these differences can help you determine whether Delaware is the right fit for your venture. When deciding on the optimal location for your business, it's crucial to assess the best state for LLC formation based on factors like fees, legal protections, and tax implications.

Delaware vs. Wyoming

Wyoming is also a popular choice for forming LLCs due to its low fees and privacy protections. Its annual report fee starts at $60 and doesn’t require a separate annual tax for delaware llc equivalent. Wyoming’s minimal disclosure requirements also appeal to business owners seeking a higher level of confidentiality. However, Delaware stands out with established corporate law precedents and robust delaware llcs frameworks. Companies focused on venture capital or complex ownership structures often prefer Delaware for greater legal certainty, despite the higher cost of forming an llc in delaware.

Delaware vs. Florida

Florida’s LLC filing fees are generally cheaper than Delaware’s, and its annual report ranges around $138.75. That said, Delaware’s well-established court system—particularly the Court of Chancery—offers predictability in corporate disputes, which can be critical if you plan to attract investors. Florida also requires a bit more personal information in public filings, which might concern those valuing privacy. Ultimately, the delaware llc advantages lie in its streamlined, business-focused judicial approach, while Florida is appealing for simpler, more localized operations.

Delaware vs. Texas and California

Texas charges no franchise tax for most LLCs under a certain revenue threshold, but it does require an annual public information report. California imposes a higher franchise tax, starting at $800 annually, which can surpass the delaware annual fees of $300. Still, if you primarily conduct business in delaware, forming elsewhere may not eliminate the need for foreign llc registration. Weighing each state’s compliance rules, taxes, and legal environment helps you choose an optimal structure for your specific growth strategy.

Is Delaware the Most Cost-Effective Option for You?

Pinpointing whether Delaware is worth the price comes down to your LLC’s goals:

- High-Growth Ventures: If you’re seeking investors or plan to expand quickly, Delaware’s legal reputation can boost credibility.

- Asset Protection: Delaware’s court system and statutes offer substantial safeguards.

- National or Global Reach: Many international investors recognize the advantages of forming an llc in Delaware for consistency and legal clarity.

However, if you run a local shop with minimal external funding, the minimum cost to form a delaware llc might be unnecessarily high. Explore your home state’s fees and compliance requirements before finalizing your decision.

Delaware privacy + premium support for your LLC

Northwest includes powerful privacy protection, real-time alerts, and Delaware-based registered agent service.

Pros and Cons of Paying More for a Delaware LLC

While Delaware is often viewed as the gold standard for business formation, its cost structure can be higher than other states. Balancing those expenses against legal protections and potential investor confidence is a crucial step.

Legal Protections and Prestige

Delaware’s Court of Chancery is a specialized business court respected for its efficiency and clear rulings, providing advantages of forming an llc in this state. The established corporate law environment offers a degree of certainty attractive to venture capital firms, private equity, and large-scale business entities. This prestige can also foster an image of stability to potential clients or partners.

- Established Precedents: Judges experienced in business entities issues

- Speedy Resolutions: Faster decisions on corporate matters

- Investor Confidence: Particularly beneficial for high-tech or startup ventures

- Limited Liability Company Benefits: Clear guidelines on member protections

However, these perks come at a premium. Annual taxes and registered agent fees can exceed those in states like Wyoming or Florida. Make sure your enterprise truly benefits from Delaware’s legal environment before committing to higher costs.

Out-of-State Business Implications (Foreign Qualification Costs)

If you form a Delaware LLC but operate in another jurisdiction, you’ll likely need a foreign llc registration. This entails:

- Extra Filing Fee: Paid to the state where you conduct business

- Annual Report or Renewal: Potential ongoing compliance fees

- Registered Agent Requirement: You’ll need a local agent in each state where you qualify

For instance, if you’re actively conducting business in delaware and Texas, you’ll pay Delaware’s annual franchise tax plus any fees required by Texas. This duplication can be significant if you’re expanding into multiple regions. Carefully project your revenue and growth plans to see if the legal benefits outweigh the additional maintaining a delaware llc cost.

