Why do so many entrepreneurs rush into launching a business without fully grasping the legal foundation it stands on? Forming a limited liability company in Alabama isn't just a paperwork formality—it’s a strategic decision that shields assets, optimizes taxes, and secures your business name. And yet, one overlooked document can derail the entire formation process.

Starting an LLC in Alabama requires a $200 filing fee, an Alabama registered agent, and strict compliance with Secretary of State rules—especially when filing your certificate of formation and local business licenses.

No one should navigate this alone. From securing your certificate of name reservation to structuring a member managed LLC that fits your business entity, this guide lays out every step—from choosing a domain name to submitting your business privilege tax return. It's not about red tape—it’s about precision. Form your LLC with clarity, or risk building your future on sand.

Why Choose an LLC in Alabama?

Starting an LLC in Alabama offers entrepreneurs a powerful combination of liability protection, tax advantages, and operational flexibility that makes it an attractive business structure for ventures of all sizes. Alabama's business-friendly environment provides specific benefits that can help your company thrive while protecting your personal assets.

Limited Liability and Privacy Benefits

The primary advantage of forming an LLC in Alabama is the personal liability protection it offers. Unlike a sole proprietorship, where your personal assets are at risk if your business faces legal action or debt, an LLC creates a legal separation between you and your company. This means your home, personal savings, and other assets remain protected if your business encounters legal problems or cannot pay its obligations.

Additionally, Alabama LLCs enjoy certain privacy benefits not available to all business types. While you must provide basic information when you file your certificate of formation, Alabama allows members to maintain a degree of privacy regarding ownership details, especially when using a professional registered agent service to handle your official correspondence.

Tax Treatment and Flexibility

One significant benefit of the Alabama LLC structure is its favorable tax treatment. By default, LLCs enjoy pass-through taxation, meaning the business itself doesn't pay federal income taxes. Instead, profits and losses pass directly to the owners' personal tax returns, avoiding the double taxation that affects corporations. This tax advantage alone makes the LLC formation option appealing to many entrepreneurs.

Alabama-Specific Advantages

Alabama offers a particularly welcoming environment for new businesses, with relatively streamlined processes for LLC formation and ongoing compliance. The state's economic development initiatives provide various incentives for businesses in certain industries, potentially including tax credits and grants for qualifying companies. Review the latest figures on small businesses in Alabama to guide your strategy.

Alabama's reasonable cost of living and business operation expenses make it an economical choice for starting an LLC, especially compared to many other states. Additionally, the state's strategic location in the Southeast provides excellent access to regional markets. For complete information about business entities in Alabama, you can visit the Alabama Secretary of State website.

The combination of worker availability and competitive wages creates an advantageous labor market for growing companies in various sectors across the state.

Form your Alabama LLC online

ZenBusiness handles your name reservation, formation paperwork, and compliance — fast and affordable.

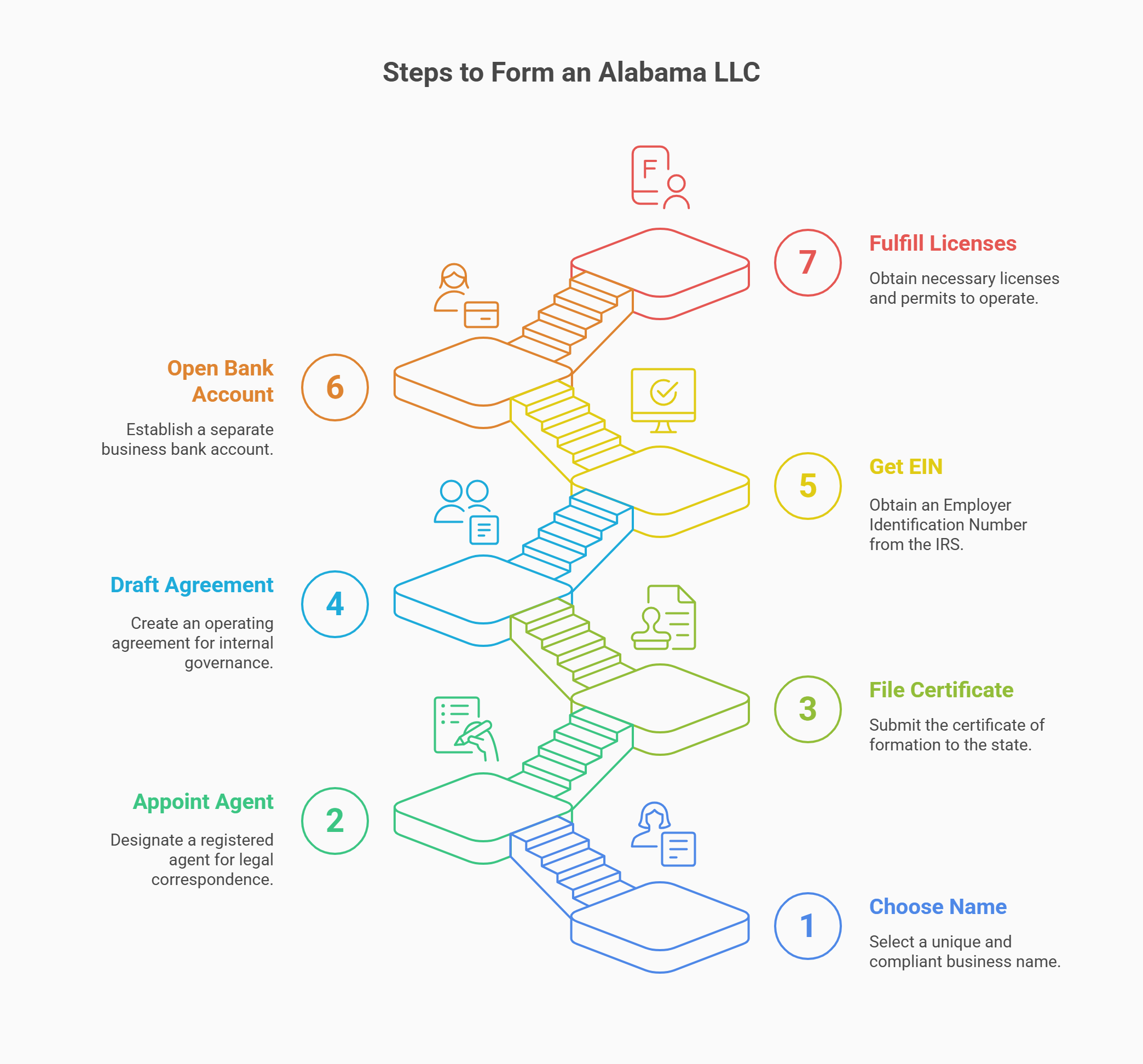

Alabama LLC Formation Process (7 Key Steps)

The formation process for an Alabama LLC is straightforward and can typically be completed within 1-2 business days if filing online. While the process involves several distinct steps, from choosing a name to obtaining necessary licenses, the entire procedure can be accomplished efficiently by following a systematic approach.

Step 1: Choose a Business Name and Reserve It

Selecting an appropriate LLC name is your first critical decision. Your chosen name must be unique and distinguishable from other business entities registered in Alabama. The state requires that your name includes “Limited Liability Company,” “LLC,” or “L.L.C.” The name cannot contain words that might confuse your LLC with a government agency or restricted business type.

Before proceeding with formation, Alabama requires you to reserve your business name by filing a name reservation request with the Secretary of State. This reservation, which costs $25, holds your name for one year while you complete the registration process.

Here are the key requirements for Alabama LLC names:

- Must include “Limited Liability Company,” “LLC,” or “L.L.C.”

- Cannot be identical or confusingly similar to existing businesses

- Cannot include restricted words without proper approval

- Must not imply government affiliation

- Cannot contain words requiring professional licensing unless qualified

If you need an LLC to start a business, this step-by-step guide will help.

Step 2: Appoint a Registered Agent in Alabama

Every LLC in Alabama must designate an Alabama registered agent to receive legal documents and official correspondence on behalf of the business. This agent must have a physical street address (not a P.O. box) in Alabama and be available during regular business hours to accept service of process and other important notices. For detailed guidance on Alabama registered agent requirements, see our comprehensive overview.

You have two main options when appointing a registered agent. You can serve as your own agent if you have a physical address in Alabama and are willing to make your address public. Alternatively, you can hire a professional registered agent service, which provides greater privacy and ensures you never miss important legal or tax notices even when you're unavailable. Make sure you understand all statutory agent responsibilities before appointing one.

Step 3: File Your Certificate of Formation

To legally establish your LLC, you must file your certificate of formation with the Alabama Secretary of State. This document, sometimes called articles of organization in other states, officially creates your LLC as a legal business entity in Alabama. Find detailed instructions on certificates of organization here.

The certificate requires basic information about your LLC, including its name, address, registered agent details, and whether it will be member managed or manager-managed. Currently, the filing fee is $200, which can be paid online or by mail.

If filing online through the Alabama Secretary of State website, you'll receive confirmation of your LLC's formation almost immediately. Mail filings typically take 1-2 weeks to process. You can also learn how long does it take for LLC to be approved in each state.