When the Price Premium Makes Sense — And When It Doesn't

Opting for Delaware’s higher fees is typically logical when you aim to scale quickly, attract sophisticated investors, or protect significant assets. Startups planning Series A or beyond often find Delaware’s strong legal framework worth the cost. However, if you’re running a small local venture, a general partnership transitioning to an LLC, or have simple ownership, the extra expenses may not yield a clear return on investment. Evaluate whether the benefits of delaware llc align with your growth trajectory to make an informed, cost-effective choice.

Unique Insight: When You Should NOT Choose a Delaware LLC

Delaware’s robust requirements for delaware llc can become overly burdensome for certain entrepreneurs. If you’re unlikely to court venture capital or operate across multiple states, you might find the filing fees and delaware annual taxes excessive. Below are clear signs that another jurisdiction could serve you better:

- Home State Advantage: If you don’t plan to expand beyond your region, forming locally may be simpler.

- Small-Scale Operations: Sole owners or family-run businesses often prefer lower-cost states.

- Minimal Legal Concerns: If your line of work is low-risk, Delaware’s advanced court system may offer unnecessary protection.

- Budget Constraints: how to set up an llc in delaware can be pricier if you’re on a tight budget.

In such cases, check the cost to file an llc in delaware against cheaper alternatives. A more straightforward approach in your home state might spare you multiple sets of compliance requirements and additional taxes. Ultimately, it’s about matching your business profile to the jurisdiction that aligns with your scale, future plans, and financial resources.

FAQ: Delaware LLC Formation and Maintenance Costs

New entrepreneurs often have specific questions about forming and maintaining a Delaware LLC. Below, you’ll find concise answers designed to clarify the most common concerns.

Expect to pay $110 to file with the delaware division of corporations, plus an annual $300 franchise tax. If you hire a registered agent, budget another $100–$300 yearly. Many LLCs also need a state business license, which starts at around $75. Optional expenses like name reservations ($50) and expedited processing can push costs higher. Overall, most standard LLCs spend $200–$600 in their first year, then $400–$800 or more annually thereafter, depending on professional services and license fees.

The biggest surprises often come from penalties and interest for late payments. If you fail to pay your annual franchise tax by June 1, you could face a $200 penalty plus monthly interest. Some industries require additional permits or professional licenses, adding costs to your total. Also, many third-party formation services charge for tasks—like acquiring an EIN—that are free when done through the IRS. Staying proactive and informed helps you avoid unexpected fees.

No. You must pay at least $110 for the initial cost of forming an llc in delaware via the Certificate of Formation. While some tasks—such as obtaining an EIN—are free, the state filing fee is mandatory. Even if you cut corners by acting as your own registered agent and skipping name reservations or expedited services, you’ll still have the annual $300 franchise tax to maintain compliance. Free formation is not an option under Delaware law.

Not usually. States like Wyoming or Florida often have lower annual fees or less rigid reporting requirements. However, the trade-off is that you lose Delaware’s specialized court system and well-established limited liability company benefits. If you anticipate raising capital or managing complex ownership, Delaware’s legal environment may save you money long-term by reducing legal risks. But for a simpler, locally focused operation, other states typically come out cheaper overall.

Yes. Non-US residents can form an llc in Delaware without American citizenship or residency. The key is hiring a requirements for registered agent service with a Delaware address and meeting all state filing obligations. You’ll still pay the same formation fees and annual tax. If you plan to open US-based bank accounts or handle US-based transactions, you may also need an EIN from the IRS. Always check specific business regulations in your home country to ensure full compliance.

Looking for an overview? See Delaware LLC Services

Form a Delaware LLC with full compliance support

Harbor Compliance handles everything from licensing to filing—ideal for growth-focused entrepreneurs.