Step 4: Draft an Alabama Operating Agreement

While Alabama doesn't legally require an LLC operating agreement, creating one is strongly recommended. This internal document establishes the ownership structure, member rights and responsibilities, profit distribution, and operating procedures for your business.

A comprehensive operating agreement helps prevent misunderstandings between members and provides critical guidance if disagreements arise. It also reinforces your LLC's legitimacy as a separate legal entity, which strengthens your limited liability protection.

Step 5: Get an EIN From the IRS

Most LLCs need an Employer Identification Number (EIN) from the Internal Revenue Service. This nine-digit number functions like a Social Security number for your business and is required for tax reporting, opening a business bank account, hiring employees, and choosing certain tax classifications.

You can obtain an EIN free of charge by applying directly through the Internal Revenue Service website. The process is straightforward and provides your employer identification number immediately upon successful application.

Step 6: Open a Business Bank Account

Establishing a separate business bank account is essential for maintaining the liability protection of your LLC. Mixing personal and business finances (called “commingling”) can jeopardize your limited liability status and create accounting complications.

To open a business account, you'll typically need to bring several documents to your chosen financial institution:

- Your LLC's Certificate of Formation

- EIN confirmation from the IRS

- LLC operating agreement

- Personal identification for all signing members

Step 7: Fulfill Local Licensing Requirements

Depending on your industry and location, your LLC may need various business licenses and permits to legally conduct business in Alabama. The state doesn't have a general business license requirement, but many professions, industries, and localities have specific licensing rules.

Many cities and counties in Alabama require a business privilege license or similar local permit. Additionally, regulated industries like food service, childcare, construction, and professional services have specific state-level licensing requirements through various Alabama regulatory boards.

For specialized industries, you may need additional permits from state agencies. Always research the requirements specific to your business type and location to ensure full compliance with all regulations.

Alabama LLC Filing Fees and Ongoing Costs

Understanding the financial commitments involved in forming and maintaining an LLC helps you budget appropriately for your business venture. Alabama's fee structure includes initial formation costs and recurring expenses that keep your business in good standing with state authorities. You can find detailed information about Alabama's tax requirements by visiting the Alabama Department of Revenue.

Initial Formation Cost ($200 Filing Fee)

The primary startup cost for an Alabama LLC is the $200 filing fee for submitting your Certificate of Formation to the Alabama Secretary of State. This one-time payment officially establishes your business as a legal entity in the state. For a complete fee breakdown, check out how much does it cost to start an LLC.

Before filing your formation documents, Alabama uniquely requires you to reserve your business name, which costs an additional $25. This brings the minimum initial formation expense to $225, not including any professional services you might use to assist with the formation process.

Annual Taxes and Report Requirements

All Alabama LLCs must file an annual report as part of the Business Privilege Tax (BPT) return. This combined filing serves as both a tax payment and an information update to the state. The minimum Business Privilege Tax is $50 per year, though the actual amount may be higher depending on your business's taxable income and net worth.

| Requirement | Fee | Due Date | Filing Method |

|---|---|---|---|

| Business Privilege Tax Return | Minimum $50 | April 15 annually | Online or mail to Alabama Department of Revenue |

| Initial Business Privilege Tax | Minimum $50 | 2.5 months after formation | Online or mail to Alabama Department of Revenue |

| Annual report | Included with BPT | April 15 annually | Filed with BPT return |

| Income tax filings | Varies | April 15 annually | Depends on tax election |

The business privilege tax return must be filed each year by April 15th. Additionally, new LLCs must file an Initial Business Privilege Tax return within 2.5 months after formation. For taxable years beginning after December 31, 2023, taxpayers whose calculated Business Privilege Tax is $100 or less are exempt from both payment and from filing the Business Privilege Tax Return.

Optional Costs (Name Reservation, Agent, Licenses)

Beyond the mandatory fees, your LLC may incur several optional or situational expenses. The $25 certificate of name reservation fee becomes an ongoing cost only if you reserve a name but don't immediately form your LLC.

Professional registered agent service typically costs between $100-$300 annually. While you can serve as your own registered agent, many business owners find the privacy and reliability of a professional service worth the investment.

Depending on your industry and location, you may need various specialized business licenses at the state, county, or municipal level. Costs vary widely based on business type and jurisdiction, from nominal processing fees to substantial annual licensing costs for regulated industries.

Several services offer domain name registration, website hosting, and email services specifically designed for small businesses, with annual costs typically ranging from $15-$300 depending on the features included. When budget matters, follow our tips for the cheapest LLC filing.

Foreign LLCs Doing Business in Alabama

If your LLC was formed in another state but wants to conduct business in Alabama, you'll need to register as a foreign LLC with the Alabama Secretary of State. This process, called foreign qualification, allows out-of-state companies to legally operate in Alabama while maintaining their original state registration. To compare advantages, explore which is the best state to open an LLC for your needs.

Who Must Register as a Foreign LLC?

Not every out-of-state business transaction requires foreign qualification. However, establishing a substantial business presence in Alabama typically triggers registration requirements. Understanding what constitutes “doing business” helps determine whether your LLC needs to register.

According to Alabama law, activities that generally require foreign LLC registration include:

- Maintaining an office, retail store, or business location in Alabama

- Having employees physically working in the state

- Regularly conducting in-person meetings with clients or customers in Alabama

- Owning real property in the state

- Applying for professional licenses or permits from Alabama authorities

Conversely, certain activities don't typically constitute “doing business” and may not require registration, such as:

- Maintaining bank accounts in Alabama

- Handling isolated transactions completed within 30 days

- Selling through independent contractors

- Collecting debts or enforcing contracts

- Conducting interstate commerce that merely passes through the state

Create your Alabama LLC with privacy

Northwest includes a free year of registered agent service and expert support with every LLC.

How to Register with the Alabama Secretary of State

To register your foreign LLC in Alabama, you must submit an application for registration to the Alabama Secretary of State. The process begins with reserving your business name in Alabama, which costs $25 and is required before filing your foreign registration application.

The foreign LLC registration application requires information about your original formation, registered agent, and business activities in Alabama. You can file the application for registration by mail or online through the Secretary of State's website. For recommendations on a registered agent multiple states, read our analysis.

Fees and Ongoing Requirements

The current filing fee for a foreign LLC registration in Alabama is $150 if submitted by mail, or $156 if filed online. This is in addition to the required $25 name reservation fee, bringing the total initial cost to $175-$181.

Once registered, foreign LLCs must fulfill the same ongoing compliance requirements as domestic Alabama LLCs. This includes filing annual business privilege tax return reports with the Alabama Department of Revenue and paying at least the minimum $50 tax. If you expand into Texas, compare options for the best registered agent service Texas.

Foreign LLCs must maintain a registered agent with a physical address in Alabama and comply with all relevant state and local business licenses requirements. If your business structure, ownership, or other significant details change, you may need to file an amendment to your foreign LLC registration. Many entrepreneurs rely on an Alabama LLC service for expert handling of filings.

Alabama LLC FAQs: Costs, Timelines, and Requirements

From filing timelines to operating agreements, this FAQ answers key questions about forming and managing an Alabama LLC—so you avoid costly mistakes and stay compliant with state requirements, from your first report to long-term maintenance.rns among business owners. If you’re exploring alternatives to CorpNet, review CorpNet alternatives for other trusted providers.

How Long Does It Take to Get an Alabama LLC?

When filing online, your Alabama LLC is typically approved immediately upon submission and payment of fees. The digital Certificate of Formation is available right away, making same-day formation possible.

– Standard processing: Immediate approval for online filings

– Mail filings: Approximately 2 weeks plus transit time

– Expedited service: Not necessary for online filings as they're processed immediately

Do You Need a Registered Agent in Alabama?

Yes, every limited liability company in Alabama must maintain a registered agent. This requirement is non-negotiable under Alabama law, and failure to maintain a proper agent can have serious consequences:

– Your LLC may fall out of good standing with the state

– You could miss critical legal notices, including lawsuit notifications

– The state may administratively dissolve your LLC after 60 days without a registered agent

– Reinstatement requires additional fees and paperwork

Is an Operating Agreement Required for Your Alabama LLC?

No, Alabama law doesn't legally require an LLC operating agreement. However, creating one is strongly recommended for several important reasons. An operating agreement formally establishes your ownership arrangements, management structure, and operating procedures, providing clarity and protection that benefit even single-member LLCs.

Can You Form an LLC in Alabama If You're Not a Resident?

Yes, you can form an LLC in Alabama regardless of your residency status. Non-residents have the same rights to establish Alabama LLCs as residents do. The key requirement is appointing an Alabama-based registered agent with a physical street address in the state to receive legal documents on behalf of your LLC.

What Happens If You Miss Your Alabama Annual Report?

Missing your annual report filing (submitted with your Business Privilege Tax return) triggers a series of consequences:

– Initial penalty: 10% of the tax due (minimum $50)

– Additional monthly penalties: 1% of the tax due

– Interest charges on unpaid amounts

– Loss of good standing status

– Potential administrative dissolution after continued non-compliance

Looking for an overview? See Alabama LLC Services

Launch your LLC in Alabama with full compliance

Harbor Compliance manages the entire formation process and ensures you meet all state requirements.